Entertainment

Billie Eilish Looked ‘Tense’ During First Sighting After ‘Stolen Land’ Speech

Billie Eilish has drawn intense scrutiny following her outspoken Grammy Awards speech condemning U.S. immigration enforcement.

After declaring that “no one is illegal on stolen land” and criticizing ICE, the singer sparked a heated online debate that has continued to grow.

Now, days later, Billie Eilish was spotted out for the first time since her controversial remarks, looking “tense,” as attention shifted from her remarks to questions about her Los Angeles home.

Article continues below advertisement

Billie Eilish Reportedly Had A Tense Look During Her First Sighting Since Her Grammys Speech

Eilish appeared tense this week as she was seen in public for the first time following backlash over her outspoken remarks at the Grammy Awards.

On Wednesday, the 24-year-old singer was photographed walking her dog, dressed in her trademark oversized and baggy style.

However, as seen in photos obtained by the Daily Mail, observers noted Eilish’s somber demeanor as she had a “tense” look on her face, suggesting the ongoing criticism of her Grammy Awards speech may be weighing heavily on her.

Article continues below advertisement

The Singer Was Accused Of Hypocrisy After Her ‘Stolen Land’ Remark

The controversy surrounding Eilish began on Sunday after the “Bad Guy” hitmaker won Song of the Year and used her acceptance speech to sharply criticize U.S. immigration enforcement.

During her speech, she declared that “no one is illegal on stolen land” before bluntly adding, “F-CK ICE.”

The statement quickly ignited intense debate across social media. Soon after, social media users began pointing out that Eilish owns a $3 million home in Los Angeles, an area historically tied to the Tongva tribe, the Indigenous people of the greater LA Basin.

As the discussion gained traction, critics accused the artist of hypocrisy and called on her to either return the property or use it to support migrants she has publicly defended.

Article continues below advertisement

Article continues below advertisement

Independent journalist Manny Marotta called out the singer on X, claiming, “A gentle reminder that Billie Eilish, worth $50 million, has given $0.00 to the original inhabitants of this ‘stolen land.’”

The backlash stems from a broader wave of political statements at the Grammys, where several celebrities used the event to protest immigration policies.

Figures such as Justin and Hailey Bieber, Kehlani, and Joni Mitchell wore small “ICE OUT” pins on the red carpet. Eilish’s comments, however, stood out for their intensity.

Article continues below advertisement

Tongva Tribe Confirms Billie Eilish’s Home Sits On Ancestral Land

A spokesperson for the Tongva tribe later confirmed that Eilish’s residence is indeed located on their “ancestral land.”

While noting that the singer has not personally contacted the tribe, the spokesperson expressed appreciation for her remarks and said the tribe had reached out to her team.

They also emphasized the importance of naming the Tongva people explicitly in conversations about Los Angeles history, adding that the tribe collaborated with the Recording Academy on the official land acknowledgment shared during Grammy week.

“The Recording Academy has been an incredible partner to our tribe, and we look forward to continuing the relationship to ensure the voices of the First People of this land are heard and honored. Ekwa Shem- We are here!” the spokesperson said, reaffirming the tribe’s presence and heritage in the region.

Article continues below advertisement

Billie Eilish Has Faced Security Concerns At Her Home In The Past

Eilish has previously faced security concerns related to her home.

In 2023, the singer was granted a restraining order against a man she accused of stalking and threatening her, her family, and her friend Zoe Donahoe.

According to court documents cited by TMZ, Shawn Christopher McIntyre was ordered to remain at least 100 yards away from the singer.

The individual was also told to refrain from contacting her, including via social media.

Billie Eilish’s Uncle Defends Her Amid Backlash, Slams Claims Of Hypocrisy

Despite the growing criticism, Eilish has also received public support from within her family. Her uncle, former U.S. congressman Brian Baird, strongly defended her and criticized the Daily Mail for suggesting she could be viewed as hypocritical if she does not give up her Los Angeles home.

“Oh, please, give me a break! This is disingenuous,” Baird said, pushing back against the narrative.

The former Democratic representative for Washington’s Third Congressional District insisted that his niece’s activism should not be dismissed so easily, noting that their family has long been involved in supporting immigrant communities.

“As Billie has explained, our family has done a lot for immigrants and their cause,” he said.

Article continues below advertisement

Speaking firmly in her defense, Baird added, “I think Billie is fantastic. Of course, we’re standing behind her.”

Continue Reading

Entertainment

Tate McRae Claps Back at Backlash for Appearing in Team USA Olympics Ad

UPDATE: 2/5/26 at 2:40 a.m. ET — Canadian singer Tate McRae appeared to hit back at backlash after appearing in an ad promoting Team USA’s 2026 Winter Olympics team.

The pop star shared a childhood photo of herself holding up a Canadian flag to her Instagram Stories on Wednesday, February 4. “… Y’all know I’m Canada down,” the “Run for the Hills” singer wrote over the image.

Original story:

Singer Tate McRae is just as excited for the 2026 Winter Olympics as the rest of us — but not everybody is a fan of how she’s expressing it.

McRae, who was born in Canada, starred in an ad for NBC Sports promoting Team USA released on Tuesday, February 3.

“I’m trying to get to Milan for an amazing Opening Ceremony and meet Team USA,” the pop star, 22, tells a snowy owl in the commercial.

McRae continues, “It’s the weekend with America’s best skating for gold and Lindsey Vonn’s epic comeback.”

The 2026 Winter Olympics kick off with the Opening Ceremony on Friday, February 6, the same day that team figure skating competition begins. Vonn, meanwhile, is scheduled to hit the slopes on Sunday, February 8, despite suffering a torn ACL after a crash in Switzerland last week.

The decision for McRae to support Team USA didn’t sit well with some fans, who called her out for abandoning her Canadian roots.

“Promoting team usa is actually crazy… girl ur from calgary, u grew up going to the saddledome and the stampede, quit pretending ur from the country that was threatening to annex us this time last year 😭😭,” one person wrote via X.

McRae was born in Calgary, Alberta, Canada and spent most of her upbringing in the province. She has long supported the NHL’s Calgary Flames, who play at the Scotiabank Saddledome.

“Tate McRae, who is from Calgary Alberta, is doing Olympic promos for Team USA… more like ‘Trait McRator’ AMIRITE!” a person commented via X.

Another wrote, “Tate mcrae doing a olympic ad for the usa is lame af but also why is a us network even choosing a canadian to endorse them?”

“Tate McRae doing a promo for NBC and Team USA for the Olympics and not Canada has me a bit sad but okay,” a dejected fan said.

McRae appearing in the ad might not be entirely random, however, as the “Sports Car” singer has recently been linked to New Jersey Devils star Jack Hughes, who will represent Team USA in Italy.

McRae and Hughes, 24, were spotted together in New York City in December 2025 after she attended one of his home games.

Hughes discussed dealing with an increased level of fame during an exclusive interview with Us Weekly last month.

“The number one thing I focus on is my game,” Hughes said. “That’s the part I have the most fun with. Obviously there’s a lot of things that come with it. But the most fun thing is to go out to a sold-out rink, ball out and play well. That’s the most important thing for me.”

He added, “All the other stuff is good, it comes on the side if you’re playing well. You kinda got to put the cart before the horse. I’m lucky to be in the position that I’m in. The most fun I have is on the ice.”

Hughes and the Team USA men’s hockey team will begin their quest for gold in Italy against Latvia on February 12.

Entertainment

Teddi Mellencamp Shares Dad John’s Reaction to Her Masked Singer Stint

Teddi Mellencamp has one of the most iconic last names in music, so it’s no surprise that she turned to her famous father, John Mellencamp, for advice before taking on The Masked Singer.

“My dad said, ‘Just sing loud and proud, and if you don’t hit a note, you don’t hit a note, but as long as you’re giving it your all, that’s what matters,’” the former Bravo star, 44, exclusively told Us Weekly after her unmasking during the Wednesday, February 4, episode of the Fox singing competition. “And so that’s what I was doing.”

Teddi didn’t initially tell John, 74, that she’d landed a gig on The Masked Singer, but when it came time to show off her pipes, she decided it was time to ask the Grammy winner for some tips.

“Once I was singing a song, then I talked to him about it. I needed advice,” she. “He’s like, ‘Don’t go out there trying to think that you’re a singer. Just go out there and sing the song the way you would if you were singing along. Have fun.’”

The advice seems to have worked, because Teddi blew the judges away with her performances of Rachel Platten’s “Fight Song” and her dad’s “Jack & Diane.” The former song, she explained, has become “an anthem” for her as she battles stage IV melanoma. (A scan in October 2025 showed “no detectable cancer,” but Teddi explained on her podcast last month that she’s still considered stage IV while she remains on immunotherapy.)

“I’m probably even going to get emotional talking about it,” Teddi said of Platten’s inspiring track. “I’m almost a year [after] having all my cancer surgeries, but it’s been a fight, and I wanted to be able to share the softer side, but also [show] you can work really hard and do the things that you want to do still.”

As for the second song, John’s 1982 No. 1 hit, Teddi initially didn’t think it was an option to even sing one of her dad’s songs because of who owned the rights. When she realized his masters had been sold, however, his catalog was on the table, and she was willing to give it a shot.

Teddi Mellencamp performs as Calla Lily on season 14 of ‘The Masked Singer.’ Michael Becker/ FOX

When Teddi spoke to Us, her dad hadn’t yet seen her take on “Jack & Diane” — he was planning to come over and watch with her so she could get “nice and embarrassed” — but he previously expressed his approval for her “Fight Song” performance.

“He thought the first episode was great,” she told Us. “I mean, he’s my dad, so it’s different. But he was like, ‘I thought you were great.’”

Tuning into The Masked Singer is apparently always a family affair in the Mellencamp household, no matter who’s under the costume. As Teddi said in Calla Lily’s first clue package, she wanted to do the show for her kids, who love the show. (She shares Slate, 13, Cruz, 11, and Dove, 5, with ex Edwin Arroyave.)

“My kids have seen me in a situation where I was recovering from brain surgery, and I wanted them to know that there’s life after that,” she explained. “And once you’re feeling better, you can push yourself and you can try new things. So, that was part of the reason that I wanted to do The Masked Singer, but the other part was because it’s my kids’ favorite show.”

The kids didn’t know in advance that their mom was on the show, but she said they figured it out as soon as they heard her voice because she always sings in the car.

“I was like, ‘How do you know?’ Because I wanted to wait [to tell them],” she recalled. “And they were like, ‘Don’t even try to fool us. We know.’”

They were then “so worried” that their mom would go home first, but that didn’t happen: She notched two performances before Calla Lily’s run came to an end despite being so nervous that she found herself shaking on stage.

“I just was like, ‘You’ve got to do this. There’s no choice,’” Teddi recalled telling herself. “You’ve just got to fight through the nerves and remember the words and sing loud.”

Teddi has been fighting hard for the past year, sharing raw insights about her health journey on her “Two T’s in a Pod” podcast, which she cohosts with The Real Housewives of Orange County’s Tamra Judge. Listeners may come expecting reality TV gossip, but Teddi hasn’t shied away from discussing the serious topic of her treatment, in part because she thinks it would be “impossible” for fans not to notice something was going on.

“You can hear the way that my voice has changed throughout the time. You can see my personality change. And I’m aware of it,” Teddi explained. “When you have brain surgery, there’s so many things affected, and I didn’t want to feel ashamed by it. So, I just wanted to talk about it and make other people not feel alone. But also, if I talk about it, then I’m less nervous about it, then I can just go along being me. I’m not trying to hide something like, ‘Hey, guys, I’m really shaky today,’ or, ‘You might notice my voice sounds funny.’”

She added, “It’s one of the side effects of one of the treatments I’m going through, and just kind of letting people know that you’re not alone. I think so many people talk about the physical aspect of having cancer, but the mental aspect has kind of been forgotten. So, as much as I can talk about that, I do.”

Just last month, Teddi opened up about starting therapy to help process all that she’s been through between her cancer battle and her divorce from Arroyave, 48.

“It’s really hard for me to tap into my feelings, because I think I’ve put up a wall,” she shared with Us. “I was so scared of what happened that I didn’t want to really dig into it and get into those emotions, but now that I have, it’s like the floodgates are open. It’s definitely been helping, because I think that when you go through a trauma and you’re just trying to white-knuckle it the whole time, it’s gonna come around. And when it came around, I was completely shocked.”

The Masked Singer, she said, helped remind her that she can keep going.

“You become such a creature of habit when you’re healing,” she said. “I’m home. I do my podcast from the house. I’m not allowed to drive yet, so my podcast room is 15 steps from where my bedroom is. It’s like everything is in one area. Being able to get out there and do that was something that showed me I can do hard things.”

The Masked Singer airs on Fox Wednesdays at 8 p.m. ET. New episodes stream the next day on Hulu.

Entertainment

This Forgotten ‘Cheers’ Spin-Off That Became Television History’s Worst Came Before ‘Frasier’

Cheers stands as one of the most iconic sitcoms of the 1980s. The series, led by Ted Danson as Sam Malone, centered around the staff and regulars of the titular bar in Boston as they took time away from their day-to-day life to go “where everybody knows your name.” The characters are among television’s most beloved: Danson’s Malone, the bar owner and former Red Sox relief pitcher; Diane (Shelley Long), the academic barmaid and love interest; Carla (Rhea Perlman), the cynical, wise-cracking and irritable waitress; Norm (George Wendt), a popular bar regular greeted with a resounding “Norm!” whenever he showed up (which was often); and Cliff (John Ratzenberger), another bar regular, a mail carrier, and know-it-all.

As the series progressed, Woody (Woody Harrelson) replaced Coach (Nicholas Colasanto) as bartender following Colasanto’s passing, while Long departing the show opened the door for Kirstie Alley‘s Rebecca, all without the series missing a beat. A spin-off was inevitable, and while any of the characters would have been effective, the call went to Kelsey Grammer‘s Frasier Crane, and Frasier (which premiered in 1993, the same year Cheers ended) would prove to be just as popular as its parent series. But the first spin-off didn’t feature any of the characters mentioned above. Preceding Frasier by six years, The Tortellis centered around characters that only ever made a handful of appearances… and unsurprisingly, it bombed.

Carla’s Ne’er-Do-Well Ex-Husband Lands ‘Cheers’ First Spin-Off With ‘The Tortellis’

In the first season of Cheers, all we knew about Carla’s ex-husband Nick was what she shared caustically. He’s a deadbeat father to five of her children, making few attempts to contact them, and no attempt to support them financially. He also cheated on Carla with another woman, Loretta. We don’t actually meet him or Loretta until Season 2’s “Battle of the Exes,” and, well, he lives up to his reputation. Nick (Dan Hedaya) is loud, boorish, and scruffy, with nary a hint of sophistication. Loretta (Jean Kasem) is a tall, blonde, and “ditzy” woman, a trophy wife who marries Nick in the same episode. And yet, after the wedding, he beelines to Cheers and begs Carla to come back to him. It’s not the last time he attempts to woo Carla back either, and it often even comes close to happening — with Nick still proving to be irresistible to her.

The Tortellis sees Loretta leave Nick and move to Las Vegas, where she hopes to make it as a performer. She moves in with her sister Charlotte (Carlene Watkins), who seemingly took her share of the smarts, and her son Mark (Aaron Moffat). Nick follows her to Las Vegas in an attempt to reconcile with her, promising to change his ways. She takes him back, tentatively, and Nick sets up a TV repair shop, and, true to his word, changes his ways. (Kind of. Not really.) Then Nick and Carla’s teenage son, Anthony (Timothy Williams), and his petulant wife Annie (Mandy Ingber) also move to Las Vegas, joining Nick and Loretta in Charlotte and Mark’s home. Six wacky stereotypical characters under one roof? Cue the hilarity.

‘The Tortellis’ Is Mercifully Cancelled After 13 Episodes

The decision to center a spin-off around characters who’ve had a handful of appearances is questionable at best, but to make it about such a despicable character and his bubble-headed wife is downright baffling. Storylines like a customer holding Nick accountable for his advertised claim of fixing a TV in a day or he’ll “eat a bug,” or Loretta confronting Charo after Nick takes longer than expected to fix a TV in her dressing room are so far apart from the savvy, well-written episodes of Cheers that it’s criminal. And speaking of criminal, Nick’s criminal past, rooted in offensive stereotypes of Italian Americans, didn’t help either, with the South Florida SunSentinel saying, “The Italian-American Anti-Defamation League should be about as enchanted with Nick Tortelli as it was with The Untouchables.” Coupled with poor ratings, The Tortellis was cancelled after only 13 episodes.

Frasier worked because people knew the character and were willing to follow him to Seattle. The series didn’t sacrifice those things that made Frasier who he was, bringing characters into the series with him that worked to both complement him and challenge him. The writing, too, was up to the same level of quality as its predecessor. Joey, the infamous spin-off of Friends, failed partially because the series changed those things that made Joey who he was, expecting fans to follow a different version of Joey to Los Angeles. The Tortellis didn’t sacrifice the characters at all, and maybe they should have. To add insult to injury, Wings, a sitcom that exists in the same world as Cheers and Frasier, had a healthy 8-season run, with characters that never showed up in Cheers at all.

Entertainment

Sherri Shepherd To ’Address’ Talk Show Cancellation At Later Date

Sherri Shepherd has officially broken her silence following the surprise cancellation of her daytime talk show, “Sherri.” Taking to social media, Shepherd shared her early thoughts about the response to the news and noted that she will have more to say at a later date.

Shepherd is the latest daytime talk show host to see her show come to an end, as Kelly Clarkson’s self-titled show was also recently confirmed to cease production this year.

Article continues below advertisement

Sherri Shepherd Reacts To Fan Response To Talk Show Cancellation

In a post on Instagram, Shepherd shared a collection of heartfelt posts from fans expressing their appreciation for her show and sadness at the news that it has been cancelled. She rounded out the post with thanks and stated she will have more to say later.

“Wow! I am completely overwhelmed by the outpouring of love for me and The @sherrishowtv,” Shepherd began her caption. “You might’ve noticed that yesterday and today I was struggling because I wasn’t feeling up to speed.”

“Well, it turns out I have Covid,” the former co-host of “The View” continued. “As soon as I feel better and return to the show, I will address all of the news that has come out. Until then, I am truly grateful that SHERRI has made such an impact on you! See ya soon.”

Article continues below advertisement

‘Sherri’ Was Recently Cancelled After Four Seasons

On Tuesday, February 3, it was announced that “Sherri” was formally cancelled and its current season will wrap up in the fall, according to Variety.

Debmar-Mercury, which distributes the show through producer Lionsgate, issued a statement confirming the news, citing the changing “daytime television landscape” as the reason for the show’s cancellation.

“This decision is driven by the evolving daytime television landscape and does not reflect on the strength of the show, its production, which has found strong creative momentum this season, or the incredibly talented Sherri Shepherd,” Debmar-Mercury co-presidents Ira Bernstein and Mort Marcus said via joint statement.

“We believe in this show and in Sherri and intend to explore alternatives for it on other platforms,” the statement continued.

Article continues below advertisement

Shepherd took the reins of her now-cancelled daytime talk show in fall 2022, initially occupying the previous time slot of the “Wendy Williams Show.” That hit show, which ran for 13 seasons, ended after a host of health and personal issues that Williams still continues to battle.

Article continues below advertisement

A Former Co-Host Of ‘The Real’ Slammed ‘Sherri’s’ Cancellation News

Loni Love, who is a former co-host of the daytime panel talk show, “The Real,” which was also cancelled, spoke out against the cancellation of Shepherd’s show, per Entertainment Weekly.

Love voiced her displeasure with production company Debmar-Mercury for how the show’s cancellation was announced, specifically in comparison to Clarkson.

“Sherri should have been given the courtesy of announcing her show’s end instead of an article announcing it. (Just like Kelly got to announce her show’s end.),” Love wrote in a post on X, formerly known as Twitter. “It’s not like The Real, which was a panel show, but this was a solo-hosted show.”

Article continues below advertisement

“Or the production company could have at least made a joint announcement as a producer and host,” she continued. “Seeing “cancelled” stamped all over your picture is depressing, especially when the show was having good ratings. Only onward and upward from this, @sherrieshepherd.”

Kelly Clarkson Broke The News Her Show Was Ending Following Intense Speculation

“There have been so many amazing moments and shows over these seven seasons. I am forever grateful and honored to have worked alongside the greatest band and crew you could hope for, all the talent and inspiring people who have shared their time and lives with us, all the fans who have supported our show, and to NBC,” Clarkson’s statement read in part.

“Because of all of that, this was not an easy decision, but this season will be my last hosting ‘The Kelly Clarkson Show.’ Stepping away from the daily schedule will allow me to prioritize my kids, which feels necessary and right for this next chapter of our lives,” she continued.

Article continues below advertisement

The “American Idol” winner closed her statement by thanking her fans.

“I want to thank y’all so much for allowing our show to be a part of your lives, and for believing in us and hanging with us for seven incredible years.”

According to Deadline, Clarkson’s contract was up at the end of the current season, and her recent personal issues were likely the deciding factor not to continue. The singer’s ex-husband and father to her children died from cancer complications in August 2025.

Viewers Have Sought Outside Television For Their Daytime Talk Show Interests

With major news personalities leaving cable and network news for streaming, such as former CNN journalist Don Lemon and former MSNBC host Joy Reid, many of their fans are following them in droves. Lemon’s YouTube channel, launched a year ago, boasts over 1 million subscribers.

Viewers are changing the way they get traditional news and daily talk show news, as the massive rise of podcasts has severely cut into the audience of daytime talk shows, which is referenced by Debmar-Mercury’s point about the “changing television landscape.”

Entertainment

‘Memba These Iconic Stars?!

‘Memba These

Iconic Stars?!

Published

Do you recall watching and listening to these stars?!

London native and singer Natasha Bedingfield was just 23 years old when she took over 2004 with her debut album “Unwritten.”

John Glover is best known for playing the perfectly coiffed antagonist, Lionel Luthor, on the WB superhero show, “Smallville.”

American actor, singer and dancer Sterling Knight was 20 years old when he was cast as Alex O’Donnell in the 2009 film “17 Again.”

And, Raquel Castro caught her big break when she starred as Gertie Trinke, daughter to Ben Affleck and Jennifer Lopez‘s characters in 2004’s comedy-romance, “Jersey Girl.”

Entertainment

Father, 5-Year-Old Reunite After Viral Detention In Minnesota

Adrian Conejo Arias is clapping back at the government’s claim that he abandoned his son while ICE agents pursued him in Minnesota. Arias is the father of the 5-year-old boy in a blue bunny hat and a Spider-Man backpack. Liam went viral after footage showed immigration officers surrounding the boy and allegedly attempting to bait the father with the child.

ICE had ultimately detained and shipped them both to a holding facility in Texas. Now, amid the father-son reunion, Adrian is setting the record straight while the government doubles down on abandonment claims.

RELATED: ICE Agents Reportedly Detain 5-Year-Old Boy In Minnesota And Use Him To “Bait” Father Into Capture

Father And Son Headed Back To Minnesota After ICE Detention

Adrian Conejo Arias spoke out after a federal judge ordered the pair’s release over the weekend. The father and son were released Sunday and returned to Minnesota, according to Rep. Joaquin Castro of Texas.

Adrian told ABC News that he loves his son Liam and would never abandon him. The father’s comments contradict the picture painted by the Department of Homeland Security (DHS), which has claimed Arias left his 5-year-old in a vehicle. But Papa Adrian is denying the DHS narrative. Additionally, he said Liam got sick while in federal custody but allegedly was not given any medicine.

Also, the father says his arrest was unjust. He said he was in the country legally, with a pending court hearing on his asylum application. The government said the boy’s father entered the U.S. illegally from Ecuador in December 2024. The family’s lawyer said he has a pending asylum claim that allows him to stay in the U.S. However, per the Associated Press, the DOJ’s Executive Office for Immigration Review’s online court docket shows no future hearings for Liam’s father.

For context, the large majority of asylum-seekers are released in the United States. Adults typically have eligibility for work permits, while their cases wind through the court system.

Homeland Security Claims Adrian Arias Left His Son

Meanwhile, Assistant Homeland Security Secretary Tricia McLaughlin said in a statement that Arias fled on foot before he was arrested, “abandoning his child.” She said ICE officers stayed with the boy.

“The facts in this case have NOT changed: The father, who was illegally in the country, chose to take his child with him to a detention center,” McLaughlin said.

However, McLaughlin did not address Adrian Conejo Arias’ statement about agents denying Liam medication while in custody. The family’s arrest and release unfolded during President Donald Trump’s crackdown on immigration. This crackdown has led to daily protests that included the shooting deaths of two American citizens by federal officers.

More Parents From 5-Year-Old’s School Detained

Neighbors celebrated Liam Arias’ return but his school in Columbia Heights had to cancel class after receiving bomb threats. Authorities said they did not find any dangerous devices. School was set to resume Tuesday.

Even before the threats, the district has felt under attack. ICE has detained over two dozen parents of students at Liam’s school, Valley View Elementary, leaving children without their caretakers. Principal Jason Kuhlman shared the update last week Friday in an interview.

“We hate Mondays. And it’s because we find out how many of our parents were taken over the weekend,” Kuhlman said.

The school started offering online classes in late January because many parents were afraid to come to school. Even with volunteers patrolling grounds during drop-off and dismissal times, fear has been dominating. Kuhlman said that during one recent day, almost 200 students were absent. The school’s population is around 570. Normally, only 20 or 30 kids would be absent on any given day.

ICE Agents Will Allegedly Wear Body Cameras

The president last week ordered his top border adviser to oversee the crackdown days after the fatal shooting of 37-year-old Alex Pretti. Alex was an intensive care nurse at a Veterans Affairs hospital. Border czar Tom Homan suggested that mistakes have been made. However, he said agents would continue to enforce federal law. Also, he called on local and state officials to cooperate with federal officers.

On Monday, Homeland Security Secretary Kristi Noem said every DHS officer in Minneapolis would immediately be issued body-worn cameras. President Donald Trump seemingly approved of the body cameras. He called them good for law enforcement “because people can’t lie about what’s happening.”

RELATED: Bad Bunny, Kehlani And More Grammy Winners Blast ICE And Honor Immigrants At 2026 Grammys (VIDEOS)

Associated Press writers Mike Catalini, Steve Karnowski, Sharon Lurye, Jake Offenhartz, Giovanna Dell’Orto, Bianca Vázquez Toness and Audrey McAvoy contributed to this report via AP Newsroom.

What Do You Think Roomies?

Entertainment

The 15 best romantic comedy movies on Netflix

:max_bytes(150000):strip_icc():format(jpeg)/netflix-rom-coms-010726-3ebfe063bba84fffb1e9cd3d2590e9c4.jpg)

Whether they concern enemies becoming lovers or complicated love triangles, you’ll fall head over heels for these rom-com films currently streaming.

Entertainment

Fans React To ‘Liberian Girl’ Challenge Twerk

Claressa Shields lit up timelines again, and nope, it’s not because Papoose is upstairs. The boxing champion hopped on TikTok’s viral ‘Liberian Girl’ Challenge, and her spicy moves have the internet cuttin’ up, per usual.

RELATED: Come On Outfit! 5 Times Claressa Shields Shut Down Critics By Confidently Showing Off Her Sense Of Style (PICS + VIDEOS)

Claressa Shields Said “My Turn” & Shook The TL UP!

Listen, when it comes to a dance challenge, just tap Claressa Shields in. Winter or not, the GWOAT pulled up, giving straight summer vibes while jumping on the ‘Liberian Girl’ Challenge. The trend comes with a few spicy lil’ moves set to Michael Jackson’s classic, and of course, Claressa added her own sauce — especially when it came to the twerk. She rocked a yellow two-piece with a crop top and pleated mini skirt, then hit a smooth walk-off that said it all. If you ask her, she ate that up and left zero crumbs. Peep the video below.

Social Media Went Straight Into Reaction Mode

Of course, The Shade Room’s comment section exploded with reactions to Claressa’s take on the ‘Liberian Girl’ challenge. Some folks vibed with her energy, while others made it clear they don’t get how anyone could hate when she’s clearly having a time.

Instagram user @niccigilbert wrote, “She looks super cute having fun, traveling the world as a champion against all odds, all the way from Flint, Michigan Go Claressa Go 👑👑👑✨✨✨💛💛”

Instagram user @buttababy03 wrote, “Pap watching from upstairs 😂😂”

While Instagram user @meekmeek2u_ wrote, “I like her 🤷🏽♀️😂Idk why it’s so popular to hate this woman. She just having fun 😂 damn.”

Then Instagram user @kristen.hurt wrote, “MAAANNNN let that lady live… We let Brittney do it, so why can’t she? 🤷🏾♀️🙂”

Another Instagram user @rose.ichiban wrote, “I actually love Clarissa ❤️”

Instagram user @mrshairtoday wrote, “Let her have fun! 😍”

Then another Instagram user @mirrajai.fit wrote, “She’s a boxer having fun trying to do a little dance. I think it’s cute 😍👏🏽”

Finally, Instagram user @ssherman31 wrote, “Seems so fun and full of life ❤️”

Claressa Claps Back At Trolls For Throwing Shade At Her Moves

While plenty of folks praised Claressa for having fun with the TikTok challenge, a few trolls chimed in and she peeped. She clapped back with a video from what looked like a workout, questioning why some people stay so miserable. Still, Claressa didn’t let the comments about her needing to be “more girly” or “loosen up” faze her one bit. She said anyone who laughed did exactly what they were supposed to do, because that’s the whole point of dance videos. “It’s a f*****g TikTok who cares! I don’t get paid to dance. I’m a fighter, I’m a world champion.” She continued to flex, “19-time world champion.”

Claressa Shows Out For ‘Counting Green’ Challenge With Papoose’s Daughter

We already told ya’ll Claressa doesn’t play when it comes to a dance challenge. In fact, she and Papoose’s eldest daughter, Dejanae Mackie, kicked off the ‘Counting Green’ challenge for Pap’s single. The ladies were getting to the money, flexing on ’em, and hitting a mean chicken while they were head while they were at it.

RELATED: Taste Test? Papoose Rates Claressa Shields’ Cooking In Skeptical Clip As Fans Side-Eye His Review (VIDEO)

What Do You Think Roomies?

Entertainment

Apple TV’s 10/10 Spy Thriller That Keeps Getting Better Is Hooking Viewers Fast

Because Apple relies entirely on a library of original films and shows, its viewership charts aren’t as dynamic as those of its competition. The sparsely populated platform has earned a reputation for focusing on quality over quantity, at least until now. This focus has resulted in shows that offer a rare combination of mass appeal and critical acclaim. There is no better example of this than the sci-fi series Severance, which has become something of a platform-defining hit for Apple TV. The streamer has emerged as a hub for long-form sci-fi over the years, with the similarly successful Foundation, Invasion, Silo, and Pluribus also competing for eyeballs. However, Apple’s biggest hit — certainly, its longest-running title — isn’t a sci-fi show at all.

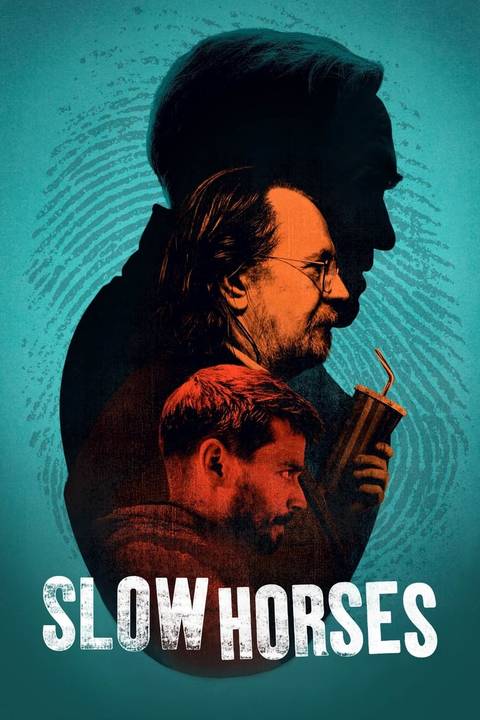

The show in question, Slow Horses, is a darkly comic spy thriller that premiered in 2022 and has aired five seasons so far. Apple is committed to making at least two more seasons, the first of which will be released this year. This week, Slow Horses passed a massive streaming milestone that puts it in the elite company of Severance and Ted Lasso — the latter comedy-drama became Apple’s first breakout hit, after premiering in 2020. Based on the book series by Mick Herron and created by screenwriter Will Smith, Slow Horses has given star Gary Oldman one of the most memorable characters in a career filled with them. Oldman has received widespread acclaim for his performance as Jackson Lamb, the chief of a band of overlooked spies.

‘Slow Horses’ Is One of the Best-Reviewed Shows Currently Streaming

According to FlixPatrol, Slow Horses has spent more than 600 days on Apple’s domestic viewership charts. It’s trailing only Severance and Ted Lasso, both of which have spent over 700 days on the list, primarily because they’ve had a head start. Slow Horses has received critical acclaim for each of its five seasons, with an overall score of 97% on Rotten Tomatoes. It peaked with Season 2 and Season 4, both of which earned perfect 100% scores. Rotten Tomatoes’ consensus for last year’s fifth season reads, “Slow Horses loosens the reins in a more lighthearted season that doesn’t quite measure up to the series’ high bar, but it still excels as one of the most compulsively watchable offerings on television.” You can watch Slow Horses at home. Stay tuned to Collider for more updates.

- Release Date

-

April 1, 2022

- Network

-

Apple TV+

- Showrunner

-

Douglas Urbanski

- Directors

-

Adam Randall, James Hawes, Jeremy Lovering, Saul Metzstein

- Writers

-

Mark Denton, Jonny Stockwood

Entertainment

Liam Neeson Worked As A Forklift Operator Before Fame

Before he was a part of the glitz and glamor of Hollywood, Liam Neeson worked as a forklift operator at a Guinness factory in his native Northern Ireland.

Neeson was on the show to promote his new horror film, “Cold Storage,” which is set to premiere in the United States on February 13.

The “Schindler’s List” star also spoke about the fortuitous circumstances that eventually led to his first-ever acting role.

Article continues below advertisement

Liam Neeson Remembers Dropping Crates While Working At A Guinness Factory

According to Neeson’s profile on the British Independent Film Awards website, one of his earliest jobs before fame was working as a forklift operator at a Guinness factory in Ballymena, Northern Ireland, where he grew up.

The actor reflected on that period of his life during his conversation with Meyers on “Late Night,” where he shared more details about the job.

“I had to stack the Guinness, and then load the lorries with Guinness that would then go out to various pubs,” Neeson explained, while joking about his clumsiness on the job. “Yeah, I dropped quite a few crates.”

The BIFA profile also lists several other jobs Neeson held before his acting days, including stints as a truck driver and an amateur boxer.

Article continues below advertisement

Neeson Credits His Height For Landing His First Acting Role

After years of working various odd jobs to make ends meet, Neeson finally landed his first acting role when he joined a production of “The Risen People” at the Belfast Lyric Players Theater.

However, he feels that the circumstances behind how he secured the part were largely a matter of chance.

Neeson told Meyers that he was cast in the play simply because the production needed someone of his stature.

“What I think got me the part when I called up for an audition, the lady Mary O’Malley, who formed the theater 75 years ago, she said, ‘What height are you?’” Neeson recalled. “I said, ‘Six foot four.’ ‘Can you be up here next Tuesday?’”

Article continues below advertisement

Liam Neeson Recalls Spending Hours In Makeup For The Movie ‘Darkman’

Neeson took another trip down memory lane on “Late Night,” this time when he spoke about the grueling makeup process he endured while filming “Darkman.”

“Five hours of makeup underneath that wrap,” Neeson said, referring to the heavy prosthetics he used for the role. “Eventually, they got it down to three and a half.”

In the 1990 cult classic, Neeson portrayed scientist Peyton Westlake, who gains superhuman abilities after an experimental procedure and seeks revenge against the criminals who brutally attacked and disfigured him.

Article continues below advertisement

The Actor Also Opens Up On Feeling ‘Embarrassed’ Receiving An Honorary Doctorate

In 2009, Neeson was awarded an honorary doctorate by Queen’s University, Belfast, where he had actually previously enrolled for an undergraduate degree in physics and computer science.

The future Hollywood star was at the school for only about a year, after which he said he failed his exams and flunked out.

Because of this, he remembers being embarrassed when he was offered the honorary degree, which he felt he had not earned.

“I didn’t study. I didn’t do essays and stuff,” Neeson said. “I was a wee bit like, ‘Really? Thanks, guys.’”

Article continues below advertisement

Liam Neeson Is Promoting His New Horror Sci-Fi Film ‘Cold Storage’

Neeson was on “Late Night with Seth Meyers” promoting his new science fiction horror film, “Cold Storage.”

The movie tells the story of two workers whose world is turned upside down after a contagious, parasitic fungus is accidentally released from a former military base beneath the self-storage facility where they work.

Georgina Campbell and Joe Keery play the leads, Naomi and Travis. Neeson plays a retired bioterror specialist called Robert Quinn, who is called upon to help deal with the outbreak.

In an interview with SFX Magazine, Keery spoke about what it was like to work with Neeson.

“Liam is killer. We grew up with his movies, so this was pretty crazy,” Keery said, per Parade. “Working with him was checking a big box for me.”

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech1 day ago

Tech1 day agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 hours ago

NewsBeat2 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report