Rachel Reeves’ retirement scheme changes could end up hurting the very people it’s designed to protect, our analysis suggests.

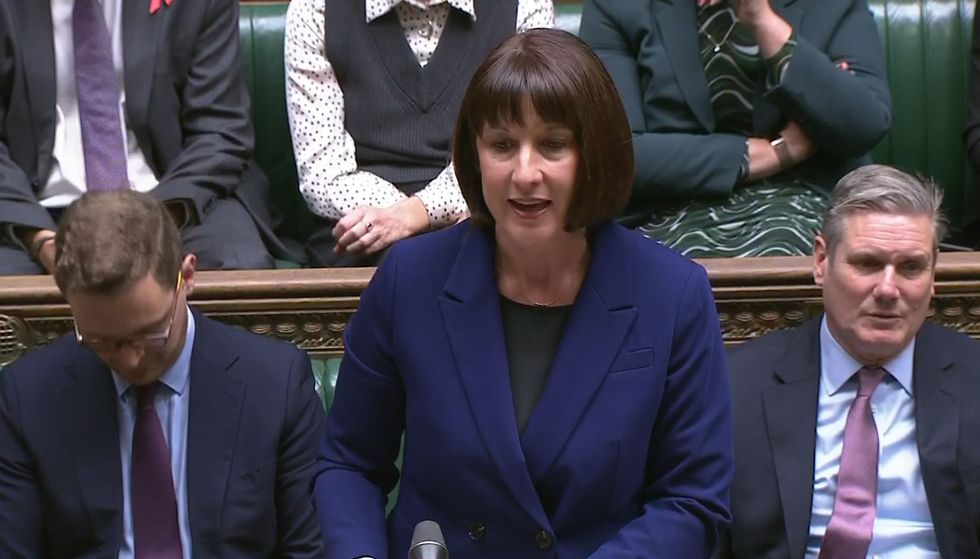

The Chancellor has advocated for a “Canadian-style” pensions model, aiming to consolidate local government pension schemes to create larger funds that can invest more significantly in UK infrastructure projects.

Reeves has argued that the consolidation of local government pension schemes could lead to more effective investment strategies.

The Canadian model, known for its large “megafunds”, allows for investment in a broader range of assets, including infrastructure and private equity, which could potentially yield higher returns for savers.

Reeves plans to merge the UK’s 86 council pension schemes into fewer, larger megafunds to achieve this scale.

Ahead of a roundtable with the head of Canada’s ‘Maple 8’ pension funds in August, the chancellor said: “The size of Canadian pension schemes means they can invest far more in productive assets like vital infrastructure than ours do.

“I want British schemes to learn lessons from the Canadian model and fire up the UK economy, which would deliver better returns for savers and unlock billions of pounds of investment.”

The Chancellor has advocated for a ‘Canadian-style’ pensions model to invest more in UK infrastructure

PA

Danger, cliff ahead

Canada offers cautionary tales that Reeves would be wise to heed.

The “Maple 8” – a group of eight large Canadian pension funds – have historically invested heavily in private markets, including infrastructure, real estate, and private equity, which can be riskier than traditional investments in equities and bonds.

For instance, the Ontario Municipal Employees Retirement System (OMERS) had to write down its 31.7 per cent stake in Thames Water to zero earlier in 2024 due to the utility’s financial troubles.

This incident exemplifies how investments in infrastructure can lead to significant losses if projects do not perform as expected or face unexpected challenges.

Consolidating pension funds also raises questions about governance, transparency, and accountability. In Canada, the consolidation into fewer, larger funds has meant less direct control by local governments or members over how their money is invested.

This is something that Georg Inderst, an independent adviser to pension funds, has picked up on, stating: “All too often, in the case of pension funds, they are far too used to delegating responsibilities to investment managers, and even the big ones don’t necessarily have the dedicated appropriate resources to do this.

“For example, the inflation linkage of some of Thames Water’s financing strikes me as not very clever and should have been a red flag for investors.”

A recent study by the Global Risk Institute examined the potential impact of a federal mandate requiring Canadian pension funds to increase their domestic investments.

The research concluded that it might negatively impact the very individuals these pension systems aim to protect. The study suggests that such mandates would interfere with the complex risk-return trade-offs essential for achieving the funds’ investment mandates.

It notes that Canadian pension funds have benefited from global diversification, which has led to a decline in the proportion of domestic investments over the past decade, specifically from 33 per cent to 18 per cent in public equity markets and from 96 per cent to 88 per cent in fixed-income markets between 2013 and 2022.

Research suggests that it might negatively impact the very individuals these pension systems aim to protect

PA

The study argues that mandating more domestic investment could be detrimental because it might force funds into less strategic or less valuable assets compared to what is available internationally.

Additionally, it points out that withholding desirable domestic assets like Toronto Pearson International Airport or Hydro Québec from pension fund investment opportunities leads to these funds seeking similar assets abroad.

Not everyone is against the scheme.

Joanne Donnelly, board secretary at the Local Government Pension Scheme Advisory Board, examined the model’s potential for significant cost savings.

She compared the varying sizes and costs of running individual pension schemes.

By pooling resources, the fragmented nature of the current 86 local government pension schemes in England and Wales could be streamlined, reducing administrative, governance, and management costs, Donnelly concluded.

What does this mean for your pension?

For those in defined benefit schemes like the Local Government Pension Scheme (LGPS), the immediate impact on your pension might be minimal since these pensions are guaranteed by the scheme’s rules.

However, if the investment strategy leads to higher or more stable returns, it could indirectly support the scheme’s financial health, potentially affecting future pension adjustments or contributions.

For defined contribution schemes, which are more directly affected by investment performance, the changes could lead to a different risk profile, potentially offering better returns if investments succeed but also introducing volatility.

GB News has reached out to HM Treasury for comment.

+ There are no comments

Add yours