Business

‘Huge’ investor demand for apartment buildings

Camden Property Trust CEO Ric Campo.

Courtesy of Camden Property Trust

A version of this article first appeared in the CNBC Property Play newsletter with Diana Olick. Property Play covers new and evolving opportunities for the real estate investor, from individuals to venture capitalists, private equity funds, family offices, institutional investors and large public companies. Sign up to receive future editions, straight to your inbox.

Fundamentals in the multifamily apartment market are weakening as a historic surge of new supply continues to make its way through the pipeline and rental demand falls back. At the same time, investor demand for these properties is rising.

As an example, Camden Property Trust, a top-10 multifamily real estate investment trust, quietly began marketing its entire California apartment portfolio — 11 properties valued at roughly $1.5 billion — a few weeks ago and has already had significant interest.

“We have a huge demand for it right now,” Ric Campo, CEO of Camden, told CNBC. “Not two or three, but hundreds.”

Campo said the company wants to focus entirely on the Sun Belt, which is where 90% of its properties are now.

“We think the Sun Belt markets are going to — once they recover, which should happen, we think in ’26 or ’27 — they will be better growth dynamic markets than California and our long-term cash flow growth, or net operating income growth, will be better concentrated in the Sun Belt than Southern California, so it’s fundamentally why we’re selling.”

As for the timing, he said poor fundamentals are actually fueling demand.

“You’ve had no rent growth, yet you’ve had wage growth, and so affordability for apartments across America has gotten better,” Campo said. “And at the same time, if you look back at the last 20 years, only during really complicated recessions or the financial crisis have apartment rents stayed flat for more than a year or two, and so the market believes fundamentally that there’ll be a turn in the market.”

Fundamentals

Rents started 2026 on a low note, with the national median in January down 1.4% year-over-year, the largest annual drop since September 2023 and the lowest January rent since 2022, according to Apartment List. Rents are now more than 6% lower than their last peak in 2022.

Rents are falling because of rising vacancies. The national vacancy rate was 7.3% in January, a record high on Apartment List’s index, which dates back to 2017. Units are also taking an average of 41 days to get leased, four days more than in January 2025 and another high for the index.

“We’re past the peak of a multifamily construction surge, but a healthy supply of new units are still hitting the market and colliding with sluggish demand, causing vacancies to continue trending up,” said Chris Salviati, chief economist at Apartment List.

More than 600,000 new multifamily units hit the market in 2024, the most new supply in a single year since 1986. That came down to 500,000 in 2025, and 2026 is expected to bring even fewer, but still above average.

“Whether or not market conditions shift will now depend on rental demand, whose outlook has grown shakier due to weakness in the labor market and general economic uncertainty,” Salviati said.

Growing investor demand

As fundamentals weaken, however, investor interest in the sector from both private capital and REITs is strengthening. Multifamily led all real estate sectors in 2025 deal-making, according to Moody’s.

Mark Franceski, managing director of research and securities at Zelman & Associates, called it “a defining conflict.”

Trailing 12-month transaction volume has increased on an annual basis for 14 consecutive months, despite essentially no change to capitalization rates, according to Franceski.

“We still believe in it as stable and steady, and the long-term outlook is good, but fundamentals and investors point to the same thing: weakness,” Franceski said.

Berkadia’s 2026 Multifamily Investor Sentiment Survey, which surveyed 249 investors to assess anticipated transaction activity and opportunities within the sector in 2026, found that 87% of investors plan to moderately or aggressively expand their multifamily portfolios in 2026, “demonstrating cautious optimism despite ongoing challenges.”

In addition, a majority of investors (59%) expect moderate rental growth in the multifamily sector this year. Regionally, the Southeast, Midwest and Texas are forecast as the top regions for multifamily investment, fueled by migration trends, affordability and business-friendly policies, according to the Berkadia survey.

The play

So how do you unpack the disconnect between the seemingly robust investor appetite to own apartments and the soft demand fundamentals?

“They’re looking through the softness today to what they see as a better environment tomorrow,” said Samuel Sahn, managing partner and portfolio manager at Hazelview Investments, an Ontario, Canada-based firm with $11 billion in assets under management.

“For those private entities that have money to invest and are taking a five- to 10-year lens, because that is the time frame that they have in their private funds, they like what the world looks like in 2027 and beyond,” he added.

Sahn said an expected upturn in household formation and sharply slowing multifamily construction starts will ultimately give landlords more pricing power for both new leases and renewals.

Franceski, however, said location (which is of course an investment variable in all real estate) will be far more critical than usual in the coming cycle.

“I would treat [local] markets like stocks. It’s a market pickers’ market the same way the stock market is. People are hyperfocused on regions and markets,” he said.

Analysts scrutinizing Camden’s California exit also factor in state regulations.

“The positive is reducing exposure from a heavily regulated state versus CPT’s broader Sunbelt investment focus,” said Alexander Goldfarb, managing director and senior research analyst at Piper Sandler.

That’s exactly what Campo is arguing, despite some saying it overheated in the past decade and is now overbuilt.

“The regulatory construct in the Sun Belt is what drives Sun Belt growth. It’s pro-business. It’s a young population, a highly qualified workforce,” Campo said.

Meanwhile, Franceski offered another angle to the play: alternatives within the sector, like senior living and student housing. Those both fall under the multifamily umbrella and also see strong future demographic trends, especially senior living.

“Everybody’s got to live somewhere. The real focus is on solid operations and stability rather than growth industry,” he said.

Business

C3.ai executive chairman Siebel sells $298k in shares

C3.ai executive chairman Siebel sells $298k in shares

Business

Silicon Motion earnings matched, revenue topped estimates

Silicon Motion earnings matched, revenue topped estimates

Business

Cattle Supply Crunch Weighs on Profit at Tyson Foods

For the three months ended Dec. 27, profit totaled $85 million.

That was down 76% from a year ago and lower than Wall Street analysts expected, according to FactSet.

Quarterly sales rose 5% to $14.31 billion, beating forecasts.

On an adjusted basis, Tyson earned 97 cents a share, outpacing analysts’ expectations.

The quarterly loss in the beef division widened to $319 million, from $26 million a year earlier. Beef prices rose about 17%, while sales volumes fell 7%.

Business

McDonald’s offers McNugget caviar kits in free Valentine’s Day giveaway

Ed Rensi on Yum! Brands Habit Burger acquisition and McDonald’s culture change

McDonald’s is launching a limited-edition giveaway ahead of Valentine’s Day that pairs one of its most recognizable menu items with a traditionally high-end product: caviar.

The fast-food chain announced Monday in a release that it will offer McNugget Caviar kits through an online-only drop at McNuggetCaviar.com.

The kits will be available free of charge while supplies last and will not be sold in McDonald’s restaurants.

The promotion marks McDonald’s first collaboration with Paramount Caviar, a U.S.-based caviar supplier known for serving Michelin-starred restaurants and luxury hotels, the company said in a press release.

MCDONALD’S BETS ON GIANT BURGERS, SECRET MENUS AND NOSTALGIA, WITH US ROLLOUT STILL UNCERTAIN

McDonald’s is collaborating with Paramount Caviar for a limited-edition giveaway for Valentine’s Day. (Paul Weaver/SOPA Images/LightRocket / Getty Images)

Each kit includes a 1-ounce tin of Baerii Sturgeon caviar labeled as McNugget Caviar, a $25 Arch Card redeemable toward Chicken McNuggets, crème fraîche and a Mother-of-Pearl caviar spoon.

CHICK-FIL-A’S NEW FROSTED SODAS, RETRO CUPS SPARK BUZZ AND QUESTIONS FROM FANS AND WORKERS

McDonald’s announced a free Valentine’s Day promotion combining Chicken McNuggets with premium caviar in limited kits available online starting February 10 at 11 a.m. ET. (McDonald’s)

McDonald’s did not say how many kits will be available but said quantities are limited and expected to go quickly once the drop opens at 11 a.m. ET on Feb. 10.

Paramount Caviar, founded in 1991, has built its reputation on sustainably sourced caviar and has expanded from the professional culinary market to direct-to-consumer offerings, according to the company.

TACO BELL ROLLS OUT NEW ‘LUXE’ $3 VALUE MENU AS FANS DEBATE THE TRADEOFFS

Fast-food giant teams up with Paramount Caviar to offer free kits starting Feb. 10 through an online-only drop. (McDonald’s)

“The crispy, golden goodness of our signature McNuggets and the salty, savory, black pearls of Paramount’s Baerii Sturgeon caviar make for a true match made in heaven for the special occasions in life,” the press release stated.

“McNugget® Caviar was created because of our customers,” a McDonald’s spokesperson said in a statement to FOX Business.

