Video

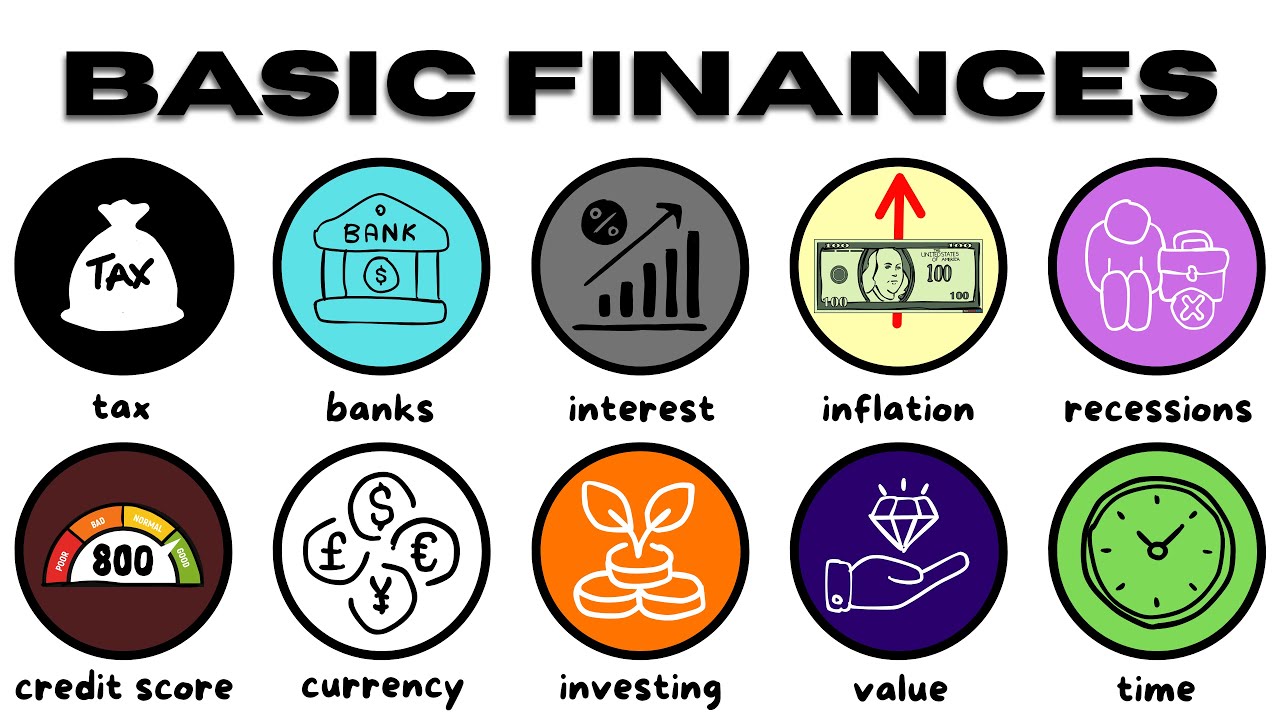

Explaining Basic Financial Concepts YOU Should Understand

This video goes over everything basic financial concept you should understand, and explains them if you don’t. Hope you enjoy!

———————————————————–

Timestamps:

0:00 Taxes

1:27 Banks

2:43 Interest

4:02 Inflation

5:36 Recessions

6:49 Credit Scores

8:11 Currency

9:15 Investing

10:16 Value

11:13 Time

source

Video

King Von – Money (Freestyle)

Follow King Von:

https://www.instagram.com/kingvonfrmdao

Tweets by KingVonFrmdaWic

Subscribe to King Von’s official channel for exclusive music videos and behind the scenes looks: http://bit.ly/Subscribe-to-King-Von

source

Video

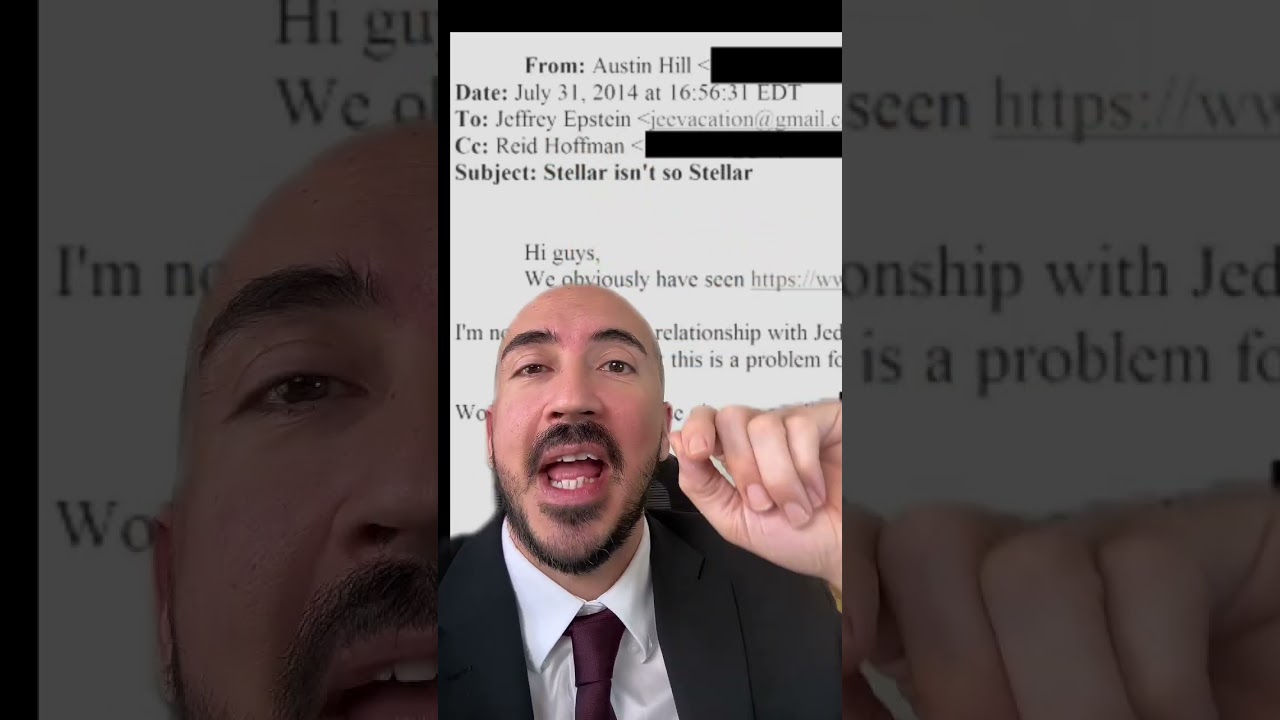

EPSTEIN FUNDED XRP – RIPPLE (THIS GOES DEEP!!)

Explosive crypto news breaks as shocking claims surface linking Epstein-era funding rumors to XRP and Ripple — and yes, this story goes deep. We unpack what’s alleged, what’s verifiable, and what it could mean for bitcoin, XRP, and the broader altcoin market. Watch till the end to separate facts from fiction and stay ahead of the narrative.

💥 Join Our Trading Group

Discord – https://discord.gg/pJYe4Z9FWa

Toobit – https://www.toobit.com/t/DiscoverCrypto

Blofin – https://partner.blofin.com/d/DiscoverCrypto

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

➡️ Protect your BTC From Taxes – https://bitcoinira.com/

➡️ Crypto Tax Services – https://www.decrypted.tax/

➡️ Use ‘DC20’ for 20% off Arculus – https://www.getarculus.com/products/arculus-cold-storage-wallet

Bitcoin Ticker Box – https://tickerbox.eu?sca_ref=8841235.jarE9W1myNW

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

➡️ Follow on X – https://x.com/DiscoverCrypto_

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

All of our videos are strictly personal opinions. Please make sure to do your own research. Never take one person’s opinion for financial guidance. There are multiple strategies and not all strategies fit all people. Our videos ARE NOT financial advice. Our videos are sponsored & include affiliate content. Digital Assets are highly volatile and carry a considerable amount of risk. Only use exchanges for trading digital assets. We never keep our entire portfolio on an exchange.

#bitcoin #crypto

source

Video

Bajaj Finance Personal Loan 2026 | Bajaj Finserv Personal Loan Kise Le |Bajaj Finance Loan Kise le

Bajaj Finance Personal Loan 2026 | Bajaj Finserv Personal Loan Kise Le |Bajaj Finance Loan Kise le

Loan Apply Link 👇👇👇

https://mdeal.in/c_pvIMBWDN

If you are planning to apply for a personal loan in 2026, this video explains everything about Bajaj Finance Personal Loan in a simple and clear way.

In this video, you will learn:

Bajaj Finance Personal Loan eligibility criteria

Required documents for Bajaj Finserv Personal Loan

Interest rate and repayment tenure details

Step-by-step Bajaj Finance loan application process

Important points to know before applying for a personal loan in 2026

This video is made only for educational purposes so that viewers can understand how personal loans work and how to apply responsibly.

👉 Always check official Bajaj Finserv sources before applying.

🔑 Keywords used in Description (5+):

Bajaj Finance Personal Loan 2026, Bajaj Finserv Personal Loan, Personal Loan Eligibility, Personal Loan Interest Rate, Bajaj Finance Loan Apply

👉 Topics Covered:

Bajaj Finance Personal Loan Eligibility 2026

Bajaj Finance Personal Loan

bajaj finserv se personal loan kaise le

bajaj finance personal loan 2026

bajaj finance personal loan kaise le

bajaj finserv

bajaj finance personal loan

bajaj finserv personal loan

bajaj finance loan kaise le 2026

bajaj finance loan

bajaj finance personal loan apply online

bajaj market personal loan online apply

bajaj finserv personal loan interest rates

bajaj finserv loan kaise le

bajaj fiannce loan details

bajaj personal loan kaise le

bajaj finserv personal loan online apply

#BajajFinanceLoan

#BajajFinserv

#PersonalLoan

#LoanGuide

#LoanApplyOnline

#BajajFinservLoan

#HowToApplyLoan

#FinanceGuide

#OnlineLoanProcess

#BajajFinancePersonalLoan

#FinancialTips

#LoanKaiseLe

#BajajLoanApply

#LoanForEmergency

#LoanInformation

#LoanProcessExplained

Disclaimer:

This video is for educational and informational purposes only. We are not associated with Bajaj Finance or Bajaj Finserv in any way. Loan approval, interest rate, and eligibility depend on the applicant’s profile and company policies. Please verify all details from the official website or customer support before applyin

source

Video

money money green green moneys all I need need#money #money #green #green #cat

Video

URGENT: If Bitcoin Doesn’t Bounce NOW It’ll Get UGLY! [DO THIS]

![URGENT: If Bitcoin Doesn’t Bounce NOW It’ll Get UGLY! [DO THIS]](https://wordupnews.com/wp-content/uploads/2026/02/1770231082_maxresdefault.jpg)

In today’s video, Kyledoops outlines a small glimmer of hope in the charts. If we don’t see a strong reaction or bounce immediately then much lower prices are likely to come. Join live as he unfolds the trade plan and how to execute for maximum profits.

_____________________

𝗙𝗘𝗔𝗧𝗨𝗥𝗘𝗗 𝗢𝗡 𝗧𝗛𝗜𝗦 𝗦𝗛𝗢𝗪

⬇⬇⬇⬇⬇⬇

🟨 𝗕𝗬𝗕𝗜𝗧 – 𝗚𝗿𝗮𝗯 𝗮 $𝟱𝟬 𝗦𝗶𝗴𝗻-𝗨𝗽 𝗕𝗼𝗻𝘂𝘀 + 𝗘𝗮𝗿𝗻 𝘂𝗽 𝘁𝗼 $𝟯𝟬,𝟬𝟬𝟬 𝗶𝗻 𝗗𝗲𝗽𝗼𝘀𝗶𝘁 𝗕𝗼𝗻𝘂𝘀𝗲𝘀!

👉 𝗦𝗶𝗴𝗻 𝘂𝗽: https://bit.ly/bybit-kyledoops

📺 𝗛𝗼𝘄 𝗧𝗼 𝗖𝗹𝗮𝗶𝗺 𝗬𝗼𝘂𝗿 𝗡𝗲𝘄 𝗨𝘀𝗲𝗿 𝗕𝗼𝗻𝘂𝘀: https://youtu.be/vSvPzNgF8j4

🏆 𝗕𝗧𝗖𝗖 – 𝗧𝗿𝗮𝗱𝗲 𝗦𝗺𝗮𝗿𝘁 & 𝗘𝗮𝗿𝗻 𝗚𝗼𝗹𝗱!! 𝗨𝗽 𝘁𝗼 𝟮𝟰,𝟬𝟬𝟬 𝗨𝗦𝗗𝗧 𝗶𝗻 𝗥𝗲𝘄𝗮𝗿𝗱𝘀!!

👉 𝗡𝗼 𝗞𝗬𝗖! 𝗦𝗶𝗴𝗻 𝘂𝗽: https://bit.ly/BTCC-GoldRush-Kyle

🎁 Plus get a HUGE 10% Deposit Bonus & trade with your bonus when you sign up!

📺 𝗛𝗼𝘄 𝗧𝗼 𝗖𝗹𝗮𝗶𝗺 𝗬𝗼𝘂𝗿 𝗡𝗲𝘄 𝗨𝘀𝗲𝗿 𝗕𝗼𝗻𝘂𝘀: https://youtu.be/tbvb7KCCbrU

🤝 Smart Move: Read the Terms

🟪 𝗕𝗜𝗧𝗙𝗨𝗡𝗗𝗘𝗗 – 𝗣𝘂𝗿𝗰𝗵𝗮𝘀𝗲 𝗔𝗻𝘆 𝗖𝗵𝗮𝗹𝗹𝗲𝗻𝗴𝗲 𝘁𝗼 𝗨𝗻𝗹𝗼𝗰𝗸 𝗔𝗰𝗰𝗲𝘀𝘀 𝘁𝗼 𝗕𝗶𝗴𝗴𝗲𝗿 𝗧𝗿𝗮𝗱𝗶𝗻𝗴 𝗙𝘂𝗻𝗱𝘀!

👉 𝗦𝗶𝗴𝗻 𝘂𝗽: https://bit.ly/join-bitfunded-kyle

_____________________

𝗦𝗧𝗔𝗥𝗧 𝗧𝗥𝗔𝗗𝗜𝗡𝗚 𝗦𝗠𝗔𝗥𝗧𝗘𝗥!

⬇⬇⬇⬇⬇⬇

🐋 𝗪𝗛𝗔𝗟𝗘 𝗥𝗢𝗢𝗠 – 𝗠𝗮𝘀𝘁𝗲𝗿 𝘁𝗵𝗲 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝗶𝗲𝘀 𝗼𝗳 𝗧𝗼𝗽 𝟭% 𝗧𝗿𝗮𝗱𝗲𝗿𝘀! 𝗟𝗲𝗮𝗿𝗻 𝘁𝗼 𝗧𝗿𝗮𝗱𝗲 𝗟𝗶𝗸𝗲 𝗮 𝗪𝗵𝗮𝗹𝗲!

👉 𝗕𝗲𝗮𝘁 𝘁𝗵𝗲 𝗛𝗲𝗿𝗱. 𝗝𝗼𝗶𝗻 𝘁𝗵𝗲 𝗪𝗵𝗮𝗹𝗲𝘀: https://bit.ly/Whale_Room_Kyle

💰 𝗪𝗛𝗔𝗟𝗘 𝗧𝗥𝗔𝗗𝗘𝗦 – 𝗧𝗵𝗲 𝗢𝗻𝗹𝘆 𝗗𝗮𝘁𝗮 𝗧𝗵𝗮𝘁 𝗠𝗮𝘁𝘁𝗲𝗿𝘀. 𝗔𝗹𝗹 𝗜𝗻 𝗢𝗻𝗲 𝗣𝗹𝗮𝗰𝗲! 𝟭𝟬𝟬% 𝗙𝗥𝗘𝗘!

👉 https://www.whaletrades.io/

_____________________

𝗧𝗥𝗔𝗗𝗘 𝗪𝗛𝗘𝗥𝗘 𝗞𝗬𝗟𝗘 𝗧𝗥𝗔𝗗𝗘𝗦!

⬇⬇⬇⬇⬇⬇

🟩 𝗕𝗟𝗢𝗙𝗜𝗡 – 𝗚𝗲𝘁 𝗩𝗜𝗣𝟭 + 𝗨𝗽 𝘁𝗼 𝗮 $𝟭,𝟬𝟬𝟬 𝗕𝗼𝗻𝘂𝘀 + 𝗮 𝗖𝗵𝗮𝗻𝗰𝗲 𝘁𝗼 𝗪𝗜𝗡 𝟵,𝟰𝟬𝟬 𝗨𝗦𝗗𝗧!

👉 𝗦𝗶𝗴𝗻 𝘂𝗽: https://bit.ly/blofin_welcome

🟧 𝗣𝗜𝗢𝗡𝗘𝗫 – 𝗦𝗶𝗴𝗻 𝗨𝗽 𝗮𝗻𝗱 𝗧𝗿𝗮𝗱𝗲 𝘁𝗼 𝗨𝗻𝗹𝗼𝗰𝗸 𝗮 $𝟭𝟬𝟬 𝗕𝗼𝗻𝘂𝘀 𝗮𝗻𝗱 𝗘𝗮𝗿𝗻 𝘂𝗽 𝘁𝗼 𝟭,𝟬𝟬𝟬 𝗨𝗦𝗗𝗧!

👉 𝗝𝗼𝗶𝗻 𝗡𝗼𝘄: https://bit.ly/Pionex_KyleDoops

🤖 𝗖𝗼𝗽𝘆 𝗞𝘆𝗹𝗲’𝘀 𝘀𝘁𝗿𝗮𝘁𝗲𝗴𝗶𝗲𝘀: https://bit.ly/Copy_Kyle

⬛️ 𝗚𝗥𝗩𝗧 – 𝗧𝗿𝗮𝗱𝗲 𝘄𝗶𝘁𝗵 𝗦𝗽𝗲𝗲𝗱 𝗮𝗻𝗱 𝗣𝗿𝗶𝘃𝗮𝗰𝘆!

☑️ Earn 10% interest on your total trading account balance!

👉 𝗝𝗼𝗶𝗻 𝗻𝗼𝘄: https://bit.ly/grvt-kyle

_____________________

🛡️ 𝗡𝗢𝗥𝗗 𝗩𝗣𝗡 – 𝗕𝗲 𝗨𝗻𝗵𝗮𝗰𝗸𝗮𝗯𝗹𝗲! 𝗞𝗲𝗲𝗽 𝗬𝗼𝘂𝗿 𝗖𝗿𝘆𝗽𝘁𝗼 & 𝗜𝗱𝗲𝗻𝘁𝗶𝘁𝘆 𝗦𝗮𝗳𝗲!

🚨 Get Up to 74% Off + 4 Extra Months FREE!

👉 𝗘𝗫𝗖𝗟𝗨𝗦𝗜𝗩𝗘 𝗢𝗳𝗳𝗲𝗿: https://nordvpn.com/kyledoops

_____________________

𝗙𝗢𝗟𝗟𝗢𝗪 𝗞𝗬𝗟𝗘!

⬇⬇⬇⬇⬇⬇

👉 𝗫: https://x.com/kyledoops

👉 𝗜𝗻𝘀𝘁𝗮𝗴𝗿𝗮𝗺: https://bit.ly/kyle-insta

_____________________

👁️🗨️ 𝗖𝗿𝘆𝗽𝘁𝗼 𝗕𝗮𝗻𝘁𝗲𝗿 𝗮𝗯𝗶𝗱𝗲 𝗯𝘆 𝘁𝗵𝗲 𝗳𝗼𝗹𝗹𝗼𝘄𝗶𝗻𝗴 𝗰𝗼𝗱𝗲 𝗼𝗳 𝗰𝗼𝗻𝗱𝘂𝗰𝘁:

https://www.cryptobanter.com/our-ethics/

We take our code of ethics very seriously and have engaged @zachxbt ( / zachxbt ) to monitor our progress. If you feel we’re not living up to it and have hard evidence please mail ZachXBT directly at reportcb@protonmail.com

⚠️ 𝗕𝗘𝗪𝗔𝗥𝗘 𝗢𝗙 𝗦𝗖𝗔𝗠𝗠𝗘𝗥𝗦 𝗜𝗡 𝗢𝗨𝗥 𝗖𝗢𝗠𝗠𝗘𝗡𝗧𝗦 𝗔𝗡𝗗 𝗖𝗢𝗠𝗠𝗨𝗡𝗜𝗧𝗬 𝗖𝗛𝗔𝗡𝗡𝗘𝗟𝗦

___________________________________________

Crypto Banter is a live-streaming channel that brings you the hottest crypto news, market updates, and fundamentals of digital assets. Join the fastest-growing crypto trading community to get notified on the most profitable trades and the latest crypto market updates & news!!

📝 𝗗𝗶𝘀𝗰𝗹𝗮𝗶𝗺𝗲𝗿:

Crypto Banter is a social podcast for entertainment purposes only.

All opinions expressed by the hosts, guests, and callers should not be construed as financial advice. Views expressed by guests and hosts do not reflect the views of the station. Listeners are encouraged to do their own research.

#CryptoMarket #BitcoinPrice #CryptoTrading #Kyle

___________________________________________

⏱ 𝗧𝗶𝗺𝗲𝘀𝘁𝗮𝗺𝗽𝘀:

00:00 Key Crypto Levels

01:08 Stock Market Update – S&P 500, DJI, QQQ, MSFT, COIN, HOOD, MSTR, DXY

06:37 Crypto Market Update – BTC Sentiment, Total Crypto Market Cap Analysis

09:09 Bitcoin Analysis Today

18:59 USDT Dominance Analysis – USDT.D

21:56 Altcoin Levels to Watch – HYPE, SOL, XRP

24:04 Commodities Levels to Watch – XAU, XAG, XPT, NATGAS

🎬 𝗠𝗼𝗿𝗲 𝗩𝗶𝗱𝗲𝗼𝘀 𝘄𝗶𝘁𝗵 𝗞𝘆𝗹𝗲 𝗗𝗼𝗼𝗽𝘀: https://www.youtube.com/playlist?list=PLmOv2_vzOoGcDGeu-HHfifExgbvmPLO3l

source

Video

We (Still) Don’t Know How Epstein Got So Rich…

To learn for free on Brilliant for a full 30 days, go to http://www.brilliant.org/howmoneyworks OR scan the QR code onscreen, or click on the link in the description. Brilliant’s also given our viewers 20% off an annual Premium subscription, which gives you unlimited daily access to everything on Brilliant.

—–

Lil Boyle’s video playlist – https://youtu.be/AJP6K2_rr90?si=Bu69w1ufKwR5lYAR

—-

Sign up for our FREE newsletter! – https://www.compoundeddaily.com/

Books we recommend – https://www.howmoneyworkslibrary.com/

Listen on Spotify – https://open.spotify.com/show/5gi1JobDJC3QqaF4aKfenR?si=f3IsgWIlSKObF8BT1Fitig

—–

My Other Channel: @HowMoneyWorksUncut @HowHistoryWorks

Edited By: Svibe Multimedia Studio

Music Courtesy of: Epidemic Sound

Select Footage Courtesy of: Getty Images

📩 Business Inquiries ➡️ sponsors@worksmedia.group

Sign up for our newsletter https://compoundeddaily.com 👈

All materials in these videos are for educational purposes only and fall within the guidelines of fair use. No copyright infringement intended. This video does not provide investment or financial advice of any kind.

#wealth #money #business

—-

Two days before his completely unsuspicious death, the “alleged” financier Jeffrey Epstein signed an updated last will and testament which roughly detailed assets worth an estimated five hundred and seventy seven million dollars.

What has remained unclear in the almost six years since though is… how he actually made all of this money…

Before becoming the centrepiece of an ongoing international scandal, Epstein was mostly publicly described as a high profile “finance guy” that made his money by moving other people’s money around in creative ways.

But even that broad definition still raises some questions.

He was supposedly charging tens of millions of dollars in fees for tax advice even though he was not a tax lawyer,

hundreds of millions for wealth management even though he never had his Series 7,

and charged massive sums as a “consultant” despite not even having a college degree…

Now the financial industry was certainly a lot less competitive back then, but even in the 1980s, ultra wealthy individuals still weren’t giving away money like this for nothing in return.

With very little in the way of verifiable achievements, staff or actual operations, it’s unclear how valuable these services really could be, which ultimately raises the obvious question…

Was Epstein a successful financier with a completely separate side hobby in diddling? Or was he a full time diddler using financial services as a cover to bankroll and launder the proceeds of his crimes?

In either case the obvious course of action would be to follow the money trail right? Well there are actually a few big groups (of varying levels of competency) who are all trying, but this is easier said than done.

A complex web of jurisdictions, shell corporations, alongside confidential client and banking secrecy laws make a paper trail hard to pin together, and that is clearly by design.

Nobody’s investment accounts should need a multi-jurisdictional flowchart to piece together unless they have something to hide right?

Even without the benefit of hindsight the whole thing does seem incredibly unusual…

The only problem is, that for a lot of high net worth and high profile individuals the only thing abnormal about all of this, is just how normal it really is…

source

Video

THIS JUST CHANGED EVERYTHING FOR XRP!!!!!!

🔥Thanks for supporting the channel. Like, share, and comment if this helped clarify what’s really happening.

💳 Uphold – Trade, Spend & Earn XRP Rewards

➖ U.S. Debit Card: https://uphold.sjv.io/559kj9

➖ Uphold Website: https://uphold.sjv.io/dOmGMq

🔸4% on elite card / 2% on virtual card🔸

🛡️Hardware Wallets I Use for XRP

D’CENT Biometric Wallets

– Single Device – 18% Discount ($159 → $129)

Biometric Wallet – Affiliates

– Two-Pack – 31% Discount ($318 → $219)

Biometric Wallet 2X Package – Affiliates

Ledger – Official Store

https://www.ledger.com/crypto-sensei

🔗Contact & Collaborations

– Business: cryptosensei@cryptonairz.com

– Collabs: BD Manager – @Jaalyn_T (Telegram)

– Collab Form: https://forms.gle/E6fskio5BBvd4zVn9

– Social Links: https://linktr.ee/Crypt0Sensei

(YouTube partnerships & brand deals only – no agencies)

📰FREE XRP Newsletter: https://joincryptonairz.com/Newsletter

❗Full Legal & Regulatory Disclaimer

https://docs.google.com/document/d/1T_wTsSkXDZqdgKDUOKfIEKF-a7ur2kX8gw-e3aAq_Q4/edit?usp=sharing

source

Video

Couple Breaks Up During Financial Audit

Oh, it’s a gooooddddd post show- I make him call his dad and finally confess EVERYTHING. Absolutely incredible… Watch here: ➡️ https://bit.ly/chpostshow

💲 See what’s new inside Dollarwise today → https://bit.ly/4ab6UM8

=============================

🔥 Un-F*ck your finances in 2-minutes → https://bit.ly/3JCuwPS

=============================

👉 Checking & Savings: Get up to a $350 bonus with a new Chime® Checking account, and earn up to 3.50% APY on your savings: https://secure.moneymatchup.com/350-bonus

🔥 GamerSupps: tasty, cheap ($0.40/serving)! Save 10% with code CALEB: https://gamersupps.gg/caleb

=============================

*Sponsors for This Video*

=============================

(insert sponsors)

=============================

Master Your Money with Caleb Hammer

=============================

⚡️Budget YOUR dream life with my simple courses: ➡️ https://bit.ly/calebhammer

⚡️Check out all of my custom Financial Audit merch: ➡️ https://bit.ly/caleb-merch

=============================

*Check Out My Resources*

=============================

👉 Get a $40,000 cash bonus by investing with Webull! https://www.webull.com/k/Caleb

👉 Checking & Savings: Get up to a $350 bonus with a new Chime® Checking account, and earn up to 3.50% APY on your savings: https://secure.moneymatchup.com/350-bonus

👉 Land a high-paying job with no experience or degree: ➡️ https://coursecareers.com/CalebHammer

👉 Get $20 from Acorns for free: ➡️ https://acorns.com/caleb

👉 First 100,000 Mine (formerly Fizz) sign-ups with code HAMMER10 get $10: https://www.usemine.com/caleb

👉 Helium Mobile: Use promo code CALEB for a FREE plan ➡️ https://hellohelium.com/

👉 Protect your online privacy and security for free with Aura: ➡️ https://aura.com/hammer

👉 Get an exclusive HighLevel 30-day trial: https://gohighlevel.com/calebhammer

=============================

*Chapters*

=============================

00:00 Intro

=============================

Want more content?

=============================

🍿Caleb Hammer LIVE: / @calebhammerlive

🍿 Financial Audit Follow-Ups here: / @financialauditfollowups

=============================

*Connect with me!*

=============================

TikTok: https://www.tiktok.com/@calebhammercomposer

X: https://x.com/sircalebhammer

IG: https://www.instagram.com/calebhammercomposer/

Facebook: https://www.facebook.com/calebhammercomposer/

=============================

*Want to be a guest on Financial Audit?*

=============================

👉 We film weekdays in our studio in Austin, Texas (in person only)! To apply, visit: https://calebhammer.com/apply

*Some of the links and other products that appear in this video are from companies for which Caleb Hammer will earn an affiliate commission or referral bonus. This is not investment advice.

Sponsorship and business inquiries: business@calebhammer.com

source

Video

LIVE: Scott Bessent appears before the House Committee on Financial Services

Watch live from Washington as U.S. Treasury Secretary Scott Bessent appears before the U.S. House of Representatives Committee on Financial Services, which is holding a hearing on the annual report of the Financial Stability Oversight Council.

source

Video

THE BIGGEST BITCOIN WHALE JUST GAVE US A MASSIVE WARNING

I AM NOT A FINANCIAL ADVISOR. ALL VIDEOS IS FOR ENTERTAINTMENT PURPOSE; AND I AM DOCUMENTING MY OWN TRADING JOURNEY.

DO NOT TRADE IF YOU ARE NOT EXPERIENCED.

CHECK OUT MY NEW TRADING CHANNEL:

https://www.youtube.com/@SatoshiStackerBackup

🔥🔥🔥

IMPORTANT VIDEOS:

Strategy tutorial : https://youtu.be/SKKtqlksAc4

Bull Market Portfolio: https://www.youtube.com/watch?v=lwPlnjpVpQI&feature=youtu.be

100x Challenge: https://www.youtube.com/watch?v=riMk4P99swo

Leverage trading tutorial: https://www.youtube.com/watch?v=X3dbVNLNdSg

~~~~~

My Trading Strategies:

1.

👉Sign Up To Pionex

💰https://bit.ly/3AhN6sw

2.

👉Claim Bonuses

💰https://bit.ly/3JZPzfS

3.

👉Links To My Main Bots:

💰BTC: https://bit.ly/48m0dWb

💰ETH: https://bit.ly/48COh2t

💰SOL: https://bit.ly/3Ckvcpx

💰BNB: https://bit.ly/3YTYByl

💰XRP: https://bit.ly/48SCptg

💰GOLD: https://bit.ly/430TbVu

💰SILVER: https://bit.ly/4pZiwrk

💰PLATINUM: https://bit.ly/4af4EV4

💰PALLADIUM: https://bit.ly/3LV0wQM

💰COOPER: https://bit.ly/3LWEo8D

4.

👉*NEW* Huge trading competition

💰https://bit.ly/4t8hTP9

👉TRADE METAL BONUS:

💰https://bit.ly/3O52uia

📝My trading sheet: https://bit.ly/3CyFjHx

CLAIM BONUSES ON MY FAVORITE EXCHANGES!

💰 Trade with Pionex: https://bit.ly/3AhN6sw ($300💰BEST EXCHANGE)

💰 Trade with TapBit: https://bit.ly/3V63fbN (HUGE BONUSES ☘️ FRIENDLY ☘️)

💰 Trade with Bybit: https://bit.ly/3ZXo1N5 ($30,300💰)

~~~~~

✖️Follow me on Twitter:

👉https://x.com/StackerSatoshi

📸 Follow me on Instagram:

👉 https://www.instagram.com/satoshistacker/

@satoshistacker

💼Marketing Inquiries:

-Telegram: @Zeil_SSMarketing

-Email: Satoshistackerbusiness@gmail.com

JOIN MY FREE TELEGRAM CHANNEL(LIMITED SPOTS):

https://t.me/satoshistacker_premium

~~~~~

Timestamps:

~~~~~

●▬▬▬▬▬▬▬▬▬▬▬Social▬▬▬▬▬▬▬▬▬▬▬●

Telegram: https://t.me/satoshistacker_premium

Twitter: https://twitter.com/StackerSatoshi

Email: realsatoshistacker@gmail.com (ONLY BUSINESS)

DISCLAIMER: Trading Bitcoin is VERY risky, and 80% of traders don’t make money. Make sure that you understand these risks if you are a beginner. I only recommend crypto trading to already experienced traders!

**Disclaimer**

Please be advised that I own a diverse portfolio of cryptocurrency as I wish to remain transparent and impartial to the cryptocurrency community at all times, and therefore, the content of my media are intended FOR GENERAL INFORMATION PURPOSES not financial advice. The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial legal or tax advice. The content of this video is solely the opinions of the speaker who is not a licensed financial advisor or registered investment advisor. Purchasing cryptocurrencies poses considerable risk of loss. The speaker does not guarantee any particular outcome. Past performance does not indicate future results.

This information is what was found publicly on the internet. This is all my own opinion. All information is meant for public awareness and is public domain. Please take this information and do your own research.

bitcoin, cryptocurrency, crypto, altcoin, altcoin daily, blockchain, decentralized, news, best investment, top altcoins, ethereum, tron, stellar, binance, cardano, litecoin, 2019, 2020, crash, bull run, bottom, crash, tether, bitfinex, rally, tone vays, ivan on tech, chico, video, youtube, macro, price, prediction, podcast, interview, trump, finance, stock, investment, halving, halvening, too late, when, fed, federal reserve, interest rates, rates, cut, economy, stock market,

source

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech11 hours ago

Tech11 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World20 hours ago

Crypto World20 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards