CryptoCurrency

Ethereum Price Holds Steady Around $2,908 As Bitmine Adds ETH

Join Our Telegram channel to stay up to date on breaking news coverage

The Ethereum price has climbed by a fraction of a percentage in the last 24 hours to trade at $2908 after Bitmine disclosed another significant increase in its Ethereum holdings during the final week of January, adding to a growing trend of large-scale ETH accumulation by institutions and corporate entities.

According to a recent press release, the digital asset firm, chaired by market strategist Tom Lee, purchased 40,302 ETH last week, bringing its total crypto and cash holdings to approximately $12.8 billion as of January 25.

This purchase follows a similar acquisition just one week earlier, when Bitmine bought 35,268 ETH. In total, the company now holds about 4.2 million ETH, alongside 193 Bitcoin, and maintains $682 million in cash reserves. Bitmine’s Ethereum holdings represent roughly 3.52% of ETH’s total circulating supply. Of this amount, more than 2 million ETH is currently staked.

Tom Lee highlighted the scale of Bitmine’s staking operations, stating that the firm has staked more ETH than any other entity globally. Once all of Bitmine’s ETH is fully staked through MAVAN and its partners, the company expects to earn around $374 million annually in staking rewards, based on a 2.81% CESR. This translates to more than $1 million in daily staking fees.

Bitmine Raises Ethereum Stake

Beyond crypto assets, Bitmine also holds strategic equity investments. These include a $200 million stake in Beast Industries, the company behind YouTuber MrBeast, and $19 million allocated to high-risk “moonshot” investments. Tom Lee previously explained that the MrBeast investment aligns with Bitmine’s goal of driving broader mainstream adoption of Ethereum.

Despite the massive ETH accumulation, Bitmine’s stock (BMNR) declined following the announcement. BMNR is trading around $28.52, reflecting broader weakness in the crypto market as both Bitcoin and Ethereum face selling pressure. Ethereum has dropped below the key $3,000 support level and is trading near $2,900, erasing its year-to-date gains.

Meanwhile, Ethereum whale accumulation continues. Recent on-chain data shows new wallets purchasing tens of thousands of ETH, while institutions like World Liberty Financial have rotated funds from Bitcoin into Ethereum, signaling ongoing strategic shifts toward ETH despite short-term price weakness.

Ethereum Eyes Recovery After Testing Major Support at $2,880

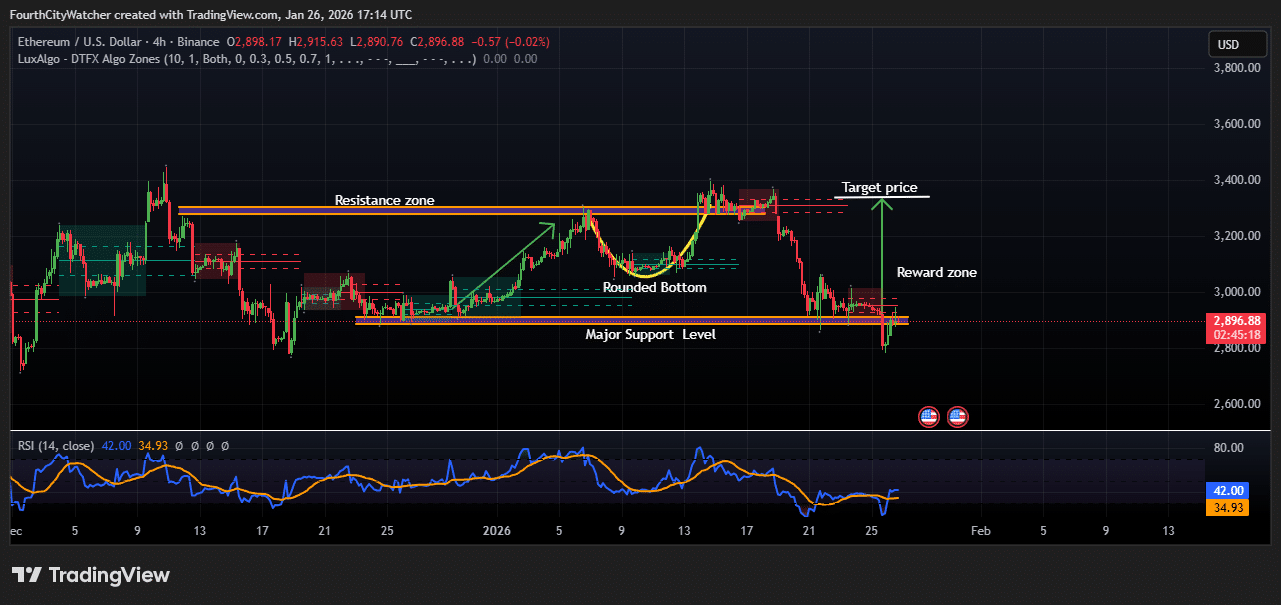

Ethereum price signals stabilization after a recent drop below the key $3,000 psychological level. The chart shows ETH is trading at $2,906, reflecting a modest 0.31% increase over the past 24 hours, as traders closely watch the cryptocurrency’s next directional move.

Analysis of the 4-hour chart highlights a critical major support level near $2,880, which has held multiple times over the past month. A bounce from this level suggests that buyers are stepping in to defend the price, creating a potential reward zone for short-term upward movements.

Traders are eyeing a possible rally toward the resistance zone around $3,300–$3,350, which aligns with previous swing highs and represents the target price for bullish momentum. The chart also reveals a rounded bottom pattern, which formed in early January and indicates accumulation and a potential reversal from bearish to bullish sentiment.

If this pattern plays out, ETH could test the upper end of the reward zone, offering traders a favorable risk-to-reward setup.

ETHUSD Chart Analysis. Source: Tradingview

The Relative Strength Index (RSI) currently reads 43.95, showing that ETH remains slightly below neutral territory but has begun to trend upward from the oversold region. This indicates that downward pressure may be easing, and momentum could gradually shift in favor of buyers if volume supports the move.

Despite short-term weakness, Ethereum continues to attract attention from institutional investors, and whale activity has intensified, signaling confidence in the mid- to long-term outlook. However, traders are cautioned that a failure to maintain support near $2,880 could open the door to further downside, potentially retesting $2,800 or lower.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage