CryptoCurrency

Arthur Hayes Turns on Monad (MON) as Whales Sweep Up 300 Million Tokens

Arthur Hayes has turned Monad (MON) into the week’s most chaotic battleground. Just 48 hours after hyping the token with a brazen “MON to $10,” the BitMEX co-founder reversed course entirely.

Meanwhile, other whales continue to accumulate the token, which hit the mainnet only recently but continues to ride a wave of spoofed token transfers.

Arthur Hayes Nukes MON Publicly, But Whales Are Secretly Accumulating

The former BitMEX CEO slammed the token, urging traders to send it to zero, just two days after the MON price recorded a sharp post-launch rally.

Sponsored

Sponsored

Hayes’ reversal began on November 25, when he joked that the bull market needed “another low float, high FDV useless Layer-1 (L1) token,” before admitting he aped in anyway.

However, by November 27, he declared himself “out,” dismissing MON altogether and telling the market to disregard it.

Yet blockchain data suggests MON’s largest players didn’t share his bearishness.

On-chain tracking by Lookonchain shows that whale address 0x9294 withdrew 73.36 million MON (around $3 million) from Gate.io within 24 hours, marking one of the largest single-address accumulations recorded this week.

Sponsored

Sponsored

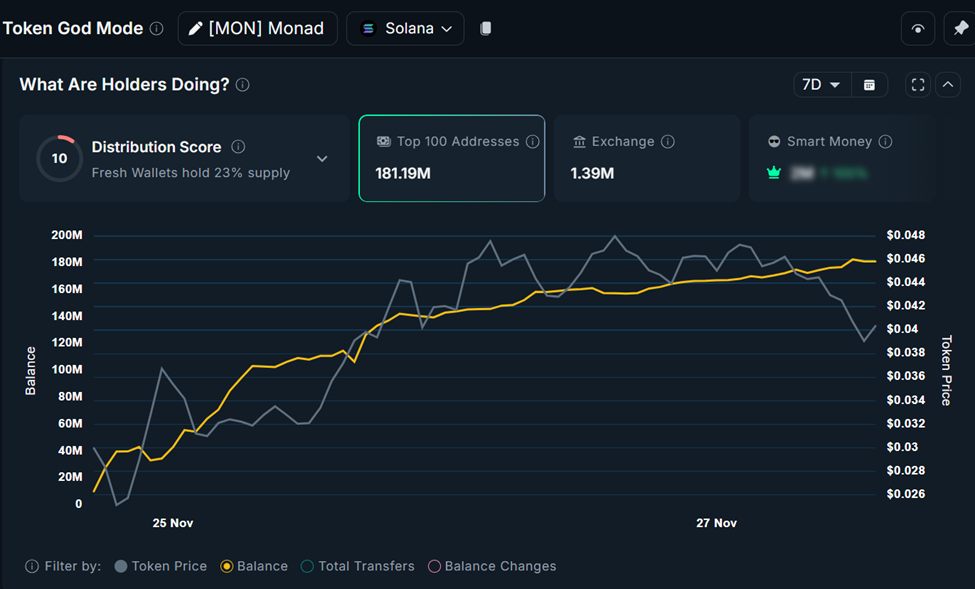

BeInCrypto also reported that mega whales (holding the highest-tier addresses) boosted their MON holdings by 10.67%, bringing their stash to 176.44 million MON after adding 17.08 million tokens worth roughly $717,000.

Meanwhile, normal whales added 4.80 million MON over the same period, expanding their holdings by 9.51% to reach 55.42 million MON.

In total, whales now control over 300 million MON, a sharp contrast to Hayes’ public dismissal of the project.

Hayes Rotates Into ENA, PENDLE, and ETHFI

While Hayes publicly torched MON, he quietly shifted capital into other tokens. Lookonchain reports that across the past two days, Hayes accumulated:

- 4.89 million ENA (Ethena), valued at $1.37 million,

- 436,000 PENDLE worth $1.13 million, and

- 696,000 ETHFI ($543K).

Sponsored

Sponsored

On November 26 alone, he spent another $536,000 on 218,000 PENDLE. The ENA trades are even more telling. Just nine hours before Lookonchain’s latest report, Hayes bought back 873,671 ENA for $245,000, even though he sold 5.02 million ENA two weeks earlier at a lower price.

“[Hayes is once again] selling low, buying high,” Lookonchain remarked, signaling either emotional trading or a deliberate strategy to scale into positions he values more than his initial entry.

Together, the moves point toward a broader rotation strategy. Hayes appears to be exiting high-FDV, meme-driven L1 narratives like MON while doubling down on “real yield” and liquid staking plays represented by PENDLE, ENA, and ETHFI.

This would align with broader market behavior, where stabilized prices mean spot flows, especially from whales, now matter more than short-term hype cycles.

Still, the contradiction between Hayes’ aggressive public FUD on MON and simultaneous heavy whale accumulation raises uncomfortable questions for the market.

Sponsored

Sponsored

Is his commentary simply emotional whiplash, or is he intentionally playing into volatility that benefits professional traders? The dynamic revives debates about whether influential voices in crypto can distort sentiment while others accumulate in the shadows.

Nevertheless, investors must conduct their own research, as Hayes’ dramatic exit from MON has not deterred the deep pockets. If anything, whales appear more interested than ever, quietly absorbing supply as retail traders digest the noise.

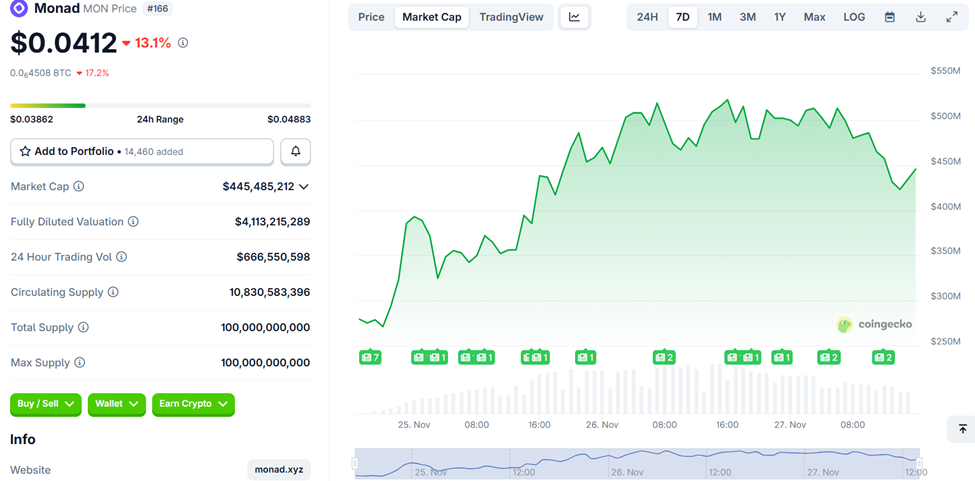

As of this writing, the MON price is down by over 13%, currently trading at $0.0412. This dump likely stems from concerns after fake token transfer attacks, where bad actors exploited the ERC-20 standard to mislead users with fake wallet activity.

In one instance, a fraudulent contract generated fake swap calls and simulated trading patterns around the MON ecosystem. The transfers aimed to exploit the early hours frenzy after Monad’s mainnet, when users were opening wallets, claiming tokens, and monitoring liquidity.