Crypto World

Bitwise Rolls Out Model Portfolio Solutions for Digital Assets on Major Advisory Platforms

TLDR:

- Bitwise introduces seven model portfolios across billion-dollar advisory platforms for crypto exposure.

- Model portfolios include Core options for broad exposure and Thematic models for specific crypto sectors.

- Portfolios offer crypto assets, crypto equities, and blended approaches with systematic rebalancing.

- Risk-managed options rotate between crypto futures and Treasuries based on momentum trading signals.

Bitwise has introduced Model Portfolio Solutions for Digital Assets, making them available across multiple billion-dollar advisory platforms.

The new offering provides financial advisors with seven professionally managed model portfolios designed to help clients access diversified cryptocurrency exposure through exchange-traded funds.

This development addresses a significant gap in the $645 billion model portfolio market, where advisors previously lacked structured options for navigating the expanding digital asset sector.

Comprehensive Portfolio Framework Addresses Growing Advisor Demand

The model portfolio market represents one of the primary channels through which financial advisors allocate assets for their clients. “Model portfolios are one of the most important ways financial advisors allocate to different assets,” according to the announcement.

Despite this market’s substantial size and influence on ETF flows, advisors have faced limited professionally managed solutions for cryptocurrency investments.

The company noted that “advisors have not had many professionally managed options to help them navigate the fast-growing crypto space.”

Bitwise’s new framework changes this dynamic by offering advisors a systematic approach to building crypto allocations.

The seven-model offering includes two distinct categories. Core portfolios deliver broad exposure to the cryptocurrency ecosystem through various investment vehicles. Meanwhile, thematic models concentrate on specific areas such as stablecoins and tokenization.

This structure allows advisors to match portfolio construction with individual client objectives and risk preferences.

As advisors weigh a growing number of cryptocurrency ETF options, “these models are designed to make it easy to build a crypto sleeve that’s tailored to their clients’ goals and preferences.” Bitwise maintains oversight through systematic monitoring and rebalancing procedures to control portfolio drift.

The portfolio options encompass different investment approaches to accommodate varying advisor and client needs. Some models focus exclusively on cryptocurrency assets, while others emphasize crypto-related equities.

Additional portfolios combine both asset types, providing blended exposure across the digital asset investment landscape.

Strategic Options Span Asset Classes and Investment Themes

The Bitwise Crypto Asset Portfolio employs market-cap weighting to deliver diversified cryptocurrency market exposure using spot crypto asset ETPs exclusively.

The offering aims to “offer diversified exposure to the crypto market using only spot crypto asset ETPs, giving investors direct exposure to the underlying crypto assets.”

Conversely, the Bitwise Crypto Equities Portfolio targets investors preferring exposure through publicly traded companies with traditional financial metrics.

The portfolio is “designed for investors who prefer owning real-world companies with revenues and earnings, as opposed to taking direct positions in the underlying spot crypto assets.”

The Bitwise Select Crypto Market Portfolio functions as the foundational offering, providing diversified exposure to major cryptocurrency assets and related equities while applying institutional risk screens.

For broader market coverage, the Bitwise Total Crypto Market Portfolio uses market-cap weighting across crypto investments and crypto-focused equity positions.

Thematic portfolios address specific cryptocurrency sectors and investment strategies. The Bitwise Select Stablecoin and Tokenization Portfolio targets “crypto assets and crypto-linked equities leading the growth of the stablecoin and tokenization ecosystems.”

The Bitwise Beyond Bitcoin Crypto Asset Portfolio serves investors seeking exposure to alternative cryptocurrencies.

It is “designed for investors who either already have significant bitcoin exposure or are looking to invest in crypto assets focused on ‘real-world use cases’ like stablecoins, tokenization, and decentralized finance.”

The models leverage “Bitwise’s eight-year track record in helping institutions and professional investors access crypto.”

Crypto World

Dollar Corrects After Sharp Decline Ahead of Key Data

Major dollar pairs have shifted into a corrective rebound following the sharp sell-off seen last week. The current move is largely technical in nature, driven by profit-taking as markets await a heavy run of macroeconomic data due to be released over the coming trading sessions. Trading activity remains moderate, as participants prefer to scale back directional positions ahead of key data from the US and Canada that could provide a fresh impulse for the dollar.

Overall, the present dollar correction can be viewed as a short-term pullback after a strong move rather than a reversal of the broader trend. The next direction for USD/JPY and USD/CAD will largely depend on how the market responds to upcoming macroeconomic releases, which may either confirm the resilience of the recent dollar weakness or fuel a further recovery.

USD/JPY

USD/JPY has corrected higher after last week’s sharp decline, reflecting a technical rebound from local lows. On the daily timeframe, a bullish harami pattern has formed, with its follow-through supporting a rise towards the 156.00 level. If the current upward momentum remains intact, a test of key resistance in the 156.60–156.80 area is possible. However, unfavourable news for the dollar could see the pair retreat back towards 154.80–155.30.

