Business

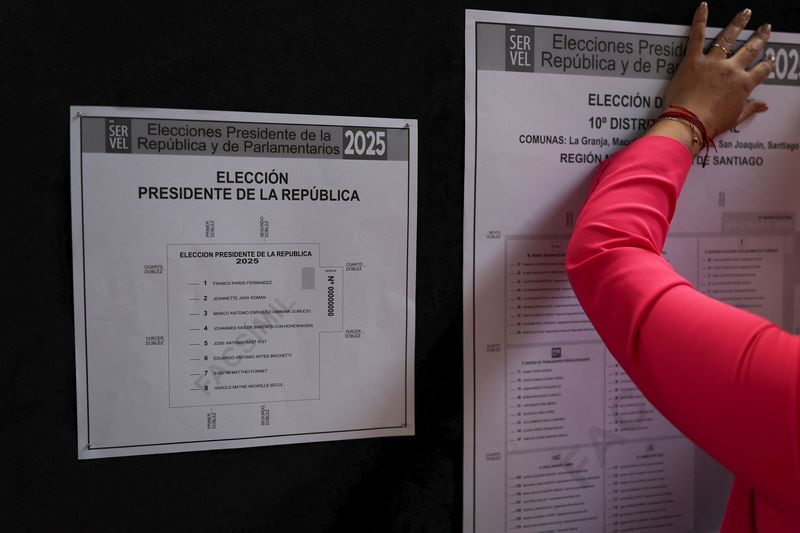

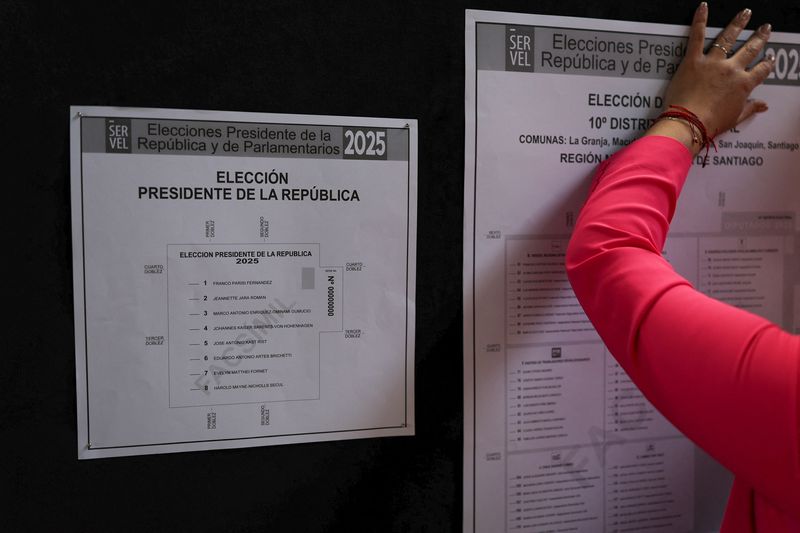

Chilean leftist Jara narrowly leads far-right's Kast in first round presidential vote

Chilean leftist Jara narrowly leads far-right's Kast in first round presidential vote

Source link