Entertainment

Chrisean Rock Wishes Her & Blueface’s Son Chrisean Jr. Was Never Born

Chrisean Rock

Wish I Never Had Jr.

… Blueface & His Mama Are Pure Evil!!!

Published

Chrisean Rock is regretting ever pushing her son with Blueface out the womb … all because she thinks her ex and his family are the definition of EVIL!!!

The embattled reality star spilled her guts during a candid conversation on the “One Night with Steiny” podcast, where she admitted she often hates having so much evil around her son — thanks to Blueface’s side.

TMZ.com

Chrisean especially called out BF’s mom, Karlissa Saffold Harvey, who hasn’t had any heartfelt feelings for her all the same!!!

TMZ.com

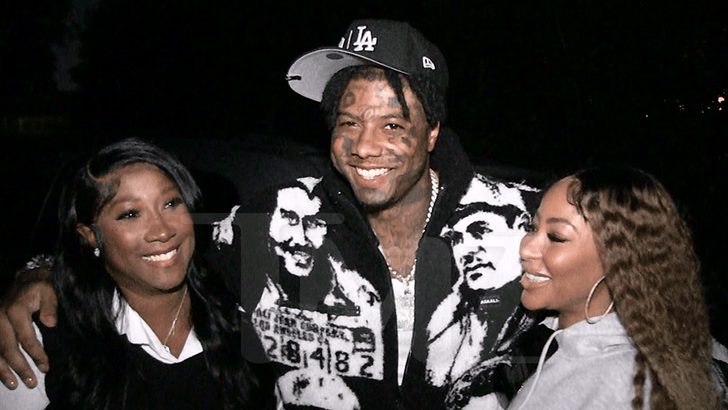

Blueface hasn’t gone tit for tat with Chrisean in a while… he’s been busy with his new GF, Hazel-E, which his mother actually approves of!!!