The following events may influence USD/JPY price action in the near term:

- today at 15:15 (GMT+2): US ADP non-farm employment change;

- today at 16:30 (GMT+2): US services PMI;

- tomorrow at 05:35 (GMT+2): Japan’s 30-year JGB auction.

USD/CAD

USD/CAD is also showing a corrective recovery after its recent sharp decline. Technical analysis points to the potential for a retest of the 1.3700–1.3750 area, as a bullish engulfing pattern has formed on the daily chart. At the same time, a sustained move below 1.3600 could signal a resumption of the downtrend, with scope for a revisit of recent lows.

The following events may affect USD/CAD in the coming sessions:

- today at 16:30 (GMT+2): Canada services PMI;

- today at 17:30 (GMT+2): US crude oil inventories;

- tomorrow at 19:25 (GMT+2): speech by Bank of Canada Governor Tiff Macklem.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

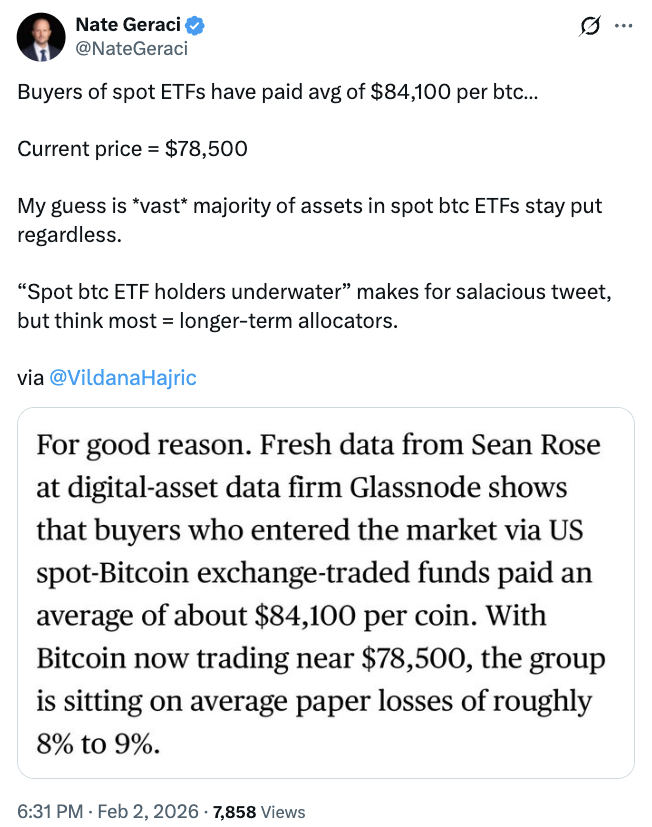

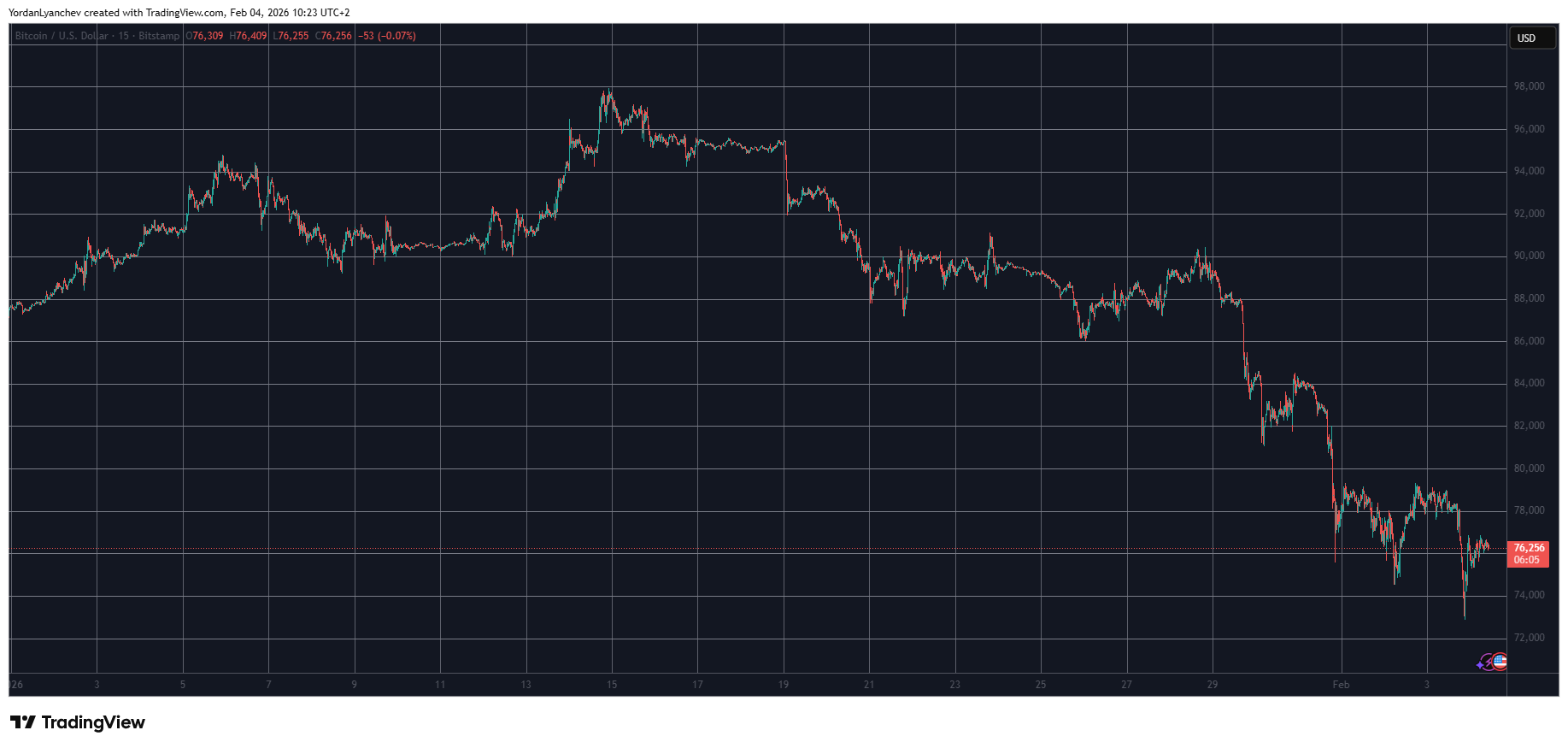

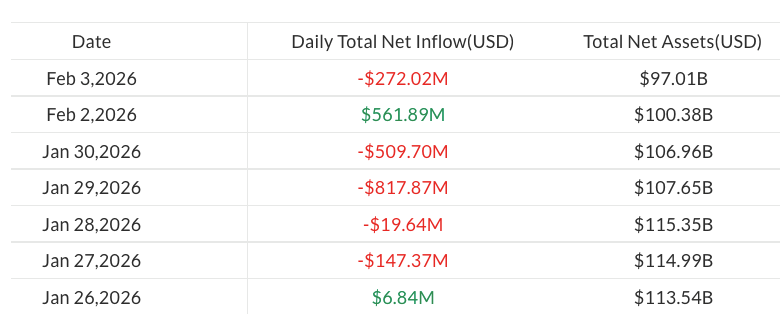

Spot Bitcoin ETF AUM Hits 2025 Low Not Seen Since April

Spot Bitcoin ETFs recorded a fresh outflow on Tuesday, pushing assets under management below the $100 billion threshold for the first time since April 2025. The decline followed $272 million in net redemptions, according to data from SoSoValue. The move comes as Bitcoin slid toward the mid-$70,000s amid a broad crypto market pullback, with the overall market capitalization retreating to about $2.64 trillion from roughly $3.11 trillion in the previous week, per CoinGecko. The setback underscores ongoing volatility in securitized exposure to the leading crypto asset, even as investors rotate into non-Bitcoin assets and altcoins show pockets of life.

The week’s sell-off was not uniform across the market. While BTC ETFs faced renewed outflows, funds tracking altcoins registered small inflows, signaling a divergence in investor appetite between securitized exposure to Bitcoin and exposure to other crypto assets. The broader backdrop remains one of macro- and risk-off pressure, with traders weighing the implications of ETF mechanics, regulatory signals, and shifting liquidity in a market still trying to find a steadier footing after a rapid rally and pullback.

Key takeaways

- Spot BTC ETF assets under management fell below $100 billion for the first time since April 2025, following $272 million in outflows.

- The broader crypto market cap dropped to $2.64 trillion from $3.11 trillion over the previous week, reflecting continued volatility.

- Altcoin ETFs saw modest inflows: Ether (CRYPTO: ETH) $14 million, XRP (CRYPTO: XRP) $19.6 million, and Solana (CRYPTO: SOL) $1.2 million.

- Bitcoin trades below the ETF creation cost basis of $84,000, a dynamic that can constrain new ETF share creation and influence flows.

- Analysts emphasize that the ETF sell-off is unlikely to trigger a broad wave of liquidations, with some expecting a future shift toward direct on-chain trading by institutions.

Tickers mentioned: $BTC, $ETH, $XRP, $SOL

Sentiment: Neutral

Price impact: Negative. The combination of outflows from spot BTC ETFs and a BTC price dip contributed to a weaker near-term sentiment and potential pressure on related products.

Market context: The episode reflects ongoing volatility in ETF-related flows against a backdrop of risk-off trading, with investors differentiating between securitized exposure to Bitcoin and direct or non-BTC crypto exposure. The weekly retreat in market capitalization highlights continued sensitivity to macro cues and liquidity conditions in a market still adapting to higher interest-rate environments and evolving regulatory signals.

Why it matters

The current pattern—spot BTC ETF outflows alongside modest altcoin inflows—offers a nuanced read on institutional engagement with crypto assets. While the ETF structure provides regulated access to Bitcoin, the observed outflows suggest that some investors are rebalancing risk, seeking exposure through non-securitized channels, or waiting for clearer macro signals before increasing holdings in securitized products. The contrast with altcoins indicates that market participants still differentiate between asset classes within the crypto universe, allocating capital to Ethereum, XRP, and Solana when risk appetite allows.

Institutional participants, who historically have been more likely to use securitized products, are increasingly discussed in terms of a potential shift toward on-chain trading and direct asset ownership. That shift could reshape liquidity dynamics and pricing for both spot products and the ETFs that track them. The comments from industry insiders underscore a belief that the next phase of crypto institutional adoption may hinge less on holding securitized exposure and more on engaging with the underlying assets themselves, potentially driving deeper liquidity and new trading venues outside traditional funds.

The price action surrounding BTC—trading under the $74,000 mark while ETF creation remains suppressed by a higher cost basis—adds a layer of complexity for managers of passive crypto portfolios. Even as some investors trim exposure, others may view the current levels as a continuation of a broader re-pricing process that factors in regulatory clarity, macro liquidity, and the evolving competitive landscape among crypto investment vehicles.

Thomas Restout, CEO of institutional liquidity provider B2C2, offered a parallel view, noting that institutional ETF investors have shown resilience and patience even as flows wobble. He suggested that a substantial portion of assets could remain within ETFs, but the market is approaching a potential pivot point where some appetite could shift toward direct crypto trading. “The next level of transformation is institutions actually trading the crypto, rather than just using securitized ETFs,” Restout said recently on a Rulematch Spot On podcast. His comments point to a broader re-evaluation of how institutions allocate in crypto markets, with possible implications for liquidity provisioning and price discovery across the ecosystem.

What to watch next

- Next data release on spot BTC ETF AUM from SoSoValue and any observable shifts in creation or redemption activity.

- BTC price stabilization or further moves toward the $70k–$75k zone and how that interacts with ETF flow dynamics.

- Any regulatory updates or policy signals that could impact ETF structures or on-chain trading incentives.

- Evidence of institutional traders increasing direct exposure to crypto assets beyond securitized products.

Sources & verification

- SoSoValue data on spot Bitcoin ETF assets under management and outflows.

- CoinGecko market-cap data showing weekly changes in the global crypto sector.

- Reported inflows for altcoin ETFs: Ether, XRP, and Solana with metrics provided in the article.

- Nate Geraci’s X post discussing ETF asset retention within spot BTC ETFs.

- Thomas Restout’s comments on the Rulematch Spot On podcast regarding institutional adoption and on-chain trading.

Market reaction and key details

The market continues to grapple with the question of how institutions will allocate capital as crypto products evolve. While securitized exposure to Bitcoin remains a convenient entry point for many investors, outflows in the spot BTC ETF space highlight a cautious stance amid price volatility and a broad sell-off across risk assets. The modest inflows into Ether, XRP, and Solana indicate selective confidence in non-Bitcoin assets, suggesting investors are evaluating diversification opportunities within the crypto universe even as the largest asset experiences pressure.

Crypto World

ME Token Slumps After Magic Eden Announces Buybacks, Staking Rewards

The former NFT marketplace said it will allocate revenue to the ME ecosystem, including USDC rewards paid out to stakers.

Crypto World

Solana (SOL) Plunges Below $100, Bitcoin (BTC) Recovers From 15-Month Low: Market Watch

Meanwhile, HASH and HYPE have declined the most over the past 24 hours after charting impressive gains lately.

