Travel

Targeted offer to buy IHG status via elite qualifying points

Typically, offers to buy elite status aren’t compelling. For example, American Airlines AAdvantage’s offers to buy elite status are usually laughably bad. However, IHG One Rewards is giving select members an offer — first reported by LoyaltyLobby — that is compelling.

If IHG targeted you for this offer to buy status, you likely received an email. The title of this email is likely similar to the one TPG senior editor Christine Gallipeau got titled “Don’t lose your Diamond Elite status, Christine,” or the one TPG managing editor Matt Moffitt got titled “Upgrade to Diamond Elite status, Matthew.”

These emails clearly state how many elite qualifying points you’d need to buy by Dec. 31, 2024, to secure a specified status through 2025. However, the elite qualifying points listed in your email are based on your account status as of Dec. 6, so the number won’t be accurate if you’ve earned elite qualifying points since then.

Related: IHG elite status: What it is and how to earn it

Targeted members will also see a tile when they log in to their IHG account, click on their name in the upper right-hand corner and scroll down.

If you click the link in the email, tile or here, you’ll land on a page where you can buy the required points. However, only targeted members will see an offer after logging in on that page. Sadly, I’m not targeted, so I can’t take advantage of this offer.

As a reminder, you’ll need 40,000 elite qualifying points for Gold Elite, 60,000 for Platinum Elite and 120,000 for Diamond Elite. When you consider that the IHG One Rewards Premier Credit Card and IHG One Rewards Premier Business Credit Card offer complimentary Platinum Elite status to cardholders — and members who aren’t eligible for either of these cards can get Platinum Elite status as a benefit of paid InterContinental Ambassador membership — the primary status you might be interested in buying elite qualifying points to claim is Diamond Elite status.

Normally, when you buy IHG points, the points aren’t elite qualifying points. However, during this offer, select members can purchase elite qualifying points that are both redeemable and count toward elite status qualification. The terms for this offer state, “EQP Points are not refundable and are applicable toward all IHG One Rewards redemptions,” where the terms previously defined EQP as elite qualifying points. The terms also state you can only make one purchase of elite qualifying points during this offer, so be sure to buy all that you need at once.

Related: When does it make sense to buy points and miles?

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Christine said she’s currently at 20 elite qualifying nights and 69,470 elite qualifying points, but she plans to stay four more nights with IHG in 2024, which should get her an additional 37,822 elite qualifying points. As such, she told me, “After this stay, I plan on buying the remaining 15,000 points needed to retain my status. I have a two-night mattress run stay I had planned for the very end of the month, but the buy points offer will cost less than that stay, so I plan on canceling it now to instead buy the remaining points.”

Meanwhile, Matt currently has Platinum Elite status through a credit card and has accrued 13 elite qualifying nights and 12,597 elite qualifying points to date in 2024. Matt said he doesn’t currently have any additional stays booked with IHG through the end of 2024 but is strongly considering buying elite qualifying points through this offer, noting, “Given I’ll be traveling full-time for at least Q1 and Q2 next year (potentially into the second half of the year), I’m sure I can get value out of the points and status.”

My husband JT is also targeted for this offer. He accrued 61 elite qualifying nights and 17,265 elite qualifying points through Dec. 16, but he enrolled in a targeted offer to get Diamond Elite status after 10 paid stays between Oct. 1 and Dec. 31. We just checked out of the stay for the 10th night on Sunday, so we won’t have any use for his offer.

Select IHG cardholders enjoy a 20% discount when purchasing points, too, which makes this offer particularly compelling. If Matt has an eligible IHG card that gives the 20% discount, he could buy 110,000 elite qualifying points — which cost $770 — for an effective cost of $616 after the 20% discount. That’s 0.56 cents per redeemable point, just 0.06 cents per point higher than TPG’s December 2024 valuation of IHG points.

Related: Last-minute strategies for earning IHG One Rewards elite status

Bottom line

If IHG has targeted you for this offer, it’s seriously worth considering. Through this offer, targeted members can buy elite qualifying points at a rate close to — if not lower than — the rate at which they can redeem them.

Even though my husband will requalify for Diamond Elite status, I’d likely buy 120,000 elite qualifying points during this offer to also requalify for Diamond Elite status if IHG had targeted me for this offer. After all, 120,000 elite qualifying points cost $800 — effectively $640 after the 20% discount — and I usually get at least 0.7 cents per point when redeeming IHG points and utilizing the fourth-reward-night-free benefit. So, without even considering the value of Diamond Elite status, I’d value the points higher than the cost I’d need to pay.

IHG Diamond Elite status continues to offer my husband and me a ton of value, including a choice of complimentary breakfast for two as a welcome amenity at pretty much any IHG hotel or resort that doesn’t offer free breakfast for all. We’ve found we also frequently get an upgraded room or suite upon request at check-in if the property is still currently selling that room type for our dates. Also, earning 100% bonus points on paid stays is a valuable Diamond Elite perk.

Related: How much value does IHG One Rewards status provide when you book directly?

As for IHG Diamond Elite members who have earned (or planned to earn) the 70 elite qualifying nights or 120,000 elite qualifying points through stays, this offer likely feels like a slap in the face. But these members do get some consolation in that IHG Milestone Rewards are based on elite qualifying nights, not points. So, even if you buy up to a status via purchasing elite qualifying points, you still won’t get access to valuable Milestone Rewards such as an annual lounge membership.

Related reading:

Travel

Boeing delays force American Airlines to suspend 3 European routes, delay Flagship Suite

American Airlines cannot catch a break from Boeing’s production woes.

The Fort Worth, Texas-based carrier will temporarily suspend three routes to Europe this summer and again push back the introduction of its new Flagship Suite business class as a result of the latest delivery delays plaguing the Boeing 787, an American spokesperson confirmed to TPG on Friday.

“As a result of ongoing Boeing 787 delivery delays, American is adjusting service on certain routes in summer 2025 to ensure we are able to reaccommodate customers on affected flights,” the spokesperson said. “We’ll be proactively reaching out to our impacted customers to offer alternate travel arrangements and remain committed to mitigating the impact of these Boeing delays while continuing to offer a comprehensive global network.”

Upgrades clearing less? Airlines say more passengers are just paying for those first-class seats

The three suspended transatlantic routes are:

- Miami International Airport (MIA) to Paris-Charles de Gaulle (CDG) from May through July

- Dallas Fort Worth International Airport (DFW) to Frankfurt Airport (FRA) in June

- New York’s John F. Kennedy International Airport (JFK) to Adolfo Suárez Madrid-Barajas Airport (MAD) in July

This is a well-trod path for American. Delays to 787 deliveries in late 2021 forced it to cut Edinburgh, Scotland; Hong Kong; and Shannon, Ireland, from its map the following year. Production challenges have continued to plague Boeing and forced additional cuts to long-haul flying at American in the years since.

American’s long-haul schedule is uniquely susceptible to Boeing delays compared to other airlines. During the coronavirus pandemic, American took advantage of the dramatic drop in international travel to accelerate plans to streamline its long-haul fleet and retired its Airbus A330 and Boeing 757 and 767 planes.

Now, the airline’s international expansion is limited by Boeing’s inability to hand over new 787s in a timely manner.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

American was scheduled to receive 10 787-9s this year, its latest fleet plan from October shows.

The latest delivery delays also mean the introduction of American’s new Flagship Suite business class is delayed again. CEO Robert Isom said Jan. 23 that the seats would begin flying this year but did not say when. The spokesperson would not specify when in 2025 the new product might debut.

Pro tips: 11 major mistakes people make with travel rewards credit cards

The Flagship Suite product is part of a larger overhaul of American’s premium offerings that also includes new premium economy seats. It will, however, mark the end of long-haul first class at American; the airline plans to remove Flagship First from its Boeing 777-300ER planes when they are refitted with the new Flagship Suite.

American’s first Airbus A321XLRs will also feature the Flagship Suite when deliveries begin later in 2025. These planes will initially fly on premium transcontinental flights between New York and both Los Angeles and San Francisco.

Even with the schedule reductions, American will continue to serve all its European destinations, including Edinburgh via a new service, this summer. It will fly to Frankfurt from Charlotte; Madrid from Charlotte, Chicago, Dallas, Miami and Philadelphia; and Paris from Charlotte, Chicago, Dallas, New York and Philadelphia, schedules from aviation analytics firm Cirium show.

American will also offer fewer frequencies on certain other routes this summer, including between Philadelphia and Rome, and Dallas and London.

Related reading:

Travel

The best UK cities for a foodie staycation named

As Britons plan their culinary adventures for 2025, new data has revealed some unexpected destinations making waves in the UK’s food scene.

While London maintains its crown as the nation’s gastronomic capital, a surprising Welsh city has emerged as a formidable contender in the rankings.

Analysis by travel experts at LateRooms.com has uncovered that Wrexham, recently thrust into the spotlight by its Hollywood-owned football club, is now the country’s second-best foodie destination.

Culinary hotspots like Leeds, Edinburgh, and Manchester also made the list, being named as places Britons should venture to for an exciting food experience.

Edinburgh make the list

PA

London’s dominance in the culinary landscape is reflected as 26.3 per cent of restaurants there have achieved five-star status, according to the LateRooms.com analysis.

Leeds secured the third position with 20.99 per cent of its eateries receiving top marks, whilst traditional tourist destinations like Edinburgh ranked lower than expected.

The rankings show a notable shift away from traditionally celebrated culinary capitals, with seaside towns Blackpool and Scarborough both securing spots in the top seven.

The top 10 foodie destinations

London – 26.3%

Wrexham – 21.71%

Leeds – 20.99%

Blackpool – 19.1%

Brighton – 18.83%

Cardiff – 18.42%

Scarborough – 18.25%

Liverpool – 17.03%

Edinburgh – 16.34%

York – 15.18%

Wrexham’s rise in the culinary world mirrors its recent sporting fame, with the city developing a unique food identity that blends Welsh traditions with international influences. The city’s Portuguese community has particularly enriched its dining scene.

The experts said: “You’ll find traditional Welsh cuisine, as well as more continental flavours. Thanks to the city’s Portuguese community, you can find pastel de natas as easy as bara birth.”

LATEST DEVELOPMENTS

Those looking for restaurants should consider a London break

PA

Leeds came in third and also has a rich mix of cuisine. The experts continued: “Like London, Leeds has a diverse and multicultural community to thank for its vibrant food scene. You won’t be short of classic hearty Yorkshire meals, but the city’s street food scene is not to be missed.”

Brighton has carved out its own niche as a sustainable dining destination, with the pros stating: “Brighton is one of the UK’s best locations for high-end plant-based dining. Chefs in this foodie hub often focus on sustainability, with an emphasis on seasonal and local produce.”

Edinburgh, despite ranking ninth, has developed a sophisticated dining culture.

“Edinburgh has become a real high-end foodie destination of late, with a fine dining scene to rival any major city. The Scottish capital boasts a thriving café culture with photogenic patisseries,” the experts highlighted.

Travel

Chase Sapphire Preferred vs. Ink Business Preferred: Which $95-a-year card should you get?

Editor’s note: This is a recurring post, regularly updated with new information and offers.

With so many fantastic travel rewards credit cards available, including some with large sign-up bonuses and phenomenal benefits, you might have difficulty choosing one (or a combination) that suits your needs. This can become even more overwhelming if you qualify for a small-business credit card, which opens the door to many additional options.

Two of the most valuable mid-tier cards from Chase include the Chase Sapphire Preferred® Card and Ink Business Preferred® Credit Card, which have similar benefits — including earning Ultimate Rewards points and annual fees of $95.

While they make a pretty powerful team, you might only want or be eligible for one or the other — for instance, if you are not looking for a business card or are nearing your 5/24 limit with Chase. Today, we will look at how these cards stack up against each other and help you decide whether one or both deserve a place in your wallet.

Sapphire Preferred vs. Ink Business Preferred comparison

| Chase Sapphire Preferred | Chase Ink Business Preferred | |

|---|---|---|

| Annual fee | $95 | $95 |

| Welcome bonus | Earn 60,000 points after spending $4,000 on purchases in the first three months of account opening. | Earn 90,000 bonus points after spending $8,000 on purchases in the first three months from account opening. |

| Earning | 5 points per dollar on hotels and car rentals purchased through Chase Travel℠

3 points per dollar on dining worldwide 2 points per dollar on all other travel 1 point per dollar on everything else |

3 points per dollar on up to $150,000 spent in combined purchases on travel, shipping, internet, cable, phone, social media & search engine advertising (each account anniversary year)

1 point per dollar on everything else |

| Trip cancellation/interruption | Up to $10,000 per person, $20,000 per trip | Up to $5,000 per person, $10,000 per trip |

| Trip delay | 12 hours, up to $500 per ticket | 12 hours, up to $500 per ticket |

| Lost & delayed luggage | 6 hours, up to $100 per day up to five days

Up to $3,000 for lost bags |

6 hours, up to $100 per day up to five days

Up to $3,000 for lost bags |

| Rental car coverage | Primary | Primary, business-related rentals |

| Purchase protection | Up to $500 per claim, $50,000 per account | Up to $10,000 per claim, $50,000 per account |

| Extended warranty | Additional one year for items with less than three years of warranty

Up to $10,000 per item, $50,000 per account |

Additional one year for items with less than three years of warranty

Up to $10,000 per item, $50,000 per account |

| Cellphone protection | None | $100 deductible, up to $1,000 per claim, maximum of three claims per 12-month period |

Sapphire Preferred vs. Ink Business Preferred welcome offer

The Chase Sapphire Preferred is currently offering a welcome offer of 60,000 Ultimate Rewards points after spending $4,000 on purchases in the first three months of account opening. The Chase Ink Business Preferred currently offers 90,000 bonus points after spending $8,000 on purchases in the first three months from account opening.

According to TPG’s January 2025 valuation, Ultimate Rewards points are worth 2.05 cents each, making these bonuses worth up to $1,230 and $1,845, respectively.

While the Ink Preferred cleans the table when it comes to bonus value, that $8,000 minimum spending requirement might be difficult for some businesses to hit, so you’ll want to consider your spending power when deciding which card to get.

Winner: Ink Business Preferred. Its welcome offer provides more value.

Related: 5 reasons to get the Ink Business Preferred

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Sapphire Preferred vs. Ink Business Preferred benefits

Both cards offer phenomenal travel protections that are quite similar, though the Sapphire Preferred is slightly more comprehensive.

Each card includes trip cancellation and interruption insurance. With the Ink Business Preferred, you’re covered for up to $5,000 per trip for nonrefundable travel expenses, up to $10,000 per trip. The Sapphire Preferred covers up to $10,000 per person or up to $20,000 per trip. Trip delay reimbursement for things like overnight lodging or meals kicks in at 12 hours with the Ink Business Preferred and the Chase Sapphire Preferred. Both cards also cover up to $500 per ticket in the event of a covered delay.

The baggage delay insurance is identical on both cards: up to $100 per day for up to five days when your bag is delayed or misdirected for more than six hours. Lost luggage insurance with both cards is up to $3,000 per passenger.

Both cards also offer primary rental car coverage, which is a fantastic benefit and alleviates the expense and hassle of dealing with an agency or your own insurance if things go wrong with a rental. However, the Ink Business Preferred’s benefits state that your rental must be for business purposes for this protection to kick in.

Both cards also provide purchase protection and extended warranty coverage as well. The Chase Sapphire Preferred offers purchase protection of up to $500 per claim with a $50,000 limit per year, and the Ink Business Preferred offers a slightly elevated coverage of $10,000 per claim with the same $50,000 maximum

In addition, both cards provide extended warranty coverage for eligible items by extending a manufacturer’s warranty by one additional year for items with less than three years of warranty. In case of a replacement or repair the cards each provide up to $10,000 per item with a $50,000 maximum per account.

Finally, the Ink Business Preferred provides cellphone protection when paying the monthly bill. The card covers up to $1,000 in case of repair or replacement with a $100 deductible.

Beyond travel protections, the Chase Sapphire Preferred offers a statement credit each account anniversary of up to $50 on hotel stay purchases through Chase Travel℠. In addition, cardholders also receive 10% anniversary bonus points each year. The bonus is based on your total spend during the account anniversary year at a rate of 1 point for every $10 spent.

Finally, the Sapphire Preferred also provides at least one year of complimentary DoorDash DashPass membership (activate by Dec. 31, 2027) and up to $10 off a month on non-restaurant DoorDash orders.

Winner: Sapphire Preferred. Its benefits outclass those on the Ink Business Preferred.

Related: Why the Sapphire Preferred is the top travel rewards card year after year

Earning points with the Sapphire Preferred vs. Ink Business Preferred

The cards’ earning rates are very different. The Chase Sapphire Preferred earns 5 points per dollar on hotels and car rentals purchased through Chase Travel℠, plus 2 points per dollar on a broad range of travel purchases, including airline tickets and hotel stays and taxis, tolls and parking. The card also earns 3 points per dollar on dining worldwide and 1 point per dollar on everything else, all with no earning caps.

The Ink Business Preferred earns a solid 3 points per dollar on the first $150,000 spent each account anniversary year on a combination of travel (the same broad category as with the Sapphire Preferred), shipping purchases, internet, cable and phone services, and advertising purchases made with social media sites and search engines. It earns 1 point per dollar on everything else.

There are a couple of things to keep in mind here. First, if dining is one of your major expenses, the Chase Sapphire Preferred is the way to go. However, if travel is your main outlay, the Ink Business Preferred’s 3-points-per-dollar bonus edges out the Sapphire Preferred’s 2-points-per-dollar rate in this category.

Another consideration is that if you are a business owner and spend a lot of money in the card’s other bonus categories, you might hit that $150,000 annual cap sooner than you think. Still, to make the Sapphire Preferred worth it over the Ink Business Preferred strictly in terms of travel, you’d have to spend $225,000 or more in travel purchases each year instead of $150,000 with the business card.

Winner: Tie. The categories differ significantly, and your preference will depend on your spending habits.

Redeeming points with the Sapphire Preferred vs. Ink Business Preferred

Both cards earn Ultimate Rewards points, some of the most valuable around.

You’ll get the highest value from your points by transferring them to one of Chase’s 14 airline and hotel loyalty partners.

Cardholders of either product can also redeem points directly for travel through the Chase travel portal to get 1.25 cents per point in value and have the option to redeem points for eligible categories through Pay Yourself Back.

Winner: Tie. You’ll get the same redemption options on either card.

Related: 6 of the best Ultimate Rewards sweet spots

Transferring points with the Sapphire Preferred vs. Ink Business Preferred

Ultimate Rewards can be transferred to 11 airline partners, including British Airways, Southwest and United, and three hotel programs: Marriott Bonvoy, World of Hyatt and IHG One Rewards.

These transfer partners can provide great value. For example, TPG managing editor Madison Blancaflor was able to snag a last-minute premium economy ticket from New York to Amsterdam using Flying Blue for just 20,500 Ultimate Rewards points using a transfer promotion.

Winner: Tie. You’ll get the same redemption options on either card.

Related: How I used a transfer bonus to get a lie-flat seat to London for just 21,000 points

Should I get the Sapphire Preferred or Ink Business Preferred?

You should consider whether you want to carry a personal credit card or one for business. If you prefer a personal credit card and can benefit from the Chase Sapphire Preferred‘s superior travel protections, not to mention its handy dining category bonus, it might be the better option for you.

Still, the Sapphire Preferred and Ink Business Preferred combination is a powerful match-up that could boost your travel rewards earnings into the stratosphere.

Bottom line

If you’re trying to decide between the Chase Sapphire Preferred and Ink Business Preferred, think about whether you want a business or personal card, which one’s category bonuses you will best be able to take advantage of, and which one’s travel protections are better suited to your needs.

The two products are among the best travel rewards credit cards currently available, and carrying both is a good way to boost your points earnings on an ongoing basis.

To learn more, read our full reviews of the Chase Sapphire Preferred and Ink Business Preferred.

Apply here: Chase Sapphire Preferred

Apply here: Ink Business Preferred

Travel

American Airlines’ plan for 2025: New biz-class suites, more lounges and improved Wi-Fi

Travelers have a lot to look forward to from American Airlines in 2025: New business-class suites, premium lounges and satellite Wi-Fi are coming, as well as a full recovery of its Chicago and Philadelphia hubs.

Those are just a few items that American CEO Robert Isom and other executives outlined during the airline’s fourth-quarter earnings call Thursday. The outlook is mostly bright with, as Isom put it, “robust demand across the board” for air travel.

But even those positive words and modest profits in the fourth quarter and full year of 2024 were not enough to appease investors. American’s forecast of a first-quarter loss — historically the weakest quarter of the calendar year for U.S. airlines — sent the airline’s stock down nearly 9% to $17.03 per share on Thursday.

Pro tips: The biggest mistakes people make with travel rewards credit cards

“I really feel like we’ve got all the pieces in the puzzle in place to really take off,” said Isom. “Now, we’ve got some work to do putting that together and selling, and telling our story better, but we are the largest in the best market in the world here in the U.S.”

Here are five key takeaways from American’s earnings call.

American will debut its new Flagship Suites

American plans to introduce its new Flagship Suite business-class seats on new Airbus A321XLR and Boeing 787-9 planes later this year, Isom said. The suites are part of a larger investment in premium offerings that includes new premium economy seats and other onboard upgrades.

First unveiled in 2022 as part of the boom in premium — particularly premium leisure — travel demand following the pandemic, the new Flagship Suites were supposed to enter service in 2024. However, the numerous supply chain issues that continue to plague the aerospace industry delayed their debut to this year.

The new seats and cabins will also be installed on American’s largest aircraft, the Boeing 777-300ER, at a later date. Isom did not offer an updated timeline for the retrofits that were previously set to begin in late 2024.

As part of the cabin upgrades, American will retire the Flagship First product that it currently offers on its small fleet of premium transcontinental Airbus A321s — the A321Ts — that flies between New York and both Los Angeles and San Francisco, and on the 777-300ER. The airline does not yet have a date for the final flight of Flagship First.

Philadelphia will get a Flagship Lounge

American plans to open a new Flagship Lounge at its Philadelphia International Airport (PHL) hub this summer, Isom said. The lounge will be in the A-West terminal used by American’s international flights and available only to travelers booked in long-haul international first or business class, as well as certain elite frequent flyers.

The lounge comes as American builds back its Philadelphia gateway. It will add new nonstops to Edinburgh and Milan from the airport this summer that, coupled with other international capacity increases, will result in more long-haul flights and seats from Philadelphia during the peak June-to-August period for the first time since the summer of 2019, schedule data from aviation analytics firm Cirium Diio shows.

Travel perks: Domestic lounges that are worth going out of your way for

American will complete its postpandemic schedule recovery

Philadelphia is not the only American hub set for a full recovery this year. The airline plans to focus its “low single digit” capacity growth in 2025, as Chief Financial Officer Devon May put it Thursday, on recovery of its northern hubs, including at Chicago’s O’Hare International Airport (ORD) and Philadelphia.

This recovery will be driven by the return of regional jets that were idled early in the pandemic, and complemented with the delivery of 40 to 50 new airplanes in 2025, May said.

“It’s no secret that we have had to build back our network,” said Isom. “I feel great that in 2025 we’re going to have our regional fleet fully deployed, and what that’s going to allow us to do is better fill out some of the hubs that are, quite frankly, ready and willing to support the network.”

In 2024, flights at American’s Chicago and Philadelphia hubs were down by about a quarter from five years earlier, Cirium Diio data shows.

High-speed Wi-Fi is coming to American’s regional jets

American plans to begin, and finish, the installation of new high-speed, satellite Wi-Fi on its two-class regional jets in 2025. This includes the Embraer E170s and E175s, and CRJ-700s and -900s in the American Eagle fleet.

“We’re really interested that our customers have access to Wi-Fi, satellite-based Wi-Fi, on everything that they fly,” said Isom.

American’s fleet of single-class regional jets — Embraer ERJ-145s — will not receive the new high-speed inflight connectivity.

Asked by Wall Street analysts if American was reconsidering its stance on in-seat entertainment screens, Isom said the airline will upgrade its in-seat entertainment offerings on long-haul aircraft, including the A321XLR and 787, but has no plans to offer the popular entertainment option on its domestic narrow-body fleet.

TPG’s picks: The most exciting new airline routes for 2025

Optimism for air traffic control improvements

“It’s imperative that we keep investing in air traffic control,” Isom said when asked his view of the new Trump administration in Washington. “There’s a lot of growth that is hoped for in the industry but we can’t [just] keep on jamming more aircraft in the skies.”

“President Trump and the administration recognize the importance of the industry to commerce,” he added.

While Isom did not elaborate on what air traffic control investments should look like, President Donald Trump has previously supported proposals to privatize the air traffic control system. Investments could also include the long-discussed and much-delayed “NextGen” upgrades that include modern, GPS-based flight tracking systems.

Related reading:

- When is the best time to book flights for the cheapest airfare?

- The best airline credit cards

- What exactly are airline miles, anyway?

- 6 real-life strategies you can use when your flight is canceled or delayed

- Maximize your airfare: The best credit cards for booking flights

- The best credit cards to reach elite status

- What are points and miles worth? TPG’s monthly valuations

Travel

6 reasons to book a balcony cabin on your next cruise

Is it worth paying extra for a balcony cabin?

As someone who has written about cruising for more than two decades, I have heard that question a lot, and I know where I stand on it: Absolutely.

You’ll almost always pay more for a balcony cabin on a ship than for a cabin that just has a window — the latter being known in industry lingo as an “ocean-view” cabin. But often, it’s not outrageously more.

For example, at the time of this story’s publishing, fares for balcony cabins on some 2026 cruises out of Galveston, Texas, were just 4% more than fares for ocean-view cabins. (Specifically, that was the differential on seven-night sailings in September 2026 on Royal Caribbean’s Symphony of the Seas; the differentials for sailings out of Galveston the same month on MSC Cruises‘ MSC Seascape and Carnival Cruise Line‘s Carnival Dream were a higher 14% and 19%, respectively.)

Ocean-view cabins on the same three ships, in turn, were running 14% to 37% more than windowless inside cabins — the third major category of cabins you’ll find on ships.

These differentials aren’t insignificant, of course. For many vacationers on a tight budget, even a small increase in price for a room can be a deal breaker.

Related: 8 cabin locations on cruise ships that you should definitely avoid

In addition, some people with extra money to spend would rather splurge on shore excursions or other extra-charge items, such as shipboard spa treatments, than on a higher-priced cabin. That makes perfect sense to me. What is most important to one person on a vacation may be different from what is important to another person.

That said, here are six things you’ll get out of a balcony cabin that I think make it worth the extra cost if you have the money to spare.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

The fresh air

For me, this is the big reason to get a balcony cabin. At any time of the day — or night — you can slide open your balcony door and breathe in the fresh ocean air. You’ll also be able to hear the sounds of the waves as they crash against the bow of your ship. It’s a wonderfully soothing, rhythmic sound — so soothing that it can lull you to sleep.

Even on cruises in cold weather, there’s nothing quite like stepping out on a balcony for a few minutes or more to soak in the salty breeze. It’s invigorating.

Related: 5 reasons to turn down a cruise ship cabin upgrade

The fresh air available on balconies also can be a lifesaver — at least for your sanity — should you find yourself confined to your cabin due to an illness. That can happen if you come down with something like norovirus or COVID-19 on a ship. This happened to cruisers quite a bit during the height of the COVID-19 pandemic, and many of the people who were isolated in cabins without balconies for days weren’t thrilled with the lack of access to fresh air.

I can attest personally to the fact that it isn’t a great situation to be stuck in a room that doesn’t have a balcony for days. In late 2020, I was isolated in a cabin without a balcony for four days during a COVID-19-related ship quarantine, even though I wasn’t sick. I would have paid just about anything during those days for even the smallest bit of outdoor space.

The ultimate privacy

Cruise ships can be crowded places. Even on luxury ships, which generally have more space per passenger than mass-market vessels, you’ll likely be sharing the pool deck with dozens or even hundreds of other people. On some of the biggest vessels, such as Royal Caribbean’s giant new Icon of the Seas, you’ll compete for deck chairs with literally thousands of others. Private, it isn’t — nor is it often quiet. The pool decks of cruise ships can be noisy places.

If you have a balcony cabin, you’re always guaranteed an outdoor space where you can lounge for a few hours in complete privacy. And, in general, it will be a quiet outdoor space. While you will sometimes hear the sounds of other passengers nearby on their own balconies, for the most part, it’s a much more serene experience than being up on the top deck.

The best views

Balcony cabins don’t just offer you access to an outdoor space. They typically also offer you a great view of the outdoors from inside your cabin.

This is because the doors leading to balconies in balcony cabins usually are made almost entirely of glass running from floor to ceiling. Often, a balcony cabin will have both a floor-to-ceiling glass door leading to the outside as well as floor-to-ceiling windows that make for what is, in effect, an outward-facing wall made entirely of glass. Ocean-view cabins without balconies, by contrast, often have just a single window. Some just have portholes.

Related: 7 reasons you should splurge for a suite on your next cruise

The result is that you’ll generally have a much better view of the outdoors from the inside of a balcony cabin than from the inside of an ocean-view cabin.

The chance for wildlife encounters

Speaking of the view, you’re going to be able to see passing wildlife much better from a balcony cabin than an ocean-view cabin. If you stand at the edge of your balcony railing, you’ll be able to twist your head side-to-side to get a 180-degree view of the passing waters. That’s two or three times the field of vision that you’ll get from gazing out a cabin window.

Related: The 5 most desirable cabin locations on any cruise ship

I’ve found balcony cabins to be particularly wonderful to have in wildlife-filled destinations such as Alaska, where ships sometimes pass such spectacular creatures as whales in the water or bears along the shoreline. Often, the captain of a vessel will spot such animals first and then make a public announcement to passengers to head to the sides of the ship to look. If you’re in a balcony cabin (and on the correct side of the ship), you’ll be gazing down upon these sights in no time.

The chance for a romantic dinner

There’s nothing that says romance like a private dinner for two under the stars. And that’s exactly what you can do on your balcony on many cruise ships, with the waves as a background soundtrack.

Some upscale lines will arrange an elegant, private dinner for two on your balcony — think white tablecloths, multiple courses, the works — at no extra charge. Among mass-market lines, Princess Cruises offers an Ultimate Balcony Dining experience at an extra charge that brings a four-course meal, Champagne and cocktails or a glass of wine. In the case of the Princess offering, you’ll even get fresh flowers and a (flameless) candle on your table.

The perfect spot to watch a port arrival

I’m a big fan of getting up early to watch as cruise ships pull into ports. In some places, such as New York and Sydney, the experience is a highlight of the trip. The arrival into New York, in particular, is one of the great cruise experiences. Your ship will glide under the giant Verrazzano-Narrows Bridge (often with just feet to spare) before passing the Statue of Liberty and the skyline of lower Manhattan.

Related: What’s a cruise cabin guarantee — and will it save you money?

But as spectacular as they are, these arrivals into ports often take place very early in the morning, before you (or at least your bed-head hair) may be ready to go out into the world. What’s great about having a balcony is that you don’t have to get dressed and ready for the day to watch a port arrival. You can just roll out of bed in your jammies and head out on the balcony.

Of course, you have to be on the correct side of the ship to get certain views. Arriving in New York, there is an allure to watching the arrival from both sides of a vessel. From the port side, you’ll get the best view of the Statue of Liberty. But the starboard side brings you the best views of downtown Manhattan, assuming you’re on a vessel heading to a midtown pier.

Bottom line

Balcony cabins cost more than ocean-view cabins or windowless “inside” cabins. But they can be worth the splurge if you’re the kind of person who likes a private place to be outdoors during a vacation. No matter how crowded your ship is, you can always escape to your balcony, if you have one, and watch the world go by with few distractions.

Planning a cruise? Start with these stories:

Travel

European country named ‘super affordable’ destination for British expats

Choosing to move abroad is a major life decision that calls for careful deliberation and planning. Thankfully, relocation experts can provide valuable insight.

Brittany, from She Run the World travel blog, recently recommended one location as particularly accessible for UK nationals looking to start fresh overseas.

She highlighted the benefits of moving to Georgia based on its straightforward long-term visa arrangements for British citizens.

“Georgia is where UK citizens can stay for up to one year without a visa, which is the same as American citizens,” Brittany shared on YouTube.

Georgia has become a popular destination for expats

GETTY

The country sits at a unique crossroads where Eastern Europe meets Western Asia, creating a distinctive cultural landscape.

“It’s kind of on the intersection between Eastern Europe and Western Asia collide so it’s not really considered one or the other,” Brittany pointed out.

“It’s very similar to Turkey in the sense that it’s where European and Middle Eastern cultures, architectures and foods really come together to create a melting pot,”

According to the traveller, the country’s appeal lies in a combination of accessible residency options and lifestyle benefits.

The capital city, Tbilisi, has long been one of the primary destinations for foreign nationals relocating to Georgia, attracting expats with its modern amenities and dynamic nightlife scene.

Professional opportunities are equally abundant in Tbilisi. This makes it an attractive option for career-focused expatriates.

The country’s affordability is another major draw because it offers British expats the chance to live economically while exploring both Eastern Europe and the Middle East.

“It’s super affordable, so it’s a great place to save money and live for cheap while also travelling around the Middle East and Eastern Europe,” explained Brittany.

The relocation expert also highlighted Gibraltar as a particularly appealing option for British citizens, with the right to live and work there indefinitely.

Britons can enjoy lower living costs in Georgia

GETTY

Located at the southern tip of Spain, facing Morocco, Gibraltar maintains a unique status as a British overseas territory.

“It’s technically considered a British overseas territory and not a part of Spain, which is why British people can live there indefinitely,” explained Brittany.

The territory’s position provides residents with easy access to both mainland Spain and North Africa.

British nationals can choose to work, study, or settle in Gibraltar without the visa restrictions typically associated with moving abroad, noted Brittany.

Travel

Review: Weinhaus Tyrol, Innsbruck, Tyrol, Austria

Hidden in plain sight in Innsbruck, Weinhaus Tyrol is known to locals but still flying under the radar of most tourists. It’s the kind of place you dream of stumbling upon, and offers an intimate private dining and wine tasting experience.

Inside, there’s an extensive display of wines, a bar and occasional barrels used as make-shift tables to enjoy a drink or two.

At the end of this corridor and down a few steps, is a small converted cellar. With its arched ceiling, stone walls half-clad in plaster and dimly-lit ambience, it exudes a rustic charm and enjoys various quaint details.

Now I don’t profess to be a wine connoisseur, but I do enjoy a glass or two, and here we were in for a treat – this wasn’t just a dinner and a few glasses of wine, but an invitation to slow down, savour and be immersed into the culinary soul of Tyrol.

A member of staff introduces our first wine to us – it’s the Schmidl Grüner Veltliner Steinfeder Ried Alte Point. The Schmidl winery is a traditional family-run estate in the Wachau, known for its respectful approach to nature and its pursuit of the highest quality. The family cultivates their vineyards in a natural way and relies on sustainable farming methods to reflect the unique terroir of the Wachau. It’s light and fresh with notes of green apple, citrus fruits, and a hint of white pepper.

A generous spread of local cheeses, a selection of perfectly cured meats and a basket of bread are brought through for us to enjoy our wines with, arranged with a rustic elegance that spoke of tradition rather than showmanship, but was nevertheless delicious.

Next up is the Müller Thurgau (a cross between Riesling and Madeleine Royale) from Weinhof Tangl, one of only 13 official wineries in Tyrol. It’s fruity and aromatic with aromas of nutmeg, pear and fresh herbs. The climate in Tyrol differs significantly from that of its southern neighbour. Despite having the same amount of sunshine hours as many cities in South Tyrol, the region experiences more frost nights, which greatly influence grape ripening and wine structure. Weinhof Tangl has been passionately run by the family for generations and their focus is on a harmonious blend of tradition and innovation.

Our third white wine of the evening is another from the Schmidl winery – a Schmidl Riesling Smaragd Küss den Pfennig. Powerful and complex, it has aromas of ripe peach, apricot and a fine minerality. The Schmidl winery is renowned for its excellent Rieslings, which reflect the unique terroir of the Wachau. The name “Küss den Pfennig” (“Kiss the Penny”) refers to a centuries-old tradition and the great value the family places on every detail of wine production.

At this point, the cheese platter – adorned with grapes, figs and wlanuts – offers a welcome balance, helping to complement the wine and absorb some of the alcohol. Tyrol is renowned for its exceptional dairy products, particularly cheeses like Tiroler Bergkäse. The superior quality is largely due to the cows grazing on the pristine mountain pastures, which enhance the flavour of the milk.

Our next wine hails from the only winery located in a European capital city — the Edelmose winery in Vienna which has a history of over 600 years. Since the Middle Ages, winemaking has been pursued there with great dedication, with historic vineyards situated on the foothills of the Vienna Woods. The unique location in the heart of a vibrant city creates an unmistakable terroir and makes Edelmose a true institution in Viennese winemaking. The Edelmoser Rosé de Vienne is made from Zweigelt and Pinot Noir grapes – it’s fresh and fruity with aromas of red berries, cherry and a hint of floral notes.

And then it’s on to our first red of the evening with the Ernst Zweigelt Deutschkreuz (Zweigelt is an Austrian cross between Blaufränkisch and St. Laurent, known for its fruit-driven and spicy red wines with soft tannins). The Ernst winery is located in Deutschkreuz, the heart of Blaufränkisch country in Burgenland, and is known for its characterful red wines. The Ernst family focuses on natural cultivation, sustainable wine production, and authentic wines that perfectly reflect the region’s terroir. The Seewinkel region is characterized by unique geological and climatic conditions that are of great importance for viticulture. The seasonal drying of the saline lakes creates specific soil conditions that impart a mineral and salty note to the wines. It’s bold and spicy with notes of dark cherries, berries and a subtle touch of vanilla.

It seems there’s another wine waiting for us, but by now, we’ve had our fill. Each wine had been exquisite but what made the experience truly special was the ambience and sense of exclusivity, and – of course – good company. For anyone visiting Innsbruck, Weinhaus Tyrol is an absolute must-visit.

Disclosure: Our trip was sponsored by Innsbruck Tourism.

Did you enjoy this article?

Receive similar content direct to your inbox.

Travel

St. Regis Longboat Key review

I may be biased, but as a born-and-raised Floridian, I can confidently say the Sunshine State is one of the best places to vacation in the United States. The draw of Southwest Florida has always been undeniable: serene beaches, picturesque sunsets and tropical weather nearly all year-round, with less-crowded beaches than what you might see in other Florida vacation spots like Daytona or Miami.

And now, nestled along Florida’s pristine Gulf Coast, comes Marriott’s newest Florida resort, the St. Regis Longboat Key. With impeccable service and luxury accommodations, the property takes everything there is to love about a Florida vacation and elevates it.

While the price for a stay here can be quite steep, this hotel can certainly be more attainable if you’re willing to save up your Marriott Bonvoy points. Here’s what it’s like to stay at the St. Regis Longboat Key — and why it earned a spot on our list of the best new hotels in 2024.

Related: The best St. Regis hotels for the most luxurious hotel stays

What is the St. Regis Longboat Key?

Celebrated as the most significant development in the region in more than 50 years, the St. Regis Longboat Key was one of the most anticipated hotel openings in 2024. It also marks a major milestone for Marriott — its 9,000th property.

The resort features 168 rooms and suites, a 20,000-square-foot spa, a beachfront lazy river and a 350,000-gallon lagoon filled with 2,800 tropical fish — all spread across 18 acres of prime beachfront real estate.

The hotel’s design is rich with tributes to Florida’s natural elements and wildlife, as well as the legacy of circus magnate John Ringling and the Ringing Brothers, including contemporary nods like elegant rope-clad chandeliers and an oval-shaped ballroom that resembles a circus tent. Even the suites continue the long-held St. Regis tradition of being named to honor prominent women who have called the surrounding area home, including Mable Ringling and Lora Whitney.

True to St. Regis form, the hotel is equipped with an extensive array of top-notch amenities and its signature butler service.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

How to book the St. Regis Longboat Key

The St. Regis Longboat Key offers nine different room and suite types. Rates for superior rooms, which average around 470 square feet and have partial water views, start at roughly $930, or 102,000 Marriott points, per night during peak months. Deluxe and grand deluxe rooms, on the other hand, have ocean views and encompass around 545 square feet. Deluxe rooms start at roughly $1,014, or 124,000 Marriott points, and grand deluxe accommodations begin at $1,161 or 154,000 Marriott points.

Then there are the 26 oceanfront suites that range from one- to four-bedroom options, all boasting what I can confirm are absolutely breathtaking views of the Gulf of Mexico that you can enjoy from your private terrace. When checking various dates throughout the calendar, suite availability for point redemption can vary depending on the season, but expect them to have starting costs of around 400,000 Marriott points or $4,000 per night for a one-bedroom suite.

When booking the St. Regis Longboat Key, you’ll want to use one of the credit cards that earn the most points for Marriott stays, and one that offers automatic Marriott Bonvoy elite status for value-added benefits. These include:

- Marriott Bonvoy Brilliant® American Express® Card: Earn 6 points per dollar spent on eligible purchases at hotels participating in the Marriott Bonvoy program; automatic Platinum Elite status; and 25 elite night credits per year toward a higher tier.

- Marriott Bonvoy Bevy™ American Express® Card: Earn 6 points per dollar spent on eligible purchases at hotels participating in the Marriott Bonvoy program; automatic Gold Elite status; and 15 elite night credits per year toward a higher tier.

- Marriott Bonvoy Bountiful™ Card: Earn 6 points per dollar spent on eligible purchases at hotels participating in the Marriott Bonvoy program; automatic Gold Elite status; and 15 elite night credits per year toward a higher tier.

- Marriott Bonvoy Business® American Express® Card: Earn 6 points per dollar spent on eligible purchases at hotels participating in the Marriott Bonvoy program; automatic Gold Elite status; and 15 elite night credits per year toward a higher tier.

- Marriott Bonvoy Boundless® Credit Card: Earn 6 points per dollar spent on eligible purchases at hotels participating in the Marriott Bonvoy program; automatic Silver Elite status; and 15 elite night credits per year toward a higher tier.

- Marriott Bonvoy Bold® Credit Card: Earn 3 points per dollar spent on eligible purchases at hotels participating in the Marriott Bonvoy program; automatic Silver Elite status; and 5 elite night credits per year toward a higher tier.

The information for the Marriott Bonvoy Bountiful card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

The location

As soon as we approached the St. Regis, it felt like we’d entered an exclusive island getaway; it is one of the few hotels you’ll find on Sarasota’s barrier islands. There were staff outside, ready to greet us by name (with warm towels and Champagne, might I add) as soon we pulled up to the valet. Once we passed through the oversized lobby doors, we were immediately welcomed by a sparkling mosaic St. Regis logo on the floor. When we looked up, our gaze went straight to the grandiose floor-to-ceiling windows that look out onto the Gulf of Mexico.

1 of 3

LAUREN WASSUM/THE POINTS GUY

If you’re traveling to the St. Regis by air, Sarasota Bradenton International Airport (SRQ) is the nearest airport. Airport transfers are not available, but the resort is just a 20-minute drive away and costs around $30 to $50 via taxi or ride-hailing service.

For a wider selection of flights, you might prefer landing at Tampa International Airport (TPA). However, the drive will take about an hour and a half, and you can expect to pay around $200 for a taxi or ride-hailing service, so you may want to rent a car instead. Valet parking at the St. Regis is $55 daily, with electric car charging stations available.

Besides soaking up the sun at one of St. Regis’s multiple pools or its private beach, guests can take a short eight-minute drive to St. Armand’s Circle, a bustling outdoor shopping and dining district that is well on its way to recovery following Hurricane Helene.

The resort is also just a bridge away from downtown Sarasota. You can venture downtown for various dining and nightlife options in a laid-back, beachy atmosphere. I highly recommend visiting the nearby Ringling Museum, which provides an enriching cultural excursion, showcasing diverse art collections and beautifully manicured gardens. With its pink-walled exterior and Italian-style design, the museum looks like a literal palace from the Renaissance period — and is also the perfect place to capture an Instagram picture of your travels.

The museum has 21 galleries, so plan to spend a few hours wandering through the different exhibits. You’ll be glad you did.

Rooms at the St. Regis Longboat Key

After check-in, I was escorted by our butler, Jennifer, up to the third floor to our suite, which was furnished and designed with neutral hues, like grays and creams, as well as organic textures that felt cohesive with the resort’s contemporary coastal aesthetic.

1 of 5

LAUREN WASSUM/THE POINTS GUY

An oval marble dining table with a sweet welcome treat was waiting for me: a chocolate turtle placed in a pool float with a pink signature pattern designed just for the St. Regis Longboat Key.

Beyond that is a generously sized living area with a large flat-screen TV and ample seating. And like the rest of the resort, the room’s true standout feature has to be the floor-to-ceiling windows that frame the terrace, offering breathtaking ocean views.

Before entering the bedroom, you walk through the hallway closet with several amenities, including the St. Regis’s signature robes and slippers, a safe, an iron and even a specialty laundry bag just for your swimsuit. The staff also noticed my husband and I had glasses, so they added some St. Regis-branded glasses cleaner on one of our closet shelves later that day.

The bathroom was like a tranquil spa retreat in itself.

1 of 5

LAUREN WASSUM/THE POINTS GUY

On one side, a discreet wash closet housed the toilet, while the other held a rainfall shower equipped with a handheld shower wand. Adjacent to the dual-vanity sink on the left was a deep soaking tub that invited relaxation.

Great food and even better service

There is plenty to choose from when it comes to eateries and bars at the St. Regis Longboat Key. The resort’s seven dining venues are diverse and vibrant, with each one offering a unique culinary experience. From an indoor steakhouse with a hidden speakeasy to a rooftop Japanese-fusion lounge overlooking the Gulf of Mexico, each dining option offered its own unique experience, complete with curated decor, making it a memorable and can’t-miss part of the guest experience.

Riva

1 of 3

LAUREN WASSUM/THE POINTS GUY

Named after the Italian word for “shore,” Riva is the premier Italian restaurant on the property and serves breakfast, lunch and dinner. The menu combines imported Italian specialties and local ingredients, from olives and prosciutto to fresh burrata and daily catches, ensuring authentic flavors.

Our first meal here was at lunch, where we tried the whipped ricotta ($8) and lemony borlotti (cranberry bean) hummus ($8) appetizers, both served with freshly made focaccia.

We enjoyed our lunch so much the first day that we also chose to have both breakfast meals at Riva. I had the sfoglina breakfast ($24), which comes with two eggs any style, hash browns, choice of meat, roasted tomato and toast. I’m a creature of habit when it comes to my coffee, and I ordered an iced vanilla latte ($8) each morning, which was delicious each time. The next time we ate here, I craved something more indulgent, so I opted for the Riva waffle ($19), topped with Nutella, caramelized bananas and blueberries.

Aura

1 of 3

LAUREN WASSUM/THE POINTS GUY

For poolside or in-restaurant dining and tropical cocktails, Aura is the place to be. While we didn’t have time for an entire meal here, some of the favorites among staff are the beef barbacoa tacos ($24) and the grouper ($26) served with mojito tartar, marinated tomatoes, lettuce and fennel and apple salad.

However, we did enjoy the guacamole ($15) poolside, which was not too dense and not too creamy but packed with flavor. I also loved that it didn’t just come with tortilla chips but crispy plantains and cassava chips as well. I could have gone for several rounds of this!

CW Prime

The crown jewel of dining at the St. Regis, CW Prime, blew me away from the moment we arrived.

1 of 4

LAUREN WASSUM/THE POINTS GUY

Before dinner, we spent a little time in the small speakeasy known as the Spirit Room. Here, there’s a discreet button that reveals an exclusive cocktail unique to that venue. Think before you push, though, as the exclusive secret cocktail, the Caroline 400, runs $400 a glass. And no, that isn’t a typo.

After drinks, we were seated in the main dining room for what would be a meal to remember.

1 of 6

LAUREN WASSUM/THE POINTS GUY

We started with crispy potato pave ($22), which features warm, crispy layers of potato with truffle aioli, pickled pearl onions and fresh truffle. We also had the crispy, fresh CW Caesar ($21) that was easily big enough to split — it can be plated separately to make sharing easier.

Our amazing server, Topher, didn’t just go over the menu but explained the concepts behind different dishes and what makes them great. I wholeheartedly think that the storytelling made each dish taste even better.

For our entrees, steak dishes were the obvious choice, seeing that they are cooked on a Josper grill. We got the 14-ounce dry-aged prime strip loin ($85), and it was cooked to absolute perfection. Expectations were high, and it was juicy and full of flavor.

Then there was the CW Prime Burger ($50), which I can confidently say was one of the best burgers I have ever tasted. It was topped with wagyu beef bacon, tomato preserve, shallot jam and aged cheddar, all between a house-made cronut bun. I still think about that burger to this day.

Oshen

1 of 2

LAUREN WASSUM/THE POINTS GUY

I couldn’t decide what I loved more about this rooftop lounge: the views or the burst of flavor from each course. I especially liked the mixed seafood ceviche ($25) and selection of sushi ($24-$28 per roll). Thanks to simple preparations and fresh ingredients, each dish tasted ultrafresh and flavorful.

Here, you’ll also find a talented cast of mixologists who serve up some delicious fusion-inspired cocktails and zero-proof drinks all night long. While every single cocktail I tried impressed me, the Edo Old-Fashioned made with Mars Shinshu Iwai whisky, five-spice bitters and Okinawan brown sugar syrup ($23) was definitely my favorite.

The St. Regis Bar

1 of 2

LAUREN WASSUM/THE POINTS GUY

Located in the heart of the lobby is the St. Regis Bar, which itself is an art piece with a soft pink and gold hand-painted mural that stretches around the bar and cascades onto the ceiling. A glass of Moet & Chandon Champagne is $35, which gives guests just a taste (literally) of the luxury that’s to come.

Every night at sunset, the St. Regis Bar holds their evening ritual: a Champagne sabering. The tradition at St. Regis dates back to 1904 when John Jacob Astor IV inaugurated the New York City St. Regis by ceremoniously sabering a bottle of Champagne. Nowadays, this custom is celebrated nightly at St. Regis properties around the world, and Longboat Key is no different. And sometimes, they even let guests saber the bottle, including yours truly — with supervision, of course.

Monkey Bar

1 of 2

LAUREN WASSUM/THE POINTS GUY

The local favorite beachfront Monkey Bar, instrumental to the legacy of The Colony Hotel, where the St. Regis now stands, has been revitalized. Accessible to both St. Regis guests and locals through a beachside entrance, the bar offers a contemporary take on tiki cocktails while also providing an array of light snacks. Among them is the Murf and Surf Dog ($34), a tribute to The Colony’s Murf Klauber and the renowned Murf Dog. This updated version of the classic hot dog is decadently garnished with a luxury twist: generous chunks of lobster.

An array of pools, private cabanas and a winding river await

Located in the resort’s central courtyard is an area aptly named “The Pools.”

1 of 6

LAUREN WASSUM/THE POINTS GUY

The main Resort Pool is family-friendly, surrounded by luxury loungers and has a large jacuzzi with plenty of space for multiple people.

The adults-only Serenity Pool is further away and located a few steps away from Monkey Bar and Aura. It has a cascading waterfall and is a perfect retreat for those seeking a quieter escape.

You can also choose to spend the day at the resort’s private beach, where guests can use two luxury loungers included as part of your daily resort fee. The best part? You can still expect the same high level of service you would get at the pools.

1 of 4

LAUREN WASSUM/THE POINTS GUY

There’s also the property’s lazy river, or as the St. Regis prefers to call it, the winding river. I was able to grab one of the single inner tubes (double tubes are also available) branded with the resort’s signature print and float along.

Although it was not accessible during my stay, there is a cavern tucked beneath the waterfall of the winding river, where Champagne can be summoned with the press of a button.

1 of 7

LAUREN WASSUM/THE POINTS GUY

Private cabanas also dot the area, with reservation prices ranging from $250 to $550 daily. After browsing online, however, I found that during peak holiday times like Christmas week, prices can spike from $800 to $1,000 for the day.

When we arrived at the pools, our butler, Jennifer, escorted us to our cabana, nestled in the middle of the winding river on the turfed Mangrove Island. It offered comfortable seating that could easily fit up to eight people, a flat-screen TV, bottled water and plenty of towels. There was also a safe and a small refrigerator filled with sodas and nonalcoholic drinks. You also get a dedicated pool butler for the day, a first-of-its-kind offering for the St. Regis resort brand.

1 of 2

LAUREN WASSUM/THE POINTS GUY

A poolside menu for Aura was also in our cabana. It’s also just a few steps away from the pools if you prefer to sit inside the restaurant for lunch. We ordered the chips and guacamole, which was the perfect appetizer to enjoy while lounging in the Florida sun.

1 of 3

LAUREN WASSUM/THE POINTS GUY

Whether you opt for a lounge chair or rent a private cabana, getting top-notch service is as easy as pushing a button. Each chair has a small St.Regis-branded wood box with two buttons inside, one to call for food and beverage and the other for concierge services.

Relax at the St. Regis Spa

The St. Regis Spa spans an impressive 20,000 square feet, presenting guests with an experience that begins at their unique Celebration Bar. Upon approval, I was welcomed with a complimentary glass of Champagne, setting the tone for what would come.

The spa is a haven of tranquility, offering a broad spectrum of nature-inspired treatments with avant-garde skincare technology. The spa also has an exclusive partnership with La Mer and is one of the only two spas in the country to do so.

Prior to my treatment, I visited the hydrothermal area, which is available to anyone with a treatment booked, to loosen my muscles. It has plenty of amenities, including a Finnish sauna, a eucalyptus steam room that cleanses your senses, a shockingly delightful snow shower, vitality waters, cold plunges and sensorial showers.

1 of 4

LAUREN WASSUM/THE POINTS GUY

I was then brought back to the treatment room to receive a wonderful 60-minute relaxation massage ($235) followed by the Soothing by La Mer facial ($275). I got to pick from a selection of scents to enhance my massage experience, and my slippers were placed in a warmer, which was a pleasant and much-welcomed surprise.

For those inclined toward a more active form of relaxation, the state-of-the-art fitness center is outfitted with cutting-edge Technogym equipment, catering to all levels of fitness enthusiasts.

Swim with marine life in the private saltwater lagoon

One of the most unique experiences the St. Regis Longboat Key offers is its 350,000-gallon saltwater lagoon, home to almost 50 stingrays and more than 40 species of 2,800 tropical fish.

If you truly want to immerse yourself in the Florida wildlife, I highly recommend the Under the Water lagoon experience, where you can snorkel with tropical fish and feed the smaller stingrays (don’t worry — the stingrays’ barbs are removed).

1 of 4

LAUREN WASSUM/THE POINTS GUY

We had two expert guides for our hourlong lagoon experience. After signing a waiver and a brief orientation, they gave us wet vests and socks to protect our feet from the rocky bottom. We started with feeding and gently petting the small cownose stingrays. While I was a little nervous at first to do so, our guides made me feel much more comfortable.

Next, we put on our snorkeling gear and swam through the lagoon on the water’s surface. Our guides pointed out different fish and told us interesting facts along the way. Once we reached the other side, we could sit down in shallow water and gently pet the larger southern stingray species.

The lagoon experience costs $125 per person and is ideal for swimmers of all skill levels. However, you must be 8 and older to participate in the full snorkel experience: 8- to 13-year-olds must be with a guardian and 14- and 15-year-olds must have a guardian’s signature. Children under 8 cannot swim in the lagoon but can participate in the stingray portion of the snorkel experience.

Accessibility

Since this is a new build, I had high expectations for accessibility features. The resort only has valet parking, but there is plenty of room for transfers, and the entrance is completely accessible.

Public areas feature wide spaces, allowing unobstructed navigation and spacious elevators for easy entry and exit. The restaurants, spa and fitness center also all have accessible entrances that are either located directly on the first floor or easily accessible by ramp or elevator.

Since the pools are a central focus of the resort, I was pleased to see that each pool and the winding river are equipped with a pool lift transfer system.

Wheelchair-accessible guest rooms ensure plenty of space, with doorways wide enough to accommodate standard-size wheelchairs and furniture thoughtfully arranged to prevent unnecessary obstructions. These rooms feature roll-in showers with grab bars, adjustable showerheads and lowered fixtures and amenities like sinks and closet rods.

Checking out

Based on my experience, I felt like the St. Regis Longboat Key provided everything one could want from a Florida vacation, offering a balanced blend of entertainment and relaxation. The resort’s tailored amenities, like the world-class spa and adults-only serenity pool, offer privacy and tranquility, while the array of pools, the winding river and the saltwater lagoon ensure that guests of all ages find enjoyment and adventure. This splashy new property easily adds to the many reasons why Florida’s Gulf Coast barrier islands should be on your travel list.

Related reading:

Travel

‘F*** off you little rats!’

A father was dragged off a Jet2 flight at Manchester Airport after launching into a drunken tirade, shouting “f*** off you little rats” at police officers who removed him from the aircraft.

Lewis Howarth became aggressive when police attempted to escort him from the Turkey-bound plane, which had to return to Terminal 1 during taxiing.

As officers removed him, hundreds of passengers clapped and cheered while filming on their mobile phones.

When told he wouldn’t be going on holiday, Howarth responded with a stream of expletives, calling officers “f******d***heads” and “rat b******s.”

Lewis Howarth of Bolton became aggressive

PA/Facebook

The incident, which occurred yesterday, led to Howarth’s arrest and subsequent court appearance at Manchester Crown Court.

Howarth had been abusive to cabin crew throughout the safety briefing, repeatedly standing up when instructed to remain seated. When asked to fasten his seatbelt, he called a stewardess a “d***head,” the court heard.

Prosecutor Saul Brody told Manchester Crown Court that the cabin crew described Howarth as “highly intoxicated” and reported him swearing at other passengers.

Initially appearing compliant when police boarded, his behaviour quickly deteriorated as they approached the exit.

LATEST DEVELOPMENTS:

Manchester Crown CourtPA

Manchester Crown CourtPA“He started to resist and tried to fight or assault those escorting him,” said Brody. “He was taken to the floor and handcuffed, and was described as thrashing his head towards the passengers and officers.”

When being escorted from the aircraft, Howarth attempted to bite one officer and kicked out at another as staff brought a wheelchair to remove him.

Upon arrest, he admitted to drinking half a bottle of whisky before boarding the flight. When an officer confronted him about his behaviour, saying “there were so many kids on there,” Howarth replied: “My kids are there… you are f*****g wrong.”

The court heard that Howarth had previous convictions for being drunk and disorderly, affray, racially aggravated harassment, assaulting a police officer and failing to comply with court orders. The incident was captured on police bodycam footage, which was later shown to Howarth.

His defence lawyer, William Staunton, told the court Howarth had been “peer pressured” into drinking by a friend due to nervousness about flying. Staunton said his client was “profoundly ashamed and deeply remorseful,” noting that Howarth part-owned a building company and had appeared on TV for DIY emergencies.

However, Recorder Geoffrey Wells dismissed the peer pressure defence as “nonsense” during sentencing.

“This behaviour was shocking. There is no excuse for being drunk when you go on an airplane. Your children saw you behaving like that. What kind of example is that? Wholly disgraceful,” the judge said.

Howarth, of Mobberley Road, Bolton, was sentenced to 14 weeks in prison, of which he will serve half before release on licence.

Travel

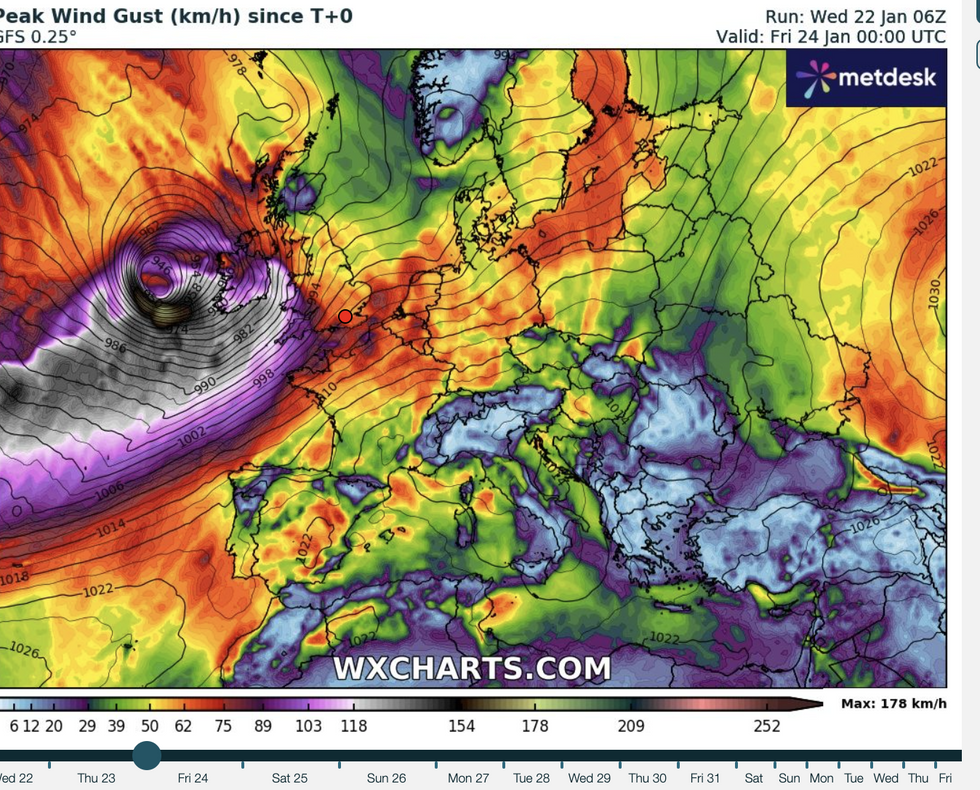

Motorway chaos sees drivers stuck in hours-long delays as Storm Eowyn batters UK

Drivers are being warned of long traffic delays across major motorways around the UK as the country is battered by Storm Eowyn.

The Met Office has issued several yellow, amber and rare red warnings as Storm Eowyn brings winds of more than 100mph and torrential rain.

At present, the M25 in Kent is closed anti-clockwise between J3 (M20 J1/Swanley) and J2 (Dartford) following a collision.

While lane one remains open, lanes two, three and four remain closed, with National Highways: South-East calling on drivers to allow extra time for their journey.

Do you have a story you’d like to share? Get in touch by emailingmotoring@gbnews.uk

Drivers are being urged to consider whether they need to travel during the dangerous conditions

NATIONAL HIGHWAYS

It follows an accident on the clockwise section of the M25 on Thursday, which claimed the life of a 53-year-old man in a single-vehicle crash.

Thames Valley Police reported that a blue Ford Kuga crashed between Junction 15 for the M4, near Slough, and Junction 16 for the M40, near Denham, Buckinghamshire.

The driver died at the scene and no other passengers or vehicles were impacted by the accidents. TVP said it was supporting the man’s next of kin.

Storm Eowyn has prompted the closure of the Severn Bridge for several hours, with National Highways: South-West monitoring wind speeds at the Severn Crossing with the M48.

The Met Office has issued several red weather warnings

PA

Drivers along the M1 northbound are waiting in hour-long delays as traffic officers continue to work on emergency carriageway repairs.

The lane closure between J28 and J29 near Mansfield has been in place since late last night, with three of four lanes closed at present.

Lane one of the section remains closed for the ongoing long-term roadworks, with lane four open to traffic. Drivers are again being asked to allow extra time for their journeys.

The M62 Ouse Bridge (between J36 and J37) is closed to high-sided and vulnerable vehicles due to strong winds.

National Highways has provided guidance for motorists who may be impacted by strong winds

NATIONAL HIGHWAYS

National Highways have called on drivers to make themselves aware of the vehicles that are vulnerable during strong winds, including motorhomes, vans, motorcycles and double-decker buses.

Speaking yesterday, Alice Simpson, spokesperson for RAC Breakdown, called on drivers to “avoid the roads” unless it is absolutely necessary.

This followed the Met Office issuing multiple red weather warnings, with Simpson saying they were the “strongest possible signal” that motorists should take care.

She added: “With the worst conditions expected in parts of Scotland and Northern Ireland, we strongly urge motorists in these areas to stay safe by parking away from trees that could be uprooted by 100mph winds.

LATEST DEVELOPMENTS:

Storm Eowyn has been described as ‘the worst storm in a century’

WX charts

“Those in northern England and northwest Wales, where amber warnings apply, should also take great care if setting out.

“It’s best to keep a firm grip on the steering wheel, avoid coastal routes where the strength of the wind will be most severe and watch out for debris.”

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login