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

“They’ve been pairing Chicken McNuggets with caviar long before we made it official,” they continued. “We know our fans want to enjoy elevated experiences without the price tag, so we want to treat them to something special — completely on us.”

Business

ArcBest: Increasingly Confident On Earnings Growth Acceleration (NASDAQ:ARCB)

I’m a passionate investor with a strong foundation in fundamental analysis and a keen eye for identifying undervalued companies with long-term growth potential. My investment approach is a blend of value investing principles and a focus on long-term growth. I believe in buying quality companies at a discount to their intrinsic value and holding them for the long haul, allowing them to compound their earnings and shareholder returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

Sun shines on Waaree Energies as tariff clouds clear

Apart from the trade deal, investors have reacted positively to the company’s strong third-quarter results. The management expects to exceed its earlier guidance for operating profit before depreciation and amortisation (Ebitda) of ₹5,500–6,000 crore for FY26, backed by robust execution and expanding order book.

ET Bureau

ET BureauAs part of its backward-integration strategy, the company is setting up a 10 Gigawatt (GW) ingot and wafer facility and expanding cell capacity by another 10GW, both targeted to be operational by FY27. This will give it a fully integrated solar value chain covering polysilicon, ingots, wafers, cells and modules, reducing dependence on imports and improving margins.

The company’s order book grew 28% sequentially to ₹60,000 crore in the December quarter, supported by an order pipeline exceeding 100 GW that provides multi-quarter revenue visibility. Around 65% of the order book is international, while domestic orders are increasingly skewed towards highermargin segments, including domestic content requirement (DCR) modules, which are solar panels manufactured in India using locally sourced components and command a pricing premium.

The company also plans to expand into related areas such as battery energy storage systems (BESS), inverters, and green hydrogen. It is setting up a 20-gigawatt-hour BESS manufacturing facility that is expected to be ready by FY28. In the December quarter, it raised around ₹1,000 crore in equity to fund lithium-ion cell and battery-pack plant.

In green hydrogen, the company intends to build a 1GW electrolyser manufacturing facility supported by production-linked incentives of ₹444 crore. The project, with planned capital expenditure of ₹676 crore, is expected to be commissioned by FY27.To comply with US non-Chinese sourcing requirements, the company has invested $30 million in an Oman-based polysilicon facility, with production expected to begin in the current quarter. This is expected to give it a fully traceable, non-Chinese supply chain, a key differentiator for its US expansion.

For the Dember quarter, the company posted its highest-ever consolidated revenue of ₹7,565 crore, doubling year-on-year, while Ebitda surged threefold to ₹1,928 crore. Module production rose by 94% to reach a record 3.5GW and cell output touched 0.75GW from a near-zero base.

Following strong quarterly performance, PL Capital has raised the earnings estimate by 5.7% and 1.2% for FY27 and FY28 respectively. The broking firm has maintained a ‘Buy’ rating on the stock with a higher target price of ₹3,600 compared with ₹4,084 earlier implying an FY28 expected price-earnings (P/E) multiple of 21.

Business

Siemens Energy to invest $1B in US power grid and turbine manufacturing

Global advisor to CEOs and corporate boards Ram Charan joins ‘Mornings with Maria’ to discuss the growth of AI in American businesses and the impact of technology on jobs.

Siemens Energy said Tuesday it will invest $1 billion to expand power grid and gas turbine manufacturing in the United States as rising electricity demand from data centers and artificial intelligence strains the nation’s energy infrastructure.

“The U.S. is the hottest electricity market at the moment in the world,” CEO Christian Bruch said in an interview, Bloomberg News reported. “The Trump Administration’s push for data centers and speeding that up” is helping to drive demand.

The investment is expected to create more than 1,500 highly skilled jobs across manufacturing, engineering and operations as Siemens Energy increases production capacity and workforce levels in the U.S.

CHEVRON CEO DETAILS STRATEGY TO SHIELD CONSUMERS FROM SOARING AI POWER COSTS

Christian Bruch, CEO of Siemens Energy, speaks during the groundbreaking ceremony at the Siemens Energy transformer plant. (Daniel Karmann/picture alliance via Getty Images)

Bruch’s comments echo President Donald Trump, who repeatedly has described America as “hot” and the “hottest country in the world” under his second term as part of an ongoing sharp rebuke of the Biden administration and its various foreign and economic policies that Trump claims stifled American growth and hobbled the nation’s standing on the world stage.

The Siemens deal will lead to benefit at least six states specifically, Fox News Digital learned, with hiring concentrated in the southeast United States.

“This massive investment underscores President Trump’s commitment to reshore American manufacturing, create high-skilled jobs for American workers, and secure our power grid as electricity demand continues to grow,” White House spokeswoman Taylor Rogers told Fox News Digital of the investment. “Together, President Trump and private partners are working to make America wealthy and energy dominant again.”

In Mississippi’s Greater Richland area, the company plans a new high-voltage switchgear facility with a training center and up to 300 new hires. North Carolina is slated for the biggest job lift — about 500 roles across Charlotte, Winston-Salem and Raleigh — as turbine manufacturing resumes in Charlotte, parts production expands in Winston-Salem, North Carolina, and grid engineering, project execution and R&D grow in Raleigh, North Carolina.

Alabama, Florida, Texas and New York also are expected to benefit from the deal, including upgrading facilities that manufacture and service equipment used to move gas and liquids through pipelines in the Empire State.

Interior Secretary Doug Burgum, who chairs Trump’s National Energy Dominance Council, called the investment “tremendous” as the administration locks down an expanded supply chain that simultaneously brings manufacturing and jobs back to U.S. soil.

“We appreciate great partners like Siemens Energy, who proactively partner with the Trump administration for the benefit of the American people, prioritizing critical components to make the United States Energy Dominant!” Burgum said.

The move comes as major technology companies pour hundreds of billions of dollars into new U.S. data centers, driving a sharp increase in electricity demand that utilities say the country’s aging power grid was not designed to handle.

Government reports have warned that data centers could account for as much as 12% of U.S. electricity demand within two years, nearly triple their share in 2024.

“Siemens Energy has been making things in the United States for more than a century, and we are experiencing a once-in-a-generation growth opportunity driven by the resurgence of U.S. manufacturing and the expansion of artificial intelligence,” Siemens Energy CEO Christian Bruch said in a statement.

Power lines on Sept. 28, 2023, in the Everglades, Florida. (Joe Raedle/Getty Images)

Surging power needs tied to large technology projects have fueled a wave of deals aimed at adding new generation and grid capacity, though supply-chain constraints, lengthy permitting timelines and regulatory hurdles continue to slow those efforts.

Siemens Energy said the $1 billion U.S. investment is part of a broader $7 billion global expansion plan and includes targeted upgrades at existing American facilities, as well as construction of a new grid-equipment factory in Mississippi.

“Siemens Energy” written on a steel girder on which a power transformer stands. (Daniel Karmann/picture alliance via Getty Images)

CLICK HERE TO GET FOX BUSINESS ON THE GO

The expansion is expected to increase Siemens Energy’s global production capacity for large gas turbines by roughly 20%.

Business

Dow Jones And U.S. Index Outlook: Major Rotation Flows And Drops

MarketPulse is an award-winning industry analysis and news site service created by OANDA Business Information & Services, Inc. Covering forex, commodities, global indices and more, our goal is to give timely, relevant and informative commentary on major macroeconomic trends, technical analysis and worldwide events impacting the industry.

Business

The Chinese planemaker taking on Boeing and Airbus

Comac’s passenger jet is attracting customers in South East Asia where demand for affordable aircraft is growing.

Business

Pinterest chief content officer Malik sells $50k in shares

Pinterest chief content officer Malik sells $50k in shares

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World5 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics4 days ago

Politics4 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video1 day ago

Video1 day agoWhen Money Enters #motivation #mindset #selfimprovement

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports3 days ago

Sports3 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread – Corporette.com

-

Crypto World3 days ago

Crypto World3 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World4 days ago

Crypto World4 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business4 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat18 hours ago

NewsBeat18 hours agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World3 hours ago

Crypto World3 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards

-

Tech3 days ago

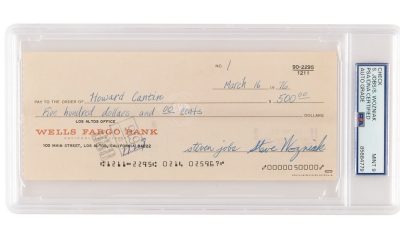

Tech3 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined

![Funny $Money - Just Ask The Streets [Shot By @TeeGlazedItProduction]](https://wordupnews.com/wp-content/uploads/2026/02/1770171384_maxresdefault-80x80.jpg)