Entertainment

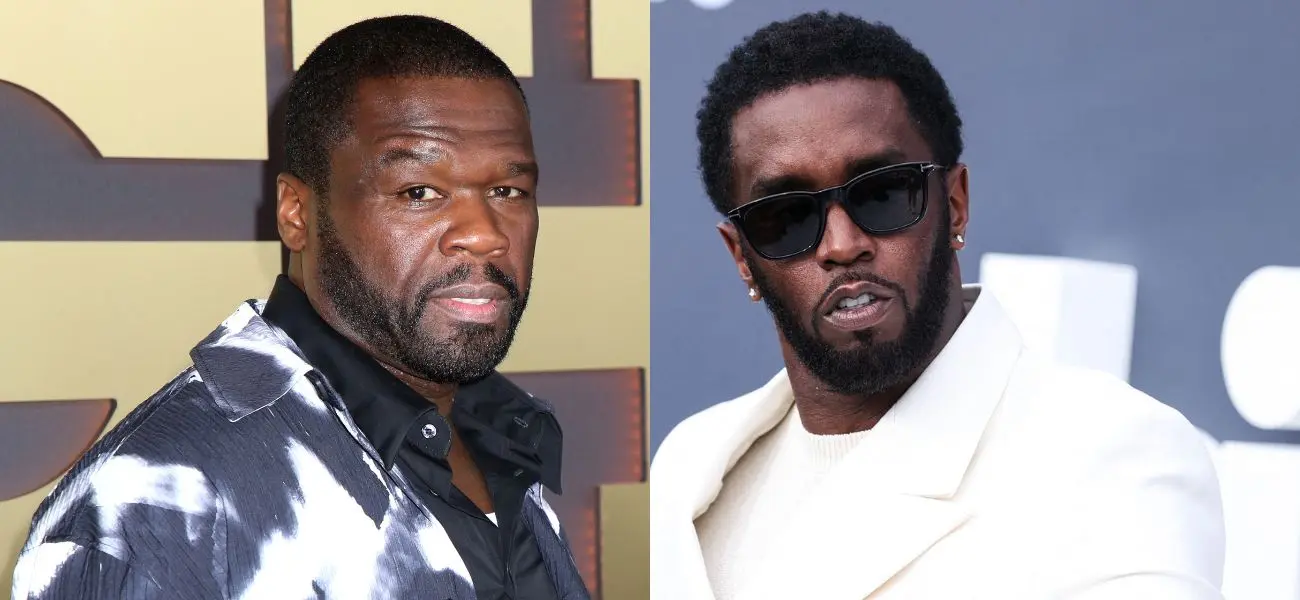

50 Cent Ties Up Loose Ends Before Exposing Diddy’s Woes

50 Cent is determined to leave nothing hanging on his end ahead of the highly anticipated Diddy documentary.

The rapper opted to settle a civil complaint case that was brought against him earlier this year.

This move comes less than a week before Netflix is set to release the documentary series, “Sean Combs: The Reckoning,” executively produced by 50 Cent.

Article continues below advertisement

50 Cent Has Agreed To Settle The Assault Lawsuit Against Him

Earlier this year, Guadalupe de los Santos filed a lawsuit against Curtis Jackson, also known as 50 Cent. Santos claimed that he was waiting at a stoplight when the door to an SUV belonging to 50 Cent was “suddenly and forcefully opened,” striking him and knocking him into the street.

The plaintiff claimed that the door of the car was intentionally opened without warning or provocation. As such, he requested damages for intentional infliction of emotional distress, among other claims.

50 Cent and his legal team initially filed a motion to dismiss Santos’ claims. However, both parties were able to reach a settlement before the hearing, which was set for December 22.

Article continues below advertisement

According to PEOPLE Magazine, court documents confirmed that both parties “reached an agreement in principle to resolve all claims.”

Article continues below advertisement

50 Cent Is Set To Release A Documentary About His Longtime Rival Diddy

50 Cent’s decision to settle his court case came less than a week before his four-part series about Sean Diddy Combs is set to air.

As reported by USA Today, the Netflix documentary will detail Diddy’s run-in with the law, following his journey up to his four-year prison sentence.

The series will be released on December 2 and is expected to feature interviews from people who were once close to the disgraced musician.

Speaking on the project, 50 Cent said, “I’m grateful to everyone who came forward and trusted us with their stories. [I am] proud to have Alexandria Stapleton as the director on the project to bring this important story to the screen.”

Article continues below advertisement

50 Cent Slammed Attorney For Trying To Extort Him

Although it is unclear if the documentary’s release date and 50 Cent’s lawsuit settlement are connected, one thing is sure- the rapper does not take legal matters lightly.

Earlier this year, the “In Da Club” artist slammed Gloria Allred, the attorney representing Santos, for allegedly attempting to extort money from him under the guise of a lawsuit.

“Gloria, you’re not gonna get any money from me that way, but if you call me, I’ll take you to dinner. LOL,” he said, per The Blast.

The 50-year-old artist brazenly admitted to not liking lawmakers and further criticized Allred, saying, “The moment I realized I don’t like lawyers. Gloria, you should know better, chase a different ambulance.”

Article continues below advertisement

50 Cent Sent A Mock Letter To The Judge Ahead Of Diddy’s Sentencing

50 Cent’s unhappiness about facing a lawsuit is a stark contrast to the excitement he showed when Diddy’s legal problems began.

Before Diddy was sentenced, he went through the trouble of drafting a satirical letter to Judge Arun Subramanian, the judge in charge of the case.

According to The Blast, the “Power” actor wrote, “I have had an ongoing dispute with Puffy for over 20 years. He is very dangerous. Multiple times, I have feared for my life.”

50 Cent also pleaded with the judge to “consider the safety of the general public before unleashing him upon them.”

He then jokingly added that “Diddy’s only going to return to hiring more male sex workers and keeping most of the baby oil away from the general public. And babies need it!”

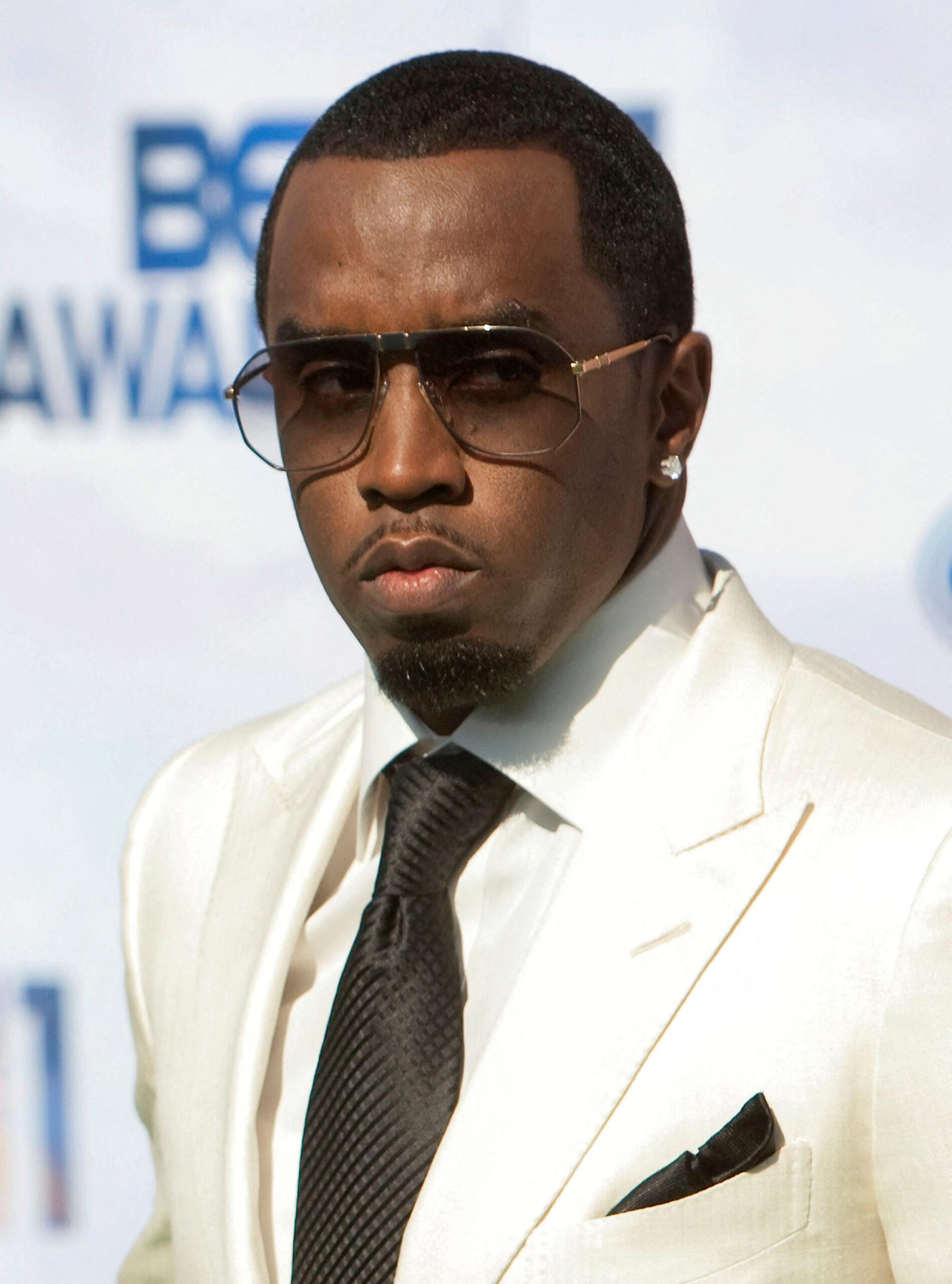

Diddy Was Performing Prison Labor In High Spirits

To 50 Cent’s joy, his foe, Diddy, ended up being convicted and was sentenced to four years in prison and a $500,000 fine for two counts of transportation for prostitution.

Despite being incarcerated, Diddy was spotted smiling as he performed his prison chores. As reported by The Blast, a recently released video showed the convicted singer working at Fort Dix’s media library inside the prison chapel.

He appeared to be in a good mood as he completed his tasks. He was also captured talking freely to other inmates and socializing in a separate video.

Notably, Diddy is expected to be released in the summer of 2028. He recently requested to be transferred to Fort Dix Federal Prison because he wanted to be closer to his family while participating in the Residential Drug Abuse Program (RDAP).