Entertainment

3 New to Hulu Movies I’m Watching This Weekend (November 28-30)

Black Friday isn’t all about great sales and turkey hangovers. On Hulu, it’s a marathon of movies old and new, from every genre you can possibly think of.

While choosing one to stream can be overwhelming, Watch With Us is here to help.

We’ve curated a small list of the three new-to-Hulu movies you should watch this weekend.

From the boisterous Zac Efron comedy Neighbors to the disturbing horror fantasy The Ugly Stepsister, you can’t go wrong watching any of these flicks.

‘Neighbors’ (2014)

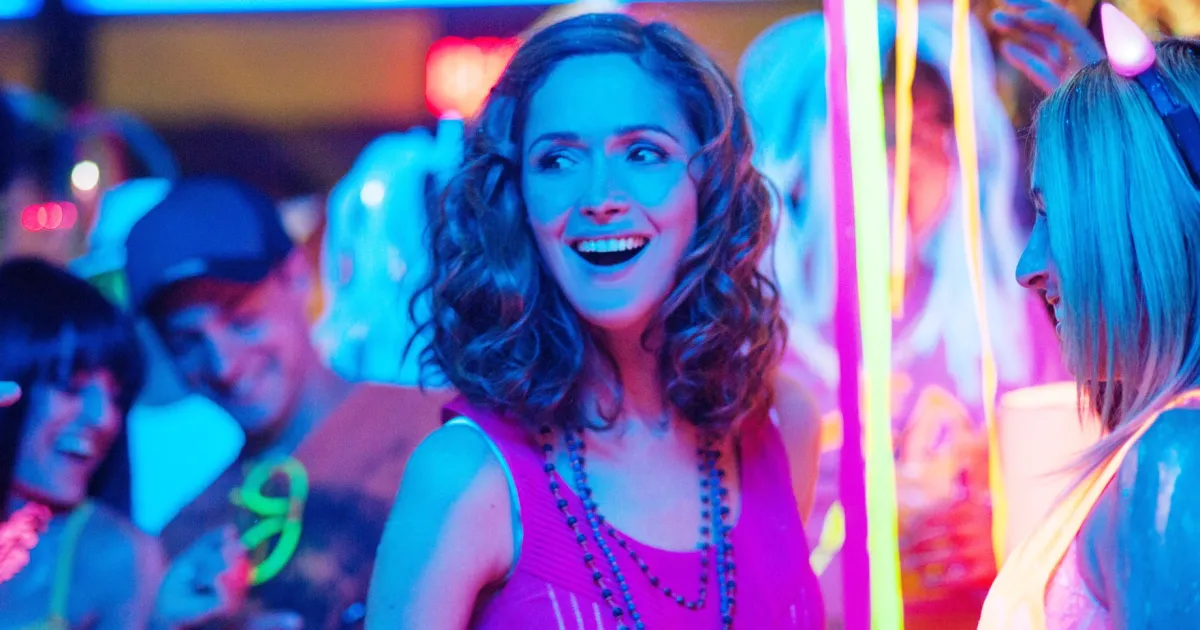

Mac (Seth Rogen) and Kelly Radner (Rose Byrne) just became parents, and their social life is almost nonexistent. That’s why they’re initially open to the new fraternity that moves into the house next door to them. The frat’s presidents, Teddy (Efron) and Pete (Dave Franco), seem like cool guys, but after a series of misunderstandings involving an out-of-control party, the Radners wage all-out war on their noisy neighbors. Teddy and Pete won’t go down without a fight, and they’re willing to do anything to keep their frat alive — even if it means destroying the Radners’ marriage.

Neighbors is a big and boisterous bro comedy that has more laughs than you think — or expect. The rivalry between Rogen and Efroin’s characters takes center stage, and while they’re hilarious, it’s Bryne who steals the show as an exasperated new mother who isn’t opposed to skullduggery to get what she wants. Normally, “the wife” character gets sidelined in a male-dominated movie like this, but Byrne shows she can play with boys and best them at their own bawdy game.

Neighbors is streaming on Hulu.

‘The Ugly Stepsister’ (2025)

Fairy tale reimaginings are all the rage these days. While some, like Wicked: For Good, are successful, others, like Disney’s Rachel Zegler-led Snow White remake, aren’t. Then there’s The Ugly Stepsister, which remiagines the Cinderella fable as a grotesque body-horror of female empowerment and obsession. Elvira (Lea Myren) is a plain-looking teenager who can’t compete with her beautiful new stepsister Agnes (Thea Sophie Loch Næss).

Desperate to improve her looks, and therefore her chances of marrying the handsome Prince Julian (Isac Calmroth), she undergoes primitive plastic surgery techniques and ingests tapeworms to make herself “beautiful.” But the more desperate Elvira becomes, the more she drives away everyone around her. As the all-important society ball approaches, Elvira is willing to do anything — including murder — to get what she wants.

A strange and hypnotic hybrid of costume drama and The Substance, The Ugly Stepsister is like watching an accident slowly unfold in front of you. Elvira’s obsession with her looks turns gruesome pretty quickly, and the film doesn’t shy away from graphically showing the lengths she’s willing to go to “beautify” herself. Beyond its obvious horror elements, The Ugly Stepsister is also an effective social commentary on female body standards. It’s the kind of horror movie that disturbs you and makes you think about it long after it’s over.

The Ugly Stepsister is streaming on Hulu.

‘Tigerland’ (2000)

It’s 1971, and the Vietnam War is still going on. Roland Bozz (Colin Farrell) doesn’t want to go, but like many men like him, he has no choice. He’s sent to a training camp called “Tigerland” that’s designed to mimic the Vietnamese area he and his army unit will soon be sent to. But Roland is sure that if he’s sent to fight, he won’t be coming back alive. He’ll do anything to get out of his assignment, and that includes clashing with other soldiers who are all too happy to find a reason to fire their guns.

Tigerland is unusual for a lot of reasons — it’s a Vietnam War movie not set in Vietnam, it’s a way movie about the prospect of going to war rather than depicting it and it’s directed by Joel Schumacher, who brought the world Batman & Robin. It’s also the movie that launched Farrell to international stardom, and it’s easy to see why — his charisma obscures everything and everyone around him. As a war film, Tigerland is just OK, but as a vehicle for a star-in-the-making, it’s a must-watch.