Crypto World

Galaxy Tokenizes First CLO on Avalanche With $50M Grove Allocation

Galaxy CLO 2025-1 totals $75 million and brings a private credit deal onchain.

Galaxy revealed on Jan. 15 that it has issued its first collateralized loan obligation (CLO) and tokenized the deal on Avalanche, a Layer 1 blockchain with a total value locked (TVL) of over $1.2 billion.

The instrument, dubbed Galaxy CLO 2025-1, totals $75 million and includes a $50 million allocation from Grove, an institutional credit protocol that operates as a Star, or SubDAO, within the Sky Ecosystem.

A CLO is a structured credit product that bundles corporate loans and sells them to investors across different risk tiers. Galaxy said the transaction will support its lending activities.

Avalanche said the CLO’s debt tranches were issued and tokenized on its network and are listed on INX for qualified investors. The network added that tokenization could enable lower-cost trading and faster settlement, while also improving transparency for investors.

“This transaction marks another meaningful step forward for onchain credit, demonstrating how familiar securitization structures can be brought onchain without compromising institutional standards,” said Sam Paderewski, co-founder at Grove Labs.

Paderewski added that Grove’s investment underscores its focus on supporting onchain tokenized credit products.

The allocation adds to Grove’s activity on Avalanche, according to the announcement. Grove previously deployed $250 million into tokenized real-world assets (RWAs) on the Avalanche network.

The announcement comes as more private credit products move onchain. Avalanche cited other institutional credit products already running on its network, including tokenized funds tied to Janus Henderson’s Anemoy Fund and Apollo’s ACRED.

Private credit remains the largest category in tokenized RWAs, with about $19.1 billion in onchain value, followed by tokenized securities, mainly Treasuries, at roughly $9 billion, according to a December report from RWAio.

AVAX, Avalanche’s native token, was trading around $13.74 on Thursday, down about 6.2% over 24 hours, according to CoinGecko. The token had roughly $388 million in daily trading volume.

Meanwhile, Galaxy (GLXY) shares were up about 13% on Thursday, trading around $31.90, according to Google Finance.

Crypto World

How To Launch Your Neo Bank With White Label BaaS Model In Poland?

“Speed and compliance beat ambition alone.” Investors who act on that truth win. Picture a crypto neo bank that plugs into Poland’s payment fabric, issues virtual IBANs and cards, settles cross-border payroll in stablecoins, and provides custody-grade controls investors can audit in real time. This is practical, not hypothetical. It is a repeatable deployment that converts frequent payment flows into predictable revenue and institutional margin.

For serious investors, the criteria are tight: prove custody safety, guarantee instant liquidity, and demonstrate regulator-ready compliance. If those boxes are checked, scaling follows; if not, growth stalls. White label Banking-as-a-service (BaaS) model combines hardened BaaS infrastructure, threshold key custody, and automated KYT so you capture speed without regulatory compromise. Opportunity windows close fast. Expect measurable KPIs and audit-ready evidence from day one.

Let’s scroll through the blog to know in detail.

Why is Poland Strategically Attractive Right Now?

Poland’s payments infrastructure is exceptionally modern. Instant rails and local schemes drive very high transaction frequency, creating a fertile environment for an integrated crypto-fiat product that sits beside existing behavior and improves margins for merchants and corporates. Recent regulatory clarity across Europe introduces a harmonized rulebook for crypto assets, reducing regulatory uncertainty for licensed providers. At the same time, demand for seamless fiat-on and off-ramps, corporate treasury efficiency, and lower cross-border friction creates a commercial runway for crypto-friendly neo banking solutions. These structural elements combined deliver both an attractive top line and predictable regulatory paths for institutional-grade services.

What Pain Points Does a Crypto Neo Bank Solve in Poland?

- Costly cross-border business payments and remittances, especially for SMEs with EU and non-EU suppliers. Stablecoin rails reduce time and FX slippage and open new settlement patterns.

- Fragmented on/off ramps. Consumers and merchants juggle centralized exchanges, separate wallets, and traditional bank accounts. An integrated account that tokenizes settlement and offers instant conversion removes friction.

- Inefficient corporate treasury for companies paying international contractors. Crypto-native treasury offers options for FX hedging and programmable payroll.

- Poor merchant acceptance paths for crypto receipts. Many merchants want exposure to crypto settlement but need instant conversion to PLN. A neo bank with native conversion fixes this.

- Trust and custody concerns among institutional counterparties. A regulated custody and compliance stack is table stakes for enterprise adoption. These are solvable with best-practice custody and a compliant CASP model.

Top-Notch Reasons to Launch a White Label Neo Bank App in Poland Now

- Digitally mature payments ecosystem- Poland’s widespread adoption of instant payments and digital banking reduces adoption friction and accelerates transaction volumes from day one.

- Regulatory clarity at the EU level- A defined compliance framework provides predictability for investors, lowers regulatory uncertainty, and supports structured market entry.

- High-value, enterprise-driven demand- SMEs, cross-border businesses, and merchants actively seek faster settlement, efficient treasury management, and seamless fiat-crypto interoperability.

- Attractive and diversified revenue model- Multiple monetization layers, including interchange, conversion fees, custody services, treasury subscriptions, and enterprise APIs improve margin resilience.

- Strong unit economics potential- High transaction frequency, lower customer education costs, and enterprise-led onboarding shorten CAC payback periods.

- Rapid go-to-market feasibility- Mature fintech infrastructure and availability of BaaS, BIN, and PSP partnerships significantly compress launch timelines.

- Scalability beyond Poland- A Poland-first strategy enables structured expansion across the EU using a single compliance and product framework.

- Growing institutional interest in Web3 infrastructure- Increasing demand for regulated crypto banking solutions positions early movers for long-term strategic advantage.

- Clear strategic exit pathways- Regulated neo-banking and crypto infrastructure assets remain attractive acquisition targets for banks, fintechs, and payment platforms.

Make sure that you hire the best white label neo bank development company globally that holds years of experience and expertise in designing business-tailored solutions along with legal and regulatory assistance.

How to Deploy Your Crypto Neo Bank With White-Label BaaS in 1 Week?

This must not sound so realistic to you, but launching an impactful white-label crypto neo banking platform is a realistic task for an experienced company, but a conditioned one too. One week is feasible as a minimum viable commercial deployment if three prerequisites are met in advance. First, a preapproved suite of partners must be in place. Second, compliance artifacts must be ready for the target customer profile. Third, the white-label BaaS must be truly modular with production-grade connectors. If those conditions exist, you can go live with a limited product set in seven days. Here is a practical day-by-day playbook.

Day 1: Provision core accounts and sandbox APIs

• Provision the tenant in the BaaS platform.

• Configure product catalog: e-wallet, virtual card, fiat wallet, crypto wallet.

• Route test BINs and IBAN ranges, and create webhooks for events.

Day 2: Integrate identity and compliance flows

• Wire KYC/KYB flows into onboarding.

• Configure AML/KYT thresholds and alerting.

• Set KYT rules for on-chain and fiat monitoring.

Day 3: Custody and liquidity setup

• Connect to custodial key management or MPC node.

• Wire liquidity provider for instant conversion between crypto and PLN.

• Sanity test settlement loops.

Day 4: Card issuance and payment rails

• Configure BIN sponsor for virtual cards and enable BLIK/SEPA rails.

• Run end-to-end card lifecycle tests.

Day 5: UX polish, risk rules, and enterprise onboarding

• Finalize frontend flows and onboarding.

• Implement throttles and risk rules for high-value transactions.

Day 6: Compliance signoff and sandbox transactions

• Execute a full test cycle for compliance reporting and audit trails.

• Load test critical flows.

Day 7: Soft launch with invited customers

• Onboard pilot SMEs and retail cohort.

• Monitor metrics and iterate immediately.

Architecture & Tech Stack Investors Must Demand

- Modular customized BaaS software core with multi-tenant isolation and secure multi-cloud deployment.

- Custody layer with MPC and institutional-grade key management, BLS or threshold signatures, and auditable signer logs.

- A compliance layer that merges on-chain KYT and fiat AML telemetry into a single risk engine.

- Payments layer with BIN orchestration, card lifecycle management, IBAN issuance, and local scheme adapters like BLIK.

- Liquidity and settlement layer with automated market making or liquidity pools for instant fiat conversion.

- Observability and audit trail stack with immutable logging, transaction reconstruction, and regulatory reporting exports.

- Upgradeable smart contract modules and off-chain reconciliations respecting MiCA reporting expectations.

Rolling Out Crypto Neo-Banking in Poland with White-Label BaaS

How Can a Blockchain Company Deliver a Customized BaaS App in a Short Time?

A credible white label BaaS service provider will present prebuilt connectors to KYC, BIN, IBAN, custody, and liquidity partners; a template-driven UI kit; a compliance module with configurable rules; and hardened APIs for enterprise integration. Critical differentiators include white box compliance for investor due diligence, turnkey custody certificates and SOC reports, and documented latency SLAs for settlement. For enterprise adoption, the provider must supply SDKs, sandbox keys, and a preconfigured regulatory evidence pack ready for KNF and other supervisors. Investors should insist on runbooks, incident response, and a roadmap for issuing CASP/CASP filings where required.

Legal & Compliance Support To Expect From a White-Label BaaS Partner

- Regulatory clarity from day one- Clear mapping of your crypto neo-banking model against EU and Polish regulatory requirements, avoiding ambiguity or rework later.

- Licensing and registration guidance- End-to-end support for CASP or VASP readiness, including scope definition, documentation, and regulator-ready submissions.

- Built-in AML and transaction monitoring- Configured AML and KYT frameworks covering both fiat and on-chain transactions with real-time alerts and audit trails.

- Enterprise-grade KYC and KYB workflows- Seamless onboarding flows with configurable risk scoring aligned with Polish and EU expectations.

- Custody and asset protection compliance- A documented custody model with institutional controls, segregation of assets, and audit-ready evidence.

- Regulatory reporting and audit readiness- Automated compliance reports, immutable logs, and support during regulator or banking partner reviews.

- Data protection and privacy alignment- GDPR-compliant data handling, storage, and access controls embedded into the platform.

- Ongoing compliance support- Continuous updates for regulatory changes, policy refinement, and compliance health monitoring post-launch.

The Bottom Line

Poland is a market where modern payment rails, technical literacy, and regulatory convergence create a window to deploy a crypto neo bank that is both profitable and compliant. For investors, the opportunity is to own a differentiated payments and treasury platform that captures recurring, high-frequency flows and monetizes custody and enterprise services.

We bring the technical architecture, custody know-how, and regulatory playbooks necessary to execute. Our team has deep experience delivering production BaaS and crypto custody integrations, and we work closely with legal partners to map MiCA obligations and local procedural requirements so your deployment is defensible and auditable from day one. We will deliver a white label crypto neo bank app with a full compliance pack, a hardened custody solution, and commercial integrations so your capital can be deployed with confidence.

Frequently Asked Questions

01. What advantages does Poland’s payment infrastructure offer for crypto neo banks?

Poland’s modern payment infrastructure, characterized by instant rails and high transaction frequency, creates a favorable environment for integrated crypto-fiat products, enhancing margins for merchants and corporates while benefiting from recent regulatory clarity.

02. What key pain points does a crypto neo bank address for businesses in Poland?

A crypto neo bank solves issues such as costly cross-border payments, fragmented on/off ramps for consumers and merchants, inefficient corporate treasury management, and poor merchant acceptance paths for crypto receipts.

03. What are the essential criteria for investors in the crypto banking sector?

Investors require proof of custody safety, guaranteed instant liquidity, and demonstrated regulator-ready compliance to ensure scalability and avoid growth stalls in the crypto banking sector.

Crypto World

Brazil lawmakers move to outlaw algorithmic stablecoins like USDe, Frax

Brazil advances a bill to ban algorithmic stablecoins and force all domestic issuers to fully collateralize tokens, tightening rules in a market where stablecoins drive 90% of crypto flows.

Summary

- Bill 4.308/2024 would prohibit issuance or trading of uncollateralized, code-based stablecoins and introduce prison terms of up to eight years for minting unbacked tokens.

- Foreign issuers like USDT and USDC would need Brazilian authorization, while local exchanges must verify comparable compliance standards or assume direct risk responsibility.

- The proposal, still subject to further committee and Senate approvals, could force algorithmic projects to redesign or exit a market processing $6b–$8b in monthly crypto volume.

Brazil’s Congress has fired a clear warning shot at uncollateralized stablecoins, advancing a bill that would effectively outlaw algorithmic designs such as Ethena’s USDe and Frax in one of crypto’s busiest markets.

Brazil inches closer towards stablecoin outlawing

Bill 4.308/2024, approved this week by the Science, Technology, and Innovation Committee, “prohibits the issuance or trading of stablecoins … which aim to maintain their value through code rather than collateral,” tightening the definition of what can legally pass as a fiat‑pegged asset in Brazil. Under the proposal, all stablecoins issued domestically must be “fully backed by segregated reserve assets,” with lawmakers creating a new criminal offense for minting unbacked tokens that carries penalties of up to eight years in prison and reframes such issuance as financial fraud.

The move comes after global scrutiny of unbacked models following Terra’s 2022 collapse and amid explosive local demand for dollar‑linked tokens. Data from Brazil’s tax authority show that stablecoins already drive roughly 90% of the country’s reported crypto transaction volumes, cementing their role as the main on‑ramp for digital assets and cross‑border flows. That dominance has made Brazil a test case for regulators worldwide: earlier analysis from Chainalysis and local officials similarly highlighted that “over 90% of Brazilian crypto flows are now stablecoin‑related,” underscoring the systemic stakes.

Foreign issuers are firmly in the crosshairs. Under the bill, offshore stablecoins such as Tether’s USDT and Circle’s USDC could only be offered by entities authorized to operate in Brazil, while local exchanges would be required to verify that issuers comply with standards “similar to Brazil’s,” or else assume direct responsibility for risk management. That aligns with a broader policy push to tax and formalize crypto flows, including plans to subject stablecoin transactions to Brazil’s IOF financial operations tax and stricter reporting regimes.

The proposal still needs sign‑off from the Finance and Taxation and Constitution, Justice, and Citizenship committees before heading to the Senate, but the direction of travel is clear: Brazil is moving toward a fully collateralized, tightly supervised stablecoin stack. If passed, the law would force algorithmic projects to either abandon their core design or exit a market that processes between $6 billion and $8 billion in crypto volume every month, much of it now intermediated through stablecoins.

This regulatory pivot lands against a volatile market backdrop. Bitcoin (BTC) trades near $71,392, with a 24‑hour range between roughly $70,120 and $76,181 on about $94.1B in volume. Ethereum (ETH) changes hands around $2,114, after swinging between $2,080 and $2,294 over the past day on roughly $46.3B in turnover. Solana (SOL) sits close to $91.48, having traded between about $90.56 and $100.52 on more than $7.5B of volume as traders reassess risk across the complex.

Brazil’s tax authority and central bank have repeatedly flagged the dominance of stablecoins in local flows, with recent analyses and consultations detailing how new rules could reshape cross‑border payments, self‑custody, and foreign‑issued tokens.

Crypto World

Strategy (MSTR) Stock: Analyst Slashes Target 60% Yet Keeps Buy Rating

TLDR

- Strategy stock dropped 5.7% to $125.66 Wednesday, tracking toward its lowest close since September 2024

- Canaccord Genuity maintained a Buy rating while cutting its price target from $474 to $185, a 60% reduction

- The company’s 713,502 Bitcoin holdings are valued at $53.6 billion as Bitcoin trades around $73,000

- Strategy’s premium to Bitcoin assets compressed to 1.06x from previous multiples exceeding 2x

- Analyst expects Bitcoin to rally 20% in 2026 and Strategy to reach a 1.25x valuation multiple

Strategy stock extended its losing streak Wednesday with a 5.7% decline to $125.66. The drop followed Canaccord Genuity’s decision to cut its price target by 60%.

The firm lowered its target from $474 to $185. Canaccord maintained its Buy rating despite the substantial reduction.

Strategy shares are down 72% since July. Wednesday’s decline put the stock on pace for its lowest close since September 9, 2024.

The price target cut reflects Bitcoin’s sharp decline. The cryptocurrency dropped to around $73,000 after hitting record highs above $126,000 in October.

Strategy holds 713,502 Bitcoins worth approximately $53.6 billion. The company’s average purchase price is $76,052 per coin.

Bitcoin Premium Evaporates

Strategy’s valuation premium has collapsed. The stock’s market-to-net-asset-value ratio now stands at 1.06. Investors previously paid more than 2x the value of Strategy’s Bitcoin holdings.

Bitcoin recently traded below Strategy’s average cost. This sparked worries about the company’s debt and dividend payments.

Canaccord analyst Joseph Vani dismissed those concerns. Strategy carries $8 billion in convertible debt against $53.6 billion in Bitcoin assets.

Vani said dividend payments on preferred stock can be funded through modest share sales. He described Strategy’s structure as built to survive a prolonged crypto downturn.

Bitcoin Rebound Expected

The analyst believes Bitcoin has been incorrectly treated as a risk asset. Vani argues it should trade as a store of value based on scarcity and verifiability.

“MSTR shares remain a bit of a lightning rod for media attention when BTC is weak,” Vani wrote. He suggested the business model was designed for market volatility.

Canaccord projects Bitcoin will rebound approximately 20% in 2026. The firm acknowledged uncertainty around timing the recovery.

Strategy won’t recapture its previous premium anytime soon. Canaccord expects shares to reach a 1.25x multiple relative to Bitcoin assets.

Strategy reports fourth-quarter earnings Thursday. The company will likely post an unrealized loss due to Bitcoin’s quarterly decline.

Vani emphasized Bitcoin’s outlook matters more than quarterly results. Strategy’s performance remains directly tied to cryptocurrency prices.

The company pioneered the digital-asset treasury strategy. Strategy issues equity and debt to accumulate Bitcoin holdings.

Bitcoin hit its lowest point in over a year Tuesday. The cryptocurrency’s weakness has pressured Strategy stock throughout the downturn.

Canaccord believes Bitcoin’s sell-off may be nearing an end. The firm sees the cryptocurrency as undervalued at current levels.

Strategy’s convertible debt remains manageable relative to its Bitcoin position. The company’s holdings provide substantial coverage for its obligations.

Crypto World

14-Month Low Sparks Fears of a Deeper Fall Below $60K

Is BTC headed for a crash to $25,000?

Bitcoin (BTC) has experienced a steep decline over the past weeks, mirroring the broader crypto market crash.

According to some analysts and experts, the situation could worsen for bulls in the short term, with the price at risk of falling below $60,000.

Fasten Your Belts

Just recently, the leading cryptocurrency tumbled below $70,000 for the first time since November 2024. As of press time, it trades at around $69,300, down 21% over the past week alone.

The renowned analyst Ali Martinez suggested that the bears might be just stepping in. He reminded that since 2015, every time BTC has lost the 100-week simple moving average (SMA), it has failed to reclaim it in time and continued toward the 200-week SMA. According to his chart, the price could drop to as low as $57,600. Prior to that, Martinez claimed that the next key support levels for BTC after the drop under $77,086 are $60,176 and $47,824.

The trader, using the X handle Hardy, also recently made a pessimistic prediction. They envisioned a massive decline in the coming months, with the bottom set at roughly $30,000.

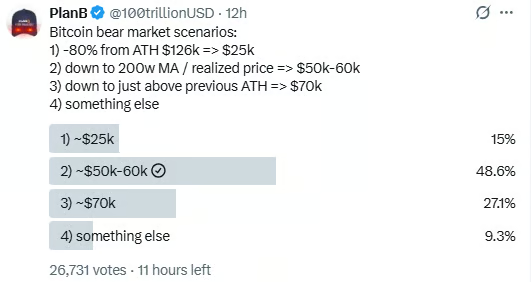

Meanwhile, PlanB (the anonymous creator of the Stock-to-Flow (S2F) model) believes several scenarios are possible, including a collapse to $25,000 and a retreat to $50,000- $60,000. The analyst took it to X to ask the followers for their take on the matter. Nearly half of the participants think a plunge to $50K-$60K is the most plausible option, while only 15% see the valuation nosediving to $25K.

Recent investor behavior supports the bearish thesis. According to data from CryptoQuant, the amount of BTC held on exchanges has been rising over the past few weeks. This suggests that many market participants have moved their holdings from self-custody to centralized platforms, typically interpreted as a pre-sale step.

You may also like:

Is It Really Over?

While BTC’s current condition may appear weak, several indicators suggest a potential rebound ahead. The Relative Strength Index (RSI) measures the speed and magnitude of recent price changes.

It ranges from 0 to 100, and anything below 30 means that the asset is oversold and due for a potential resurgence. On the contrary, ratios above 70 are considered bearish territory. As of this writing, the RSI stands at roughly 19.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

TRX outperforms BTC as Tron Inc continues to accumulate the token

- Tron (TRX) outperforms Bitcoin (BTC) despite recent market volatility.

- Tron Inc. keeps accumulating TRX, boosting token support.

- Key resistance for Tron sits at $0.2846 while the immediate support is at $0.2758.

Of late, Tron (TRX) has demonstrated remarkable resilience in the volatile cryptocurrency market.

Despite overall market weakness, TRX has outperformed Bitcoin over the past few weeks.

The token has only seen a modest decline of around 2.3% in the past 24 hours, compared to Bitcoin’s sharper drop of 7.3%.

At press time, TRX traded at approximately $0.2797, maintaining a stable position within its 24-hour range of $0.2799 to $0.2868.

This strong performance is closely linked to the continued accumulation strategy by Tron Inc., the company behind the TRX ecosystem.

Tron Inc.’s strategic TRX purchases

Tron Inc., a Nasdaq-listed firm focused on crypto treasury strategies, has been actively increasing its TRX holdings in recent months.

The company’s treasury currently holds nearly 680 million TRX tokens after recent purchases amounting to around 175,000 TRX (worth approximately $49,000).

Notably, Justin Sun, the founder of Tron, has publicly endorsed the company’s buy-the-dip strategy, encouraging continued accumulation.

Tron Inc.’s approach mirrors strategies seen in other corporate crypto treasuries, such as MicroStrategy’s Bitcoin holdings.

By holding TRX as a core asset, Tron Inc. signals long-term confidence in the token and the broader Tron ecosystem.

The accumulation also serves as a stabilizing factor, providing underlying support to TRX during periods of market volatility.

TRX technical outlook and the key levels to watch

From a technical perspective, TRX faces important resistance and support levels.

The first major resistance, according to analysts, is at $0.2846, which, if broken, could push the token toward $0.2944.

The third resistance level lies at $0.3012, offering a potential upside target for bullish traders.

On the downside, TRX must maintain support at $0.2758 to avoid further decline.

Technical indicators, however, signal a possible continuation of the current bearish trend with TRX currently below its 50-day and 200-day EMAs, reflecting short-term bearish momentum.

The MACD also remains on the negative side, and the RSI is hovering near 35, indicating persistent selling pressure.

A drop below this level could see the token fall to the next support near $0.2635.

However, the strong accumulation by Tron Inc. provides a stabilizing force, which could help the token recover and surpass resistance levels.

Market sentiment

Market sentiment for TRX remains cautiously optimistic.

Even though the token has slipped for several consecutive days, the accumulation trend suggests institutional confidence.

Derivatives data show negative funding rates, implying that traders are willing to pay to hold short positions.

Futures open interest has slightly declined, signaling reduced speculative activity.

This environment may allow TRX to consolidate before attempting another upward move.

Analysts suggest that maintaining above $0.2758 is critical for short-term momentum.

Breaking above $0.2846 could reignite bullish sentiment, while failure to hold support may trigger deeper corrections.

Overall, TRX’s relative outperformance against Bitcoin, combined with Tron Inc.’s treasury strategy, points to a token with strong institutional backing.

Crypto World

Nvidia (NVDA) Stock Drops as H200 Export Negotiations Remain Unresolved

TLDR

- Nvidia stock fell 1.4% to $177.74 as H200 chip export negotiations with the Trump administration remain stuck over Know-Your-Customer requirements and other licensing conditions.

- The U.S. signaled approval for ByteDance’s chip purchase two weeks ago, but commercially practical terms have not been finalized.

- Nvidia warns restrictive conditions could drive Chinese customers to foreign chip suppliers as China has already granted preliminary approval to ByteDance, Tencent, Alibaba, and Deepseek.

- Stock trades below key resistance levels at $182-$184 with critical support at the 200-day moving average near $168.

- Commerce Department’s January 15 regulation requires third-party lab testing and rigorous customer screening to prevent military access.

Nvidia shares dropped 1.4% to $177.74 on February 5 as the chipmaker’s negotiations with the Trump administration over H200 AI chip exports remain unresolved. The regulatory uncertainty is weighing on investor sentiment as both sides work to finalize commercially viable licensing terms.

The Trump administration indicated roughly two weeks ago it would approve ByteDance’s license to purchase H200 chips. However, Nvidia has not agreed to the proposed conditions. The main sticking point involves Know-Your-Customer procedures designed to prevent Chinese military entities from accessing advanced AI technology.

Nvidia clarified its position through a spokesperson. “We aren’t able to accept or reject license conditions on our own,” the company said. “Although KYC is important, KYC is not the issue. For American industry to make any sales, the conditions need to be commercially practical, else the market will continue to move to foreign alternatives.”

Regulatory Framework Takes Shape

The Commerce Department published new regulations on January 15 that formally loosened licensing policy for advanced AI chips. But the framework includes strict requirements. Applicants must certify their customers will implement rigorous screening procedures to prevent unauthorized remote access.

Companies must also provide lists of remote users connected to countries of concern including Iran, Cuba, and Venezuela. A U.S. third-party lab must test the chips before shipment. This testing requirement is viewed as the mechanism for collecting the U.S. government’s 25% fee on sales.

President Trump announced the chip export arrangement in December. The same terms apply to comparable chips from Advanced Micro Devices and Intel. China hawks criticized the decision as a national security risk.

China has granted preliminary approval to ByteDance, Tencent, Alibaba, and AI startup Deepseek to import the chips. Regulatory conditions on China’s side are still being finalized.

Technical Picture Shows Weakness

Nvidia stock is trading below its 20-day moving average at $184 and 50-day moving average at $182. Both levels now act as resistance zones. The 200-day moving average near $168 represents the key support level that would preserve the broader uptrend.

The Relative Strength Index sits in the low 30s, approaching oversold conditions without confirming a reversal. Volume has been moderate during the decline, suggesting a corrective move rather than panic selling.

Near-Term Outlook

Analysts expect Nvidia to trade in a $170 to $185 range until regulatory clarity emerges. A break above $185 would require positive developments on export approvals or strength across the AI sector. That could push shares toward $195-$200.

One source indicated some chips are likely to reach China before Trump’s planned April meeting with Chinese President Xi Jinping. The Commerce Department typically circulates pending licenses to State, Defense, and Energy departments before finalizing terms.

Nvidia emphasized it serves as an intermediary between U.S. regulators and end customers. The company cannot unilaterally modify license conditions but can provide feedback on commercial viability. The prolonged approval process has delayed H200 orders as Chinese customers await clarity on national security requirements.

Crypto World

SoFi hits record revenue and doubles down on crypto

SoFi posts record quarter with $1B revenue, stronger crypto and payments push, and 2026 growth outlook as shares climb over 6% on guidance.

Summary

SoFi Technologies Inc. reported its first billion-dollar revenue quarter and net income of $173.5 million in the fourth quarter, the company announced, marking the financial technology firm’s ninth consecutive profitable quarter.

Adjusted net revenue reached $1.013 billion, up 37% from the same period last year, according to the company’s financial results. Adjusted EBITDA grew 60.6% to $317.6 million, representing a 31% margin. Fee-based revenue surged 53% to $443.3 million, the company reported.

The fintech added a record 1.027 million new members during the quarter, bringing its total membership to 13.7 million, with product additions hitting 1.6 million. Financial Services products, including SoFi Money, Relay, and Invest, drove 89% of the expansion, with segment net revenue rising 78% to $456.7 million, according to the results.

SoFi advanced its cryptocurrency and blockchain strategy in the fourth quarter, launching its stablecoin, SoFiUSD, on a public blockchain for enterprise 24/7 settlement and resuming consumer crypto trading. The company also expanded blockchain-enabled cross-border payments via the Bitcoin Lightning Network in over 30 countries, following its partnership with Lightspark.

Chief Executive Officer Anthony Noto outlined plans for borrowing and staking options, building on earlier 2025 announcements, according to the company.

Management projected total membership growth of at least 30% in 2026, with full-year adjusted net revenue expected at $4.66 billion and adjusted net income around $825 million. Shares rose over 6% in pre-market trading following the announcement.

Crypto World

A16Z says AI agents will need crypto rails for identity and payments

AI agents will increasingly transact and interact on-chain, with blockchains providing identity, payments, and contract rails to prevent impersonation and automate tasks.

Summary

- A16Z argues AI agents need blockchain rails for micropayments, high-speed, low-fee transactions, and automated smart contract execution.

- The firm sees blockchains as critical identity infrastructure to verify agents and reduce impersonation in digital ecosystems.

- A16Z frames crypto as the technical backbone for autonomous AI systems, aligning with its broader AI–blockchain investment thesis.

Venture capital firm Andreessen Horowitz (A16Z) stated that blockchain technology may serve a critical function in verifying artificial intelligence agents and preventing impersonation, according to a report published by the firm.

The investment company explained that on-chain tools are particularly well-suited to support AI agent activities, including micropayments, high-velocity transactions, and smart contract execution.

A16Z indicated that blockchains could provide essential identity verification infrastructure as AI agents become more prevalent in digital ecosystems.

The firm’s analysis highlighted the technical compatibility between blockchain systems and the operational requirements of autonomous AI agents, particularly in scenarios requiring rapid, low-value transactions and automated contract execution.

Andreessen Horowitz, known as A16Z, is a prominent Silicon Valley venture capital firm that has invested extensively in cryptocurrency and blockchain technology companies.

Crypto World

GlobalStake rolls out bitcoin yield gateway as institutions revisit BTC yield

Institutional attitudes toward bitcoin yield are beginning to shift and there is now renewed interest in BTC rewards after years of skepticism driven by smart-contract risk, leverage, and opaque strategies, GlobalStake co-founder Thomas Chaffee told CoinDesk on Thursday.

Products that allow users to earn a return on their bitcoin holdings often require wrapping BTC into protocols, involving smart contract risk or strategies that don’t scale, so institutions didn’t see “a risk-return profile that made sense,” according to Chaffee.

That reluctance is starting to change, Chaffee said, not because institutions suddenly want more risk, but because the types of strategies available to them have evolved. Rather than protocol-based yield or token incentives, allocators are increasingly gravitating toward fully collateralized, market-neutral approaches that resemble traditional financial strategies already familiar to hedge funds and treasuries, he said.

“The behavior change we’re seeing isn’t institutions chasing yield,” Chaffee said. “It’s institutions finally engaging once the strategies, controls, and infrastructure look like something they can actually deploy capital into at scale.”

The renewed interest comes after years of failed or short-lived attempts to generate yield on bitcoin, many of which unraveled during the 2022 market downturn as prominent lenders froze withdrawals and ultimately collapsed amid liquidity stress, most notably when crypto lending service Celsius Network indefinitely paused withdrawals and transfers citing “‘extreme market conditions’” in mid-2022 and later entered bankruptcy.

Chaffee is not the only one seeing renewed institutional interest in bitcoin yield. “People holding bitcoin, — whether on balance sheet or as investors — increasingly see it as a pot just sitting there,” Richard Green, director of Rootstock Institutional, told CoinDesk recently. “It can’t just sit there doing nothing; it needs to be adding yield.” Green said professional investors now want their digital assets to “work as hard as possible” within their risk mandates.

Chaffee explained that GlobalStake, which provides staking infrastructure across proof-of-stake networks, began hearing the same question repeatedly from clients over the past several years: whether similar institutional-grade yield opportunities existed for bitcoin.

GlobalStake unveiled its Bitcoin Yield Gateway on Thursday, a platform designed to aggregate multiple third-party bitcoin yield strategies behind a single onboarding, compliance, and integration layer.

The co-founder explained the company expects roughly $500 million in bitcoin to be allocated within three months. “We expect the bitcoin to be allocated during the gateway’s first-quarter roll-out period, sourced from a custodial partner based in Canada, demand generated by parties through our partner MG Stover, and our clients, which include family offices, digital asset treasuries (DATs), corporate treasuries, and hedge funds.”

Other firms are approaching the problem from the infrastructure layer. Babylon Labs, for example, is developing systems that allow native bitcoin to be used as non-custodial collateral across financial applications, an effort aimed at expanding BTC’s utility rather than generating yield directly.

Crypto World

Alphabet Beats Expectations as AI Spending Risks Take Center Stage

Editor’s note: Alphabet has reported a strong fourth quarter, beating market expectations on both revenue and earnings, driven by continued resilience in advertising and a sharp acceleration in Google Cloud profitability. While headline growth remains solid, the results have refocused investor attention on the scale of Alphabet’s capital expenditure, particularly its aggressive push into artificial intelligence. With AI adoption expanding rapidly across platforms like Gemini, the key question is no longer demand, but whether and when that usage can be translated into sustainable revenue and returns for shareholders.

Key points

- Alphabet’s Q4 revenue rose 18% year on year, with earnings exceeding expectations.

- Google Cloud revenue jumped 48% to USD 17.7 billion, with operating income more than doubling.

- Advertising revenue remained resilient, growing 14% year on year.

- Capital expenditure reached USD 91.5 billion in the quarter, with 2026 guidance set at USD 175–185 billion.

- Gemini has surpassed 750 million monthly users, highlighting rapid AI adoption.

Why this matters

Alphabet’s results underline a broader shift across Big Tech, where profitability in core businesses is increasingly funding massive AI investment cycles. For investors, the tension lies between long-term strategic positioning and near-term pressure on free cash flow and margins. For the wider digital economy, Alphabet’s spending signals how central AI infrastructure has become to future competitiveness, influencing cloud markets, enterprise adoption, and the pace at which AI moves from experimentation to monetised products.

What to watch next

- How Alphabet manages capital expenditure discipline relative to revenue growth.

- Signals around AI monetisation beyond user growth metrics.

- Cloud margin trends as investment intensity remains elevated.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Abu Dhabi, United Arab Emirates – February 05, 2026: Alphabet (NASDAQ: GOOG) reported a solid fourth quarter, with revenue rising 18% year on year and earnings surpassing market expectations, underpinned by resilient performance across its core businesses.

Google’s advertising segment continued to show strength, with advertising revenue up 14% year on year. Google Cloud was the standout performer, posting revenue growth of 48% to USD 17.7 billion and delivering operating income of USD 5.3 billion—more than double the figure recorded in the same period last year.

Commenting on the results, Zavier Wong, Market Analyst at eToro, said that while Alphabet’s headline numbers were encouraging, investor attention has shifted toward the scale and execution risk of the company’s capital expenditure plans.

During the quarter alone, Alphabet spent USD 91.5 billion and has guided for capital expenditures of USD 175–185 billion in 2026—well above market expectations. From a shareholder perspective, this level of spending materially reduces free cash flow in the near term, with returns on AI investments yet to be proven at scale.

Alphabet is effectively asking investors to be patient and trust that artificial intelligence will evolve into a significant revenue driver.

While the company has little choice but to invest heavily to remain competitive with rivals such as Microsoft, Amazon, and OpenAI, the timeline for meaningful AI monetisation remains uncertain.

AI adoption is clearly accelerating, with Alphabet’s Gemini platform surpassing 750 million monthly users.

However, the gap between usage and monetisation remains wide, and prolonged delays in converting AI engagement into revenue could weigh on margins and earnings.

Wong added that although AI spending has so far been viewed as necessary and largely justified, Alphabet’s latest guidance represents a material escalation. “This marks one of the most significant risks we’ve seen so far in the current AI investment cycle,” he noted.

Media Contact:

PR@etoro.com

About eToro

eToro is the trading and investing platform that empowers you to invest, share and learn. We were founded in 2007 with the vision of a world where everyone can trade and invest in a simple and transparent way. Today we have 40 million registered users from 75 countries. We believe there is power in shared knowledge and that we can become more successful by investing together. So we’ve created a collaborative investment community designed to provide you with the tools you need to grow your knowledge and wealth. On eToro, you can hold a range of traditional and innovative assets and choose how you invest: trade directly, invest in a portfolio, or copy other investors. You can visit our media centre here for our latest news.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech1 day ago

Tech1 day agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat3 hours ago

NewsBeat3 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report