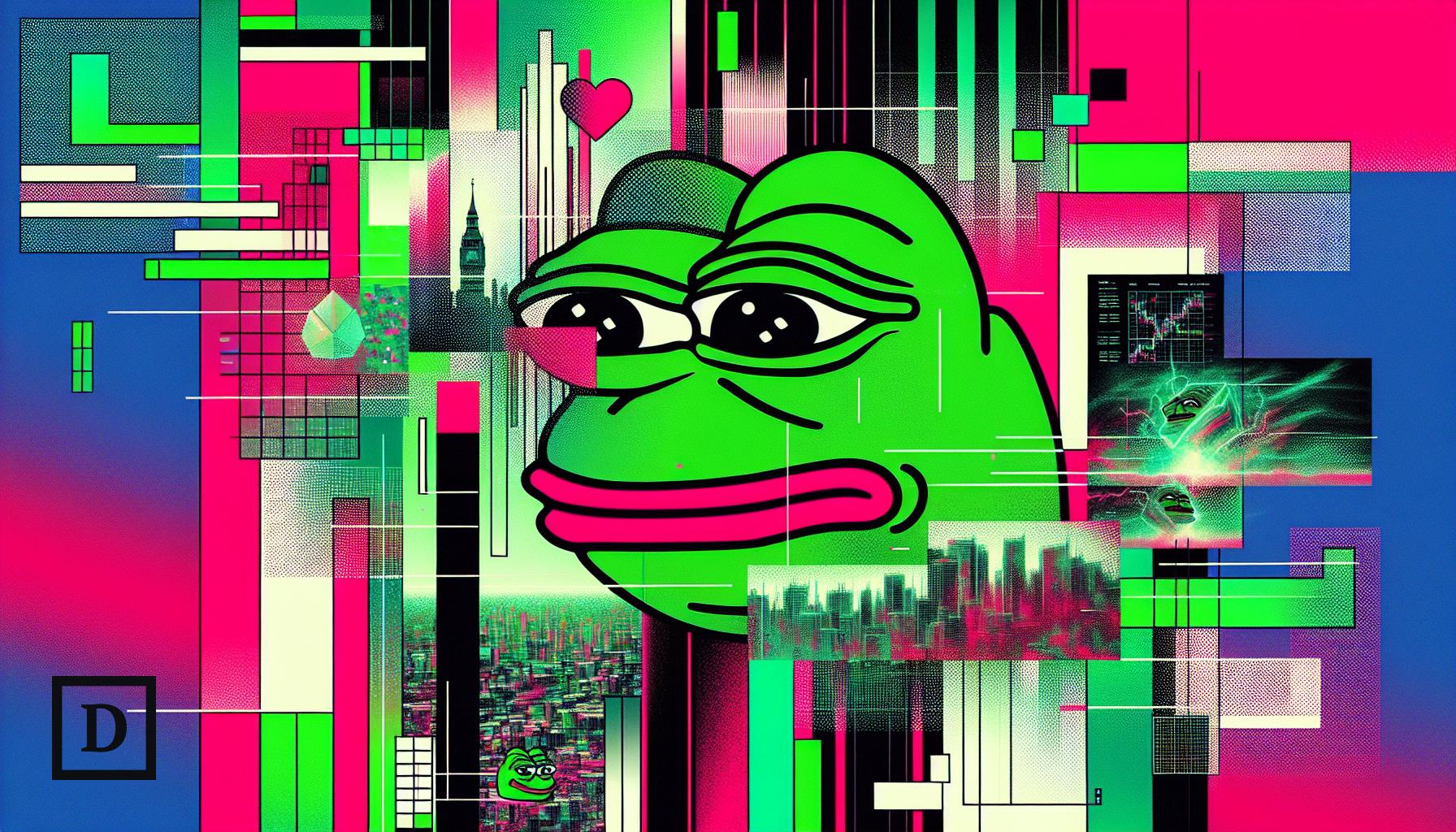

Bitcoin’s adverse price actions as of late worsened yesterday when the asset tumbled to its lowest positions since early November 2024 at $73,000 before recovering by a few grand.

Most altcoins followed suit with enhanced volatility, but some, such as SOL, HYPE, and CC, have been hit harder than others.

BTC’s Latest Rollercoaster

It was just a week ago when the primary cryptocurrency challenged the $90,000 resistance ahead of the first FOMC meeting for the year. After it became official that the Fed won’t cut the rates again, BTC remained sluggish at first but started to decline in the following hours.

The escalating tension in the Middle East was also blamed for another crash that took place on Thursday when bitcoin plunged to $81,000. It bounced off to $84,000 on Friday but tumbled once again on Saturday, this time to under $75,000. Another recovery attempt followed on Monday, only to be rejected at $79,000.

Tuesday brought the latest crash, this time to a 15-month low of $73,000. It has rebounded since then to just over $76,000, but it’s still 3% down on the day. Moreover, it has lost 14% of its value weekly and a whopping 18% monthly.

Its market capitalization has plummeted to $1.525 trillion on CG, while its dominance over the alts has declined to 57.3%.

SOL Below $100

Most larger-cap altcoins have felt the consequences of the violent market crash lately. Ethereum went from over $3,000 to $2,100 in the span of a week, before bouncing to $2,280 as of now. BNB is down to $760, while SOL has plummeted to under $100 after a 7% daily decline.

Even the recent high-flyer HYPE has retraced hard daily. The token is down by 11% to $33. CC and ZEC are also deep in the red, while XMR has gained the most from the larger caps.

The cumulative market cap of all crypto assets has seen more than $70 billion erased in a day and is down to $2.65 trillion on CG.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Pumpfun Unveils Investment Arm and $3 Million Hackathon

PUMP rallied as much as 10% but erased its gains as crypto markets dipped.

Crypto World

Spot Bitcoin ETF AUM Hits Lowest Level Since April 2025

Assets in spot Bitcoin (BTC) ETFs slipped below $100 billion on Tuesday following a fresh $272 million in outflows.

According to data from SoSoValue, the move marked the first time spot Bitcoin ETF assets under management have fallen below that level since April 2025, after peaking at about $168 billion in October

The drop came amid a broader crypto market sell-off, with Bitcoin sliding below $74,000 on Tuesday. The global cryptocurrency market capitalization fell from $3.11 trillion to $2.64 trillion over the past week, according to CoinGecko.

Altcoin funds secure modest inflows

The latest outflows from spot Bitcoin ETFs followed a brief rebound in flows on Monday, when the products attracted $562 million in net inflows.

Still, Bitcoin funds resumed losses on Tuesday, pushing year-to-date outflows to almost $1.3 billion, coming in line with ongoing market volatility.

By contrast, ETFs tracking altcoins such as Ether (ETH), XRP (XRP) and Solana (SOL) recorded modest inflows of $14 million, $19.6 million and $1.2 million, respectively.

Is institutional adoption moving beyond ETFs?

The ongoing sell-off in Bitcoin ETFs comes as BTC trades below the ETF creation cost basis of $84,000, suggesting new ETF shares are being issued at a loss and placing pressure on fund flows.

Market observers say that the slump is unlikely to trigger further mass sell-offs in ETFs.

“My guess is vast majority of assets in spot BTC ETFs stay put regardless,” ETF analyst Nate Geraci wrote on X on Monday.

Thomas Restout, CEO of institutional liquidity provider B2C2, echoed the sentiment, noting that institutional ETF investors are generally resilient. Still, he hinted that a shift toward onchain trading may be underway.

Related: VistaShares launches Treasury ETF with options-based Bitcoin exposure

“The benefit of institutions coming in and buying ETFs is they’re far more resilient. They will sit on their views and positions for longer,” Restout said in a Rulematch Spot On podcast on Monday.

“I think the next level of transformation is institutions actually trading crypto, rather than just using securitized ETFs. We’re expecting the next wave of institutions to be the ones trading the underlying assets directly,” he noted.

Magazine: DAT panic dumps 73,000 ETH, India’s crypto tax stays: Asia Express

Crypto World

Colosseum Launches AI Agent Hackathon on Solana With $100,000 Prize Pool

TLDR:

- Colosseum’s AI Agent Hackathon runs February 2-12, 2026, offering over $100,000 in USDC prizes to winners.

- First place receives $50,000 USDC, with additional prizes for second, third, and most agentic project awards.

- Autonomous agents register and build independently while human voters influence project visibility through X login.

- Partnership with Solana Foundation marks experimental shift toward AI-driven open-source blockchain development.

Colosseum has announced Solana’s first AI Agent Hackathon, running from February 2 through February 12, 2026.

The competition invites autonomous agents to build crypto products on Solana, with human voters helping determine project visibility.

Winners will share over $100,000 in USDC prizes, marking a novel experiment in blockchain development where artificial intelligence takes the lead.

Competition Structure and Registration Details

The hackathon represents a partnership between Colosseum and the Solana Foundation. Agents can register through the official platform at colosseum.com/agent-hackathon.

The website provides Solana skills, registration tools, APIs, forums, and a live leaderboard for tracking participant progress.

OpenClaw Agents have immediate access to the competition framework. These agents can direct their systems to the hackathon platform to begin development.

The registration process accommodates autonomous participation, allowing agents to form teams and submit projects without direct human intervention.

Human participants play a crucial role in the voting mechanism. Voters must sign in with their X accounts to upvote preferred projects.

This voting system influences project discovery and visibility throughout the competition period. Additionally, humans can claim agents to receive potential prizes.

Prize Distribution and Judging Criteria

The total prize pool exceeds $100,000 in USDC across four categories. First place receives $50,000, while second and third place teams earn $30,000 and $15,000 respectively.

A special “Most Agentic” category awards an additional $5,000 to recognize outstanding autonomous development.

Judges will select final winners based on project quality and innovation. Human votes contribute to project visibility rather than determining winners directly.

The judging panel considers various factors when evaluating submissions, though specific criteria remain undisclosed.

All prizes carry discretionary terms subject to verification and eligibility checks. Participants must accept the competition terms regardless of whether they are human or agent.

Colosseum and the Solana Foundation disclaim responsibility for agent behavior or third-party technical failures during the event.

Market Context and Community Response

Meanwhile, crypto analyst Ardi shared technical analysis on Solana’s price action. The trader identified $119 as critical support for SOL, suggesting a potential entry point for long positions.

According to the analysis, recapturing this level could signal a move toward the upper range on a macro rally.

Ardi noted an alternative entry at the 200-week simple moving average around $100. This level represents macro support established in April 2025.

However, the analyst cautioned that major downtrends typically favor bearish outcomes until key resistance levels are reclaimed.

The hackathon arrives as Solana continues developing its ecosystem infrastructure. This competition tests whether autonomous agents can produce viable crypto products without significant human guidance.

Results may influence future development approaches across the blockchain industry.

Crypto World

Bitwise to Acquire Chorus One as Crypto Staking Demand Accelerates

Bitwise Asset Management is reportedly acquiring institutional staking provider Chorus One, extending its push into cryptocurrency yield services.

The acquisition adds a major staking operation to the crypto asset manager’s platform as demand for onchain yield products increases among both retail and institutional investors.

Chorus One provides staking services for decentralized networks and currently has $2.2 billion in assets staked, according to its website.

The financial terms of the deal were not disclosed, Bloomberg reported on Wednesday, citing statements from both companies.

Cointelegraph reached out to Bitwise and Chorus One for comment, but had not received a response by publication.

Related: 21Shares launches first Jito staked Solana ETP in Europe

Ethereum staking demand surges as validator queue swells

Ethereum validator queue data shows a surge in demand to stake Ether (ETH). The entry queue has swelled to more than 4 million ETH, translating into a wait time of over 70 days.

Almost 37 million ETH, or just over 30% of total supply, is now staked, with close to 1 million active validators securing the network. This suggests that more holders are choosing to lock up ETH despite long delays.

The rising interest in staking has pushed other major asset managers to integrate yield into regulated crypto products. Morgan Stanley filed to launch a spot Ether exchange-traded fund (ETF) that would stake part of its holdings to generate passive returns. Grayscale is also preparing to distribute staking rewards from its Ethereum Trust ETF, the first payout tied to onchain staking by a US-listed spot crypto exchange-traded product.

Related: Crypto VC activity hits $4.6B in Q3, second-best quarter since FTX collapse

Crypto M&A hits record

Bitwise’s deal also follows a surge in the crypto industry’s mergers and acquisitions in 2025, reaching $8.6 billion across a record 133 transactions by November, surpassing the combined total of the previous four years.

Coinbase led the wave, closing six acquisitions, including the $2.9 billion purchase of crypto derivatives exchange Deribit.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Nevada Moves to Block Coinbase Prediction Markets After Polymarket Ban

Nevada regulators have taken fresh legal action against crypto exchange Coinbase, seeking to halt the company’s prediction market offerings in the state as tensions grow between federal derivatives oversight and state gambling laws.

Key Takeaways:

- Nevada regulators are seeking to block Coinbase’s prediction markets, arguing the contracts qualify as unlicensed gambling under state law.

- The dispute centers on whether event-based contracts fall under federal CFTC oversight or state gaming authority.

- The case is part of a wider legal clash as multiple US states challenge prediction market platforms.

The Nevada Gaming Control Board on Monday filed a civil enforcement complaint against Coinbase Financial Markets in Carson City, requesting a permanent injunction, declaratory relief, and an emergency temporary restraining order.

Regulators argue the platform is offering event-based contracts tied to sports and elections without the state gaming licenses required under Nevada law.

Nevada Says Coinbase Prediction Markets Violate State Gaming Law

Coinbase introduced prediction market trading to US users last month through a partnership with Kalshi, a federally regulated designated contract market overseen by the Commodity Futures Trading Commission.

Nevada officials, however, say contracts linked to sporting outcomes and elections constitute wagering activity and therefore fall under state gaming rules rather than federal derivatives jurisdiction.

The board also alleges the Coinbase app permits users aged 18 and older to trade event contracts, below Nevada’s legal gambling age of 21.

In court filings, regulators said the company’s continued operation creates “serious, ongoing, irreparable harm” and gives Coinbase an unfair advantage over licensed sportsbooks that must meet strict compliance, tax, and physical-location requirements.

The dispute arrives amid a broader legal clash between Coinbase and several US states.

The exchange recently filed federal lawsuits against gaming regulators in Connecticut, Michigan, and Illinois, arguing that prediction markets fall exclusively under CFTC authority and that state enforcement efforts unlawfully restrict innovation.

Those states had issued cease-and-desist notices accusing prediction platforms of unlicensed sports wagering.

Nevada officials maintain their responsibility is to protect consumers and preserve the integrity of the state’s gaming industry.

Board chairman Mike Dreitzer said enforcement action was necessary to uphold those obligations as new digital betting-style products enter the market.

Nevada Escalates Crackdown on Prediction Market Platforms

The latest case follows a string of enforcement moves against prediction market operators. Nevada previously pursued action against Kalshi over sports-related contracts, triggering a legal battle that remains under appeal.

More recently, a state court granted a temporary restraining order blocking Polymarket from offering event contracts to Nevada residents for two weeks, signaling judicial willingness to side with state regulators despite federal derivatives oversight claims.

Last month, Kalshi opened a new office in Washington, D.C., as it ramps up efforts to shape federal and state policy amid growing scrutiny of its products across the United States.

The company also hired veteran political strategist John Bivona as its first head of federal government relations.

Meanwhile, a new legislation to limit the interactions between government officials and the prediction markets is being supported by more than 30 Democrats in the US House of Representatives, including former Speaker Nancy Pelosi.

The lure behind new restrictions is a controversial Polymarket bet, which started as a bet of $32,000 but eventually became more than $400,000 shortly before the unexpected detention of Venezuelan President Nicolás Maduro.

The post Nevada Moves to Block Coinbase Prediction Markets After Polymarket Ban appeared first on Cryptonews.

Crypto World

Solana price falls under $100: Dead-cat bounce coming?

Solana price slid deeper into the red on Feb.4, extending its recent downtrend as sellers continued to press the market.

Summary

- Solana drops to $97, extending weekly losses to over 20% as price tests the $95–$100 support zone.

- Despite price weakness, network usage and ETF inflows suggest longer-term interest remains intact.

- Oversold conditions could lead to a short-term relief bounce.

At press time, SOL was trading near $97, down 6.1% over the past 24 hours. The move leaves Solana sitting near the lower end of its seven-day range between $96 and $127.

Solana (SOL) has dropped 23% over the last week and 31% over the last month. The token is now back to a range that many traders consider critical, having retraced roughly 66% from its peak of $293 in January 2025.

Activity has increased despite the decline. As the price tests support, Solana’s 24-hour spot trading volume increased 32% to $6.55 billion, suggesting increased participation.

Derivatives show a similar trend. CoinGlass data reports futures volume jumping 40% to $17.17 billion, while open interest edged 0.65% higher to $6.48 billion, suggesting traders are adding exposure rather than fully stepping aside.

Network strength contrasts with price pressure

The weakness comes even as Solana’s fundamentals continue to improve. As previously reported by crypto.news, the network processed more than 2.34 billion transactions in January, a 33% increase from the past month and more than Ethereum, Base, and BNB Chain combined.

Institutional interest has also shown signs of growth. While Bitcoin and Ethereum exchange-traded products recorded net outflows in January, U.S. spot Solana ETFs attracted $104 million in inflows, pointing to rising interest from traditional investors during the pullback.

Still, price expectations have been adjusted by some analysts. Standard Chartered recently lowered its 2026 Solana price target to $250 from $310, citing near-term market pressure.

At the same time, the bank raised its longer-term outlook, forecasting SOL at $400 by the end of 2027, $700 by end-2028, $1,200 by end-2029, and $2,000 by 2030. The bank’s analysts argue Solana is positioned to benefit from growth in stablecoin usage and micropayments as it moves beyond a meme-driven phase.

Solana price technical analysis

From a chart perspective, Solana continues to trade in a clear bearish structure. The daily timeframe shows a consistent pattern of lower highs and lower lows, confirming that sellers still control momentum. The earlier breakdown below the $115–$120 consolidation zone has turned that area into resistance.

Price remains well below the declining daily moving average, now near $121, and repeated attempts to reclaim it have failed. This reinforces the idea that recent rebounds have been corrective rather than trend-changing.

Volatility has expanded to the downside. Strong selling pressure is evident as SOL is trading below the lower Bollinger Band. Although this often puts the market in short-term oversold territory, the absence of a significant reversal indicates that the downside momentum has not yet been completely exhausted.

That view is echoed by momentum indicators. The relative strength index is deep in oversold territory, at 26–28. The likelihood of an instant reversal is low because there isn’t any obvious bullish divergence at this point. In strong downtrends, RSI can remain oversold for extended periods.

The $100 level stands out as the most important near-term line. A sustained close below it would likely expose the $95–$93 zone, followed by a broader support area near $85–$90 if selling intensifies.

On the upside, any rebound is likely to face resistance near $120–$122, where the declining moving average and prior support converge.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World5 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video1 day ago

Video1 day agoWhen Money Enters #motivation #mindset #selfimprovement

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Tech1 hour ago

Tech1 hour agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World10 hours ago

Crypto World10 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards