Area sits near key employment sites under Atom Valley plans

A masterplan to effectively build a new town on farmland just next to a key M60 motorway junction is set to be approved this week. A total of 1,550 new homes are earmarked for a large chunk of land between Simister and Bowlee.

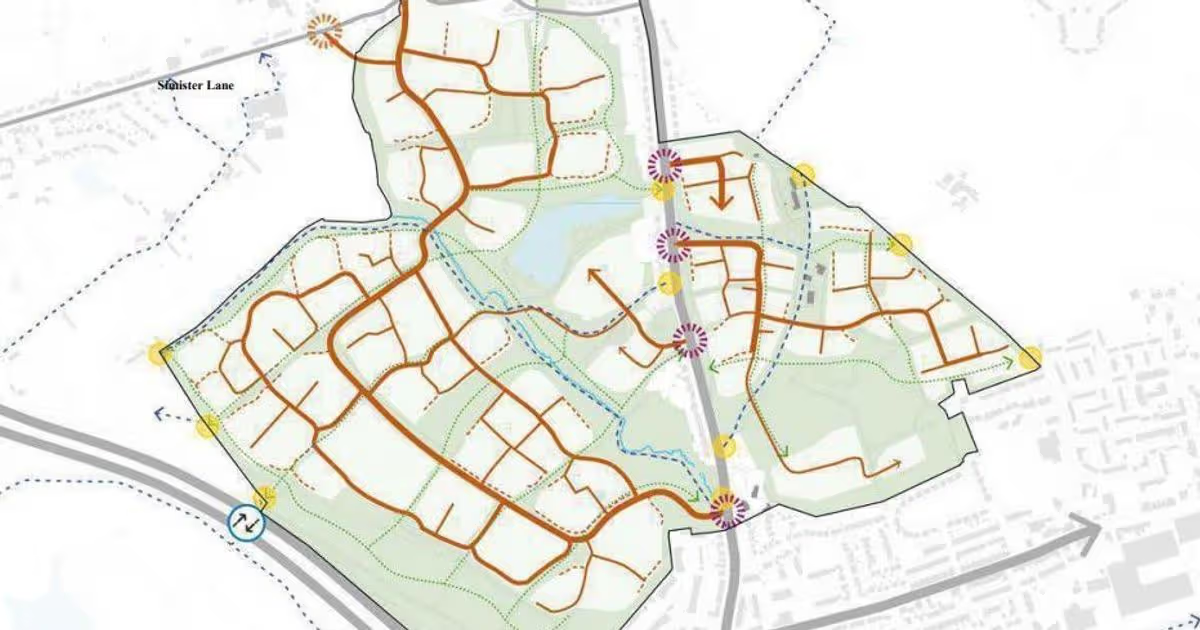

New roads, transport stations and connections to walking and pedestrian routes are all mooted. New schools, health services, local shops, community space, growing gardens are also touted as part of this huge project.

The area is already situated next to big employment sites, with more expected over the next two decades as part of the wider Atom Valley scheme.

Atom Valley is one of six growth locations in Greater Manchester and includes significant parts of Bury, Oldham and Rochdale. It is a vast area of 17m sq ft employment space, with the potential to offer 20,000 ‘highly skilled’ roles in the technology and manufacturing sectors as well as thousands of new homes.

This Simister and Bowlee scheme falls under the project named the Northern Gateway. New transport links are seen as key to connecting the new homes to what is expected to become the largest and most accessible employment and innovation hubs in the region, driving substantial investment into Greater Manchester.

Metrolink extensions to Middleton as well as the new tram-train are seen as key in these plans. The tram-train would be a new public transport vehicle that could travel on both rail lines and tram tracks, without being connected to the overhead lines.

The Simister and Bowlee site is 98 hectares and encompasses land to the east and west of Heywood Old Road (the A6045). It is predominantly agricultural grazing land divided into fields by boundaries of hedgerows, fencing and trees.

Like many of the areas targeted in the Northern Gateway scheme, the site is not well served by public transport. Although it is expected to benefit from the proposed Metrolink extension, that is possibly decades away.

In the meantime, road infrastructure improvements and the creation of cycle and pedestrian routes are on the cards for the short term. The connections across the Atom Valley area would be expected to be established through a new Metrolink tram extension to Middleton and further afield after two decades of development.

The Simister Bowlee Development Framework document reads: “The Simister Bowlee site represents the largest combined employment and residential growth opportunity in the north of England.

“This development will help address Greater Manchester’s acute housing and affordability crisis by delivering a diverse mix of homes for all life stages, supported by essential community facilities, a new primary school and accessible green spaces.

“Located across Bury and Rochdale boroughs, this neighbourhood will become a place future generations come to live, work and play.”

Rochdale’s town hall bosses are expected to sign off on the progress of the draft framework document at their cabinet meeting next week in Number One Riverside (February 5).