Crypto World

Trump’s White House won’t tolerate attacks on the president in crypto bill, adviser says

President Donald Trump’s negotiators on the U.S. Senate’s crypto market structure bill refuse to sign off on legislation that goes after the president directly for his digital assets business ties — one of the chief points Democrats have demanded in talks over how the U.S. industry should be governed.

Some of the earlier proposals for the ethics provisions in the bill — especially those proposed by Senator Adan Schiff of California — were “completely outrageous,” Patrick Witt, the executive director of the President’s Council for Advisors for Digital Assets, told CoinDesk TV in an interview Tuesday at the Ondo Summit in New York.

“We’ve made clear that there are red lines,” he said. “We’re not going to allow the targeting of the president individually or his family members.”

He said he’s hopeful that Democrats will be pitching more reasonable versions “that feel a little bit closer to something that could ultimately be agreed to.” And he said he thinks a solution will be found.

“But at the end of the day, this is not an ethics bill,” he said.

Witt led a meeting of crypto policy experts and representatives of the U.S. banking industry on Monday, where the digital assets insiders left frustrated that the bankers hadn’t yet come to the table to offer a way forward on their stablecoin yield disagreements.

He told CoinDesk that the meeting “exposed some new areas of agreement,” but the White House is trying to thread the needle between bankers worried about protecting their own deposit businesses and clearing a path for stablecoin products

“We’re trying to broker a deal,” he said. “My No. 1 job is to get a bill to the president’s desk. He wants to see this bill get done.”

But it’s the Senate Democrats who may pose the tougher sell at this stage, as they continue to push for crypto limits for senior government officials, along with other major requests.

In the earlier proposals that would have limited government officials’ spouses from industry involvement, “a lot of senators’ wives and husbands maybe would have been put out of work by that,” Witt said.

Democrats met with industry representatives on January 16, two days after a Senate Banking Committee hearing on advancing the legislation fell apart. And the Democratic lawmakers are planning to meet again on Wednesday to keep talking about their approach, according to a person briefed on the plans. If they can’t embrace a compromise bill in the Senate Banking Committee, the legislation may have to be advanced with only Republican support, as a similar version already was in the Senate Agriculture Committee.

In the end, though, legislation will have to have significant Democratic support to pass the Senate, which generally demands a 60-vote majority to approve a bill. The White House directed industry insiders to get their compromise ideas together by the end of February, according to people familiar with the discussion. The longer this legislative process drags on, the harder it’ll be to pass a bill before Congress departs to campaign for this year’s midterm elections.

Witt was also asked on Tuesday whether he’d be willing to identify how much in crypto the U.S. government currently holds, an especially relevant figure in light of the ongoing presidential plan to set up federal stockpiles.

“No,” he said. “I’m not going to go into that.”

Read More: Senate Agriculture’s crypto market structure draft peppered with Democrat pitches

Crypto World

MetaMask and Ondo Set To Tokenize Securities, ONDO Price?

Ondo Finance announced a major integration with MetaMask to bring tokenized US stocks and ETFs directly into the popular self-custodial wallet.

Yet the ONDO token barely moved on the news, continuing a month-long decline that has seen it lose over a third of its value.

Sponsored

MetaMask and Ondo Finance unveiled their integration at the Ondo Global Summit on February 3. The partnership brings more than 200 tokenized US securities to the MetaMask mobile wallet through Ondo Global Markets.

Users in supported jurisdictions can now buy, hold, and trade tokenized versions of major stocks, including Tesla, NVIDIA, Apple, Microsoft, and Amazon. The offering also includes ETFs such as SLV for silver exposure, IAU for gold, and QQQ for tech stocks.

The integration works through MetaMask Swaps on the Ethereum mainnet. Users acquire Ondo Global Markets tokens using USDC, with trading available 24 hours a day, five days a week. Token transfers remain possible around the clock.

“Access to US markets still runs through legacy rails. Brokerage accounts, fragmented apps, and rigid trading windows haven’t meaningfully evolved,” said Joe Lubin, Founder and CEO of Consensys and Co-Founder of Ethereum. “Bringing Ondo’s tokenized US stocks and ETFs directly into MetaMask shows what a better model looks like.”

Ian De Bode, President at Ondo Finance, emphasized the strategic value of reaching MetaMask’s user base. He noted that the integration brings pricing comparable to traditional brokerages like Robinhood into a self-custodial, on-chain environment.

Sponsored

Geographic Restrictions Limit Impact

Despite the headline-grabbing announcement, a closer look reveals significant limitations. The list of excluded jurisdictions reads like a directory of the world’s major financial markets.

Users in the United States, the European Economic Area, the United Kingdom, Switzerland, Canada, China (including Hong Kong), Singapore, Japan, Korea, and Brazil cannot access the service. The exclusions effectively limit availability to less-regulated emerging markets.

This geographic constraint likely explains the muted market reaction. The integration represents a technical milestone, but the addressable market remains small.

ONDO Token Shrugs Off the News

The ONDO token traded at $0.2811 at the time of publication, down 37.3% over the past month. The 24-hour price change showed a modest 0.2% decline, suggesting the market viewed the integration as a non-event for token value.

Sponsored

Looking at the monthly chart, ONDO has been in a steady decline from around $0.45 in early January to its current level near $0.28. The MetaMask news failed to reverse or even pause this downtrend.

Market data shows ONDO with a market cap of $1.37 billion and total value locked exceeding $2 billion. The disconnect between protocol metrics and token performance reflects a broader pattern in the real-world asset sector.

RWA Tokens Struggle Despite Sector Growth

Ondo’s price action fits a well-documented trend across RWA governance tokens. According to CoinGecko’s 2025 RWA Report, most tokens in the sector posted negative returns between January 2024 and April 2025, ranging from -26% to -79%.

| Token | Protocol | Return |

|---|---|---|

| ONDO | Ondo Finance | +314.1% |

| OM | MANTRA | +733.9% → then crashed 90% |

| SYRUP | Maple Finance | +24.0% |

| CFG | Centrifuge | -26% to -79% range |

| GFI | Goldfinch | -26% to -79% range |

| ENA | Ethena | -26% to -79% range |

Sponsored

The report attributes this disconnect to structural factors. During bull markets, DeFi lending protocols offer alternative yield opportunities without requiring RWA exposure. Meanwhile, capital flows primarily into institutional products like BlackRock’s BUIDL fund and stablecoin infrastructure rather than governance tokens.

Tokenized treasuries grew 544% to $5.6 billion in market cap, with BlackRock’s BUIDL capturing 44% market share. Private credit protocols like Maple Finance dominate, accounting for 67% of active loans. Yet these successes rarely translate into token-holder returns.

The pattern suggests RWA governance tokens function more as speculative instruments than as direct claims on protocol growth.

What Comes Next

The MetaMask integration positions Ondo for growth if regulatory environments evolve. The infrastructure now exists for seamless trading of tokenized securities within a major self-custodial wallet.

Until key markets open up, the practical impact remains constrained. For ONDO holders, the announcement serves as another reminder that protocol milestones and token performance often diverge in the RWA sector.

Crypto World

builders shrug off ETH drop as network activity holds steady

Ether’s weekend slide at the turn of February revived a familiar question: is the Ethereum network falling behind newer competitors or struggling to justify its valuation?

As ETH plunged by as much as 17% alongside most of crypto, skeptics wondered whether this was a warning sign that the protocol’s dominance may be eroding.

Yet inside Ethereum’s ecosystem, the sell-off has not been met with the same alarm. Developers and long-term players largely framed the move as a market-driven correction rather than a verdict on Ethereum’s health.

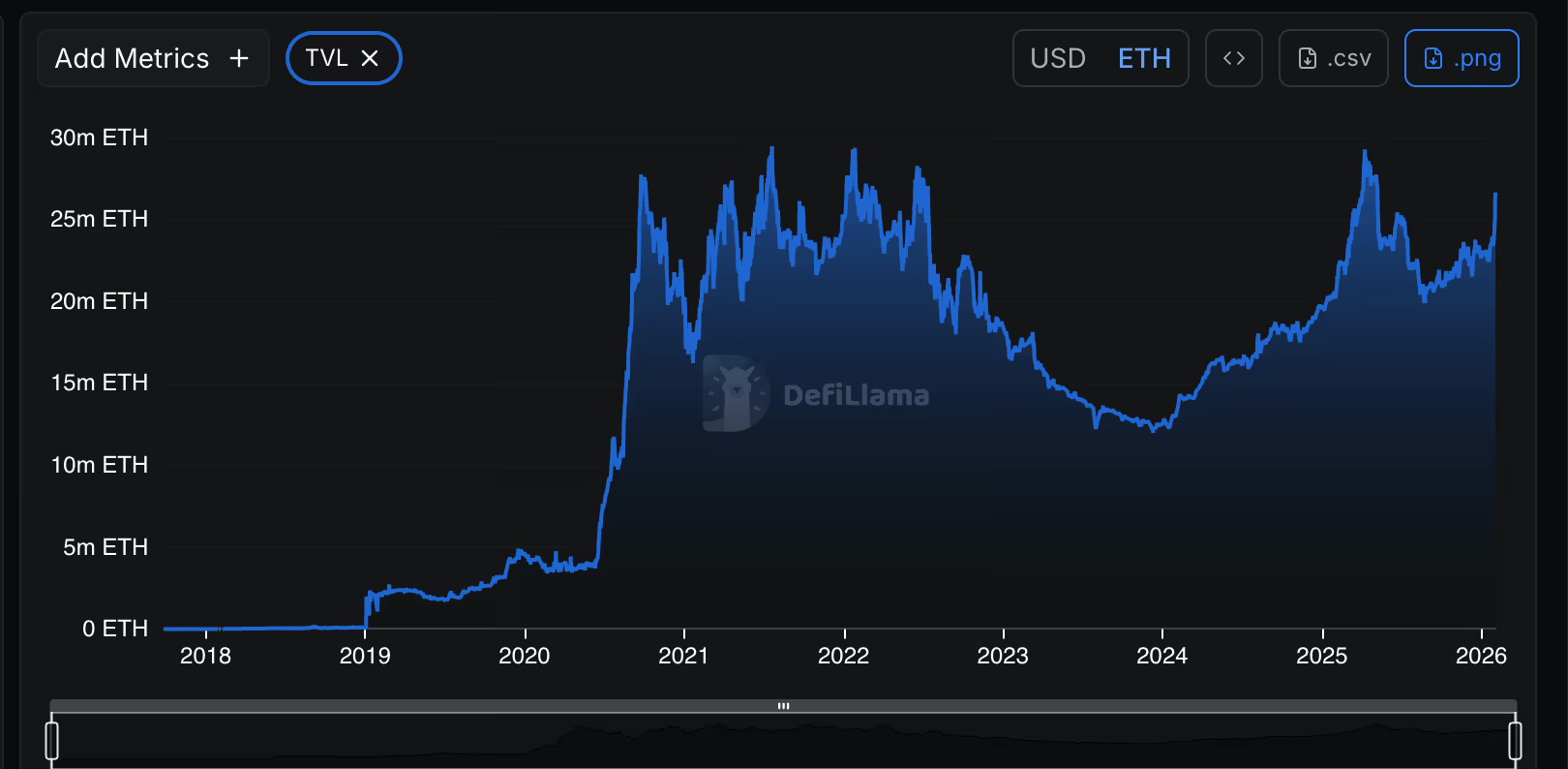

By several measures, network activity remains near peak levels. “Ethereum TVL is actually near all-time highs when denominated in ETH,” said Sam Ruskin, an analyst at Messari, suggesting capital has not meaningfully fled the ecosystem even as the token’s dollar price slipped.

Other indicators point in the same direction. The entry queue for ETH staking — the wait validators face to help secure the network — has stretched to roughly 70 days, a signal that demand to commit capital to Ethereum, especially among large institutions, remains strong despite short-term volatility.

That resilience is also showing up across decentralized finance, where activity has held up even as prices have soured. Traders and users are still engaging with onchain applications in search of yield, a sign that usage has not evaporated alongside sentiment.

“We’re still growing and getting more users and revenue, but token price is lagging,” said Mike Silagadze, the CEO of ether.fi, one of the largest restaking networks, to CoinDesk over Telegram. “We’re just focusing on the long run.”

Some market observers argue that the price move itself is being overinterpreted. Marcin Kazmierczak, CEO of blockchain data firm RedStone, said ether’s decline looks more like market “noise” than a signal of weakening fundamentals, particularly as retail trading activity fades. What matters more, he said, is a level of institutional conviction around onchain finance that he hasn’t seen before.

“The absence of retail excitement is actually refreshing – the next cycle will be driven by real adoption, not memes, and it allows builders to focus on creating long-term value,” Kazmierczak added.

That disconnect between price action and progress on the ground is a familiar pattern in Ethereum’s history. Periods of market turbulence have often coincided with some of the network’s most consequential development milestones, as builders continue to ship regardless of short-term sentiment.

“As we have seen with the Merge, the market is pretty bad at pricing in the fundamental technical realities of chains,” said Marius Van Der Wijden, a core developer at the Ethereum Foundation, noting that major technical changes are often only fully reflected in prices well after they are completed.

For some analysts, the divergence between price and onchain data reflects broader market dynamics rather than Ethereum-specific weakness. Ruskin said the network “looks as healthy as it ever did,” arguing that ETH’s recent decline is more closely tied to bitcoin’s movements or wider market sentiment than to any deterioration in Ethereum’s fundamentals.

Read more: DeFi’s quiet strength: Value locked on platforms holds as market selloff tests traders

Crypto World

Crypto Markets Slide as Government Shutdown Delays Jobs Report

Bitcoin and Ethereum fell as investors weighed delayed economic data, tightening risk appetite, and mixed ETF flows.

Crypto World

XRP Price Dips 3% as Garlinghouse Supports CLARITY Act

Join Our Telegram channel to stay up to date on breaking news coverage

The XRP price has dipped 3% in the last 24 hours to trade at $1.89 after Ripple CEO Brad Garlinghouse reaffirmed his support for the CLARITY Act, despite ongoing concerns over some of the bill’s provisions.

Garlinghouse said the crypto industry needs regulatory clarity rather than perfect legislation, arguing that a practical framework would encourage innovation across the digital asset sector. He emphasized that waiting for an ideal bill could slow progress at a time when clearer rules are urgently needed.

The White House has also signaled strong backing for the crypto bill. Patrick Witt, executive director of the President’s Council of Advisors on Digital Assets, noted that compromises are often necessary to achieve meaningful progress. He suggested that the current, more crypto-friendly political environment presents the best opportunity yet for market structure legislation to pass.

“Let’s not let perfect be the enemy of good” – this right here is the key. No piece of legislation has ever been perfect by everyone’s standards. What we need is a clear framework, allowing innovation to flourish — exactly what Market Structure will deliver.

I’ll keep saying it… https://t.co/NXAlnazzdv

— Brad Garlinghouse (@bgarlinghouse) January 21, 2026

Garlinghouse Bullish on Crypto

Garlinghouse shared an optimistic outlook for the broader crypto market in a CNBC interview, predicting that digital assets will reach new all-time highs this year. However, not everyone believes the CLARITY Act will have a major impact on XRP. Analyst unknowDLT argued that the bill is unlikely to affect XRP directly, adding to the debate over whether market structure laws benefit all tokens equally or mainly support certain parts of the industry.

Meanwhile, White House crypto czar David Sacks said that once market structure legislation is passed, banks will fully enter the crypto space. He expects traditional banking and crypto to eventually merge into a single digital assets industry, with the same rules applying to all companies offering similar products. Sacks also said banks’ views on yield will evolve, especially as they become more involved in stablecoins.

He pointed to the GENIUS Act, passed in August, which includes provisions related to yield, although it prevents stablecoin issuers from directly offering rewards. Third-party crypto service providers, however, can still provide yield to users. Sacks stressed that compromise is essential to get the CLARITY Act signed into law, noting that previous crypto bills failed multiple times before succeeding.

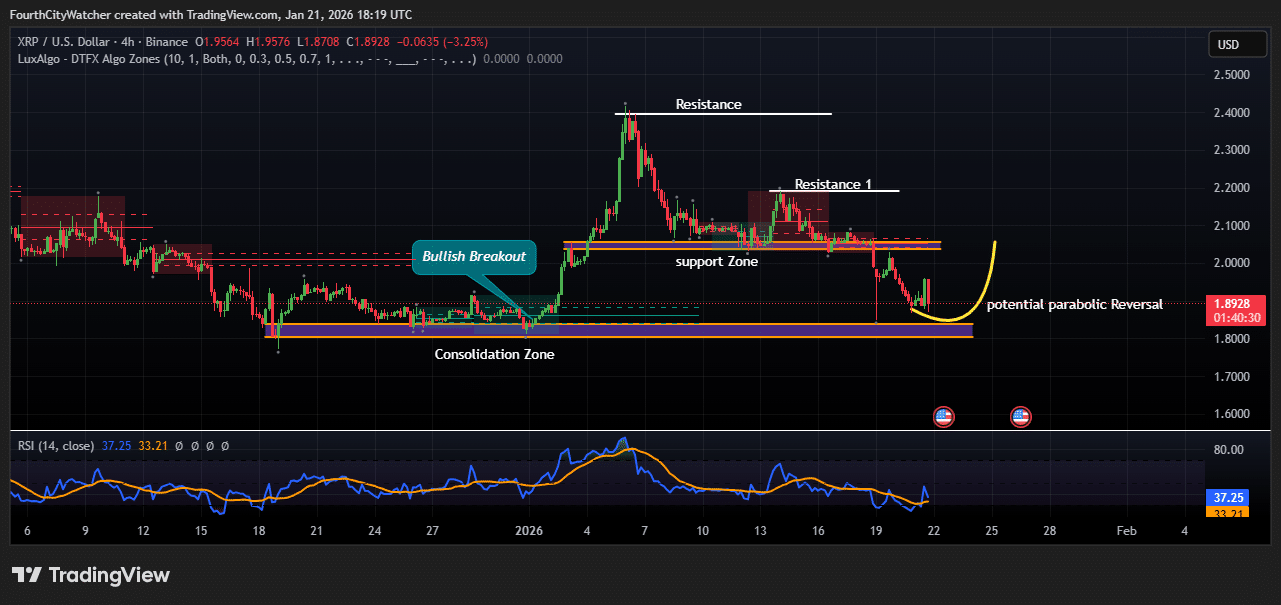

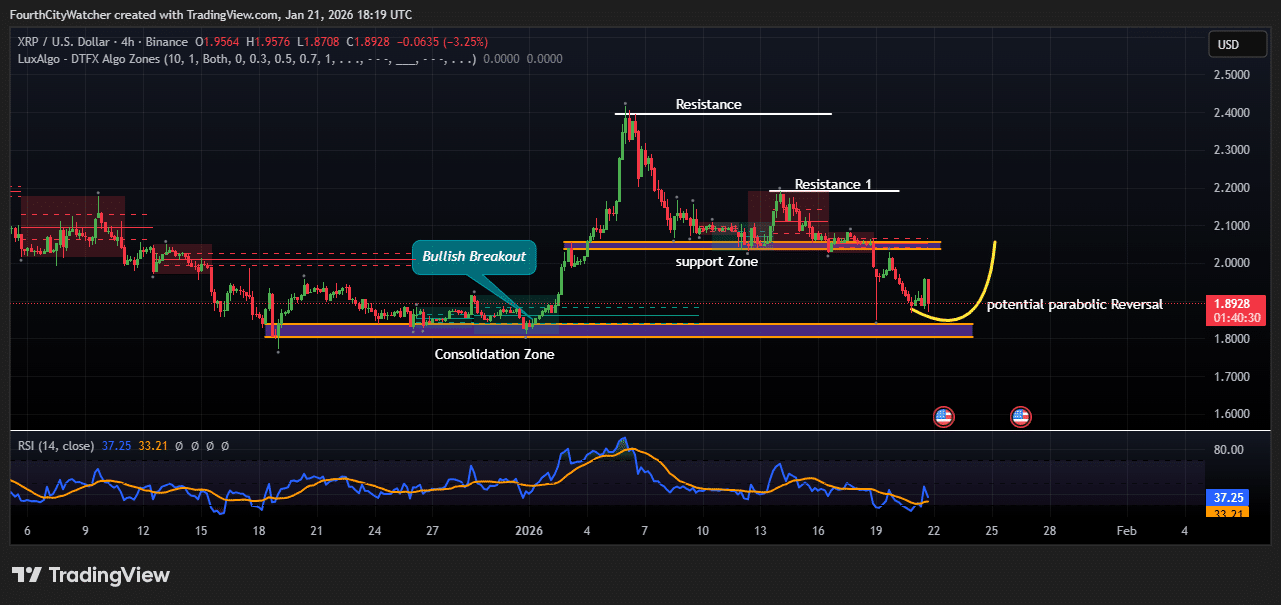

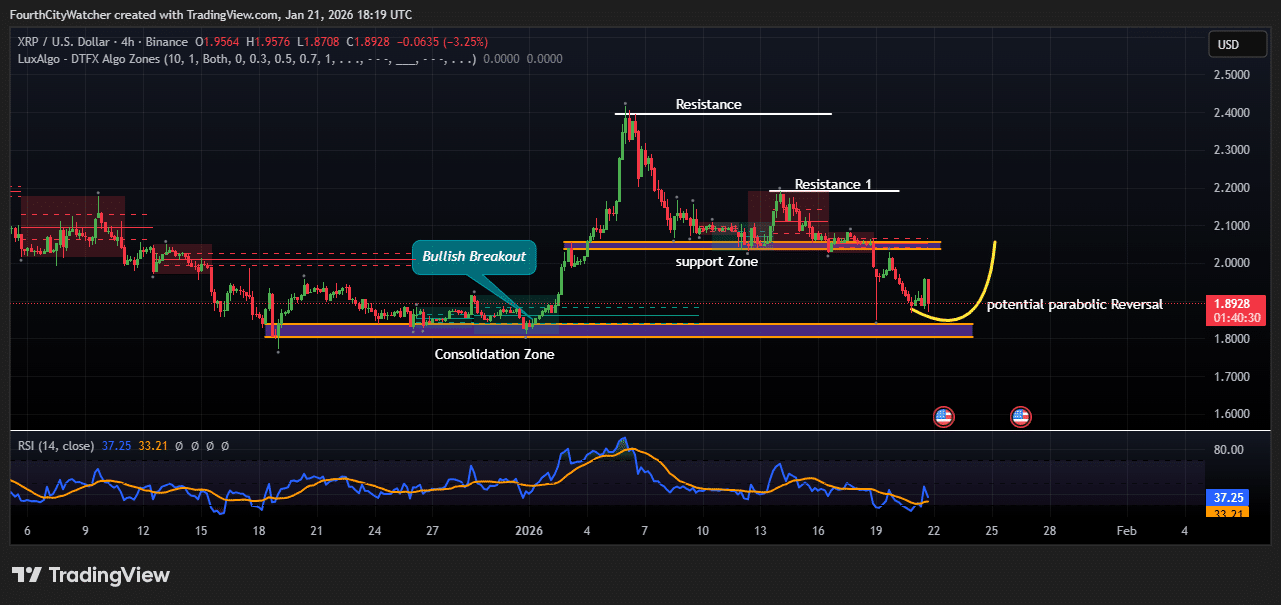

XRP Price Bulls Defend Key Support, Parabolic Reversal in Focus

The XRPUSD pair remained under pressure on Wednesday, extending its short-term downtrend as sellers continued to dominate the 4-hour chart. The token was trading near $1.89, down more than 3% on the session, after failing to reclaim a critical resistance zone around the $2.05–$2.10 range.

The chart shows that XRP previously enjoyed a strong bullish breakout from a prolonged consolidation zone near $1.85, which fueled a sharp rally toward the $2.40 area earlier this month. However, that move was met with heavy selling pressure, forming a clear rejection at the upper resistance and triggering a broader corrective phase.

Following the pullback, XRP attempted to stabilize above the former support zone near $2.00. This area briefly acted as a demand region, but repeated rejections at Resistance 1 weakened bullish momentum. Once price lost the $2.00 psychological level, bears pushed XRP lower toward the $1.85–$1.88 support band, which has historically attracted buyers.

XRPUSD Chart Analysis. Source: Tradingview

Notably, the current structure suggests XRP may be forming a rounded base. The highlighted potential parabolic reversal indicates that as long as price holds above the lower support zone, bulls could attempt a recovery move. A successful bounce from this level would likely target the $2.00 region first, followed by a retest of $2.10 if momentum improves.

Momentum indicators remain mixed. The RSI (14) is hovering around 37, signaling that XRP is approaching oversold territory but has not yet confirmed a strong bullish divergence. This suggests downside risk still exists, though selling pressure appears to be slowing.

From a market perspective, traders are closely watching whether buyers can defend the current demand zone. A breakdown below $1.85 would invalidate the bullish reversal setup and expose XRP to deeper losses toward $1.70. On the upside, reclaiming $2.00 would be an early signal that bulls are regaining control.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Bitcoin Nears $90K After Trump Scraps 10% Tariffs

Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin is seeking the $90,000 reclaim as US President Donald Trump dropped tariff threats and ruled out seizing Greenland from an ally by force.

Trump’s theatrics and consequent tensions have kept markets on edge this week, prompting investors to take the latest developments with a pinch of salt even as relief was palpable.

BTC has edged up a fraction of a percentage to trade at $89,955 as of 1:19 a.m. EST, with an intraday low of $87,304 and a high of $90,295, according to Coingecko data.

The crypto market also edged up to $3.13 trillion in market capitalization. As a result, the total liquidations in the crypto market came in at $605 million.

Trump Backs Off EU Tariffs, Markets Edge Higher

Crypto investors eased back into risk after President Donald Trump struck a calmer tone on Greenland and signaled a path toward a deal that pulled some heat out of markets.

According to Trump, he had reached the “framework of a future deal” involving NATO over Greenland, and indicated he would hold off on the tariff threat.

JUST IN: Trump says the US has outlined a framework for a future deal involving Greenland after a meeting with NATO Secretary General Mark Rutte

Tariffs scheduled for Feb. 1 have been postponed.

Negotiations will be led by VP JD Vance and Secretary of State Marco Rubio…— Laura Shin (@laurashin) January 21, 2026

“It’s a long-term deal. It’s the ultimate long-term deal. It puts everybody in an excellent position, especially as it pertains to security and to minerals,” Trump told reporters.

While speaking at the World Economic Forum in Davos, Trump said he would not impose the tariffs and ruled out the use of force in the dispute over the Danush territory.

“I won’t do that,” the U.S. President said at Davos of an attack to secure Greenland.

“Okay? Now everyone’s saying,’ Oh, good,’ that’s probably the most significant statement I made because people thought I would use force. I don’t have to use force, I don’t want to use force, I won’t use force.”

Trump’s words came as markets waited to see the full extent of EU trade retaliation over the Greenland issue.

As the crypto markets edged higher, gold prices remained largely steady after hitting a record high near $4,900/ounce in the previous session.

Silver prices rose 1% to $94.03 per ounce, just below record highs of $95.89/oz hit earlier this week.

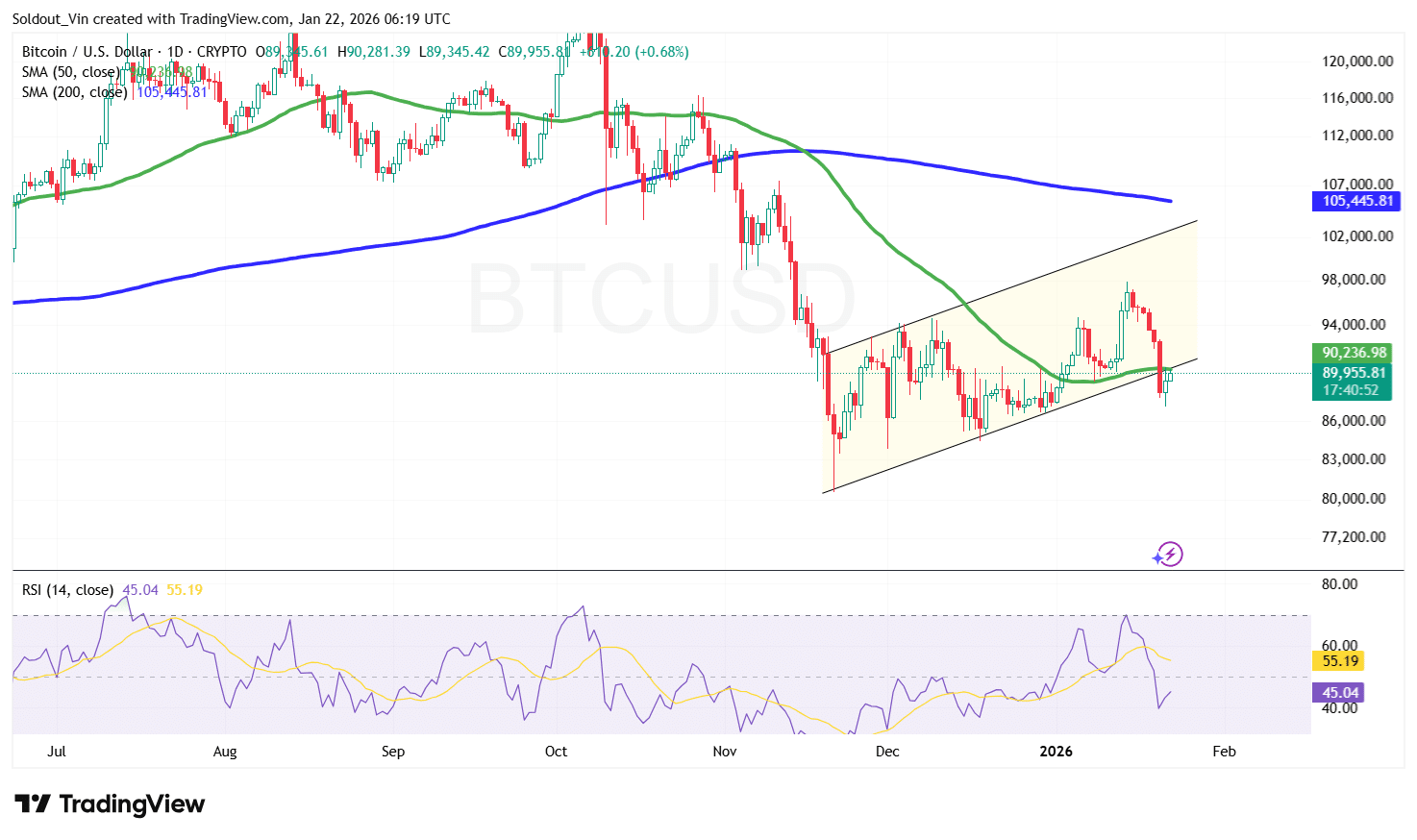

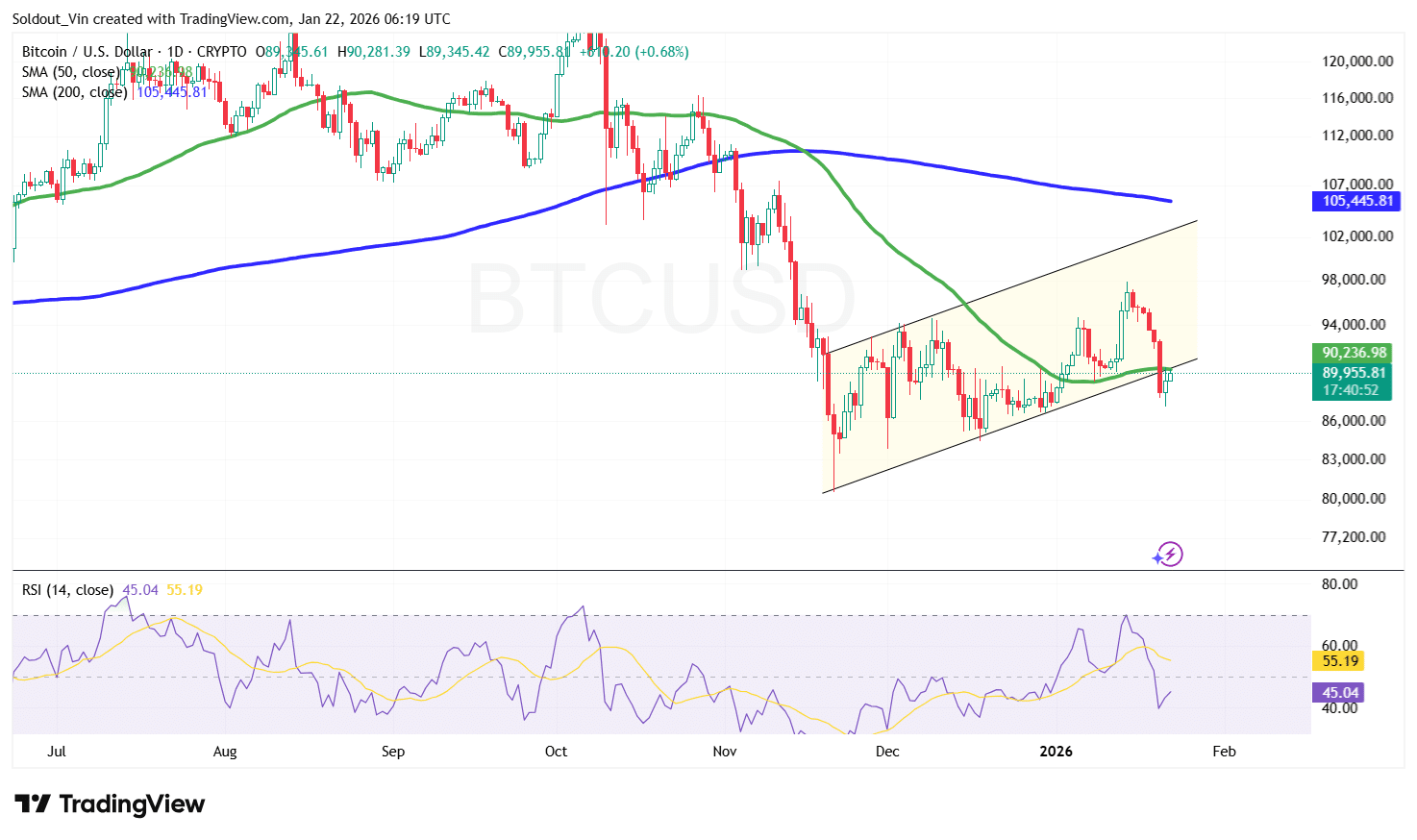

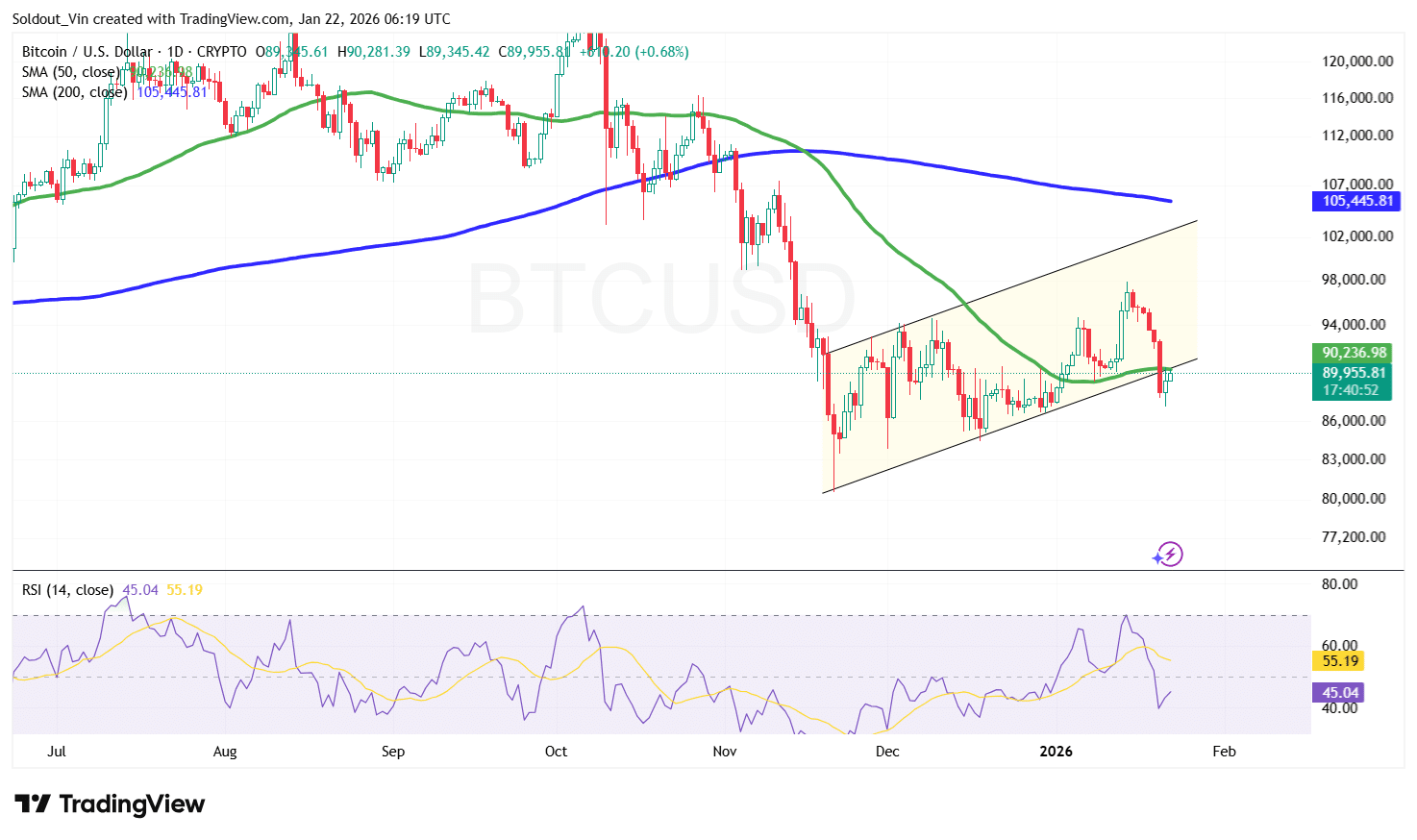

Bitcoin Price Set For A Rally Back Above $100K

Bitcoin price is currently consolidating near the $89,000–$90,000 region, holding just above short-term support around $87,000–$88,000, which buyers have defended following the sharp sell-off from November highs.

This consolidation comes after a strong decline from the $115,000 area, where selling pressure accelerated and forced the price of BTC into a corrective phase. Demand stepped in near the $82,000 zone. The rebound from this area suggests downside momentum has slowed in the long term.

Bitcoin is trading around the 50-day Simple Moving Average (SMA) near $90,200, but remains well below the 200-day SMA around $105,000, which continues to act as major resistance on the upside.

The downward slope of the 200-day SMA indicates the broader trend remains bearish unless Bitcoin can reclaim this level and hold above it.

Bitcoin’s Relative Strength Index (RSI) is hovering around 45, sitting below the neutral 50 mark. This suggests momentum remains weak, though not oversold, leaving room for a recovery attempt if buying pressure increases.

From the 1-day BTC/USD chart, Bitcoin price is trading within a rising channel following the sell-off. This structure often represents a bearish continuation pattern, with price currently trading between channel support and resistance. A move toward the $94,000–$98,000 resistance zone is possible, where the upper channel boundary aligns with prior rejection levels.

A clean breakout above $98,000, followed by a reclaim of the 200-day SMA near $105,000, would be the first meaningful signal of a trend reversal.

For Bitcoin to realistically target a sustained move back above $100K, it would need a confirmed trend shift, which may call for a close above the $95,000 zone.

Conversely, failure to break above channel resistance could trigger another pullback, with $88,000 acting as initial support, followed by the $85,000 demand zone if selling pressure returns.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Top 5 Altcoins To Buy For Catching the Next Ethereum-Style Run: Digitap ($TAP) Best Crypto to Buy in 2026

Ethereum’s biggest run didn’t start with headlines. In early 2020, ETH traded below $150, with low retail interest, rising network usage, and steady capital accumulation in the background. Over the next 18 months, Ethereum climbed more than 20x, driven by DeFi adoption, stablecoin growth, and real demand.

Today, investors are scanning for similar patterns. The market is volatile, but capital is moving selectively. Projects with working products, expanding user bases, and clear use cases are getting more attention than purely narrative-driven tokens.

Below are five altcoins to buy that are increasingly mentioned as candidates for the next major cycle:

- Digitap ($TAP): Crypto banking app in presale, focused on cross-border payments

- Hyperliquid (HYPE): Derivatives platform expanding into prediction markets

- Morpho (MORPHO): DeFi lending protocol with strong institutional backing

- Jupiter (JUP): Solana-based DeFi superapp with growing product scope

- Quant (QNT): Enterprise interoperability project showing technical stabilization

1. Why Digitap’s Timing and Utility Are Drawing Early Interest

Digitap is a crypto presale focused on cross-border payments, with a live platform that makes using crypto feel closer to everyday banking. This innovative project removes much of the complexity that still exists in the crypto space and addresses a gap many analysts see as critical for broader adoption.

With Visa cards in circulation, active iOS and Android apps, and over 120,000 connected wallets handling cross-border transfers, Digitap is showing early signs of real usage. That traction helps explain why $TAP is increasingly mentioned among the best crypto to invest in.

USE THE CODE “BIGWALLET35” FOR 35% OFF $TAP TOKENS. LIMITED OFFER

From an investment angle, timing is central. The presale launched at $0.0125 and is now priced at $0.0467, putting early participants up over 270%. The next price increase to $0.0478 is scheduled in 6 days, and stages have been filling quickly. So far, $5M has been raised, with 212M tokens sold.

The confirmed launch price is $0.14, which keeps upside visible for late-stage presale buyers. As prices step up every few days, the main variable becomes entry timing.

2. Hyperliquid Momentum Builds After HIP-4 Proposal

Hyperliquid has built momentum as a derivatives-first platform. On February 2, the project introduced HIP-4, a proposal to add outcome-based trading, including prediction markets and options-style products.

This expansion matters because 99% of Hyperliquid’s fees are converted into HYPE buybacks, creating a direct link between usage and token demand. Broadening the product set could increase fee volume if adoption follows.

Technically, HYPE remains strong. The token trades above its 7-day and 30-day moving averages, and MACD momentum remains positive. Holding support near the $26 level keeps the current structure intact.

3. Morpho Rebounds as DeFi Lending Activity Grows

Morpho operates in the DeFi lending space, allowing users to earn yield or borrow assets through noncustodial vaults and markets. The protocol has grown into one of the top lending platforms by TVL.

Price action recently showed a rebound from oversold levels, with MORPHO moving back above its short-term average. Longer-term resistance remains, but fundamentals continue to improve. TVL surpassed $8.2B, growing more than 26% month over month during late 2025.

Institutional validation adds weight. Morpho was included in Grayscale’s Top 20 list, and the Ethereum Foundation deployed capital into the protocol. That backdrop supports MORPHO’s role as core DeFi infrastructure.

4. Jupiter Grows Beyond Swaps With New DeFi Tools

Jupiter has become one of the most used DeFi platforms on Solana. It dominates swap routing and continues to expand into perpetuals, DCA tools, portfolio tracking, and lending.

The project recently secured $35M from ParaFi Capital, settled in JupUSD, with extended lockups. JupUSD’s circulating supply nearly doubled to $77M, improving liquidity across Jupiter’s ecosystem.

Jupiter also integrated Polymarket on Solana, adding prediction markets to its suite. While this broadens use cases, it also shifts focus beyond JUP’s core governance role. Scale remains Jupiter’s main advantage.

5. Quant Finds Support After Extended Downtrend

Quant has struggled over longer timeframes but recently stabilized near a major technical level. Price found support around the $69 Fibonacci retracement, and RSI moved out of oversold territory.

The broader market saw a modest bounce, and QNT slightly outperformed that move. However, sentiment remains mixed, and the token is still well below its longer-term averages. A move above the $72–$76 range would be needed to confirm a stronger recovery.

Quant remains a higher-risk enterprise play, but it stays relevant when markets begin to rotate toward infrastructure.

How Investors Are Positioning Ahead of the Next Bull Run

Ethereum’s early run rewarded projects that combined utility, timing, and adoption before the market caught on. Digitap fits this setup the best by being early, active, and focused on a real financial problem. With prices stepping up every few days and adoption metrics already in place, timing matters more here than with fully priced assets.

Hyperliquid, Morpho, Jupiter, and Quant each bring credible narratives. But for investors looking to position ahead of the next cycle rather than react to it, Digitap’s presale structure and live product make it one of the more closely watched altcoins to buy in 2026.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Epstein files show crypto ties to Coinbase, Blockstream: DOJ

Convicted sex offender Jeffrey Epstein’s hidden crypto investments came to light in a new release of so-called Epstein files — documents from the U.S. Department of Justice (DOJ), revealing his $3 million stake in Coinbase and links to Bitcoin developer Blockstream.

Summary

- Epstein invested $3 million in Coinbase in 2014 through a U.S. Virgin Islands-based entity.

- Epstein also backed Bitcoin developer Blockstream in 2014 but sold his stake months later due to conflicts of interest.

- The revelations are part of a new batch of documents released by the U.S. Department of Justice.

Epstein, according to Bloomberg, invested in Coinbase through a U.S. Virgin Islands-based entity in 2014, years after his criminal conviction. The deal was brokered by Brock Pierce, a cryptocurrency mogul and former child actor, and Brad Stephens, co-founder of Blockchain Capital.

At the time, Epstein’s $3 million investment represented less than 1% of Coinbase, which was valued at $400 million. Emails indicate that Coinbase co-founder Fred Ehrsam was aware of Epstein’s involvement, though it’s unclear whether a planned meeting ever took place.

Blockchain Capital attempted to acquire part of Epstein’s stake in 2018, and Epstein even considered reinvesting during Coinbase’s Series E round. The company went public in 2021 and is now valued at nearly $50 billion.

Epstein crypto dealings didn’t end with Coinbase

Epstein also backed Bitcoin-focused company Blockstream in 2014 but sold his stake a few months later due to conflicts of interest.

In a statement, Blockstream CEO Adam Back clarified that the company has no financial ties to Epstein’s estate. Epstein’s involvement in crypto was part of his broader investment portfolio, which spanned finance, media, and technology, securing him access to powerful networks.

These latest revelations, part of thousands of pages of Epstein’s financial records, underscore his deep, secretive ties to the world of digital assets.

Crypto World

Base AI Agent Ecosystem Surges as AI Social Platform Moltbook Goes Viral

Activity on Base-based AI-powered launchpad Clanker has surged as traders speculate on the rise of autonomous AI agents.

Crypto World

Trump MAGA statue has strange crypto backstory

A 15-foot-tall statue of former President Donald Trump, cast in bronze and gilded in gold leaf, has a home: a 7,000-pound pedestal at one of Trump’s golf resorts.

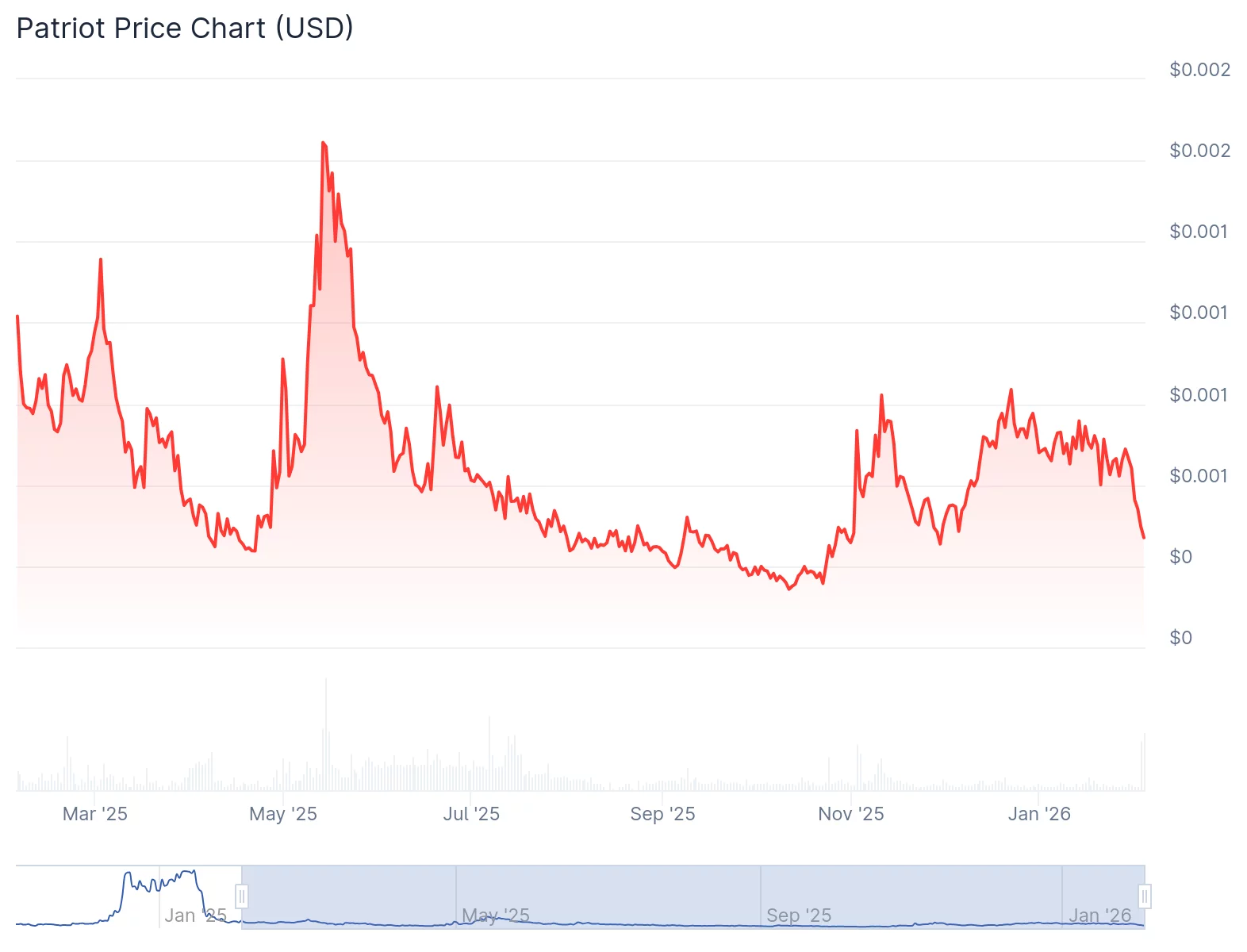

But this monument, dubbed “Don Colossus,” is not just a tribute to the 34-felony-count president. According to the New York Times, it’s at the heart of a bizarre cryptocurrency venture that’s seen a rollercoaster of financial hopes, legal disputes, and strange alliances — and it may just be the wildest moneymaking scheme of the Trump era.

Summary

- A 15-foot statue of Trump was used to promote the struggling PATRIOT memecoin, which lost over 90% of its value shortly after its launch.

- The project faced delays, infighting, and a legal dispute with sculptor Alan Cottrill, who claimed he was owed $75,000 for intellectual property rights, stalling the statue’s public debut.

- Despite the coin’s failure, the project continues with plans for an official unveiling at Trump’s Doral golf resort.

The statue was funded by cryptocurrency investors who paid $300,000 to commission a sculptor to create it as a homage to Trump. It was then used to promote PATRIOT, a memecoin with little function beyond speculation, designed to capitalize on MAGA hype.

The coin went on sale in late 2024, briefly spiking in value as Trump made bold promises about turning the U.S. into the “crypto capital of the planet.” But as with many memecoin ventures, the excitement didn’t last.

PATRIOT’s price plummeted, losing over 90% of its value within months, marred by delays and infighting among the investors. The statue, initially planned for a grand unveiling, became a symbol of the volatile and often dubious nature of memecoins, which are known for their reliance on viral trends and celebrity endorsements.

However, its sheer size and golden sheen have continued to draw attention, and it has remained the centerpiece of a marketing campaign designed to revive the struggling cryptocurrency.

The project’s backers, including crypto developers and right-wing activists, used social media to promote the statue, hoping to gain enough internet buzz to revive the coin’s value.

Official Trump ‘trumps’ Patriot

While the statue was being built, it encountered multiple setbacks, including a clash with Ohio-based sculptor Alan Cottrill, who claimed he was owed $75,000 for intellectual property rights. The dispute over the use of his design for marketing purposes led to a bitter standoff, with Cottrill threatening to withhold the statue until he was fully compensated. Despite these tensions, the statue’s construction proceeded, and a concrete-and-stainless-steel pedestal was installed at Trump’s golf complex in January 2026.

Though the Trump family publicly distanced itself from the coin, Trump promoted the project, including a link shared to Breitbart News, and kept the spotlight on PATRIOT.

His own coin, Official Trump (TRUMP), launched shortly before the PATRIOT unveiling, further complicating the situation and leading to a drop in interest in the competing crypto token. The timing couldn’t have been worse, as the price of PATRIOT tanked just as Trump’s official token took off.

The PATRIOT saga, though financially rocky, continues to capture the public’s imagination. The statue, intended as a marketing stunt for the coin, is now poised for an official unveiling in Doral, Florida.

Trump has reportedly expressed interest in attending the event, though no official date has been set.

In the meantime, Cottrill is still waiting for full payment for his work, while the investors continue to promote the project online, hoping the statue’s golden finish will spark renewed interest.

Despite the setbacks, the statue stands as a symbol of one of the stranger intersections between politics, crypto, and celebrity culture. The backers of PATRIOT have insisted that the project wasn’t about getting rich — it was about building a “people’s crypto token” that would celebrate Trump and his supporters.

As of now, it seems more like a monument to memecoins.

Crypto World

Vitalik Buterin Calls for Evolving Ethereum’s L2 Vision as Base Layer Grows

TLDR

- Vitalik Buterin reassesses Ethereum’s Layer 2 scaling vision in light of faster-than-expected base layer growth.

- Buterin emphasizes that Ethereum’s Layer 2 networks have not achieved the full decentralization once envisioned.

- Leading rollups such as Optimism and Arbitrum have made progress but still face challenges in trustless execution and cross-chain interoperability.

- The original concept of Ethereum scaling with L2 rollups may no longer align with the network’s evolving needs.

- Vitalik Buterin advocates for more focus on native rollups and tighter integration of ZK-EVM technology into Ethereum’s base layer.

Vitalik Buterin, Ethereum’s co-founder, is reassessing Ethereum’s Layer 2 (L2) scaling vision. His recent comments on X reflect concerns over the slow progress of decentralization in L2 networks. As Ethereum’s base layer scales, Buterin suggests that the framework positioning L2 rollups as quasi-native shards no longer aligns with the network’s current trajectory.

Vitalik Buterin Reassesses Ethereum’s L2 Scaling Approach

In a shift from previous views, Vitalik Buterin has called for a reevaluation of Ethereum’s L2 scaling plans. Ethereum’s Layer 1 has grown faster than expected, while L2 decentralization has lagged. Buterin emphasized that L2s have not fully reached the decentralized “Stage 2” model once envisioned for Ethereum scaling.

L2 networks, such as Optimism and Arbitrum, have achieved milestones but still face challenges. They trail in achieving full decentralization and cross-chain interoperability. Buterin’s reassessment highlights these shortcomings and questions whether L2s can fulfill their intended promise of scaling Ethereum.

Ethereum L2 Struggles to Meet Expectations

The original vision for Ethereum L2s was to provide a scaling solution with a trustless, decentralized environment. However, the progress has been slower than anticipated, especially in the areas of cryptographic guarantees and interoperability. Despite advancements in L2 rollups, such as Base and Arbitrum, they still fall short of full decentralization and are not yet fully integrated into Ethereum’s core system.

Buterin’s recent comments suggest that Ethereum L2 must adapt to the evolving network dynamics. Ethereum’s base layer, with increasing gas limits and scalability, may make L2 solutions less crucial in the future. This shift calls into question whether L2 rollups will remain the go-to solution for Ethereum scaling as Layer 1 becomes more capable.

The Shift Toward Native Rollups and ZK-EVM Integration

As Ethereum’s base layer grows more robust, Vitalik Buterin and others in the Ethereum community have started focusing more on native rollups. These rollups, integrated more deeply into the Ethereum protocol, could replace the need for separate L2 solutions. Buterin has expressed growing support for native rollups, particularly those built around zero-knowledge (ZK) proofs, which offer more efficient and secure scaling.

The development of ZK-EVM technology is key to this shift. It has the potential to enable more seamless integration between the Ethereum base layer and rollups. This move could lead to a more streamlined approach to scaling Ethereum while maintaining decentralization and security, a shift that Buterin believes aligns better with the network’s long-term goals.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World5 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics4 days ago

Politics4 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video1 day ago

Video1 day agoWhen Money Enters #motivation #mindset #selfimprovement

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports3 days ago

Sports3 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread – Corporette.com

-

Crypto World3 days ago

Crypto World3 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World4 days ago

Crypto World4 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business4 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat19 hours ago

NewsBeat19 hours agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World4 hours ago

Crypto World4 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards

-

Tech4 days ago

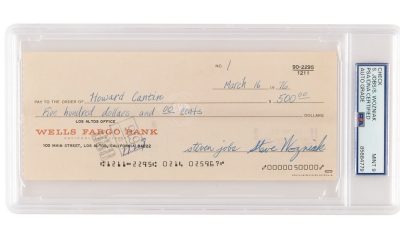

Tech4 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined