Anthony Joshua has faced widespread criticism for his controversial scoring of Saturday’s heavyweight title fight between Oleksandr Usyk and Tyson Fury in Riyadh.

The British heavyweight, who provided round-by-round scoring during the television broadcast, awarded the fight to Fury with a score of 115-114.

His assessment stood in stark contrast to the official result, which saw Usyk claim a unanimous points victory.

The 35-year-old’s scorecard showed him giving Fury five rounds of the contest and Usyk six, while marking the final round as a draw.

Anthony Joshua has faced widespread criticism for his controversial scoring of Saturday’s heavyweight title fight between Oleksandr Usyk and Tyson Fury in Riyadh

PA

All three of the judges scored the bout 116-112 in favour of the Ukrainian champion at the Kingdom Arena in Saudi Arabia.

The disparity between Joshua’s scoring and the official judges’ cards was particularly notable in the final rounds.

Joshua’s decision to score the last round as a draw, while giving Fury a narrow victory overall, drew immediate attention from boxing observers.

JUST IN:Tyson Fury drops cryptic nine-word hint about retirement after crushing defeat to Oleksandr Usyk

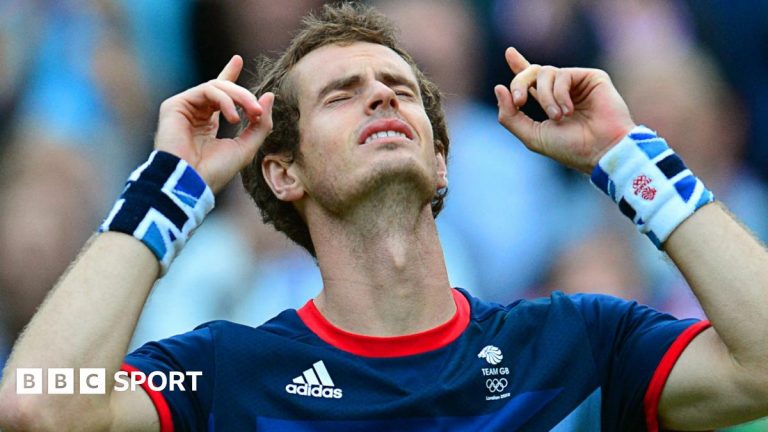

Anthony Joshua felt Tyson Fury had done enough to beat Oleksandr Usyk

PA

The inclusion of an experimental AI judge for the fight led to one fan mockingly questioning whether Joshua himself was the AI scorer, highlighting the controversy around his assessment.

Other fans took to social media to express their disbelief at Joshua’s scoring of the contest.

One viewer suggested Joshua was still ‘dizzy’ from his September knockout loss to Daniel Dubois.

RIYADH REACTION:Tyson Fury ‘robbed’ as boxing fans blast judges following Oleksandr Usyk defeat

“Anthony Joshua should never be a boxing judge, I don’t know what fight he was watching,” wrote another critic.

The criticism continued with another fan stating: “Anthony Joshua couldn’t score this fight to save his life.”

Social media users also questioned Joshua’s ability to accurately score professional bouts, with multiple comments expressing bewilderment at his interpretation.

LATEST SPORTS NEWS:

Fury himself contested the official scoring, insisting he had won the bout by a clear margin.

“I swear to God, I thought I won by three rounds!” Fury told Sky Sports Boxing after the fight.

His promoter Frank Warren was equally critical of the judges’ decisions.

Anthony Joshua could still face Tyson Fury despite the Gypsy King’s defeat to Oleksandr Usyk

PA

“I’m dumbfounded by the scorecards,” Warren said. “They gave him [Fury] four rounds out of the 12, which is impossible.”

Warren further expressed his frustration with the scoring: “I’ve been around a long time and I know I am biased, but one judge didn’t give him any rounds from round six onwards. How can that be? That’s impossible. It’s crazy.”

Fury walked out of the ring after being shown the full scorecard by Warren.

+ There are no comments

Add yours