Crypto World

Alphabet Beats Expectations as AI Spending Risks Take Center Stage

Editor’s note: Alphabet has reported a strong fourth quarter, beating market expectations on both revenue and earnings, driven by continued resilience in advertising and a sharp acceleration in Google Cloud profitability. While headline growth remains solid, the results have refocused investor attention on the scale of Alphabet’s capital expenditure, particularly its aggressive push into artificial intelligence. With AI adoption expanding rapidly across platforms like Gemini, the key question is no longer demand, but whether and when that usage can be translated into sustainable revenue and returns for shareholders.

Key points

- Alphabet’s Q4 revenue rose 18% year on year, with earnings exceeding expectations.

- Google Cloud revenue jumped 48% to USD 17.7 billion, with operating income more than doubling.

- Advertising revenue remained resilient, growing 14% year on year.

- Capital expenditure reached USD 91.5 billion in the quarter, with 2026 guidance set at USD 175–185 billion.

- Gemini has surpassed 750 million monthly users, highlighting rapid AI adoption.

Why this matters

Alphabet’s results underline a broader shift across Big Tech, where profitability in core businesses is increasingly funding massive AI investment cycles. For investors, the tension lies between long-term strategic positioning and near-term pressure on free cash flow and margins. For the wider digital economy, Alphabet’s spending signals how central AI infrastructure has become to future competitiveness, influencing cloud markets, enterprise adoption, and the pace at which AI moves from experimentation to monetised products.

What to watch next

- How Alphabet manages capital expenditure discipline relative to revenue growth.

- Signals around AI monetisation beyond user growth metrics.

- Cloud margin trends as investment intensity remains elevated.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Abu Dhabi, United Arab Emirates – February 05, 2026: Alphabet (NASDAQ: GOOG) reported a solid fourth quarter, with revenue rising 18% year on year and earnings surpassing market expectations, underpinned by resilient performance across its core businesses.

Google’s advertising segment continued to show strength, with advertising revenue up 14% year on year. Google Cloud was the standout performer, posting revenue growth of 48% to USD 17.7 billion and delivering operating income of USD 5.3 billion—more than double the figure recorded in the same period last year.

Commenting on the results, Zavier Wong, Market Analyst at eToro, said that while Alphabet’s headline numbers were encouraging, investor attention has shifted toward the scale and execution risk of the company’s capital expenditure plans.

During the quarter alone, Alphabet spent USD 91.5 billion and has guided for capital expenditures of USD 175–185 billion in 2026—well above market expectations. From a shareholder perspective, this level of spending materially reduces free cash flow in the near term, with returns on AI investments yet to be proven at scale.

Alphabet is effectively asking investors to be patient and trust that artificial intelligence will evolve into a significant revenue driver.

While the company has little choice but to invest heavily to remain competitive with rivals such as Microsoft, Amazon, and OpenAI, the timeline for meaningful AI monetisation remains uncertain.

AI adoption is clearly accelerating, with Alphabet’s Gemini platform surpassing 750 million monthly users.

However, the gap between usage and monetisation remains wide, and prolonged delays in converting AI engagement into revenue could weigh on margins and earnings.

Wong added that although AI spending has so far been viewed as necessary and largely justified, Alphabet’s latest guidance represents a material escalation. “This marks one of the most significant risks we’ve seen so far in the current AI investment cycle,” he noted.

Media Contact:

PR@etoro.com

About eToro

eToro is the trading and investing platform that empowers you to invest, share and learn. We were founded in 2007 with the vision of a world where everyone can trade and invest in a simple and transparent way. Today we have 40 million registered users from 75 countries. We believe there is power in shared knowledge and that we can become more successful by investing together. So we’ve created a collaborative investment community designed to provide you with the tools you need to grow your knowledge and wealth. On eToro, you can hold a range of traditional and innovative assets and choose how you invest: trade directly, invest in a portfolio, or copy other investors. You can visit our media centre here for our latest news.

Crypto World

How Borderless Markets Are Unlocking Frictionless Access and Liquidity via Digital Asset Tokenization

For decades, global financial markets have been shaped by geographic boundaries, jurisdiction-specific regulations, and legacy infrastructure designed for localized participation. Even in mature economies like the United States, access to high-value or alternative assets is often restricted by capital requirements, lengthy settlement cycles, and reliance on multiple intermediaries. While digitization has improved operational efficiency, it has not eliminated the structural friction that limits who can participate in markets or how freely capital can move across borders.

While digitization increased operational efficiencies, it did not remove the structural impediments to market participation or the unfettered ability of capital to move cross-border. With emerging borderless markets, financial institutions will overcome these barriers by providing a shared digital infrastructure, rather than siloed regional systems. In essence, borderless markets create an ecosystem where assets will be accessible, transferable, and traded on a global scale; additionally, these new types of markets will enable continuous accessibility, transparency of ownership, and seamless participation from all participants relative to each asset.

Central to this recent transformation of who can access the market, or what level of liquidity is available in the market, is the digital asset tokenization. Through the development of sophisticated tokenizing assets, real-world and financial assets can be converted from physical form to a programmable digital representation that can be transacted across multiple markets without being subject to geographic limits. Tokenizing assets, combined with the use of enterprise-level tokenization platforms and the pending development of specialized tokenization development services, creates a mechanism for frictionless access to the market and provides the necessary level of liquidity to maintain a level of market efficiency.

What Are Borderless Markets and Why Do They Matter to U.S. Investors?

Borderless markets are financial ecosystems where assets are created, accessed, and traded without being constrained by geography or legacy financial rails. These markets rely on digital asset tokenization to standardize ownership, enable real-time settlement, and allow global participation through a unified digital infrastructure. Rather than operating through fragmented regional systems, borderless markets are built on tokenized frameworks that support seamless access and liquidity across jurisdictions.

For U.S. investors and enterprises, borderless markets are increasingly relevant because they align directly with modern capital efficiency and scalability goals. Through structured asset tokenization development, traditionally restricted or illiquid assets can be redesigned to support broader participation while maintaining transparency and control.

1. Expanded Market Access

The traditional investment paradigm has limited participation due to the high minimum thresholds associated with investments, jurisdiction restrictions, and complicated procedures for onboarding investors. Tokenization enables borderless marketplaces, providing Americans access to multiple asset classes around the world—like real estate, private credit, infrastructure, etc.—through fractional digital ownership models.

2. More Accessible Capital Movement

capital currently invested in legacy markets are usually tied up for long periods, depending on how long each transaction takes to settle and all intermediate steps in the process between the time a person sends money and receives it back. Borderless marketplaces facilitate capital mobility in that they accelerate – or complete – transaction processing so there is less time between transaction completion, and since they allow investors to redeploy capital across the entire marketplace, they shorten traditional holding periods.

3. Increased Liquidity Opportunities

Because the liquidity of an asset is no longer dependent on a specific location and only one buyer and instead can be accessed through a tokenized asset’s availability on multiple marketplaces globally for anyone to buy at any time, it necessarily increases the velocity of transactions being completed, leading to improved price discovery.

Competitive Advantage for U.S.-based Enterprise

U.S. companies employing borderless market principles to attract financing will not only have access to potential sources of capital, but also will be able to conduct business with that capital in a manner aligned with the laws and regulations of the state or country where they were originally incorporated: creating a significant competitive advantage when it comes to raising funds, monetizing an asset, and expanding into international markets.

Therefore, borderless markets are not just about monetary access; instead, they redefine how markets are structured by providing the infrastructure for establishing market operations through tokenized assets across all geographic regions.

Build a Tokenization Platform with Antier

How Digital Asset Tokenization Enables Borderless Market Access

Digital asset tokenization involves representing ownership rights, economic value, and transfer conditions of an asset as blockchain-based tokens governed by smart contracts. Unlike traditional digitization, tokenization embeds access and transferability directly into the asset’s design.

Tokenization for Improved Market Access

Tokenization for improved market access transforms participation models in several critical ways:

- Lower Investment Thresholds: High-value assets can be divided into smaller units, allowing broader participation from both retail and institutional investors.

- Always-On Accessibility: Tokenized assets operate on blockchain networks that function continuously, removing time-zone and market-hour restrictions.

- Direct Asset Interaction: Investors can engage with assets through digital wallets and platforms, reducing reliance on layered intermediaries.

- Global Distribution: Asset issuers can reach international investors without duplicating infrastructure or market-specific issuance processes.

For U.S.-based issuers, digital asset tokenization enables controlled global exposure while preserving governance, reporting, and transparency standards.

Asset Tokenization Development as the Foundation for Liquidity

Liquidity challenges are often embedded in the structural design of assets rather than market demand. Many traditional assets are illiquid due to high unit values, long settlement cycles, and limited secondary trading opportunities. Asset tokenization development addresses these limitations by redesigning assets specifically for liquidity.

How Tokenization Improves Liquidity

Understanding how tokenization improves liquidity requires examining its impact on market mechanics:

- Expanded Buyer Participation: Fractional ownership increases the number of potential buyers, creating deeper and more active markets.

- Secondary Market Enablement: Tokenized assets are inherently compatible with digital trading venues, supporting ongoing liquidity beyond primary issuance.

- Reduced Settlement Risk: Near-instant settlement minimizes counterparty risk and capital lock-up, encouraging higher transaction volumes.

- Programmable Liquidity Controls: Smart contracts automate compliance, transfer restrictions, and corporate actions, enabling liquidity without regulatory compromise.

For U.S. enterprises managing traditionally illiquid assets, asset tokenization development unlocks liquidity while maintaining institutional-grade controls.

Tokenization Platform Development for Seamless Global Participation

While tokenized assets form the foundation, scalable borderless markets rely on sophisticated tokenization platform development. Platforms serve as the operational layer that manages issuance, onboarding, trading, and lifecycle events.

Core Capabilities of Enterprise Tokenization Platforms

Effective tokenization platforms support frictionless access through:

- Integrated Investor Onboarding: Identity verification and eligibility checks aligned with U.S. regulatory expectations.

- Automated Issuance Workflows: Streamlined token creation, allocation, and distribution processes.

- Cross-Border Trading Infrastructure: Support for global participation without duplicating regional systems.

- Real-Time Transparency: Continuous visibility into ownership records, transaction history, and asset performance.

Tokenization platform development ensures that borderless markets operate reliably at scale, supporting both institutional performance and long-term growth.

Why Enterprises Choose Tokenization Development Services in the U.S.

Implementing tokenization is not a plug-and-play initiative. It requires deep expertise across blockchain engineering, asset structuring, compliance alignment, and scalability planning. As a result, enterprises increasingly rely on specialized tokenization development services.

Role of a Tokenization Development Company

Partnering with an experienced tokenization development company enables organizations to:

- Design asset-specific token models aligned with liquidity and access goals

- Build scalable tokenization platforms capable of supporting multiple asset classes

- Align tokenization strategies with U.S. regulatory expectations

- Accelerate deployment timelines while maintaining security and performance

For U.S. enterprises, tokenization development services provide the foundation needed to operationalize borderless market strategies with confidence.

Use Cases Driving Borderless Markets Through Tokenization

Tokenized Real-World Assets

Real estate, commodities, and infrastructure assets benefit from fractional ownership, improved liquidity, and global investor participation.

Private Markets and Alternative Investments

Tokenization improves access to traditionally opaque private assets while enabling secondary trading opportunities.

Cross-Border Capital Formation

Issuers can raise capital globally while maintaining centralized governance and reporting frameworks.

These use cases demonstrate how borderless markets move from concept to execution through structured tokenization initiatives.

Strategic Considerations for U.S. Enterprises Entering Borderless Markets

Before launching tokenization initiatives, enterprises must evaluate:

- Asset suitability for tokenization

- Target investor demographics

- Platform scalability requirements

- Long-term liquidity and governance strategy

A structured approach to asset tokenization development ensures sustainable outcomes rather than short-term experimentation.

Frictionless Access and Liquidity as the New Market Standard

Borderless markets are redefining how value is accessed, transferred, and monetized in the global economy. Through digital asset tokenization, enterprises can overcome geographic limitations and legacy inefficiencies that have historically constrained participation and liquidity. By investing in robust asset tokenization development, scalable tokenization platform development, and expert tokenization development services, U.S. enterprises can unlock frictionless access and sustainable liquidity across global markets. Tokenization is no longer a future concept—it is the infrastructure shaping the next generation of borderless financial markets.

Crypto World

Gemini to Exit UK Market, Shifts Accounts to Withdrawal-Only From March 5

Gemini has announced it will cease operations in the United Kingdom, marking another high-profile exit as the country transitions to a stricter regulatory regime for digital asset firms.

In a notice sent to customers, Gemini said UK operations will formally end on 6 April 2026, with all UK customer accounts placed into withdrawal-only mode from 5 March 2026.

The exchange advised users to either transfer assets to an external wallet or offboard via a partner platform ahead of the deadline.

Accounts Shift to Withdrawal-Only Mode

Under the transition plan, Gemini said customers will no longer be able to trade or make new deposits after 5 March. Users who wish to liquidate crypto holdings into fiat must do so before that date, while all crypto and fiat withdrawals must be completed by 6 April.

As part of the offboarding process, Gemini has partnered with eToro, offering customers the option to open an eToro account to assist with transferring assets. Gemini also urged users to cancel recurring orders and begin unstaking any staked assets ahead of the shutdown.

The company warned customers to remain vigilant against potential scams, stating that Gemini representatives will not contact users directly by phone or text during the transition.

Regulatory Pressure in the UK Market

Gemini’s exit comes as the UK moves from an interim crypto registration regime into full authorisation under the Financial Services and Markets Act (FSMA). The shift represents a material tightening of expectations around governance, operational resilience, and senior management accountability for digital asset firms operating in the country.

While the UK has positioned itself as open to financial innovation, the new framework introduces deeper regulatory scrutiny and ongoing supervisory engagement — a dynamic that has prompted several global crypto firms to reassess their UK footprint.

A Selective Regime Takes Shape

“Gemini’s decision to exit the UK raises a bigger question than any single firm’s strategy,” said one industry observer. “What does participation look like once the UK moves from a registration regime into full FSMA authorisation?”

The transition, they noted, is not merely about meeting higher standards on paper, but about sustained oversight, historical scrutiny, and personal accountability at the senior management level. For global firms, the calculus increasingly hinges on whether the UK market justifies that level of regulatory exposure in a fast-evolving sector. Some firms will decide the trade-off makes sense. Others may not.

Implications for the UK Crypto Landscape

Gemini’s departure does not necessarily signal failure of the UK’s regulatory approach, but it does suggest the regime is intentionally selective. As authorisation moves from theory into delivery, success may depend less on scale and more on regulatory experience, judgement, and willingness to operate under continuous supervision.

Gemini was contacted for comment at press time but did not respond.

The post Gemini to Exit UK Market, Shifts Accounts to Withdrawal-Only From March 5 appeared first on Cryptonews.

Crypto World

Kalshi expands surveillance, enforcement efforts ahead of Super Bowl 60

The Kalshi logo arranged on a laptop in New York, US, on Monday, Feb. 10, 2025.

Gabby Jones | Bloomberg | Getty Images

Kalshi on Thursday announced new initiatives to expand its surveillance and enforcement frameworks as skepticism builds around the booming predictions market space.

The announcement comes days before Super Bowl 60, which has already drawn more than $160 million in prediction market trading volume, according to Kalshi. The platform and its peers allow users to buy event contracts for outcomes in politics, pop culture, financial markets and sports.

Prediction trades on predetermined outcomes — like, for example, on which companies will air Super Bowl ads on Sunday — have prompted questions of possible insider trading. New York Attorney General Letitia James on Monday issued a warning about what she called “unregulated prediction markets.”

“Being federally regulated means that Kalshi bans market manipulation, insider trading, has limits on the types of markets it lists, runs Know-Your-Customer (KYC) and Anti-Money Laundering (AML) checks on every user before they can trade, and publicly reports all trades to the CFTC daily,” the company said in a release. “Kalshi also spent years building custom prediction market trade surveillance and enforcement systems that are similar to those used in the stock market.

Kalshi said Thursday it has taken further steps, forming an independent surveillance advisory committee, which will provide quarterly analysis to the company’s outside counsel and publish statistics on investigations into suspicious activity on its platform. The company also announced surveillance partnerships with Solidus Labs and the Director of the Wharton Forensic Analytics Lab.

The prediction market will also now work with the former Under Secretary of the Treasury for Terrorism and Financial Intelligence to advise Kalshi on “market integrity, trading surveillance and financial compliance matters.”

Kalshi lawyer Robert DeNault has also been appointed to the role of Head of Enforcement, where the company said he will work with the advisory committee to identify insider trading and market manipulation.

Lastly, Kalshi said it has created hubs on its website to provide resources for consumers on responsible trading and market integrity.

In a post on X, CEO Tarek Mansour said if the company finds any wrongdoing, the penalties include fines and referrals to the Commodity Futures Trading Commission — which regulates event contracts in the U.S. — and the Department of Justice for prosecution.

“In the past year, we ran over 200 investigations and froze relevant accounts,” Mansour wrote. “Of these, over a dozen have become active cases and several have been referred to law enforcement.”

Mansour added that Kalshi has based its market surveillance system on those used by the New York Stock Exchange and the Nasdaq, flagging suspicious behavior by running trades through pattern recognition models.

“All industries have bad actors and no system is perfect, Kalshi’s included,” Mansour wrote. “But we are committed to improving daily. Lots of work ahead!”

Disclosure: CNBC has a commercial relationship with Kalshi.

Crypto World

Liquidations Top $1.3 Billion as BTC Plummets Below $67K, ETH Loses $2K Support

Most other altcoins like BNB and XRP have joined the ride south with massive declines of their own.

Bitcoin can’t catch a break in the past several days, marking consecutive multi-month lows, with the latest coming minutes ago at well under $67,000.

The last time the cryptocurrency traded at such low levels was in early November, just as the US presidential elections took place and the country elected the so-called ‘crypto president,’ Donald Trump.

The past few weeks have been brutal for BTC. It challenged $90,000 just eight days ago, last Wednesday, but the rejection at that level brought unimaginable pain for the market leader and most of the altcoin followers.

Bitcoin first dumped to $81,000 last Thursday, then continued south to under $75,000 during the weekend, but the bears kept the pressure on. The past several hours have been violent as well, with BTC plunging to $66,900 (as of press time). This means that the asset has lost well over $20,000 in just over a week.

The altcoins have not been spared. ETH continues with its massive decline, with another 9% daily decline to under $2,000 – its lowest level since last April. BNB has plunged by 10% to $660, while XRP is down by a whopping 15% in the past 24 hours alone to $1.32.

Further losses are evident from the likes of ZEC (-19%), MORPHO (-14%), NEXO (-14%), XMR (-12%), LEO (-12%), SUI (-11%), and many others. As such, it’s no wonder that over-leveraged traders have been harmed severely.

Data from CoinGlass shows that the 24-hour liquidations have rocketed to over $1.3 billion. In the past hour alone, the wrecked positions are up to $350 million. The number of wiped out traders is close to 300,000 daily, with the single-largest position taking place on Aster, which was worth over $11 million.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Uniform Labs’ Multiliquid and Metalayer Launch RWA Redemption Facility on Solana

Multiliquid and Metalayer Ventures have launched a facility that allows instant redemption (liquidity) for tokenized real-world assets (RWAs) on Solana.

In a press release shared with CryptoNews, the firm said the facility is positioned as the first dedicated vehicle intended to solve one of tokenization’s most persistent challenges: liquidity at redemption.

Raised and managed by Metalayer Ventures with support from Uniform Labs, it is designed to scale over time based on market feedback and performance, offering a blueprint for future redemption-liquidity deployments across tokenized markets.

The RWA Liquidity Gap

The launch comes as Solana’s tokenized RWA ecosystem surpasses $1 billion in on-chain assets, making it the third-largest blockchain network for tokenization.

Despite rapid growth, much of the RWA market—particularly non-Treasury assets such as private credit, private equity, and real estate—remains structurally illiquid. Redemptions are typically limited to issuer-controlled windows, rather than continuous secondary markets.

This mismatch is becoming more visible even in ostensibly “cash-like” products. The Bank for International Settlements has warned that tokenized money market funds face liquidity mismatches between on-chain instruments and off-chain settlement, a dynamic that could amplify stress during periods of elevated redemption demand.

“Traditional finance has repo markets, prime brokerage, and overnight lending facilities. Tokenized markets have had nothing comparable, until now,” said Will Beeson, founder and CEO of Uniform Labs.

How the Facility Works

Metalayer Ventures acts as the capital provider, raising and managing the pool of capital that allows instant redemptions. Multiliquid—developed by Uniform Labs—supplies the smart contract infrastructure, issuer relationships, and liquidity platform that underpin pricing, compliance enforcement, interoperability, and swaps.

Instead of waiting days or weeks for issuer-led redemptions, holders can convert supported tokenized assets into stablecoins instantly, 24/7. The facility purchases assets at a dynamic discount to net asset value (NAV), compensating liquidity providers for offering immediate access to capital.

Institutional-Grade Infrastructure on Solana

Uniform Labs expects a two-layer liquidity ecosystem to emerge: active market participants pricing real-time exits, and larger balance-sheet allocators warehousing assets to redemption for steadier yield.

The model is expected to gain traction as tokenized assets are increasingly used as collateral across DeFi and institutional venues.

The facility will initially support assets from issuers including VanEck, Janus Henderson, and Fasanara, spanning tokenized Treasury funds and select alternative assets. Integrations with Solana DeFi protocols such as Kamino are under discussion.

Nick Ducoff, head of institutional growth at the Solana Foundation, said reliable redemptions are becoming “critical infrastructure” as Solana’s RWA market scales, positioning the network as a leading venue for issuance, trading, and redemption of tokenized assets.

The post Uniform Labs’ Multiliquid and Metalayer Launch RWA Redemption Facility on Solana appeared first on Cryptonews.

Crypto World

Multiliquid, Metalayer Roll Out Instant Redemptions for Tokenized RWAs

Multiliquid and Metalayer Ventures have launched an institutional liquidity facility to provide instant redemptions for tokenized real-world assets (RWAs) on Solana.

The facility allows holders of tokenized assets to convert positions into stablecoins instantly. The vehicle is raised and managed by Metalayer Ventures, with infrastructure and market support provided by Uniform Labs, the developer behind the Multiliquid protocol, according to an announcement shared with Cointelegraph.

“Traditional finance has repo markets, prime brokerage and overnight lending facilities. Tokenized markets have had nothing comparable, until now,” said Will Beeson, founder and CEO at Uniform Labs. “This is the liquidity infrastructure that institutional RWA markets will require at scale.”

Last year, the Bank for International Settlements warned that tokenized money market funds face liquidity mismatches that could amplify stress during periods of elevated redemption demand.

Related: Startale, SBI launch blockchain for institutional FX, RWA trading

Standing buyer delivers instant RWA liquidity

Metalayer’s facility functions as a standing buyer of tokenized RWAs, purchasing assets at a dynamic discount to net asset value.

Metalayer Ventures supplies and manages the capital backing redemptions, while Multiliquid provides the smart contract infrastructure used for pricing, compliance enforcement and settlement.

The vehicle will initially support tokenized assets issued by companies including VanEck, Janus Henderson and Fasanara, covering tokenized Treasury funds and select alternative investment products.

Related: True tokenization demands asset composability, not wrapped bubbles

Solana gains ground in tokenized RWAs

Solana (SOL) has emerged as a growing venue for tokenized RWAs. It ranks eighth among blockchains by total RWA value with about $1.2 billion represented across 343 assets, according to RWA.xyz data. While its market share remains modest at 0.31%, Solana is showing steady momentum, with RWA value up by more than 10% in the past month.

Canton Network, Ethereum (ETH) and Provenance are the three largest blockchains for tokenized RWAs by total value.

Canton dominates the market with more than $348 billion in RWAs and over 88% market share. Ethereum ranks second with $15 billion in tokenized assets, while Provenance also holds $15 billion with fewer assets.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Tether Makes $100M Strategic Equity Investment in Anchorage Digital

Tether, issuer of the stablecoin USDT, said it has made a $100 million equity investment in Anchorage Digital, deepening an existing relationship between the two firms.

In a blog post the firm said the investment is being made through Tether Investments and reflects growing focus between stablecoin issuers and federally regulated financial institutions as digital assets continue to integrate into mainstream finance.

Strengthening Regulated Digital Asset Infrastructure

Anchorage Digital Bank N.A. is the first federally chartered digital asset bank in the United States, providing institutions with custody, staking, governance, settlement, and stablecoin issuance services.

Tether said the investment reflects its view that Anchorage plays a critical role in enabling digital assets to operate safely and at scale within established regulatory frameworks.

Both firms said they are focused on the foundational infrastructure that supports institutional participation in crypto markets especially as regulatory scrutiny intensifies globally.

Strategic Focus Beyond Capital

Tether said its growth has been made by a stronger emphasis on regulatory focus and collaboration with institutions operating under clear legal oversight.

Anchorage Digital’s position at the intersection of regulation and security made it a natural partner as Tether looks to support long-term market integrity.

The relationship between the two companies predates the investment. Anchorage Digital Bank is the issuer of USAT giving Tether direct experience operating within Anchorage’s compliance, custody, and banking framework. That operational familiarity has informed Tether’s decision to take an equity stake.

Institutional Confidence in Stablecoin Infrastructure

“Tether exists to challenge the status quo and build global infrastructure for freedom,” said Paolo Ardoino, CEO of Tether. “Our investment in Anchorage Digital reflects a shared belief in the importance of secure, transparent, and resilient financial systems.”

Anchorage Digital CEO and co-founder Nathan McCauley said the investment validates the firm’s long-term approach. “We’ve believed from day one that digital assets would only scale through secure, regulated foundations,” he said.

Positioning for the Next Phase of Adoption

For Tether the investment reinforces a broader strategy centered on long-term partnerships with regulated institutions that are helping define how stablecoins function within existing financial systems.

As policymakers and institutions continue to shape the future of digital money, infrastructure providers like Anchorage Digital are increasingly seen as critical intermediaries.

Tether and Anchorage Digital said they aim to support broader participation in digital assets while promoting stability, transparency and confidence — pillars they view as essential for the next phase of global digital asset adoption.

The post Tether Makes $100M Strategic Equity Investment in Anchorage Digital appeared first on Cryptonews.

Crypto World

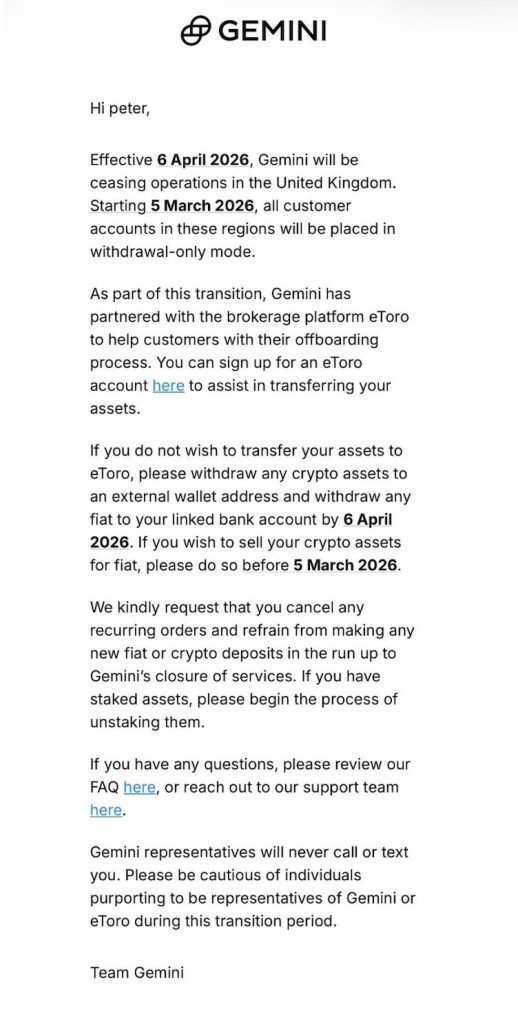

BTC price news: Bitcoin falls under $68,000

Bitcoin slid under the $68,000 level in U.S. morning hours Thursday, extending a week-long selloff that has tracked weakness across global risk assets and deepened concerns about near-term downside.

Crypto liquidations crossed $1 billion over the past 24 hours, wiping out about $980 million million in bullish leveraged bets as the slide forced traders to close positions they could not keep funded.

Price fel lunder $70,000 earlier in the day, with liquidity heatmaps pointing to further downside.

Liquidity thins out quickly until just under $70,000, per Coinglass data, where another smaller cluster appears. That makes $70,000 a mechanically important level. If price pushes cleanly through it, there’s less forced buying from liquidations to slow the move, raising the risk of a faster flush toward the high $60,000s.

A liquidation heatmap is a map of where leveraged traders are most likely to get forced out. Bright bands mark price levels with lots of estimated liquidation points, which can act like short term magnets for price moves. Traders use it to spot crowded zones and likely volatility pockets, not exact turning points.

Crypto World

Tether invests $100 million in U.S.-regulated crypto bank Anchorage

Tether, the company behind the world’s largest stablecoin USDT said it has invested $100 million in Anchorage Digital, a federally regulated digital asset bank.

Anchorage, which holds a national banking charter in the U.S., offers custody, staking, settlement and stablecoin issuance services to institutional clients.

The two companies already had a working relationship, with Anchorage serving as the banking partner behind Tether’s USAT stablecoin, designed specifically for the U.S. market to comply with local regulations.

The investment gives Tether a foothold in the fast-growing U.S. stablecoin infrastructure, which is moving towards regulated players after the GENIUS Act was written into law last year. Tether, headquartered and regulated in El Salvador, traditionally focuses on offshore users and emerging markets with its $185 billion USDT token.

“Tether exists to challenge the status quo and build global infrastructure for freedom,” said Paolo Ardoino, CEO of Tether, said in a statement. “Our investment in Anchorage Digital reflects a shared belief in the importance of secure, transparent, and resilient financial systems.”

Crypto World

Michael Saylor missed out on a $33 billion profit at Strategy

Strategy (formerly MicroStrategy) managed to turn an unrealized bitcoin (BTC) profit of $32.6 billion into a $2.2 billion loss thanks to founder Michael Saylor’s reluctance to sell.

To be specific, four months ago on October 6, the company owned 640,031 BTC acquired for $73,983 apiece but worth $125,000 apiece at prevailing market prices.

As of yesterday’s Nasdaq close, however, Strategy now owns 713,502 BTC acquired for $76,052 and worth just $72,925.

In other words, Strategy had an unrealized BTC profit of $32.6 billion on October 6 that has turned into a $2.2 billion loss.

Even excluding the last four months of purchases to restrict yesterday’s figure to the original 640,031 BTC, that still recalculates to an equally embarrassing swing from a $32.6 billion profit to a $670 million loss on only the BTC the company owned four months ago.

Read more: Michael Saylor is running out of ways to boost Strategy’s BTC per share

New lows across multiple metrics

Management’s choice to not sell means Strategy’s balance sheet has $33 billion less in assets than it could have, less capital gains tax.

This figure also ignores the effects on BTC’s price of Strategy selling such large sums.

As of yesterday’s close, the company’s common stock MSTR had a market capitalization of just 0.82x the value of the company’s BTC holdings — down 75% from its November 2024 high of 3.4x.

In addition to a 76% loss since its November 2024 high, including its latest 52-week decline of 61%, Strategy leadership has also failed to capture those tens of billions of dollars of investment income along the way.

It might seem tempting, given these losses, to point to a reminder of Saylor’s previously devout and confident proclamations that he never intended to sell Strategy’s BTC.

Unfortunately, he did say those things in the distant past, but even that promise has been deteriorating along with most other metrics at Strategy.

Indeed, Saylor now discusses the possibility of selling Strategy’s BTC, including official statements from the company and its CEO, albeit in euphemisms such as raising capital or covering dividend obligations.

Moreover, the company recently diluted equity holders for $1.44 billion with $0 in associated BTC purchases in order to shore up USD, not BTC, for a rainy day. That day might be arriving soon.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech1 day ago

Tech1 day agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat4 hours ago

NewsBeat4 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report