Politics

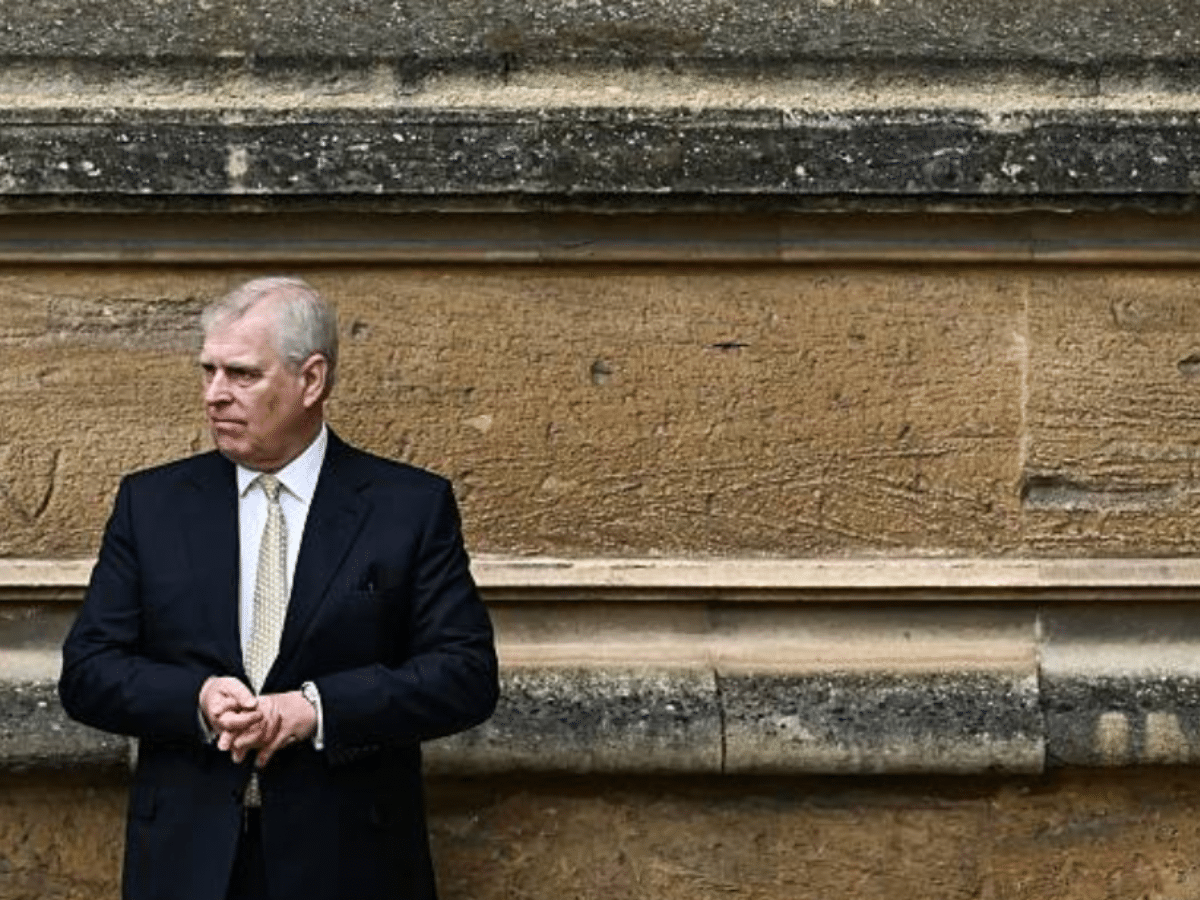

Andrew Windsor somehow embroiled in further allegations

Channel 4 News have reported on a second woman who has come forward with further allegations against Andrew Windsor, following the latest US release of the Epstein Files.

The disgraced royal has faced pressure from across UK and US society to take accountability for his long-term, close relationship with convicted paedophile Jeffrey Epstein.

Channel 4 News also went on to discuss the incredibly murky ties between political advisor and Labour peer Peter Mandelson, who has since resigned from the Labour Party to save ’embarrassment’. Bit late for that, but all right then.

Epstein: Second woman comes forward with allegations about Andrewhttps://t.co/gZeN5CD9Gm

— Channel 4 News (@Channel4News) February 1, 2026

Andrew caught ‘with his trousers off’

The Channel 4 News piece on the murky connections between prominent public figures and Epstein went as follows:

The concerning image of the man formerly known as Prince Andrew has prompted a government response, urging Andrew Mountbatten Windsor to explain himself as a second woman comes forward… A second woman is alleging Epstein sent her to have sex with the then Prince Andrew when in her twenties. Those mentioned in the release may not be found guilty of wrongdoing, but those who condemned Epstein out loud but called him a friend in private are now locked into a waiting game of public shame.

Our own Willem Moore wrote yesterday about the UK PM’s reluctance to ask Andrew Windsor to apologise. The weak PM instead appears to suggest the spoilt former prince should lend his wisdom and knowledge to aide US investigations but should stop short of admitting guilt. Entrenched Western power structures continue to protect abusers, showing a deep resistance to accountability for the wealthiest in society. Moore wrote:

It’s important to understand that the Epstein Files contain claims which may have no merit when investigated. At the same time, you also need to realise that:

We may never know which claims have merit and which don’t, because the authorities have failed to investigate the many crimes linked to Epstein.

There is more than enough known about Windsor’s activities to say he’s a degenerate and a liar.

Web of abuse among elite and alleged cover-ups

The renewed attention generated by the latest release of the Epstein files has intensified critiques of entrenched power structures. This has also prompted fresh arguments for the dismantling of institutions such as the British monarchy:

Andrew Mountbatten-Windsor invited Jeffrey Epstein to Buckingham Palace and promised him a lot of privacy. pic.twitter.com/1xrskvgffA

— Mukhtar (@I_amMukhtar) January 30, 2026

They knew Andrew Windsor was a beast and were fully aware of what was happening on that island.

They closed ranks and provided cover for some of the most depraved child abusers on the planet. #EpsteinFiles #AbolishTheMonarchy pic.twitter.com/wHp1VtSmv1

— Paul (@LeftySeparatist) February 1, 2026

Elite desperately closing ranks

The continued release of documents has heightened public concerns about elite-linked sexual abuse. This has only reinforced the view that the wealthy and powerful face far less scrutiny than their working class ‘inferiors’. This blatant and offensive imbalance of accountability and responsibility follows a long line of scandals where those with power are rarely punished, implying that wealth offers protection from punishment.

As the UK’s criminal justice system tightens its grip on ordinary people, anger is likely to grow over the preferential treatment of the wealthiest against the interests of everyone else.

Featured image via the Canary

Politics

Is Lady Danbury Leaving Bridgerton? Producer Jess Brownell Speaks Out

Bridgerton showrunner Jess Brownell has a reassuring update for anyone worried about Lady Danbury’s future in the hit period drama.

After three seasons as Queen Charlotte’s right-hand woman in the popular Netflix series, Adjoa Andoh’s character has been seen in the latest run of episodes contemplating whether she wants more for herself.

After Lady Danbury’s declaration that she intends to step back from service, many fans have been concerned that this could mean Adjoa may not be appearing in the coming seasons of Bridgerton.

However, during a recent interview with Deadline, Bridgerton’s executive producer said she and her team have “no intentions” of that being the case.

“I want to say very clearly that we have no intentions of Adjoa stepping back,” she insisted. “She’s still absolutely a part of the story in season five.

She continued: “It was more about wanting to explore the dynamic between a friendship in which there’s a power imbalance, which is very on theme with this season, where we’re looking at the relationship between servants and their employers.”

She continued: “The Queen and Lady Danbury are real friends, but because of the power imbalance, it was interesting to explore what happens when Lady Danbury wants to do something for herself. It was an opportunity to explore new depth for their friendship.”

As Brownell stated, themes of power and class are being explored in all areas of Bridgerton season four, including its central love story between Luke Thompson and Yerin Ha’s characters.

Luke and Yerin recently explained how these divisions led to the setting of one of the stand-out steamy scenes between characters Benedict Bridgerton and Sophie Baek, who grow close after meeting at a masquerade ball early on in season four.

The first half of Bridgerton’s fourth season is currently streaming on Netflix, with part two following on Thursday 26 February.

Politics

Rafe Fletcher: Statist Singapore builds homes whilst statist Britain just plans

Rafe Fletcher is the founder of CWG and writes The Otium Den Substack

You can regularly eat and drink for free in Singapore.

Just turn up at one of the British property seminars that pepper the city’s function rooms. Developers and agents swallow the cost of a few freeloaders because it has been a fruitful market. Singaporeans are the second largest group of foreign home owners across England and Wales.

Demand isn’t spurred by colonial nostalgia. Rather, Singaporeans can buy a second home in Britain with far less hassle than in Singapore. And developers welcome the liquidity lacking in those supported only by a British-earned income. Just as a punitive tax regime leaves British buyers short of a deposit, so builders find construction can leave them short of a profit once they have navigated nebulous planning diktats.

Confronting the resulting housing bubble may look awkward for the Conservatives. Even in 2024, 37 percent of outright homeowners voted for them, a 12-point lead on Labour in second place. But the consequences of ducking the issues are starker. Those homeowners will see values deplete anyway under Labour’s trajectory of making everyone poorer. And the Conservatives will make no inroads with a generation shut out of the housing market.

It’s a lesser problem in Singapore where 90 per cent of citizens are homeowners. A product of mass public housebuilding under the Housing and Development Board (HDB). Only Singaporeans are eligible to buy these properties. Buyers draw upon their Central Provident Fund (CPF), a forced personal savings system to put down a deposit on HDBs’ subsidised values. Mortgages are offered with fixed interest rates of 2.6 per cent.

The HDB market is heavily restricted. They can’t be purchased by non-citizens and Singaporeans can only own one unit at a time. Re-sales are prohibited for five years, so there’s no “flipping” on the back of sudden value increases. If Singaporeans want to buy a second home, they must enter the fully private market, which constitutes just 20 per cent of the country’s housing stock. Doing so incurs 20 per cent stamp duty on any second property and 30% on additional ones after that.

Hence why buying in Britain is much more attractive where non-resident stamp duty is only two percent. With far lower tax rates and HDBs available at 3.8 times average income, Singaporeans have the means to buy British stock. Penalising such foreign buyers may play well optically. But as it is, they’re vital in getting homes built. Britain’s largest developer Barratt Redrow recently blamed a lack of them for missing its sales target. International capital helps developers meet affordable housing provisions under Section 106 of the Town and Country Planning Act. Without buyers for higher-price units, the think-tank Onward reports that the cost of delivering new homes often exceeds their capital values.

Section 106 is one of many regulatory hurdles strangling supply. Onward’s research shows that small and medium-sized (SME) developers have been effectively priced out of the market. In the late 1980s, SMEs delivered about 40 per cent of new homes; by 2007, 30 per cent; and today just 12 per cent. They don’t have the scale or balance sheet to weather the costly and cumbersome planning permission process.

Mired in such regulation, Britain’s housing policy is hardly less statist than Singapore. But that statism resides in obstructiveness instead of forcefulness. Singapore can build because the state owns 90 per cent of the land (HDBs and most private housing are on 99-year leases). A situation engineered through the Land Acquisition Act of 1966 that empowers the government to buy any land it wishes at current market value. It is frustrating for golfers as the city-state’s few remaining courses are forcibly purchased to make way for new housing. But it gives the government total control over the supply-chain and costs.

A similar land grab is probably only contemplated by Zack Polanski in Britain. And it’s more likely to resemble Zimbabwe if it comes under the Greens. But there are other lessons Britain can learn from Singapore.

Firstly, provide tax-free incentives for young people to save for a house. Robert Colville writes in The Times that Brits with student loans are paying 50p in tax from every pound they earn over £50,000 and 71p over £100,000. Getting a deposit together is often hopeless for even top-earning graduates without help from the bank of mum and dad. Something like Singapore’s CPF would allow workers to save into a specific house-buying account. It need not be compulsory nor state managed. But it should be ring-fenced and explicitly linked to first-home purchase.

Secondly, remove uncertainty. Singapore’s Urban Redevelopment Authority fixes land use, density and infrastructure expectations in advance. Builders operate within known limits. They don’t have to contend with Section 106-esque regulations that leave developers unsure if local housing associations will even buy the affordable housing they’re obligated to provide. Get things built first.

Finally, Britain needs to stop concerning itself with fringe measures that play only to the politics of envy. I recently went to an event at the Seven Palms complex on Singapore’s Sentosa island, an enclave of wealthy foreigners. It had the ghostly feel of many of London’s high-end developments, with owners mostly in absentia. We may criticise the atmosphere created by such projects but they’re incidental to the wider problem. It’s virtue signalling rather than serious policy.

Britain’s housing crisis is not unique amongst developed nations. But alongside an acute supply shortage, it faces weakening demand. If the most talented young people don’t believe there’s a realistic route to buying, they will leave. And house prices will fall anyway while the country gets poorer. Fixing things now may unsettle Conservative voters who sit on high paper valuations. But a reckoning will come anyway. Perhaps those free evenings out in Singapore will start to dwindle.

Singapore shows the benefits of a government that acts forcefully. Britain shows the consequences of a government that meanders – forcing risk onto developers, disincentivising building and earning, and pandering to NIMBYism. Noel Skelton’s property-owning democracy was once an inspiration to a young Lee Kuan Yew.

The Conservatives need to reclaim that legacy to feed aspiration rather than resentment.

Politics

Why Cola Tastes Different In Glass Bottles

Did you know cola is made with a kola nut? The ingredient, which is from Africa, is where the fizzy drink gets its caffeine from.

Of course, some cola brands keep the other parts of their recipe top-secret. But why do beverages made by the same company seem to taste different in a glass bottle, can, and plastic bottle?

Well, according to Rowland King, a director at the glass bottles supplier, Quality Bottles, there’s real science behind the difference.

Why does cola taste different in a glass bottle vs a can or plastic bottle?

First, there’s the chemistry of each material to consider.

“Glass is chemically inert and non-porous, which means it doesn’t react with the drink or absorb flavour compounds,” King said.

“That helps keep the taste exactly as intended from the moment it’s filled to the moment it’s opened”.

Some experts think the polymer lining of tinned fizzy drinks can lead to a milder taste, while it’s possible that acetaldehyde in plastic bottles could affect the flavour.

And carbonation (bubbles) matter, too, King added.

“Fizzy drinks rely on dissolved CO₂ for their bite and freshness. Over time, plastic is slightly permeable to gas, even when sealed.

“Glass isn’t, so carbonation is typically retained more consistently, which can noticeably affect the taste and how it feels to drink.”

The screw or crown caps commonly used on glass bottles provide a tighter seal, too, allowing less CO2 to escape.

“Bottle shape also comes into it,” King continued.

“A narrow bottleneck concentrates aroma and slows down how quickly the drink hits the palate. That subtly changes the flavour perception compared to drinking from a wide can opening or pouring into a cup.”

Then, there’s temperature to consider

I personally love an ice-cold can of diet cola – sometimes called a “fridge cigarette” – because I feel like it stays cooler and crisper than plastic bottles.

But King explained, “Glass bottles are thicker and tend to chill more evenly and stay cold a bit longer once removed from the fridge. Since temperature strongly affects flavour perception, that alone can make the drink seem more refreshing.”

Of course, companies try their hardest to make their product taste as consistent as possible across a range of containers, King stated.

But, he ended, “material science is material science. The container does make a difference, especially with carbonated drinks”.

Politics

The House Article | Britain needs a National Pier Service to save our seaside heritage

Grade II-listed Southport Pier, the oldest iron pier in the country (Alamy)

3 min read

Britain’s piers are more than Victorian seaside relics – they define the British coast and the communities that depend on them, driving tourism and underpinning local economies.

Both of us represent constituencies — Worthing West and Southport — where the state of our piers is a huge talking point for constituents.

There are currently 60 operational piers in the UK, down from 150 in the early 20th century. Sadly, last week Storm Ingrid’s 60mph winds destroyed Teignmouth’s famous Grand Pier overnight.

Other British seaside piers face a growing political crisis, with about 20 per cent at risk of being lost due to rising costs, climate change and maintenance issues. Many MPs – us included – are calling for a ‘National Pier Service’ or ‘National Piers Trust’ to manage, preserve and regenerate many of these iconic structures, which are vital to local, seasonal economies.

The benefits of such a model include economies of scale. Centralising key functions such as procurement and maintenance through bulk purchasing and shared contracts, deploying specialist expertise via a dedicated national team, and pooling insurance risks for better terms would reduce expenses and improve quality.

Commercial branding, marketing and events would attract more visitors and generate higher revenues. Centralised training and workforce development would enhance service quality and safety while minimising duplication. Collectively, these efficiencies would make limited public and charitable funding stretch further, enabling the preservation and revitalisation of more piers without placing more strain on local councils and communities.

Southport Pier is the second longest in the country and has a proud history. It closed in 2022 due to its condition, but thanks to £20m funding from central government, the pier is due to be repaired and reopened in 2027.

Worthing’s Grade II-listed art deco pier is a much-loved feature of the town for residents and visitors alike and was named UK Pier of the Year in 2019. Opened in 1862 and reconstructed in 1887 to mark the Jubilee of Queen Victoria, it survived almost complete collapse due to storm damage in 1913 and a huge fire 20 years later that could be seen as far away as Beachy Head. More recently, storm damage caused the pier to be closed for almost three months at the end of last year, during which Beccy supported the borough council’s extensive restoration work.

This month we saw DCMS announce that £1.5bn will be invested in cultural organisations over the next five years to restore national pride. The funding will protect and restore more than 1,000 arts venues, museums, libraries and heritage buildings across the country. The investment will tackle urgent capital needs, preserve local heritage, and provide accessible, no- or low-cost cultural experiences for families. We are campaigning to ensure piers are part of the funding.

This Labour government’s core mission is a decade of renewal, and Britain’s iconic piers are a national symbol of our identity – after 14 years of Tory mismanagement, they should be treated as such.

Coastal towns have long been left behind through the austerity of consecutive Conservative governments, but Labour is now working to tackle regional inequality.

To combine the history and aesthetic of piers with a modern regeneration of coastal economies, let’s invest in rebuilding and refurbishing these iconic British monuments.

Dr Beccy Cooper is the Labour MP for Worthing West and Patrick Hurley is the Labour MP for Southport

Politics

What to know about Trump’s $12 billion critical minerals strategy | Energy Pod

What to know about Trump’s $12 billion critical minerals strategy | Energy Pod

lead image

lead image

Politics

Zarah Sultana just showed how solidarity is done

Your Party MP Zarah Sultana has backed the Greens’ candidate Hannah Spencer in the Gorton and Denton by-election later this month. Sultana has also called for left unity and stressed the threat to Muslims posed by the far-right of which Reform UK is part:

The unelected interim leadership of Your Party has still not formalised local branches or ensured members have access to their own data. This should have been resolved months ago, allowing local members to democratically select a Your Party candidate for the upcoming Gorton & Denton by-election.

The candidate list is now published and it is clear that Hannah Spencer, a local plumber and trade unionist, is the strongest challenger to Labour and Reform. I am, therefore, giving my personal critical support to her and the Green Party in this by-election, and I urge others to do the same.

I have always been clear that the left is strongest when it is united. Our real opponents are not one another. They are Reform and the far-right. As a young Muslim woman, I understand viscerally what it would mean for the far-right to gain power in this country. This is not an abstract debate for me, nor the millions of people across the country whose safety would be directly affected.

That is why I want Your Party to become what it was founded to be: a mass working-class party that unites the left, provides a genuine socialist and anti-imperialist alternative, and prevents Nigel Farage and his cronies from ever getting the keys to Downing Street. Together, Your Party will be that vehicle.

Ultimately, defeating fascism must be our number one priority.

My statement on the Gorton & Denton by-election: pic.twitter.com/HSrgDf70h2

— Zarah Sultana MP (@zarahsultana) February 3, 2026

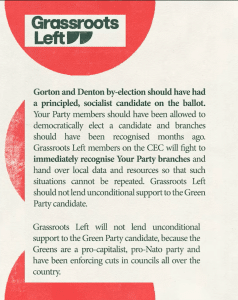

Sultana’s statement followed an “awful”, factional statement by the Your Party ‘Grassroots Left’ slate that she has backed. The statement attacks the Greens as ‘pro-capitalist, pro-NATO’ and says that the faction cannot “lend unconditional support” to Spencer.

Of course, no one asked them to or suggested that they should lend unconditional support to anyone. As Sultana pointed out, the far-right is an existential threat to Muslims and other minority groups and defeating fascism has to take priority over purism and posturing. The Workers Party has recognised this and announced it will not stand a candidate to allow support to concentrate behind Spencer to defeat the red, blue and teal Tories.

Zarah Sultana did the right thing by coming out with a clear statement of support. If the whole of Your Party does not galvanise to help the Greens win what is likely to be a tight election between them and the Farage fascists, shame on it.

Featured image via the Canary

Politics

Zack Polanski Accuses Nigel Farage Of Avoiding Debate

Farage said “if you pick a fight which a chimney sweep you get covered in soot” when asked whether he would take Polanski up on the offer.

It comes after the Green Party leader knocked back the chance of a debate with Reform policy chief Zia Yusuf.

Referring to Polanski’s support for drug legalisation, Farage added: “You know, he’s got a fan club. All the heroin smokers think he’s absolutely marvellous.”

But Polanski told HuffPost UK: “Farage is running scared – he doesn’t want to talk about Reform’s super-rich backers, their Russia links, their plans to strip rights away from working people and to introduce charges to use the NHS.”

The Greens are locked in a three-way battle with Reform and Labour in the crunch Gorton and Denton by-election, which takes place on February 26.

Polanski added: “Farage knows that in Gorton and Denton, Labour are out of the race and Hannah Spencer is coming for Reform.

“It’s no surprise Farage is hiding behind cheap jokes – he’s got nothing to gain and everything to lose from going up against someone willing to say it how it is.”

Politics

Starmer moves to BLOCK release of more dirt on Mandelson

In an appalling move, Keir Starmer has moved to block some of the dirt on Peter Mandelson from getting out. The reason given is as follows:

🚨 UPDATE: Keir Starmer has tabled an amendment to the Tory motion which would exempt “papers prejudicial to UK national security or international relations”

h/t @danbloom1 https://t.co/AxU5OVVOW5 pic.twitter.com/cc8Svb3zRK

— Politics UK (@PolitlcsUK) February 3, 2026

Broken trust

Of course, no one believes this is down to national security. After all, Starmer is the man who hired known paedophile associate Peter Mandelson in the first place. As such, it’s clear Starmer doesn’t have the UK’s interests in mind when he makes decisions.

No, everyone can see this for what it is; a last minute attempt for Starmer to save himself and his cronies from embarrassment (and potential criminal charges).

This video should come back to haunt him. Everyone on twitter knew. One journalist finally asked. Did he not bother to follow up? Did he not think he needed to? Did he know anyway? Starmer is as corrupt and dodgy as any of them and he needs to resignhttps://t.co/B5069DqFTP

— any other leader would be 20 points ahead (@anyotherleader1) February 4, 2026

This isn’t the only headache for Starmer, either, as Skwawkbox wrote for the Canary yesterday:

Keir Starmer has given evidence to the Met Police of Peter Mandelson leaking confidential government information to serial child rapist – and Mandelson’s bestie – Jeffrey Epstein. The evidence includes original emails containing sensitive economic information. The emails released by the US justice department also show Mandelson engaging in insider trading that would enrich Epstein and his allies.

Now Starmer has. But his Downing Street officials – and therefore Starmer – were aware of Mandelson’s emails to Epstein months before now, probably even longer.

And as people are pointing out, Mandelson’s Epstein friendship is far from the only unseemly connection between Labour and total depravity:

Labour MP Dan Norris sat on the board of the Snowdon Trust, which supports disabled students, + the Kidscape child safety charity.

He co-wrote “Don’t Bully Me”, advising school children on how to deal with abuse.

He even launched a booklet to educate parents about paedophiles. pic.twitter.com/kn1wrDwonv

— Jody McIntyre (@jodymcintyre_) February 3, 2026

The emails keep coming too, including this exchange which shines a light on the relationship between Mandelson and Epstein (read the below email first):

A defining feature of the Labour right is that they are *desperate* moochers – from the Blairs taking free clothes from Paul Smith, to Starmer’s suits and glasses and Taylor Swift tickets, to Mandelson exhausting the patience of the world’s most prolific sex offender pic.twitter.com/MslTOv5ZSV

— Nicholas Guyatt (@NicholasGuyatt) February 3, 2026

What’s clear from this is that Mandelson was desperate for Epstein’s attention; Epstein, meanwhile, clearly just saw Mandelson as a pawn in his international power games. This is clearly why the pathetic Mandelson ended up sending him British state secrets.

What sort of man betrays his country to encourage the affections of a paedophile?

Justice at last?

Many – including the Canary – were speaking out against Mandelson and Starmer long before these latest revelations:

Peter Mandelson, now Starmer’s Ambassador to the USA, with Jeffrey Epstein.

I was sacked as Ambassador for opposing torture and illegal rendition.

The worlid of power is a dark place indeed. pic.twitter.com/PJG4Byfh21— Craig Murray (@CraigMurrayOrg) September 9, 2025

We published this about Peter Mandelson 4 yrs ago

Whilst Keir Starmer was being advised by Mandelson & the media invited him on their shows

Thanks to the lack of media scrutiny Starmer felt emboldened to appoint him Ambassador to US

The media & government do not work for you pic.twitter.com/itEhIw4LG5

— Double Down News (@DoubleDownNews) February 3, 2026

Mandelson has been sacked; pressured to resign from Labour, and bullied into stepping down from the lords. But this isn’t enough.

He must face criminal consequences for leaking British state secrets to Epstein, with a full investigation into whatever else the pair got up to.

Further than that, Starmer must answer for what he knew, and for how this sorry affair came to pass.

Featured image via Number 10

Politics

Jason Bateman Faces Backlash Over Charli XCX Interview Questions

Jason Bateman is facing criticism over his line of questioning during a recent interview with Charli XCX.

The Ozark actor co-hosts the podcast SmartLess with Sean Hayes and Will Arnett, where each week a member of the team will introduce a surprise celebrity guest to the other two co-presenters, who they then proceed to interview.

During the latest episode of the Golden Globe-nominated interview series, the celebrity guest was Charli XCX, and as the hour-long conversation progressed, the Grammy winner, who is an only child, was asked if that’s something she’d want for her own future children.

“I actually don’t really want to have kids,” the 360 singer responded. “So…”

She was then pressed on why, to which she admitted her stance “could change” in the future, with Sean Hayes interjecting: “Oh, that’s none of my business.”

Charli continued: “It’s like – I love the fantasy of having a child. Like, naming it… sounds so fun. But that is exactly a sign for me as to why I should not have one. The fact that that feels like the coolest part about it, maybe I’m not ready, you know what I mean?”

Jason then told her: “You know, all that could change… I’m sort of backing into giving myself a half-assed compliment here, but my wife did not want to have kids, so the story goes, so she tells it.

“And she said once we started going out, and she met [me], she was like, ‘OK I think I could have a kid with this guy’. So you might find somebody…”

“Well, I’m married,” Charli then pointed out, having tied the knot with fellow musician George Daniel in 2025.

Charli then added that she “knew” where Jason was going with his line of questioning and was “looking forward” to pointing out that she’s now married, to which he quipped: “Maybe with your next husband you’re going to want kids.”

Since the episode began airing, many have been voicing their disappointment with Jason for raising such a personal and sensitive topic in a public setting, as well as for telling Charli she could change her mind after her statement about probably not wanting children…

HuffPost UK has contacted Jason Bateman’s team for comment.

Charli previously sang about her complex feelings about potentially having children in the future on the song I Think About It All The Time, featured on her Grammy-winning album Brat.

She previously said during a 2024 interview with Rolling Stone: “Am I less of a woman if I don’t have a kid? Will I feel like I’ve missed out on my purpose in life? I know we’re not supposed to say that, but it’s this biological and social programming.

“There’s a lot of pressure on women to not talk about that stuff super openly, especially not in pop music or in music generally; we’re supposed to be sexy and free and fun and wild.”

Politics

Newslinks for Wednesday 4th February 2026

Mandelson facing full criminal investigation as Kemi piles on political pressure

“Scotland Yard began a full criminal investigation into Peter Mandelson on Tuesday. The move followed more damning revelations about the ex-Labour grandee’s relationship with paedophile Jeffrey Epstein. While he was a Cabinet minister, the former spin doctor repeatedly tipped off the tycoon about market-sensitive government plans, emails suggest. On Tuesday, the Government and ex-prime minister Gordon Brown got in touch with the Metropolitan Police, leaving the peer facing an unprecedented probe. It came as the Daily Mail uncovered further sensational details about Lord Mandelson’s dealings with Epstein, with whom he remained close even after the financier had been jailed for child sex offences. One bombshell email seemingly showed the pair discussing confidential negotiations over a £10billion Ministry of Defence contract while Lord Mandelson was business secretary in Gordon Brown’s government. In another exchange, on the day Epstein was released from prison, the pair appeared to joke about celebrating with ‘two strippers’ – with Lord Mandelson branding his paedophile friend a ‘naughty boy’ for making the suggestion. Lord Mandelson has previously suggested his status as a gay man meant he was ‘kept separate from what (Epstein) was doing in the sexual side of his life’. Among the three million pages of so-called Epstein Files released by the US Department of Justice are bank statements that suggest Lord Mandelson and his husband, Reinaldo Avila da Silva, received payments from Epstein totalling tens of thousands of pounds.” – Daily Mail

- Tories to force Starmer to publish Mandelson vetting advice using arcane Commons rule – Daily Express

- Tories seek disclosure of vetting process for Mandelson’s ambassador role – The Guardian

- Starmer to release Mandelson files – Daily Telegraph

- Starmer faces scrutiny over Mandelson’s appointment as police investigate alleged leaks to Epstein – BBC News

- Epstein paid Mandelson’s husband $4k a month – Daily Telegraph

- ‘Bye bye, smelly’: How Mandelson and Epstein seemingly ‘plotted against Gordon Brown during his final months in office’ – Daily Mail

- Gordon Brown lashes out against Starmer as his 30-year grudge against Mandelson boils over – Daily Express

Comment:

- A personal tragedy but a jaw-dropping scandal – Daniel Finkelstein, The Times

- When I met Peter Mandelson, I knew straight away he was rotten – Allison Pearson, Daily Telegraph

- Mandelson scandal shortens odds on Starmer following him out the door – Peter Walker, The Guardian

- Labour owes debt to giant of politics in modern era – Matthew Parris, The Times

- Mandelson may have indelibly tarred Labour as the party of sleaze – Tom Harris, Daily Telegraph

- Westminster could talk of little else… this scandal has left our political class quite numb – Quentin Letts, Daily Mail

Reform drops promise to scrap two-child benefit cap … but Braverman and Jenrick vote to scrap it

“Nigel Farage has dropped his support for abolishing the two-child benefit cap, instead calling for it to be retained to fund support for pubs. The Reform UK leader said he wanted to bring down the “exploding, ballooning welfare budget” and stop many families from claiming benefits for more than two children. The comments put the party at odds with Labour: Rachel Reeves promised in last year’s budget to abolish the cap. Farage said the estimated £3 billion saving from retaining the cap could be used to pay for tax cuts, including reducing VAT by half from 20 per cent for the hospitality sector and a beer duty cut of 10 per cent… Farage said that the two-child benefit cap would be abolished only for households where both parents were British and in full-time work. Reform estimates that covers only about 3,700 of the roughly 500,000 households with more than two children who are likely to benefit from Labour’s reforms, which takes effect in April. Reform sources said that Farage had been consistent in arguing the cap should benefit British citizens. Last May, he said that “lifting the two-child cap is the right thing to do” in part because “we believe for lower-paid workers this actually makes having children just a little bit easier for them”. Reform has gradually been shedding some of its most costly policies, including pledges made at the last general election, in an effort to convince voters and traders its plans are economically credible.” – The Times

- Reform blunder as Suella Braverman and Robert Jenrick vote with Labour on benefits – Daily Express

- Braverman and Jenrick ‘accidentally’ vote for two child cap to be removed in blunder – LBC News

- Nigel Farage pledges tax cuts for pubs funded by reinstating the two-child benefit cap – The Sun

- Labour’s push to lift the two-child benefits cap ‘will hand £25,000 windfalls’ to thousands of Britain’s biggest jobless families – Daily Mail

Comment:

- Our pubs are in peril thanks to reckless policies… here’s my five point plan to help save the great British boozer – Nigel Farage, The Sun

Tories promise to change employment law after bus driver sacked for punching robber

“The Tories have pledged to introduce a new “Good Samaritan” law to protect employees who use reasonable force to protect customers. The party said it would introduce the measures to prevent a repeat of the sacking of bus driver Mark Hehir, 62, after he chased down a thief who robbed a female passenger. Kieran Mullan, a shadow justice minister, said employment law needed to be rewritten to ensure employees who acted within their rights to use “reasonable force” to prevent crime should not be sacked. “The criminal law is clear on our right to use reasonable force to prevent crime and help the victims of crime. This case is not a one-off,” said Mr Mullan. “It is clear we need to ensure the right balance in employment law for employers and employees. Mark has put an amazing spotlight on this issue and we are going to act.” Kemi Badenoch, the Tory leader, who met Mr Hehir on Tuesday, said: “Nobody should ever lose their job for doing the right thing. We obviously don’t want to strangle businesses with more regulations. But heroes like Mark deserve our full support, because crime and disorder are in no one’s interest. So we will be working out solutions to support both employers and employees on the front lines.”” – Daily Telegraph

- Passenger whose necklace was stolen on London bus says ‘hero’ driver ‘didn’t deserve’ sacking – ITV News

- ‘Bus driver who punched thief made me feel safe’ – BBC News

- Victim of theft on bus feels ‘so guilty’ over hero driver’s sacking – The Times

News in brief:

- Kemi Badenoch has a chance to rebuild the Tories – Loic Fremond, UnHerd

- Britain’s shameful tolerance for terrorism – Jonathan Sacerdoti, The Spectator

- Stop preaching about politics – Marcus Walker, The Critic

- No, England’s countryside is not too white – Andrew Tettenborn, CapX

- Peter Mandelson will haunt Labour – George Eaton, The New Statesman

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video1 day ago

Video1 day agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 hours ago

Tech3 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World12 hours ago

Crypto World12 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards