Crypto World

Treasury Draws Firm Line as Bitcoin Reserve Debate Roils Capitol Hill

The U.S. Treasury faced sharp questions Tuesday over Bitcoin policy during a tense Capitol Hill hearing. Lawmakers focused on whether the government should purchase Bitcoin or allow federal assets to back crypto. Treasury Secretary Scott Bessent firmly stated that taxpayer funds would not be used to buy or support digital currencies.

Treasury Blocks Bitcoin Intervention Despite Pressure

During a House Financial Services Committee hearing, Rep. Brad Sherman pressed Bessent about potential Bitcoin-related bailouts. Sherman suggested the Treasury could direct banks to hold Bitcoin or tweak reserve policies to support crypto. However, Bessent responded that the law gives him no such authority, and he cannot compel banks to make crypto purchases.

Bessent further clarified that taxpayer funds cannot be invested in digital currencies or in any tokens, including Solana-based meme assets. He emphasized that his role under current regulations does not permit using federal funds for Bitcoin exposure. Sherman countered by raising concerns over private banking funds, but Bessent maintained that those are not public monies.

The exchange intensified when Sherman questioned if the government would ever use tax revenue to accumulate Bitcoin reserves. Bessent reiterated that only seized Bitcoin is held by the U.S. government under existing forfeiture processes. He cited prior seizures totaling $1 billion, with $500 million retained and now worth over $15 billion.

TRUMP Coin Draws Fire During Crypto Oversight Talks

Rep. Sherman also referenced the “TRUMP” meme coin issued on the Solana blockchain, linking it to speculation and volatility. He asked if such coins could ever qualify for government-backed purchases or policy inclusion. Bessent replied that neither the Treasury nor the FSOC has the authority to act on speculative meme coins.

While Bessent stayed neutral on the TRUMP coin, Sherman emphasized its unregulated nature and alleged political branding. He warned that using public resources for these assets could set a dangerous precedent. The discussion signaled growing discomfort among lawmakers about crypto products perceived to be linked to public figures.

Bessent declined to provide specific commentary on TRUMP coin but reinforced that the Treasury does not engage in speculative crypto activities. He stood by the department’s position that taxpayer dollars should not enter volatile or unregulated digital markets. This stance continues to define Treasury policy amid rising political attention on meme coins.

World Liberty Financial Raises Scrutiny Over Security Risks

Rep. Gregory Meeks shifted focus to World Liberty Financial, citing concerns about foreign ties and investor transparency. He referenced statements from founder Eric Trump, who claimed he had undisclosed yet “meaningful” investors. Meeks argued that such ambiguity could pose national security risks, especially if linked to foreign capital.

The lawmaker also pointed out that the WLFI token had lost over 50% of its value, adding to concerns of instability. He said discussion forums revealed unease about governance, suggesting that the Trump family controlled key decisions. Meeks argued this ownership structure could allow selective profit-taking from token sales.

Senator Elizabeth Warren had previously called for an investigation into a deal involving a UAE royal entity and World Liberty Financial. Meeks followed up by urging tighter oversight of any bank license applications tied to the firm. However, Bessent refused to intervene, stating that the Office of the Comptroller of the Currency operates independently.

Crypto World

Nvidia (NVDA) Stock Drops as H200 Export Negotiations Remain Unresolved

TLDR

- Nvidia stock fell 1.4% to $177.74 as H200 chip export negotiations with the Trump administration remain stuck over Know-Your-Customer requirements and other licensing conditions.

- The U.S. signaled approval for ByteDance’s chip purchase two weeks ago, but commercially practical terms have not been finalized.

- Nvidia warns restrictive conditions could drive Chinese customers to foreign chip suppliers as China has already granted preliminary approval to ByteDance, Tencent, Alibaba, and Deepseek.

- Stock trades below key resistance levels at $182-$184 with critical support at the 200-day moving average near $168.

- Commerce Department’s January 15 regulation requires third-party lab testing and rigorous customer screening to prevent military access.

Nvidia shares dropped 1.4% to $177.74 on February 5 as the chipmaker’s negotiations with the Trump administration over H200 AI chip exports remain unresolved. The regulatory uncertainty is weighing on investor sentiment as both sides work to finalize commercially viable licensing terms.

The Trump administration indicated roughly two weeks ago it would approve ByteDance’s license to purchase H200 chips. However, Nvidia has not agreed to the proposed conditions. The main sticking point involves Know-Your-Customer procedures designed to prevent Chinese military entities from accessing advanced AI technology.

Nvidia clarified its position through a spokesperson. “We aren’t able to accept or reject license conditions on our own,” the company said. “Although KYC is important, KYC is not the issue. For American industry to make any sales, the conditions need to be commercially practical, else the market will continue to move to foreign alternatives.”

Regulatory Framework Takes Shape

The Commerce Department published new regulations on January 15 that formally loosened licensing policy for advanced AI chips. But the framework includes strict requirements. Applicants must certify their customers will implement rigorous screening procedures to prevent unauthorized remote access.

Companies must also provide lists of remote users connected to countries of concern including Iran, Cuba, and Venezuela. A U.S. third-party lab must test the chips before shipment. This testing requirement is viewed as the mechanism for collecting the U.S. government’s 25% fee on sales.

President Trump announced the chip export arrangement in December. The same terms apply to comparable chips from Advanced Micro Devices and Intel. China hawks criticized the decision as a national security risk.

China has granted preliminary approval to ByteDance, Tencent, Alibaba, and AI startup Deepseek to import the chips. Regulatory conditions on China’s side are still being finalized.

Technical Picture Shows Weakness

Nvidia stock is trading below its 20-day moving average at $184 and 50-day moving average at $182. Both levels now act as resistance zones. The 200-day moving average near $168 represents the key support level that would preserve the broader uptrend.

The Relative Strength Index sits in the low 30s, approaching oversold conditions without confirming a reversal. Volume has been moderate during the decline, suggesting a corrective move rather than panic selling.

Near-Term Outlook

Analysts expect Nvidia to trade in a $170 to $185 range until regulatory clarity emerges. A break above $185 would require positive developments on export approvals or strength across the AI sector. That could push shares toward $195-$200.

One source indicated some chips are likely to reach China before Trump’s planned April meeting with Chinese President Xi Jinping. The Commerce Department typically circulates pending licenses to State, Defense, and Energy departments before finalizing terms.

Nvidia emphasized it serves as an intermediary between U.S. regulators and end customers. The company cannot unilaterally modify license conditions but can provide feedback on commercial viability. The prolonged approval process has delayed H200 orders as Chinese customers await clarity on national security requirements.

Crypto World

SoFi hits record revenue and doubles down on crypto

SoFi posts record quarter with $1B revenue, stronger crypto and payments push, and 2026 growth outlook as shares climb over 6% on guidance.

Summary

SoFi Technologies Inc. reported its first billion-dollar revenue quarter and net income of $173.5 million in the fourth quarter, the company announced, marking the financial technology firm’s ninth consecutive profitable quarter.

Adjusted net revenue reached $1.013 billion, up 37% from the same period last year, according to the company’s financial results. Adjusted EBITDA grew 60.6% to $317.6 million, representing a 31% margin. Fee-based revenue surged 53% to $443.3 million, the company reported.

The fintech added a record 1.027 million new members during the quarter, bringing its total membership to 13.7 million, with product additions hitting 1.6 million. Financial Services products, including SoFi Money, Relay, and Invest, drove 89% of the expansion, with segment net revenue rising 78% to $456.7 million, according to the results.

SoFi advanced its cryptocurrency and blockchain strategy in the fourth quarter, launching its stablecoin, SoFiUSD, on a public blockchain for enterprise 24/7 settlement and resuming consumer crypto trading. The company also expanded blockchain-enabled cross-border payments via the Bitcoin Lightning Network in over 30 countries, following its partnership with Lightspark.

Chief Executive Officer Anthony Noto outlined plans for borrowing and staking options, building on earlier 2025 announcements, according to the company.

Management projected total membership growth of at least 30% in 2026, with full-year adjusted net revenue expected at $4.66 billion and adjusted net income around $825 million. Shares rose over 6% in pre-market trading following the announcement.

Crypto World

A16Z says AI agents will need crypto rails for identity and payments

AI agents will increasingly transact and interact on-chain, with blockchains providing identity, payments, and contract rails to prevent impersonation and automate tasks.

Summary

- A16Z argues AI agents need blockchain rails for micropayments, high-speed, low-fee transactions, and automated smart contract execution.

- The firm sees blockchains as critical identity infrastructure to verify agents and reduce impersonation in digital ecosystems.

- A16Z frames crypto as the technical backbone for autonomous AI systems, aligning with its broader AI–blockchain investment thesis.

Venture capital firm Andreessen Horowitz (A16Z) stated that blockchain technology may serve a critical function in verifying artificial intelligence agents and preventing impersonation, according to a report published by the firm.

The investment company explained that on-chain tools are particularly well-suited to support AI agent activities, including micropayments, high-velocity transactions, and smart contract execution.

A16Z indicated that blockchains could provide essential identity verification infrastructure as AI agents become more prevalent in digital ecosystems.

The firm’s analysis highlighted the technical compatibility between blockchain systems and the operational requirements of autonomous AI agents, particularly in scenarios requiring rapid, low-value transactions and automated contract execution.

Andreessen Horowitz, known as A16Z, is a prominent Silicon Valley venture capital firm that has invested extensively in cryptocurrency and blockchain technology companies.

Crypto World

GlobalStake rolls out bitcoin yield gateway as institutions revisit BTC yield

Institutional attitudes toward bitcoin yield are beginning to shift and there is now renewed interest in BTC rewards after years of skepticism driven by smart-contract risk, leverage, and opaque strategies, GlobalStake co-founder Thomas Chaffee told CoinDesk on Thursday.

Products that allow users to earn a return on their bitcoin holdings often require wrapping BTC into protocols, involving smart contract risk or strategies that don’t scale, so institutions didn’t see “a risk-return profile that made sense,” according to Chaffee.

That reluctance is starting to change, Chaffee said, not because institutions suddenly want more risk, but because the types of strategies available to them have evolved. Rather than protocol-based yield or token incentives, allocators are increasingly gravitating toward fully collateralized, market-neutral approaches that resemble traditional financial strategies already familiar to hedge funds and treasuries, he said.

“The behavior change we’re seeing isn’t institutions chasing yield,” Chaffee said. “It’s institutions finally engaging once the strategies, controls, and infrastructure look like something they can actually deploy capital into at scale.”

The renewed interest comes after years of failed or short-lived attempts to generate yield on bitcoin, many of which unraveled during the 2022 market downturn as prominent lenders froze withdrawals and ultimately collapsed amid liquidity stress, most notably when crypto lending service Celsius Network indefinitely paused withdrawals and transfers citing “‘extreme market conditions’” in mid-2022 and later entered bankruptcy.

Chaffee is not the only one seeing renewed institutional interest in bitcoin yield. “People holding bitcoin, — whether on balance sheet or as investors — increasingly see it as a pot just sitting there,” Richard Green, director of Rootstock Institutional, told CoinDesk recently. “It can’t just sit there doing nothing; it needs to be adding yield.” Green said professional investors now want their digital assets to “work as hard as possible” within their risk mandates.

Chaffee explained that GlobalStake, which provides staking infrastructure across proof-of-stake networks, began hearing the same question repeatedly from clients over the past several years: whether similar institutional-grade yield opportunities existed for bitcoin.

GlobalStake unveiled its Bitcoin Yield Gateway on Thursday, a platform designed to aggregate multiple third-party bitcoin yield strategies behind a single onboarding, compliance, and integration layer.

The co-founder explained the company expects roughly $500 million in bitcoin to be allocated within three months. “We expect the bitcoin to be allocated during the gateway’s first-quarter roll-out period, sourced from a custodial partner based in Canada, demand generated by parties through our partner MG Stover, and our clients, which include family offices, digital asset treasuries (DATs), corporate treasuries, and hedge funds.”

Other firms are approaching the problem from the infrastructure layer. Babylon Labs, for example, is developing systems that allow native bitcoin to be used as non-custodial collateral across financial applications, an effort aimed at expanding BTC’s utility rather than generating yield directly.

Crypto World

Alphabet Beats Expectations as AI Spending Risks Take Center Stage

Editor’s note: Alphabet has reported a strong fourth quarter, beating market expectations on both revenue and earnings, driven by continued resilience in advertising and a sharp acceleration in Google Cloud profitability. While headline growth remains solid, the results have refocused investor attention on the scale of Alphabet’s capital expenditure, particularly its aggressive push into artificial intelligence. With AI adoption expanding rapidly across platforms like Gemini, the key question is no longer demand, but whether and when that usage can be translated into sustainable revenue and returns for shareholders.

Key points

- Alphabet’s Q4 revenue rose 18% year on year, with earnings exceeding expectations.

- Google Cloud revenue jumped 48% to USD 17.7 billion, with operating income more than doubling.

- Advertising revenue remained resilient, growing 14% year on year.

- Capital expenditure reached USD 91.5 billion in the quarter, with 2026 guidance set at USD 175–185 billion.

- Gemini has surpassed 750 million monthly users, highlighting rapid AI adoption.

Why this matters

Alphabet’s results underline a broader shift across Big Tech, where profitability in core businesses is increasingly funding massive AI investment cycles. For investors, the tension lies between long-term strategic positioning and near-term pressure on free cash flow and margins. For the wider digital economy, Alphabet’s spending signals how central AI infrastructure has become to future competitiveness, influencing cloud markets, enterprise adoption, and the pace at which AI moves from experimentation to monetised products.

What to watch next

- How Alphabet manages capital expenditure discipline relative to revenue growth.

- Signals around AI monetisation beyond user growth metrics.

- Cloud margin trends as investment intensity remains elevated.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Abu Dhabi, United Arab Emirates – February 05, 2026: Alphabet (NASDAQ: GOOG) reported a solid fourth quarter, with revenue rising 18% year on year and earnings surpassing market expectations, underpinned by resilient performance across its core businesses.

Google’s advertising segment continued to show strength, with advertising revenue up 14% year on year. Google Cloud was the standout performer, posting revenue growth of 48% to USD 17.7 billion and delivering operating income of USD 5.3 billion—more than double the figure recorded in the same period last year.

Commenting on the results, Zavier Wong, Market Analyst at eToro, said that while Alphabet’s headline numbers were encouraging, investor attention has shifted toward the scale and execution risk of the company’s capital expenditure plans.

During the quarter alone, Alphabet spent USD 91.5 billion and has guided for capital expenditures of USD 175–185 billion in 2026—well above market expectations. From a shareholder perspective, this level of spending materially reduces free cash flow in the near term, with returns on AI investments yet to be proven at scale.

Alphabet is effectively asking investors to be patient and trust that artificial intelligence will evolve into a significant revenue driver.

While the company has little choice but to invest heavily to remain competitive with rivals such as Microsoft, Amazon, and OpenAI, the timeline for meaningful AI monetisation remains uncertain.

AI adoption is clearly accelerating, with Alphabet’s Gemini platform surpassing 750 million monthly users.

However, the gap between usage and monetisation remains wide, and prolonged delays in converting AI engagement into revenue could weigh on margins and earnings.

Wong added that although AI spending has so far been viewed as necessary and largely justified, Alphabet’s latest guidance represents a material escalation. “This marks one of the most significant risks we’ve seen so far in the current AI investment cycle,” he noted.

Media Contact:

PR@etoro.com

About eToro

eToro is the trading and investing platform that empowers you to invest, share and learn. We were founded in 2007 with the vision of a world where everyone can trade and invest in a simple and transparent way. Today we have 40 million registered users from 75 countries. We believe there is power in shared knowledge and that we can become more successful by investing together. So we’ve created a collaborative investment community designed to provide you with the tools you need to grow your knowledge and wealth. On eToro, you can hold a range of traditional and innovative assets and choose how you invest: trade directly, invest in a portfolio, or copy other investors. You can visit our media centre here for our latest news.

Crypto World

Will XRP Plunge Below $1 in February? ChatGPT Reassesses After Ripple’s Crash

The last time we asked ChatGPT this question, it was rather dismissive. Now, its answers were significantly less optimistic.

The price moves from precisely a month ago could hardly have anticipated what happened in the following 30 days. XRP, for example, skyrocketed by 30% at the time to $2.40 amid growing ETF inflows.

The subsequent rejection and correction, though, were brutal. After several consecutive leg downs, the culmination, at least for now, transpired earlier today when it plunged below $1.40 and now struggles at $1.35. As such, we decided to revisit a painful question for ChatGPT.

Below $1 Now?

CryptoPotato first asked this question over the weekend when the landscape around Ripple and its native token was not as grim. XRP traded at around $1.60 after its most recent crash, but it seemed as if it had bottomed. Perhaps that’s why most AIs agreed that the chances for a drop beneath $1.00 in February were quite slim at the time.

However, that perceived bottom gave in during the current trading week, as mentioned above. Consequently, we asked ChatGPT whether its view on the matter will change now.

The AI’s short answer was yes, as the probability of such a drop is “meaningfully higher now than it was when XRP was at $1.60-$1.70.” At the time, the token still traded above major structural support, and the broader market hadn’t rolled over so decisively. There was no confirmed breakdown of higher-timeframe levels, and the sentiment wasn’t entirely bearish.

A lot changed in the following several days, though. Momentum has accelerated to the downside as XRP sold off aggressively, “slicing through intermediate supports and failing to hold rebounds.” Additionally, February has just started, and there’s too much time for such a drop to occur if the overall conditions do not improve rapidly.

Dip or Breakdown?

Given the current circumstances, ChatGPT believes that the probability of XRP remaining above $1.00 in February is around 40%. It expects that there will be some consolidation and choppy trading after such heightened volatility and declines.

You may also like:

However, it also noted that there’s a 35-40% chance of a liquidity sweep to just under $1.00 in the next few weeks. It would be prompted by a fast sell-off, resulting in a panic wick, before a sharp rebound. This scenario, it added now, has become “very real.”

It still dismissed the possibility of a full-on breakdown below $1.00, saying the percentages are around 15-20% now. Although this scenario appears least likely for ChatGPT, it still acknowledged that it had gone from negligible (over the weekend) to quite possible (now).

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

XRP Sentiment Beats Bitcoin and Ethereum Despite Price Drop

TLDR

- XRP sentiment beats BTC and ETH even as price drops and sell pressure rises

- Strong XRP optimism clashes with losses and heavy exchange inflows

- XRP mood surges above rivals while on-chain data signals weakness

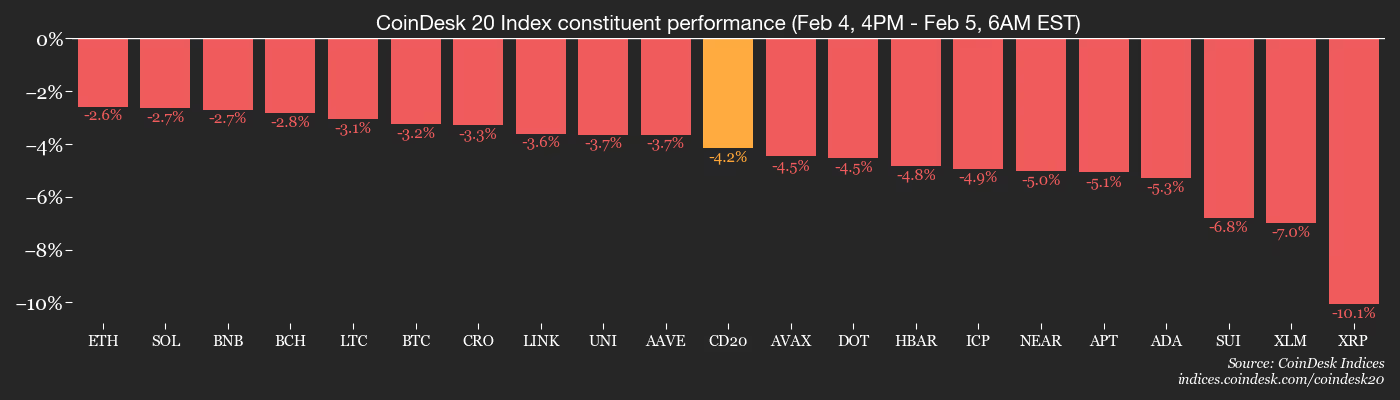

XRP shows stronger trader sentiment than major rivals even as prices slide across the crypto market. Recent analytics place XRP well above Bitcoin and Ethereum on social mood indicators. Price action and on-chain signals still reflect pressure, and momentum remains uneven.

XRP Sentiment and Market Structure

Santiment data ranks XRP with a Positive/Negative sentiment score far above competing large-cap assets. The reading stands above Ethereum and Bitcoin even after a notable weekly decline. Yet XRP lost more value than both peers during the same period.

The price fell over six percent during the past week, and losses exceeded market averages. However, social platforms continue to reflect higher confidence around XRP than other major tokens. This divergence creates tension between sentiment readings and real trading behavior.

On-chain metrics add pressure because unrealized losses now outweigh profits across many wallets. Glassnode data shows XRP approaching levels associated with capitulation cycles in past downturns. Meanwhile, loss-heavy transactions dominate flows, and panic selling continues to outpace profitable exits.

Bitcoin Holds Preference During Market Weakness

Bitcoin sentiment trails XRP, yet market structure still favors Bitcoin during broad risk-off conditions. The Altcoin Season Index places the market firmly inside a Bitcoin-dominated phase. Traders prefer relative stability, and capital rotates toward larger assets during stress.

The Crypto Fear and Greed Index recently printed one of its lowest readings in months. That score signals strong fear, and it reflects hesitation across the wider crypto environment. Such conditions often appear near short-term bottoms, yet volatility remains elevated.

Market commentators note that weakness has persisted for several weeks across major tokens. Some analysts frame the period as an extended cooling phase after earlier rallies. Even so, Bitcoin continues to anchor liquidity, and it attracts defensive positioning during uncertainty.

Ethereum Tracks Broader Risk Sentiment

Ethereum sentiment sits between Bitcoin and XRP, yet it fails to match XRP’s social strength. Weekly performance shows Ethereum declining close to five percent alongside Bitcoin. This parallel movement confirms Ethereum’s alignment with overall market direction.

Network activity remains steady, yet speculative appetite has cooled across decentralized finance segments. Lower transaction enthusiasm reflects reduced risk tolerance, and capital rotates toward safer positions. Ethereum mirrors that caution because traders scale back aggressive exposure.

Exchange flows across major assets show rising balances that often precede additional selling pressure. XRP recorded significant inflows, and Ethereum followed a similar exchange pattern. Unless buying activity returns, both assets may struggle to establish firm support levels.

Crypto World

Vitalik Buterin Offloads Nearly $6.6M in ETH Amid Price Decline

Ethereum co-founder Vitalik Buterin has sold a significant amount of his personal ETH holdings over the past several days.

Summary

- Ethereum co-founder Vitalik Buterin has sold nearly 3,000 ETH worth about $6.6 million, according to on-chain data shared by Lookonchain, with sales reported to be ongoing.

- The transactions follow Buterin’s disclosure that he has set aside 16,384 ETH to fund long-term open-source and infrastructure projects, easing concerns of an abrupt sell-off.

According to blockchain analytics shared by Lookonchain, Vitalik has offloaded 2,961.5 Ethereum (ETH), worth approximately $6.6 million, at an average price of around $2,228 per ETH. The selling is reported to be ongoing.

Lookonchain’s alert on X highlighted the on-chain movements from an address publicly associated with Vitalik, noting multiple smaller swap transactions likely routed through decentralized protocols to limit market impact.

This activity has coincided with increased market volatility. Ethereum was trading at $2,075 at press time, down 7.5% over the past 24 hours. ETH price has recently traded lower, and sales by major holders can influence short-term sentiment among traders.

Sales by founders and early contributors tend to draw heightened scrutiny in crypto markets, as they are often viewed as confidence signals rather than routine liquidity events. While the amount sold represents a small fraction of Ethereum’s total supply, on-chain transparency means such moves are immediately visible and widely discussed.

Vitalik Buterin’s ETH sales linked to planned long-term funding

The recent ETH sales are not an isolated or abrupt decision. Last week, Buterin publicly announced that he had set aside 16,384 ETH from his personal holdings, roughly $44–$45 million at current prices, to support long-term initiatives.

In a detailed post on X, Buterin said the allocation is part of his broader vision to fund open-source, secure, and verifiable technology, including infrastructure and public-goods research. The disclosure has led some market participants to view the recent sales as part of a planned funding strategy rather than a sudden sell-off.

Crypto World

Ethereum price slips further as Vitalik Buterin dumps $6.6M ETH

- Ethereum price drops to $2,127 amid market weakness and high volatility.

- Vitalik Buterin sells $6.6M ETH, part of planned funding moves.

- Key support at $2,007, with resistance targets at $2,133 and $2,274.

Ethereum (ETH) is under pressure as the cryptocurrency continues to face a significant pullback.

The price of ETH has dropped to $2,098.91, down 5.6% in the last 24 hours.

This decline is part of a broader downtrend, with Ethereum losing around 28% over the past week and nearly 34% over the past three months.

Trading volume, however, remained elevated at $54.5 billion in the last 24 hours, highlighting strong market activity despite the falling prices.

Vitalik Buterin’s ETH trades

Adding to the market concerns, Ethereum co-founder Vitalik Buterin has sold millions in ETH.

Reports indicate that wallets linked to Buterin moved roughly 2,961.5 ETH, valued at approximately $6.6 million at the time of sale.

vitalik.eth(@VitalikButerin) is dumping $ETH fast!

Over the past 3 days, Vitalik has sold 2,961.5 $ETH($6.6M) at an average price of $2,228 — and the selling is still ongoing.https://t.co/Q9G1lEsdiP pic.twitter.com/C1vBn5UimJ

— Lookonchain (@lookonchain) February 5, 2026

These transactions attracted attention due to the timing of the Ethereum downturn.

Additional reports highlight a separate $29 million ETH transfer, part of a planned reallocation by Buterin.

The movement included converting ETH to wrapped ETH (wETH) and sending smaller amounts to his Kanro charity, which focuses on biotechnology and infectious disease research.

Analysts stress that these transfers are likely strategic funding moves, not panic selling.

Nevertheless, the market has interpreted these large movements as bearish signals.

ETH price analysis

Ethereum has been under pressure due to broader crypto market weakness.

The 24-hour price range for ETH is currently $2,077.42 to $2,258.21, reflecting volatility and uncertainty.

Ethereum’s market capitalisation stands at $257 billion, with a circulating supply of 120.6 million ETH.

The cryptocurrency is still down 57% from its all-time high of $4,946.05 in August 2025.

Despite the decline, Ethereum remains a major player in the crypto ecosystem, with investors closely monitoring large wallet movements.

Ethereum price forecast

Traders are watching key levels for signs of market direction.

The first support level to monitor is $2,007.

If ETH fails to hold this level, it could drop further to the next support at $1,800.

On the upside, $2,133 is the initial resistance level.

A sustained break above this could push Ethereum toward $2,274, with the third resistance at $2,396.

Analysts like CoinLore suggest that maintaining a price above the $2,007 support is critical for any potential recovery.

Conversely, breaking below this level could accelerate selling pressure and test lower price floors.

In conclusion, Ethereum faces a challenging period as both founder wallet activity and broader market trends weigh on the price.

Traders should pay close attention to the support and resistance levels, as these will likely guide short-term movements in ETH.

Crypto World

Bitcoin’s (BTC) 21 million supply cap won’t help stop the selloff: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)

With bitcoin’s bear market raging and the price dropping to the lowest since November 2024, its core pitch, a hard cap of 21 million supply, faces fresh skepticism.

Some observers say that alternative investment vehicles like ETFs, cash-settled futures and options and other services like prime-broker lending have diluted that scarcity appeal. These tools let investors access bitcoin without owning the real thing, creating a “synthetic supply” that floods the market.

“Once you can synthetically manufacture the supply, the asset is no longer scarce, and once scarcity is gone, price becomes a derivatives game, not a supply-and-demand market. This is exactly what has happened to Bitcoin,” veteran analyst and writer of The Kendall Report, Bob Kendall, wrote on X.

Gold, silver, oil and equities saw a similar structural change with the debut of alternative investment vehicles, Kendall wrote. In 2023, CoinDesk highlighted how financialization of BTC creates paper claims that mimic abundance in a market defined by raw scarcity.

This is also why investors should tread carefully with onchain metrics like the “percentage of illiquid supply,” because these don’t account for massive “paper supply” from ETFs and futures that dilute the 21 million cap.

In the market, bitcoin lost even more ground, falling below $70,000 for the first time in more than a year.

According to veteran chart analyst Peter Brandt, the selloff has all the hallmarks of campaign selling, or coordinated selling by institutions and large traders rather than retail capitulation. Brandt is not sure at what level or when the decline will halt.

Most observers expect a slide to under $60,000 while firms like Stifel fear a more profound decline to $38,000, given the strengthening correlation with tech stocks, which have also taken a beating lately.

Hyperliquid’s HYPE remains the only consistent hideout. The token is up 11% on the year, while BTC is down nearly 19%. One other interesting token is TRX, which is down just 2%, outperforming the broader market possibly, on the back of dip buying by treasury firm Tron Inc.

In traditional markets, Wall Street’s so-called fear gauge, the VIX index, is revisiting January highs above 20.00, signaling risk aversion. U.S. Treasury market action suggests expectations for a smaller Fed balance sheet. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Feb. 5: Zilliqa to undergo its hardfork enabling Cancun.

- Macro

- Feb. 5, 2 p.m.: Mexico interest-rate decision (Prev. 7%)

- Feb, 5, 4:30 p.m.: Fed balance sheet for the period ending Feb. 4

- Earnings (Estimates based on FactSet data)

- Feb. 5: Bullish (BLSH), pre-market, $0.15

- Feb. 5: Strategy (MSTR), post-market, -$18.64

- Feb. 5: IREN Limited (IREN), post-market, -$0.18

- Feb. 5: CleanSpark (CLSK), post-market, -$0.02

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Feb. 5: PancakeSwap to host an ask me anything (AMA) session with Arbitrum.

- Feb. 5: Olympus to host a community call with a live Q&A session.

- Feb. 5: Aster to host an AMA session with its CEO.

- Unlocks

- Token Launches

- No major launches scheduled.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is down 1.62% from 4 p.m. ET Wednesday at $71,467.00 (24hrs: -6.52%)

- ETH is up 0.24% at $2,130.50 (24hrs: -5.93%)

- CoinDesk 20 is down 1.68% at 2,077.53 (24hrs: -7.15%)

- Ether CESR Composite Staking Rate is up 18 bps at 3.01%

- BTC funding rate is at 0.0008% (0.8793% annualized) on Binance

- DXY is up 0.29% at 97.90

- Gold futures are down 1.22% at $4,890.20

- Silver futures are down 7.55% at $78.02

- Nikkei 225 closed down 0.88% at 53,818.04

- Hang Seng closed up 0.14% at 26,885.24

- FTSE is down 0.43% at 10,357.59

- Euro Stoxx 50 is down 0.36% at 5,949.05

- DJIA closed on Wednesday up 0.53% at 49,501.30

- S&P 500 closed down 0.51% at 6,882.72

- Nasdaq Composite closed down 1.51% at 22,904.58

- S&P/TSX Composite closed up 0.56% at 32,571.55

- S&P 40 Latin America closed down 2.89% at 3,653.05

- U.S. 10-Year Treasury rate is down 0.8 bps at 4.27%

- E-mini S&P 500 futures are unchanged at 6,904.75

- E-mini Nasdaq-100 futures are up 0.14% at 25,033.50

- E-mini Dow Jones Industrial Average Index futures are down 0.25% at 49,466.00

Bitcoin Stats

- BTC Dominance: 59.26% (-0.39%)

- Ether-bitcoin ratio: 0.02981 (1.56%)

- Hashrate (seven-day moving average): 913 EH/s

- Hashprice (spot): $32.02

- Total fees: 3.22 BTC / $240,320

- CME Futures Open Interest: 114,080 BTC

- BTC priced in gold: 14.6 oz.

- BTC vs gold market cap: 4.77%

Technical Analysis

- The chart shows daily price swings in decentralized exchange Hyperliquid’s HYPE token.

- HYPE’s price has surged past the trend line that characterizes the decline from September highs.

- The breakout indicates that the path of least resistance is to the higher side and shifts focus to resistance at $50.

Crypto Equities

- Coinbase Global (COIN): closed on Wednesday at $168.62 (-6.14%), -1.51% at $166.07 in pre-market

- Circle Internet (CRCL): closed at $55.05 (-1.98%), -1.25% at $54.36

- Galaxy Digital (GLXY): closed at $20.16 (-8.28%), -1.49% at $19.86

- Bullish (BLSH): closed at $27.20 (-1.59%), -0.51% at $27.06

- MARA Holdings (MARA): closed at $8.28 (-8.51%), -1.81% at $8.13

- Riot Platforms (RIOT): closed at $14.14 (-7.82%), -1.34% at $13.95

- Core Scientific (CORZ): closed at $16.15 (-8.96%), +0.37% at $16.21

- CleanSpark (CLSK): closed at $10.22 (-10.04%), -1.47% at $10.07

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $40.29 (-11.06%)

- Exodus Movement (EXOD): closed at $10.70 (+2.20%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $129.09 (-3.13%), -3.24% at $124.91

- Strive (ASST): closed at $0.59 (-13.20%), -6.74% at $0.55

- SharpLink Gaming (SBET): closed at $7.08 (-7.57%), -2.54% at $6.90

- Upexi (UPXI): closed at $1.36 (-12.26%), -2.21% at $1.33

- Lite Strategy (LITS): closed at $1.06 (-7.83%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$544.9 million

- Cumulative net flows: $54.73 billion

- Total BTC holdings ~1.28 million

Spot ETH ETFs

- Daily net flows: -$79.4 million

- Cumulative net flows: $11.94 billion

- Total ETH holdings ~5.92 million

Source: Farside Investors

While You Were Sleeping

Miners are being squeezed as bitcoin’s $70,000 price fails to cover $87,000 production costs (CoinDesk): Bitcoin is now some 20% below its estimated average production cost, increasing financial pressure across the the crypto mining industry.

Precious metals, oil slide as global tensions ease; copper down (Reuters): Prices of commodities from silver and gold to crude oil and copper dived on Thursday as global tensions eased after talks between China and the U.S., which is also set to sit down with Iran.

Trillion-dollar tech wipeout ensnares all stocks in AI’s path (Bloomberg): Hundreds of billions of dollars were wiped off the value of stocks, bonds and loans of companies big and small across Silicon Valley, with software stocks at the epicenter.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech1 day ago

Tech1 day agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 hours ago

NewsBeat2 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report