Crypto World

How to Choose the Right AI Development Partner for Enterprises in 2026

Key Takeaways:

- Enterprises need production-ready, scalable AI systems to drive real business impact.

- Clarify business problems, workflows, and success metrics before choosing a partner.

- Look for technical expertise, domain knowledge, and co-development capabilities.

- Ensure data protection, governance, and ongoing support are built in.

- Evaluate use cases, conduct technical assessments, run PoCs, and finalize IP and support models.

The landscape of enterprise technology has shifted. In 2026, artificial intelligence is no longer an experimental feature; it is the core engine of corporate strategy. According to Gartner, by 2026, more than 80% of enterprises will have moved from basic generative AI pilots to production-grade systems, including multi-agent architectures and domain-specific models.

As the global AI market is projected to reach $312 billion in 2026, the pressure to choose a capable AI development partner has never been higher. This guide provides a strategic framework for identifying, evaluating, and onboarding the right AI development company to lead your digital transformation.

Understanding Your AI Requirements Before Engaging a Partner

Before evaluating any AI development company, enterprises must clearly define their internal objectives and constraints. As AI systems become more complex, success increasingly depends on aligning technical architecture with measurable business outcomes.

1. Clarify the Business Problem

Enterprises should begin by identifying the exact problem AI is expected to solve. This may include reducing operational inefficiencies, improving decision accuracy, automating high-volume workflows, or enabling new revenue models. Leading organizations are shifting away from bottom-up experimentation toward targeted, high-impact transformations aligned with strategic priorities.

2. Identify the Type of AI Solution Required

Different business goals require different AI approaches. Common enterprise-grade solutions in 2026 include:

- Multi-Agent Systems (MAS): Autonomous agents that collaborate to execute complex, multi-step workflows.

- Domain-Specific Language Models (DSLMs): Models trained or fine-tuned on industry-specific data to improve reliability and contextual understanding.

- Recommendation and Personalization Engines: AI systems that drive individualized experiences across marketing, sales, and digital platforms.

3. Define Success Metrics Early

Traditional metrics such as model accuracy are no longer sufficient. Enterprises increasingly track performance through operational and financial indicators, including decision latency reduction, inference cost relative to business value, risk mitigation, and employee productivity gains.

Choose a Trusted AI Development Partner

The Enterprise AI Partner Landscape in 2026

The market for custom AI development services has matured and diversified. Selecting the right AI development partner depends heavily on an organization’s scale, regulatory environment, and technical maturity.

Common Types of AI Service Providers

- Global Consulting Firms: Suitable for large-scale digital transformation initiatives, though often slower and more expensive to execute.

- Niche AI Specialists: Strong in advanced R&D and complex model development but may face challenges scaling enterprise-wide deployments.

- Product-Led AI Firms: Offer faster deployment using pre-built platforms, with potential limitations in customization and IP ownership.

1. Co-Development and IP Ownership

- Global Consulting Firms: Suitable for large-scale digital transformation initiatives, though often slower and more expensive to execute.

- Niche AI Specialists: Strong in advanced R&D and complex model development but may face challenges scaling enterprise-wide deployments.

- Product-Led AI Firms: Offer faster deployment using pre-built platforms, with potential limitations in customization and IP ownership.

2. Co-Development and IP Ownership

Enterprises are increasingly favoring co-development models that allow them to build proprietary intellectual property alongside their AI solutions provider. This approach reduces dependency on vendor-controlled platforms and supports long-term strategic flexibility.

3. Local vs. Distributed Delivery Models

While distributed teams offer cost efficiencies, enterprises in regulated industries often prioritize providers with a strong regional presence to address data residency, compliance, and governance requirements.

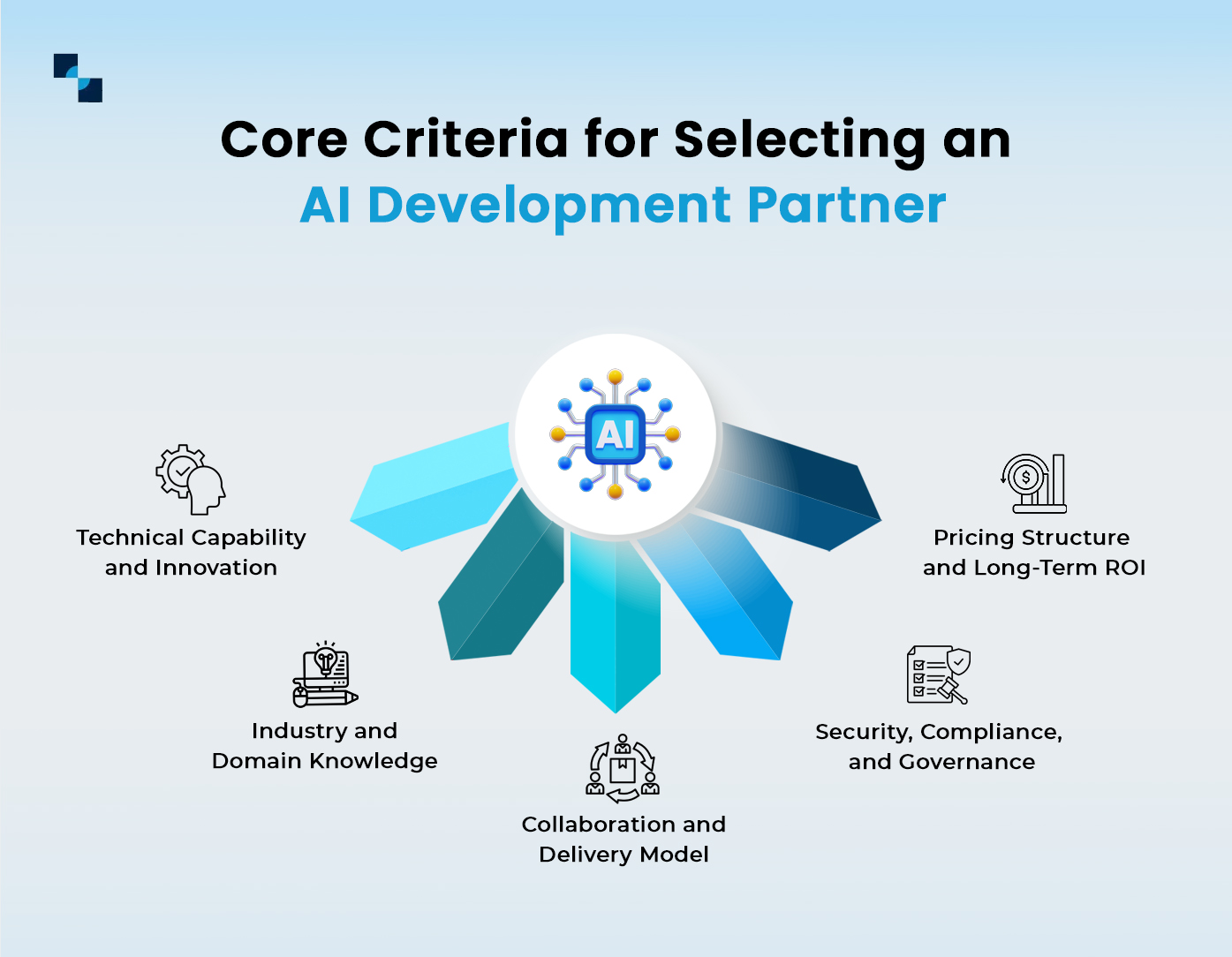

Core Criteria for Selecting an AI Development Partner

1. Technical Capability and Innovation

An enterprise AI development partner must demonstrate hands-on expertise with modern AI architectures, including agent-based systems, retrieval-augmented generation (RAG), and vector databases. Equally important is a commitment to continuous research and experimentation with evolving open-source and commercial AI frameworks.

2. Industry and Domain Knowledge

Domain familiarity significantly accelerates development timelines and reduces operational risk. Partners with experience in regulated industries such as finance, healthcare, or logistics are better equipped to handle domain-specific data structures, compliance obligations, and validation requirements.

3. Collaboration and Delivery Model

AI development is inherently iterative. Enterprises should look for transparent governance structures, clearly defined roles across data science and engineering teams, and agile delivery processes that emphasize frequent validation over long development cycles.

4. Security, Compliance, and Governance

In 2026, AI security and governance are non-negotiable. A qualified AI solutions provider for enterprises must demonstrate adherence to regional regulations, provide explainability mechanisms, and maintain full data lineage across training and deployment pipelines.

5. Pricing Structure and Long-Term ROI

Enterprise AI investments typically extend beyond initial development. Organizations should assess the total cost of ownership, including infrastructure usage, ongoing monitoring, retraining, and performance optimization. Flexible pricing models—such as dedicated teams or hybrid engagement structures—often provide better long-term value than rigid fixed-price contracts.

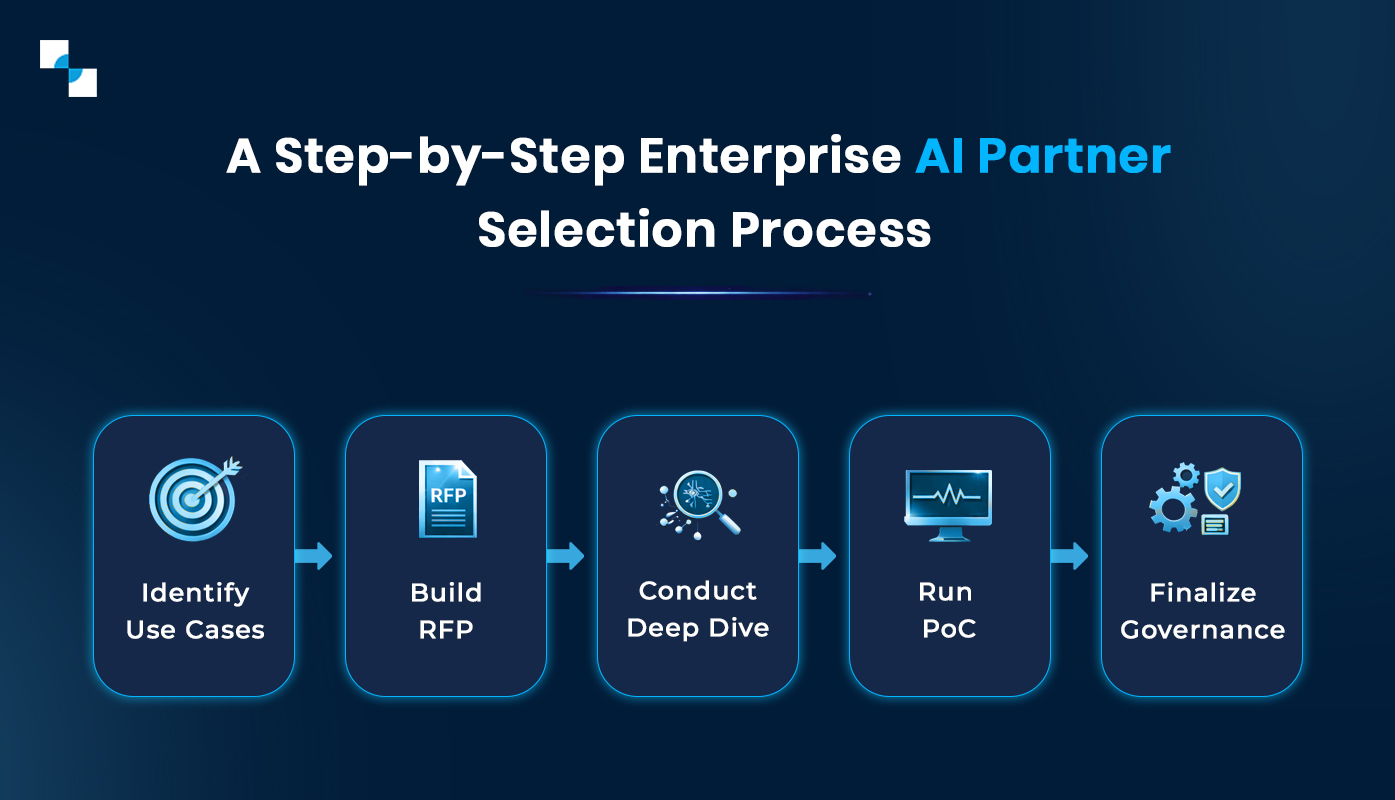

A Step-by-Step Enterprise AI Partner Selection Process

Step 1: Identify High-Value Use Cases

Rather than pursuing broad AI initiatives, enterprises should prioritize workflows where AI can deliver measurable operational impact. High-value use cases often involve decision automation, exception handling, or high-volume manual processes.

Step 2: Design a Future-Ready RFP

Modern RFPs should assess more than cost and timelines. Enterprises should evaluate a partner’s MLOps maturity, approach to model monitoring, explainability frameworks, and ability to support agentic workflows.

Step 3: Conduct a Technical Deep Dive

Involving senior technical stakeholders is essential. Enterprises should assess architecture design, data handling strategies, and cloud-native deployment approaches to ensure scalability and avoid vendor lock-in.

Step 4: Run a Production-Oriented PoC

A proof of concept should reflect real-world conditions. Using unrefined enterprise data allows organizations to evaluate a partner’s ability to manage data complexity, deliver reliable performance, and meet defined KPIs within a limited timeframe.

Step 5: Finalize Governance, IP, and Support Models

Before onboarding, enterprises should clearly define IP ownership, model maintenance responsibilities, performance SLAs, and post-deployment support mechanisms to ensure long-term alignment.

Critical Warning Signs When Evaluating an AI Development Partner

- Unclear System Architecture: If a provider cannot clearly explain how their AI system works end to end—including data flow, decision logic, and integration points—it’s a sign the solution may not be production-ready.

- No Plan for Post-Deployment Maintenance: AI models require continuous monitoring, retraining, and performance evaluation. A partner that treats deployment as the finish line is likely to deliver a system that degrades quickly over time.

- Lack of Cost Transparency: Be cautious of vendors who provide high-level estimates without detailing infrastructure usage, cloud compute requirements, data preparation costs, or long-term operational expenses.

- Generic or Reused Demonstrations: If the same demo or example is used across industries and use cases, it suggests limited customization capability. Enterprise AI solutions should be designed around specific business and domain requirements.

- Limited Accountability After Delivery: A weak or undefined support model—such as unclear SLAs, response times, or ownership boundaries—can create operational risk once the solution is live.

Positive Indicators When Evaluating an AI Development Partner

- Clearly Documented Development Processes: A strong AI development partner follows well-defined, repeatable frameworks for data ingestion, model training, validation, deployment, and monitoring. This signals maturity and reduces delivery risk.

- Deep Focus on Data Quality and Validation: Instead of starting with tools or timelines, the right partner spends time understanding your data sources, data integrity, labeling standards, and validation methods. This focus on ground truth is critical for reliable AI outcomes.

- Security Built into the Design Phase: Trusted enterprise AI partners address data protection, access controls, and model security early in the design process—often recommending secure execution environments and governance measures without being prompted.

- Strong Alignment with Business Objectives: A capable AI development company consistently connects technical decisions to business impact, ensuring models are designed to support measurable outcomes rather than theoretical performance.

- Clear Ownership and Long-Term Support Model: Reliable partners define responsibilities for maintenance, updates, monitoring, and issue resolution upfront, demonstrating accountability beyond initial delivery.

Build Future-Ready AI Solutions with Us

Building Long-Term AI Capability Through the Right Partnership

Choosing the right AI development partner is no longer just a procurement decision—it’s a strategic pivot. By 2026, the gap between AI leaders and laggards will be defined by the quality of their technical partnerships.

At Antier, we help enterprises build robust, scalable, and ethically grounded AI solutions. Whether you are looking for custom AI development services or need an enterprise AI solutions provider to overhaul your operations, our team is ready to bridge the gap between vision and production.

Crypto World

World Liberty Financial Offloads Bitcoin to Pay Debt

The Trump family’s DeFi protocol was forced to sell $5 million of BTC today to cover an Aave loan.

World Liberty Financial (WLFI), the decentralized finance (DeFi) protocol affiliated with President Trump’s sons, was forced to sell some Bitcoin at roughly $67,000 today to avoid liquidation on Aave.

According to Arkham Intelligence, the WLFI wallet was forced to liquidate more than 170 BTC, worth roughly $11 million, to repay its loans on Aave.

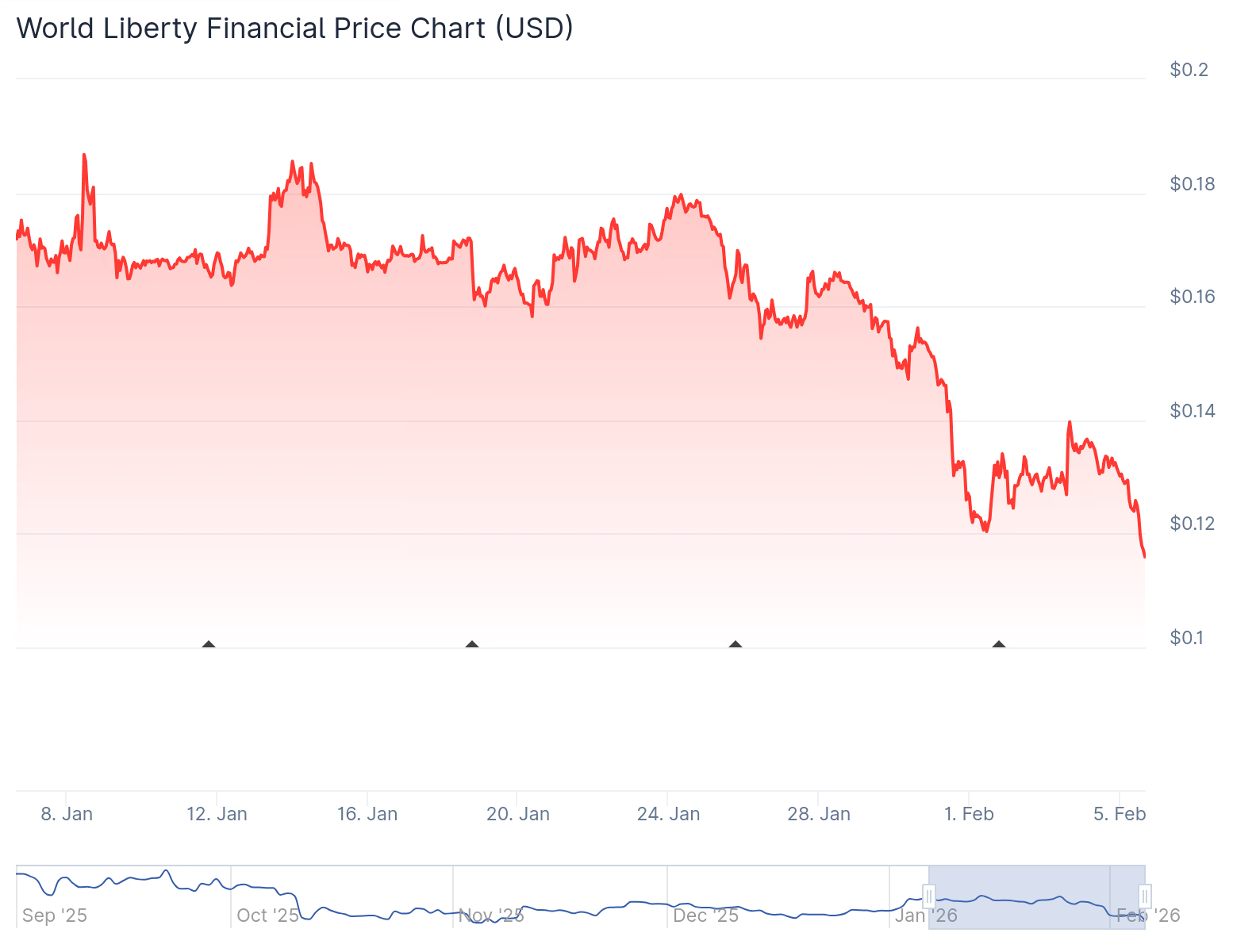

Meanwhile, the WLFI token is down 14% today, slightly underperforming BTC and ETH, which are both down 13%.

WLFI has been in a consistent downtrend since its token launch in September. The token started trading on Sept. 1 at $0.23, or a $6.6 billion market capitalization, and now trades 65% lower at $0.115.

In addition to the protocol’s financial woes, Trump’s political opponents continue to call for probes and investigations into the DeFi protocol.

Today, U.S. Representative Ro Khanna announced that he has launched an investigation into a $500 million investment in WLFI from the United Arab Emirates. Back in November, Senators Elizabeth Warren and Jack Reed claimed that the protocol is tied to malicious actors from North Korea and Russia; however, it remains unclear if there has been any progress on this probe.

Warren, in particular, is no fan of cryptocurrency, broadly referring to DeFi users as “scammers” and labeling the GENIUS bill as a “grift.”

Crypto World

Is It Time For A Bounce?

Bitcoin touched new lows under $64,000 as market selling reached a historic level, and analysts warn that the bottom is not in. Does data support analysts’ sub-$60,000 prediction?

Bitcoin (BTC) has fallen 13% over the past four days, sliding to $63,844 from $79,300. It is currently trading below $69,000, which is the 2021 bull market high, a level many see as a support level.

The drop was matched by a sharp decline in futures activity, with BTC’s open interest falling by more than $10 billion over the past seven days.

Analysts are now focusing on the long-term technical zones and onchain indicators that may signal a major turning point for BTC.

Key takeaways:

-

Bitcoin has dropped 13% in four days, slipping below the 2021 cycle high near $69,000 after a sharp leverage reset.

-

A key Bitcoin demand zone from $58,000 to $69,000 is supported by heavy transaction volume and the 200-week moving average.

-

Oversold technical and sentiment indicators suggest downside pressure may be peaking for BTC, even if a relief rally fails to manifest.

Why the $69,000 level matters for Bitcoin

The $69,000 level represents the peak of the 2021 bull market. Prior cycle tops have historically acted as support during bear markets. In the last cycle, Bitcoin bottomed near the 2017 high of $19,600 before briefly dipping lower to about $16,000 in November 2022.

The current drop below $69,000 may follow this pattern. However, past cycles also show that prices can fall below prior highs before forming a final bottom. This keeps downside risk open for BTC.

Bitwise European Head of Research André Dragosch noted that a large share of recent transactions occurred between $58,000 and $69,000. This range also aligns with the 200-weekly moving average near $58,000, reinforcing it as a key demand zone.

Meanwhile, crypto analyst exitpump highlighted that large BTC bids are visible on order books between $68,000 and $65,000, suggesting buyer interest on dips.

Related: Bitcoin price may drop below $64K as veteran raises ‘campaign selling’ alarm

BTC flashes record oversold signals

Market analyst Subu Trade said that Bitcoin’s weekly relative strength index (RSI) has fallen below 30. Bitcoin has reached this level only four times, and in each case, the price rallied by an average of 16% over the next four days.

Crypto analyst MorenoDV also noted that the adjusted net unrealized profit/loss (aNUPL) has also turned negative for the first time since 2023. This means the average holder is now at a loss. Similar conditions in 2018–2019, 2020 and 2022–2023 all led to price recoveries for BTC.

While a relief rally might not take shape immediately, Moreno pointed out that the current “speed of sentiment deterioration” is much faster than the previous cycles. The analyst added,

“This rapid transition suggests an acute sentiment reset rather than a gradual decline, potentially shortening the capitulation phase.”

Related: Three signs that Bitcoin price could be near ‘full capitulation’

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

ETHZilla to Tokenize $4.7 Million in Manufactured Home Loans on Ethereum Layer 2

ETHZilla plans to tokenize the loan portfolio into a cash-flow-generating manufactured home loan token.

ETHZilla has announced its acquisition of a portfolio comprising 95 manufactured and modular home loans valued at approximately $4.7 million, with plans to tokenize these assets on Ethereum Layer 2. This strategic move is aimed at enhancing transparency and accessibility in real estate finance.

The tokenization initiative will be executed through the Liquidity.io ecosystem, with the launch expected in late February or early March.

“Manufactured housing loans offer predictable cash flows and strong underlying collateral, which we believe makes them well suited for tokenization within a regulated, transparent structure,” said McAndrew Rudisill, CEO of ETHZilla.

ETHZilla’s strategy is designed to meet institutional compliance and reporting standards, crucial for the integration of real-world assets into blockchain systems.

The manufactured housing market is projected to grow significantly, from $45.82 billion in 2024 to $75.1 billion by 2035, driven by affordability and sustainability.

This article was generated with the assistance of AI workflows.

Crypto World

Gemini To Exit UK, EU, and Australia To Focus on Business in US

Crypto exchange Gemini announced its exit from the United Kingdom, European Union and Australia markets on Thursday, as the company slashed its workforce by 25%.

Gemini cited artificial intelligence automating labor and making engineers “100x” more efficient, and a more challenging business environment in the UK, EU and Australia, as reasons for the exit, according to Thursday’s announcement:

“These foreign markets have proven hard to win in for various reasons, and we find ourselves stretched thin with a level of organizational and operational complexity that drives our cost structure up and slows us down.

“We don’t have the demand in these regions to justify them. The reality is that America has the world’s greatest capital markets,” the announcement said.

The company will instead focus its resources on developing its prediction market platform, Gemini Predictions, which launched in December 2025, and building its business in the US.

The news comes at a challenging time for the crypto industry, as digital asset prices continue to bleed amid a broad market downturn that began with a flash crash in October and the stalling of the CLARITY Act, a widely anticipated US crypto market structure bill.

Related: SEC dismisses civil action against Gemini with prejudice

Gemini shifts focus to prediction markets as the sector grows

Gemini’s announcement highlighted the growing role of prediction markets in its strategy, which it says will be “more front-and-center” on its platform.

“Our thesis is that prediction markets will be as big or bigger than today’s capital markets,” the announcement said.

The company said it has recorded over 10,000 users on Gemini Predictions and $24 millon in trading volume since launch.

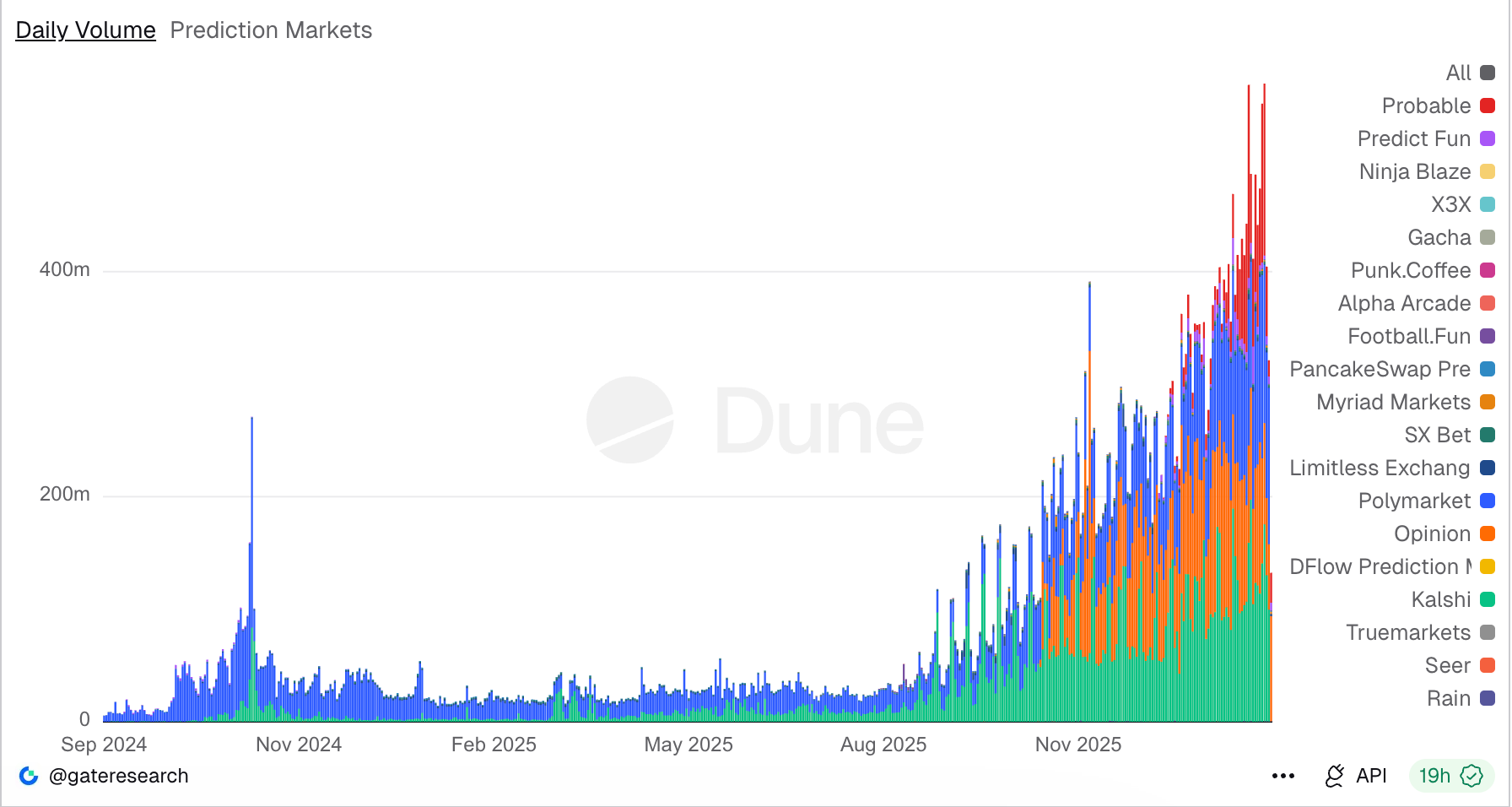

Prediction market trading volume surged in the third quarter of 2024 during the US presidential election, with a 565.4% quarter-on-quarter increase in total trading volume, reaching about $3.1 billion.

In January 2026, daily prediction market trading volume ranged from about $277 million to about $550 million, according to data from Dune.

The market remains dominated by Polymarket and Kalshi, with Polymarket accounting for over 37% of total prediction market 24-hour trading volume and Kalshi commanding over 26%, according to Dune.

Magazine: One metric shows crypto is now in a bear market: Carl ‘The Moon’

Crypto World

HBAR Price Faces a 30% Crash Risk as ETFs Remain Absent

HBAR price remains under heavy pressure as the broader crypto market stays weak. The token is down nearly 47% over the past three months and has slipped another 6% in the past 24 hours, tracking Bitcoin’s latest decline. More importantly, this is not just a short-term sell-off. Hedera’s price has been falling steadily since September, losing almost 67% from its highs.

Behind this move is a deeper problem: shrinking network liquidity, weak institutional demand, and fading retail participation. As TVL continues to fall and ETF inflows remain absent, charts now suggest that HBAR could face another major downside leg. Here is what the data is showing.

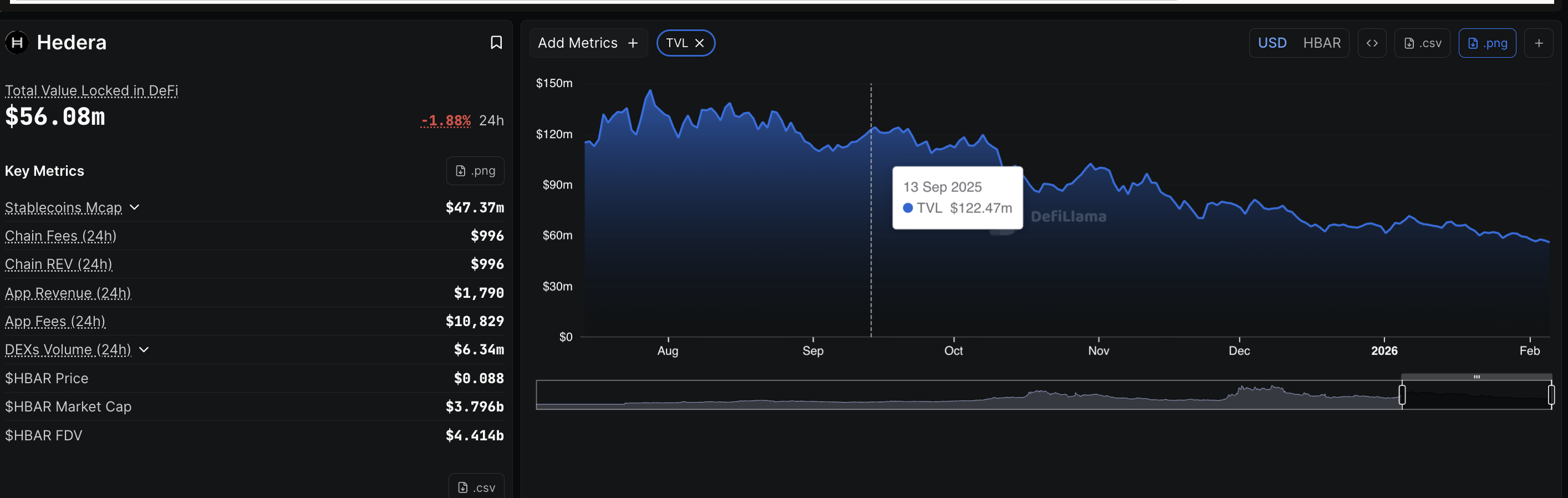

Hedera’s TVL Collapse Shows Liquidity Has Been Leaving for Months

HBAR’s downtrend began in mid-September, when the price started trading against a falling trendline. Soon, the weakening prices entered a falling channel as lower highs met lower lows. Since then, every rally has been weaker, and each breakdown has pushed the token lower.

Sponsored

Sponsored

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This HBAR price action mirrors what happened to Hedera’s on-chain liquidity.

Total value locked was near $122.5 million in September. It has now dropped to around $56 million, a decline of more than 50%. TVL measures how much capital is locked inside DeFi protocols. When TVL falls, it usually means users are withdrawing funds and activity is slowing.

In simple terms, money started leaving the network months ago. The price just followed this fundamental weakness. This explains why HBAR’s decline looks gradual rather than sudden. Liquidity has been drying up steadily. Without fresh capital, rallies fail quickly.

As long as TVL stays weak, HBAR’s upside remains structurally limited.

Sponsored

Sponsored

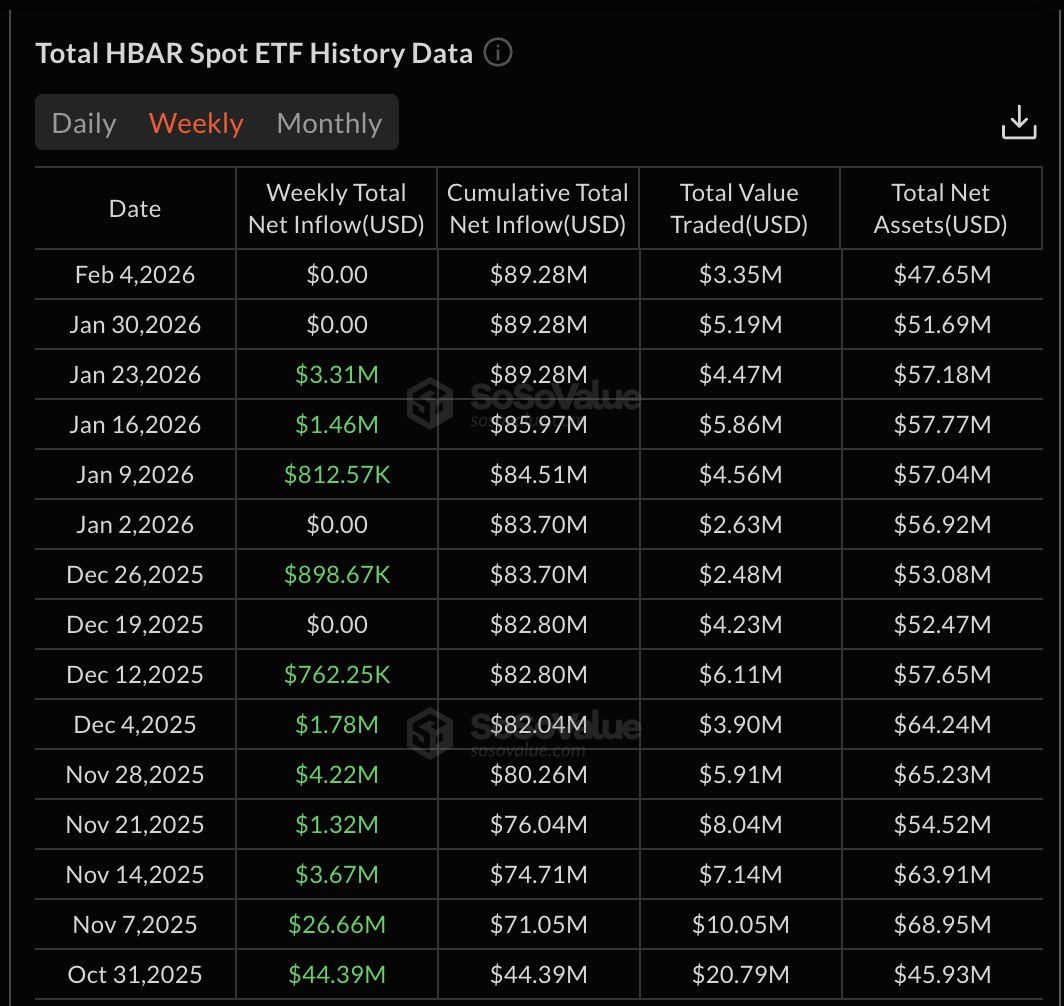

CMF Shows Selective Buying, But ETF and Retail Demand Remain Weak

Not all signals are bearish.

The Chaikin Money Flow has been rising since mid-December, even as the price moved lower. This creates a bullish divergence, showing that some larger investors are accumulating. However, CMF is still below zero. Outflows still dominate. Inflows are improving, but not strongly enough.

At the same time, spot HBAR ETFs have shown no recent inflows over the past two weeks. ETFs bring institutional capital and could help CMF move above the zero line. Their absence limits upside momentum.

The bigger warning comes from On-Balance Volume. OBV has been trending lower since October. This showed that participation and conviction were steadily weakening even during short-term bounces. Recently, OBV broke below this descending support line.

When OBV loses long-term support, it signals that selling pressure is accelerating and that market participation is deteriorating. It suggests that fewer buyers are stepping in, even at lower prices.

Sponsored

Sponsored

So the current setup looks like this:

- Some large buyers are accumulating slowly (CMF divergence)

- Institutional flows remain weak (ETF inactivity)

- Broader participation is shrinking (OBV breakdown)

Without strong volume support, rallies lack follow-through. This explains why HBAR continues to fail at resistance despite occasional inflow signals.

Until OBV stabilizes and ETF demand improves, upside moves are likely to remain fragile.

Sponsored

Sponsored

Falling Channel and OBV Breakdown Point to a 30% Risk Zone

The Hedera Price structure confirms this fragile setup.

HBAR remains trapped inside a falling channel that has guided price lower since September, with a breakdown projection of around 30% if the lower trendline breaks.

The first major support sits near $0.080-$0.076. This zone has been in place since the October 10 crash. A daily close below it would weaken the structure. Below that, the next support lies near $0.062, based on Fibonacci extensions to the downside.

If this level breaks, the channel projection points toward $0.043, opening the 30% breakdown path. On the upside, recovery remains difficult.

HBAR must first reclaim $0.107. A move above $0.134 is needed to break the bearish channel. But that likely requires:

- A sustained TVL rebound

- Consistent ETF inflows

Without both, any HBAR price bounce attempt may fade quickly.

Crypto World

Aster Testnet Launches; Mainnet Rollout and New Features Coming in Q1

TLDR

- Aster’s layer-1 blockchain testnet is now live for all users, marking a key milestone for the platform.

- The Aster team plans to launch the mainnet in the first quarter of 2026.

- New features, including fiat currency on-ramps, will be introduced in Q1 2026.

- Aster will release its code for developers, fostering ecosystem growth and innovation.

- The platform’s shift to a perpetual futures DEX positions it as a competitor to Hyperliquid.

Aster, a decentralized crypto exchange (DEX) and perpetual futures platform, has announced the launch of its layer-1 blockchain testnet. The testnet is now available to all users, with the mainnet rollout scheduled for the first quarter of 2026. This major milestone is part of the company’s ambitious plans to enhance its platform and expand its offerings.

Aster’s Upcoming Features and Q1 2026 Launch Plans

Aster’s roadmap for 2026 includes several key developments that will significantly enhance its services. The introduction of fiat currency on-ramps will allow users to seamlessly convert their traditional currency into digital assets. Along with this, Aster will release its code for developers, enabling third-party builders to contribute to the platform’s growth.

The upcoming Aster layer-1 mainnet is designed to improve the platform’s efficiency and scalability. It will also serve as the backbone for future features and expansions. These developments are expected to increase Aster’s appeal to both traders and developers, fostering a more vibrant ecosystem.

In March 2025, Aster rebranded as a perpetual futures DEX. This move positioned the platform as a competitor to Hyperliquid, another prominent perpetual futures DEX. Hyperliquid operates on its own application-specific blockchain network, highlighting the trend of Web3 projects developing custom layer-1 blockchains for high-throughput transactions.

Aster’s decision to launch its own layer-1 blockchain aligns with this growing trend. It reflects the increasing demand for specialized blockchains that can handle high transaction volumes. By moving away from general-purpose chains like Ethereum and Solana, Aster aims to provide a more tailored and efficient solution for its users.

Surge in Perpetual Futures Trading Volume and Market Growth

The perpetual futures market saw a sharp rise in trading volume during 2025. According to DefiLlama, the cumulative trading volume nearly tripled, growing from approximately $4 trillion to over $12 trillion by the year’s end. About $7.9 trillion of this volume was generated in 2025, signaling increasing interest in crypto derivatives.

Monthly trading volumes hit the $1 trillion mark in October, November, and December. This surge highlights the growing demand for perpetual futures contracts, which allow traders to keep positions open without expiration dates.

Crypto World

Zcash Price Warning: Another Major Crash Incoming?

Zcash price remains under heavy pressure as bearish momentum continues to build across the market. After losing nearly 35% since late January, Zcash (ZEC) is now slipping deeper inside a falling channel that has guided prices lower for months.

Weak volume, fading whale interest, and shrinking derivatives activity are all reinforcing the downside trend. With multiple indicators flashing warning signs, charts now suggest that Zcash may be entering another breakdown phase.

Falling Channel and OBV Breakdown Show Sustained Selling Pressure

Zcash has been trading inside a clear falling channel since November, marked by consistent lower highs and lower lows.

Sponsored

Sponsored

After peaking above $740, ZEC entered this declining range and has already experienced one major collapse of more than 56% inside the channel, also the breakdown target. Each rebound has become weaker, showing that buyers are unable to shift momentum.

The weakening structure is confirmed by On-Balance Volume (OBV) tracks buying and selling pressure by adding volume on up days and subtracting it on down days. Rising OBV suggests accumulation, while falling OBV signals distribution.

From early November through late January, Zcash’s OBV was forming an ascending trendline. This showed that some Zcash buyers were still trying to accumulate, even as the price traded inside a falling channel.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

That support finally failed on January 29. Since this breakdown, Zcash has already fallen nearly 36%. This validates the OBV signal and shows that the loss of volume support directly translated into lower prices.

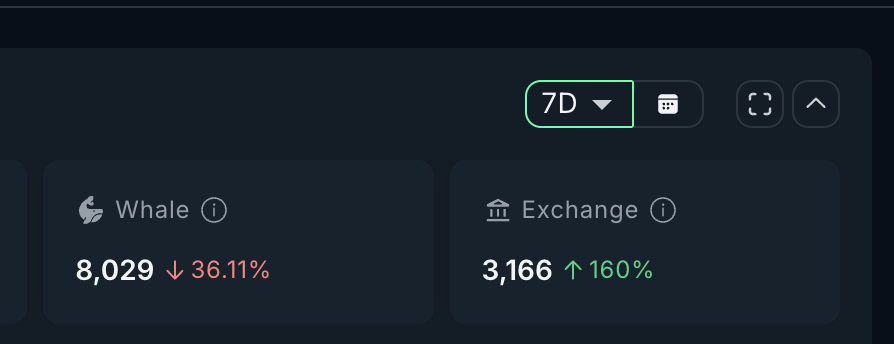

On-chain behavior reinforces this trend. Over the past seven days, whale holdings have declined by around 36%, with large wallet counts falling toward the 8,000 range. This suggests that major holders are trimming exposure rather than accumulating.

Sponsored

Sponsored

At the same time, exchange balances have surged by nearly 160%. Rising exchange supply usually means more tokens are being prepared for sale, increasing immediate selling pressure.

Together, the falling channel, OBV breakdown, whale reduction, and exchange inflows point to sustained distribution. Retail participation is weakening, long-term holders are reducing exposure, and supply is moving toward selling venues. This combination explains why ZEC continues to struggle to hold support.

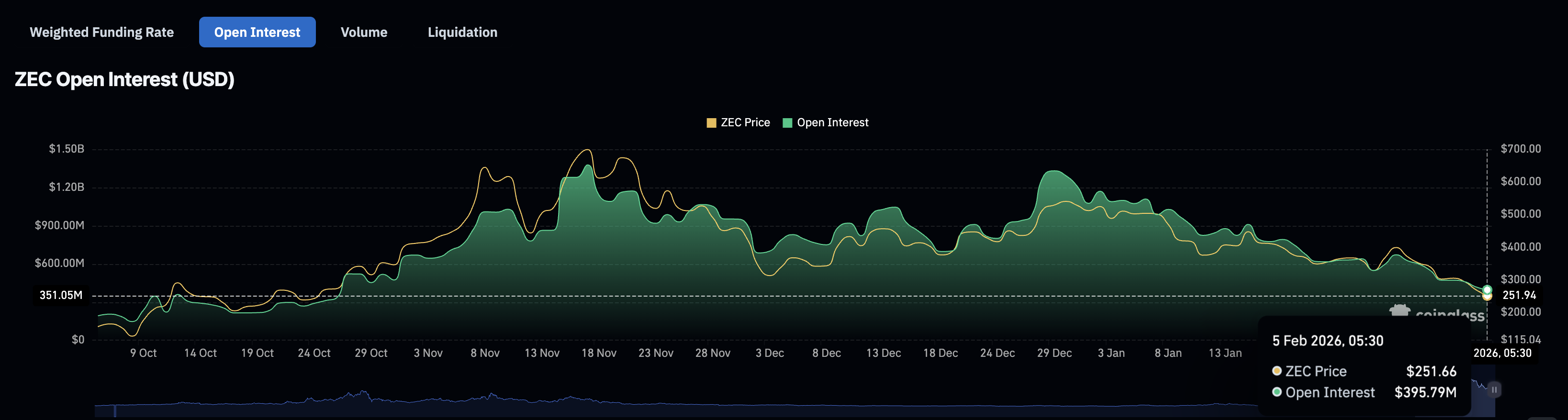

Derivatives Activity Weakens as Remaining Long Positions Add Risk

With spot participation fading, the next question is whether derivatives can push prices up, as they have during past short squeezes.

So far, the data suggests limited support.

Zcash open interest peaked near $1.13 billion in December. It has now dropped to around $395 million, a decline of nearly 65%. This shows that speculative interest has cooled sharply, with many traders closing positions and moving to the sidelines.

Sponsored

Sponsored

When open interest falls this much, it signals reduced conviction. There is less leverage in the system to drive strong rebounds, and fewer traders willing to defend key levels.

At the same time, funding rates have cooled since October but remain slightly positive. Positive funding means that long positions still dominate, even though overall participation is shrinking. In simple terms, fewer traders are active, but many of those who remain are still betting on higher prices.

This creates a fragile setup. If prices fall further, these remaining longs become vulnerable to liquidation. When liquidations occur in low-liquidity conditions, they can trigger rapid downside moves.

So even though derivatives no longer have enough “fuel” to drive a major rally, the presence of exposed long positions still amplifies breakdown risk. Instead of supporting price, leverage now increases the chance of accelerated selling.

Sponsored

Sponsored

Key Zcash Price Levels Show Why the $100 Zone Remains in Focus

The Zcash price remains trapped inside its falling channel, with the lower trendline continuing to guide the price lower. The first major support zone sits at $230.

A sustained daily close below $230 would expose the next support near $212, but not without triggering a trendline breakdown.

If $212 fails, the channel projection and Fibonacci extensions both point toward the $103 region. This zone represents the full downside move implied by the current structure.

On the upside, recovery remains difficult. ZEC must first reclaim $286 to regain short-term stability. A move above $389 is needed to improve the medium-term structure. A rally toward $557 would require a major revival in volume, whale accumulation, and derivatives participation, making it unlikely under current conditions.

As long as Zcash remains below $230 and fails to hold $212, downside risks dominate. Without renewed participation and capital inflows, the charts continue to favor a move toward the $100 zone.

Crypto World

QT Fears Behind Crypto Sell-Off Are Overblown

Markets sold Bitcoin after Warsh nomination, but Binance Research argues liquidity and structural limits make severe QT unlikely.

A major sell-off swept through crypto markets in the last few days, pushing Bitcoin (BTC) to its lowest price since November 2024.

According to analysis from Binance Research, the move was triggered by news that Kevin Warsh had been nominated to chair the Federal Reserve, with markets interpreting his historical stance as a sign of aggressive liquidity tightening, forcing widespread deleveraging.

However, Binance Research suggested the reaction may be overblown, as physical constraints in the financial system could prevent the severe balance sheet reduction the market fears.

Liquidity Crisis Hits the End of the Chain

Per Binance analyst Michael JJ, last week’s turbulence displayed classic signs of a liquidity scramble. Following disappointing earnings from major tech firms such as Microsoft and rising geopolitical tensions, the nomination of Warsh, known for advocating a reduction of the Fed’s bond holdings, sparked a rush to exit risk.

Traders facing margin calls sold their most liquid assets to raise cash, and precious metals saw trading volumes spike to over ten times normal levels as the U.S. dollar rebounded sharply. Data presented by the on-chain technician shows cryptocurrencies acted as “end-of-liquidity-chain” assets, meaning they were among the first sold when liquidity was needed elsewhere.

When gold fell, crypto fell with it, but when the metal rebounded, digital assets continued to drop alongside stocks. This confirmed its low priority in the liquidity hierarchy. In that period, Bitcoin broke below several critical technical supports, including the head-and-shoulders neckline and key moving averages, hitting an intraday low near $73,000 on February 4.

Are QT Fears Overstated?

The core of the Binance Research argument is that markets are overpricing the risk of Quantitative Tightening (QT) under a potential Warsh chairmanship. While his proposals call for shrinking the Fed’s balance sheet, the report outlined technical constraints that may make aggressive contraction physically difficult.

You may also like:

For instance, the Fed’s reverse repo facility, a crucial buffer, is approaching its depletion point. This means future QT would directly drain bank reserves, potentially pushing them below regulatory minimums and risking a repo market crisis like the one seen in 2019.

Furthermore, the U.S. Treasury’s need to issue about $2 trillion in new debt annually requires a buyer. If the Fed steps back as a net purchaser through QT, the private sector must absorb the supply, which could strain markets.

The analysis suggests that without changes to banking regulations, such as exempting Treasuries from certain capital ratios, the financial system’s “plumbing” cannot support the balance sheet shrinkage Warsh has historically supported.

As a result, such regulatory changes are seen as a longer-term possibility, not an immediate threat.

The report also pointed to the resolution of the latest U.S. government shutdown on February 3 as a positive development that may have been overlooked in the recent market frenzy. The development removed a source of near-term policy uncertainty, allowing federal agencies to be funded through September 2026.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

IQVIA Stock Drops as 2026 Outlook Misses Wall Street Expectations

TLDR

- IQVIA’s stock dropped 8.5% following the company’s weaker-than-expected 2026 profit forecast.

- The company’s adjusted earnings forecast for 2026 ranged from $12.55 to $12.85 per share, missing Wall Street’s estimate of $12.95.

- Despite strong fourth-quarter results, IQVIA’s revenue of $4.36 billion and adjusted profit of $3.42 per share were overshadowed by the weak outlook.

- Investors focused on the disappointing guidance, causing the stock to decline, even after a solid quarterly performance.

- IQVIA’s stock has been volatile, with 10 price moves greater than 5% in the past year, signaling ongoing market uncertainty.

Shares of IQVIA (NYSE: IQV) dropped 8.5% in the morning session following the company’s weak profit forecast for 2026. The clinical research firm’s outlook for adjusted earnings fell short of Wall Street expectations. Investors focused on the disappointing guidance rather than strong fourth-quarter results, pushing the stock lower.

IQVIA’s Full-Year 2026 Forecast Misses Wall Street Expectations

IQVIA projected adjusted earnings for 2026 to range from $12.55 to $12.85 per share. This forecast was below the analysts’ average estimate of $12.95 per share. Despite the company’s solid fourth-quarter performance, which included revenue of $4.36 billion and an adjusted profit of $3.42 per share, the weak guidance overshadowed the positive results.

The disappointing forecast caused concern among investors, as it reflected a potential slowdown in future growth. As a result, IQVIA’s stock took a sharp decline in response to the news. Investors appeared to be more focused on the company’s outlook rather than its recent achievements, leading to a market reaction that drove the price lower.

Strong Fourth-Quarter Results Fail to Offset Weak Guidance

IQVIA exceeded expectations in the fourth quarter, posting strong revenue and earnings figures. The company’s revenue of $4.36 billion surpassed estimates, and its adjusted profit of $3.42 per share also beat consensus forecasts. However, despite these positive results, the stock market’s attention shifted quickly to the lowered profit projections for 2026.

The focus on the weaker future guidance led to a significant drop in IQVIA’s share price. Investors seem to have placed more weight on the company’s forward-looking expectations than its recent performance. This resulted in a sell-off, which has left the stock struggling to recover from the early loss.

IQV Stock Volatility Continues to Influence Investor Sentiment

IQVIA’s stock has shown volatility in recent months, with 10 moves greater than 5% over the past year. Today’s 8.5% drop fits within this pattern, but it also signals that the market views the news as impactful yet not a major shift in the company’s overall outlook. The recent downturn represents a continuation of IQVIA’s unpredictable stock movements.

Despite the recent fall, IQVIA’s stock price remains down 17% for the year. The company’s shares are trading at $187.09, a significant 23.4% below their 52-week high of $244.29. Investors who have held IQVIA stock for five years have seen a modest return, with their investment now valued at $1,005 for every $1,000 invested.

Crypto World

Bitcoin spirals toward $65,000, headed for worst drawdown since FTX crash

Bitcoin tumbled below $66,000 during early afternoon U.S. hours as this week’s crypto selloff accelerated into a bloodbath on Thursday.

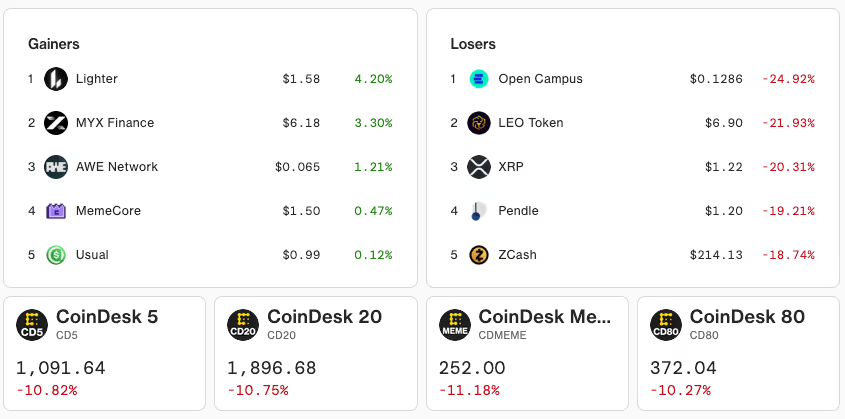

The largest cryptocurrency fell more than 10% over the past 24 hours to a session low of $65,156, according to CoinDesk data, the weakest level since October 2024 and below the 2021 peak.

Feb. 5 could be one of the worst days in bitcoin’s history. BTC is on track to suffer its steepest one-day drawdown — 10.5% since midnight UTC at current prices — since Nov. 8, 2022, when the collapse of crypto exchange FTX sent BTC below $16,000 after a 14.3% drop on the day.

Crypto wasn’t the only asset class under relentless selling pressure. Silver also plunged 15% during the day, and is now almost 40% below its record high just a week ago. Gold also fell more than 2.8% to $4,820, but that selloff wasn’t as bad as silver. The precious metal is now trading about 15% below its record last week.

Software stocks, often moving in lockstep with bitcoin, continued to selloff, with the thematic iShares Expanded Tech-Software ETF (IGV) declining more than 3% and down 24% year to date. The S&P 500 and the tech-heavy Nasdaq were also 1% lower.

Crypto stocks weren’t spared either. Coinbase (COIN), Galaxy (GLXY), Strategy MSTR) and BitMine (BMNR) tumbled more than 10%, while several crypto miners, including Bitfarms (BITF), CleanSpark (CLSK), Hut 8 (HUT), and Mara (MARA), saw similar losses.

“One big factor is just very thin liquidity,” said Adrian Fritz, chief investment strategist at 21shares. “If there is a bit of a sell pressure, it usually triggers a lot of liquidations.”

In a fragile market environment with only a few buy and sell orders to cushion trades, even modest sell-offs can trigger a large price reaction, in turn triggering further liquidations.

While some have said the worst is over for weeks now, Fritz believes otherwise.

“There’s still no signal that we bottomed out. I think it’s too early. There’s no confirmed turnaround,” he said.

He points to the 200-moving-day average — currently around $58,000 to $60,000 — as a key support level to watch. That level also aligns with bitcoin’s “realized price,” or the average cost basis of all bitcoin holders, which he believes could serve as a strong, multi-year support.

Read more: Bitcoin can still fall further. Historical data shows $60,000 will be the bottom

Altcoins decimated

Bitcoin’s performance could seem minor compared to the brutal selloff in altcoins.

Almost all CoinDesk index prices, including major tokens and memecoins, are down by more than 10% over the last 24 hours.

XRP, which fell 19% over the same 24-hour period, underperformed most other large-cap cryptos.

While Fritz said he believes there’s no specific trigger that puts extra pressure on the token, he said that “from a technical point of view, there’s not a lot of support levels for XRP.”

Read more: Here is what industry veterans are saying as bitcoin tumbles below $70,000

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World7 days ago

Crypto World7 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat7 days ago

NewsBeat7 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business3 hours ago

Business3 hours agoQuiz enters administration for third time

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat10 hours ago

NewsBeat10 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration