Politics

US grapples with imperial ambitions

The Trump administration has returned $500 million in oil money from previous oil transactions with Venezuela. A US official said it was to keep the country’s services running. The US kidnapped Venezuela president Nicolas Maduro on 3 January. In his place, former oil minister deputy Delcy Rodriguez is running the oil-rich nation.

A US official told The New Arab on 4 February:

Venezuela has officially received all $500 million from the first Venezuelan oil sale.

The unnamed individual said the money would be:

disbursed for the benefit of the Venezuelan people at the discretion of the US government.

The cash seems to have been from an oil deal struck in January:

So in essence, we allowed Venezuela to use their own oil to generate revenue to pay teachers and firefighters and police officers and keep the function of government operating so we didn’t have systemic collapse.

The official said the money, which had been held in Qatar, was a:

temporary, short-term account to ensure Venezuela received the funds needed to operate.

Venezuela: agreed-upon procedures

The official even explained there were plans to move money from future oil sales:

into a fund located in the US and to authorise expenditures for any obligation or expense of the government of Venezuela or its agencies and instrumentalities upon instructions that are consistent with agreed-upon procedures.

The New Arab also reported pro-Maduro street protests. Maduro’s son Nicolasito was in attendance. He told reporters of the demonstrators:

These people are not American. We have achieved a profound anti-imperialist consciousness.

Maduro is in a New York jail. He claims he is a prisoner of war. The US has indicted him for drugs and weapon possession charges Yet whatever the balance of power in Venezuela is now – and whatever the anti-imperialist rhetoric on display – this seems to suggest that the Venezuelan government is not calling the shots any more.

Trump’s massive military build-up and eventual special forces raid on Venezuela seems to have done the job. The US seeks to dominate the Western hemisphere entirely. Trump has now moved onto bullying Iran. The Venezuelan revolution, whatever its merits and shortcomings, seems to have stalled for now.

Time will tell if it becomes another footnote in US imperial history.

Featured image via the Canary

Politics

Israeli biolab in US leaves several ‘deathly ill’

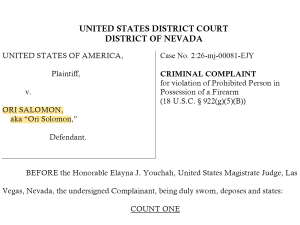

Police in Las Vegas have arrested an Israeli citizen in an armed raid after an illegal ‘biolab’ made several people exposed to it ‘deathly ill’. 55-year-old Ori Salomon aka Ori Solomon was arrested on charges “disposing of and discharging hazardous waste” charges – and later also charged with illegal possession of six firearms – including an assault rifle of Israeli make.

Police recovered more than 1,000 samples of likely hazardous material after finding a freezer, multiple fridges and other laboratory material including:

biosafety hood, a biosafety sticker, a centrifuge, multiple refrigerators, red-brown unknown liquids in gallon-sized containers, and refrigerated vials with unknown liquids.

Bizarrely, it was not the first such raid. A Limited Liability Company tied to the county’s record of the property has the same name as a company named in an ongoing federal case in California involving a similar biological laboratory.

Israeli biolab raid

The Las Vegas raid followed a tip-off that lab equipment and hazardous materials were being stored at the residential property. The weapons charge was added later because the original warrant for the raid did not include firearms. The charge sheet says that Salomon/Solomon:

knowing that he was an alien admitted to the United States under a nonimmigrant visa, knowingly possessed the firearms below, which were in and affecting interstate commerce, all in violation of 18 U.S.C. §§ 922(g)(5)(B) and 924(a)(2):

a. a Springfield Armory SA-XD ACP 45 caliber bearing the serial numberUS734441;

b. a Savage Mark II .22 caliber rifle bearing the serial number 399291;

c. a Euroarms Brescia-Italy .36 Navy bearing the serial number 30614;

d. a Springfield Armory XD-9 9mm Handgun bearing the serial numberXD193283;

e. an IWI US Tavor-x95 5.56 bearing the serial number T0066621; and

f. a Glock 19 9mm Handgun bearing the serial number ANK965US.

The IWI Tavor-x95 ‘bullpup assault rifle’ is made in Israel and used by Israel’s military. The Austrian Glock 19 is also widely used by Israeli armed forces.

Court documents state that after entering the garage, several people became “deathly ill,” and “could not get out of bed”, according to local TV station KLAS. Samples have been taken by FBI aircraft to the National Bioforensic Analysis Center in Maryland.

Local media have speculated that the Israeli biolab may have been involved in the production of counterfeit medicines. However, there is another possibility. Islamophobic Israel advocates have claimed that ‘Iranian’ cells in the US were planning terror attacks.

The claims appear to be an attempt to fuel US aggression toward Iran and led to warnings that Israel itself is planning ‘false flag’ attacks in the US. The colony has a long and proven record of using such attacks to achieve political and military ends.

Featured image via author

Politics

Starmer’s fake apology exploits Epstein victims

Keir Starmer has ‘apologised’ for Peter Mandelson in a speech in Sussex. Kind of, but not really. You know the kind of thing. The “I’m sorry people felt offended” apology that puts the blame on others.

Starmer turns on Mandelson after it’s too late

Starmer said he was sorry for believing Mandelson’s lies — ‘Peter’ was never added as Starmer tried desperately to distance himself. Distance himself from the man he took on as his senior adviser when Mandelson’s closeness to child-rapist Jeffrey Epstein was already well known. From the man he then appointed as ambassador to the US, despite knowing the same.

From the man whose protégé he still has as his chief of staff.

Despicably, Starmer then cynically exploited Epstein’s victims to try to get himself off the hook. It was the first time he’d mentioned them since Mandelson blew up in his face. It was only to use them, shamelessly, to excuse not releasing what pre-ambassador vetting had told him about Mandelson and Epstein.

The Met Police, very conveniently, announced that the Mandelson vetting records can’t be released because releasing them might compromise an investigation. Everyone understands this, surely correctly, to mean the supposed investigation into Mandelson’s insider trading and leaking of state information to Epstein.

Starmer claimed he was deeply frustrated by the Met’s decision. Yeah, right. But then he claimed that he accepted it because releasing the Mandelson files might rob Epstein’s victims of justice for Epstein’s crimes. Exposing Starmer’s decision to ignore Mandelson’s ardour for the child-rapist poses zero threat to the US investigation into Epstein’s crimes against children and young women.

It was an appalling, disgusting, entirely cynical ploy

And then, out of nowhere, Starmer began attacking the hundreds of thousands of people who march against Israel’s genocide. He repeated the Israel lobby’s lie that marching against genocide makes UK Jews scared. Nonsense. UK Jews are front and centre of every march and rally — so much so, that the BBC and others have to hide them. Leaving them in would expose that lie and the lie that all Jews support Israel, you see.

To reinforce his smear, Starmer reminded his listeners that Jews suffered the UK’s most recent terror attack. He left out that the Jewish casualties at the Manchester synagogue attack were shot by armed police. Also left out that the people of Palestine continue to suffer daily terrorist attacks by Israel — including many bombed and burned this week. Also ‘forgot’ to mention the 1.5m Palestinians starving and freezing in Gaza under Israel’s blockade. He ‘forgot’ to mention that the Gaza ‘ceasefire’ is a sick joke. He ‘forgot’ to mention that Israeli extremists are attacking Palestinians in the West Bank and burning their homes.

Of course he did. Starmer is too determined to criminalise pro-Palestinian speech and protest. He is holding anti-genocide protesters in prison without trial, arresting grannies for opposing genocide. He sends his lawyers to try to ensure journalists who support Palestinian rights and freedom are locked up.

And he doesn’t give a flying you-know-what for the victims of Jeffrey Epstein beyond their usefulness to keep the Mandelson files hidden. To anyone watching closely, he made that perfectly clear.

Watch below:

Featured image via the Canary

Politics

Trump’s shadow hangs over the Winter Olympics

President Donald Trump won’t be representing the U.S. at the opening ceremony of the Italian Olympic Games in Milan’s famous San Siro Stadium. But his shadow will surely loom over the two-week-long sporting spectacle, which kicks off Friday.

The president’s repeated jabs at longtime partners, his inconsistent tariff policy and repeated plays for Greenland have shown just how much he’s shifted the traditional world order. The resulting international “rupture,” as described by Canadian Prime Minister Mark Carney in Davos last month, has turned beating the Americans in Italy from a crowning sporting achievement to an even greater moral imperative for the president’s rivals.

“This is life and death,” said Charlie Angus, a former member of Parliament in Canada with the New Democratic Party and prominent Trump critic. “If it’s the semifinals and we’re playing against the United States, it’s no longer a game. And that’s profound.”

The Trump administration has big plans for these Olympics, according to a State Department memo viewed by POLITICO. It hopes to “promote the United States as a global leader in international sports” and build momentum for what the White House sees as a “Decade of Sport in America,” which will see the country host the Summer Olympics and Paralympics in 2028 and the Winter Olympics and Paralympics in 2034, as well as the FIFA World Cup this summer.

But a combative administration may well complicate matters.

He’s sending Vice President JD Vance, a longtime critic of Europe’s leaders, to lead the presidential delegation in Milan. Then there’s ICE. News that American federal immigration agents would be on the ground providing security during the games sparked widespread fury throughout the country.

Trump has also clashed with many of the countries vying to top the leaderboards in Milan. Since returning to the White House in January, he’s antagonized Norway, which took home the most medals in the 2022 Beijing Winter Olympics, over a perceived Nobel Peace Prize snub and clashed repeatedly with Canada, which finished fourth.

“We’re looking at the world in a very different light,” Angus said. “And we’re looking at a next-door neighbor who makes increasingly unhinged threats towards us. So to go to international games and pretend that we’re all one happy family, well, that’s gone.”

Trump has also sparred with Emmanuel Macron, the president of France, (the 13th-place finisher in Beijing) and threatened a military incursion in pushing Denmark (a Scandinavian country which curiously hasn’t medaled in the Winter Olympics since 1998) to cede Greenland.

All while seeming to placate Russia, whose athletes competed under a neutral flag in 2022 due to doping sanctions and secured the second-most medals in the Beijing games, which ended just days before President Vladimir Putin invaded Ukraine.

The Olympics have long collided with geopolitics, from Russia’s ban in response to its war in Ukraine to South Africa’s 32-year-long exclusion as punishment for apartheid. And Beijing’s time in the limelight was marred by a U.S. diplomatic boycott over China’s treatment of its Uyghur population.

White House spokesperson Anna Kelly said Trump’s political agenda of putting America First is paying off.

“Fairer trade deals are leveling the playing field for our farmers and workers, NATO allies are taking greater responsibility for their own defense, and drugs and criminals are no longer entering our country,” she said. “Instead of taking bizarre vendettas against American athletes, foreign leaders should follow the President’s lead by ending unfettered migration, halting Green New Scam policies, and promoting peace through strength.”

When reached for comment, the State Department deferred to the White House about the political ramifications of the games. A State Department spokesperson also highlighted the role that its Diplomatic Security Service would serve as the security lead for Americans throughout Olympic and Paralympic competition.

Hockey, arguably one of the winter Olympic Games’ highest-profile sports, has already been roiled by Trump’s global agenda. Just look at last year’s 4 Nations Face-Off, which pitted the U.S. and Canada against each other in preliminary play and then again in the final.

Canadian fans booed the American national anthem mercilessly when the two sides faced off in Montreal. Trump called the U.S. locker room on the morning of the final and showered the Great North with incessant 51st state gibes, and then-Prime Minister Justin Trudeau responded boisterously when Canada won the championship in overtime.

“You can’t take our country — and you can’t take our game,” he wrote.

The American men’s team will play Denmark in Milan — fittingly — on Valentine’s Day, and could see the Canadians at the medal rounds.

“I’m sure they’ll concentrate on the events they compete in rather than get involved in politics,” Anders Vistisen, a member of the European Parliament from Denmark, said of his compatriots in a statement. “Maybe Trump’s antics will give them even more motivation? Who knows?”

Elsewhere in Italy, Americans Sean Doherty, Maxime Germain, Campbell Wright, and Paul Schommer will match up against 2022 champion Quentin Fillon Maillet from France in biathlon throughout the games. And Canadian short track speedskater and medal favorite William Dandjinou will look to hold off multiple Americans at the Milano Ice Skating Arena.

“With the current American president, no one knows what he will do or say tomorrow,” said legendary goaltender Dominik Hasek, a gold medalist with Czechia in the 1998 Nagano Games and a one-time rumored presidential candidate in his home nation. “If he doesn’t make negative comments about athletes from other countries in the coming weeks, everything will be fine. But that could change very quickly after one of his frequent hateful attacks.”

Hasek, a frequent critic of Putin’s war in Ukraine, said Trump “has antagonized most of the people of the democratic world with his attitudes and actions.”

That doesn’t exactly scream “Faster, Higher, Stronger — Together,” the Olympic motto revamped by the IOC in 2021.

“It was personal,” Angus, the former Canadian lawmaker, said of the tense Canada-U.S. showdown in the 4 Nations Face-Off last year. “This was deeply personal. We were at the moment of people brawling in the stands, and that was because of Donald Trump and the constant insults. He turned that game into war.”

But now at the Olympics, the U.S. is just one of more than 90 nations competing. And Trump’s international critics say they’re determined to not let their anger with Trump ruin the games — if just not to give him the satisfaction.

“People are done with Donald Trump’s flagrant attempts to goad us and poke at us and insult us,” Angus said. “It’s like water off our back. We’re a much tougher people than we were last year.”

Nahal Toosi contributed to this report.

Politics

Epstein chats show US bigotry behind escalating war against China

Jeffrey Epstein and the far-right figures around him wanted to push US war with China. And elitist bigotry was very much part of this.

Today, the US Cold War against China is escalating, particularly in Latin America. But with Donald Trump trying to assert US dominance and reduce Chinese influence in the region, he’s also been showing the world his clear disdain for international law.

And as past chats between Trump associates Jeffrey Epstein and Steve Bannon show, that’s not the only disdain within these circles of power.

From Epstein to Vance — a swamp of racism and classism

The idea that a Global South nation could become an economic superpower within decades clearly causes discomfort among Western white supremacist elites. In particular, it has increasingly exposed US decadence, amid extreme militarisation, growing wealth inequality, and political capture by misanthropic billionaires.

The first Trump administration didn’t just further empower racists. Its public demonisation of China also coincided with increasing hate crimes against Asian communities in the US.

Epstein and Bannon — both millionaires — referred to the Chinese government as “peasants”. And current US vice-president JD Vance has said the same thing. (Vance rose to prominence thanks to billionaire Palantir co-founder Peter Thiel, who also appears in the Epstein files.)

Interestingly “peasants” to describe the Chinese is the exact same term that JD Vance used 👇🤔pic.twitter.com/Wl0N8CinRJ

— Arnaud Bertrand (@RnaudBertrand) February 3, 2026

Other messages from Epstein snootily suggested a lack of civilisation and intelligence, while encouraging a “military display” to show China who’s boss.

As Jacobin wrote back in 2019, Epstein’s racism and classism was:

a case study of the abuses and pathologies inherent to extreme wealth

And the hot topic in these circles was clearly China, and how to defeat it. It was the enemy, Epstein said, and he wanted the US to treat it as a “piñata”. He also suggested working with far–right Indian leader Narendra Modi on the “China problem“.

One step China has been taking in Latin America was to build links through investment, which could aid access to resources and markets. And Epstein noted in particular the importance of China’s support in Venezuela, with its massive oil resources.

This is where we come up to the current day, with Epstein’s old friend in the White House taking steps in Venezuela and elsewhere to try and push out Chinese influence.

Trump’s campaign to stop countries dealing with China

The US, under both Republicans and Democrats, didn’t like China — its main global competitor economically — forging links in Latin America. But Trump has gambled that China won’t get into a full-blown war to protect its interests in the region. And in Venezuela, he seemed to be right.

China had invested a lot in Venezuela. But when the US illegally invaded the country in January 2026 to abduct its leader, there was no meaningful response from China. Trump made it clear this military action was to try and replace Chinese influence in Venezuela with US influence. And China may now struggle to recover billions from the country.

Trump has essentially said the same about Cuba. Cutting the island’s access to Venezuelan oil was the first step. But the big picture is to challenge China in the region. Because Cuba has also received Chinese investment, and the ambassador there has even called Cuba:

a model for China’s relations with Latin America and the Caribbean

As with Venezuela, China has expressed its concern about US efforts to strangle Cuba. But the question is, would it actually challenge US military action there?

Elsewhere in Latin America, Trump’s behind-the-scenes pressure has been enough to get what the US wants.

Panama, for example, had also received Chinese investment. But the country has now left China’s Belt and Road Initiative (which also included Venezuela, Cuba, and others) and has just annulled port contracts with a Hong Kong company that has been operating at the Panama Canal for decades.

Could Trump’s bullying backfire, though?

Billionaires, imperialists, colonial war criminals, and the far right have worked hard across the West to develop a powerful, toxic alliance. Trump is part of this, just as Epstein was. But by actually turning on his usually compliant allies, he may actually have weakened their commitment to the project he’s heading.

There are many legitimate criticisms of China’s government, from death penalty numbers to poor treatment of certain groups. And Western propaganda outlets are all too quick to amplify these more than the crimes of Western allies. But in comparison to Trump’s shameless and openly predatory behaviour, China is looking more and more like the ‘adult in the room’.

Trump may plead with allies not to cosy up to China, but even junior partners to US imperialism in Canada and the UK have recently been hedging their bets by improving relations. And as Chinese artist Ai Weiwei has said:

I used to advocate that Western leaders should publicly condemn China on human rights. But today I have completely changed my view. The West is not even qualified to criticise China.

China itself, meanwhile, is presenting itself as a safer pair of hands for the global economy. President Xi Jinping, for example, wants the country’s currency to “become a global reserve currency” and has criticised the greedy disconnection of Western financial markets, calling for an alternative that can:

avoid the Western predicament of financial oligarchs hijacking public policy and deepening social division.

And with the rule of racist, classist sex-offenders in the West becoming more and more obvious, that argument certainly sounds appealing.

Featured image via the Canary

Politics

Starmer faces new paedo scandal over silence on Zionist peer links

Keir Starmer’s Number 10 is refusing to say whether new peer — and ‘Labour Friend of Israel’ member — Matthew Doyle ended his friendship with paedophile former ‘Labour rising star‘ Sean Morton after Morton’s conviction. The PM’s office is also refusing to say what Starmer knew about the status of the pair’s friendship before Doyle was made a peer last month.

The 2018 conviction

Morton is a Scottish former Labour councillor convicted in 2018 of counts of possessing serious child sexual abuse images and extreme pornography. He was placed on the sex offenders register and, in another example of light sentencing of Labour paedophiles, made to do 140 hours of community service.

The questions come as Starmer admitted this week to knowing about Peter Mandelson’s ongoing, ardent relationship with serial child-rapist Jeffrey Epstein. Starmer knew about it when he appointed Mandelson as UK ambassador to the US. He must also have known about Mandelson’s insider-trading with Epstein.

It’s already a matter of record that Starmer gave Doyle the peerage despite knowing Doyle campaigned for Morton’s election after Morton had been charged. The refusal to deny it also strongly suggests that Doyle continued the friendship after conviction — and that Starmer knew. It suggests it so strongly that even liberal Zionist Gabriel Pogrund finds the silence “weird”. Pogrund said that:

This is getting weird now

In response to @TomTugendhat, Darren Jones doesn’t even acknowledge question re Lord Doyle

PM/McSweeney warned about his links to paedophile Sean Morton, so ordered investigation before peerage approved

Yet zero info on what it found, inc when… https://t.co/lNmsewhBbb pic.twitter.com/x6iGMC4a3c

— Gabriel Pogrund (@Gabriel_Pogrund) February 3, 2026

As well as being another example of Starmer appointing friends of paedophiles, the Doyle-Morton case is the latest in Labour’s long list of Zionist child abusers. Former Blair and Starmer adviser Doyle is a member of Labour Friends of Israel (LFI), the Israel lobby group connected with Israeli embassy cash and anti-Palestinian racism. He has also been a listed speaker at events held by notorious lobby group BICOM.

Scottish Labour leader Anas Sarwar is under pressure to kick MSP Pam Duncan-Glancy out of the party altogether for her friendship with Sean Morton. Duncan-Glancy resigned her front-bench position and said she will not seek re-election, calling the friendship a “serious lapse in professional judgment”. Right. Sarwar appears no better than Starmer, but Duncan-Glancy at least fell on her sword.

But all this is just the tip of a very large nonceberg of the overlap between paedophilia and ‘Labour’ support for Israel.

Starmer about to hit the Nonceberg

Starmeroid MP Dan Norris’s recent arrest for rape was his second on suspicion of sex offences. The first, in 2025, was for alleged rape and paedophilia and is still under investigation. As we’ve seen, Starmer’s mentor and chief adviser Peter Mandelson resigned over his notorious links with serial child rapist and Israeli agent Jeffrey Epstein. In early January, Israel fanatic Jewish Labour Movement (JLM) organiser Liron Velleman admitted child sex offences.

We’re just getting started.

In January last year, former Blair minister Ivor Caplin was arrested in a sting operation as he allegedly attempted to meet a 15-year-old boy for sex. Local police went after local left-winger Greg Hadfield for exposing the explicit content Caplin posted on his X feed – Hadfield defeated the ‘vexatious’ charge in November 2025. However, no charges have yet been brought against Caplin and a court did not impose bail conditions after his initial bail expired. Despite the ongoing police investigation, Caplin was recently invited to speak on LBC about Keir Starmer’s move to block Greater Manchester mayor Andy Burnham’s bid to stand in a parliamentary election.

There’s more

Hackney councillor Tom Dewey, an organiser in pro-Israel group ‘Labour First’, admitted possession of the most serious category of child rape images in 2023. The party knew of his arrest when it allowed him to stand for election. After his conviction, it blocked local women members from its systems to prevent them discussing the case.

And in March 2025 Sam Gould, who worked for Starmer’s health secretary Wes Streeting, quit as a Redbridge councillor after being convicted on two separate counts of indecent exposure to a 13-year-old girl.

The LFI/JLM paedophile issue mirrors the even wider issue in Israel itself. The regime is currently ignoring well over 2,000 extradition requests for alleged and convicted paedophiles. In April 2025, Shoshana Strook, the daughter of Israel’s far-right settlements minister fled to police and asked them to protect her, accusing both her parents and one of her brothers of raping her as a child, over a period of years, and filming the rapes.

Jewish anti-Zionist academic Norman Finkelstein says Israeli society is “rotten to the core”. That sickness doesn’t stop at the border.

Featured image via the Canary

Politics

The West’s war on ‘whiteness’

The post The West’s war on ‘whiteness’ appeared first on spiked.

Politics

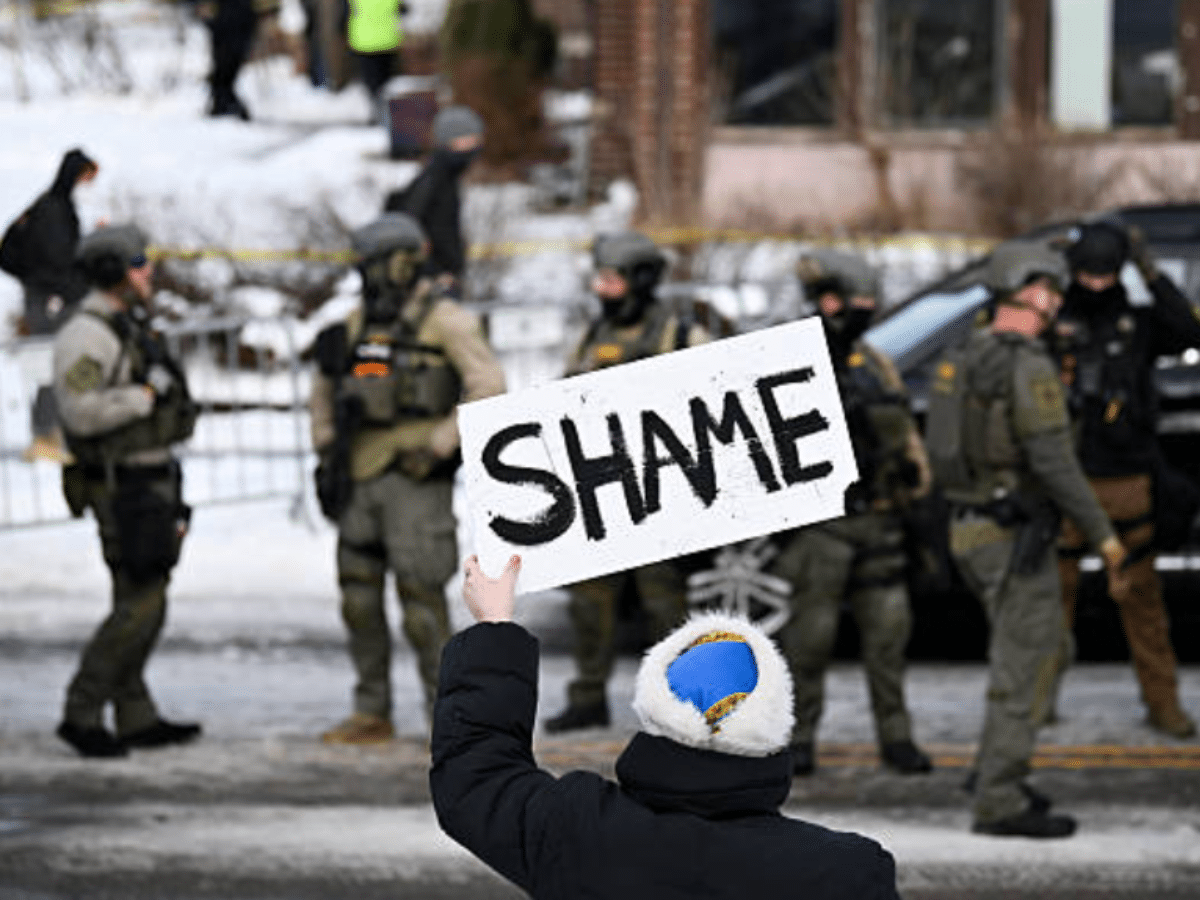

ICE purposely overwhelms Minnesota courts

Mass arrests by Immigrations and Customs Enforcement (ICE) are overwhelming the US court system in Minnesota.

The Trump administration’s massive deportation spree in Minnesota – pompously titled ‘Operation Metro Surge’ – created a corresponding surge in emergency legal cases. This left courts so short-staffed that several top lawyers quit outright. Still others have voiced their intention to follow suit in recent weeks.

The Minnesota US attorney’s office stated that:

The Civil Division of the U.S. Attorney’s Office in this district has been utterly overwhelmed by the number of recent habeas petitions in Minnesota, during a time when the Office is short staffed.

ICE flouting orders

Justice Department records show massive numbers of legal violations by ICE, including violations of judges’ orders, illegal arrests, and botched court filings.

Minnesota judges are particularly alarmed at defiance from Homeland Security and their Justice Department counterparts in Washington. In particular, ICE is regularly flouting orders to bring their detainees before a judge when ordered – a legal right and duty known as habeas corpus.

Politico described one situation in which:

In one recent case, ICE arrested a man with no criminal record who was residing legally in Minnesota on a rare “T” visa, meant for victims of a severe form of human trafficking or who aided law enforcement in a trafficking investigation. A day after a magistrate judge inquired about the case, the Justice Department said it should be dismissed because the man had been released. Four days later, however, DOJ sent a cryptic filing misidentifying the man as “she” and suggesting he had been relocated to a detention facility in El Paso.

DOJ then blew off the deadline to clarify what had occurred, leading the judge to conclude that “ICE transferred Petitioner from Minnesota to Texas without notice and indeed, from this record it appears that even [DOJ] may not have known about the transfer.”

‘Broken system’

Underscoring the depths of the crisis, on Tuesday 2 February, a judge asked prosecutor Julie Le why his federal court orders were being ignored by ICE. Le, in apparent distress, said:

The system sucks. This job sucks. And I am trying every breath that I have so that I can get you what you need.

She went on to add that:

Sometime I wish you would just hold me in contempt, your honor, so that I can have a full 24 hours of sleep.

Le argued that ICE officials simply ignore her and other Justice Department lawyers when they tell them to obey the courts. Even simple inquiries went completely unanswered, and Le’s threats of legal repercussions made no impact.

The prosecutor branded the situation a “broken system”, and even revealed that she’d tried to quit – but there was no-one ready to replace her.

Open authoritarianism

However, Trump’s team are denying their responsibility for the situation. Tricia McLaughlin, a spokesperson for the Department of Homeland Security (DHS), tried to blame the judges themselves for the crisis:

The Trump administration is more than prepared to handle the legal caseload necessary to deliver President Trump’s deportation agenda for the American people. It should come as no surprise that more habeas petitions are being filed by illegal aliens — especially after many activist judges have attempted to thwart President Trump from fulfilling the American people’s mandate for mass deportations.

This line of reasoning is severely faulty. It is a court’s role, when necessary, to determine the legality of an individual’s actions. If the state could ignore a habeas petition on the grounds of an individual being “illegal”, it could simply declare anybody illegal without trial.

This is both clearly a monstrous abuse of power, and precisely what the Trump administration is doing.

A Justice Department spokesperson likewise blamed “rogue judges” for the massive increase in detention cases. They argued that without the judges rulings, there wouldn’t be any “concern over DHS following orders.”

That is to say, if the judges didn’t demand that ICE follows the law, there would be no issue. Again, an openly authoritarian proclamation.

Shock and awe

The fact that Minnesota’s courts are overwhelmed is not a glitch in the system. It’s not a result of the Justice Department being understaffed, or – God forbid – ICE being under-resourced. Rather, this overwhelm is part of the plan.

Trump has always relied on shock and awe tactics. He perpetrates as many open crimes and heinous violations of basic human decency as quickly as possible, such that his opponents barely have time to muster a reaction before the next onslaught.

Because the courts are overwhelmed, ICE and the Trump administration can act with impunity. The administration has said outright that if it’s allowed to break the law, then there won’t be any issues. It intends to break the law; it intends to ignore basic legal rights; it intends to deport anyone it sees fit. This was always the plan.

Featured image via the Canary

Politics

Slept 8 hours but STILL woke up exhausted? You may have ‘paradoxical insomnia’

!function(n){if(!window.cnx){window.cnx={},window.cnx.cmd=[];var t=n.createElement(‘iframe’);t.display=’none’,t.onload=function(){var n=t.contentWindow.document,c=n.createElement(‘script’);c.src=”//cd.connatix.com/connatix.player.js”,c.setAttribute(‘async’,’1′),c.setAttribute(‘type’,’text/javascript’),n.body.appendChild(c)},n.head.appendChild(t)}}(document);(new Image()).src=”https://capi.connatix.com/tr/si?token=19654b65-409c-4b38-90db-80cbdea02cf4″;cnx.cmd.push(function(){cnx({“playerId”:”19654b65-409c-4b38-90db-80cbdea02cf4″,”mediaId”:”764b7ab2-fa67-4cbf-98ff-798b8f128429″}).render(“6984dd1fe4b04d5037ef3588”);});

Politics

An Expert’s Guide To Talking To Your Boss About ADHD

As many as 76% of employees who have been diagnosed with, or suspect they might have, ADHD, say that they have chosen not to tell their boss about it. A whopping 65% do so out of fear they’ll be discriminated against by management.

Of course, as consultant psychiatrist Dr Devendra Karnal from Private ADHD & Autism UK pointed out, “Under the Equality Act, an employer’s duty to make reasonable adjustments only applies if they know about the condition”.

But, career psychologist Dr George Sik from eras pointed out, the caution is understandable.

“Many people delay telling their employer about ADHD because they’re trying to protect themselves,” he told HuffPost UK.

“There’s still a real fear of being judged as less capable or more difficult to manage, even when someone is performing well. For a lot of people, waiting feels safer than risking the label being misunderstood.”

Here, the experts shared their guide to discussing ADHD with your boss.

When is the right time to tell your employer about ADHD?

“There isn’t a single right moment to disclose ADHD, as it really just depends on how safe the environment feels and whether support is genuinely needed. However, when it’s starting to affect your workload or wellbeing, that might be a sign that staying silent is costing more than speaking up,” Dr Sik told us.

“Disclosure tends to land best when it’s raised proactively in a calm, neutral setting, as opposed to raising it reactively during something like a performance review.”

How should I approach a discussion about ADHD with my boss?

Consultant psychiatrist Dr Bongani Dhuba, also from Private ADHD & Autism UK, said that focusing on outcomes instead of labels can help.

Instead of saying you’re constantly distracted, he suggested, try saying something like, “I produce my best work with written briefs and minimal interruptions”.

“Many people cope well initially, especially in structured roles, but struggle later as demands increase or routines change,” Dr Sik added.

“Rather than focusing on the diagnosis itself, it can help to explain what’s changed and what would help you work at your best. For example, you could say: ‘I’ve noticed I’m struggling more with competing deadlines, and believe a couple of small adjustments would really help me perform better.’”

“Managers tend to respond better when the conversation is about performance and solutions, not personal shortcomings. You’re not asking for special treatment but just explaining how to do your job well.”

Anything else?

Yes! Dr Karnal said you should present your strengths at the same time as sharing your support needs.

“Remember to present the full picture and highlight the value you bring, not only the extra support and conditions you’ll need,” the psychiatrist said.

Don’t apologise for your differences, and, Dr Sik advised, “Disclosure tends to land best when it’s raised proactively in a calm, neutral setting, as opposed to raising it reactively during something like a performance review”.

Document everything you and your employer have agreed on, Dr Duba added.

“If adjustments are discussed, it’s a good idea to follow up with a short summary email to protect the employee and the employer from misunderstandings later.”

Politics

WATCH: Philippe Sands Confronted by Chagos Campaigner

Starmer’s mate and surrender deal architect Philippe Sands was confronted in Parliament by a Chagossian. Save Chagos…

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World7 days ago

Crypto World7 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat7 days ago

NewsBeat7 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business3 hours ago

Business3 hours agoQuiz enters administration for third time

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat10 hours ago

NewsBeat10 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration