CryptoCurrency

Solana Falls 3% Despite $1.3 Billion in Weekly Stablecoin Inflows

Join Our Telegram channel to stay up to date on breaking news coverage

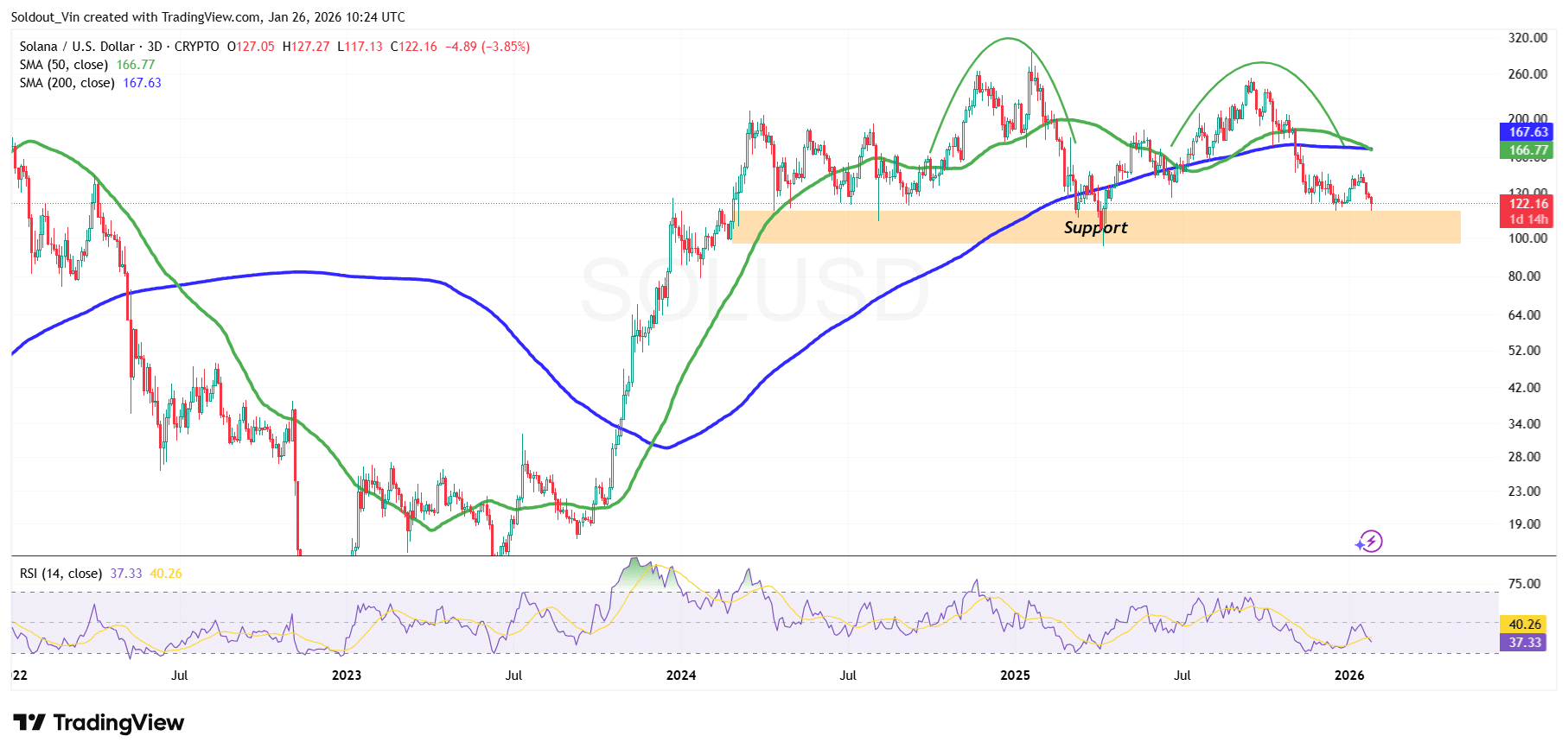

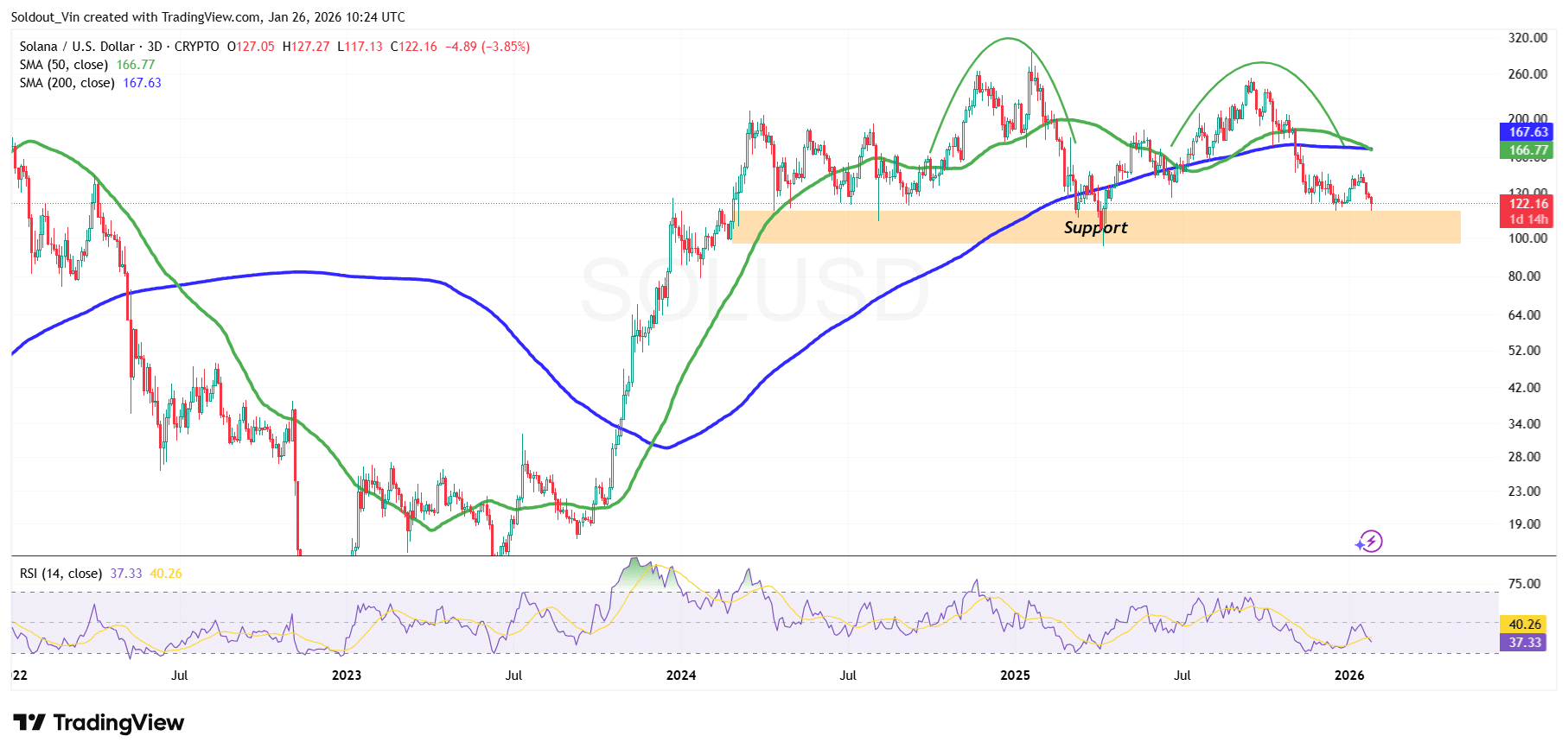

Solana price dropped below a crucial support level around $123 on Monday morning, as BTC and most altcoins faced rejection. SOL plummeted to an intraday low of around $117.75, as it faced a hurdle within the $126.84 level, according to Coingecko data.

This level marks its lowest since December 2025, and is over 58% below the September high of $253.

SOL is down 3.7% over the last 24 hours, trading at $122.16 as of 05:24 a.m. EST. However, trading volume has skyrocketed by 319% to $6.7 billion, a sign that trading activity is increasing.

The drop in the price comes even as Solana’s weekly stablecoin inflows clocked in over $1.3 billion.

Solana Attracts $1.3B in Stablecoin Inflows

Solana has recorded the largest stablecoin inflows across all blockchains over the last week, adding around $1.3 billion in new stablecoin supply, according to data from Artemis.

Such a trend signals growing capital flows into Solana and a shift toward the blockchain for faster, more active transactions. Therefore, liquidity continues to build on its DeFi ecosystem.

Based on the data, the Ethereum ecosystem has experienced an outflow of around $3.4 billion from the stablecoin supply, marking one of the largest weekly outflows in recent months and highlighting a change in user behavior.

The shift from other blockchains to Solana can be attributed to its lower fees and higher throughput compared to Ethereum, often described as the most expensive blockchain in the crypto space.

As the SOL price remained on edge, fundamentals still remained strong ahead of the upcoming Alpenglow upgrade in February or March.

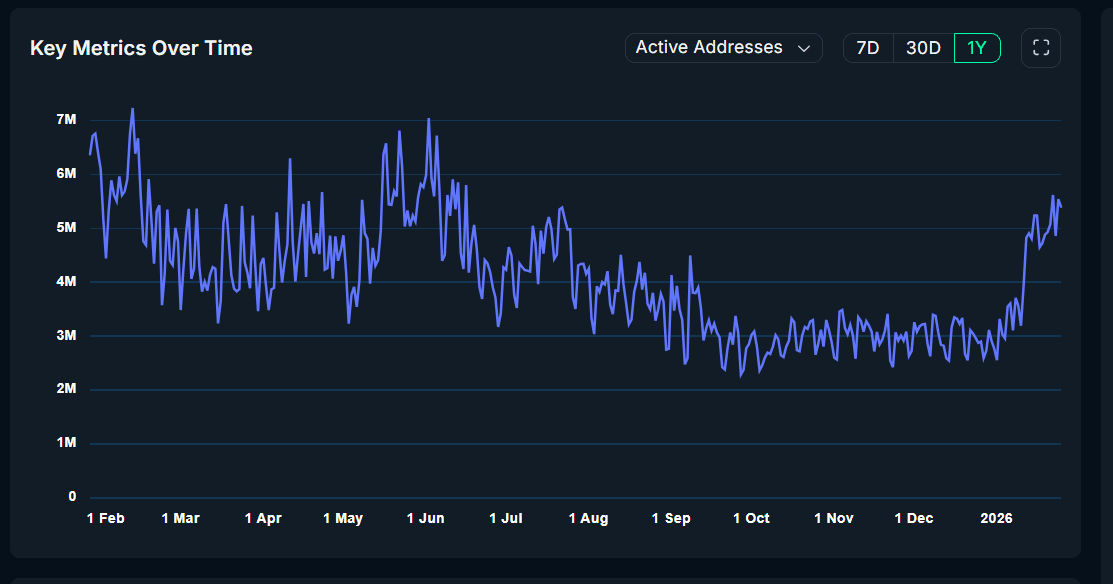

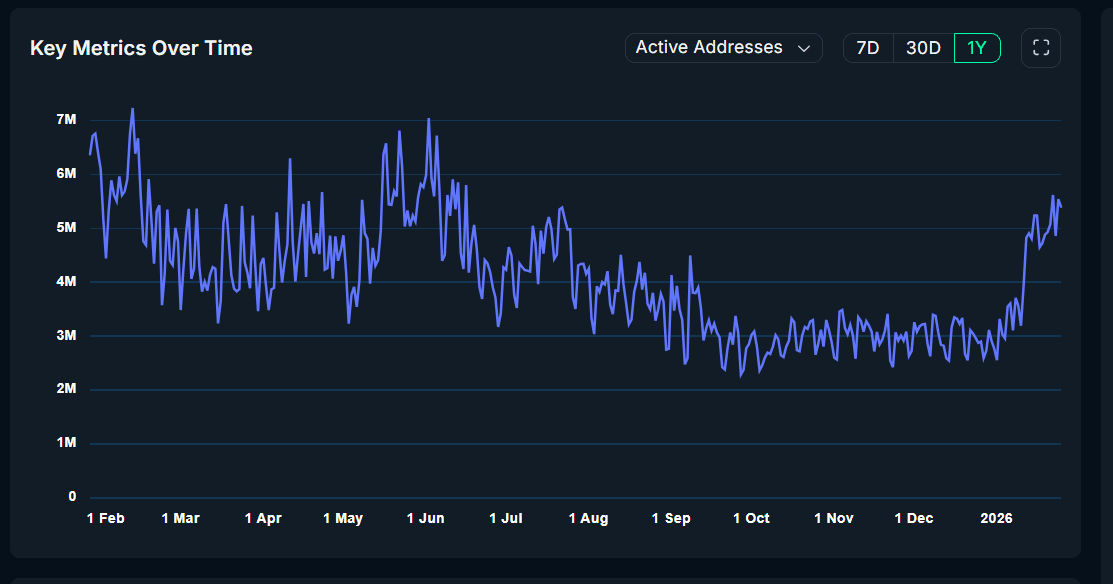

Solana’s metrics are jumping and are far better than those of other blockchains, according to Naansen data.

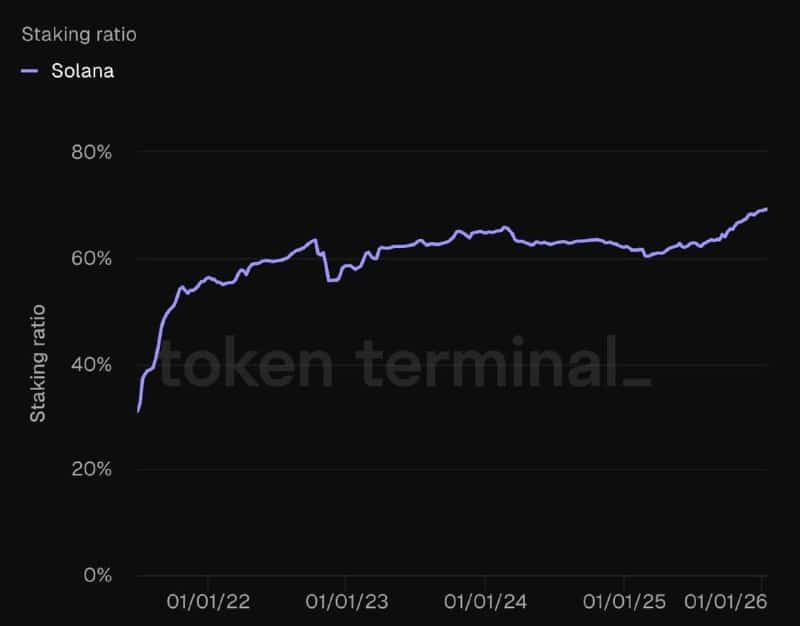

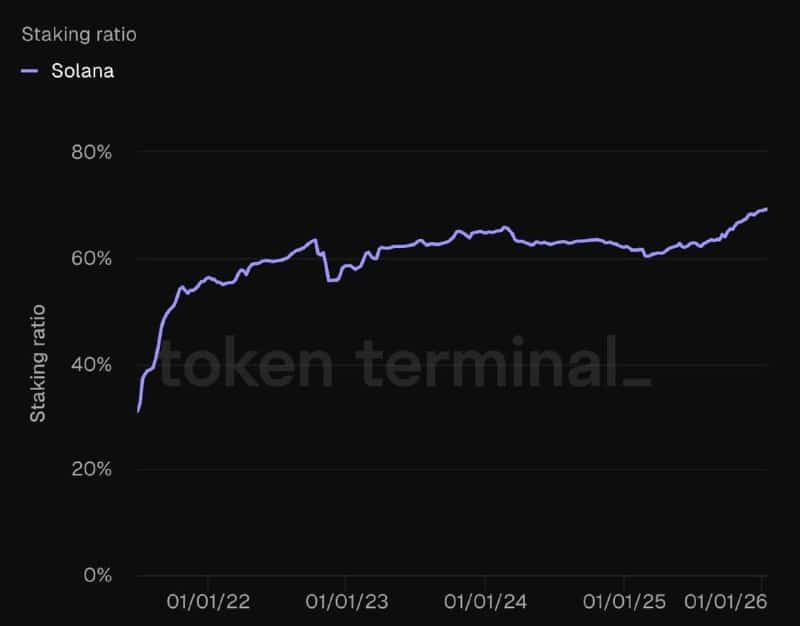

Meanwhile, staking activity surged to an all-time high of 70%, with over $60 billion worth of SOL staked. This shows strong conviction from long-term holders, signaling that investors were committed to the network’s future.

With fundamentals turning positive, can Solana’s price recover from its 9% weekly drop?

Solana Price Still Under Bearish Pressure

Solana price is currently retracing into the $120 demand zone, an area that has previously acted as a weekly consolidation base.

SOL remains below both the 50-day and 200-day Simple Moving Averages (SMAs) on the weekly chart, indicating the price is still under bearish pressure.

Recent price behavior shows SOL moving sideways within a broader range, with buyers consistently stepping in around the $120–$130 region. This repeated defense suggests longer-term market participants continue to accumulate, even as shorter-term traders reduce exposure.

The bearish pressure has been driven by SOL’s price forming a double top pattern, which could signal a further decline.

Meanwhile, the 50-day SMA has crossed below the 200-day SMA, forming a death cross around the $167 level amid the recent drop from above the $130 area.

Momentum indicators support this view. The weekly RSI is currently at 37.33, following a recent drop that suggests sellers are still in control.

SOL is back trading within the $110-$125 support area, which has recently held the price since its dramatic rally back in 2023.

The death cross and falling RSI indicate the price is at risk of a further decline. If this happens, the price of SOL could keep dropping, risking a sustained plunge to the $110 support area in the coming days.

Conversely, the rising fundamentals could signal a recovery. In such a scenario, the Solana token would need to reclaim the 50-day SMA around $166. If this happens, the price of Solana could surge back to the $179 area, which has previously acted as support and is now acting as resistance.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage