Entertainment

Why Chet Hanks Wants to Make a ‘Strip Club’ Song With Mom Rita Wilson

Whether he’s in the studio or in front of the Netflix cameras, Chet Hanks is all about stretching his creativity muscle — especially if it includes a possible collaboration with his mom, Rita Wilson.

“I can’t afford her,” Hanks, 35, exclusively told Us Weekly of possibly working alongside his mother on Saturday, January 31, while attending the Clive Davis Pre-Grammys Gala at the Beverly Hilton Hotel in Los Angeles, California.

“I’d probably have to sign my life away,” he jokingly added of his mom’s affordability, before dishing on what type of collaboration he would be interested in.

“I don’t know, maybe we’ll have to do, like, a really ratchet, like, strip club song or something,” he continued. “I don’t know. You never know. I think she’s got it in her.”

Wilson, 69, who shares Chet and his brother Truman Hanks with husband and famed actor Tom Hanks, attended Saturday’s event alongside her son, who opened up to Us about how inspiring his mother has been in his own career. (Tom also shares son Colin Hanks and daughter Elizabeth Hanks with his ex-wife, Samantha Lewes.)

“It inspired me that she’s just, like, really gone for it,” Chet told Us on Saturday. “And I just think that you have to have that drive, and I could learn a lot from that, you know? I’m, like, I’m kind of torn between acting and music. My time commitments are kind of my obstacle.”

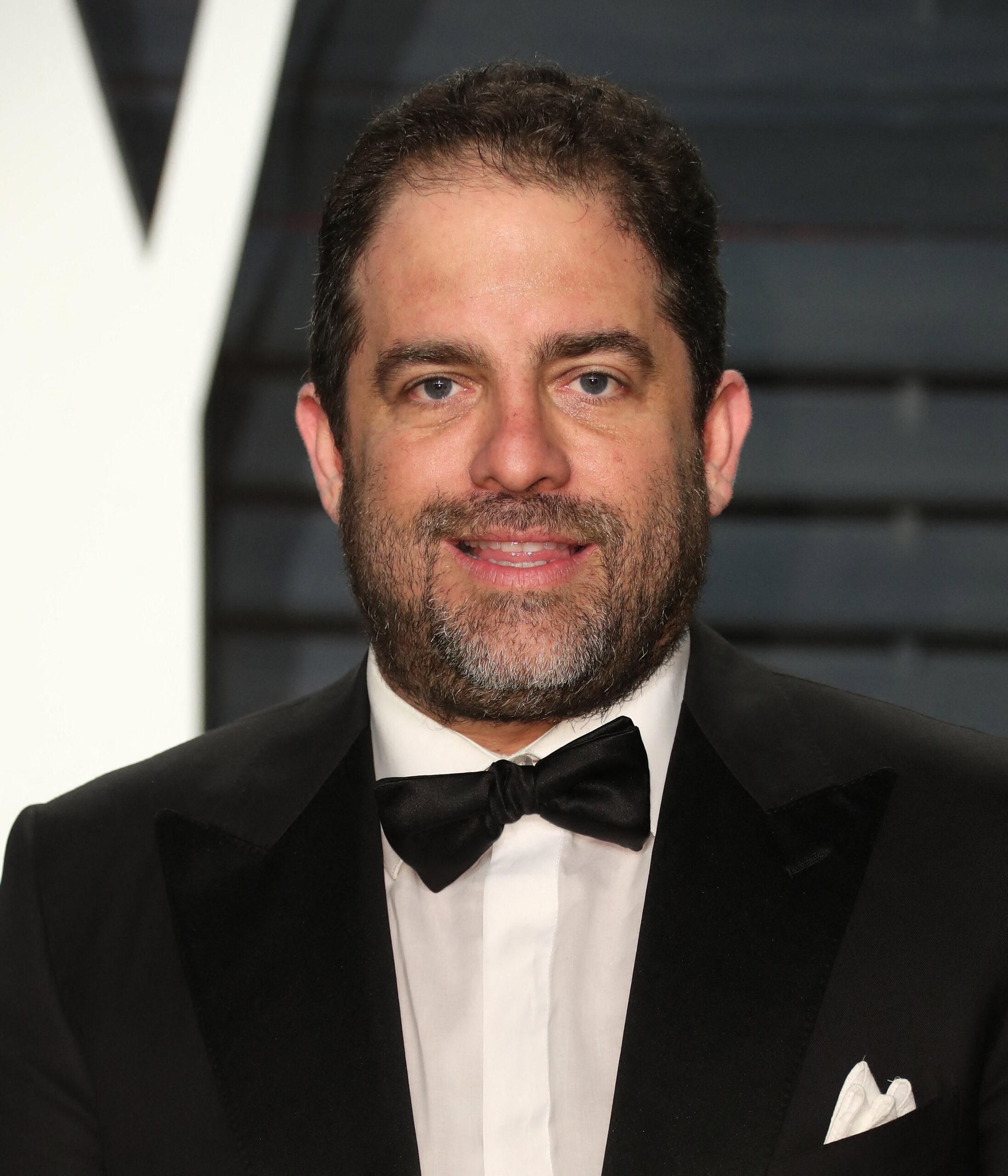

Chet Hanks and Rita Wilson Getty Images

He added, “You know, you really have to give 100 percent to whatever you’re doing, and I’m trying to give 100 percent to two things. But yeah, so I think it just requires you just to double down on your grind.”

Chet’s family has been by his side through his various ups and downs, including his public struggle with alcohol and substance abuse. In March 2025, the Running Point star talked to Us about what it meant to celebrate three years of sobriety.

“Everything. Everything,” he told Us at the time. “If I wasn’t sober, none of these opportunities would even be possible.”

He continued, “My advice is if you think you might have a problem, then you do have a problem. Because if you’re thinking about it, the chances are that you can make a change and you just need to stop thinking and just do it.”

On Saturday, Chet told Us that his past experiences is one of the reasons why he also draws inspiration from singer Jelly Roll, who has also been open about his previous substance abuse issues.

“Well, I’ve never worked with him, but I know him,” Chet said. “I’m really grateful to know him. He’s been really friendly and nice, and he’s inspired me just because he’s kind of an outsider to country music. And now he’s on top of it.”

He continued, “But you know, coming from … [I] think we kind of have some similar things in our past and our history and stuff, and it’s just awesome to see somebody break out in such a way, coming kind of from the outside of it.”

Entertainment

HBO Max's New Answer to 'The Bear' Sets the Stage for a 'Dawson's Creek' Reunion

The Bear has quietly become one of the biggest shows in the world in the last few years. The hit comedy, which is really more of a drama, has aired almost a new season every year since it first premiered in 2022, and it has left other streamers trying to replicate its Emmy-winning success. The show stars Jeremy Allen White (Deliver Me From Nowhere) and Ayo Edebiri (Opus) alongside Ebon Moss-Bachrach (The Fantastic Four: First Steps), and it follows a young chef from the fine dining world who returns home to Chicago after the death of his brother to take over his family’s sandwich shop.

Entertainment

Says She’s Not Transphobic (Video)

Nicki Minaj has sparked reactions after sharing why she believes she is not transphobic. Additionally, the rapper shared why she chose to place her support behind Donald Trump.

RELATED: Whew! Social Media Is Goin’ OFF After Nicki Minaj Called Herself Trump’s “Number One Fan” & Held His Hand At Account Summit (WATCH)

Nicki Minaj Says She’s Not Transphobic & Explains Trump Alignment

On Tuesday, February 3, a new episode of the ‘Katie Miller Pod’ was released via YouTube and featured Nicki Minaj as a guest. As the conversation opened, Minaj explained that she placed her support behind President Donald Trump after seeing “how he was being treated.”

“I felt that that same — a lot of that bullying and the smear campaigns, and all of that lying — I felt like that had been done to me for so many years. And I was watching it in real time happen to someone else, and I didn’t think he deserved it,” Minaj explained.

As the conversation continued, Minaj seemed to note that Trump expressed to her his respect for her fanbase and the LGBTQ+ community. Around nine minutes into the interview, Minaj shared her own stance, explaining that although she disagrees with pro-trans rhetoric being pushed in schools, she is not transphobic. Furthermore, she stated that she believes “adults” should be able to do what they’d like with their bodies.

See what she said below.

Social Media Is Sharing Reactions

Social media users reacted to Nicki Minaj’s comments about not being transphobic in TSR’s comment section.

Instagram user @1princessmehgann wrote, “Real barbz Know she isn’t transphobic”

While Instagram user @t.beezus added, “She literally said children … when was the community attacked ? Y’all lack basic comprehension !”

Instagram user @iyawoijebu wrote, “Nicky we judging you and we don’t care!”

While Instagram user @804.saucy added, “Yall not following … what she’s saying is kids shouldn’t have the option at such a young age to change their gender when they don’t even know what they want yet”

Instagram user @istayblessedxo wrote, “I think about 99% of America agrees with her on that. People should not be able to make a life changing decision like that until at least 21. If you’re can’t drink before 21 you shouldn’t be able to change your gender.”

While Instagram user @dijouncruz added, “The ‘Trans part of the LGBT’ pay attention ya’ll smh”

Instagram user @tarisunscripted wrote, “Please get her off my algorithm.”

While Instagram user @chanel__5 added, “She did say this but it’s the way you delivered it with a party that thrives off H8TE”

Before Nicki Minaj Shared That She’s Not Transphobic, She Sparked Reactions With Recent Donald Trump Alignment

Before Nicki Minaj shared that she’s not transphobic, she raised eyebrows with her apparent political alignment with Donald Trump. As The Shade Room previously reported, in November 2025, Minaj appeared at the United Nations. There, she noted her support of Donald Trump speaking on the alleged Christian persecution in Nigeria.

RELATED: Screenshot Appears To Show Tammy Rivera Calling Nicki Minaj A “Bootlicker” As Clip Resurfaces Of Charlie Kirk Saying Rapper Isn’t Good Role Model

Then, earlier this month, Minaj appeared at the Trump Account Summit. Additionally, she said she was the president’s “number one fan” and even held his hand.

RELATED: Birds Of A Feather? Waka Flocka Sparks Reactions With Message For Nicki Minaj Amid Shade Over Trump Support (PHOTO)

What Do You Think Roomies?

Entertainment

Inside Team USA’s Dramatic Journey to the 2026 Winter Olympics (Excl)

The 2026 Winter Olympics are officially here — and Team USA is arriving in Italy with star power, storylines and sky-high expectations.

As the world’s best athletes descend on Milan and Cortina d’Ampezzo, all eyes are on the Americans: from Ilia Malinin’s can’t-miss moment in men’s figure skating to Mikaela Shiffrin’s long-awaited redemption tour on the slopes, and Madison Chock and Evan Bates chasing gold as newlyweds in their fourth Olympic Games together.

With pressure mounting and history on the line, these athletes aren’t just competing for medals — they’re skating, skiing and sliding into some of the most defining moments of their careers.

Us Weekly spoke exclusively to some of Team USA’s biggest stars as they prepare to take center stage when the Milano Cortina Games kick off February 6.

Redemption Mode

Some of the most powerful Olympic stories are born from heartbreak.

In 2022, alpine skier Mikaela Shiffrin arrived in Beijing as a heavy favorite, expected to dominate the slopes. Instead, she suffered a stunning series of DNFs (Did Not Finish) and left without a medal. “A lot of people who were tuning into Mikaela Shiffrin for her biggest race were tuning in when I didn’t win a medal,” Shiffrin tells Us. “They were saying, ‘Don’t even come home. You failed us. You didn’t bring home any gold.’”

The emotional weight of that moment has stayed with her — and reshaped her perspective heading into 2026. “That’s the hardest thing or the most loaded thing, and I’m very aware of it now, emotionally and mentally,” she continues. “The hurdle I’ve been working on with my team and with my psychologist and with my family and everybody around me is: We could go to these Games and we could do everything right, and it could still go wrong.”

Now, coming off a dominant season that saw her make World Cup history, Shiffrin, 30, is embracing a different mindset. “Going into [the Olympics] as an athlete, you’ve really got to be open-minded,” she explains. “Now that we have all of this in- formation, all of this experience, could we boil it down a little bit and remember that we’re just ski racing here?”

Redemption is also front and center for the U.S. women’s figure skating team, which heads into Milan Cortina with unfinished business. After leaving Beijing without the gold many believed was within reach, the Americans are skating with something to prove — and the depth to do it.

Amber Glenn, Isabeau Levito and Alysa Liu headline a stacked field, blending technical firepower with hard-earned experience on the world stage. For these skat- ers, 2026 isn’t just another Olympic cycle — it’s a chance to turn lingering frustration into gold.

“If we do our jobs in Milan, then more than likely some- one is going to be up there,” Glenn has said of the podium.

American Pride

For many athletes, the Olympics represent more than medals — they’re a rare chance to unite a country.

“It’s one of the greatest honors to be able to go to the Olympics and represent the U.S.,” ice dancer Madison Chock, 33, tells Us. “For us being Americans, we have such pride in our patriotism and really, the American dream.”

That responsibility isn’t lost on veterans like hockey player Hilary Knight, who will compete in her fifth and final Games. “If you want to call us sports ambassadors or sports envoys, we can have an impact on someone’s life in a small way,” Knight, 36, says. “I do think there’s a greater responsibility when you’re representing your country on the world stage.”

Honorary coach and NBC correspondent Snoop Dogg agrees. “One thing about the Olympics that I love is that it gives me a chance to be in front of people to represent what Americans look like, what we feel like, how we love, how we appreciate,” he’s said.

High-Stakes Drama

If any event captures the emotional intensity of the Olympics, it’s figure skating — and few understand that better than Tara Lipinski and Johnny Weir.

“You hear the music, you see the rings, there’s this magic to it,” says Lipinski, 43, who won gold at the 1998 Nagano Olympics at just 15 years old. “I think that’s why the whole world loves this event. It’s one of these things where you realize that this group of athletes has sacrificed their whole life. They’re building to this one moment in time. It’s four minutes on the ice that could change their entire life.”

For Lipinski, that emotional cocktail is exactly what makes the sport unforgettable.

“It’s everything you could want,” she adds. “The pressure, the suspense, the glitz, the glamour.”

Now working together as NBC Sports analysts, Lipinski and Weir experience those moments from the booth — but the nerves never disappear.

“Figure skating isn’t known as the most hugs and kisses, warm and fuzzy sport,” Weir, 41, explains. “But we all appreciate how small and niche and special this family is. As the older generation watching the younger generation of skaters, we want the best for them because we know exactly how it feels to be in their shoes.”

Snowboarder Chloe Kim, 25, has already had a front-row seat to Olympic drama before even strapping in. The reigning halfpipe superstar entered the season sidelined by a torn labrum in her shoulder that left her status uncertain.

For the athlete, the weeks leading up to the Games became a test of patience and resilience — rehabbing, recalibrating and waiting to see if her body would cooperate in time. Whether she’s at full strength or fighting to find her rhythm, Kim arrives carrying the emotional weight of a comeback that started long before the Opening Ceremony.

Must-Watch Phenom

The Olympic experience is one unlike any other — with athletes from all over the world converging in one place, each chasing a moment of immortality. Sixteen different sports disciplines will be featured in Milano Cortina, with more than 3,500 athletes representing 93 countries.

And while the depth of competition is staggering, a select few still rise above the noise and become must-watch storylines. One of them is Team USA’s Ilia Malinin, who will have all eyes on him when the men’s figure skating competition begins.

“There’s kind of different ways I approach it,” Malinin, 21, tells Us. “I like to embrace it a lot, especially closer to a competition. Feeling that pressure is kind of like, ‘OK, everyone’s looking at me. Now I really need to be at my best. Be on my A-game.’”

But even the sport’s most dominant skater admits the pressure can cut both ways.

“There’s also days that won’t be the best days,” he continues. “A lot of the time, what I’ll do is say, ‘OK, there’s a lot of pressure on me, let me just block this out and focus on what I really need to do and try not to think about people’s expectations of me.”

Nicknamed the Quad God, Malinin knows fans often see him as untouchable — something he’s eager to challenge on Olympic ice.

“Everyone sees me at competitions and I’m just so focused, I’m really in a different mindset where I’m pretty much as perfect as I can be,” Malinin explains. “But in reality, I’m not perfect. I’ll have bad days, I’ll have good days. It’s really the thing that tells people, ‘Oh, he’s really human like the rest of us.’”

The MVPs You Won’t See on the Podium

Beyond the athletes, the Games will be stacked with scene-stealing personalities, led by Snoop Dogg, who’s returning as an on-air commentator and cultural ambassador — and promising to keep things anything but predictable.

“You know, one thing about me, I’m unexpected, I’m unorthodox, but I’m always full of fun,” Snoop tells Us, adding that his mission is “making sure that America is represented in a peaceful, beautiful way to the globe.”

While he’s happy to entertain Olympic viewers, the rapper admits he’s still learning — though there’s one event already at the top of his watch list. “I think the sport I’m looking forward to the most [is] figure skating, because I just really, truly appreciate and love the art and the craft that it takes to become a figure skater,” he says — especially with the music, the fashion and the possibility that “my girl, Martha Stewart, may meet me out there at the front row of the figure skating final.”

He’ll be joined around the Olympic universe by Flavor Flav, official sponsor and “hype-man” for the USA Bobsled and Skeleton team, bringing his trademark energy as an enthusiastic supersupporter in the stands. Also on board: Stanley Tucci, who’s set to lend his signature charm and sophistication to cultural and culinary storytelling from Italy — proving that at these Games, the characters off the field may be just as compelling as the competition itself.

Vonn Is Back — and So Is the NHL

The 2026 Games mark a couple of noteworthy returns: skier Lindsey Vonn and NHL players participating in the Olympics for the first time since 2014 in Sochi.

Vonn, 41, who last competed in the Olympics in 2018, announced her return to the sport in November 2024 and earned a spot on the team in December 2025, a miraculous comeback that felt nearly unfathomable after having a partial knee replacement just months before coming out of retirement.

“But after a successful season that saw her reach the podium in seven of eight races, the legend declared, “I’m not the underdog anymore!” Vonn, a three-time Olympic medalist, reflected, “This is 24 years after my first Olympics. I’ve won everything I could have ever won. I’m not doing this to prove anything to anyone. I’m doing this because I think I can do well, it’s a meaningful place for me, and I think I can make a positive impact.”

Despite tearing her ACL during a World Cup race in Switzerland just days before the start of the Games, Vonn said she still intended on competing.

“I know what my chances in these Olympics were before this crash, and even though my chances aren’t the same now, there is still a chance,” she shared via Instagram. “And as long as I have a chance, I will not lose hope. I will not give up! It’s not over yet!”

Men’s hockey will also be a focal point, as the NHL’s best players will represent their home countries for the first time in over a decade.

New Jersey Devils star Jack Hughes will play for Team USA alongside his older brother, Quinn Hughes, which means the entire Hughes family is looking forward to a European vacation.

“A bunch of my cousins, aunts and uncles are making the trip,” Jack, 24, tells Us. “We’ve got some friends coming over, too. All the people in our lives are so excited to be part of this. It’s such a special event. You never know if we’ll be able to go back.”

Pomp and Circumstance

Of course, no Olympics would be complete without the spectacle. The 2026 Games officially kick off February 6 with a massive Opening Ceremony at Milano San Siro Olympic Stadium — a moment athletes say never gets old.

This year’s will feature performances from global super stars Mariah Carey and Italian icon Andrea Bocelli, setting the stage with equal parts star power and national pride. “I’m just looking forward to soaking it all in,” bobsledder Boone Niederhofer says.

For Chock, the spotlight is a reminder of what it took to get there. “It’s the years, decades of work that you put in,” she says. “But that’s what makes the Olympics special.”

And when the Games draw to a close, the celebration will come full circle at the Closing Ceremony on February 22 at the historic Arena di Verona, where athletes finally get to exhale, celebrate their accomplishments and pass the Olympic flame forward — a final, emotional send off to two unforgettable weeks in Italy.

Entertainment

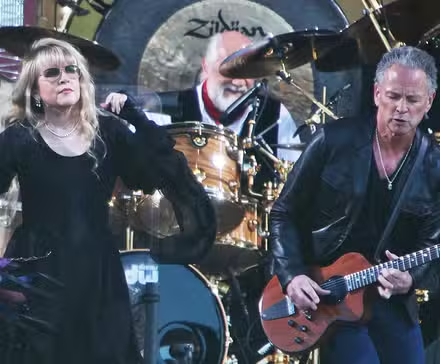

Fleetwood Mac’s Stevie Nicks Wrote a Song Even More Heartbreaking Than “Dreams” or “Silver Springs”

Few people are as good as Stevie Nicks at writing songs that pierce right through your soul. Both in her solo work and with Fleetwood Mac, she has written the best songs about love, heartbreak, and loss. Ever since she was very young, she has known how to capture the rawest feelings in her songs. In fact, she wrote her most heartbreaking song when she was just 25. This track went on to become one of Fleetwood Mac’s greatest hits, and it’s hard to believe it was written by a person in her 20s.

Stevie Nicks Wrote This Song About a Difficult Time in Her Life

Stevie Nicks is the mastermind behind several hits about heartbreak and love. “Silver Springs” is the perfect example. In it, Nicks expresses raw anger, pain, love, and revenge. But while this song might be more aggressive in its heartbreak, there is another song that will quietly devastate the listener, and might be the best Fleetwood Mac song. That song is “Landslide.”

In 1973, Stevie Nicks was dating bandmate Lindsey Buckingham. The couple had recently released their album, the first and only one the duo put out, and their future was uncertain. Nicks was accompanying her partner on a trip to Aspen, Colorado, to a rehearsal, because Buckingham had joined Don Everly’s band as a touring musician. It was a difficult time for the couple. Their album, “Buckingham Nicks,” hadn’t done so well, and they were questioning what their next step should be. “It was horrifying to Lindsey and I because we had a taste of the big time, we recorded in a big studio, we met famous people, we made what we consider to be a brilliant record and nobody liked it,” Stevie Nicks explained.

Buckingham had joined Don Everly’s band not because he wanted to be a touring musician, but because they were struggling financially. Meanwhile, Stevie Nicks was working odd jobs. “I had been a waitress and a cleaning lady, and I didn’t mind any of this. I was perfectly delighted to work and support us so that Lindsey could produce and work and fix our songs and make our music.” However, after having had their chance with “Buckingham Nicks,” the prospect of going back to what they used to do felt wrong. “I had gotten to a point where it was like, ‘I’m not happy. I am tired. But I don’t know if we can do any better than this. If nobody likes this, then what are we going to do?’”

Fleetwood Mac Rejected This Hit Song Written by Stevie Nicks Twice Causing Her to Quit the Band

A classic almost went unheard.

“Landslide” Represents Stevie Nicks’ Decision Not to Give Up

“Landslide” is not only a solid track and a moving song; it’s, in a way, the reason why Fleetwood Mac exists. Nicks spent two weeks with Lindsey Buckingham in Aspen while he was rehearsing, and she wrote “Landslide” while they were there. She was reflecting on their future, and the lyrics, while they are now seen as a beautiful metaphor, were very literal at the time.

“I made a decision to continue. “Landslide” was the decision,” Stevie Nicks explained. “‘When you see my reflection in the snow-covered hills’—it’s the only time in my life that I’ve lived in the snow,” she revealed. In Aspen, she was “looking up at those Rocky Mountains and going, ‘Okay, we can do it. I’m sure we can do it.’ In one of my journal entries, it says, ‘I took Lindsey and said, We’re going to the top!’ And that’s what we did. Within a year, Mick Fleetwood called us, and we were in Fleetwood Mac.”

Stevie Nicks was only 25 years old when she wrote this song, which makes it even more impressive. The lyrics, and particularly the chorus, make it seem like it was written by an older person looking back on their life. “Time makes you bolder / Even children get older / And I’m gettin’ older, too,” she sings longingly. She might have been young, but she had lived a lot of life in those short 25 years. She had fallen in love with the man who would become her songwriting partner long after the relationship was over. She had tried and failed at music, and was still about to make a huge impact in the music world. She just didn’t know it. The commercial failure of “Buckingham Nicks” was a low blow for both of them, but Stevie Nicks was wise enough to reflect on the ups and downs in life, putting it into words in a way that shows that even then, she was wise beyond her years. And just like that, she turned her uncertainty and fear into one of the greatest songs ever written.

Entertainment

Dog the Bounty Hunter's stepson arrested over the fatal shooting of his 13-year-old son

:max_bytes(150000):strip_icc():format(jpeg)/dog-the-bounty-hunter-grandson-anthony-zecca-020426-28c958cfbbcc46b1a9979c01e9f091fe.jpg)

Gregory Zecca has been charged with aggravated manslaughter of a child with a firearm and using a firearm while under the influence in connection to the July 19 incident.

Entertainment

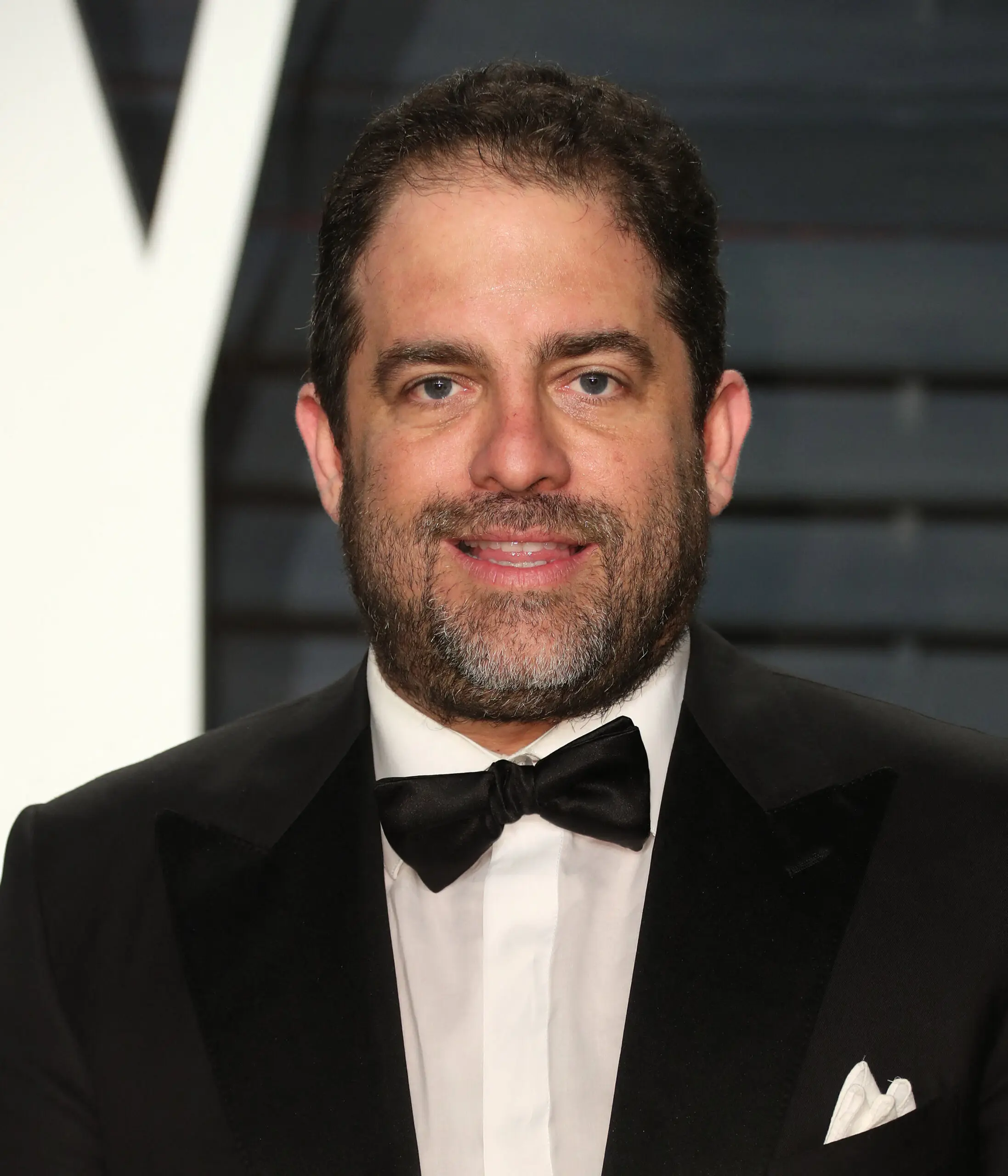

Brett Ratner Calls Epstein Photo Speculation ‘Crazy’ And ‘Horrible’

This comes after a massive new batch of documents tied to the criminal investigation into the late financier’s activities was released.

The photo, depicting Epstein seated alongside Ratner and two women whose faces are hidden, has begun trending online just as the “Rush Hour” director attempts a Hollywood comeback with his new documentary, “Melania.”

Ratner has largely remained on the sidelines of the industry in recent years, after multiple allegations of improper conduct surfaced against him in 2017.

Article continues below advertisement

Brett Ratner Continues To Deny Any Personal Relationship With Jeffrey Epstein

The photo of Ratner and Epstein with two unidentified women has sparked renewed scrutiny of the director and his relationship with Epstein.

Ratner has moved quickly to shut down any suggestions that he enjoyed a close personal relationship with Epstein.

“I didn’t have a personal relationship with him,” he insisted, during an interview with Fox News Digital.

The filmmaker claimed that the woman he was cuddling was his partner at the time, and that he was therefore not worried when the photo first emerged.

“I knew who was the person in the photo,” Ratner said. “So, I wasn’t concerned about it at all.”

Article continues below advertisement

The Director Spoke About The Effects Of Speculation About Him

Ratner also addressed the personal toll that the continued speculation surrounding his alleged ties to Epstein has taken on his life.

Reflecting on the fallout from the resurfaced photo, the filmmaker defined the discourse as “crazy” and “horrible,” while doubling down on his claim that he believed he was attending an innocent social event alongside his partner.

“My fiancée invited me to that event,” Ratner said. “At the time, the girl in the picture was my fiancée. And that’s it. That’s all.”

Article continues below advertisement

Epstein Photo Emerges As Brett Ratner Returns To Hollywood With ‘Melania’

Ratner has been strongly pushing back against rising speculation since the resurfaced Epstein photo began circulating online.

This new scrutiny comes at a pivotal moment for the filmmaker, who is attempting a return to Hollywood with his new documentary, “Melania.”

Ratner was effectively cancelled from the industry following allegations of sexual harassment against him, a reality that has come at a steep personal and professional price.

Back in 2013, Ratner secured a lucrative 75-film co-financing and co-producing agreement with Warner Bros.

That deal ultimately collapsed after the allegations, prompting the studio to sever ties with his production company.

Prior to “Melania,” Ratner’s last time in the director’s chair was in the 2014 action-adventure film “Hercules,” starring Dwayne Johnson.

Article continues below advertisement

‘Melania’ Enjoyed A Strong Opening Domestic Weekend

“Melania” surprised many industry insiders with a strong box office debut during its opening domestic weekend.

The documentary grossed roughly $7 million from nearly 2,000 theaters, an unusually high figure for a nonfiction release.

However, some social media users were also quick to point out that documentaries are rarely as backed at the same financial level as “Melania.”

Amazon reportedly outbid rivals, including Netflix and Disney, with a record-setting $40 million deal for the film’s distribution rights.

Article continues below advertisement

At the top of the domestic box office rankings was Sam Raimi’s “Send Help,” which earned approximately $20 million. Mark Fishbach’s indie “Iron Lung” followed closely behind in second place with $18 million.

Brett Ratner Is Also Rumored To Be Returning To The ‘Rush Hour’ Franchise With A Fourth Film

Ratner’s prospects of mounting a full Hollywood comeback appear to be gaining momentum.

Reports suggest that Donald Trump has been pushing for a fourth installment of the “Rush Hour” franchise under the director’s guidance.

In November 2025, Variety reported that the president had been lobbying behind the scenes to revive the popular series.

Should the project move forward, Paramount Pictures is expected to take charge of distribution.

Leading stars Chris Tucker and Jackie Chan have both previously expressed interest in reprising their roles. Chan has even urged the producers to “hurry up” with a fourth film before he and Tucker grow too old to make it happen.

Entertainment

The Long Lost Star Trek Episode Starring Milton Berle

Captain Kirk and his crew soon discover their advanced technology is due to cultural interference by a Federation scientist called Bayne. Bayne was to be played by the iconic and notorious Milton Berle.

By Saralyn Smith

| Published

Norman Spinrad thought the script he wrote in 1967 called “He Walked Among Us” had been lost to time until it showed up with an autograph-seeking fan at a convention. The fan scanned the faded script and emailed it to Spinrad, who has published it as an e-book.

Captain Kirk Versus Milton Berle

The script had the Enterprise encountering a primitive race called the Jugali, who used technology that should have been well beyond their ability to develop. Captain Kirk and his crew soon discover their advanced technology is due to cultural interference by a Federation scientist called Bayne. Bayne was to be played by the iconic and notorious Milton Berle.

Bayne had good intentions, but as things often do in science fiction, those good intentions result in unintended consequences. Because of his interference, the Jugali begin worshipping Bayne as a god. Captain Kirk’s job is to get him out of there without further damaging the Jugali.

The whole Bayne is a god mess would have ended up being comedic, had the script made it on screen. But that’s not what the script’s writer, Conrad Spinrad intended. So he set out to sabotage his own episode of Star Trek.

How Conrad Spinrad Killed His Own Star Trek Script

By Spinrad’s own account, the screenplay was a victim of a sometimes terrible but integral part of big- and small-screen productions: the rewrite. Roddenberry originally commissioned a dramatic script from Spinrad that would feature Milton Berle (and an “overgrown backlot village set” Roddenberry was apparently fond of). Berle — who was commonly referred to as “Mr. Television” — was arguably the biggest television star in the medium’s history and was mostly known for comedy.

The Star Trek line producer wasn’t aware that Berle could also do drama, though, and rewrote Spinrad’s script into “an unfunny comedy.” Spinrad was so disgusted and ashamed of the rewrite that he campaigned against its production: “This is so lousy, Gene [Roddenberry], that you should kill it!” I told him. “You can’t, you shouldn’t shoot this thing! Read it and weep!”

His pleas paid off, and the script was never filmed, but that also meant he never received any of the residuals that would have gone along with a produced syndicated episode. Eventually, Spinard made at least a little money off his work by publishing the script for fans to read.

Entertainment

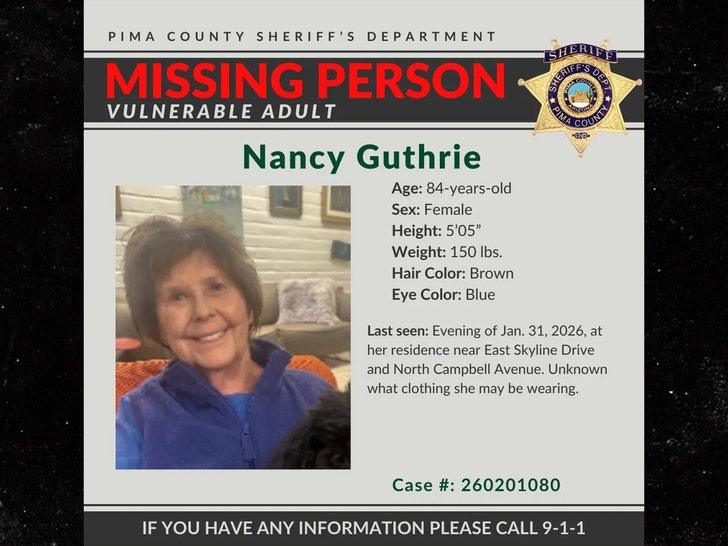

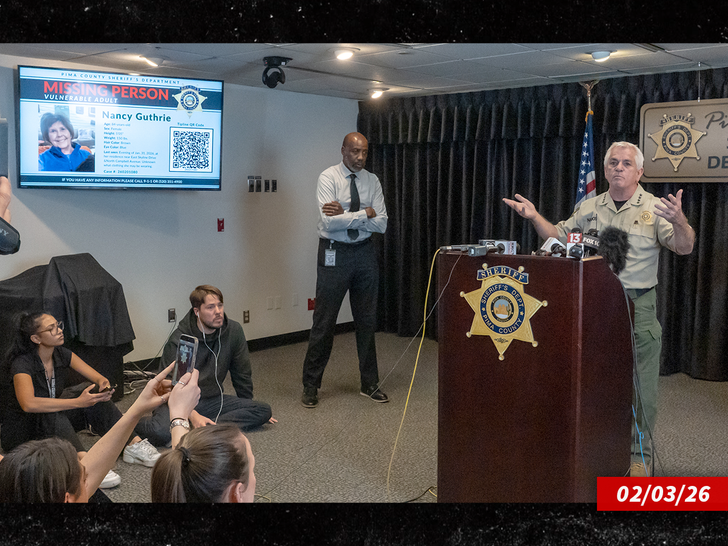

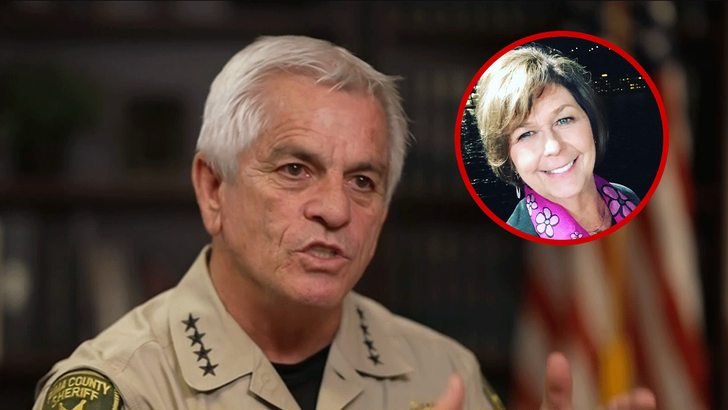

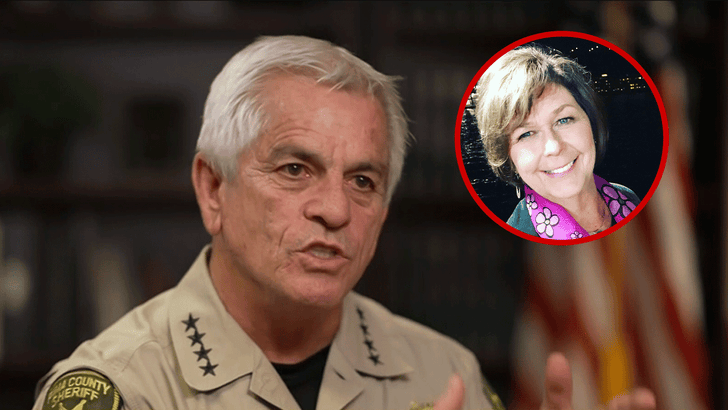

Pima County Sheriff Says He Believes Nancy Guthrie Is Alive

Search for Nancy Guthrie

Sheriff Says They Have to Believe She’s Alive

… ‘Nothing Else to Go On’

Published

NBC

As the search continues for Savannah Guthrie‘s kidnapped mother … Pima County Sheriff Chris Nanos painted a cautiously hopeful picture of where the investigation is at right now.

In a new interview Wednesday, Nanos told ‘TODAY’ … “We have nothing else to go on but the belief that she is here, she’s present, she’s alive, and we want to save her.”

As you know … detectives suspect Savannah’s 84-year-old mom Nancy was taken from her Arizona home in the middle of the night against her will.

While some details have come out, none of them have led to cracking the case or even identifying any persons of interest in the Tucson-area case.

As we reported … Nancy has a pacemaker that reportedly stopped synching with her Apple devices early Sunday, before she was reported missing. While there is video of blood on Nancy’s front porch, detectives have not said if she’s believed to have suffered any injuries in her abduction. DNA evidence has been collected and sent for testing.

Additionally, TMZ received an alleged ransom note demanding millions of dollars in Bitcoin in exchange for Nancy’s release … and PCSD says they are aware of the alleged note and are coordinating with the FBI.

For now, authorities say there’s no credible information indicating Nancy was “targeted.”

Entertainment

D4vd’s Friend Neo Langston Appears Before Grand Jury in Celeste Rivas Investigation

D4vd’s Friend Neo

Appears Before Grand Jury In Rivas Case

Published

D4vd‘s friend Neo Langston finally went in front of a grand jury after being arrested in Montana for failing to appear as a witness.

Neo showed up Wednesday to a Los Angeles courthouse where a grand jury has been convened since November to gather information on the death of Celeste Rivas … whose dismembered corpse was found last September inside D4vd’s Tesla in Hollywood.

TMZ.com

We got Neo on his way out of the courthouse … and he was mum as our photog peppered him with questions.

We caught up with Beth Silverman, the deputy D.A. presenting the case in Los Angeles, on her way into the courthouse … and she was all business.

TMZ.com

Neo was in front of the grand jury for about 30 to 40 minutes … and he has since left the courtroom.

Given Neo’s friendship with D4vd, who is a suspect in Celeste’s murder, it’s surprising Silverman spent only 40 minutes with him … the prosecutor has been aggressive with questioning witnesses.

TMZ broke the story … Neo, a popular streamer, was cuffed by a small army of cops in Helena, MT, after an L.A. judge signed off on an arrest warrant.

Neo, who had been squirreled away at his mom’s house, was then transported to L.A. and booked into LAPD’s Metropolitan Detention Center on $60,000 bail before bonding out.

Now, it appears Neo was asked questions in the Rivas case. Multiple witnesses have already testified.

TMZ previously reported D4vd is likely to be charged with Celeste’s murder … and LAPD homicide detectives have ID’d a second suspect who may have been involved “before, during, and after” her death.

Entertainment

Everything we know about “Fallout ”season 3 and what's next for Lucy and the Ghoul

:max_bytes(150000):strip_icc():format(jpeg)/FALLOUTSEASON2-020326-01-e807c88968d743cbabf7053bd7182943.jpg)

War is coming to New Vegas.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech11 hours ago

Tech11 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World20 hours ago

Crypto World20 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards