Business

GreensKeeper Value Fund Q4 2025 Letter

Getty Images

Renewal

The Value Fund posted a return of +0.4% for 2025. (1) Our results were significantly dampened by currency headwinds; specifically, the weakening U.S. dollar created a drag of approximately -4.3% on full-year returns.

While we maintain a long-term policy of not hedging currency fluctuations to avoid high transaction costs, years like 2025 demonstrate the short-term volatility this can introduce to our results. We remain committed to this “long game” approach, as the cost savings of remaining unhedged historically outweigh these periodic fluctuations.

We trailed the broader markets in a year defined by continued upward momentum. The S&P/TSX led the charge with a +31.7% return, driven largely by its materials subsector (gold). In the U.S., the S&P 500 +12.5% and DJIA +9.7% also advanced. (2) For the S&P 500, performance was once again driven by a handful of names rather than broad participation.

The “Magnificent Seven” (Alphabet, Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA)) were responsible for 42% of the S&P 500’s gains. This distortion is evident when viewing the S&P 500 Equal Weight Index, which returned only 6.4%—a significant 6.1% lag behind its market-cap-weighted cousin. (3) The pervasiveness of price-insensitive passive indexing is likely exacerbating these effects.

We admire the business models of most of the Magnificent Seven and their dominance in technological innovation, particularly AI. We would happily own most of them at the right price—indeed, Alphabet has been a portfolio holding for years.

However, we remain grounded in the simple truth that even a wonderful business is not worth an infinite price. As this bull market matures, we hear increasingly exotic arguments designed to justify extreme valuations and irrational risk-taking. We listen politely to these latest variations of ‘this time is different,’ and simply allocate our capital elsewhere.

We were in good company. Other respected value managers, such as Terry Smith of Fundsmith, were similarly underweight the ‘Magnificent Seven’ and trailed the indices as a result. Like them, we refuse to abandon our discipline simply because the market has become expensive—and in some pockets, detached from reality.

Being out of step with the crowd is an occupational hazard for value investors. Even legends endure periods of doubt. Consider this prominent Barron’s cover story from December 1999, which argued that Warren Buffett had ‘lost his magic touch’ and become ‘too conservative, even passé. ’ The dot-com bubble burst just three months later, and this episode was quickly forgotten (but not by us). Buffett’s long-term track record—and the virtue of patience— speak for themselves.

Source: Barron’s, Dec. 27, 1999; Substack

In a market where valuations remain stretched, we deliberately prioritized capital preservation by trimming—or exiting—several positions that had reached our price targets. Our 2025 returns were also affected by a single poor stock pick—our investment in Fiserv—discussed in detail in the Portfolio Update below.

Mistakes are an unavoidable reality of investing. Rather than sweep them under the rug, we adopt Charlie Munger’s practice of rubbing our noses in them. It is an uncomfortable exercise, but it is the only way to truly learn and ensure that mistakes are not repeated.

The Value Fund has now delivered positive returns in 13 of its 14 years. While we are proud of this track record, we recognize that our 2025 performance lagged.

But like the seasons, each new year brings renewal. Few investors possess the discipline to stick with a strategy during periods of underperformance, particularly in the later stages of a bull market. I can assure you that we do.

We enter 2026 with a defensive posture—cash and equivalents currently represent 14.7% of the portfolio—and a firm belief that, over the long run, valuations matter.

Portfolio Update

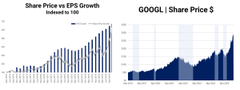

Our top performer in 2025 was Alphabet Inc. (GOOG) +64.8%. Alphabet had a volatile year, with its shares finishing the year 120% above the low reached in April. We have owned GOOG since 2018 and are no strangers to price swings (see the charts below). In our view, last year’s stock volatility was a textbook example of price decoupling from value—driven more by shifting market narratives and sentiment than by any material change in Alphabet’s underlying fundamentals or intrinsic value.

The dominant narrative of 2025 was the market’s evolving view of Alphabet’s search business in an AI-first world. Since ChatGPT’s launch in 2022, the prevailing fear has been that Google was late to the party and at risk of displacement, much as it displaced incumbents in prior decades.

We took the contrarian view, believing the market had written off the business too quickly. Alphabet still commands roughly 90% of web search, generates over $150bn in annual operating cash flow, and remains a magnet for world-class research talent. Its DeepMind division is at the leading-edge of AI-related breakthroughs. YouTube holds a dominant market share and is also a proprietary asset for training Gemini models.

As the year progressed, Alphabet silenced the doubters. The company aggressively transformed its research into consumer-ready products. Importantly, its proprietary Tensor Processing Units (TPUs) allowed the company to scale infrastructure far more efficiently than competitors. By using its own silicon, Google avoids the so-called “Nvidia Tax”—the steep markup competitors pay for third-party chips—giving it a structural cost advantage. This efficiency powered the deployment of Gemini 3, which by November was leading key performance benchmarks across text, image, and video.

Alphabet also launched and integrated AI Overviews and AI mode within search, the largest overhaul of its search product in many years, all while continuing to grow revenues at an attractive rate.

We believe Alphabet’s future remains bright. Its ability to distribute AI across a massive product suite used by billions, while self-funding infrastructure, is a formidable moat. However, as the stock appreciated rapidly, it approached our estimate of intrinsic value and grew to an outsized portion of the portfolio. Consistent with our discipline, we trimmed the position to manage risk, taking profits while maintaining GOOG as one of our largest holdings.

American Express (AXP) was our second-largest contributor in 2025, returning +24.7%. The company delivered consistent double-digit revenue growth, underpinned by the spending power of its premium consumer base.

Early signs from the platinum card refresh (and fee increase) launched in late Q3 were positive, and management expects the updated product to support growth in 2026. Strategic initiatives to court younger generations are paying off. Millennials and Gen Z accounted for 60% of global new account acquisitions. Moreover, these new members are active: their spending accelerated by 40% in the second half of the year. Crucially, this growth did not come at the cost of credit quality. Delinquencies remained low throughout the year, standing in stark contrast to the rising defaults seen at other issuers catering to less affluent consumers.

Compagnie Financière Richemont (CFRUY) was our third-largest contributor in 2025, gaining 41.8%. True to our original thesis, Richemont’s Jewelry Maisons (Cartier, Van Cleef & Arpels, and Buccellati) continued to outperform the broader luxury market.

A key development was the stabilization of the Chinese consumer. Sales in China turned positive in Q2 and Q3, ending a streak of quarterly declines dating back to 2023. With Asia accounting for a third of sales, and all other regions growing at double-digit rates, the revenue outlook is strengthening.

On the cost side, the surge in precious metal prices (gold +64%, silver +150%) presents a margin headwind. While Richemont possesses immense pricing power, management remains fiercely protective of brand stewardship. They have historically avoided aggressive price hikes that might later require reversals. While this discipline may sacrifice some short-term margin, it preserves long-term brand equity with customers.

This approach proved superior in 2025: while luxury peers eroded their brand value through discounting to clear inventory, Richemont maintained its prestige and pricing integrity. This long-term thinking is all too rare, and one of the things we like about the company’s management.

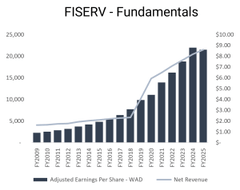

Our worst performer by far in 2025 was Fiserv Inc. (FISV), which declined 67.3%. To put it bluntly: we got this one wrong. Our thesis collapsed due to a combination of deteriorating fundamentals and a material reassessment of past growth quality.

New management peeled back the curtain in Q3, revealing that the double-digit organic growth of recent years was an illusion fueled by Argentine inflation accounting. When adjusted, growth was less than half of what was reported. This implies that rather than gaining share as we believed, Fiserv had been ceding ground to competitors. Worse, it appears prior management ‘borrowed’ from the future to boost short-term earnings—pressuring legacy clients, hiking prices aggressively, and starving core banking platforms of investment. To say that we felt misled is an understatement.

Following these disclosures, we completely re-underwrote the investment. We have lowered our intrinsic value estimate to reflect the lower growth profile and the capital required to fix the business. However, with the stock trading at 8x earnings and a 13% free cash flow yield, we believe that pessimism is fully priced in.

We support the new management team’s efforts to ‘right the ship’—including rolling back price hikes and resuming necessary investments—even though these moves will weigh on near-term results.

We have maintained our position—for now—but our categorization of Fiserv has changed. We no longer view the company as a long-term compounder. We now view the stock as an opportunistic value investment and will look to exit as it approaches our revised price target.

Our second-largest detractor was Lululemon Athletica (LULU), down 45.7%. The decline reflects concerns over the sustainability of growth: while the company grew 7% globally, same-store sales in the Americas contracted by approximately 5%.

Our assessment suggests the brand remains healthy, but execution faltered. Product launches lacked the ‘newness’ needed to engage U.S. consumers. We view the upcoming Spring 2026 collection—the first under the new Creative Director—as a critical test of the company’s ability to correct this misstep. International same-store sales continue to grow quickly, and LULU is set to expand further into Europe and Asia in 2026.

The stock faced an additional external shock from U.S. trade policy. The removal of the ‘de minimis’ exemption hit Lululemon uniquely hard, as the company fulfilled nearly 70% of its U.S. e-commerce orders from Canadian distribution centers that previously enjoyed duty-free status. This change compressed margins by approximately 4%. If our view of the brand’s pricing power holds true, Lululemon should be able to recapture these margins over time through logistics adjustments and selective price increases.

Late in the year, the company announced a significant leadership transition: CEO Calvin McDonald will be stepping down, and the Board has initiated a search for his successor. We remain convinced that the brand equity is intact. The path to recovery is clear: a return to the product-first, technical innovation that built Lululemon’s reputation. If the company executes on this ‘back to basics’ strategy, we expect the Americas segment to resume its growth trajectory and the stock to rerate.

We were relatively active with the portfolio during the year. Driven by a widening disparity in valuations, we completely sold out of four positions: Vertex Pharmaceuticals (VRTX), Merck & Co. (MRK), Check Point Software Technologies Ltd. (CHKP) and CBOE Global Inc. (CBOE)—and initiated three new ones highlighted below.

In our view, the market is underappreciating the durability and breadth of Novo Nordisk’s (NVO) GLP-1 franchise relative to the massive global obesity opportunity. This thesis was bolstered shortly after year-end, when Novo launched the oral formulation of Wegovy in the U.S. to early signs of strong demand. The stock is up 22% YTD in 2026 as of writing.

Since publishing our thesis on Icon PLC (ICLR) in May, the industry backdrop has begun to improve. Large pharmaceutical companies have signed agreements with the Trump administration, providing much-needed clarity on tariffs and drug pricing policy. Simultaneously, biotech activity picked up in the second half of the year—particularly for Phase II and III assets—which sets the stage for a stronger 2026 for contract research organizations (CROs) like Icon.

ICLR has recovered from the lows seen in May, but the company is still managing through elevated cancellations. Gross business wins remain in line with peers, suggesting the company’s competitive positioning remains intact. Once the elevated cancellations flow through the backlog, revenue growth should reaccelerate.

Our most recent addition to the Value Fund is Adobe Inc. (ADBE). Like much of the software sector, Adobe struggled in 2025 under the weight of a prevailing narrative: that Generative AI will render its core creative suite obsolete. We believe this risk is vastly overstated and that Adobe is uniquely positioned to integrate AI models into its workflow, cementing its status as the standard-bearer for professional creatives. With the stock trading at just 16x earnings, revenue growing at ~10%, and the company aggressively repurchasing shares, the risk/reward setup was too favorable to ignore

The Value Fund finished 2025 with a net return of +0.4%. We ended the year with a defensive cash position of 14.7% and a total portfolio value of $57.3 million, which includes $18.9 million in unrealized gains.

We remain committed to long-term ownership. Our average portfolio turnover over the past five years is just 12.4%, implying an average holding period of roughly eight years. However, as noted earlier, our valuation discipline led us to trim several long-held winners this year. This resulted in realized capital gains, which were distributed to unitholders and automatically reinvested in additional units on December 31, 2025.

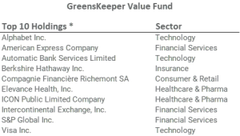

Additional performance statistics and disclosures follow this letter. A comprehensive snapshot of the portfolio will be provided to clients after MNP completes its audit of the Fund’s financial statements in March. Please see the table below for our top 10 holdings at year’s end.

Firm Update

Given the reception to our previous Virtual Town Hall, which you can watch here, we will be hosting another one this spring. We look forward to sharing the date and registration details in the coming weeks.

It has been an eventful year at GreensKeeper:

- GreensKeeper completed its registration with the US Securities and Exchange Commission (SEC). This expands our ability to take on additional U.S. clients. We are already adding to our client base and look forward to welcoming more international partners to our firm in 2026.

- Michael Van Loon is now registered as an Associate Portfolio Manager, is a CFA Level III candidate and continues to take on additional research, trading, and compliance responsibilities at the firm.

We believe true accountability comes from shared outcomes. Every member of our team has their entire investment portfolio positioned alongside yours. In my case, it accounts for the bulk of my net worth. This alignment ensures that our focus remains exactly where it should be: protecting capital and delivering attractive risk-adjusted returns. In an industry where few truly “eat their own cooking, ” we view it as a privilege to partner with our clients.

Thank you for your continued trust and for the opportunity to grow your wealth alongside our own

Michael P. McCloskey, President, Founder & Chief Investment Officer

Michael Van Loon, Associate Portfolio Manager

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.