Crypto World

Strategy’s Saylor Signals Bitcoin Dip Buy After Weekend Slide

Strategy founder Michael Saylor signaled continued Bitcoin accumulation after a weekend rout shaved a sizeable portion from the firm’s exposure. The executive chairman posted “More Orange” on X, sharing a chart that tallies roughly $55 billion in Bitcoin purchases since August 2020. The post, a familiar signal to followers, comes as BTC endured a weekend slide of more than 13% that briefly pushed the company’s vast position into the red. The timing is notable: while the market wrestled with macro headlines, Strategy’s approach appears to be anchored by a belief in long-term value rather than near-term price movements.

Key takeaways

- Strategy has accumulated a total of over 712,647 Bitcoin under management, with its largest single purchase to date occurring on Jan. 20 when it bought 22,305 BTC.

- The weekend move knocked BTC from about $87,970 to roughly $75,892 before a partial rebound, momentarily testing Strategy’s cost basis around $76,040.

- The market backdrop included a hawkish tilt in U.S. policy chatter, as Kevin Warsh was nominated to lead the Federal Reserve, a development that contributed to risk-off sentiment across assets.

- Crypto market sentiment deteriorated, with the Fear & Greed Index signaling a six-week low and commentary from prominent figures reflecting growing skepticism about a rapid bitcoin cycle.

- Beyond crypto, traditional assets also softened, with the S&P 500 slipping and precious metals pulling back after the political and macro news flow.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. The weekend sell-off briefly pushed Strategy’s BTC exposure into the red, before a partial recovery.

Market context: The pullback in risk assets and a shifting macro backdrop intersect at a moment when large crypto holders are weighing the balance between long-term conviction and near-term volatility. The broader environment features evolving expectations around monetary policy, regulatory signals, and power dynamics in the crypto market, all of which can influence liquidity and investor appetite in the near term.

Why it matters

The narrative around Strategy’s Bitcoin strategy has long hinged on the belief that the asset serves as a treasury anchor and a potential source of asymmetrical upside. The latest signals suggest management remains committed to stacking BTC despite cyclical pullbacks. The use of a public chart to benchmark purchases—paired with a visible, ongoing cadence of additions—helps maintain transparency about the company’s exposure and strategy. This kind of disciplined accumulation can influence rival treasuries and corporate holders who watch large players for price and sentiment cues, underscoring Bitcoin’s role as a macro asset rather than a mere trading instrument.

The weekend price action, highlighted by a dip below the prior cost basis, also emphasizes the trade-off between timing and conviction. Strategy’s aggregate holdings have benefited from earlier entry points when BTC traded at markedly different levels, and the most notable single purchase on Jan. 20—22,305 BTC—illustrates the scale at which the firm operates. While the price subsequently rallied to around $76,765, the intraday swing underscores the volatility inherent in the market and the risk management considerations that large holders must monitor, including mark-to-market effects and the potential for liquidation risk in stressed conditions.

Additionally, political and monetary developments provide a connected backdrop. The nomination of Kevin Warsh as Fed chair has been interpreted by some as leaning toward tighter monetary policy and a potential unwind of easy-money policies. If confirmed, Warsh’s approach could influence inflation expectations, bond yields, and liquidity dynamics, factors that typically ripple into crypto markets as investors reassess risk and seek hedges or liquidity substitutes. The commentary around Warsh—paired with a hawkish stance and calls for restraint—has fed risk-off sentiment that tends to weigh on highly speculative assets in the near term.

On the sentiment front, notable voices within the ecosystem have moderated their outlooks. Changpeng Zhao, the former Binance chief, indicated a cooler stance on the so-called Bitcoin supercycle, signaling that even early proponents acknowledge macro headwinds can temper the pace of structural upside. This admission aligns with a broader breath of caution across market watchers who calibrate expectations against ongoing macro uncertainty and the tactical shifts of large holders who may reallocate as prices move and regulatory clarity evolves. The Crypto Fear & Greed Index, frequently cited as a sentiment barometer, slipped to a six-week low, reflecting a confluence of fear and caution among traders and investors alike.

Beyond Bitcoin itself, the weekend’s movements reverberated through traditional markets. The S&P 500 fell by roughly 0.43%, and gold and silver also tumbled amid the risk-off mood, illustrating how macro headlines can spill into crypto and affect liquidity and pricing across asset classes. While relief rallies can occur, the episode reinforces the interconnected nature of crypto markets with conventional financial markets and policy expectations, especially as investors weigh the pace and scale of future Fed actions against the backdrop of inflation, employment data, and global financial stability concerns.

What to watch next

- Follow Strategy’s public disclosures and X posts for any additional BTC purchases or shifts in allocation strategy.

- Monitor the Federal Reserve’s policy trajectory and any formal communications from Kevin Warsh if he ascends to the chair chair position.

- Track Bitcoin’s price around critical levels near the mid-to-high $70k range and any subsequent retests of the $80k threshold.

- Watch market sentiment indicators, including the Fear & Greed Index, for signs of a reversal in risk appetite among crypto traders.

- Observe responses from other large treasury holders and institutions to quantify whether Strategy’s moves influence broader corporate crypto treasuries.

Sources & verification

- Michael Saylor’s X post titled “More Orange” with the BTC purchase chart, indicating cumulative purchases since August 2020.

- Record of Strategy’s largest annual purchase on Jan. 20, involving 22,305 Bitcoin.

- Bitcoin price movements over the weekend, from approximately $87,970 to $75,892, and a rebound to about $76,765.

- News on Kevin Warsh’s nomination to the Fed chair position and the possible policy implications.

- Statements from Changpeng Zhao regarding the Bitcoin cycle outlook and macro headwinds, as reported in contemporaneous coverage.

- Crypto Fear & Greed Index readings showing a six-week low amid the episode of risk-off sentiment.

Bitcoin (CRYPTO: BTC) accumulation persists amid volatility

Strategy’s ongoing accumulation strategy continues to emphasize a long‑horizon view of Bitcoin as an anchor asset rather than a short-term trading instrument. The firm’s public signal—via Saylor’s posts and the accompanying explicit chart—has become a recurring feature of the narrative around large, corporate-led crypto treasuries. The reported total holdings, exceeding 712,647 BTC under management, places Strategy at the forefront of corporate crypto treasury activity. With a track record of sizable buys and a willingness to deploy capital during periods of volatility, the company demonstrates how institutional players view Bitcoin as a strategic hold rather than a momentum play.

The price action over the weekend threatened to widen the gap between market price and cost basis for some holders, including Strategy. The brief dive below the firm’s cost basis at roughly $76,040 underscores the risk of mark-to-market losses even for long-term holders who have demonstrated resilience through previous cycles. Yet the subsequent rebound highlights the market’s ongoing evaluation of Bitcoin’s value proposition in a shifting macro context, where policy signals and macro risk sentiment can quickly alter the price trajectory. Investors watching these developments will be looking for signs of stability around key support levels and indicators that might signal a renewed appetite for risk or a retreat to safety.

From a broader perspective, recent headlines reflect a crypto ecosystem that remains sensitive to policy and macro developments. Warsh’s nomination adds a layer of uncertainty to the rate-hiking debate and the eventual unwind of quantitative easing, a combination that has historically influenced liquidity stipulations in crypto markets. Meanwhile, the chorus of veteran market participants who have warned about the fragility of a “supercycle” narrative has grown louder, especially as fears of regulatory tightening and macro slowdown linger. In this environment, Strategy’s approach—continuing to accumulate on pullbacks while maintaining a substantial treasury position—appears to be a deliberate attempt to balance exposure with risk controls while preserving optionality for future price appreciation.

As the market digests these developments, the role of public signals from large holders becomes increasingly important. By communicating a steady intention to accumulate, Strategy contributes to market narratives around Bitcoin’s longevity and potential resilience in the face of volatility. The immediate reaction to the latest weekend move—temporary softness followed by partial recovery—serves as a reminder that the crypto market can be reactive in the short term, even as institutional players maintain a longer-term orientation.

https://platform.twitter.com/widgets.js

Crypto World

Solana price outlook: bears test $90 amid massive liquidations

- Solana dropped to $90 amid massive liquidations across the crypto market.

- Bitcoin and Ethereum fell to under $73,000 and $2,150.

- Standard Chartered forecasts SOL rally to $250 in 2026 and $2,000 by 2030.

Cryptocurrencies are bearish, and Solana’s price has experienced one of the sharpest declines among top altcoins.

In the past 24 hours, the cryptocurrency has dropped nearly 10% to under $91, with many traders caught off guard amid heightened market volatility.

As can be seen in the crypto heat map below, Solana’s plunge aligns with broader market pressure. Billions of dollars in leveraged positions have been wiped out in the past week as the sector faces massive unwinding.

Price dips 10% amid crypto liquidations

With market sentiment in shambles for much of 2026, it is no surprise that Bitcoin tanked to its multi-month lows of $72,800.

BTC and ETH’s latest dips mean Michael Saylor’s Strategy and Tom Lee’s BitMine currently sit on billions of dollars in unrealized losses.

Digital asset treasury companies that flocked to Solana, BNB, Cardano, and others have similar trajectories.

For Solana, the coin’s price under the psychological level of $100 has strengthened this. Sellers sustained this negative trend with another 10% push over the past 24 hours, hitting lows of $90.60.

Onchain perpetual markets on Solana contributed significantly, with over $70 million in liquidations from Solana-based platforms in the past 24 hours.

During the downturn, over $65 million of these were longs.

The surge in forced selling exacerbated the decline, with high leverage amplifying losses for over 15,900 bullish traders.

The liquidations reflect the rapid deleveraging that has also wiped billions of bullish bets from Bitcoin and Ethereum.

Solana price prediction

The SOL dip is part of a broader market correction, but there’s a potential for recovery if bulls hold $90.

However, liquidity contractions and liquidation overhangs, such as the $800 million in total liquidations in the past 24 hours, suggest a possible down leg as excess leverage clears.

The technical picture also has Solana trading below its 50-day moving average around $132, which adds to the bearish outlook of the RSI and MACD.

SOL could drop to $70 if markets continue to struggle.

Despite the overall bearish picture, Standard Chartered has pointed out a bullish forecast for SOL.

According to the bank, SOL could reach $2,000 by 2030 but has cut its 2026 forecast to from about $310 to $250.

Catalysts include the macro picture and capital flows, as well as a fresh explosion in rotation from memecoins to top altcoins. Stablecoin adoption is another factor in the bank’s outlook.

Crypto World

Nomura pushes back on crypto retreat concerns as it tightens risk controls

Nomura Holdings pushed back against suggestions it is losing confidence in crypto, saying tighter risk controls at its Laser Digital unit are designed to limit short-term earning swings while it focuses on longer-term strategies, the bank told CoinDesk in emailed comments on Wednesday.

“Given the nature of the crypto-asset business, we recognize that a certain level of earnings volatility is inherent, and we recognize the importance of taking a medium- to long-term perspective,” the bank said. “At the same time, to limit short-term earnings swings, we have further tightened position and risk limits. We will continue to capture growth opportunities in the crypto market while strengthening our services and customer base.”

The clarification follows comments from Nomura’s chief financial officer, Hiroyuki Moriuchi, who said during an earnings briefing that the firm introduced “stricter position management” at Laser Digital to reduce risk exposure and limit earnings swings driven by crypto market volatility. Losses at the unit contributed to a 9.7% decline in Nomura’s fiscal third-quarter profit.

The bank’s strategy shift comes as the crypto market is hit by a steep decline with total value slumping by nearly half a trillion since Jan. 29, according to CoinGecko data. Bitcoin tumbled to its lowest level since President Donald Trump won re-election in early November 2024 on Tuesday, hitting a low of $72,870 although it later bounced back to over $76,000, according to CoinDesk data.

Nomura’s decision follows the Oct. 10 flash crash, which wiped out more than $19 billion in leveraged positions just days after bitcoin hit a record high above $126,200. Bitcoin ended the year around $87,000, roughly 31% below its peak, while total crypto market capitalization also fell over 30% to just over $3 trillion.

Nomura denied the decision means it has lost faith in the sector. “Laser Digital’s risk controls performed as designed: exposure was reduced early, losses were contained, and the firm avoided the more severe impacts felt worldwide,” it said.

The banking firm, considered Japan’s largest investment bank, with $673 billion in assets under management as of late last year, acknowledged that volatility is an unavoidable feature of the crypto business.

“By nature of the digital asset business, Laser Digital and other industry peers have beta exposure to the market,” the bank told CoinDesk. “However, risk taking at Laser Digital is at Trad-Fi institutional grade, and Q3 performance is not representative of any fundamental weakness.”

Crypto World

Crypto networks respond after Vitalik Buterin told them they ‘no longer makes sense’ for Ethereum

For years, Ethereum’s layer-2 networks have marketed themselves as extensions of Ethereum itself. “Arbitrum is Ethereum,” Offchain Labs co-founder Steven Goldfeder wrote on X in March 2024. “Base is Ethereum,” Coinbase’s layer-2 team posted in April 2025.

But following recent comments from Ethereum co-founder Vitalik Buterin questioning whether Ethereum still needs a dedicated layer-2 roadmap, many of those same teams are now emphasizing something different: that rollups are not Ethereum at all.

Goldfeder, for one, struck a noticeably different tone after Buterin’s post, writing on X instead: “Arbitrum is not Ethereum.”

“It’s a core part of the ecosystem, a close-knit ally, and has enjoyed a symbiotic relationship for the last half-decade. But it is not Ethereum,” he added in the post.

Buterin’s remarks, which suggested that as Ethereum becomes faster and cheaper, the original rationale for layer-2s may be shifting, reignited debate over whether rollups will become less necessary as the base layer improves.

Layer-2 networks were previously incorporated into Ethereum’s roadmap to scale the network by processing transactions off the main blockchain and settling them back to Ethereum, helping reduce congestion and fees.

The debate is not abstract. Several layer-2 networks now secure billions of dollars in user funds, making them some of the largest platforms in crypto. Coinbase-backed Base holds roughly $4 billion in total value locked, while Arbitrum secures more than $2 billion, according to DefiLlama data.

‘Less relevant’

But leaders across the layer-2 ecosystem say this moment is being misunderstood.

Rather than signaling an existential threat, they argue, Ethereum’s progress is forcing rollups to clarify their purpose and to stand on their own.

Ben Fisch of the Espresso Foundation said Buterin’s comments reflect a logical evolution in how Ethereum’s scaling strategy is being framed.

“I think that Vitalik’s post is very consistent with that idea now that he’s saying, ‘The whole purpose of layer-2s in the first place was to scale Ethereum. Well, now we’re making Ethereum faster so they’re becoming less relevant,” Fisch said to CoinDesk in an interview.

Still, Fisch rejected the idea that this makes rollups obsolete.

“I think it’s the start of layer-2s flourishing and becoming independent from Ethereum,” he said.

“A layer-2 may use Ethereum as a service, but it by no means is beholden to Ethereum or what the leaders of Ethereum think.”

That perspective is increasingly echoed by layer-2 leaders themselves.

Base, Coinbase’s layer-2 network, welcomed improvements at the base layer, with Jesse Pollak, the head of Base, calling Ethereum scaling “a win for the entire ecosystem,” while stressing that rollups will need to offer more than lower fees.

“Going forward, L2s can’t just be ‘Ethereum but cheaper,’” Pollak said.

Polygon CEO Marc Boiron made a similar argument. Polygon recently said it would pivot its efforts to focus primarily on payments, and Boiron said Buterin’s comments were less about abandoning rollups than about raising expectations for them.

“Vitalik’s point was not that rollups are a mistake, but that scaling alone is insufficient,” Boiron told CoinDesk. “The real challenge is building a unique blockspace that works for real-world use cases like payments, where cost, reliability, and consistency matter.”

Others have gone further, arguing that rollups should be understood as independent platforms rather than extensions of Ethereum itself. Jing Wang, co-founder of the Optimism Foundation and CEO of OP Labs, compared layer-2s to standalone web services.

“L2s are websites. Every company will have its own, tailored to its needs. Ethereum is an open settlement standard,” Wang said to CoinDesk. “It’s important for Ethereum to stay true to those base layer values to give L2s the flexibility to customize.”

Taken together, the reactions suggest that while Buterin’s post has raised questions about the role of layer-2s, leaders across the ecosystem see it less as a threat than as a transition, one that is forcing rollups to reconcile how they’ve branded themselves with what they are now trying to become.

Crypto World

Solana Price Could Fall to $65 as Unstaking Surges 150%

The Solana price remains under heavy pressure in early February, with the token down nearly 30% over the past 30 days and trading inside a weakening descending channel. Price continues to grind toward the lower boundary of this structure as long-term conviction fades.

At the same time, net staking activity has collapsed, exchange buying has slowed, and short-term traders are building positions again. Together, these signals suggest that more SOL is becoming available for potential selling just as technical support weakens.

Sponsored

Sponsored

Staking Collapse Meets Descending Channel Breakdown Risk

Solana’s latest weakness is being reinforced by a sharp drop in staking activity. The Solana staking difference metric tracks the weekly net change in SOL locked in native staking accounts. Positive values show new staking, while negative readings indicate net unstaking.

In late November, long-term conviction was strong. During the week ending November 24, staking accounts recorded net inflows of over 6.34 million SOL, marking a major accumulation phase.

That trend has now fully reversed. By mid-January, weekly staking flows had turned negative. The week ending January 19 showed net unstaking of around –449,819 SOL. By February 2, this had worsened to –1,155,788 SOL, a surge of roughly 150% in unstaking within two weeks.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This means a growing amount of SOL is being unlocked from staking and returned to liquid circulation. Once unstaked, these tokens can be moved to exchanges and sold immediately, increasing downside risk.

This collapse is happening as price trades near the lower edge of its descending channel with a 30% breakdown possibility in play.

Sponsored

Sponsored

With SOL hovering near $96, the combination of technical weakness and rising liquid supply creates a dangerous setup. If selling accelerates, the channel support may not hold.

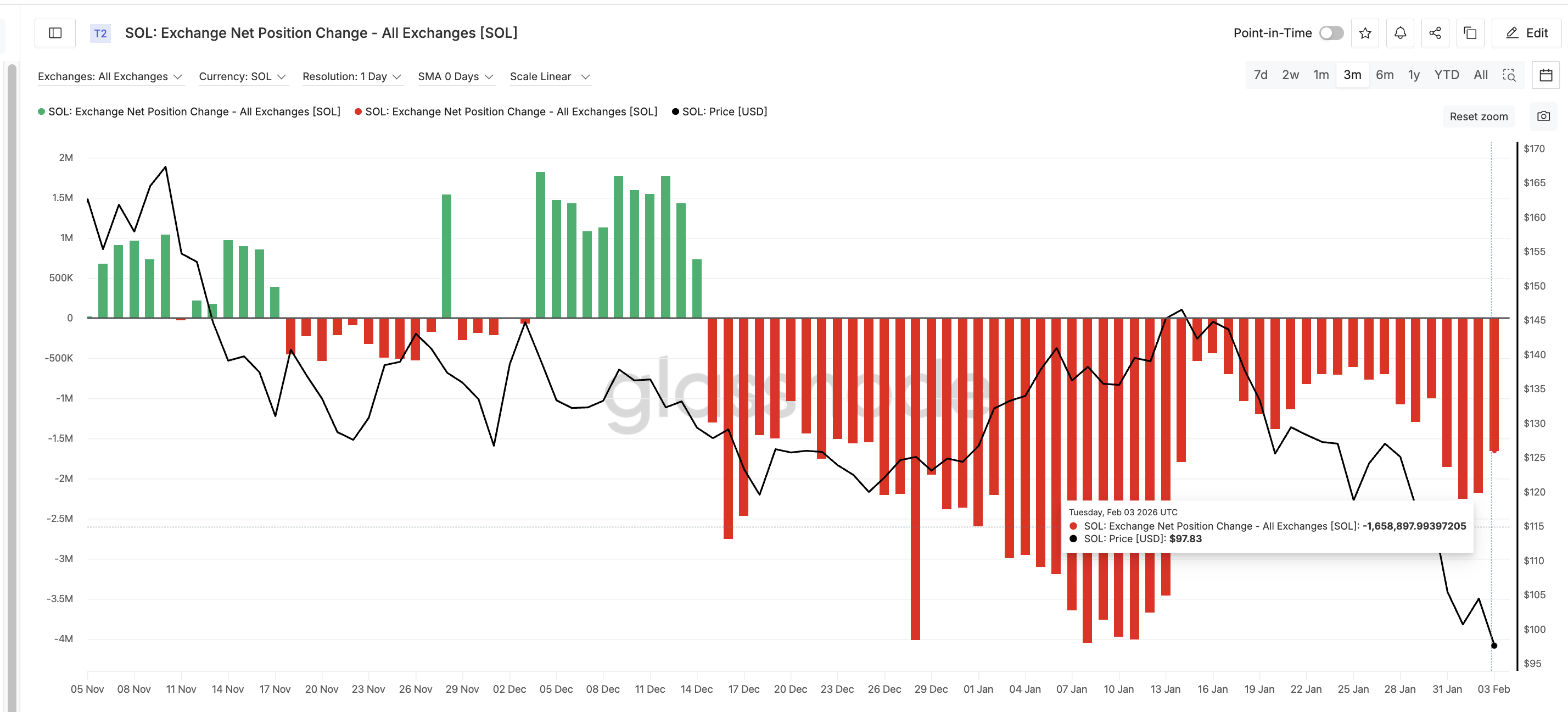

Exchange Buying Slows as Speculators Increase Exposure

Falling staking activity is now being reflected in exchange flows. Exchange Net Position Change tracks how much SOL moves onto or off exchanges over a rolling 30-day period. Negative values indicate net outflows and accumulation, while rising readings signal slowing demand.

On February 1, this metric stood near –2.25 million SOL, showing strong buying pressure. By February 3, it had weakened to around –1.66 million SOL. In just two days, exchange outflows dropped by nearly 26%, signaling that accumulation has slowed.

Sponsored

Sponsored

This decline in buying is occurring as unstaking accelerates, increasing the amount of SOL available for trading. When supply rises while demand weakens, the price becomes more vulnerable to sharp declines.

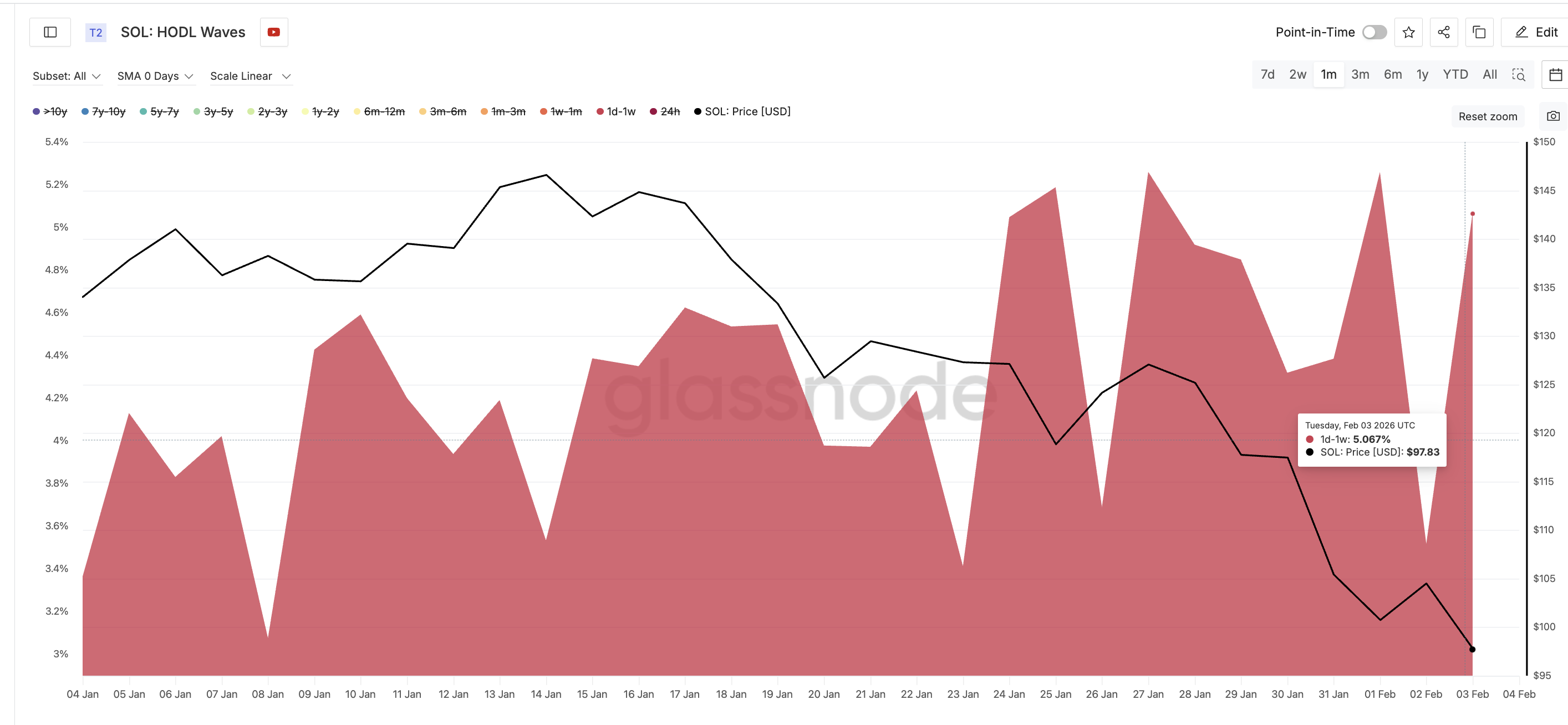

At the same time, speculative activity is rising.

HODL Waves data, which separates wallets based on holding time, shows that the one-day to one-week cohort increased its share from 3.51% to 5.06% between February 2 and February 3. This group represents short-term Solana holders who typically enter during volatility and exit quickly.

Similar behavior appeared in late January. On January 27, this cohort held 5.26% of the supply when SOL traded near $127. By January 30, their share dropped to 4.31% as the price fell to $117, a decline of nearly 8%.

This pattern suggests that speculative money is positioning for short-term bounces rather than long-term holding, increasing the risk that bounces will fade.

Sponsored

Sponsored

Key Solana Price Levels Still Point to $65 Risk

Technical structure continues to mirror the weakness seen in on-chain data. SOL remains locked inside a descending channel that has guided price lower since November. After losing the critical $98 support zone, the price is now trading near $96, close to the channel’s lower boundary.

If this support fails, the next major downside target lies near $67, based on Fibonacci projections. A deeper move could extend toward $65, aligning with the full measured 30% breakdown of the channel.

On the upside, recovery remains difficult. The first level that Solana must reclaim is $98, followed by stronger resistance near $117, which capped multiple rallies in January. A sustained move above $117 would be required to neutralize the bearish structure.

Until then, downside risks remain elevated.

With staking collapsing, exchange buying weakening, and speculative positioning rising, more SOL is entering circulation just as technical support weakens. Unless long-term accumulation returns, Solana remains vulnerable to a deeper correction toward $65.

Crypto World

Lawsuits are piling up against Binance over Oct. 10

Social media sentiment continues to turn against Binance for its alleged role in crypto liquidations on October 10.

Immediately after October 10, traders were already threatening legal action. However, this year, new lawsuits and arbitrations look to be underway, along with numerous other complaints and legal setbacks.

A simple chart of crypto asset prices illustrates the reason for the dogpile of complaints against Binance.

Following months of clear correlation with broad indices like the S&P 500 and Nasdaq 100, crypto decoupled precisely on October 10 — and has trended downward ever since.

Read more: Binance’s $1B BTC buy fails to win back trust after Oct. 10

October 10 auto-deLeveraging

As the world’s largest crypto exchange, Binance had a unique role to play in October 10.

For example, flash-crash prices as low as 99.9% existed only on the exchange on that date, and it had just changed its pricing feeds and treatment of a major stablecoin, Ethena USDE.

Wintermute CEO Evgeny Gaevoy called Binance’s Auto-DeLeveraging prices “very strange,” while Ark Invest’s Cathie Wood blamed billions in crypto liquidations on a Binance “software glitch.”

A post with millions of impressions also called out errors in Binance’s pricing oracles for cross-margin unified accounts.

Ethena USDE played a particularly important role in Binance’s October 10 liquidations. After crashing to less than $0.67 on Binance, USDE has regained its $1 peg but has shed more than half its market capitalization since 10/10.

Binance attempts to restore confidence

Without admitting to responsibility, Binance nonetheless quickly — and voluntarily — agreed to pay huge sums of money to customers that suffered losses on that date.

Shortly after the event, Binance announced $328 million in compensation plus another $400 million worth of loans and vouchers.

In another attempt restore confidence amid the bearish knock-on effects of October 10, Binance announced in late January 2026 that it would use its entire $1 billion SAFU (Secure Asset Fund for Users) emergency reserve to buy bitcoin (BTC) over a 30-day period.

It has not helped much. The giant BTC buy failed to win back its fans-turned-critics, with negative topics about Binance still trending on social media on a nearly daily basis.

As pressure continues to build over the exchange’s role in the historic liquidation event, founder Changpeng Zhao has blamed fake social media and unrelated bitcoin traders for bearishness.

He also attempted to divert blame from Binance onto Donald Trump for the crash, saying, “It’s pretty clear that the tariff announcements preceded the crash, not Binance system issues or Binance doing anything.”

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Wall Street giant CME Group is eyeing its own ‘CME Coin,’ CEO says

CME Group CEO Terry Duffy has suggested the derivatives giant is exploring launching its own cryptocurrency.

In response to a question from Morgan Stanley’s Michael Cyprys during the company’s latest earnings call, Duffy confirmed the firm is exploring “initiatives with our own coin that we could potentially put on a decentralized network.”

The comment was brief and came in response to a question about the role of tokenized collateral. In response, Duffy first noted that the world’s largest derivatives exchange is carefully reviewing different forms of margin.

“So if you were to give me a token from a systemically important financial institution, I would probably be more comfortable than maybe a third or fourth-tier bank trying to issue a token for margin,” Duffy said. “Not only are we looking at tokenized cash, we’re looking at different initiatives with our own coin.”

The company is already working on a “tokenized cash” solution with Google that’s set to come out later this year and will involve a depository bank facilitating transactions. The “own coin” Duffy referenced appears to be a different token that the firm could “potentially put on a decentralized network for other of our industry participants to use.”

The CME declined to clarify whether this “coin” would function as a stablecoin, settlement token or something else entirely when asked by CoinDesk.

However, if such an initiative goes through, the implications are significant.

While CME Group has previously flagged tokenization as a general area of interest, CEO Terry Duffy’s comments this week mark the first time the exchange has explicitly floated the concept of a proprietary, CME-issued asset running on a decentralized network.

The firm is set to launch 24/7 trading for all crypto futures in the second quarter of the year, and is also set to soon offer cardano, chainlink and stellar futures contracts.

CME’s average daily crypto trading volume hit $12 billion last year, with its micro-ether and micro-bitcoin futures contracts being top performers.

The launch wouldn’t make CME the first traditional finance giant to launch its own token. JPMorgan has recently rolled out tokenized deposits on Coinbase’s layer-2 blockchain Base via its so-called JPM Coin (JPMD), quietly rewiring how Wall Street moves money.

Crypto World

Bitnomial Lists First US-regulated Tezos Futures

The Chicago-based cryptocurrency exchange Bitnomial has launched futures tied to Tezos’s XTZ token, marking the first time the asset has a futures market on a US Commodity Futures Trading Commission-regulated exchange.

According to Wednesday’s announcement, the futures contracts are live and allow institutional and retail traders to gain exposure to XTZ (XTZ) price movements using either cryptocurrency or US dollars as margin.

Futures contracts let traders hedge risk or gain price exposure by agreeing to buy or sell an asset at a set price on a future date, without holding the asset itself.

Regulated futures markets are often viewed as a prerequisite for broader institutional participation in the US, including potential spot exchange-traded funds (ETFs), because they provide standardized price discovery and oversight under the CFTC.

“CFTC-regulated futures market with six months of trading history checks a key box under the SEC’s generic listing standards for spot ETFs,” Bitnomial president Michael Dunn said.

Dunn told Cointelegraph the company is “actively looking at new tokens” for potential US institutional and retail derivatives markets, but declined to comment on specific assets.

Previously, Bitnomial listed US-regulated futures tied to assets including Cardano (ADA), XRP (XRP) and Aptos (APT), positioning it among the few venues offering regulated crypto derivatives beyond Bitcoin (BTC) and Ether (ETH) in the US.

Bitnomial’s push to list futures tied to altcoins has not been without regulatory hurdles. In August 2024, the exchange sought to self-certify XRP futures with the CFTC, but the Securities and Exchange Commission (SEC) objected, arguing the contracts required registration as a securities exchange.

After suing the SEC in October 2025 and later dropping the case, Bitnomial launched XRP futures in March, citing the agency’s evolving approach to crypto policy.

Related: CFTC issues no-action letter to Bitnomial, clearing way for event contracts

A brief history of Tezos

Tezos’ mainnet launched in June 2018 following a 2017 initial coin offering that raised about $232 million in Bitcoin and Ether. While not the first proof-of-stake blockchain, Tezos was among the earliest layer-1 networks to combine proof-of-stake with formal onchain governance, enabling token holders to approve protocol upgrades that allowed the network to evolve without hard forks.

During the 2021–2022 non-fungible token boom, the blockchain carved out a niche as a lower-cost, energy-efficient alternative to Ethereum for minting and trading NFTs. As Ethereum gas fees surged, artists and game publishers such as Ubisoft gravitated to Tezos, citing lower transaction costs and the network’s proof-of-stake design.

During these years, Tezos also secured high-profile sports partnerships with Red Bull Racing and McLaren Racing, and was later reported to be preparing a multi-year training kit sponsorship with Manchester United valued at more than $27 million per year.

Tezos’ native token, XTZ, hit an all-time high of $9.12 in October 2021, according to CoinGecko data, but has since fallen about 95% and is now trading around $0.46.

On Jan. 25, Tezos implemented its Tallinn protocol upgrade, cutting base-layer block times to six seconds as part of the network’s 20th onchain upgrade.

Magazine: Bitcoin is ‘funny internet money’ during a crisis: Tezos co-founder

Crypto World

Can DOGE and SHIB Crash to $0 in 2026? 4 AIs Make Predictions

Can 2026 turn out to be a devastating year for the biggest meme coins?

The meme coin sector has been deeply impacted by the latest crypto collapse, with its market capitalization plummeting below $40 billion.

We consulted four of the most popular AI-powered chatbots about whether the crisis will continue and specifically asked whether Dogecoin (DOGE) and Shiba Inu (SHIB) could crash to $0 sometime this year.

The Chances are Small

According to ChatGPT, there is a theoretical possibility, although it is extremely doubtful, for the biggest meme coins (in terms of market cap) to nosedive to zero.

It reminded that the tokens trade actively on major exchanges and have millions of holders, and that is unlikely to change in 2026. At the same time, given current market conditions, ChatGPT suggested that a deeper crash could occur in the following months.

“DOGE and SHIB are among the most widely held cryptocurrencies in the world. Millions of wallets hold these assets, many with no intention of selling at extremely low prices. This creates a distributed supply base, reducing the odds of a total demand vacuum. Even during prolonged bear markets, a subset of holders continues to transact, stake (where applicable), or speculate,” it stated.

Grok – the chatbot integrated within X – claimed a collapse to $0 can’t be ruled out in extreme scenarios. However, it predicted that DOGE and SHIB can stabilize later in 2026 if Bitcoin (BTC) rebounds and hype returns.

“DOGE might hover around $0.10–$0.15, and SHIB could aim to “delete a zero” (reach $0.00001+) with burns and upgrades,” it forecasted.

Not a Chance at All

Google’s Gemini explained that for a cryptocurrency to hit zero, it must have zero buyers and be delisted from all leading exchanges. It stated that such a development is unlikely for several reasons.

First, Dogecoin has made significant progress in the past years, and there are even approved spot DOGE ETFs in the US. It is also Elon Musk’s favorite cryptocurrency, while Shiba Inu has evolved into a complex ecosystem with a vast and devoted community.

You may also like:

Perplexity predicted that smaller meme coins may plummet to $0 in 2026, but it won’t be DOGE or SHIB. The chatbot even envisioned a potential spike to $0.50 and even $1 for Dogecoin in the coming months should hype return. It outlined a less bullish prediction for SHIB, assuming that its price may pump by a maximum of 20% this year.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin Slides to Lower Lows After Failed $76,000 Relief Bounce

Bitcoin (CRYPTO: BTC) slipped to fresh lows not seen since late 2024 after a wavering relief bounce failed to sustain momentum, with the asset testing new pressure near the $72,000 area as US traders returned to the desk. Data feeds from TradingView highlighted weakness in the US session, with dips briefly pushing BTC beneath $73,000 and lighting up the $72,000 mark on major venues such as Bitstamp. The move underscored a broader risk-off tone in macro markets, where gold struggled to reclaim lofty levels and equities drifted lower at the open. Traders and analysts alike flagged a potential safety net around the 200-week exponential moving average (EMA) near $68,000, a level that has historically been watched as a long-term anchor during drawdowns.

Key takeaways

- Bitcoin breached the previous Tuesday low, slipping to a sub-$73,000 print as Wall Street opened and sellers resurfaced.

- The broader macro backdrop cooled, with precious metals giving back gains and equity indices under pressure in the early session.

- Analysts emphasized the importance of the 200-week EMA around $68,000 as a potential long-term support line, should selling intensify.

- Market participants warned that ongoing volatility could push BTC toward psychological and technical levels that have historically invited capitulation bids or further setbacks.

- Uncertainty surrounding U.S. fiscal policy—specifically government funding deadlines—kept headlines active and contributed to headline risk over the near term.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. The slide into sub-$73,000 territory and the failure of a relief rally reinforce a cautious to bearish stance among traders.

Trading idea (Not Financial Advice): Hold. The market is weighing potential further downside against possible stabilizations near key moving averages, warranting patience before committing to new longs.

Market context: The move comes as a broader risk-off environment takes hold, with macro assets showing renewed sensitivity to headlines and policy signals. Traders will be watching for continued liquidity shifts, near-term fiscal risk headers, and how these factors affect risk assets across crypto and traditional markets.

Why it matters

The latest price action illustrates how Bitcoin continues to trade in a high-volatility regime where macro headlines and on-chain signals interact in real time. The retreat below $73,000, following a brief relief rally above $76,000, signals that buyers are not yet reclaiming the recent highs with sustained force. Technical observers point to the 200-week EMA near $68,000 as a possible anchor if selling accelerates, given its historical role as a gravity point during prolonged pullbacks. The market’s attention on long liquidations—signaling aggressive positioning by leveraged traders—also underscores the fragility of near-term upside scenarios as risk appetite remains fragile.

Beyond price levels, the narrative is shaped by the broader macro context. Gold’s inability to recapture higher ground and the mixed performance of U.S. equities in early trading echo a risk-off mood that often spills into crypto markets. The scene is further complicated by a shifting policy backdrop in Washington. While a fresh government shutdown was avoided in the near term, the funding deadline extended only through mid-February keeps policymakers in the spotlight and potentially adds a layer of headline risk for financial assets, including BTC. In such moments, traders often search for wall-based support from familiar levels or moving averages, while hedging strategies come into play as a counterbalance to drawdown risk.

Industry commentary has reflected the ongoing difficulty of sustaining relief rallies in a market dominated by uncertain macro cues. Notably, market participants have flagged that recent price behavior resembles “bear market price action” rather than a durable bottoming process. The sense of urgency around downside risk was palpable across trading desks, with some analysts forecasting the next target in a scenario of continued weakness around the $50,000 to $60,000 region if macro conditions deteriorate further. The debate underscores how crypto markets are increasingly responsive to cross-asset dynamics, including shifts in precious metals, equities, and macro policy signals that set the tone for liquidity and risk tolerance across the sector.

What to watch next

- Watch BTC’s weekly close relative to the key levels around $74,000 and $68,000 (the latter aligning with the 200-week EMA) to gauge whether downside pressure accelerates or subsides.

- Observe liquidity and leverage indicators, including any uptick in long liquidations near the $72,000–$73,000 area, which could signal renewed selling pressure.

- Monitor macro headlines, especially any updates on U.S. fiscal policy deadlines (Homeland Security funding extended through February 13) that could reframe risk sentiment in both crypto and traditional markets.

- Track relief-bounce dynamics: a sustained move back above the $76,000–$77,000 zone would be a meaningful sign of a shifting intraday risk appetite, while failure to do so could reinforce the bear case.

- Pay attention to data from on-chain analytics and market commentators who tie volume patterns to potential trend reversals; sustained high-volume declines typically indicate persistent selling pressure.

Sources & verification

- BTC price action and levels referenced via analyses that cite TradingView price feeds and Bitstamp data.

- Historical reference to the 200-week EMA near $68,000 as a potential long-term anchor.

- Market comments from QCP Capital’s Asia Color update on volatility and headline risk.

- Market commentary from traders on social channels and related coverage discussing bear-market price action and resistance levels.

- Liquidation metrics from CoinGlass indicating ongoing long liquidations and total crypto liquidations.

Bitcoin price action and macro backdrop

Bitcoin (CRYPTO: BTC) faced renewed selling pressure after briefly testing higher ground, with the asset sliding back toward the lower end of the recent trading band as the U.S. market reopened. The intraday trajectory pointed to a deeper tilt toward risk-off dynamics that have characterized much of the recent price action in crypto, equities, and precious metals. A key focus for traders has been whether BTC can sustain any bounce above the $76,000 level or if sellers reassert themselves and push the price toward the next major magnetic price point around $68,000—the approximate footprint of the 200-week EMA that market technicians often monitor for long-term support.

TradingView data showed the weakness extended into a sub-$72,500 print on main venues, reinforcing the idea that relief rallies have struggled to gain traction in the current environment. The pattern aligns with a broader narrative in which macro assets give back gains after brief recoveries, as evidenced by gold failing to reclaim a higher plateau and U.S. stocks trading lower at the open. Within this framework, traders have looked to various anchors—technical, on-chain, and sentiment-based—to price the probability of further downside versus a potential stabilization or rebound.

Several observers have emphasized the persistence of bear-market price action, citing high-volume moves down as a signal that selling pressure remains dominant when price moves lower. A popular chart-focused view suggests that if BTC closes under the $74,000 threshold, the next meaningful objective could shift toward the $50,000–$60,000 area, a scenario that several analysts deem plausible given the current macro setup. In the meantime, market participants cited a potential safety net around $68,000, anchored by the 200-week EMA, a level that has historically attracted buyers during extended retreats. The market’s mood remains cautious, with risk tolerance tightly tethered to evolving macro headlines and policy signals.

“Ugly interim weekly candle for bulls. IF we close sub 74k – its safe to say 50k area is next,” trader Roman wrote in his latest analysis on X.

Beyond the price action, the market remains sensitive to policy developments and funding timelines, with headlines about government funding continuing to influence risk appetite. In a related note, the broader crypto ecosystem continues to digest liquidity dynamics, with long-liquidation pressure mounting whenever price breached key support zones. The combined effect is a landscape where investors weigh the probability of a sharp drawdown against the possibility of a sustained base-building phase that could set the stage for a longer-term recovery should macro conditions cool and liquidity improve.

Crypto World

XRP price risks drop below $1.50 amid crypto market crash

- Ripple’s XRP dropped nearly 5% in 24 hours and 20% in the past week.

- Bitcoin’s dip to $72,900 saw XRP come close to breaking below $1.50.

- XRP saw over $19 million in ETF inflows on February 3, 2026.

XRP has fallen sharply, shedding about 20% over the past week to trade near the critical $1.50 level.

The Ripple cryptocurrency, which has declined by about 5% over the past 24 hours amid a broader crypto market downturn, risks dipping below a key level despite witnessing a fresh uptick in exchange-traded fund inflows.

Overall bearish pressure has led the cryptocurrency market cap to drop to $2.66 trillion, with the crash on “Black Sunday II” having plummeted Bitcoin to under $73,000 on Wednesday.

Meanwhile, top altcoins such as Ethereum, BNB, and Solana have also sold off significantly.

ETH, SOL and BNB dropped to $2,100, $91 and $727 respectively on Wednesday.

Key triggers include President Trump’s tariff threats, panic sell-offs amid a risk asset dip, and negative reaction to Federal Reserve policy fears and the recent nomination of Kevin Warsh as the next Fed chair.

Institutional ETF inflows have failed to stem the downside action.

XRP price slips towards $1.50

XRP’s slide to near $1.53 across major exchanges amid risk-off sentiment means that another slip could push prices lower.

Data shows Ripple futures open interest currently averages $2.53 billion, and aligns with the shrinking retail demand and trader caution.

Per CoinGlass data, OI has shrunk from over $8.3 billion on October 10, when a bloodbath pushed XRP price from above $2.80 to under $2.30.

Sellers have since seen prices hit lows under $1.55, with the downside accelerating since January 6, 2026, when prices retested the $2.30 level.

A dip in OI points to a sustained decline in retail interest, which has previously impacted bulls.

The trend holds despite digital asset investment products, including spot XRP ETFs, seeing notable cumulative inflows over the past week.

Spot XRP ETFs also attracted net inflows on Tuesday, with about $19.4 million in net inflows.

What’s next for the Ripple (XRP) price?

Bitcoin’s drop to $72.8,000 exacerbates the bearish outlook, despite the swift bounce as investors reacted to developments that prevented a US government shutdown. However, bears are still in control.

XRP has lost over 33% in the past month, hitting $1.53 on February 4 and extending declines from January highs around $2.35.

Analysts say $1.53-$1.50 is a potential key reload zone, but buyers must absorb the likely pressure.

Bearish risks persist amid macro caution, and another leg down might potentially see sellers test lows of $1.25. However, the upside amid a bullish divergence has $1.59 as a key pivot towards $2.00.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech11 hours ago

Tech11 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World20 hours ago

Crypto World20 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards