Entertainment

Eminem Makes Surprise Cameo During Jack White’s Thanksgiving NFL Halftime Set

Detroit Double Trouble

Eminem Crashes Jack White’s Thanksgiving Halftime Party!!!

Published

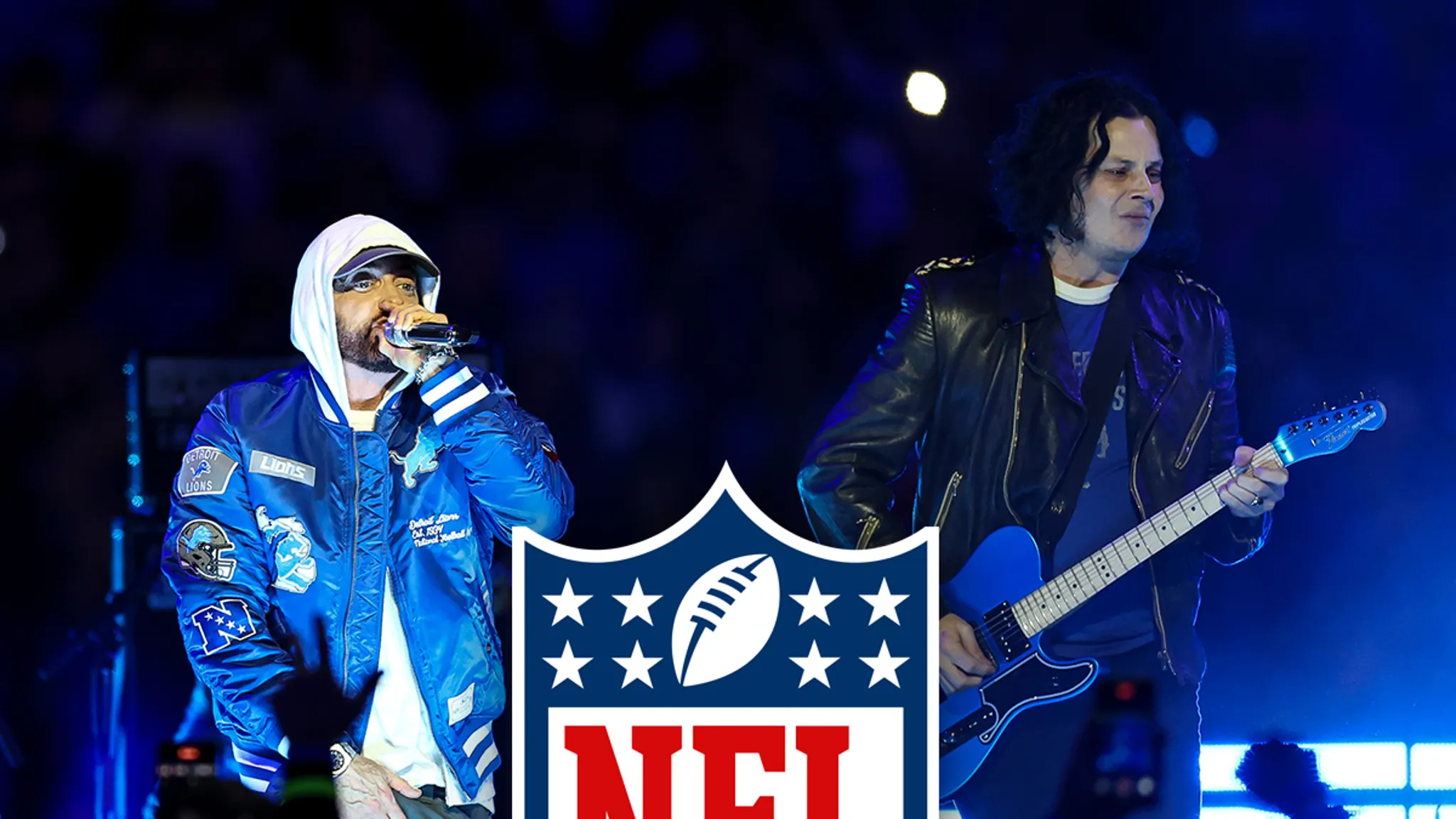

Talk about shocking the system — two of Detroit’s biggest legends collided when Eminem crashed Jack White’s stage during the NFL’s Thanksgiving Halftime Show at the Lions’ annual Turkey Day Classic.

Eminem joins Jack White on stage for the NFL Thanksgiving Halftime Show! pic.twitter.com/gtIkusVtWR

— TSN (@TSN_Sports) November 27, 2025

@TSN_Sports

Jack was the only one officially on the bill — tearing into “Seven Nation Army,” the forever stadium anthem at Ford Field — before he shocked the crowd by bringing out fellow Detroit legend Eminem for a surprise cameo.

Eminem hit the stage in full Detroit armor — hoodie up and rocking a custom Lions jacket — and launched into a wild mashup of “Till I Collapse” with the White Stripes’ “Hello Operator.”

Honestly, Eminem popping up tracks — he and his longtime manager, Paul Rosenberg, were literally just hired as executive producers for the Lions’ halftime show through 2027.

Game on the line and Wicks makes the play of the day pic.twitter.com/DnXiuH4THt

— NFL (@NFL) November 27, 2025

@NFL

And yeah, solid hire … ’cause Em knew EXACTLY how to light that place up. Ford Field went feral the second he hit the stage!

Shame that was Detroit’s only win of the night — the Packers still handed ’em an L, 31-24.