CryptoCurrency

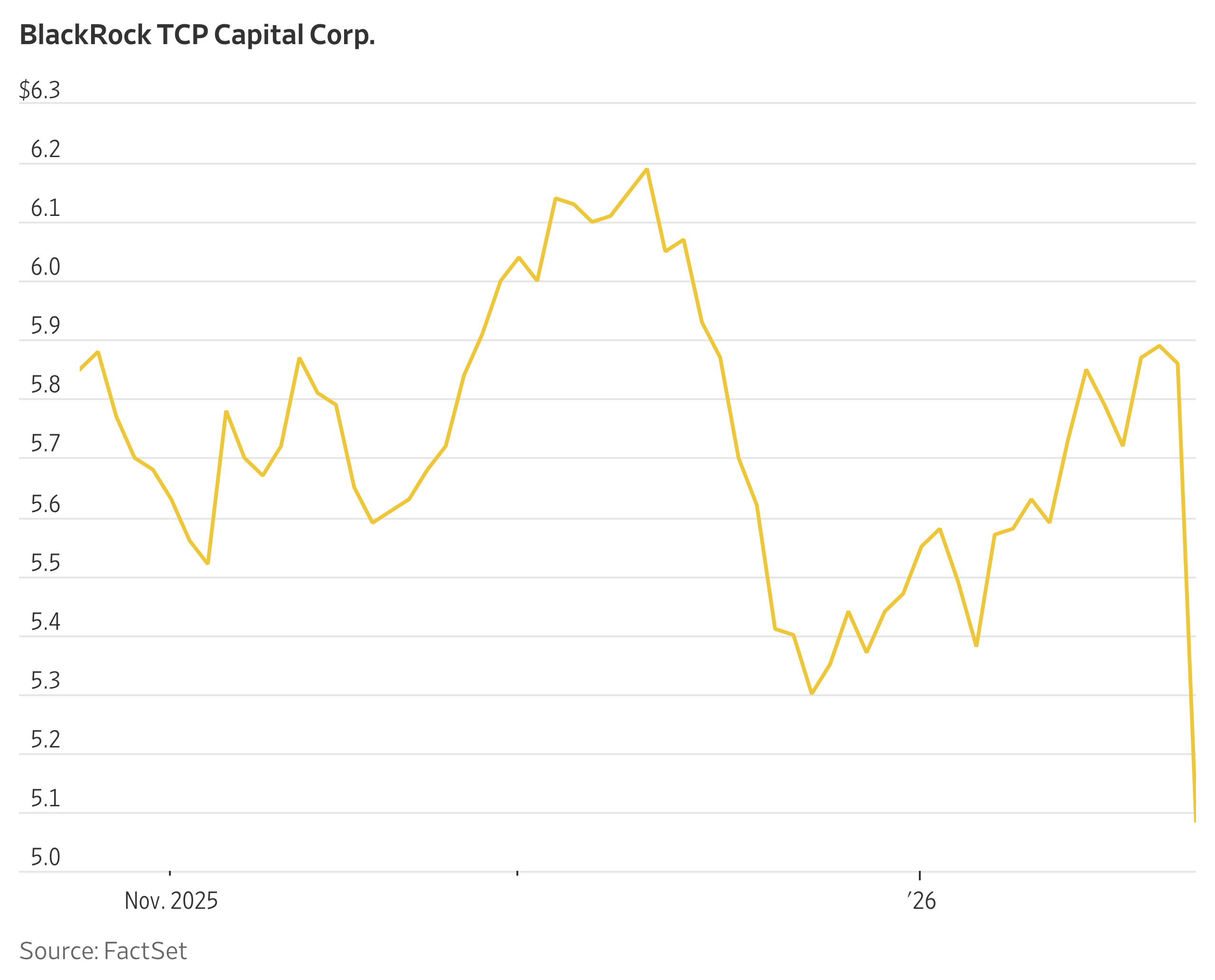

BlackRock Private Credit Fund Tanks

Mounting losses in a business development company managed by BlackRock sent prices of the fund’s stocks and bonds tumbling Monday, reflecting mounting investor angst about the private-credit market.

BlackRock TCP Capital disclosed late Friday a 19% decline in the net asset value of the private corporate loans it owns tied to a sharp rise in nonperforming loans to about 10% of its portfolio. The fund is one of several BDCs The Wall Street Journal highlighted in a report about troubled BDCs in December.

BDCs typically make high-interest loans to midsize corporations with junk credit ratings, using income from the loans to pay big dividends to their investors. The funds raise the money they lend out by selling shares and by borrowing cash in bond and loan markets.