Entertainment

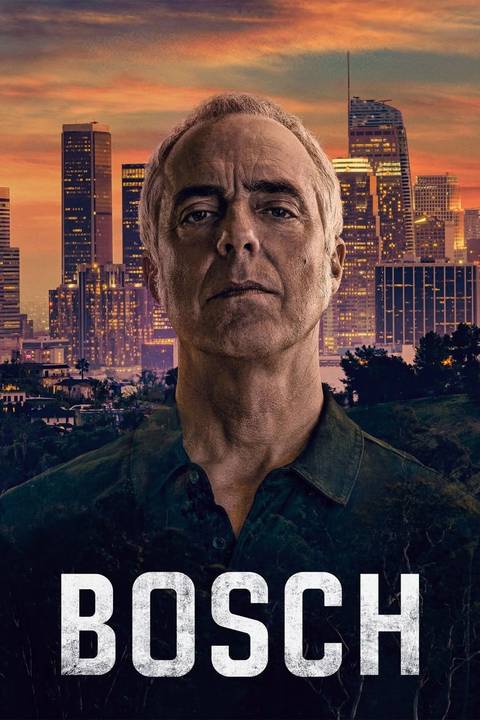

‘Bosch’ Prequel Series Gets Its Most Encouraging Update Yet

This article covers a developing story. Continue to check back with us as we will be adding more information as it becomes available.

Fans of Michael Connelly’s Bosch universe have been eating well lately — and the latest update on Bosch: Start of Watch might be the most promising yet. Only weeks after Prime Video confirmed Ballard would return for Season 2 and MGM+ ordered the long-rumored Bosch prequel to series, Connelly himself has now shared new details that signal the project is moving full steam ahead.

The upcoming series stars Cameron Monaghan (Shameless) as a young Harry Bosch, stepping into the role Titus Welliver defined over 10 seasons. The prequel will follow Bosch during his rookie years as an LAPD patrol officer in 1992 Los Angeles, immersing viewers in a city on the brink — volatile with racial tension, gang violence, police corruption, and civil unrest. Joining Monaghan is Omari Hardwick (Power), who plays veteran officer Eli Bridges, Bosch’s mentor as he navigates the most turbulent era in modern LAPD history.

What’s the Status on the New Bosch Series?

Speaking during The Proving Ground Book Club chat, Connelly offered the strongest update yet. Expanding a bit more on the series, Connelly revealed that the project is xpected to start filming in April, that is a prequel to the streaming series, not based on the novels, and will focus on Bosch as a rookie patrol officer in 1992 Los Angeles. In terms of scripts, Connelly noted that “we’re well down the road in the writing room on that” and that it’s “coming along really good,” hilariously adding that the series is referred to as “Baby Bosch” in the writers’ room. When Start of Watch was first announced, Connelly celebrated the rare chance to excavate Bosch’s beginnings.

“I’m deeply grateful to Michael Wright and the team at MGM+ for championing this next chapter in Bosch’s journey with such remarkable care and integrity,” shared Connelly when news of the prequel series was first announced. “Being able to see how Harry Bosch became the man we have loved for 10 seasons is a gift to me and his many fans. I can’t wait to dig in with Cameron and the writers to explore this uncharted character territory.”

The official logline promises a raw look at a young Bosch pulled into a dangerous high-profile heist and a web of corruption that threatens to break him before his career begins. The series will cement the roots of the code that defines him: Everybody counts, or nobody counts.

Bosch, Bosch: Legacy and Ballard stream on Prime Video.

- Release Date

-

2015 – 2021-00-00

- Network

-

Prime Video

- Showrunner

-

Eric Ellis Overmyer

- Directors

-

Alex Zakrzewski, Ernest R. Dickerson, Patrick Cady, Aaron Lipstadt, Adam Davidson, Daisy von Scherler Mayer, Kevin Dowling, Neema Barnette, Tim Hunter, Zetna Fuentes, Christine Moore, Jim McKay, Laura Belsey, Matt Earl Beesley, Phil Abraham, Roxann Dawson, Sarah Pia Anderson, Stephen Gyllenhaal, Tara Nicole Weyr, Thomas Carter, Hagar Ben-Asher

- Writers

-

Jeffrey Alan Fiskin, Tom Bernardo, Elle Johnson, John Mankiewicz, Shaz Bennett, Alex Meenehan, Katie Pyne, Osokwe Vasquez, Lolis Eric Elie, Jessica Kivnik, Mitzi Roberts