Crypto World

Wirex Powers Chimera Card Launch for Self-Custodial Bitcoin Spending

Wirex, a full-stack crypto card issuer and Banking-as-a-Service (BaaS) provider, today announced it is powering the launch of the Chimera Card — a Bitcoin-funded debit card that brings practical, everyday Bitcoin spending to users worldwide.

Wirex BaaS: One Integration, Complete Infrastructure

Through a single API integration, Chimera Wallet gains access to Wirex’s complete BaaS stack:

- Non-Custodial Card Issuance — Virtual and physical debit cards that let users spend while maintaining full control of their assets. Includes seamless Apple Pay and Google Pay integration.

- EUR & USD IBAN Accounts — Named virtual IBANs with SEPA Instant and Faster Payments connectivity for seamless fiat on/off ramping across 30+ countries.

- Unified Balance Management — Real-time stablecoin-to-fiat conversion at point of sale, with zero prefunding requirements.

- DeFi Yield with Enterprise Controls — Integrated yield opportunities on idle balances with full compliance and risk management.

“Our BaaS platform exists so that innovators like Chimera can focus on building great products instead of navigating payment infrastructure complexity,” said Daniel Rowlands, General Manager, Onchain Finance at Wirex.“With a single integration, Chimera gets non-custodial cards, banking rails, and DeFi — everything needed to launch a world-class Bitcoin spending experience globally. That’s the power of full-stack BaaS.”

Rapid Global Deployment

By leveraging Wirex BaaS, Chimera avoids the complexity of building payment infrastructure from scratch — no separate card issuers, banking partners, or compliance frameworks to manage. The result: a debit card accepted at 80+ million merchants worldwide, with users maintaining self-custody of their Bitcoin throughout.

The Chimera Card is a natural extension of our vision to make Bitcoin usable in everyday life without compromising self-custody,” said Simone De Gaspari, Chimera Chief Strategy Officer.

“By enabling direct wallet-based funding and pairing it with global debit card acceptance, we’re giving users a transparent way to spend Bitcoin while remaining in control of their assets.

Key Features of the Chimera Card

- Direct wallet-based funding via Bitcoin or the Lightning Network

- Global acceptance at any merchant accepting debit and credit cards worldwide

- Truly self-custodial, with card balances held fully onchain with private keys managed by the end users — eliminating commingling risk and providing protection in the event of issuer insolvency

- Bitcoin-to-fiat conversion at prevailing market rates with transparent pricing

- Permanent 1.5% transaction fee for pre-order customers (vs. 2% standard), with zero monthly and top-up fees for life

- Travel-friendly FX rates and ATM access for global spending

- The card also features seamless Apple Pay and Google Pay integration for contactless payments, along with travel-friendly FX rates and ATM access for global spending.

Pre-Orders Now Open

Pre-orders for the Chimera Card are now open for a limited time. Customers who reserve their card during the pre-order period will receive permanent fee protection. Both virtual and physical cards are expected to be available by the end of Q1 2026.

Reservation link | Pre-order fee: 20 CHF

About Wirex

Wirex is a global payments platform serving both consumers and businesses, offering card-based payment products alongside card issuance and banking infrastructure for partners. For end users, Wirex provides payment cards and banking features designed for everyday spending.

For businesses, Wirex offers Banking-as-a-Service APIs, card issuance, and payment rails that enable digital platforms to launch compliant, globally accepted card programs. Trusted by over 7 million users since 2014, Wirex has processed $20 billion+ in transactions across 130 countries. As a principal Visa and Mastercard member, it makes crypto spendable anywhere — instantly and effortlessly.

About Chimera Wallet

Chimera Wallet is a next-generation Bitcoin wallet focused on usability, transparency, and real-world functionality. Built on Bitcoin’s VTXO technology, Chimera enables users to manage their Bitcoin, fund everyday spending through an integrated Visa card, access gift cards, and participate in referral programs — all within a single interface.

Chimera Wallet is designed to bridge native Bitcoin infrastructure with practical financial tools, making Bitcoin easier to use in everyday life without unnecessary complexity. For more information, visit chimerawallet.com.

Crypto World

Bitwise to Acquire Chorus One as Crypto Staking Demand Accelerates

Bitwise Asset Management is reportedly acquiring institutional staking provider Chorus One, extending its push into cryptocurrency yield services.

The acquisition adds a major staking operation to the crypto asset manager’s platform as demand for onchain yield products increases among both retail and institutional investors.

Chorus One provides staking services for decentralized networks and currently has $2.2 billion in assets staked, according to its website.

The financial terms of the deal were not disclosed, Bloomberg reported on Wednesday, citing statements from both companies.

Cointelegraph reached out to Bitwise and Chorus One for comment, but had not received a response by publication.

Related: 21Shares launches first Jito staked Solana ETP in Europe

Ethereum staking demand surges as validator queue swells

Ethereum validator queue data shows a surge in demand to stake Ether (ETH). The entry queue has swelled to more than 4 million ETH, translating into a wait time of over 70 days.

Almost 37 million ETH, or just over 30% of total supply, is now staked, with close to 1 million active validators securing the network. This suggests that more holders are choosing to lock up ETH despite long delays.

The rising interest in staking has pushed other major asset managers to integrate yield into regulated crypto products. Morgan Stanley filed to launch a spot Ether exchange-traded fund (ETF) that would stake part of its holdings to generate passive returns. Grayscale is also preparing to distribute staking rewards from its Ethereum Trust ETF, the first payout tied to onchain staking by a US-listed spot crypto exchange-traded product.

Related: Crypto VC activity hits $4.6B in Q3, second-best quarter since FTX collapse

Crypto M&A hits record

Bitwise’s deal also follows a surge in the crypto industry’s mergers and acquisitions in 2025, reaching $8.6 billion across a record 133 transactions by November, surpassing the combined total of the previous four years.

Coinbase led the wave, closing six acquisitions, including the $2.9 billion purchase of crypto derivatives exchange Deribit.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Nevada Moves to Block Coinbase Prediction Markets After Polymarket Ban

Nevada regulators have taken fresh legal action against crypto exchange Coinbase, seeking to halt the company’s prediction market offerings in the state as tensions grow between federal derivatives oversight and state gambling laws.

Key Takeaways:

- Nevada regulators are seeking to block Coinbase’s prediction markets, arguing the contracts qualify as unlicensed gambling under state law.

- The dispute centers on whether event-based contracts fall under federal CFTC oversight or state gaming authority.

- The case is part of a wider legal clash as multiple US states challenge prediction market platforms.

The Nevada Gaming Control Board on Monday filed a civil enforcement complaint against Coinbase Financial Markets in Carson City, requesting a permanent injunction, declaratory relief, and an emergency temporary restraining order.

Regulators argue the platform is offering event-based contracts tied to sports and elections without the state gaming licenses required under Nevada law.

Nevada Says Coinbase Prediction Markets Violate State Gaming Law

Coinbase introduced prediction market trading to US users last month through a partnership with Kalshi, a federally regulated designated contract market overseen by the Commodity Futures Trading Commission.

Nevada officials, however, say contracts linked to sporting outcomes and elections constitute wagering activity and therefore fall under state gaming rules rather than federal derivatives jurisdiction.

The board also alleges the Coinbase app permits users aged 18 and older to trade event contracts, below Nevada’s legal gambling age of 21.

In court filings, regulators said the company’s continued operation creates “serious, ongoing, irreparable harm” and gives Coinbase an unfair advantage over licensed sportsbooks that must meet strict compliance, tax, and physical-location requirements.

The dispute arrives amid a broader legal clash between Coinbase and several US states.

The exchange recently filed federal lawsuits against gaming regulators in Connecticut, Michigan, and Illinois, arguing that prediction markets fall exclusively under CFTC authority and that state enforcement efforts unlawfully restrict innovation.

Those states had issued cease-and-desist notices accusing prediction platforms of unlicensed sports wagering.

Nevada officials maintain their responsibility is to protect consumers and preserve the integrity of the state’s gaming industry.

Board chairman Mike Dreitzer said enforcement action was necessary to uphold those obligations as new digital betting-style products enter the market.

Nevada Escalates Crackdown on Prediction Market Platforms

The latest case follows a string of enforcement moves against prediction market operators. Nevada previously pursued action against Kalshi over sports-related contracts, triggering a legal battle that remains under appeal.

More recently, a state court granted a temporary restraining order blocking Polymarket from offering event contracts to Nevada residents for two weeks, signaling judicial willingness to side with state regulators despite federal derivatives oversight claims.

Last month, Kalshi opened a new office in Washington, D.C., as it ramps up efforts to shape federal and state policy amid growing scrutiny of its products across the United States.

The company also hired veteran political strategist John Bivona as its first head of federal government relations.

Meanwhile, a new legislation to limit the interactions between government officials and the prediction markets is being supported by more than 30 Democrats in the US House of Representatives, including former Speaker Nancy Pelosi.

The lure behind new restrictions is a controversial Polymarket bet, which started as a bet of $32,000 but eventually became more than $400,000 shortly before the unexpected detention of Venezuelan President Nicolás Maduro.

The post Nevada Moves to Block Coinbase Prediction Markets After Polymarket Ban appeared first on Cryptonews.

Crypto World

Solana price falls under $100: Dead-cat bounce coming?

Solana price slid deeper into the red on Feb.4, extending its recent downtrend as sellers continued to press the market.

Summary

- Solana drops to $97, extending weekly losses to over 20% as price tests the $95–$100 support zone.

- Despite price weakness, network usage and ETF inflows suggest longer-term interest remains intact.

- Oversold conditions could lead to a short-term relief bounce.

At press time, SOL was trading near $97, down 6.1% over the past 24 hours. The move leaves Solana sitting near the lower end of its seven-day range between $96 and $127.

Solana (SOL) has dropped 23% over the last week and 31% over the last month. The token is now back to a range that many traders consider critical, having retraced roughly 66% from its peak of $293 in January 2025.

Activity has increased despite the decline. As the price tests support, Solana’s 24-hour spot trading volume increased 32% to $6.55 billion, suggesting increased participation.

Derivatives show a similar trend. CoinGlass data reports futures volume jumping 40% to $17.17 billion, while open interest edged 0.65% higher to $6.48 billion, suggesting traders are adding exposure rather than fully stepping aside.

Network strength contrasts with price pressure

The weakness comes even as Solana’s fundamentals continue to improve. As previously reported by crypto.news, the network processed more than 2.34 billion transactions in January, a 33% increase from the past month and more than Ethereum, Base, and BNB Chain combined.

Institutional interest has also shown signs of growth. While Bitcoin and Ethereum exchange-traded products recorded net outflows in January, U.S. spot Solana ETFs attracted $104 million in inflows, pointing to rising interest from traditional investors during the pullback.

Still, price expectations have been adjusted by some analysts. Standard Chartered recently lowered its 2026 Solana price target to $250 from $310, citing near-term market pressure.

At the same time, the bank raised its longer-term outlook, forecasting SOL at $400 by the end of 2027, $700 by end-2028, $1,200 by end-2029, and $2,000 by 2030. The bank’s analysts argue Solana is positioned to benefit from growth in stablecoin usage and micropayments as it moves beyond a meme-driven phase.

Solana price technical analysis

From a chart perspective, Solana continues to trade in a clear bearish structure. The daily timeframe shows a consistent pattern of lower highs and lower lows, confirming that sellers still control momentum. The earlier breakdown below the $115–$120 consolidation zone has turned that area into resistance.

Price remains well below the declining daily moving average, now near $121, and repeated attempts to reclaim it have failed. This reinforces the idea that recent rebounds have been corrective rather than trend-changing.

Volatility has expanded to the downside. Strong selling pressure is evident as SOL is trading below the lower Bollinger Band. Although this often puts the market in short-term oversold territory, the absence of a significant reversal indicates that the downside momentum has not yet been completely exhausted.

That view is echoed by momentum indicators. The relative strength index is deep in oversold territory, at 26–28. The likelihood of an instant reversal is low because there isn’t any obvious bullish divergence at this point. In strong downtrends, RSI can remain oversold for extended periods.

The $100 level stands out as the most important near-term line. A sustained close below it would likely expose the $95–$93 zone, followed by a broader support area near $85–$90 if selling intensifies.

On the upside, any rebound is likely to face resistance near $120–$122, where the declining moving average and prior support converge.

Crypto World

Bitmine Chair Tom Lee Shrugs Off ETH Treasury Losses, Asks If ETFs Should Face Same Scrutiny

Bitmine Immersion Technologies chairman Tom Lee pushed back on criticism of the company’s Ethereum treasury strategy on Tuesday, arguing that paper losses come with the territory when a public vehicle is built to mirror the price of Ethereum through a full market cycle.

Lee’s comments were made in response to a social media post that accused Bitmine of sitting on a steep unrealized loss and setting up future selling pressure for Ether.

“BMNR is now sitting on a -$6.6 Billion dollar unrealized LOSS on the ETH they’ve accumulated. This is ETH in the future that will be sold, putting a future ceiling on ETH prices. Tom Lee was the final exit liquidity for OG ETH whales to get out of their worthless token,” the tweet read.

Lee Defends ETH Treasury As Long-Term Tracking Strategy

In response, Lee said the company’s goal is to track Ether’s price closely and aim to outperform over time through its approach, rather than trying to smooth out drawdowns.

He said unrealized losses show up naturally during broad crypto pullbacks, and he questioned why critics treat that as uniquely problematic when index products also swing lower during market declines.

