Entertainment

Host, Nominations, Performances & More

Roommates, the 68th Annual Grammy Awards are almost here! Music’s biggest night is going down on Sunday, February 1st at the Crypto.com Arena in Los Angeles — and from the looks of it, this year’s show is about to be BIG! Let’s get into all of the details so you can be seated, ready, and tuned in for every moment.

RELATED: From R&B To Rap & More, See Which Artists Secured Grammy Award Nominations For 2026 (Exclusive Details)

How To Watch The Grammy Awards & Who Is On Hosting Duty?

The 68th Annual Grammy Awards will air live on Sunday, February 1st at 8 p.m. ET (3 p.m. PT) on CBS. You will be able to stream the show on Paramount+ and Hulu if you’re watching from home. As for the red carpet pre-show, E! News will kick things off at 6 p.m. ET (3 p.m. PT) with their usual takeover, and if you can’t catch it on television, you can tune in through their Facebook, X, and Instagram account.

Now let’s talk about hosting duties. Trevor Noah is back in emcee mode for the night! The comedian is reportedly returning to run the show once again after hosting five years straight from 2021 to 2025.

Grammy Nominees 2026: Who’s Competing For Gold?

This year’s nominee list is STACKED — but Kendrick Lamar leads the pack with nine nominations across record, song, and album of the year. As TSR previously reported, this marks K. Dot’s third time landing nominations in all three major categories at once. He’s also in the running for pop duo/group performance, melodic rap performance, rap song, and rap album. On top of that, he picked up two nods in the rap performance category.

Lady Gaga, Jack Antonoff, and Canadian hitmaker Cirkut sit right behind Kendrick with seven nominations each. Gaga scored nominations for song, record, and album of the year — marking her first time earning nods in all three categories simultaneously. She’s also competing in pop solo performance, pop vocal album, dance pop recording, and traditional pop vocal album. Antonoff pulled in double nominations for record, album, and song of the year thanks to his work with Kendrick and Sabrina Carpenter. He also landed his first-ever rap song nomination for ‘tv off’ with Lamar, featuring Lefty Gunplay.

Meanwhile, the album of the year lineup includes Sabrina Carpenter’s ‘Man’s Best Friend,’ Bad Bunny’s ‘Debi Tirar Más Fotos,’ Justin Bieber’s ‘Swag,’ Clipse’s ‘Let God Sort Em Out,’ Leon Thomas’ ‘Mutt’, and Tyler, The Creator’s ‘Chromakopia.

Who Will Hit The Stage?

Just like the nominee list, the performances are just as star-studded. According to Yahoo, Justin Bieber, Olivia Dean, Addison Rae, Katseye, Sombr, Leon Thomas, Lady Gaga, Sabrina Carpenter, Lola Young, and Alex Warren will hit the stage. The Clipse members Pusha T and Malice are also set to reportedly team up with Pharrell Williams for a special performance. But that’s not all, a few surprises may pop out, so make sure to tune in.

RELATED: Came Thru Drippin’! Ye, GloRilla, Jaden Smith & More Go Viral At GRAMMY Awards With THESE Red Carpet Looks (PHOTOS)

What Do You Think Roomies?

Entertainment

Mitch McConnell Hospitalized With Flu-Like Symptoms

Mitch McConnell

Hospitalized

Published

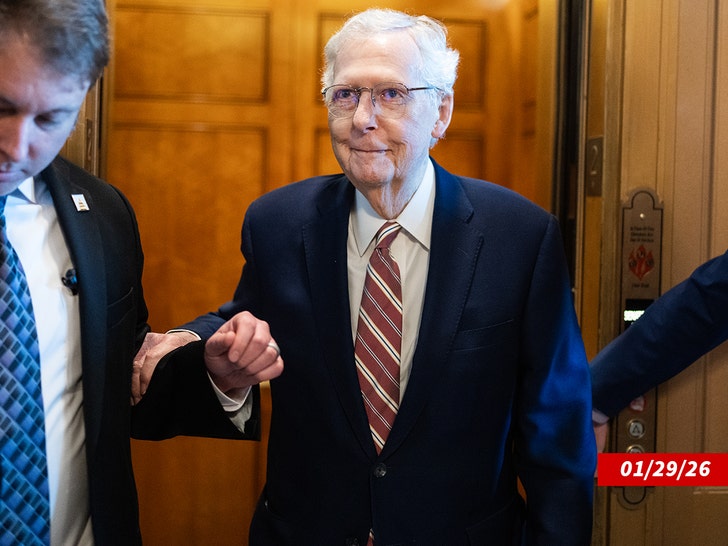

Mitch McConnell is under medical care after a health scare.

The 83-year-old Kentucky Republican was hospitalized Monday night after experiencing flu-like symptoms over the weekend, his office said. According to a spokesperson, McConnell checked himself into a local hospital out of “an abundance of caution” to be evaluated by doctors.

The good news here is his camp says his prognosis is positive. “He is grateful for the excellent care he is receiving,” the statement read, adding that McConnell has remained in regular contact with his staff and is already looking forward to getting back to work in the Senate.

No further details were provided about how long McConnell is expected to remain hospitalized.

In October, the lawmaker tumbled to the ground in the halls of the U.S. Capitol while being asked about ICE by activists. He was helped to his feet by aides and continued on to cast votes after the incident.

X/@ErikRosalesNews

Earlier this year, he said he would not seek reelection in 2026, planning to serve out the rest of his current term through January 2027.

Entertainment

Walton Goggins Reacts to the Fallout Season 2 Finale and That Shocking Moment

Editor’s Note: The following contains spoilers for the finale of Fallout Season 2.

After a long, winding road, we’ve finally made it to the end of Season 2 of Fallout and, boy, was it a doozy. With the NCR and the Legion fully converging on New Vegas, we see Lacerta Legate (Macaulay Culkin) taking on the new role of Caesar and march on New Vegas right after Maximus (Aaron Moten) and the NCR have dealt with the droves of Deathclaws. Inside of Vault-Tec, we see Lucy (Ella Purnell) confront her father, Hank (Kyle Maclean), with some help from the Ghoul (Walton Goggins). And, after a full season of hunting and a lifetime of searching and hoping, the Ghoul arrives at the cryo chambers of Barb (Frances Turner) and Janey (Teagan Meredith), only to find them empty with a cryptic message that sends him in the direction of Colorado.

Wrapping up the second season, we spoke to Aaron Moten and Walton Goggins about that eventful finale and discussed with the actors where their characters have landed after an arduous season. We discussed the potential of Maximus joining a new faction in Season 3, along with where his relationship with Lucy will be heading now that it seems they are together in New Vegas. We discussed the heartbreaking moment when the Ghoul finds those empty cryo-pods and what that means for his character, and Goggins teases (or avoids teasing) where the Ghoul might be headed to next.

Aaron Moten Talks About New Factions and Whether Maximus Will Join the NCR Now That They’ve Arrived in New Vegas

“I think maybe the faction life, to me, is not for him.”

COLLIDER: Aaron, I want to kick off with you. With the NCR in New Vegas, and it seems like Lucy’s intending to stay by Maximus’ side, which is great. Do you think Maximus is going to find a new purpose with the NCR? Is that something that you would like his character to do?

AARON MOTEN: You know, I really don’t know the answer to the question as to what he’s going to find, but I can tell you, I have such empathy for Maximus, you know what I mean? I really want him to discover a more personal route through this world, a little bit like what the Ghoul has discovered. There’s a reason that the Ghoul is a lone wanderer, and I don’t think that I want Maximus to be alone. I don’t think he wants to be alone, but I think he should play things a little closer in terms of his family. I think maybe the faction life, to me, is not for him. You know what I mean? But that’s me talking. I don’t know the answer to that question.

I think it’s interesting, because I feel like he would do so well with the NCR, but then I’m like, “Well, he just came from another group, maybe he doesn’t need to be reintegrated into it.

MOTEN: Yeah, maybe the group projects aren’t for you, dude.

Moten Reveals Where He Wants To See Maximus and Lucy’s Relationship Go in Future Seasons

“I want them to really, really take the Wasteland by the reins for what their portion of it is, and find some sense of home.”

Now that Maximus and Lucy are reunited, is there something that you want for those two characters? Because I feel like they’ve gone on the journey separately this entire season, and they come together and it’s this really beautiful moment, and I think they’re so sweet together. Is there something that you hope for that character dynamic moving forward?

MOTEN: There’s this thing that I like about people, and it’s friends, it’s people that are in relationships, it’s just like of one mind thing. You can be walking down the street, and you know how your friend would react to something that you see in a day. I just want them to create this world together and carve it out for themselves, whatever that is. You know what I mean? I want them to really, really take the Wasteland by the reins for what their portion of it is, and find some sense of home.

Walton Goggins Reacts to the Ghoul’s Revealtion With the Empty Cryo Chambers in ‘Fallout’ Season 2

“…the organic version always wins out.”

Walton, what was it like when you learned that at the end of this road that the Ghoul has been taking all season, that those cryo chambers are empty? Did you know all along or were you like living it as the scripts were coming?

GOGGINS: Did I know? Did I know? Did I know? Well, yeah, yes, I knew. Look, this is a collaboration. This is a family, right? And I’ve been doing this for a very long time, and I’ve been given a seat at a number of tables over the course of my time in this business. And [Jonathan Nolan] and Geneva [Robertson-Dworet] and Graham [Wagner] care greatly what I think and it is a conversation. What does this mean? And what does this mean if they’re there? What does this mean if they’re not there? And the organic version always wins out. What would probably really happen? And to make it as believable as possible.

Watching it for the first time last night, while you guys were watching it, I saw it in real time, and I thought, yeah, for me, it was the right decision, because what does it say about the Ghoul, and what does it say about humanity? And that is, hope always springs eternal. We are hopeful or there is no reason for this species to exist. There is hope that things will get better. There is hope for reunification. There is hope for justice. There is hope for the things that we all want out of life and so I can’t wait to see where it goes from here.

‘Fallout’ Season 2 Might Be Setting Up Its Most Disturbing Transformation Yet

Fallout’s most disturbing horror has always been intentional, and Season 2 knows it.

Well, I’m looking forward to it. I’m looking forward to seeing you in Colorado.

GOGGINS: I can neither confirm nor deny that! We’ll see what happens! [Laughs]

I watched the episode and so did you! Don’t need to be evasive about this!

GOGGINS: [Laughs]

MOTEN: [Laughs]

All episodes of Fallout Season 2 are now available to stream on Prime Video.

- Release Date

-

April 10, 2024

- Network

-

Amazon Prime Video

- Showrunner

-

Lisa Joy, Jonathan Nolan

- Directors

-

Frederick E. O. Toye, Wayne Che Yip, Stephen Williams, Liz Friedlander, Jonathan Nolan, Daniel Gray Longino, Clare Kilner

- Writers

-

Lisa Joy, Jonathan Nolan

Entertainment

Jennifer Aniston insists Jason Bateman's hair is 'envied by every man' she knows

:max_bytes(150000):strip_icc():format(jpeg)/LolaVie-Jennifer-Aniston-Jason-Bateman-020326-07a662a968c44f729d83fc4d8c9d067d.jpg)

The “Morning Show” plays a hairstylist to her longtime friend and frequent costar in a new ad for her haircare brand.

Entertainment

OG ‘Real Housewives Of New York’ Set For New Reality Show On E!

The “Real Housewives of New York” are back, sort of. It has been announced that a crop of OG “RHONY” stars have officially landed their own upcoming reality series, but don’t expect to see it on Bravo.

The five ladies, confirmed to be LuAnn de Lesseps, Sonia Morgan, Ramona Singer, Kelly Bensimon, and Jill Zarin, will be headed to the E! network for a brand-new series chronicling their lives.

Article continues below advertisement

’RHONY’ Stars Land New Show On A Brand New Network

E! isn’t the only change for the ladies, as they will also be in a new city, ditching the urban oasis of New York for the more laidback vibe of Palm Beach, Florida, according to PEOPLE.

Currently operating under the working title “The Golden Life,” the 10-episode docuseries is described as “sun-soaked with a sliver of shade,” according to the official press release shared with the outlet.

“Bound by decades of shared history, fallouts and friendship, this fan-favorite group of New Yorkers are starting fresh together in the Sunshine State. In this new ‘golden’ era of life, the longtime friends are thriving in and around Palm Beach with fabulous second homes and a bustling social scene,” the series’ description said.

Article continues below advertisement

“With their signature humor and non-stop hijinks, the series will follow the group as they navigate dating, family, and career milestones. Though skies are bright in Florida, unresolved drama looms as they reconnect after years of highs and lows,” the statement press release continued.

To celebrate the news, the cast posted a video to Instagram of themselves sharing the announcement with their fans. De Lesseps, Morgan, Singer, Bensimon, and Zarin were all spliced together confirming their return, or in the words of de Lesseps, “We’re back darlings!”

The series is set to begin filming this spring and is reported to air before the end of the year.

Article continues below advertisement

The Rebooted ‘Real Housewives Of New York’ Was Put On Pause Due To Low Ratings

In May 2025, Page Six exclusively shared the news that after two seasons, the rebooted “RHONY” had been put on pause indefinitely due to low ratings.

It was announced in 2021, that the OG cast of “RHONY” would not return to the series and an entirely new, and much younger, cast would replace them, which eventually occurred in 2023. Additionally, it was intended at the time for the resident “RHONY” cast to move to “RHONY Legacy,” but that series never came to fruition.

Fans never embraced the new cast and ratings were less than stellar from the start and only continued to get worse. This prompted Bravo to pause the show in order to find a new cast.

Article continues below advertisement

Andy Cohen Previously Gave An Update On The Future Of ‘RHONY’

While speaking at BravoCon in November 2025, Bravo boss Andy Cohen gave fans an update about where things stand with the reality series.

Per Reality Blurb, when asked about the status of the show and if a new cast had been secured, Cohen simply replied, “We’re close.” However, the “Watch What Happens Live!” host stopped short of confirming a return date or timeframe.

Article continues below advertisement

Select OG ‘RHONY’ Cast Members Have Continued To Film Together

Despite their tenure as “Real Housewives of New York” ending, certain ladies from the legacy cast have continued to appear together via other shows.

De Lesseps, Morgan, Zarin, Bensimon, and Singer have all appeared on the Peacock spinoff, “Real Housewives Ultimate Girls Trip,” which premiered back in 2021. De Lesseps and Morgan also landed their own show “LuAnn & Sonia: Welcome to Crappie Lake” in 2023, also on Peacock.

LuAnn de Lesseps Has Maintained A Long-Standing Relationship With The ‘Housewives’ Brand

In summer 2025, de Lesseps once again joined a “Housewives” spinoff, when she was announced as part of the cast of “Bravo’s Love Hotel,” which featured fellow “Housewives” Gizelle Bryant, Ashley Darby, and Shannon Beador.

She joins Bryant, Porsha Williams, Lisa Barlow, Teresa Guidice, and Kyle Richards, as they travel cross-country for girls’ trip fun with dozens of other “Housewives” from the past and present.

Entertainment

Kyle Richards Says Deleting This Scene From ‘RHOBH’ Would Be A ‘No-Brainer’

Kyle Richards has spent 15 years in front of Bravo cameras filming “Real Housewives of Beverly Hills.” However, that doesn’t mean everything has been all rainbows and sunshine.

During a recent appearance on Andy Cohen’s “Watch What Happens Live,” Kyle Richards discussed the lows that sometimes come with filming an explosive reality show like “RHOBH.” The veteran reality star also shared which moment she wished “cameras had not captured.”

Article continues below advertisement

Kyle Richards Wishes Bravo Cameras Didn’t Capture This One Moment

On the Thursday, January 29, episode of “WWHL,” Kyle responded to a fan who asked about the “one moment” she wishes “cameras had not captured.”

Immediately, Kyle referenced the “limo scene” from season 1 of “RHOBH.”

For those unfamiliar, the explosive segment showed Kyle arguing with her sister, Kim, and later revealing that the latter struggled with alcohol addiction.

“That’s a no-brainer for me,” Kyle said.

Article continues below advertisement

Kyle Richards Previously Reflected On The Infamous Limo Scene With Sister Kim

The infamous limo fight between Kim and Kyle has lived on in “Housewives” history, often referenced on social media and in throwback scenes on the show.

While Kyle’s accusation about Kim eventually gave Kim the chance to speak openly about her struggles, the “Halloween” star previously admitted to regretting her behavior.

“That night should have never happened,” Kyle said, according to Bravo’s Daily Dish. “It was incredibly difficult to go through in the first place and even more difficult to watch and relive it,” she wrote. “There were problems brewing between my sister and me off camera. I’m not good at hiding my feelings as well as others, so I brought my feelings in front of camera.”

Article continues below advertisement

Kyle And Kim Richards Begged Bravo To Cut Fight Out Of Show

Kyle echoed those sentiments in the “Real Housewives” tell-all book, “Not All Diamonds and Rosé: The Inside Story of the Real Housewives From the People Who Lived It.”

Speaking with the book’s writer about the moment, Kyle explained how dealing with Kim’s drinking negatively impacted her.

“When people drink, they’re not the nicest people in the world, let’s just put it that way,” she said. “And it doesn’t bring out the best in others around them, either.”

Cohen also discussed the moment, revealing Kim and Kyle were “begging Evolution [the show’s production company] and Bravo to take the scene out of the show.”

Needless to say, the sisters didn’t get their way, and, according to Shari Levine, NBCUniversal Executive Vice President, it was to preserve the series’ integrity.

Article continues below advertisement

“All of the Housewives series are based on shooting people their lives and documenting their real interactions,” Levine said. “The series really does capture life as it happens. And everyone has moments that they want to keep off the air. The great equalizer for all the franchises is that it’s all out there. If it’s shot, we will edit it in.”

Article continues below advertisement

Kyle Has Experienced Major Changes Over Last Few Years

As for the current season of “RHOBH,” Kyle is back in the hot seat with her co-stars, who are pushing to learn more about the reality star’s alleged relationship with country singer Morgan Wade.

Kyle and Morgan first made headlines when the pair appeared to be cozying up to each other, after reports surfaced that Kyle and her husband, Mauricio Umansky, were splitting.

During a season 15 episode, Kyle admitted she was in another relationship after her time with Mauricio concluded; however, she didn’t name her ex-partner.

“It’s just complicated,” she said on the show. “I’ve gone through so much in these past few years, and it really has changed my perspective on life and how I want to live.”

“While I am sad about the relationship, I’m also really grateful. You get lost in being a wife and a mother, and you can kind of forget about who you are. And I learned a lot about myself in that time,” she added.

Article continues below advertisement

Kyle Talks About Possibly Leaving ‘RHOBH’

As for her time on the show, Kyle got candid about her possibly saying goodbye to the series.

“Listen, that day obviously will come,” she said, adding that she’s been on the series for a “long time.” She continued, “Fifteen years. It really is. It’s a long time. I don’t know how long this can go on, how long I can go for.”

“I mean, it’s very difficult for your life [to be] out there and have the world weighing in on analyzing things and people not knowing you know the full scope of full details,” she said. “And judging you without being able to explain everything, it’s very difficult. So it depends on what year and what season, whether I can handle it or not.”

Entertainment

Trump attacks CNN reporter after she presses him on Epstein files: 'I don't think I've ever seen you smile'

:max_bytes(150000):strip_icc():format(jpeg)/donald-trump-Kaitlan-Collins-020326-efea23cb5299418f9420e28149672397.jpg)

The network and journalist Kaitlan Collins have responded.

Entertainment

10 Movies From 1992 That Are Now Considered Classics

1992 was one of those deceptively stacked years that didn’t announce its greatness all at once. It represented a moment where Hollywood spectacle, literary adaptations, political biography, genre reinvention, and abrasive indie cinema were all colliding in productive ways. Most important of all, a new generation of filmmakers was ripping up all the old rules.

The result was an interesting collection of bangers. Several of these films were commercially successful on release, but many were controversial, divisive, or misunderstood. With time, however, their ambition has become unmistakable. The titles below represent the best of the best of 1992.

10

‘Candyman’ (1992)

“Be my victim.” While occasionally a little rough around the edges, Candyman‘s sheer density of frights earns it a place in the horror pantheon. Story-wise, it focuses on a graduate student (Virginia Madsen) researching urban legends who becomes entangled with the myth of a supernatural killer said to appear when his name is spoken five times into a mirror. That sounds like fairly standard genre stuff, but what initially plays like a conventional slasher gradually reveals itself as something far more ambitious.

The movie’s themes are just as important as the scares, grounding the supernatural in real social divisions. In particular, Candyman uses horror to explore race, class, and the way violence is mythologized and erased within American cities. The killer (Tony Todd) is not just a monster, but a symbol shaped by collective fear and historical injustice. Todd’s fantastic performance does most of the heavy lifting. (That scene with the bees! Talk about being committed to the role.)

9

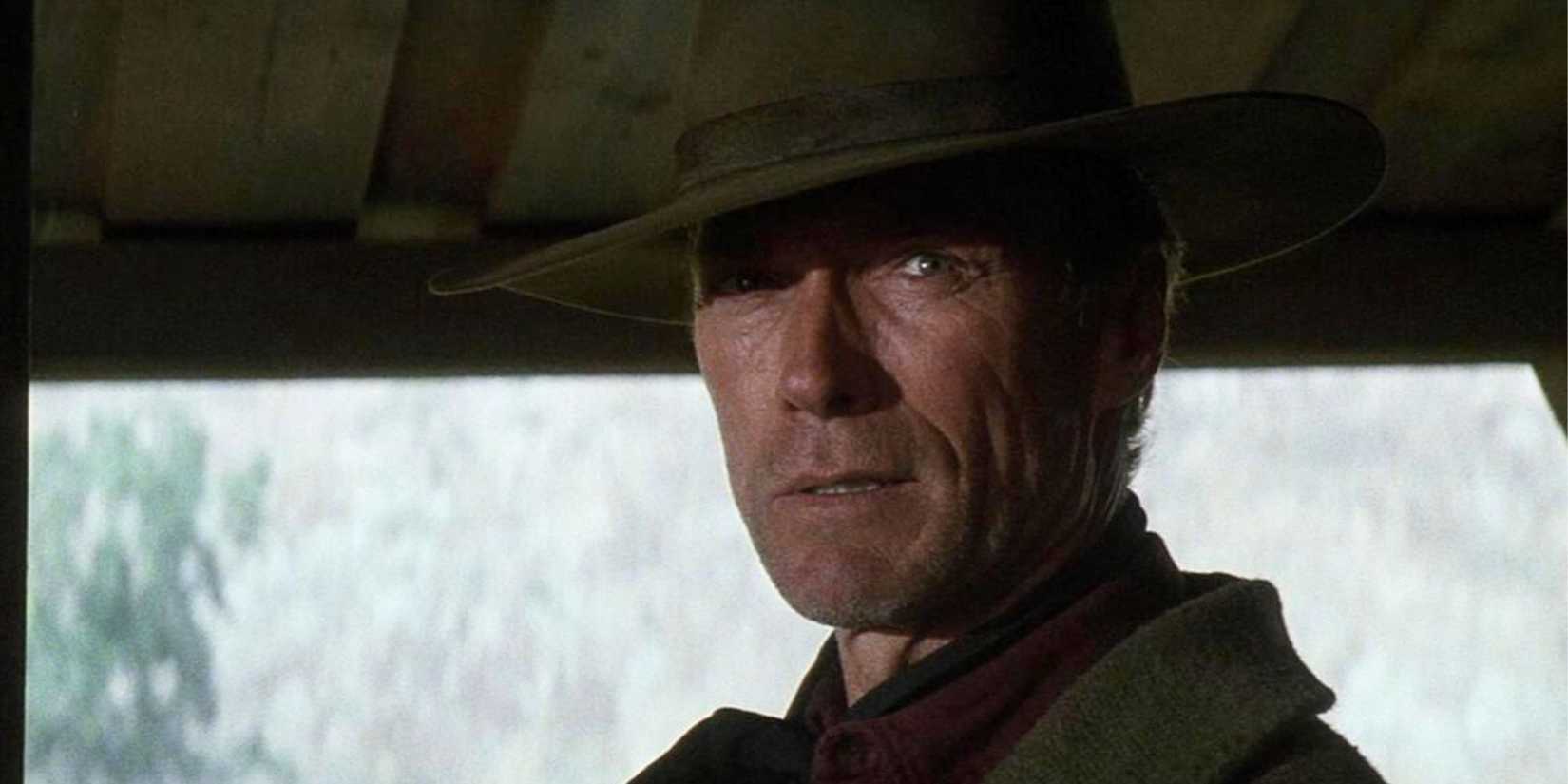

‘Unforgiven’ (1992)

“Deserve’s got nothing to do with it.” Clint Eastwood consciously conceived of Unforgiven as his final Western, his closing statement on the genre that made him a star. Here, he plays an aging former outlaw pulled back into violence for one last job, using the character to pretty much dismantle the mythology of the American Western. While the plot centers on a bounty offered for the men who disfigured a prostitute, the story quickly becomes an interrogation of legend, reputation, and moral consequence.

Eastwood was in a unique position to tell this story. His direction treats the genre with both familiarity and skepticism, acknowledging its power while stripping away its lies. Most strikingly, Unforgiven refuses to glamorize killing. The violence in it is clumsy, terrifying, and permanent, leaving emotional wreckage in its wake. The result is a moving farewell to heroic fantasy and a reckoning with what those stories concealed.

8

‘The Crying Game’ (1992)

“I know who you are.” The Crying Game is simultaneously a political thriller involving an IRA kidnapping and an intimate drama about identity, guilt, and desire. The plot follows a British soldier (Forest Whitaker) captured during a conflict in Northern Ireland and the unexpected emotional bond that forms between captor and captive. After the soldier’s death, the story shifts to London, where loyalty and memory blur into obsession. The narrative twists are hard-hitting, yet what really sets the movie apart from others in the genre is its empathy.

The Crying Game takes an intelligent, sensitive approach to its material. It treats identity as fragile and deeply personal, resisting sensationalism even when dealing with taboo subject matter (The Troubles in Ireland were still underway when it was released, making it somewhat controversial). Over time, however, the movie’s reputation has matured beyond shock value, recognized instead as a thoughtful exploration of how political violence spills into private lives.

7

‘The Last of the Mohicans’ (1992)

“I will find you.” By 1992, Daniel Day-Lewis had proven himself in dramas like The Unbearable Lightness of Being and My Left Foot, but he was still a surprising pick to headline a sweeping frontier romance set during the French and Indian War. Nevertheless, he did a fantastic job in the part. He plays Nathaniel “Hawkeye” Poe, a colonial-raised frontiersman caught between cultures as imperial powers clash. He finds himself caught in a storm of warfare, survival, and doomed love.

On the directing side, Michael Mann strips away pageantry in favor of physical immediacy, treating landscapes as living forces rather than scenic backdrops. In the process, he achieves an impressive balance between epic scale and human emotion. The action scenes are visceral, the romanticism unguarded, and the sense of loss profound. Fundamentally, the film is a kind of blockbuster fantasy, but one with much more heart than most.

6

‘Glengarry Glen Ross’ (1992)

“Always be closing.” Glengarry Glen Ross takes place almost entirely in offices and restaurants, yet it feels as brutal as any battlefield. The plot revolves around desperate real estate salesmen pushed to compete for their jobs through manipulation, humiliation, and moral compromise. Based on David Mamet’s play, the film is driven by language: profane, rhythmic, and razor-sharp. The stars, including Al Pacino, Jack Lemmon, Alec Baldwin, and Alan Arkin, deliver the barbed dialogue with clear relish. The “Always be closing” monologue, in particular, has become iconic for a reason.

Most of these characters posture at power, but every one of them is trapped in a system that rewards cruelty and punishes hesitation. Indeed, this movie is an unsparing portrait of the worst of capitalism. The anxieties it captures (precarious work, hollow motivation, performative masculinity) feel even more relevant today. Despite (because of?) all this, the movie was a box office disappointment, yet has since become a cult classic.

5

‘Batman Returns’ (1992)

“I’m Catwoman. Hear me roar.” Batman Returns is a studio blockbuster that feels profoundly personal and strangely melancholy. The plot pits Batman (Michael Keaton) against two grotesque figures: a vengeful outcast (Danny DeVito) raised in the sewers and a woman (Michelle Pfeiffer) reborn through trauma. The visuals reflect this bleak mood. Gotham itself becomes a warped reflection of repression and spectacle. Building on the foundation laid by the 1989 movie, Tim Burton transforms the superhero genre into a gothic fairy tale about alienation and desire.

Indeed, heroes and villains alike are driven by loneliness and obsession to the point that good and evil are not always so easy to separate. This approach was bold and innovative for the time, paving the way for countless dark superhero films to follow (not least Christopher Nolan‘s Batman trilogy). Over time, the film has been reappraised as one of the most idiosyncratic big-budget movies ever released by a major studio. Its darkness, once controversial, now feels daring.

4

‘Bram Stoker’s Dracula’ (1992)

“I have crossed oceans of time to find you.” With this movie, Francis Ford Coppola reimagined Dracula as a baroque tragedy, an ambitious undertaking that he (mostly) pulls off. The story follows Dracula’s (Gary Oldman) arrival in Victorian England, setting the stage for a battle between ancient desire and modern rationality. While some aspects, like Keanu Reeves‘ accent, caught a lot of flak, the film’s atmosphere and visual grandeur are worthy of praise. The whole thing is unapologetically excessive.

Coppola embraces theatricality, practical effects, and operatic emotion, rejecting realism in favor of sensation. The film knows exactly what it is and commits fully, swinging for the fences with a big, gothic spectacle. Some viewers will find that simply too over the top and overwrought, but others will appreciate the craft and commitment. The movie also deserves props for deviating from Dracula tropes, particularly with the count’s look and clothing.

3

‘Malcolm X’ (1992)

“By any means necessary.” Denzel Washington received an Oscar nomination for his towering performance in this biopic from Spike Lee. He plays the civil rights leader from troubled youth to global revolutionary figure, convincingly portraying his transformation through crime, faith, activism, and political awakening. At the time, Washington was most well-known for playing calm heroes, so it was striking for audiences to see him getting fiery and full of anger.

The result is a complex, challenging epic, clocking in at well over three hours long. Crucially, Lee refuses simplification, presenting Malcolm as evolving rather than fixed. He treats history as contested, shaped by ideology, betrayal, and reinvention. Simply put, this is one of the most ambitious American biographies ever made. By leaning into the messiness and contradiction of its subject, Malcolm X also becomes a fascinating study of the era and society that the man both grappled with and shaped.

2

‘A Few Good Men’ (1992)

“You can’t handle the truth!” A Few Good Men capped off Rob Reiner‘s remarkable run of movies from the late ’80s into the early ’90s, a streak that gave us classics like Stand By Me and The Princess Bride. This one is a legal drama built around a military trial investigating the death of a Marine (Michael DeLorenzo) following an unofficial disciplinary order. While the movie runs on legal thriller mechanics, its real interest lies in institutional loyalty and moral evasion. The courtroom becomes a stage where authority is performed rather than questioned.

In particular, the movie understands how systems protect themselves by outsourcing blame. The dialogue is sharp, the conflicts legible, and the ethical stakes unmistakable. The legal drama has been around for so long and has been explored so well that it’s difficult to find something new and interesting to say in it, but A Few Good Men managed to put its own distinctive stamp on the genre, one that still holds up today.

1

‘Reservoir Dogs’ (1992)

“I’m gonna torture you anyway, regardless.” Reservoir Dogs detonated into cinema like a challenge. The premise is deceptively simple: a robbery goes wrong and trust unravels among the criminals involved. However, that seemingly straightforward setup is elevated by bold, energetic storytelling, firing on multiple cylinders at once. Quentin Tarantino fractures time, foregrounds dialogue, and treats genre as language rather than formula, weaving in film references and allusions with total confidence. This is one of the most assured directorial debuts of all time.

In 1992, Reservoir Dogs announced a new sensibility, one where pop culture, brutality, and wit coexist without hierarchy. Every scene is calibrated for maximum tension, every line is memorable, and the use of music is ironic yet still deeply entertaining. In other words, all of QT’s hallmarks were here in microcosm, hinting at the more complex masterpieces he would deliver in the decades to follow.

- Release Date

-

September 2, 1992

- Runtime

-

99 minutes

-

Mr. White / Larry Dimmick

-

Mr. Orange / Freddy Newandyke

-

Michael Madsen

Mr. Blonde / Vic Vega

-

Chris Penn

“Nice Guy” Eddie Cabot

Entertainment

Kim Kardashian And F1 Legend Lewis Hamilton Have Gone On A ‘Few Dates’

Kim Kardashian and Lewis Hamilton‘s rumored relationship has seemingly been going on for a while, as sources suggest the pair have been on a “few dates” together.

The reality TV star and Formula One legend sparked relationship rumors after they were seen enjoying a cozy date at a country club in Witney, Oxfordshire.

Kim Kardashian’s new romance comes after she opened up about her divorce from her ex-husband, Kanye West, stating that their past relationship has affected her dating life.

Article continues below advertisement

Kim Kardashian And Lewis Hamilton Have Been On A ‘Few Dates’

Kardashian is reportedly dipping her toes back into the dating scene as reports suggest she has been on a “few dates” with her longtime friend and rumored partner Lewis Hamilton, but things are still “casual.”

“She has felt ready to put herself back out there recently,” a source told Us Weekly. “Everyone around her wants her to be happy after everything she has gone through.”

Over the last few years, the SKIMS founder has gone through a rough patch, enduring a divorce from ex-husband Kanye West, as well as a 2016 robbery incident in Paris.

Hamilton and Kardashian have been friends for decades now, as they posed together at the 2014 GQ Men of the Year ceremony alongside the race star’s then-girlfriend Nicole Scherzinger and the SKIMS founder’s ex-husband, Kanye West.

Article continues below advertisement

Kim Kardashian And Lewis Hamilton Enjoyed A Cozy Weekend Getaway

Over the weekend, the pair sent the internet into a frenzy when they were seen hanging out on a romantic getaway in the U.K.

The “KUWTK” alum and the F1 legend stayed at the exclusive Estelle Manor in the Cotswolds, where they reportedly used the posh spa before sharing a meal together in a private room.

“It all appeared to be very romantic. Kim and Lewis made use of all the facilities on offer,” a source said, per reports.

“She had two bodyguards with her and Lewis had a close protection officer, but they remained in the background,” they added. “Two of the three stood guard outside the door to their room, so no one could disturb them.”

Before news of their alleged relationship circulated, they attended Kate Hudson’s NYE party in Aspen, Colorado, although they weren’t pictured together.

Article continues below advertisement

Again on Monday, they stoked more fires to the rumors as they jetted off to Paris for a low-key romantic getaway, as TMZ obtained a video of them checking in to their hotel.

Article continues below advertisement

The Reality TV Star Has Been Linked With Other Men Before

Since her divorce from the “Donda” rapper, Kardashian has been linked to other men, including Pete Robinson and pro football player Odell Beckham Jr.

“It was never serious between Kim and Odell, but they are taking a pause on seeing each other,” a source told Us Weekly at the time. “It was always casual, but Kim has been really busy with other priorities and isn’t putting in as much effort. The dynamic lost its spark, but they are still friends.”

The insider added, “They are still on good terms, and both agreed it’s best they stay friends. Odell is gearing up for season training, and they both knew it was never a long-term relationship.”

Article continues below advertisement

She has previously opened up about her relationship, sharing that there are times when she loves to be single. However, there are times when she “would love that relationship.”

The reality TV star also weighed in on the qualities she looks for in a partner, saying she hopes to find someone with “Good morals and values, a calm person, dependable. Takes accountability. I think that’s my number one thing.”

Kim Kardashian Called Her Marriage With Kanye West ‘Toxic’

Kardashian’s new romance comes a few months after she opened up about her “toxic” marriage to West and her co-parenting struggles.

During an appearance on the “Call Her Daddy” podcast, the business mogul stated that the rapper’s intellect is what initially attracted her, and that she saw him as a “larger than life” kind of person.

However, their romance went downhill after a series of mental health issues and public breakdowns West experienced.

“When someone has like their first mental break, you want to be super supportive, and you want to help figure that out and be there for them,” she explained. “But when someone isn’t willing to make changes that I think would’ve been super healthy and beneficial, it makes it really hard to continue on in a relationship that can be toxic.”

Article continues below advertisement

At the time, Kardashian also stated that the reason she stayed in her marriage with West, despite his issues, was for the sake of their children.

The SKIMS Founder Said Her Connection To The Rapper Has Affected Her Dating Life

Kardashian also spoke about how her marriage to West has forever impacted her dating life, despite their separation.

“There has been situations where I’ll get close to someone, then it’s like, ‘wait, wait, wait, I don’t really want to deal with your ex. I don’t want to deal if he’s going to say something,’” Kardashian claimed.

“So it has been a little frustrating, but then I get ‘my’ person wouldn’t care about that,” she added about her love life.

Entertainment

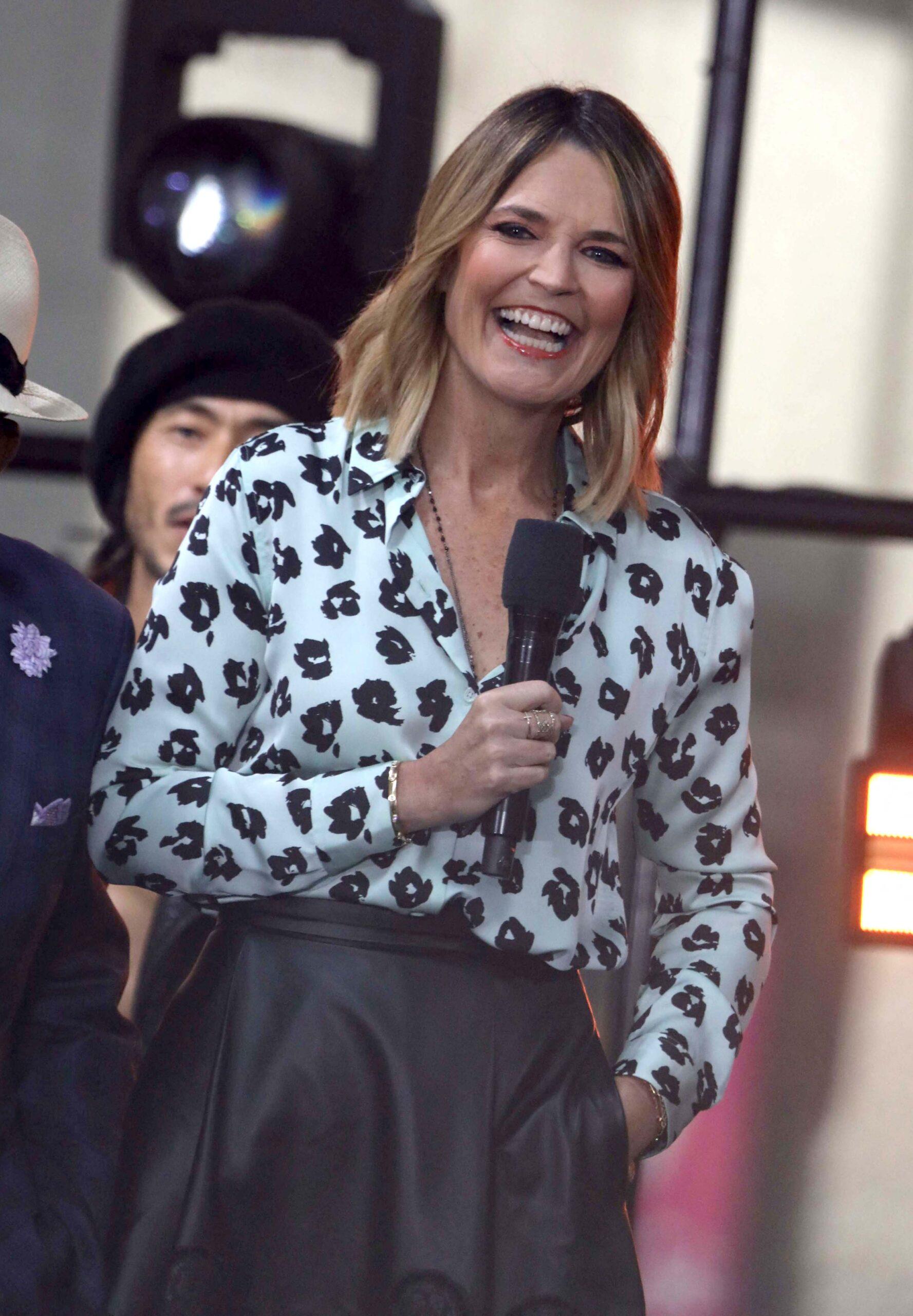

Savannah Shares Message Following Mother’s Disappearance

Savannah Guthrie has spoken out following the shocking disappearance of her mother. In an emotional post on social media, the “Today” show co-host pleaded for her mother’s safe return.

As authorities continue to search for 84-year-old Nancy Guthrie, it has been determined that she may have possibly been abducted from her home in Arizona.

Article continues below advertisement

Savannah Guthrie Asks For Prayers Following Her Mother’s Disappearance

In an Instagram message, Guthrie asked her fans to continue to pray for the safe return of her mother, as she remains missing since her reported disappearance over the weekend.

“We believe in prayer. We believe in voices raised in unison, in love, in hope,” Guthrie’s message began. “We believe in goodness. We believe in humanity. above all, we believe in Him. Thank you for lifting your prayers with ours for our beloved mom, our dearest Nancy, a woman of deep conviction, a good and faithful servant.”

The host continued, asking for prayers. “Raise your prayers with us and believe with us that she will be lifted by them in this very moment. We need you. ‘He will keep in perfect peace those whose hearts are steadfast, trusting in the Lord.’ A verse of Isaiah for all time for all of us.”

Article continues below advertisement

Guthrie ended her post with the plea, “Bring her home.”

Additionally, Guthrie also issued a statement regarding her mother’s disappearance via the “Today” show:

“On behalf of our family, I want to thank everyone for the thoughts, prayers and messages of support,” the statement read, per Deadline. “Right now, our focus remains on the safe return of our dear mom. We thank law enforcement for their hard work on this case and encourage anyone with information to contact the Pima County Sheriff’s office at 520-351-4900.”

Article continues below advertisement

Nancy Guthrie’s Disappearance Prompted Local Authorities To Ask For ‘Help’

On Saturday, January 31, Nancy disappeared from her Arizona home and an official search for her whereabouts was initiated the following day, according to PEOPLE.

During a press conference surrounding her disappearance, Sheriff Chris Nanos, from the Pima County Sheriff’s Department, stressed that time is of the essence in finding Nancy, specifically due to her limited mobility and the scene of her home showing signs that a crime took place.

Article continues below advertisement

“This is an 84-year-old lady who suffers from some physical ailments, has some physical challenges, is in need of medication — medication that, if she doesn’t have in 24 hours, it could be fatal,” Nanos said. “So we make a plea to anyone who knows anything about this, who has seen something, heard something, to contact us. Call 911. We don’t need another bad, tragic ending. We need some help.”

“As I said yesterday, we saw some things at the home that were concerning to us,” Sheriff Nanos continued. “We believe now, after we’ve processed that crime scene, that we do, in fact have a crime scene, that we do in fact have a crime and we’re asking the community’s help.”

Article continues below advertisement

Blood Is Said To Have Been Found At The Scene Of Nancy’s Home

On Tuesday, February 3, a law enforcement source close to the case told CBS News that “a little bit of blood” was found inside Nancy’s home.

However, at this time the blood does not have an identified source but is currently being tested to determine who it belongs to. Per the outlet, investigators in the case and crime scene analysts continue to search Nancy’s home for evidence regarding her disappearance.

Pima County authorities now believe that Nancy was abducted from her home, dispelling previous speculation that she simply wandered away, which is highly unlikely due to her limited mobility and lack of cognitive impairment.

The Pima County Sheriff’s Department told the outlet they believe that Nancy was taken from her home in Tucson in the middle of the night.

Nancy’s Pacemaker Added Further Suspicion In The Case

According to the New York Post, Nancy’s pacemaker stopped syncing to her Apple devices, specifically her Apple Watch, in the early morning hours of February 1 at 2 a.m. local time.

Authorities arrived on the scene at Nancy’s home several hours later in the early afternoon, discovering that both her iPhone and Apple Watch were still there.

The Pima County Sheriff’s Department has also continued to stress that the longer Nancy remains missing, the likelihood that her whereabouts could have a tragic ending increases, as they urge anyone with any information to reach out.

Article continues below advertisement

Savannah Guthrie Has Taken A Break From Her Hosting Duties

Understandably, Guthrie has decided to step away from her co-host duties at the “Today” show, as she recently left New York, where the show films, for Arizona.

She has also since dropped out of co-hosting the 2026 Winter Olympics, which are set to premiere on Friday, February 6, on NBC. As of now, Guthrie will remain off the air indefinitely.

Entertainment

“Fallout” season 2 ending explained: Unpacking Hank's plan (and that post-credits scene)

:max_bytes(150000):strip_icc():format(jpeg)/FalloutSeason2Ending-020326-ad606f56e806457f98291f0520b3ed2e.jpg)

Season 2 of Prime Video’s sci-fi hit promises war. A lot of it.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World5 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video1 day ago

Video1 day agoWhen Money Enters #motivation #mindset #selfimprovement

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports3 days ago

Sports3 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread – Corporette.com

-

Crypto World3 days ago

Crypto World3 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World4 days ago

Crypto World4 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business4 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat22 hours ago

NewsBeat22 hours agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World7 hours ago

Crypto World7 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards

-

Tech4 days ago

Tech4 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined