Politics

This ayatollah fanclub heaps shame on London

If you want to know what treachery means, look no further than the reactionary march through London on Saturday. To see the true meaning of betrayal, the true meaning of duplicity, the true meaning of knifing an already oppressed people in the back, witness those dumb Londoners singing the praises of the Islamic Republic at the very moment the great people of Iran are fighting to dislodge that wicked regime. ‘Freedom!’, cry young Iranians. ‘I don’t think so’, reply the Islamism-addled freaks of the British capital.

Hitting the streets to laud the ruthless theocrats of Tehran would be bad at any time. Doing it when thousands of people have been massacred by those theocrats for the ‘crime’ of longing for liberty is unforgivable. And yet it happened. Right here in free, modern London. In their thousands they traipsed to spout their conformist drivel about the dastardly Jewish State and their harebrained belief that the ayatollahs of Iran are a force for good. It was dolled up as ‘a protest’ but really it was a mass dancing on the graves of those butchered by the mullahs.

The march was called by the Palestine Coalition, a caucus of every bourgeois arsehole who mistakes hating Israel for having a personality. From the keffiyeh clowns of the Palestine Solidarity Campaign to the knackered hippies of the Campaign for Nuclear Disarmament, they swarmed the streets to mourn the thousands of innocents put to death by Iran’s tyrants. Only joking – they were wailing about Israel. Well, what else is there?

Indeed, far from offering solidarity to Iranians, some of these fake progressives mocked those poor souls. Some cheered their killers. Some carried placards featuring the face of Ayatollah Khamenei. Others waved the flag of the Islamic Republic. And of course there was the usual demented ‘anti-Zionism’ that has seized both the liberal middle classes and Islamist radicals like a particularly stubborn pox. Privileged Gen Zers wailed about ‘kicking the Zionists out, out, out’, even miming kick movements to show just what kind of violence they’d love to visit on the evil, squatting Jews of the Holy Land. ‘Globalise the intifada’, they chanted, to make their violent urges crystal clear.

It was an orgy of bigotry of the like we have sadly got used to since 7 October 2023. But this time even worse. This was, to all intents and purposes, a pro-murder rally. It was a march in defence of medieval religious violence. It was a mass act of excuse-making for the apocalyptic slaying of thousands of civilians. I don’t want to hear a peep from the brunching classes who will plead: ‘We were only there to show our support for Gaza.’ Because the minute you saw the flag of the Islamic Republic, the minute you saw the ayatollah’s face, the minute you saw mobs praising those butchers in Tehran, you should have fled. That you didn’t, that you were content to rub along with apologists for Islamist tyranny, speaks volumes. It suggests your unhinged loathing for Israel has fried every last one of your moral faculties.

Not content with gushing over Iran’s Islamist murderers, some praised their anti-Semitic proxies, too. There were calls to de-proscribe not only Palestine Action but also Hezbollah and Hamas. Hezbollah’s goons have been deployed to brutally suppress the freedom-yearning people of Iran. Just imagine you are a 21-year-old Iranian woman whose face has been caved in by some misogynistic brute from Lebanon and then you see people in London standing not with you but with him. Calling not for you to be liberated from religious tyranny but for him to be liberated from proscription by the British government. The sense of betrayal would be overwhelming.

We need to grapple with the seriousness of what happened in London on Saturday. Mobs of people sided with Islamist fanaticism. They cosied up to the killers of women. They aligned themselves, publicly and proudly, with the venal ayatollah classes who are content to lay waste to thousands of lives if it will help them to preserve their Koranic power. Rarely has the moral decay of the protesting classes been so starkly on display – a psychotic religious regime massacres thousands and these people either say, ‘But what about Israel?!’ – or worse, ‘Good’.

Saturday’s march was a funeral for moral decency. No one of good conscience, no one of sound moral standing, can be the least bit confused as to what side to take in Iran. This is a theocracy that savagely punishes women for living freely, and which ruthlessly locks up dissenters and apostates, and which has brazenly slain thousands for daring to desire freedom. If you look at this and think to yourself, ‘It’s complicated’, then you have fully vacated the realm of reason. You have made your peace with barbarism.

Some say the Gazaholics of the activist class are being hypocritical. These people weep for the dead of Gaza but shrug their shoulders over the dead of Iran. I disagree. There’s moral consistency here. For in both their anti-Israel fury and their nonchalance over the butchery in Iran, these people are siding with the carnival of bloody reaction that is Islamist fanaticism. Their 7 October apologism and their shameful silence on the Iranian massacres spring from the same dark, warped source – a creepy sympathy for Islamism, a belief that this religious mania represents some kind of resistance to the West, to Israel, to capitalism, to modernity. Their anger over the war in Gaza and their coolness over the mass murder in Iran are both grim proof of the moral rot of identitarianism.

For how much longer will we surrender our streets to the Israel haters and the ayatollah fanclub? To the intifada-cheering middle classes and the mullah-loving Islamists? To those who think the Jewish nation fighting back against its invaders is ‘genocide’ but the mass murder of protesters by tooled-up theocrats is nothing to get worked up about? Mass solidarity with Iranians is what we need right now. The only time I want to see the flag of the Islamic Republic on the streets of London is in the minutes before someone sets it on fire.

Brendan O’Neill is spiked’s chief political writer and host of the spiked podcast, The Brendan O’Neill Show. Subscribe to the podcast here. His latest book – After the Pogrom: 7 October, Israel and the Crisis of Civilisation – is available to order on Amazon UK and Amazon US now. And find Brendan on Instagram: @burntoakboy.

Politics

4 In 10 Cancer Cases ‘Preventable’: 3 Factors Matter Most

New research from the World Health Organisation’s (WHO’s) global analysis has suggested that 37% of cancer cases worldwide are, to some degree, “preventable”.

The study, conducted with the WHO’s International Agency for Research on Cancer (IARC), looked at data from 85 countries concerning 36 cancer types.

“Preventable” cancers were higher in men (45% of cases globally) than in women (30%).

Study author and WHO Team Lead for Cancer Control, Dr André Ilbawi, said: “This is the first global analysis to show how much cancer risk comes from causes we can prevent”.

Which “modifiable factors” might affect our cancer risk?

In this study, researchers looked at the effect of 30 potentially modifiable factors on global cancer risk.

These included alcohol and tobacco use, physical activity levels, air pollution, and UV ray exposure.

Lung, stomach, and cervical cancers accounted for almost half of “preventable” cases; lung cancers were linked to smoking and air pollution, while stomach cancers were associated with Helicobacter pylori infection.

Cervical cancers were “overwhelmingly caused by human papillomavirus (HPV)”.

The study was also the first to look at “infectious causes of cancer alongside behavioural, environmental, and occupational risks,” the study’s senior author and Deputy Head of the IARC Cancer Surveillance Unit, Dr Isabelle Soerjomataram, said.

Of the 18.7 million cancer cases noted in the study (7.1 million of which were deemed possibly preventable), three potentially modifiable factors were deemed “the leading contributors to cancer burden”.

- Smoking tobacco (3.3 million)

- Infections like HPV (2.3 million)

- Alcohol use (700,000).

The WHO urged “context-specific prevention strategies”

“By examining patterns across countries and population groups, we can provide governments and individuals with more specific information to help prevent many cancer cases before they start,” said Dr André Ilbawi.

Following the study’s release, the WHO said that the results underscore the need for “context-specific prevention strategies”.

These include “strong tobacco control measures, alcohol regulation, vaccination against cancer-causing infections such as human papillomavirus (HPV) and hepatitis B, improved air quality, safer workplaces, and healthier food and physical activity environments.”

Politics

Ike Ijeh: How to end Labour’s lurid legacy of towers

Ike Ijeh is Head of Housing, Architecture & Urban Space at Policy Exchange.

Margaret Thatcher once famously intoned that Tony Blair was her “greatest achievement”. With a similar level of ironic counterintuition, one could reasonably argue that British municipal socialism’s greatest urban achievement over the past 25 years has been the luxury residential tower block.

These structures now proliferate across our inner-cities and suburbs and whether they are in Manchester, Birmingham, Croydon or Southwark, in the vast majority of cases, they were brought to you either by a Labour mayor or a Labour council.

In 2002 London had just twelve buildings taller than St. Paul’s Cathedral. After two Labour mayors and a Conservative mayor who promised to stop tall buildings then ended up building significantly more than his Labour predecessor, the capital now has well over 120.

Most of these towers are residential and they are frequently justified on the basis that they will help fix the housing crisis. But this has demonstrably not been the case and there is even an argument to suggest they might have made it worse. As Policy Exchange’s 2024 Tall Buildings paper exclusively revealed, of the new residential units created in the 70+ high-rises taller than St. Paul’s built since the Millennium, only 6 per cent have been affordable and just 0.3 per cent have been social housing.

Equally, despite decades regurgitating tall buildings, London retains the lowest residential density of any European capital save for Rome, Oslo and Dublin. Additionally, it offers only a quarter of the density of low-rise Paris.

This is why Policy Exchange’s latest paper calls for a fresh approach to solving the housing crisis. Instead of a rush to build tall, S.M.A.R.T Density: Building Dense, Building Beautiful, advocates for a smarter and more intelligent approach to density that essentially makes high density more desirable.

Housing density is currently occupying rare political prominence because the latest revision to the NPPF (National Planning Policy Framework) explicitly calls for residential density across England to be increased. This is a wise and natural response to the housing crisis and we saw it percolate through the Government’s policy portfolio last month when, as part of its ongoing planning reforms, it was announced that high density housing around strategic rail hubs will receive default planning permission.

However, high density, especially in the marginal greenbelt constituencies the Government wishes to install it, is frequently an electorally incendiary proposition precisely because local residents often fear it will lead to inappropriate tall buildings, harmful development, bad design, poor infrastructure and fractured communities.

This is scorched earth territory painfully familiar to Conservatives. The landmark Chesham and Amersham by-election was lost in 2021 due to the proposed zonal planning reforms that would have increased density in certain wards. And even the historic Conservative losses of Westminster and Wandsworth councils at the following year’s local elections could be construed, at least in part, as electoral punishment for both councils’ obdurate pursuit of locally contentious and sporadically ridiculed regeneration schemes like Nine Elms, Paddington Basin and the lamentable Marble Arch Mound.

Therefore, Policy Exchange’s S.M.A.R.T. Density paper seeks to publicly and politically rehabilitate high density from an acquired taste to an aspirational target. It does so by recommending that high density schemes adopt many of the characteristics advocated by Policy Exchange’s Building Beautiful programme, such as placemaking excellence, community empowerment and aesthetic quality. But it principally calls for the wholesale reintroduction of two entities once common to English urban planning: mid-rise and mansion blocks.

Mid-rise can be up to 40 per cent cheaper than high-rise to build and because it doesn’t absorb the spatial, structural, economic and energy inefficiencies high-rises eventually accumulate over a certain height, it can produce densities that either match or exceed those generated by tall buildings.

One of the strongest examples of mid-rise housing is the mansion block, the late 19th century London invention that is capable of producing astonishingly high densities within a format that is effectively a traditional, horizontal skyscraper.

Had Nine Elms been covered with mansion blocks rather than skyscrapers, not only could we have created a timeless new neighbourhood far more sympathetic to London’s traditional scale and character, but, in the midst of a housing crisis, we could have built thousands more homes too. Plus, because mid-rise is cheaper to build than high-rise, a mansion block-focused Nine Elms could have provided significantly more affordable and social housing.

Additionally, we have calculated that were our S.M.A.R.T. Density approach used to raise Birmingham’s density to London’s, this would mean another 200,000 homes in the city, a massive boost to one of Britain’s biggest regional economies. Equally, because high density makes transport improvements more viable, it would have been less likely to spark last month’s indefinite postponement of a new tram network for Leeds – already England’s least dense big city and, by no coincidence, Europe’s largest city without rapid rail transit.

But there is another, more politically localised advantage to increasing density. While Labour has deftly pirouetted from backing council estate tower blocks in the 1970s to privately developed luxury skyscrapers in the 2020s, British conservatism has not had a positive regeneration narrative since the transformation of Liverpool and London docklands in the 1980s. It desperately needs one.

It just so happens that the London districts that specialise in mid-rise and mansion blocks, such as Kensington, Chelsea, Maida Vale, Marylebone and Westminster, are not only some of the most dense echelons of the capital but they also happen to be some of the most desirable. If conservatives can use the density approach advocated in our paper to construct a housing crisis solution centred on recreating Marylebone rather than simply reaching targets, then Labour’s lurid legacy of towers could finally give way to a more popular, productive and patriotic sequel.

Politics

THE RENT BOY SHAGGER of No10 Says Mandelson Betrayed The Country And Lied To Him About His Relationship With Epstein. This man Starmer is a Moral Degenerate.

The worst hypocrisy from the mouth of the worst Traitor in parliament this really is the pot calling the kettle black, Starmer is selling out the UK to the EU for which he should be hanged as a Traitor , and the rent boy shagger of No 10 is now hanging his best bum friend out to dry, this man has no morals, no honour, and no balls to say he is a low life scumbag demeans scumbags.

Starmer said he regretted appointing Mandelson as the UK ambassador to the US (Alamy)

3 min read

Keir Starmer has accused Peter Mandelson of betraying the country and lying to Downing Street about his relationship with Jeffrey Epstein, as the Prime Minister comes under pressure over his initial decision to appoint Mandelson as US ambassador.

Speaking in PMQs on Wednesday, Starmer said he regretted appointing Mandelson as the UK ambassador to the US, and announced that he had agreed with the King to remove him from the Privy Council over the growing scandal surrounding his relationship with Epstein.

Starmer admitted to MPs that he was aware of Mandelson’s relationship with the paedophile financier when he appointed him as the UK’s ambassador in Washington, but said that Mandelson “lied” to him about the depth and extent of that relationship.

The PM sacked Mandelson as the UK’s ambassador in the US in September after more details about the nature of his relationship with Epstein emerged.

Starmer said that Mandelson had “completely misrepresented the extent of his relationship with Epstein and lied throughout the process”.

On Tuesday night, the Metropolitan Police confirmed it will investigate the former cabinet minister for misconduct in public office.

Earlier in the day, Mandelson, who was a key figure in the New Labour administrations of Tony Blair and Gordon Brown, and has remained an influential figure in the Labour Party, said he would resign from the House of Lords amid growing outrage over his links to Epstein.

The government is also planning to use legislation to remove Mandelson’s peer title — an action which no UK government has taken since World War One.

It came after millions of court documents relating to Epstein were published by the US Department of Justice, revealing that Mandelson had shared confidential and high-level UK government information with him, including that the euro bailout was coming.

Speaking on Wednesday, Starmer said: “To learn that there was a cabinet minister leaking sensitive information at the height of the response to the 2008 crash is beyond infuriating.

“And I am as angry as the public and any member of this House. Mandelson betrayed our country, our Parliament, and my party.”

“Mr Speaker, he [Mandelson] lied repeatedly to my team when asked about his relationship with Epstein before and during his tenure as ambassador.

“I regret appointing him.

“If I knew then what I know now, he would never have been anywhere near government.”

On Tuesday, PoliticsHome reported that the Prime Minister was coming under growing pressure from Labour MPs to sack his chief of staff, Morgan McSweeney, over his key role in the original appointment of Mandelson as US ambassador.

Questioned by Tory leader Kemi Badenoch, the PM defended McSweeney, who is seen as the driving force of the Starmer project, and said he had confidence in him.

“Morgan McSweeney is an essential part of my team. He helped me change the Labour Party and win an election. Of course, I have confidence in him,” he said.

The Conservatives are calling on Starmer to publish all documents regarding the vetting of Mandelson ahead of his appointment as US ambassador. The PM has said that he intends to publish all relevant documents, apart from those that could undermine national security and international relations. MPs will vote on what should be published later on Wednesday.

The PM also said that the Metropolitan Police had been in touch “to raise issues about anything that would prejudice their investigations”.

“We’re in discussion with them about that, and I hope to be able to update the House,” he added.

Politics

Reform bigots can’t even vote correctly

Earlier this year, Suella Braverman and Robert Jenrick dramatically defected to Reform. Since then, not everything has gone to plan.

According to Politics UK, both Braverman and Jenrick accidentally voted WITH Labour to abolish the two cap-benefit cap last night on 3 January. This is a direct conflict with Reform’s party line.

🚨 NEW: Robert Jenrick and Suella Braverman accidentally voted with Labour to abolish the two-child benefit cap tonight after entering the wrong lobby pic.twitter.com/RsZSHsGfMV

— Politics UK (@PolitlcsUK) February 3, 2026

Reform backed the wrong horses

Jenrick is the mastermind behind painting over a children’s mural in an asylum centre, so of course he found his political home with Reform. It’s the same with Braverman, who famously said that seeing a migrant plane take off to Rwanda was her “dream” and her “obsession.”

On 3 January, Nigel Farage announced that Reform would, unsurprisingly, vote against removing the two-child cap. And of course he did it with a pint in his hand:

If this doesn’t sum up Reform, I don’t know what does: kick millions of kids back into poverty (by reintroducing the two child benefit limit) so that a six quid pint of beer will reduce to £5.95…https://t.co/04sFXQthYZ

— Anne-Frances Hayes, Politics and all that. (@anne_staveley) February 3, 2026

As Alex Cocker wrote for the Canary:

Never a party to miss a vapid appeal to populism, Reform UK have announced plans to cut beer duty by 10%. Except, how do they plan to fund such a feat? Well, by reintroducing the two-child benefit cap, of course.

Under Reform’s new commitment, the party would gradually phase out business rates altogether for UK pubs. Incidentally, they’d also plunge around 350,000 children back into poverty, and 700,000 into deep poverty.

Despite Jenrick and Braverman enjoying cruelty, it appears they weren’t quite awake for last night’s vote on the two-child benefit cap.

Because they voted with Labour.

Ouch.

UPDATE: It’s been pointed out to me that because they went thru lobby the votes recorded. The record on HoC vote here. So Jenrick and Braverman voted WITH Labour to lift the two child benefit cap 🫣 https://t.co/SjVH1ZuGQ7 pic.twitter.com/R9p9DLYKXS

— Beth Rigby (@BethRigby) February 3, 2026

Farage looks like a fool

After Farage’s very public welcome to Jenrick and Braverman, this fuck up from the both of them makes him look a little silly.

I warmly welcome @SuellaBraverman to Reform UK! 🇬🇧 pic.twitter.com/eGZoK0SdKG

— Nigel Farage MP (@Nigel_Farage) January 26, 2026

As Maddison Wheeldon wrote for the Canary:

this latest whiplash episode suggests that Farage likewise lacks any real vision or principle. But we already knew that.

Let’s see if Farage can at least get his MPs to vote with the party line next time, shall we?

Featured image via UK Government

Politics

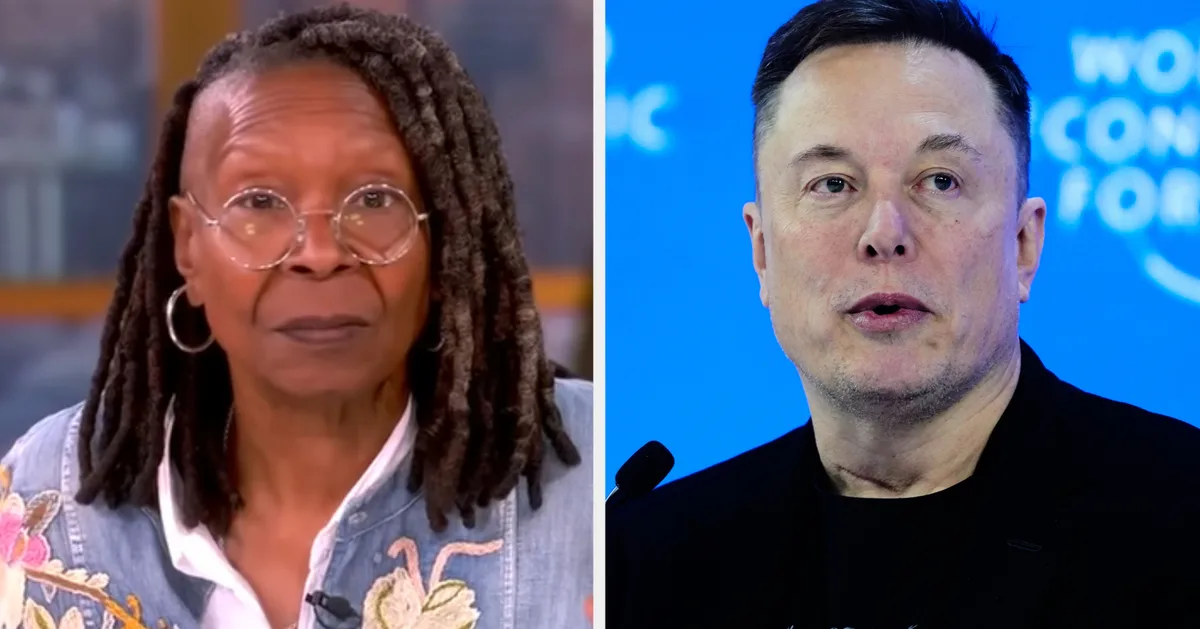

Whoopi Goldberg Schools Elon Musk After He Slammed Lupita Nyong’o Odyssey Casting

Whoopi Goldberg has urged Elon Musk to “sit down” and stay out of “artistic” discussions, after the divisive X CEO’s recent comments about Lupita Nyong’o’s role in the new adaptation of The Odyssey.

Last week, speculation online suggested that Oscar winner Nyong’o would be playing Helen Of Troy in Christopher Nolan’s new film, which immediately sparked backlash from some more conservative critics.

Responding to one post which claimed Lupita playing the role would “ruin” The Odyssey and another describing this as an “insult” to the source text, Musk accused filmmaker Nolan of having “lost his integrity”.

This was then debated during Tuesday’s edition of The View, where moderator Goldberg made her feelings on the matter clear.

“Musk claims that Nolan has lost his integrity… ooh, you know… because Homer described this fictional character as fair-skinned, blonde, who was so beautiful that men started a war over her,” Goldberg said.

“I don’t know if you realise this, Lupita is also considered one of the world’s most beautiful women. So, I’m not sure what you’re trying to say.”

The Sister Act star then pointed out: “You don’t have to actually go to the movie. I don’t know why you feel like you need to speak on this. And I would suggest looking in a mirror, if you have any concerns about people’s looks, if this is where we’re going.”

She added: “And don’t try to clown me, baby! I know what I look like. There are so many things I want to say to you that are rude and awful. But I won’t do it. But know that I’m thinking it.”

After her fellow panellists expressed similar feelings about Musk’s comments, Goldberg concluded: “Elon, just sit down. For this, when it comes to artistic stuff, go sit down, please.”

During the conversation, Sara Haines indicated that Musk had “bigger fish to fry than characters in a movie”, following the news that X’s offices had been raided in France, with prosecutors claiming this was part of an investigation into potential criminal offences including complicity in the possession and distribution of “child pornography images,” personal rights violations through the generation of AI-generated sexual imagery, alleged fraudulent data extraction and the denial of “crimes against humanity”.

Musk claimed this was a “political attack” while an X spokesperson claimed the raid as an “abusive act” against the company.

Last week, leaked emails also appeared to show Musk enquiring about visits to paedophile Jeffrey Epstein’s island in the early 2010s.

Responding to the matter on X, Musk said: “If I actually wanted to spend my time partying with young women, it would be trivial for me to do so without the help of a creepy loser like Epstein and I would still have 99 per cent of my mind available to think about other things. But I don’t.”

Politics

Trump’s 2 Words To Sum Up Peter Mandelson’s Fall From Grace

Donald Trump has appeared to downplay former US ambassador Peter Mandelson’s fall from grace over his links to Jeffrey Epstein.

Mandelson served as the UK’s main link to the Trump administration for much of last year until he was sacked for his friendship with Epstein, the dead paedophile.

After the US Department of Justice released a fresh batch of files unveiling Epstein’s extensive network with the elite over the weekend, it was revealed that Mandelson may have been leaking confidential government information to the disgraced financier.

The peer quit the Labour Party on Sunday night and, after intense backlash, stood down from the House of Lords though his title technically remains.

When reminded by a reporter in the Oval office that Mandelson has been forced to resign over his links to Jeffrey Epstein, Trump replied: “I didn’t know about it. I really don’t know too much about it.

“I know who he is, but it’s… too bad.”

Trump previously claimed not to know who Mandelson was during his most recent state visit to the UK, back in autumn.

“I don’t know him, actually,” he said, at a joint press conference with Keir Starmer.

Asked if he was offended by that, Mandelson brushed it off. The former US ambassador told The Times this week: “He’s so clever.

“I mean, if he had defended me, that would have been embarrassing to the prime minister.

“If he had attacked me, it would have been hurtful to me.”

He also praised the US president in the interview, saying: “You may not like all of Trump’s decisions, but at least he is decisive.”

Trump welcomed Mandelson when he first started in the job a year ago, praising his “beautiful accent” in May and welcoming him into the Oval Office in early September, shortly before he was fired.

Politics

PMQs: Who’s Asking the Questions?

Johanna Baxter (Lab) Julie Minns (Lab) Kerry McCarthy (Lab) Charlie Dewhirst (Con) Luke Charters (Lab) Alex Baker (Lab) Jonathan Brash (Lab) Neil Hudson (Con) Alan Strickland (Lab) Helen Hayes (Lab) Layla Moran (LibDem) Ben Goldsborough (Lab) Christine Jardine (LibDem) Chris Coghlan (LibDem)

Politics

Is Lady Danbury Leaving Bridgerton? Producer Jess Brownell Speaks Out

Bridgerton showrunner Jess Brownell has a reassuring update for anyone worried about Lady Danbury’s future in the hit period drama.

After three seasons as Queen Charlotte’s right-hand woman in the popular Netflix series, Adjoa Andoh’s character has been seen in the latest run of episodes contemplating whether she wants more for herself.

After Lady Danbury’s declaration that she intends to step back from service, many fans have been concerned that this could mean Adjoa may not be appearing in the coming seasons of Bridgerton.

However, during a recent interview with Deadline, Bridgerton’s executive producer said she and her team have “no intentions” of that being the case.

“I want to say very clearly that we have no intentions of Adjoa stepping back,” she insisted. “She’s still absolutely a part of the story in season five.

She continued: “It was more about wanting to explore the dynamic between a friendship in which there’s a power imbalance, which is very on theme with this season, where we’re looking at the relationship between servants and their employers.”

She continued: “The Queen and Lady Danbury are real friends, but because of the power imbalance, it was interesting to explore what happens when Lady Danbury wants to do something for herself. It was an opportunity to explore new depth for their friendship.”

As Brownell stated, themes of power and class are being explored in all areas of Bridgerton season four, including its central love story between Luke Thompson and Yerin Ha’s characters.

Luke and Yerin recently explained how these divisions led to the setting of one of the stand-out steamy scenes between characters Benedict Bridgerton and Sophie Baek, who grow close after meeting at a masquerade ball early on in season four.

The first half of Bridgerton’s fourth season is currently streaming on Netflix, with part two following on Thursday 26 February.

Politics

Rafe Fletcher: Statist Singapore builds homes whilst statist Britain just plans

Rafe Fletcher is the founder of CWG and writes The Otium Den Substack

You can regularly eat and drink for free in Singapore.

Just turn up at one of the British property seminars that pepper the city’s function rooms. Developers and agents swallow the cost of a few freeloaders because it has been a fruitful market. Singaporeans are the second largest group of foreign home owners across England and Wales.

Demand isn’t spurred by colonial nostalgia. Rather, Singaporeans can buy a second home in Britain with far less hassle than in Singapore. And developers welcome the liquidity lacking in those supported only by a British-earned income. Just as a punitive tax regime leaves British buyers short of a deposit, so builders find construction can leave them short of a profit once they have navigated nebulous planning diktats.

Confronting the resulting housing bubble may look awkward for the Conservatives. Even in 2024, 37 percent of outright homeowners voted for them, a 12-point lead on Labour in second place. But the consequences of ducking the issues are starker. Those homeowners will see values deplete anyway under Labour’s trajectory of making everyone poorer. And the Conservatives will make no inroads with a generation shut out of the housing market.

It’s a lesser problem in Singapore where 90 per cent of citizens are homeowners. A product of mass public housebuilding under the Housing and Development Board (HDB). Only Singaporeans are eligible to buy these properties. Buyers draw upon their Central Provident Fund (CPF), a forced personal savings system to put down a deposit on HDBs’ subsidised values. Mortgages are offered with fixed interest rates of 2.6 per cent.

The HDB market is heavily restricted. They can’t be purchased by non-citizens and Singaporeans can only own one unit at a time. Re-sales are prohibited for five years, so there’s no “flipping” on the back of sudden value increases. If Singaporeans want to buy a second home, they must enter the fully private market, which constitutes just 20 per cent of the country’s housing stock. Doing so incurs 20 per cent stamp duty on any second property and 30% on additional ones after that.

Hence why buying in Britain is much more attractive where non-resident stamp duty is only two percent. With far lower tax rates and HDBs available at 3.8 times average income, Singaporeans have the means to buy British stock. Penalising such foreign buyers may play well optically. But as it is, they’re vital in getting homes built. Britain’s largest developer Barratt Redrow recently blamed a lack of them for missing its sales target. International capital helps developers meet affordable housing provisions under Section 106 of the Town and Country Planning Act. Without buyers for higher-price units, the think-tank Onward reports that the cost of delivering new homes often exceeds their capital values.

Section 106 is one of many regulatory hurdles strangling supply. Onward’s research shows that small and medium-sized (SME) developers have been effectively priced out of the market. In the late 1980s, SMEs delivered about 40 per cent of new homes; by 2007, 30 per cent; and today just 12 per cent. They don’t have the scale or balance sheet to weather the costly and cumbersome planning permission process.

Mired in such regulation, Britain’s housing policy is hardly less statist than Singapore. But that statism resides in obstructiveness instead of forcefulness. Singapore can build because the state owns 90 per cent of the land (HDBs and most private housing are on 99-year leases). A situation engineered through the Land Acquisition Act of 1966 that empowers the government to buy any land it wishes at current market value. It is frustrating for golfers as the city-state’s few remaining courses are forcibly purchased to make way for new housing. But it gives the government total control over the supply-chain and costs.

A similar land grab is probably only contemplated by Zack Polanski in Britain. And it’s more likely to resemble Zimbabwe if it comes under the Greens. But there are other lessons Britain can learn from Singapore.

Firstly, provide tax-free incentives for young people to save for a house. Robert Colville writes in The Times that Brits with student loans are paying 50p in tax from every pound they earn over £50,000 and 71p over £100,000. Getting a deposit together is often hopeless for even top-earning graduates without help from the bank of mum and dad. Something like Singapore’s CPF would allow workers to save into a specific house-buying account. It need not be compulsory nor state managed. But it should be ring-fenced and explicitly linked to first-home purchase.

Secondly, remove uncertainty. Singapore’s Urban Redevelopment Authority fixes land use, density and infrastructure expectations in advance. Builders operate within known limits. They don’t have to contend with Section 106-esque regulations that leave developers unsure if local housing associations will even buy the affordable housing they’re obligated to provide. Get things built first.

Finally, Britain needs to stop concerning itself with fringe measures that play only to the politics of envy. I recently went to an event at the Seven Palms complex on Singapore’s Sentosa island, an enclave of wealthy foreigners. It had the ghostly feel of many of London’s high-end developments, with owners mostly in absentia. We may criticise the atmosphere created by such projects but they’re incidental to the wider problem. It’s virtue signalling rather than serious policy.

Britain’s housing crisis is not unique amongst developed nations. But alongside an acute supply shortage, it faces weakening demand. If the most talented young people don’t believe there’s a realistic route to buying, they will leave. And house prices will fall anyway while the country gets poorer. Fixing things now may unsettle Conservative voters who sit on high paper valuations. But a reckoning will come anyway. Perhaps those free evenings out in Singapore will start to dwindle.

Singapore shows the benefits of a government that acts forcefully. Britain shows the consequences of a government that meanders – forcing risk onto developers, disincentivising building and earning, and pandering to NIMBYism. Noel Skelton’s property-owning democracy was once an inspiration to a young Lee Kuan Yew.

The Conservatives need to reclaim that legacy to feed aspiration rather than resentment.

Politics

Why Cola Tastes Different In Glass Bottles

Did you know cola is made with a kola nut? The ingredient, which is from Africa, is where the fizzy drink gets its caffeine from.

Of course, some cola brands keep the other parts of their recipe top-secret. But why do beverages made by the same company seem to taste different in a glass bottle, can, and plastic bottle?

Well, according to Rowland King, a director at the glass bottles supplier, Quality Bottles, there’s real science behind the difference.

Why does cola taste different in a glass bottle vs a can or plastic bottle?

First, there’s the chemistry of each material to consider.

“Glass is chemically inert and non-porous, which means it doesn’t react with the drink or absorb flavour compounds,” King said.

“That helps keep the taste exactly as intended from the moment it’s filled to the moment it’s opened”.

Some experts think the polymer lining of tinned fizzy drinks can lead to a milder taste, while it’s possible that acetaldehyde in plastic bottles could affect the flavour.

And carbonation (bubbles) matter, too, King added.

“Fizzy drinks rely on dissolved CO₂ for their bite and freshness. Over time, plastic is slightly permeable to gas, even when sealed.

“Glass isn’t, so carbonation is typically retained more consistently, which can noticeably affect the taste and how it feels to drink.”

The screw or crown caps commonly used on glass bottles provide a tighter seal, too, allowing less CO2 to escape.

“Bottle shape also comes into it,” King continued.

“A narrow bottleneck concentrates aroma and slows down how quickly the drink hits the palate. That subtly changes the flavour perception compared to drinking from a wide can opening or pouring into a cup.”

Then, there’s temperature to consider

I personally love an ice-cold can of diet cola – sometimes called a “fridge cigarette” – because I feel like it stays cooler and crisper than plastic bottles.

But King explained, “Glass bottles are thicker and tend to chill more evenly and stay cold a bit longer once removed from the fridge. Since temperature strongly affects flavour perception, that alone can make the drink seem more refreshing.”

Of course, companies try their hardest to make their product taste as consistent as possible across a range of containers, King stated.

But, he ended, “material science is material science. The container does make a difference, especially with carbonated drinks”.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 hours ago

Tech5 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World14 hours ago

Crypto World14 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards