Crypto World

Ripple launches Ripple Treasury to help Arc Miner modernize its enterprise cash and digital asset management

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Ripple launches Ripple Treasury to boost XRP payment infrastructure as Arc Miner expands XRP-based revenue tools.

Summary

- Ripple Treasury boosts XRP’s enterprise role as Arc Miner expands XRP-based income for users.

- Arc Miner aligns with Ripple’s vision, offering automated XRP cloud mining and daily payouts.

- From institutions to individuals, Ripple Treasury and Arc Miner strengthen XRP’s payment ecosystem.

Ripple launched Ripple Treasury, an enterprise-grade innovative solution designed to improve the efficiency of global corporate finance operations. The Arc Miner platform integrates traditional cash management with digital asset functionality, providing corporate finance teams with a new tool for unified management of fiat and crypto assets.

Ripple’s launch of Ripple Treasury is an enterprise-grade treasury management platform focused on improving payment processes, liquidity allocation, and digital asset settlement efficiency, highlighting the key role of XRP in payment infrastructure. Meanwhile, platforms like Arc Miner are also responding to the expanding application of XRP, bringing users more XRP-based revenue opportunities through technological integration.

1: Visit the Arc Miner website and register an account (new users receive a $15 bonus).

2: Choose one or more mining contracts and activate them.

3: Once the mining contract is activated, enjoy daily earnings payments.

Popular contracts in 2026, examples:

- [Trial Contract] Investment: $100, Term: 2 days, Total Profit: $107.4

- [Classic Contract] Investment: $500, Term: 6 days, Total Profit: $540.5

- [Classic Contract] Investment: $2,500, Term: 20 days, Total Profit: $3,225

- [Advanced Contract] Investment: $10,000, Term: 40 days, Total Profit: $16,560.

- [Super Contract] Investment: $100,000, Term: 50 days, Total Profit: $205,500

Why should Arc Miner users pay attention to this innovation?

Just as Ripple is reshaping enterprise-level payment architecture, Arc Miner is changing the mining experience for individuals and institutions with a similar philosophy:

Ripple Treasury aims to address the financial bottlenecks of enterprises, while Arc Miner, through its web3 intelligent cloud mining model, helps users easily participate in and benefit from the construction of global blockchain infrastructure without having to deal with complex technologies.

From businesses to individuals, XRP is connecting everything

Ripple Treasury and Arc Miner represent the two ends of the digital asset era — institutions and individuals, respectively. Together, they are building a modern payment ecosystem centered on XRP, encompassing fund management, payment efficiency, asset appreciation, and wealth creation.

Interested investors can visit the official website or download the app to track their income anytime.

Official email: [email protected]

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Base Fixes Transaction Delays After Config Error, Preserves L2 Lead

Base, Coinbase’s Ethereum layer-2 network, faced a weekend slowdown caused by a configuration error in a recent transaction-propagation change. While users reported elevated drops and longer waits for on-chain inclusion, blocks continued to be produced and the network did not experience a full outage. In a Wednesday post on X, Base explained that the modification to how transactions were propagated caused the block builder to repeatedly fetch transactions that could not be executed as base fees rose rapidly. The team rolled back the change and said stability has been restored, while outlining plans for longer-term fixes to harden the system against similar hiccups.

Key takeaways

- The incident stemmed from a propagation-change that triggered repeated fetches of non-executable transactions as base fees climbed, prompting a rollback to restore stability.

- Despite the hiccup, the network remained operational and continued producing blocks, indicating resilience even as throughput slowed.

- Longer-term fixes are targeted at the transaction pipeline, overhead reduction, mempool handling, and enhanced rollout monitoring, with an estimated one-month timeline.

- Base is the leading Ethereum layer-2 by TVL, holding about $4.2 billion and roughly 47.6% of the Ethereum L2 market, according to DefiLlama data on a recent Wednesday.

- Arbitrum (CRYPTO: ARB) sits in second place with about 27% of the L2 market, while other networks remain in single-digit shares.

- The episode underscores Base’s central role in Coinbase’s broader “super-app” strategy, integrating stablecoins and on-chain utilities into an expanding suite of products beyond traditional trading.

Tickers mentioned: $ETH, $ARB

Sentiment: Neutral

Market context: The episode highlights ongoing scaling tensions in the Ethereum ecosystem as users migrate activity to layer-2 solutions. Base’s ascent to a majority share of Ethereum L2 TVL underscores the significance of reliability as decentralized finance, payments, and other on-chain use cases increasingly rely on L2 infrastructure. The incident comes amid a landscape where TVL concentration among leading L2s remains pronounced, making resilience and governance in rollout processes particularly important for market participants.

Why it matters

The event is a reminder that even the most sophisticated scaling stacks face operational risk as they push higher throughput and lower fees for users. For Base, the stakes are heightened by Coinbase’s strategy to turn the network into the backbone of an “everything exchange”—a platform that blends crypto trading with stocks, prediction markets and other financial services. By positioning Base as the on-chain distribution layer for Coinbase’s broader product suite, the company aims to accelerate adoption and embed on-chain rails across multiple product lines.

From a technical perspective, the rollback demonstrates a fast-response mechanism in practice: a rollback to a safe configuration, followed by a commitment to strengthen the pipeline and monitoring. The plan to streamline the transaction pipeline, trim unnecessary overhead, optimize the mempool’s handling of pending transactions, and bolster monitoring during infrastructure rollouts indicates a shift from quick patch fixes toward more foundational resilience. The time horizon—a little over a month—reflects the emphasis on both rapid stabilization and longer-term reliability enhancements.

Market researchers and on-chain developers will be watching how these improvements translate into real-world throughput and user experience. Base’s leadership in TVL among Ethereum L2s—reported at about $4.2 billion and a 47.6% share on one recent update—highlights the impact of operational reliability on capital allocation across competing networks. Arbitrum trails at roughly 27% of the L2 market, illustrating a competitive dynamic where even small improvements in efficiency or uptime can influence flow and engagement on L2 ecosystems. The broader implication is that reliability, governance, and measurable performance gains become critical differentiators as users evaluate where to deploy capital and where to build new applications.

Crucially, the incident sits within Coinbase’s broader strategic framework. By strengthening Base and expanding its use cases—from stablecoins to real-world financial utilities—the company signals a long-term commitment to on-chain infrastructure as a foundation for diverse products. This approach is consistent with the trend of crypto platforms seeking to commoditize on-chain rails, enabling a wider array of services that extend beyond custody and trading. As the ecosystem evolves, the emphasis on robust, observable performance will be a key factor shaping developer and user confidence in Layer-2 networks as scalable, secure conduits for everyday financial activity.

What to watch next

- Progress of the one-month improvement window: updates on the rollout, new monitoring dashboards, and any interim performance metrics.

- Any subsequent status notices from Base on X or through official channels detailing stability metrics or new incidents.

- Changes to the transaction pipeline and mempool handling, including benchmarks on throughput and latency during peak periods.

- Definitive commentary from Coinbase and Base leadership about how the improvements may influence adoption of the “everything exchange” concept.

Sources & verification

- Official Base status update on X describing the rollback and restored stability: https://x.com/buildonbase/status/2018845942884237816

- DefiLlama data on Ethereum layer-2 TVL shares and Base’s market position: https://defillama.com/chains/ethereum

- Arbitrum market share reference: https://cointelegraph.com/arbitrum-price-index

Base’s scaling hiccup and the road ahead

Base sits atop Ethereum (CRYPTO: ETH), and its rapid ascent as the leading Ethereum layer-2 has reframed how developers and users think about scaling, gas efficiency, and on-chain usability. In the latest episode, a propagation-change misstep briefly disrupted everyday activity, renewing focus on the fragility that can accompany swift deployments. The network’s ability to continue producing blocks, even as a backlog of transactions faced difficulty entering the mempool, underscored resilience—yet also exposed the delicate balance between speed and reliability that underpins Layer-2 ecosystems.

In a Wednesday update on X, Base explained that the root cause lay in how transaction propagation was implemented during a previous change. As base fees climbed, the block builder repeatedly fetched transactions that could not be executed, creating artificial pressure and delays. The corrective move—rolling back the change—appeared to restore stable operation, and engineers signaled that the episode had highlighted gaps to address in the near term. The planned fixes emphasize a broader redesign: a more streamlined transaction pipeline, reduced overhead, refined mempool logic, and heightened vigilance during infrastructure rollouts. The goal is not only to restore performance but to prevent recurrence as activity continues to migrate toward Layer-2 solutions.

Techniques for measuring and maintaining throughput will be central as Base competes for dominance with other major Layer-2 networks. Arbitrum, for example, remains a formidable contender with a substantial share of the market, illustrating that users and developers weigh reliability, cost, and developer experience as they allocate liquidity across L2s. The competitive dynamic among networks—Base’s dominant position versus Arbitrum’s strong footing—suggests that even incremental improvements to uptime or transaction latency can yield meaningful shifts in on-chain activity and liquidity flows.

Beyond the technical fixes, Base’s role within Coinbase’s strategic framework is increasingly clear. The company has signaled a push toward an “everything exchange” model, a platform that blends crypto trading with traditional financial products and services. Stablecoins and on-chain payments are part of this vision, but the network’s future hinges on how seamlessly it can scale, support diverse product features, and maintain a high level of reliability for users and developers alike. As Base expands, it becomes a pillar in Coinbase’s broader ambition to normalize on-chain interactions across everyday financial use cases, reinforcing the importance of robust Layer-2 infrastructure in a rapidly evolving crypto landscape.

Crypto World

Here’s How US Funding Certainty Calmed Markets and Lifted Bitcoin

Bitcoin dipped to $72.8K during U.S. shutdown fears, then rebounded sharply after lawmakers passed a funding bill.

Bitcoin (BTC) slid to around $72,800 yesterday as U.S. lawmakers debated a stopgap funding package before rebounding once the House passed the bill on February 4, 2026, easing fears of a government shutdown.

The quick turnaround showed how closely crypto prices still track U.S. political risk, even when no blockchain-specific news is involved.

Shutdown Fears Ripple Through Crypto

According to a February 4 post by on-chain analytics firm Santiment, the sell-off unfolded during U.S. trading hours while headlines pointed to a tight vote in the House. As uncertainty built, BTC quickly fell, triggering about $30 million in DeFi liquidations and mirroring a synchronized drop in the S&P 500 and even gold, an asset typically viewed as a safe haven.

This correlation indicates traders were reducing exposure to volatile assets broadly due to the political standoff, not crypto-specific news.

The concern centered on whether Congress would approve a roughly $1.2 trillion funding package to keep most federal agencies running through September 30. Failure would have led to a partial shutdown, delaying economic data and adding stress to an already cautious market.

The tense vote saw Republican divisions, with one representative voting against the bill due to foreign aid provisions.

However, the bill ultimately passed, averting a shutdown and causing markets to respond with immediate relief. Bitcoin bounced from its lows, climbing over 5% within hours, and the S&P 500 also recovered. According to Santiment, the speedy recovery showed that fears of political dysfunction, rather than a fundamental reevaluation of Bitcoin’s value, were behind the earlier sell-off.

You may also like:

Broader Pressures on Bitcoin’s Price

While the funding bill news provided a clear short-term catalyst, Bitcoin is still facing broader headwinds. Per data from CoinGecko, the asset is down nearly 14% in the last seven days and 17% for the month.

A recently published analysis from Galaxy Digital pointed to deteriorating on-chain metrics, with research head Alex Thorn noting that 46% of Bitcoin’s circulating supply is now “underwater,” meaning it was last moved at higher prices, which can increase selling pressure. He also pointed out that there was a lack of significant accumulation by large holders.

Furthermore, on February 3, reports that Iran was seeking to shift the format of nuclear talks with the U.S. contributed to another leg down in Bitcoin’s price, pushing it below $75,000 and burning at least $20 million worth of derivative positions.

Additionally, some analysts like Doctor Profit have revised their downside targets, saying the cycle bottom could hit a range between $44,000 and $54,000. However, the key question is whether the resolution of the immediate U.S. political risk will be enough to reverse these negative technical and on-chain trends, or if BTC is still vulnerable to a deeper test of support.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

GAS Tanks 90% After AI Dev ‘Steps Back’

The Gas Town token has plunged to a $1.1 million valuation just four days after peaking above $60 million.

Crypto World

Most Crypto Holders Want to Pay with Bitcoin but Rarely Do, Survey Show

But most say limited merchant acceptance and high fees stop them from spending crypto.

Crypto World

Classic Chart Pattern Signals ETH Could Slip Below $2K

The price of Ethereum’s native token, Ether (ETH), risks sliding below $2,000 in February as a classic bearish setup plays out.

Key takeaways:

-

ETH breakdown keeps $1,665 downside target in focus.

-

MVRV bands also point to price sliding toward $1,725 or lower before a potential bottom.

ETH risks declining 25% in February

As of Wednesday, ETH had entered the breakdown stage of its prevailing inverse-cup-and-handle (IC&H) pattern. This could extend a downtrend that has already erased about 60% from its August 2025 peak.

An IC&H pattern forms when price forms a rounded top and then drifts higher in a small recovery channel. It typically resolves when the price breaks below the neckline support, often falling by as much as the cup’s maximum height.

Ether broke below the inverse cup-and-handle neckline near $2,960 in January. It later rebounded to retest that level as resistance, a common post-breakdown move, only to resume its decline.

ETH’s rebound also stalled below the 20-day (green) and 50-day (red) EMAs, which acted as overhead resistance.

These confluence indicators raised ETH’s odds of declining toward the IC&H breakdown target at around $1,665, down 25%, in February or by early March.

Historically, the inverse cup-and-handle hits its projected downside target with an 82% success rate, according to a study by Chartswatcher.

From a macro perspective, Ethereum’s downside risk is increasing as traders cut back on crypto bets, worried the market could slip into a broader 2026 downturn similar to past “four-year cycle” pullbacks.

Fears of an “AI bubble” popping are also forcing traders to avoid riskier bets such as crypto.

Ethereum’s MVRV bands hint at $1,725 target

Ethereum’s technical downside target sat just below the lowest boundary of its MVRV extreme deviation pricing bands, currently at $1,725.

These bands are onchain price zones that show when ETH is trading below or above the average price at which traders last moved their coins.

Historically, ETH price plunged near or even below the lowest MVRV band before bottoming out.

That includes the April 2025 bounce, when the ETH price rose 90% a month after testing the lowest MVRV deviation band around $1,390. A similar rebound occurred in June 2018.

Related: ETH funding rate turns negative, but US macro conditions mute buy signal

Therefore, Ether may decline toward $1,725 or below in February, which lines up with the IC&H downside target.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

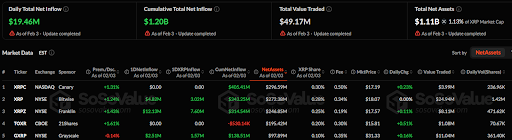

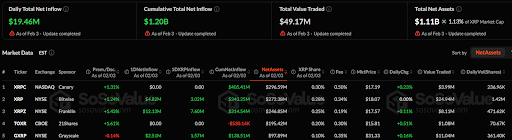

XRP ETFs Report $19.46M Daily Inflow as Total Assets Hit $1.11B

TLDR

- Total daily net inflow across XRP ETFs reached $19.46 million, with cumulative net inflow at $1.20 billion.

- XRPC ETF on NASDAQ saw no daily inflow, with assets totaling $296.59 million, representing 0.30% of XRP’s share.

- The XRP ETF, sponsored by Bitwise on NYSE, had a daily net inflow of $4.82 million, with assets of $272.38 million.

- The XRPZ ETF reported a daily inflow of $12.13 million, with assets at $246.85 million and a +0.11% daily change.

- The GXRP ETF had a negative daily change of -0.14%, with a net inflow of $2.51 million and assets of $195.42 million.

According to a SoSoValue update as of February 3, the total daily net inflow across XRP ETFs stood at $19.46 million. This brings the cumulative total net inflow to $1.20 billion. The total value traded on the day amounted to $49.17 million, with the total net assets reaching $1.11 billion, representing 1.13% of XRP’s market cap.

XRPC and TOXR ETFs Record No Change in Daily Flows

The XRP ETFs on the market showed various levels of performance. A look at individual XRP ETFs reveals that XRPC ETF, listed on NASDAQ and sponsored by Canary, saw no change in daily inflow with a cumulative net inflow of $405.41 million.

The fund’s assets amounted to $296.59 million, and it represented 0.30% of XRP’s market share. Its market price stood at $17.19, with a daily change of +0.23%. The value traded reached $3.99 million, with daily volume hitting 236.96K shares.

The TOXR ETF, listed on CBOE and sponsored by 21Shares, saw a positive change of +1.61%. Despite no inflow or outflow, the ETF has had a cumulative net inflow of $314.54 million and assets of $195.42 million, representing 0.25% of XRP’s share. The market price was $15.81, showing a +0.51% daily change. The value traded was $1.08 million, with 70.67K shares traded on the day.

XRPZ, GXRP, and XRP ETFs Reports Inflows

XRP on the NYSE, sponsored by Bitwise, experienced a daily net inflow of $4.82 million. Its total assets amounted to $272.38 million, representing 0.28% of XRP’s share. The fund’s market price was $18.07. The value traded reached $24.94 million, with a daily volume of 1.42 million shares.

The XRPZ ETF, listed on the NYSE and sponsored by Franklin, reported a daily inflow of $12.13 million. The ETF’s assets amounted to $246.85 million, or 0.25% of XRP’s share. Its market price was $17.57, reflecting a +0.11% daily change. This ETF saw $8.11 million in value traded, with a daily volume of 471.62K shares.

Finally, the GXRP ETF, listed on the NYSE and sponsored by Grayscale, had a negative daily change of -0.14%. It recorded a net inflow of $2.51 million, bringing total assets to $195.42 million. The ETF’s market price was $31.33, up 0.16% on the day. The total value traded was $11.04 million, and daily volume was 361.40K shares.

Crypto World

Tether scales back $20 billion funding ambitions after investor resistance: FT

Tether has quietly pulled back from plans to raise as much as $20 billion in fresh capital after facing investor resistance to a proposed valuation that would rank the stablecoin issuer among the world’s most valuable private companies, per an FT report on Wednesday.

The company, which issues the USDT stablecoin with over $185 billion in circulation, had explored a funding round last year that could have valued Tether at around $500 billion, according to people familiar with the talks.

Advisers have since floated raising closer to $5 billion, a sharp reduction from earlier discussions, as investors questioned both the size of the deal and the valuation.

Chief executive Paolo Ardoino said the larger figures had been misunderstood, describing the $15 billion to $20 billion range as a ceiling rather than a target.

“That number is not our goal,” Ardoino said in an interview to FT. “If we were selling zero, we would be very happy as well.”

Tether’s fundraising push has drawn attention because the company is already highly profitable and has limited operational need for external capital. Ardoino said the firm generated roughly $10 billion in profit last year, largely from interest earned on the assets backing USDT, and added that insiders were reluctant to sell shares.

Still, prospective investors have raised concerns about a valuation that would place Tether alongside firms such as SpaceX, ByteDance and leading artificial intelligence companies. Some have also pointed to regulatory risks and long-standing questions around reserve transparency as sticking points.

Tether has faced scrutiny since its founding over the quality of its reserves and the use of USDT in illicit activity. While the company now publishes quarterly attestations from BDO Italia, it has not released a full audit. Ratings agency S&P Global downgraded Tether’s reserve assessment last year, citing increased exposure to assets such as bitcoin and gold.

But Ardoino has defended the company’s approach, arguing that Tether’s profitability compares favorably with loss-making AI firms commanding similar valuations.

“If you believe some AI company is worth $800 billion with a huge minus sign in front, be my guest,” he said.

Tether’s growing footprint in U.S. Treasuries and gold has made it one of the most significant bridges between traditional finance and digital assets — a role that continues to attract attention even as investors debate how much the company is worth.

Crypto World

Over 60% of crypto press releasesl inked to high-risk or scam projects, study finds

Crypto press release distribution services have become a tool for questionable projects to sidestep third-party scrutiny and create an illusion of legitimacy, a new report from Chainstory shows.

The researchers reviewed 2,893 releases sent out between June and November last year. They found that more than 60% came from projects with “classic red flags” such as an anonymous team making unrealistic claims, copy-paste websites and aggressive tactics to scare investors into action. Some were outright scams confirmed as fraudulent by cross-referencing with blacklists and active scam alerts.

Unlike established, traditional distribution services, crypto-focused press wires often have deals that guarantee placement on dozens of websites with little oversight. These paid-for placements often appear alongside actual news, sometimes without clear labels, making it difficult for readers to tell the difference.

“If you stumble upon a crypto press release on a news site, odds are better than 50/50 that the project behind it is of low credibility (or worse),” the researchers wrote in the report published Tuesday.

Most of the releases were self-authored marketing announcements about minor product updates, token sales or exchange listings, the team said. Only about 2% reported meaningful news like venture funding or acquisitions, types of stories that would typically earn editorial coverage.

CoinDesk contacted several press wires, but none had replied by publication time.

Pay to display

At heart is the relationship between distribution services and websites. The wires act as a pipeline, pushing out content for a fee, while the websites charge to display them without editorial filtering, according to the report.

To the casual reader, it may look like coverage from reputable media outlets, even though no journalist reported the story and the claims within the release are unverified.

This tactic is not limited to startups. Major exchanges regularly push press releases announcing every token listing to create a sense of constant activity, the researchers noted. There is no suggestion the exchanges are involved in wrongdoing.

The scattergun approach, however, boosts visibility with search engines, clutters news feeds and muddies the line between reporting and promotion while giving otherwise unproven or high-risk projects a veneer of unearned legitimacy.

“The core mechanism of the crypto press release industry is piggybacking,” the study said. “By funneling content through syndication networks, issuers avoid the ‘newsworthiness’ filter of a newsroom and instead rely on the credibility of the distribution platform.”

In one example from December, scammers used fake branding to impersonate Circle Internet (CRCL), the issuer of the USDC stablecoin. The release promoted a fake tokenized metals platform and linked to what appeared to be a wallet-draining site. The release was debunked by CoinDesk, but only after appearing on multiple news sites.

While some news outlets have started labeling or limiting press release content, the lack of clear standards and editorial filters remains a vulnerability in the crypto media ecosystem, the report said.

Crypto World

Crypto’s wealthy investors and industry leaders see IPO hype waning in 2026

The hype around cryptocurrency companies going public is waning because markets are still viewed as insufficiently large for the traditional finance (TradFi) firms that are taking an increased interest in the industry.

Fewer investors feel as confident as they did last year, according to a report from the influential CfC St. Moritz, Switzerland crypto conference, which recorded the outlook and predictions of 242 respondents at the event.

After a record 2025 that saw 11 IPOs raise $14.6 billion, “sentiment points to waning IPO intensity and rising consolidation risk,” the report said. Liquidity shortages are seen as the biggest threat, according to the report.

Of 242 respondents, 107 believe “TradFi is taking over” crypto, up more than 50% year over year.

Attendees, however, noted an improvement in crypto regulation in the U.S. and UAE. The U.S. jumped from last to second place in regulatory favorability within a year, reflecting rising confidence, and the UAE remains the top jurisdiction.

“The CfC St. Moritz Report captures the thinking of some of the most influential decision-makers in digital assets,” said Nicolo Stöhr, CEO of the CfC St. Moritz. “Their responses point to a clear shift in priorities, from hype to infrastructure, liquidity, and regulatory credibility, as well as a rapidly changing view of the U.S. market. This is informed capital speaking, and it reflects where the industry is truly heading.”

Crypto World

Polymarket & Kalshi Give Free Groceries During Prediction Market Boom

Two leading prediction-market platforms, Kalshi and Polymarket, are leaning into experiential marketing as they vie for dominance in a fast-growing segment of the financial landscape. Kalshi staged a $50 grocery giveaway for more than 1,000 Manhattan residents on Tuesday, drawing lines that stretched for blocks and highlighting the power of real-world perks to convert interest into signups. In tandem, Polymarket announced plans to open a free grocery store, a venture branded as “The Polymarket,” slated to launch next week with a pledge of $1 million to Food Bank for NYC to assist food access across all five boroughs. The dual promotions illustrate how prediction-market platforms are blending commerce, charity, and media partnerships to expand reach beyond digital trading floors.

Thousands have already picked up their free Kalshi groceries!

We are being told we’ve already inspired other companies to keep up the initiative!

2 more hours to get yours

Westside Market | 84 3rd Ave. NYC pic.twitter.com/8R11OGODLu

— Kalshi (@Kalshi) February 3, 2026

Kalshi’s giveaway took place at the Westside Market on 84 3rd Ave in Manhattan, a venue chosen to maximize visibility among urban shoppers already accustomed to the grocery aisles of daily life. The event ran between 12 pm and 3 pm local time, and footage circulating on social media shows long lines that extended for several blocks. The guest list for the promotion tallied 1,795 names, a figure described by Kalshi as an indicator of robust interest in markets that sit at the intersection of public participation and financial speculation. The company’s broader strategy in 2025 included generating $263.5 million in fee revenue, illustrating how these platforms monetize crowdsourced insights through prediction activity and related services.

“Free groceries. Free markets. Built for the people who power New York.”

Meanwhile, Polymarket revealed a parallel push to inject the experience of its markets into real-world settings. The company said it had signed a lease to open what it brands as “New York’s first free grocery store,” aiming to launch the venture next Thursday at 12 pm local time. In support of the initiative, Polymarket donated $1 million to the Food Bank for NYC to bolster food access across all five boroughs. The timing aligns with a broader push by both platforms to integrate traditional media strategies with their online ecosystems, including public-facing campaigns and high-visibility advertising components that are increasingly difficult to distinguish from mainstream marketing.

The Polymarket initiative was not the only signal of a broader marketing tilt. Kalshi has engaged in media partnerships, including collaborations with CNN and CNBC during 2023 and 2024 cycles, while Polymarket has pursued collaborations with Dow Jones in early 2024. These alliances reflect a trend in which prediction-market operators seek to normalize and accelerate participation through mainstream outlets, a move that can affect liquidity and user acquisition in a space that sees daily volume in the hundreds of millions.

Kalshi gives out free groceries to thousands of New Yorkers https://t.co/62BO68KbuZ pic.twitter.com/rBnSAqWdBg

— Historic Vids (@historyinmemes) February 3, 2026

Across the industry, trading volumes in prediction markets have surged in recent months, with daily activity measured well above $400 million. The scale underscores the sector’s momentum as traditional finance intersects with decentralized and on-chain thinking. Kalshi’s and Polymarket’s growth has been underscored by their valuations; both platforms have drawn multibillion-dollar assessments following significant funding rounds and strategic integrations. The volume growth is notable because it coincides with a broader reaggregation of liquidity around derivative-style contracts tied to current events, sports outcomes, and macro developments—areas where prediction markets have garnered increasing interest from both retail and institutional participants.

Those market dynamics intersect with regulatory and competitive considerations. Industry observers note that prediction-market advertising faced a high-profile challenge during major U.S. sports broadcasts, specifically with the Super Bowl slated for Feb. 8, when advertising restrictions were cited as a constraint for such platforms. In the meantime, the promotional efforts by Kalshi and Polymarket reflect a broader appetite to test new distribution channels and community-building models, particularly in major markets like New York City where both platforms are headquartered.

Kalshi has distributed free groceries to thousands in NYC as part of a broader push to democratize markets

— Historic Vids (@historyinmemes) February 3, 2026

Both Kalshi and Polymarket are rooted in New York City, a jurisdiction that remains central to the industry’s branding and strategy. The city’s status as a financial hub, housing the New York Stock Exchange and the Nasdaq, provides a backdrop that could help attract mainstream attention to prediction markets as legitimate tools for forecasting and civic participation. The partnerships with traditional media outlets, coupled with on-the-ground promotions, illustrate how the space is attempting to bridge online activity with tangible, real-world experiences.

Market context

Market context: The prediction-market segment continues to exhibit rapid growth in liquidity and engagement, even as it navigates a complex regulatory and advertising environment. The combination of large-donor events, high-profile media partnerships, and city-focused promotions indicates a push to normalize and scale these platforms beyond niche online communities, while still relying on event-driven incentives to drive signups and participation.

Why it matters

For users, these promotions may lower the friction to engage with prediction markets and explore how markets price events in real time. For investors and builders, the initiatives reveal the potential for user acquisition through experiential programs and philanthropy, while also highlighting the importance of disciplined risk management and regulatory awareness as volumes rise. The campaigns also reflect a broader trend of blending consumer experiences with financial instruments, a development that could shape how new entrants think about distribution, trust-building, and community governance in prediction ecosystems.

From a market structure perspective, the convergence of media partnerships, real-world store concepts, and online trading desks could influence liquidity flows, contract design, and the range of outcomes that platforms offer. The emphasis on partnerships with established media brands and charity groups may help broaden the audience beyond traditional traders, a factor that could influence the valuation trajectories and strategic priorities of these operators in the coming quarters.

What to watch next

- Launch date and details for “The Polymarket” free grocery store, including its location, hours, and product offerings, scheduled for next Thursday at 12 pm local time.

- Results and turnout from Kalshi’s Westside Market promotion, including any follow-on campaigns or additional free-grocery events.

- Regulatory and advertising developments around prediction markets ahead of major events such as the next Super Bowl.

- Any new media partnerships or cross-promotional campaigns as the platforms seek to sustain growth in NYC and beyond.

Sources & verification

- Kalshi’s Westside Market grocery giveaway details, including the event timing and location (Westside Market, 84 3rd Ave, Manhattan).

- Guest-list figures and attendance reporting for Kalshi’s promo (1,795 sign-ups; media estimates of “thousands”).

- Polymarket’s lease announcement for a new NYC grocery store and the $1 million donation to Food Bank for NYC.

- The Polymarket post on X announcing the store launch and related updates.

- Industry context on prediction-market volumes and Kalshi’s 2025 fee revenue ($263.5 million) and “multibillion-dollar valuations.”

- Partnerships with Dow Jones (Polymarket) and CNN/CNBC (Kalshi) and broader media activity.

- Advertising restrictions related to the Super Bowl affecting prediction-market promotions.

- DefiLlama’s reporting on daily prediction-market trading volumes (above $400 million).

Grocery promos illuminate the race to shape prediction markets

The rivalry between Kalshi and Polymarket is less about a single product and more about a narrative that blends user engagement, real-world impact, and media visibility. Kalshi’s promotional event at the Westside Market in Manhattan demonstrates a direct approach to converting curiosity into participation, with a tangible payoff in the form of free groceries and a high turnout. The associated social-media chatter—evidence of a pipeline from online engagement to offline foot traffic—suggests the campaign achieved its core objective: to broaden awareness and recruit a broader audience into a space that has, to date, been dominated by digital activity and a relatively narrow subset of enthusiasts.

Polymarket’s response—a move to open a free grocery store—extends the promotional strategy into a durable, long-form engagement. By tying the store to a charitable effort with a reported $1 million donation to Food Bank for NYC, the company frames its market ecosystem as an instrument for social good while simultaneously creating a venue for real-world interaction with its trademark “free markets” concept. The lease agreement and the store’s planned launch time—12 pm local time on a Thursday—edge the project closer to a conventional retail rollout, albeit anchored by a prediction-market frame that invites visitors to consider probabilities in everyday decisions.

From a market-structure perspective, these promotional pushes are set against a backdrop of surging liquidity. Daily volumes in prediction markets exceed $400 million, a level that signals growing appetite for event-driven contracts and crowd-sourced forecasting. Kalshi’s reported 2025 fee revenue of $263.5 million, coupled with “multibillion-dollar valuations,” underscores the financial scale that these platforms have achieved in a relatively short period. While the revenue and valuation figures reflect fundraising and partnerships rather than pure trading profits, they point to a vibrant ecosystem in which media tie-ins, sponsorships, and philanthropic commitments intersect with product development and user acquisition strategies.

The campaigns also reflect a broader regulatory and reputational environment. The industry has faced scrutiny around advertising during major events, including proposals to limit promotional activity around the Super Bowl. As Kalshi and Polymarket expand their footprint, they will likely navigate this landscape by emphasizing transparency, compliance, and partnerships with established brands. The NYC focus of both initiatives spotlights the importance of local markets in building a scalable national or international footprint for prediction markets, an approach that echoes the way traditional financial markets have grown through regional hubs connected by digital platforms.

//platform.twitter.com/widgets.js

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video1 day ago

Video1 day agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 hours ago

Tech3 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World12 hours ago

Crypto World12 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards