[matched_con]

Source link

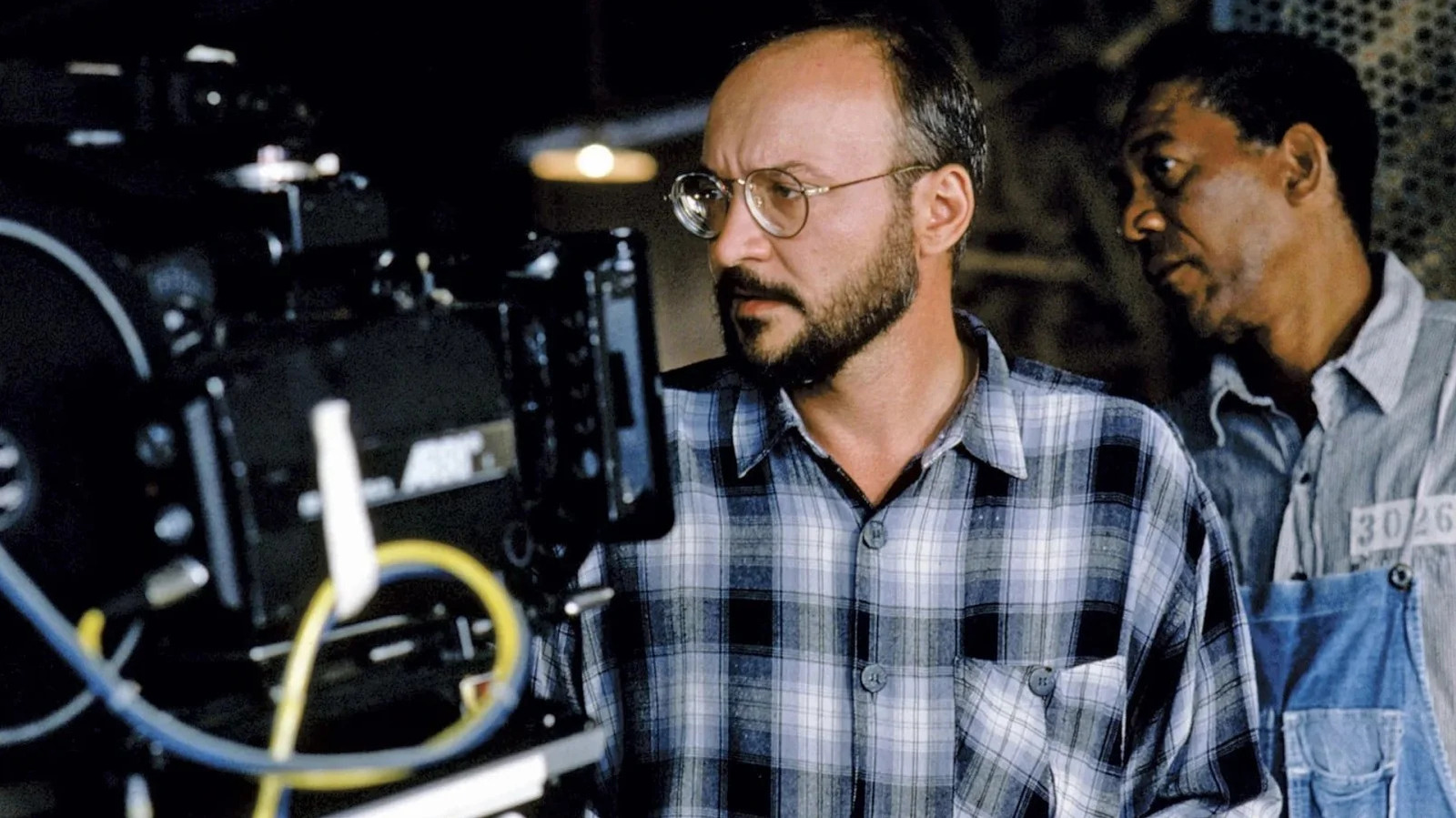

The Trashy 2000s Crime Thriller Frank Darabont Was Supposed To Direct

Estimated read time

1 min read

You May Also Like

Frasier’s Apartment Was Literally Built Over Another Iconic TV Location

December 24, 2024

Justin Baldoni’s Podcast Co-Host Quits Amid Blake Lively Allegations

December 24, 2024

+ There are no comments

Add yours