Ether has slid sharply in the latest leg of the downturn, and Bitmine’s growing treasury has amplified the mark-to-market moves that come with a concentrated position.

Bitmine itself has framed the strategy as a long-duration bet on Ethereum’s role in finance and capital markets, pairing accumulation with staking infrastructure.

Bitmine’s ETH Holdings Climb To 4.24M As Paper Losses Pass $6B

In a recent company release, Bitmine said it held 4.24M ETH as of Jan. 25 and said it acquired 40,302 ETH over the prior week. Meanwhile, unrealized losses topped $6B.

The same statement pointed to a shifting political and institutional backdrop. It quoted President Donald Trump saying that Congress is working on crypto market structure legislation that he hopes to sign soon, and it positioned tokenization as a theme gaining traction among large financial players.

Lee has also tied the sell-off to market structure stress, pointing to the aftershocks of a record $19B liquidation event in October and to the way flows into metals can drain risk appetite from crypto during fragile periods.

The episode has reopened a wider debate around corporate-style crypto treasuries, especially those using Ether rather than Bitcoin.

Lee appears to be treating the recent drawdown as part of the cycle, not proof that the strategy is broken, and he has kept his longer-term pitch intact that Ethereum sits at the centre of where finance is heading.

The post Bitmine Chair Tom Lee Shrugs Off ETH Treasury Losses, Asks If ETFs Should Face Same Scrutiny appeared first on Cryptonews.

Crypto World

Is Tether IPO Just A Pipe Dream?

Tether, issuer of the $185 billion USDT stablecoin, has dramatically scaled back its private fundraising ambitions.

It raises doubts about a potential IPO once fueled by speculation from crypto insiders like BitMEX co-founder Arthur Hayes.

Sponsored

Sponsored

Investor Pushback Forces Tether to Reassess Funding Ambitions

Tether was initially exploring a $15–20 billion raise at a $500 billion valuation. The figure would have placed the stablecoin issuer among the world’s most valuable private firms.

However, according to the Financial Times, Tether is now considering as little as $5 billion, or potentially no raise at all.

The latest pullback follows a year of heightened market chatter. In September 2025, Hayes reignited Tether IPO speculation, suggesting a public listing for the stablecoin issuer could overshadow Circle’s successful USDC debut.

At the time, Tether’s valuation was pegged at over $500 billion. This positioned it alongside tech and finance giants such as SpaceX, OpenAI, and ByteDance.

Hayes framed the potential listing as a strategic move, with Tether’s USDT circulation of $185 billion and its revenue-generating structure giving it a competitive edge over Circle.

Yet investor sentiment has tempered the hype. Backers reportedly balked at the lofty $500 billion valuation, citing:

- Regulatory scrutiny

- Reserve transparency concerns, and

- Past allegations of illicit use.

Sponsored

Sponsored

Tether Stays Profitable Amid Market Headwinds, Keeping IPO Optional

A recent S&P Global Ratings downgrade highlighted Tether’s exposure to riskier assets, such as Bitcoin and gold, further heightening caution.

“S&P said there had been an increase in high-risk assets in Tether’s reserves over the past year, including bitcoin, gold, secured loans, corporate bonds, and other investments, all with limited disclosures and subject to credit, market, interest-rate, and foreign-exchange risks. Tether continues to provide limited information on the creditworthiness of its custodians, counterparties, or bank account providers,” Reuters reported, citing S&P.

The broader crypto market’s decline over the past six months further dampened enthusiasm for sky-high valuations, even for the sector’s most profitable player.

Ardoino, however, remains confident in Tether’s fundamentals. He described the $15–20 billion figure as a misconception. According to Ardoino, the company would be “very happy” raising zero capital.

Sponsored

Sponsored

“That number is not our goal. It’s our maximum, we were ready to sell…If we were selling zero, we would be very happy as well,” read an excerpt in the report, citing Ardoino.

Tether reported $10 billion in profits for 2025, down about 23% from the prior year due to Bitcoin price declines but offset by strong returns on gold holdings.

With profitability firmly intact, Tether has little operational need for additional funds. This suggests the fundraising drive is as much about credibility and strategic partnerships as it is about cash.

Tether IPO: Just a Pipe Dream?

The retreat also reshapes expectations for the Tether IPO. While a public listing is no longer imminent, regulatory tailwinds and strategic initiatives keep the option alive.

US stablecoin legislation under President Trump, along with Tether’s new US-compliant USAT token, could provide a pathway for legitimacy in the domestic market.

Sponsored

Sponsored

Therefore, groundwork could be laid for a potential 2026 IPO if market conditions improve, though the valuation may need to be recalibrated.

Still, Tether’s cautious pivot carries a broader signal for the crypto ecosystem. As the market’s de facto reserve currency with massive Treasury and gold holdings, the company’s retreat highlights a growing emphasis on profitability and transparency over hype.

For other high-valuation crypto firms eyeing public markets, Tether’s experience may serve as a blueprint: sustainable growth and strong fundamentals are increasingly critical to investor confidence, even for marquee names in the industry.

It is also worth noting that Tether CEO Paolo Arodino once articulated that the firm does not need to go public. However, he did not rule it out either.

Crypto World

Crypto Markets Slide as BTC Falls Below $90K, ETH Drops 7%

Tuesday’s sell-off wiped $713M in leveraged positions and came after Trump’s Greenland tariff threats.

Crypto World

Bitcoin ETF outflows deepen as ether and XRP funds quietly attract inflows

Bitcoin exchange-traded funds saw fresh outflows on Tuesday even as ether- and XRP-linked products drew net inflows, indicative of a growing split in how investors are positioning across major crypto assets during the latest bout of market volatility.

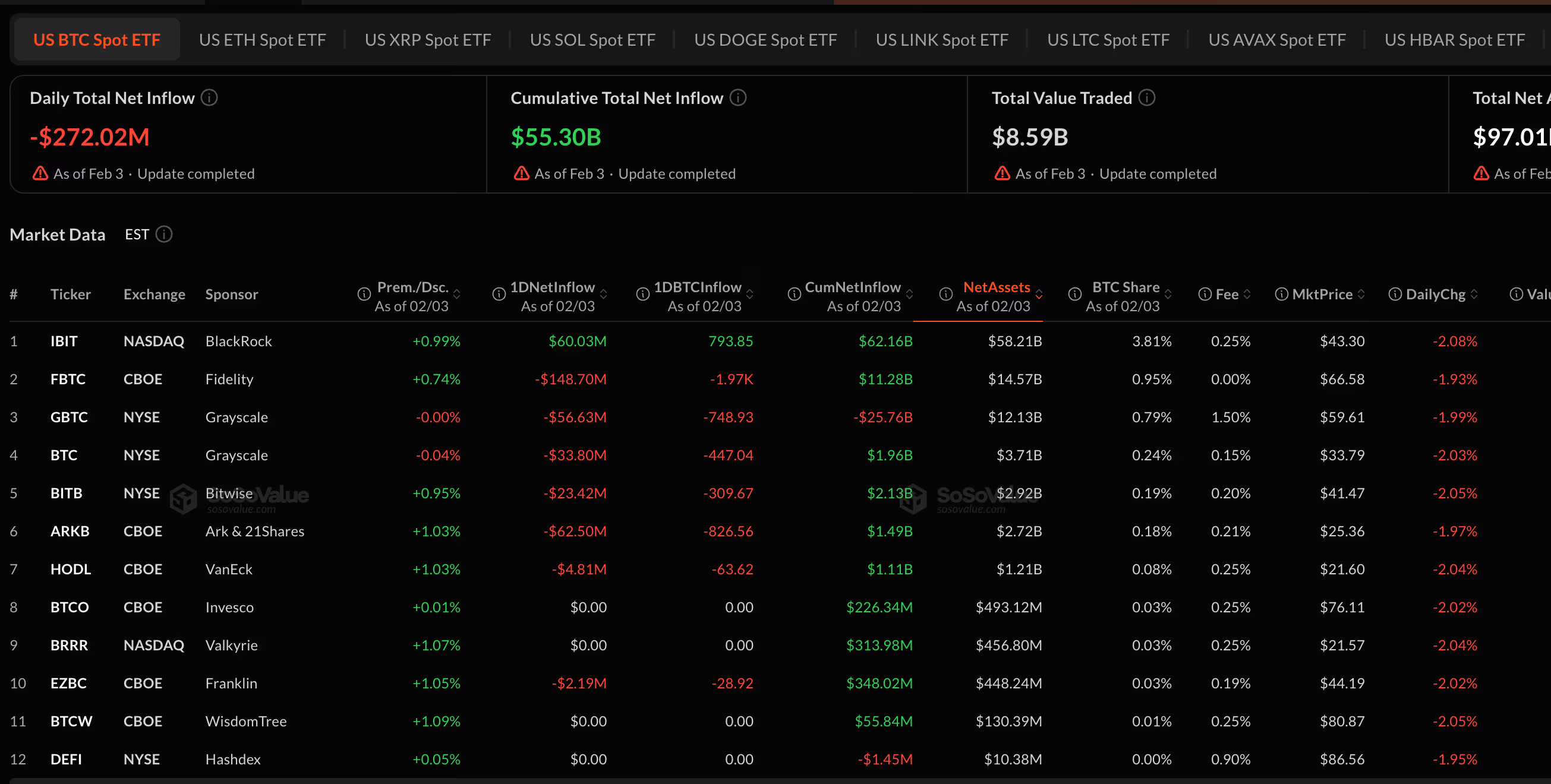

U.S.-listed spot bitcoin ETFs recorded roughly $272 million in net outflows on Feb. 3, according to data compiled by SoSoValue, extending a pattern of distribution that has emerged during bitcoin’s recent price swings.

The withdrawals came as bitcoin whipsawed sharply, sliding toward $73,000 before rebounding above $76,000, a move traders attributed to thin liquidity and fast-moving macro headlines.

In contrast, spot ether ETFs posted net inflows of about $14 million on the day, while XRP-focused products attracted nearly $20 million, suggesting some investors are rotating exposure rather than exiting crypto markets outright.

The divergence reflects shifting risk preferences rather than a wholesale loss of confidence in digital assets.

Bitcoin has increasingly traded as a macro-sensitive risk asset, reacting quickly to equity-market stress, tighter financial conditions and concerns around technology valuations.

Tuesday’s selling coincided with a sharp selloff in U.S. software stocks after Anthropic’s new AI automation tool reignited fears that artificial intelligence could disrupt traditional software business models, pressuring broader tech benchmarks.

The flows also echo a broader theme visible across markets: selective risk-taking rather than blanket risk-off behavior. While bitcoin ETFs have borne the brunt of near-term de-risking, capital is still moving within the crypto complex, favoring assets perceived as offering distinct use cases or relative value.

Crypto World

Grayscale Files for Near Protocol ETF

Join Our Telegram channel to stay up to date on breaking news coverage

Grayscale Investments has officially submitted an S-1 registration statement to the US Securities and Exchange Commission (SEC) for a groundbreaking Near Protocol (NEAR) exchange-traded fund (ETF).

According to the submitted S-1, Grayscale intends to convert the Near Trust into an ETF and rename the Trust as Grayscale Near Trust ETF.

This filing now represents a strategic expansion beyond BTC and ETH products, challenging the established regulatory perimeter for altcoin-based investment vehicles. As a result, the application could pave the way for a new era of institutional access to layer-1 blockchain assets, provided it navigates the SEC’s rigorous review process successfully.

BREAKING: Grayscale has filed to convert its Grayscale Near Trust into a spot NEAR ETF ( $GSNR)

Grayscale Trust holds ~$900K in $NEAR and Trades at a premium to NAV.

If Approved, it Would follow Bitcoin and Ethereum ETF moves, Highlighting Rising Institutional interest in… pic.twitter.com/NsB4YbMW88

— Crypto Patel (@CryptoPatel) January 21, 2026

When approved, it plans to list shares under the ticker GSNR, currently traded on the OTCQB market, on the NYSE Arca. However, the firm is set to announce fees and other details in a later filing with the SEC.

CSC Delaware Trust Company is the trustee, The Bank of New York Mellon is the transfer agent and the administrator, and Continental Stock Transfer & Trust Company is the co-transfer agent of the trust.

The prime broker and the custodian will be Coinbase and the custody arm of the American exchange.

In the filing, Grayscale also hinted at a likelihood of staking. If the staking condition is satisfied, “The sponsor anticipates that the Trust would enter into written arrangements with the Custodian to stake the Trust’s NEAR to one or more vetted third-party staking providers.”

After the filing, James Seyffart, a popular Bloomberg ETF analyst, believes that Crypto ETP filings with the SEC are set to continue.

Crypto ETP filings continue to come across the SEC’s desk. https://t.co/wJhFQcGMtM

— James Seyffart (@JSeyff) January 20, 2026

NEAR Price Recovers To Jump Over 3%

After the announcement, the Near Protocol token price jumped 3% in the last few hours, despite a 1.5% drop in the previous day to trade at $1.54 as of 1:58 a.m. EST, with an intraday high of around $1.56 and a low of $1.50, according to Congecko data.

The slight surge comes even as jitters run through the crypto market, with the space shedding nearly 2% over the last 24 hours to a market cap of $3.10 trillion.

The NEAR trading volume has also gained over 14% to $211 million, a signal of increased trading activity.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Canadian Regulator Sets Tighter Crypto Custody Standards to Curb Losses

Canada’s top investment industry watchdog has rolled out a new set of rules aimed at tightening how crypto assets are held and safeguarded, as regulators move to limit losses linked to hacks, fraud, and weak governance.

Key Takeaways:

- Canada introduced new interim crypto custody rules to curb losses from hacks and fraud.

- Custodians now face tiered limits based on capital strength, oversight, and resilience.

- The framework adds stricter governance, insurance, and audit requirements while supporting innovation.

The Canadian Investment Regulatory Organization (CIRO) on Tuesday published its Digital Asset Custody Framework, outlining detailed expectations for dealer members that operate crypto asset trading platforms.

The framework is designed as an interim measure and will be enforced through membership terms and conditions, allowing CIRO to react more quickly to emerging risks while longer-term rules are developed.

Canada Introduces Tiered Custody Rules

CIRO said the framework directly addresses the “technological, operational, and legal risks unique to digital assets,” drawing on lessons from past failures, including the collapse of QuadrigaCX in 2019, which left thousands of customers unable to recover funds.

At the core of the new regime is a tiered, risk-based structure for crypto custodians. Under the model, custodians are placed into one of four tiers based on factors such as capital strength, regulatory oversight, insurance coverage, and operational resilience.

Top-tier custodians may hold up to 100% of client crypto assets, while lower-tier providers face progressively tighter limits, with Tier 4 custodians capped at 40%.

Dealer members that choose to custody assets internally are limited to holding no more than 20% of the total value of client crypto.

The framework also imposes a broad set of operational requirements. These include formal governance policies covering private key management, cybersecurity controls, incident response procedures, and third-party risk management.

Custodians must carry insurance, undergo independent audits, provide security compliance reports, and conduct regular penetration testing.

Custody agreements are required to spell out liability in cases where losses stem from negligence or preventable failures.

CIRO said the approach is intended to be proportionate, balancing stronger investor protection with room for innovation and competition.

The rules were developed in consultation with crypto trading platforms, custodians, and other industry participants, and were benchmarked against international practices.

Canada Steps Up Crypto Enforcement After Major FINTRAC Fines

The move comes amid heightened scrutiny of crypto compliance in Canada. In October, the country’s financial intelligence agency, FINTRAC, fined local exchange Cryptomus roughly $126 million for failing to report suspicious transactions tied to darknet markets and fraud.

Earlier in the year, FINTRAC also imposed penalties on offshore platforms KuCoin and Binance for similar breaches.

As a self-regulatory body, CIRO has the authority to investigate misconduct among its members and impose sanctions, including fines and suspensions.

As reported, Canada is preparing to roll out its first comprehensive framework for fiat-backed stablecoins under the 2025 federal budget, closely mirroring the regulatory path taken by the United States earlier this year.

The Bank of Canada is expected to spend $10 million over two years, starting in fiscal year 2026–2027, to oversee the rollout.

The move comes just months after the US passed its GENIUS Act in July, a landmark stablecoin bill that heightened global regulatory momentum.

The post Canadian Regulator Sets Tighter Crypto Custody Standards to Curb Losses appeared first on Cryptonews.

Crypto World

Aave Shuts Down Avara Brand and Family Crypto Wallet

Aave Labs is consolidating its branding around core decentralized finance offerings, signaling a shift away from its umbrella project Avara. The reorganization follows a string of moves intended to streamline product focus and accelerate mainstream adoption of Aave’s DeFi stack. In a post on X, founder and CEO Stani Kulechov explained that Avara—an umbrella for projects including the Family crypto wallet and Lens-related initiatives—will be deprecated as the team doubles down on bringing Aave to a wider audience. The announcement underscores a broader theme in the ecosystem: simplifying user experiences to drive mass adoption rather than expanding brand reach through ancillary products.

Key takeaways

- Aave Labs replaces Avara as the central branding home for current and future products, including Aave App, Aave Pro, and Aave Kit.

- The Family wallet on iOS is winding down, with onboarding of new users halted and a slated wind-down over the next year.

- Lens governance has shifted away from Aave, with stewardship handed to Mask Network and Aave taking on a primarily advisory role for Lens-related work.

- The change is part of a broader strategic refocus on DeFi product development and ecosystem integration rather than broad branding expansion.

- Aave remains the dominant DeFi protocol by total value locked (TVL), hovering around $30 billion, well ahead of competitors.

Tickers mentioned: $AAVE

Price impact: Negative. The AAVE price recently declined about 0.7% in the last 24 hours, trading around $127.40.

Market context: The move comes as the DeFi sector consolidates leadership around core lending and borrowing protocols. With Aave at the forefront of TVL—roughly $30 billion, according to DefiLlama—the branding simplification may help streamline user onboarding and product development amid fluctuating risk sentiment and regulatory scrutiny that has grown tighter around decentralized finance offerings.

Why it matters

The decision to sunset Avara and consolidate into Aave Labs signals a strategic bet on a more focused, product-led growth path. By winding down the Family wallet and relegating Lens governance to a governance partner, Aave appears to be prioritizing a seamless end-user experience and clear product ownership. For investors and developers, the move provides a more direct line of accountability for delivering DeFi features that scale: a more cohesive roadmap, clearer product boundaries, and less fragmentation across brands.

On the user experience front, the Family wallet’s wind-down represents a realignment of resources toward experiences that encourage sustained engagement, such as savings-oriented features rather than open-ended wallet functionality. While the wallet’s iOS app will be phased out over the coming year, existing users will still be able to access their funds via Aave’s web interfaces through at least 2027. This keeps funds secure and accessible while the underlying infrastructure continues to support Aave Labs’ broader product ecosystem.

The Lens protocol transition, previously under Aave stewardship, to Mask Network, underscores a broader industry trend: governance and development responsibilities are increasingly distributed to specialized teams. While Aave maintains an advisory role, the strategic emphasis remains on preserving protocol integrity and enabling DeFi deployment at scale. This alignment could help reduce overlaps and accelerate deployment timelines for core Aave products in areas like lending, borrowing, and asset management, reinforcing the network’s competitive position in a crowded DeFi landscape.

In formal terms, Aave Labs will house all current and future offerings, including the Aave App, Aave Pro, and Aave Kit. The branding simplification aims to minimize confusion for users navigating a growing suite of tools and services. By concentrating branding under a single umbrella, the company aims to deliver a more coherent user journey—from onboarding to advanced use cases—without sacrificing the security and reliability that have underpinned its market leadership.

From a market perspective, Aave’s status as the largest DeFi protocol by total value locked provides a cushion against volatility in the broader crypto markets. With TVL around $30 billion and Lido’s staking protocol trailing at roughly $21.7 billion, the competitive landscape remains robust. The price action of AAVE—which traded around $127.40 after a 0.7% daily dip—reflects the typical sensitivity of blue-chip DeFi tokens to broader liquidity and regulatory dynamics, even as the core product suite continues to evolve in line with the company’s strategic reorientation.

What to watch next

- April 1: No new users will be onboarded to the iOS Family Wallet, marking a hard stop for new installations.

- April 1, 2027: Existing Family Wallet users retain access to their funds via Aave’s web interfaces; iOS app access ends, completing the wind-down.

- Updates on Aave App, Aave Pro, and Aave Kit within Aave Labs, including roadmap milestones and governance developments.

- Lens protocol governance and collaboration with Mask Network—monitor any public governance proposals or technical integrations.

Sources & verification

- Stani Kulechov’s X post announcing the sunset of Avara and the move to focus on bringing Aave to the masses.

- Avara blog post detailing that current and future products will operate under Aave Labs and the wind-down of the Family wallet on iOS.

- DefiLlama TVL data confirming Aave as the largest DeFi protocol with approximately $30 billion in total value locked.

- CoinGecko price data showing AAVE trading around $127.40 with a ~0.7% daily decline.

Why it matters

The branding consolidation is a signal of maturity for Aave as it increasingly treats DeFi tooling as an integrated ecosystem rather than a set of standalone products. By aligning development under Aave Labs, the project can allocate resources more efficiently, reduce friction for users, and accelerate delivery of core DeFi capabilities that have driven adoption since the early days of the protocol.

For builders, the move clarifies accountability and ownership for each product, potentially speeding up integration work and reuse of components across the Aave ecosystem. For users, a streamlined brand can translate into a simpler onboarding flow, more consistent user interfaces, and fewer disruptions caused by shifting project scope. Regulators, too, may appreciate a well-defined product suite with centralized governance and clearer risk management practices across Aave’s core offerings.

In the broader crypto market, the emphasis on DeFi-focused growth comes at a time when liquidity and risk appetite remain uneven. However, as institutional and retail demand for scalable, compliant, and user-friendly DeFi tools persists, Aave’s renewed focus could bolster confidence in its trajectory and reinforce its position as a leading provider of decentralized financial primitives.

What to watch next

- Roadmap updates for Aave App, Aave Pro, and Aave Kit under Aave Labs in the coming quarters.

- Any governance proposals related to Lens or other partnerships tied to the Lens ecosystem.

- Evolving product onboarding experiences aimed at broad user segments, including savings-focused features.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World5 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video1 day ago

Video1 day agoWhen Money Enters #motivation #mindset #selfimprovement

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World9 hours ago

Crypto World9 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards

-

Tech4 days ago

Tech4 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined