Related: Everything to Know About the Ongoing Search for Nancy Guthrie

Advertisement

The self-proclaimed King of Five Nights of Freddy’s is now king of the box office. After a strong theatrical debut, breaking industry predictions and earning praise from audiences, Iron Lung continues to exceed expectations despite being self-funded and self-distributed. This horror sci-fi film marks the directorial debut of Mark Fischbach (aka Markiplier), which tells the story of a convict piloting a submersible in a post-apocalyptic universe.

Iron Lung currently sits at a Verified Hot audience score of 89% and a low critics’ score of 43% on Rotten Tomatoes. Additionally, Iron Lung grossed $21.5 million worldwide during its opening weekend, exceeding its reported $3 million budget. Since its release, Fischbach has hosted livestreams reacting to the movie’s box office results, to the point that he got emotional following its opening weekend. According to the YouTuber, he hopes his film will inspire other independent filmmakers, as Iron Lung was able to compete with Disney at the box office.

As of writing, Iron Lung has generated over $26 million worldwide, allowing the film to enter the Top 10 Highest-Grossing films of 2026, now sitting at #10. Fischbach hosted another livestream this week, where he praised Iron Lung becoming the “Number 1 movie in America.” He also announced that Iron Lung will be in theaters for another week and will be distributed in Southeast Asia.

Iron Lung takes place in a distant future, where the universe has succumbed to an apocalyptic event called “The Quiet Rapture,” in which the stars and habitable planets have vanished, and survivors now reside in space stations. Fischbach stars in the film, playing Simon, a convict who’s selected to pilot a submersible called “The Iron Lung” on a moon that features an Ocean of Blood in hopes of finding resources. In exchange for his work, he will be granted his freedom. As he navigates this bloody sea, he discovers that he might not be alone in the ocean.

Fischback directed, wrote, starred in, and edited Iron Lung, and also features Caroline Rose Kaplan, Troy Baker (The Last of Us), Elsie Lovelock, Elle LaMont (Alita: Battle Angel), and Seán McLoughlin (Jacksepticeye). Originally, Iron Lung was supposed to have a limited theatrical run in 60 locations in North America. But after a strong fan campaign, in which people contacted their local movie chains to bring the movie to their region, Iron Lung is now available in over 4,000 locations across North America, Europe, and Oceania.

Iron Lung is now showing in theaters. Follow Collider to keep up to date with the latest updates.

January 30, 2026

127 Minutes

Mark Fischbach

Mark Fischbach

Will Hyde, Amy Nelson, Jeff Guerrero

Mark Fischbach

Speaker #2 (Voice)

:max_bytes(150000):strip_icc():format(jpeg)/Iron-Lung-020226-0c940f6f0d8541a4a7189d7eede2477a.jpg)

Mark Fischbach leaned on his devoted fanbase to get his feature directorial debut on 2,500 screens.

Published

TMZ.com

Fab Morvan, of Milli Vanilli fame, says he spent years being scapegoated by the music industry … but his new Grammy nomination may have given his career new life in America.

We caught up with Fab in L.A. nearly 36 years after the 1990 lip-syncing scandal, which led to the Recording Academy revoking Milli Vanilli’s Best New Artist prize. But on Sunday, Fab made his triumphant return to the award show as a nominee!

He told us, “My wings were clipped. I guess they reattached this weekend. The best is yet to come.”

While Fab assured us he doesn’t care about awards, he was still mighty proud to show off the bronze Tiffany & Co. medallion he was given after being nominated for narrating his memoir, “You Know It’s True: The Real Story of Milli Vanilli.”

Fab told us, “He’s official, y’all!” referring to himself in third person. And he’s not just official … he’s working!

The French-born singer told us he’s been touring Europe for the past 3 decades but now he’s signed with an agency in the U.S., and they have big plans.

“We’re about to do many shows,” he promised. “I think the next one’s in Irvine with Vanilla Ice, Salt-N-Peppa, Tone Loc, Young MC, and so on.”

Congrats, Fab! Welcome back!

Roomies, Victoria Woods is not letting up and has continued goin’ OFF after her sister GloRilla dropped a few spicy reposts in response to Victoria claiming that she neglects their family.

After Victoria Woods doubled down on her claims about her sister, Glo appeared to be in a lighthearted mood and began sharing reports via her Facebook page “Gloria Woods.” Furthermore, she initially reported a photo of herself smiling at a red carpet appearance. Additionally, the caption read, “If I send u dis, jus kno I can’t help u “

Afterward, Glo reposted an apparent photo of her sister, which had the caption, “If I send you this just know I’m finna beg”

Then, Glo shared a post, writing, “Indeed.com.”

Afterward, Glo reposted apparent text messages with her cousin alongside a post of the family member sharing how the rapper has always been there for her.

Then, Glo ended the night by updating her profile photo to an apparent AI photo of her sister in a Fedex uniform.

Victoria Woods caught her sister’s repost and profile picture update and clapped back with, “Our momma work at fedex h*e not me.”

Afterward, Victoria continued going off on her sister, writing, “And another thing B***H while you trying to get my page took GLORIA.” Then she followed up with another post, writing, “And I’m done with this s**t keep making her feel like shes right ion gaf about what nobody has too say..we all struggle in that house so for you to make it out and forget about us is diabolical“

Since then, Victoria has been posting screenshots of her Cash App and sending thank yous to those who have been sending her money.

As The Shade Room previously reported, earlier this week, Victoria took to Facebook, writing, “I’ll Really Go Live And Expose Yall Favorite Rapper Same Mom, Same Dad, 10 Siblings Yall Think she this upright ass person when she really not ain’t fwu since she got on and I’m constantly getting acknowledgment for being her sister and she ain’t fwu at all Gloria Woods call my bluff it’s been 4years why the media haven’t seen your siblings? And don’t say cause you protecting us cause we still in Memphis it’s cause you talk about our struggles and you don’t fw na let’s clock it.”

Subsequently, Victoria added, “And our parents are not straight!! Our dad just borrowed 100$ from our mom yall think yall know shit but don’t !! I had to give my mom 1800$ on a 2400$ rent cause Yall favorite rapper blocked her !! Im tired of being quiet”

Afterward, Glo appeared to clap back at her sister’s claims by sharing apparent texts from her mom thanking her for her support.

In response, Victoria appeared to call cap on the texts.

Furthermore, Victoria went live and even called out Yo Gotti, too.

What Do You Think Roomies?

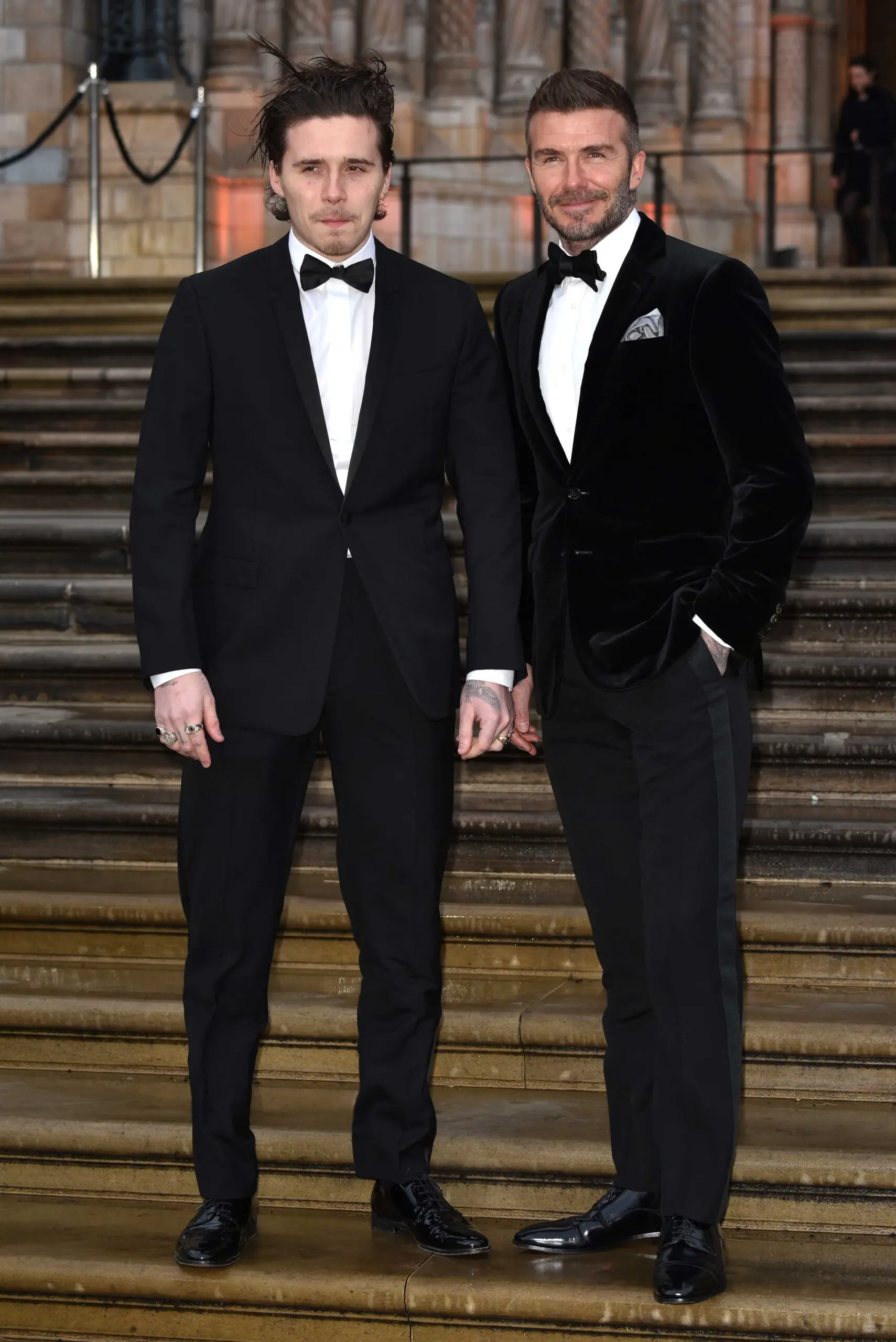

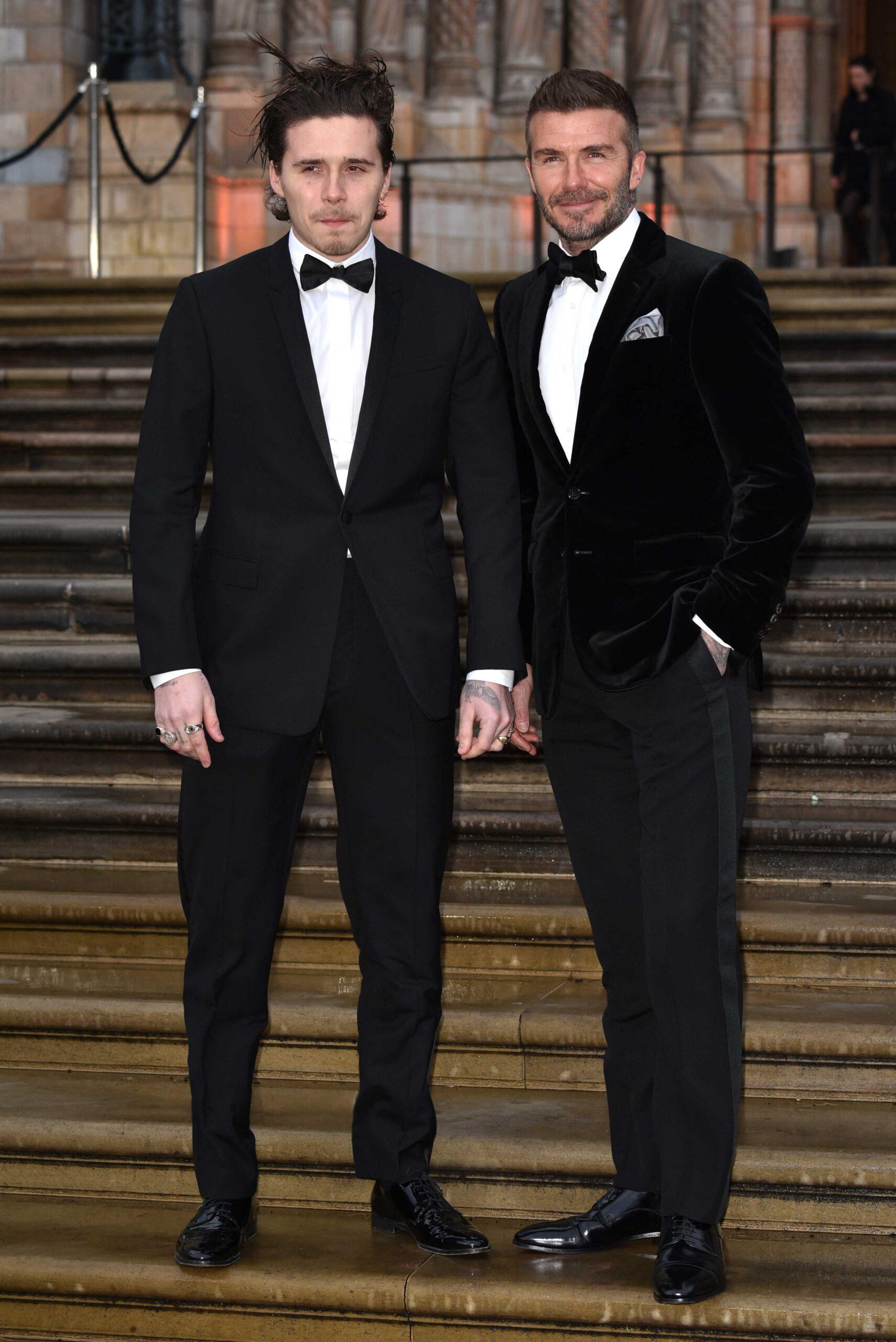

According to reports, Brooklyn has allegedly removed the tattoos he had dedicated to his parents, as the family feud, which began last month with Brooklyn’s bombshell allegations, continues.

Article continues below advertisement

Things in the ongoing Beckham family drama have taken another turn, and this time it’s Brooklyn sending a message to his parents without saying a word. Per Us Weekly, the oldest child of David and Victoria has allegedly removed the tattoos he got dedicated to them.

In recent images of Brooklyn out with wife Nicola Peltz, the anchor tattoo on Brooklyn’s right arm which featured “DAD” in the middle, appears to have now been covered up with three nondescript symbols.

The tattoo also has the words “Love You Bust,” underneath the anchor and is still present. According to the outlet, “Bust” is a loving nod to Brooklyn and David’s past relationship, as they referred to each other as “Buster,” a name which is tattooed on David’s neck.

Article continues below advertisement

However, David isn’t the only one who had his tribute tattoo removed. Brooklyn also allegedly covered up the “Mama’s Boy” tattoo on his chest in honor of Victoria.

Article continues below advertisement

In the bombshell posts he made last month calling out his family, Brooklyn ended his message by making it abundantly clear that he has no current interest in repairing his fractured relationship with his family.

“I have been silent for years and have made every attempt to keep these matters private,” Brooklyn wrote in multiple messages posted to his Instagram Stories.

“Unfortunately, my parents and their team have continued to go to the press, leaving me with no choice but to speak for myself and tell the truth about only some of the lies that have been printed,” he continued.

Brooklyn made his stance clear with his family moving forward. “I do not want to reconcile with my family. I’m not being controlled, I’m standing up for myself for the first time in my life.”

Article continues below advertisement

He also hurled accusations that his mom Victoria “hijacked” the first dance at his wedding by dancing “inappropriately” and making him feel “uncomfortable” and “humiliated.”

Article continues below advertisement

Cruz, along with his siblings Romeo and Harper Beckham, has shown a strong sense of support for his superstar parents.

Accompanying the family as they shut down Paris Haute Couture Fashion Week late last month, where Victoria was honored, Cruz has also supported her through music.

On Thursday, February 5, Cruz posted a video on Instagram, playing the guitar, as Victoria and the Spice Girls (minus Mel B) sat around and sang a stripped-down version of their 1998 hit, “Viva Forever.”

“I think I found my openers… you think they have potential? Something exciting coming later today 😉 keep an eye out and get involved,” Cruz wrote in the video’s caption.

Known to always support his mother’s status as a pop music icon, Cruz got a “Posh” tattoo in her honor back in 2023.

Per PEOPLE, an inside source told the outlet that despite the backlash from his allegations, Brooklyn “has no regrets about speaking out publicly against his parents.”

The source also shared that Brooklyn believes he was in the right to speak out against his parents and feels “at peace” for airing out their tense relationship publicly.

In addition to alleging that Victoria “hijacked” the first dance at his wedding by dancing “inappropriately” and making him feel “uncomfortable” and “humiliated,” Brooklyn further accused his parents of years of behind-the-scenes sabotage regarding his marriage and using the media to paint a negative picture of the couple, who were married in 2022.

Article continues below advertisement

“My mum cancelled making Nicola’s dress in the eleventh hour despite how excited she was to wear her design, forcing her to urgently find a new dress,” Brooklyn wrote.

However, a resurfaced 2022 Vogue interview with Nicola and her stylist contradicted Brooklyn’s claims.

It was revealed in the interview that Nicola had a custom Valentino Haute Couture wedding gown ready for her to walk down the aisle that took a year to create.

Nicola’s stylist also shared with the outlet the details of the extensive design process, such as selecting sketches and fabrics for “the ultimate couture experience.”

By Robert Scucci

| Published

After The Evil Dead’s commercial success, Sam Raimi was eager to work on another project with Bruce Campbell, with help from the Coen brothers, in the form of 1985’s Crimewave. While this sounds like the best movie you’ve probably never heard of, it’s best to approach this one with guarded enthusiasm because what sounds awesome on paper doesn’t quite work on screen as intended. It’s not that the script isn’t funny, or that the setpieces aren’t ambitious, but rather that Raimi wasn’t allowed to edit the film due to studio interference. The end result is a movie that feels disjointed and incomplete despite the talent involved.

Had Raimi and the Coen brothers conceptualized the film later in their careers, when they had more clout and creative leverage, Crimewave could have been a masterpiece of subversive comedy. All the elements that draw you to it are present, but everything feels cobbled together and without a clear sense of direction. At the end of the day, that’s pretty much what you should expect when getting into a dark, neo-noir crime comedy inspired by Hitchcock, filtered through B-movie production values that lean fully into slapstick humor, as if you were watching a Laurel and Hardy bit stretched to feature length.

Still, if you’re a fan of the filmmakers, it’s a fascinating creative misstep to witness. If nothing else, it lets you check off one of their more obscure titles, a movie that never really had a chance to thrive upon release, but is now adored as the cult classic it was always destined to be.

Crimewave tells its primary story in flashbacks, leading up to the execution of Victor Ajax (Reed Birney), who finds himself strapped into an electric chair as midnight approaches. You’re also treated to a smash cut of a group of nuns crammed into a sedan, barreling toward the prison for reasons that won’t be explained until much later. Victor insists that he’s innocent, and hopes he can convince the executioner to spare him by recounting what really happened before he was apprehended and incarcerated.

Victor’s flashbacks tell the story behind the murders he’s been accused of committing, but given how convoluted everything becomes, it’s no wonder he’s minutes away from getting zapped out of his mortal coil. According to Victor, he worked as a technician for Ernest Trend (Edward R. Pressman), the co-owner of Trend-Odegard Security. While installing security cameras in his boss’s apartment building, Victor is sent off to track down his dream girl, Nancy (Sheree J. Wilson), who just so happens to live in the same building. What Victor doesn’t realize is that this errand is a deliberate distraction, as he’s supposed to be heading back to the shop across the street, completely unaware of what Mr. Trend already knows.

Mr. Trend has just learned that his business partner, Mr. Odegard, is trying to sell the company out from under him. In response, he hires exterminators Faron (Paul L. Smith) and Arthur (Brion James) to kill Odegard at the shop. Meanwhile, Victor attempts to charm Nancy, who is openly disinterested in him, but infatuated with Renaldo The Heel (Bruce Campbell), a sleazy rival who plans on buying the company from Odegard. Through this love triangle, the machinations of Mr. Trend, and the exterminators’ willingness to wipe out anyone in their path to make sure the sale doesn’t go through, Victor finds himself in the middle of a murder spree that becomes increasingly slapstick in execution, but incriminating all the same.

As bedlam unfolds according to Victor’s recounting of events, we gradually piece together what really happened that night. Whether or not he’s telling the truth, however, is left for the judge and executioner to decide as the clock ticks closer to midnight.

The most disappointing aspect of Crimewave is that it contains all the raw elements you’d expect from a Sam Raimi film written by the Coen brothers. Bruce Campbell is reliably Bruce Campbell, and the slapstick is pushed so far into absurdity that it feels like an early preview of what the Coens would later refine in films like Raising Arizona and O Brother, Where Art Thou? Unfortunately, Raimi simply didn’t have the authority he needed to fully realize the project on his own terms, and the resulting studio interference hurt Crimewave far more than it helped.

While Crimewave remains a fun watch thanks to its cast, oddball story beats, and occasionally elaborate setpieces, its individual parts never quite line up to form a satisfying whole. The silver lining is that its failure directly inspired Raimi to double down on Evil Dead II after recovering from this production. In that sense, Crimewave became a necessary stepping stone that pushed the franchise we know and love into bolder, more unrestrained territory.

Had Crimewave been conceived in the 90s, 2000s, or later, the final product would likely have been far more cohesive. By that point, Raimi and the Coen brothers would have had enough creative control to fully embrace the absurdity baked into the screenplay. Even so, it’s still a Sam Raimi film written by the Coen brothers, which means you can expect a healthy dose of offbeat, dark humor that reflects the sensibilities they’ve consistently delivered throughout their careers. It just happens, in this case, to miss the mark more often than it hits, making for a messy but undeniably interesting watch.

As of this writing, Crimewave is streaming for free on Tubi.

Published

TMZ.com

Political commentator Quentin Jiles was a runner-up on “The Traitors” 3 years ago, so he knows what it takes to survive the roundtable … and he told us the politicians he thinks would be immediately banished.

Watch the video … Quentin stopped by “TMZ Live” to dish on who in D.C. gives off so much overtly traitorous energy, the other Faithfuls would banish them whether they were Traitors or not.

Quentin gave us 2 very notable names … and one them, Quentin joked, catches a flight out of his state “every time the wind blows,” which would be an immediate red flag to the rest of the contestants.

According to Quentin, a critical skill for doing well on “The Traitors” is gaining your castmates’ trust … which is an ability that Quentin says is extremely lacking with these 2 Washington power players.

But there was one person in particular — a Supreme Court Justice — whom Quentin thinks is just duplicitous enough to win the whole thing!

By Joshua Tyler

| Published

Star Trek’s Starfleet Academy dropped an episode centered entirely around the commander of Deep Space Nine, Captain Benjamin Sisko. It’s titled “Series Acclimation Mil” and the plot involves Cirroc Lofton returning as Jake, in hologram form, and it ends with a voiceover that sounds like a cameo from Sisko himself, Avery Brooks. It’s not. It’s a lie.

Avery Brooks did not participate in this episode of Starfleet Academy and has, in fact, retired from acting in general and Star Trek specifically. He has no intention of returning, let alone for a show like this.

The voice you heard at the end of Starfleet Academy was Avery Brooks’s voice, but it wasn’t something he recorded for the series. Instead, the show’s producers stole Avery’s voice off a spoken word album he once did, and they’re now passing it off as the return of the Sisko.

Here’s what Avery Brooks said in the stolen dialogue: “Divine laws are simpler than human ones, which is why it takes a lifetime to be able to understand them. Only love can understand them. Only love can interpret these words as they were meant to be interpreted.”

If you watched the episode, you probably thought that dialogue sounded weird, out of place, and didn’t obviously fit exactly what was going on in the show. Now you know why. It wasn’t meant for the show.

The show’s producers are trying to make it seem like the theft of Avery’s voice was done with his blessing, but that doesn’t seem to be strictly true. Alex Kurtzman claims, “I had a very beautiful interaction with Avery.” Who knows what that means? It could have been an email or a call from his lawyer.

The rest of what the Starfleet Academy team is telling the media suggests that Cirroc Lofton spoke with Brooks about it for them. Lofton and Brooks have maintained a close relationship over the years since the end of DS9, with Brooks becoming something of a surrogate father to Lofton.

Other than whatever private discussions Cirroc may have had with him, Avery Brooks had nothing to do with Starfleet Academy. Writer Tawny Newsome says Brooks was “aware of the project.” Being “aware” the show exists is the full extent of Brooks’s involvement, according to the show’s creative team.

Aside from stealing Avery Brooks’s voice to capitalize on his legacy, most of the episode was terrible and involved an annoying girl reducing his role as the Emissary to some sort of superhero trope that would spawn a legion of Emissaries, or something equally ridiculous. It was dumb and childish, but didn’t trample on the excellence of Deep Space Nine, which is a win.

If there’s a positive in the episode, it’s Cirroc Lofton, who was dignified and insightful. I have a hard time believing all of his dialogue was written by the Starfleet Academy crew; much of it sounded very different from the usual dreck they spew, and I found myself wondering if he’d come up with some of it himself.

We learn that Jake Sisko never published the novel he was writing. The reason given is some strange justification about how not publishing it made him feel close to his father. That’s a shame, since there’s nothing Ben Sisko would have liked more than to see Jake publish his book.

However, Lofton delivers the best performance we’ve seen from anyone on Starfleet Academy so far while focusing his discussion of Benjamin Sisko on Sisko’s role as a great father. That was always a key to the character, and one of the most beautiful and unique things about Deep Space Nine.

Cirroc Lofton proved he’s grown into the kind of man that both Ben Sisko and Avery Brooks would be proud of. Unfortunately, the episode itself ruined it by robbing Avery Brooks of his voice and using it to trick viewers into putting up with their streaming service.

Article continues below advertisement

Frankel took to her TikTok account on February 5 to share how she feels about reality TV, specifically “Housewives.” She began, “Am I going back to Housewives? So, I have made a conscious effort to protect my peace. I’m really happy. I’m really settled. I am significantly more successful than when I created Skinny Girl because I’ve chosen to do things the way I want to do them.”

From there, she spoke about the “freedom” she’s created and her love for working with various brands and doing philanthropy. Regarding doing a show like “Housewives,” she said, “I have been asked. Just so you know, and I don’t know that that particular formula is the best for me spiritually, physically, emotionally, I’ve done it, and no one’s ever been more successful as a result of it.”

Article continues below advertisement

In the end, she said, “Don’t worry. I’ve got a couple of tricks up my sleeve.”

Article continues below advertisement

Frankel also discussed “The Golden Life” during her TikTok update. The former “RHONY” star said, “I’m so happy for the women, and I’m happy for E!. I think it’s disruptive. I think it’s interesting. I think it’s business. I think it’s so many things.” Regarding her calling the show disruptive, it’s worth noting that E! is no longer under the same NBCUniversal umbrella as Bravo, meaning it has no contractual ties to “The Real Housewives of New York City.”

Article continues below advertisement

Frankel echoed similar sentiments recently when she reacted to the initial reports about the upcoming E! series. She said on TikTok, “What do I think about the Housewives going to E! in a new reboot, OG style? I’m glad you asked. I think it’s fantastic. E! came in, savage, baracoota style and said, ‘These [ladies] aren’t expired, so you know what, let’s put ’em back on the shelf.”

She continued, “And Ramona is going to come out of hibernation like a bear. Ready to eat something. Jill, the machinations, she’s been turning the wheels, making this happen. Jill had something to do with this ending up in the end zone.”

Article continues below advertisement

Many “Real Housewives of New York City” fans have reacted to Frankel’s comments about returning to the show or being on the new one. Many believe she should film with her former costars, and some would even like to see her return to Bravo. One person said, “PLEASEEE, we need to see you humble Kelly again.”

Someone else replied, “Honestly, just do it. We only have one lifetime; they’d pay you a bag, and you will never have this chance with that same group of women again.” Another person said, “It won’t be the same without you and Dorinda.” A different fan wrote, “I didn’t hear a no.”

A different “RHONY” fan stated, “Please, please go back. We need you to deal with Kelly. Let her know she’s down there and you’re up here! Finally, someone else had a suggestion. They said, “Girl, I get it frankly. But you COULD host the reunion!!!! Andy would absolutely die.

Article continues below advertisement

Page Six first reported in January 2026 that Sonja Morgan, Jill Zarin, Kelly Bensimon, de Lesseps, and Singer had signed a deal for a new show on E! The report also stated that the ladies and the network hoped to have the new series on the air by the end of 2026.

Several days later, on February 3, E! finally confirmed that the rumors were true. Per the show’s synopsis, “Bound by decades of shared history, fallouts and friendship, this fan-favorite group of New Yorkers are starting fresh together in the Sunshine State.”

It continued, “In this new ‘golden’ era of life, the longtime friends are thriving in and around Palm Beach with fabulous second homes and a bustling social scene. With their signature humor and non-stop hijinks, the series will follow the group as they navigate dating, family, and career milestones.”

Reports say the ladies will begin filming the show in the spring.

Article continues below advertisement

Frankel may not be returning to “Housewives” anytime soon, but she is advancing her career in other ways, including with a new dating app, The Core. She spoke to The Hollywood Reporter in January 2026 about the new platform, which recently hosted its first event in Miami.

Regarding how her private dating platform is different, she said, “It’s mostly men on dating apps. [The Core] has mostly women, which is why all the good men are coming. We have more amazing, high-quality women than men, so the cream-of-the-crop men follow. Every woman in the room was high quality — not trying to get your money or ask what your net worth is, whether you rent or what car you drive. It wasn’t like that at all.”

Platform memberships start at $7,500.

With his first two films, Kogonada created a style for himself that felt just right, telling stories that managed to be light, yet powerful. 2017’s Columbus and 2021’s After Yang were soulful and simple, but exquisitely crafted and emotionally wrecking. Even his video essays on different filmmakers like Wes Anderson, Richard Linklater, Stanley Kubrick, and many other filmmakers with distinct styles still managed to capture his own flourishes and talents.

But last year, Kogonada took a shot at something more mainstream with A Big Bold Beautiful Journey, starring Colin Farrell and Margot Robbie. This romantic fantasy, which wasn’t written by him, felt like Kogonada trying to bring his specific style into a narrative that didn’t quite match his tone. The movie was a curious failure, and a film that felt like Kogonada trying to stretch himself and losing a bit of himself in the process.

Finding himself exhausted by the logistics of making a bigger film, Kogonada went to Hong Kong with a few friends after the opening of A Big Bold Beautiful Journey, and in just three weeks, they made the film zi. Almost as though Kogonada was actively attempting to fight back against the last film he made, zi was made with an incredibly small team, shot spontaneously, and trying to build the story as they went along. The result is a film that feels like Kogonada attempting to get back to where he once was before A Big Bold Beautiful Journey, but with a movie that feels more like an experiment than anything else.

Set in Hong Kong, we meet Zi (Michelle Mao), a woman who keeps having visions of her future self that she can’t escape. Zi is waiting for the result of a scan, and is struggling with the uncertainty of what’s going on when she meets L (played by Kogonada favorite, Haley Lu Richardson), who offers to help her. We also find that these two are being followed by Min (Jin Ha), who we discover had a decade-long relationship with L, and since he works at the neurology center Zi was observed at, it seems he knows more than he lets on about what’s going on in Zi’s head.

Kogonada’s films usually take their time, quiet pieces that feel impeccably structured and regimented, yet zi is decidedly bucking that trend. There’s an intentionally ephemeral quality to the story, as though all of this could be a dream, or it could all be a hazy reality. Because of that, it certainly owes plenty to Wong Kar-wai, who also frequently films without a clear idea of where the story is going. Unfortunately, that doesn’t entirely work as well here as it does with Wong Kar-wai, with a story that slides through your fingers just when it seems like you’ve found something to grasp onto.

Because of that, zi isn’t what you’d call a return to form for Kogonada, but rather, somewhat of a reset artistically for the writer-director-editor. Zi is a character presented as lost, confused in her life, and especially unsure about what she keeps seeing as her future self that keeps coming into her field of view. It’s hard not to see this as symbolic of what Kogonada must be feeling now as a filmmaker, uncertain of his future, unsure of where to go, but desperately searching for answers. It’s also a film that’s likely more intriguing for its meta-narrative than for the story that was obviously being made up on the spot as Kogonada’s team went.

In a way, zi does feel like Kogonada falling in love with filmmaking again through this experimental process, and in doing so, he’s sticking with a small team of people he obviously trusts. His cast and crew are all producers on this project, and it does feel like an effort of love. Richardson is never better than when she’s in Kogonada’s camera, and she’s a burst of life in this story. Mao is decent as a character we can’t quite pin down and of which we don’t get many solid answers about, while Jin Ha as Min is best when he’s put alongside Richardson and reckoning with their recent relationship that fell apart — yet frustrating as a character who has answers that he refuses to share about what’s going on.

Kogonada also brought along his After Yang and A Big Bold Beautiful Journey cinematographer Benjamin Loeb, who makes Zi’s foggy world come to life in beautiful, confusing ways, while the soundtrack mostly relies on the music of Ryuichi Sakamoto, who the film is dedicated to. As an aesthetic piece, zi is undoubtedly successful, and even when the story is hard to parse, it’s hard to not get wrapped up in the pleasing sights and sounds of what Kogonada is going for.

The Director Behind ‘The Acolyte’ Episode 3 Made One of the Best Sci-Fi Films of the 2020s

Kogonada’s 2022 film is brilliant a examination of living with modern technology.

But again, zi is a film that is more of an experiment than a movie, and that’s what ultimately hurts it. We can feel the run-and-gun nature of this story in every scene, the unclear direction that’s obviously being made up on the spot, and the performances that don’t quite know what to play because they don’t know enough about their characters. zi almost comes off like a mood board for a potential Kogonada film more than a concrete Kogonada film. Every once in a while, zi seems like it’s moving forward to finding the structure it so desperately needs, close to latching onto some semblance of narrative that we can fully connect with, but it soon fades away like a passing vision. Like Zi, we watch the film searching for answers and clarity that never come.

Even though zi isn’t quite the powerhouse of independent cinema that films like Columbus and After Yang were, it does feel like the work that Kogonada needed to do in order to right his sails and figure out where to go next. zi is essentially a cinematic palette cleanser for the filmmaker, and while it’s interesting to watch him work through his issues after the failure of his last film, and hopefully, fall back in love with film, it’s just not entirely there. At the beginning of zi, the title character asks if she’ll be lost forever. With zi, Kogonada proves that he’s no longer lost, but he’s at least on the right track to finding where he needs to be.

zi premiered at the 2026 Sundance Film Festival.

January 24, 2026

99 Minutes

Kogonada

Kogonada

Kogonada, Michelle Mao, Jin Ha, Haley Lu Richardson, Christopher Radcliff, Benjamin Loeb

Celebrities are speaking out after Savannah Guthrie and her siblings shared an emotional video about their missing mom, Nancy Guthrie.

“We want to thank all of you for the prayers for our beloved mom, Nancy,” Savannah, 54, tearfully began in a clip posted via Instagram on Wednesday, February 4. “We feel them and we continue to believe that she feels them too. Our mom is a kind, faithful, loyal, fiercely loving woman of goodness and light. … She is a devoted friend. She is full of kindness and knowledge. Talk to her and you’ll see.”

Savannah added that Nancy’s “health is fragile” before addressing reports that a ransom note has been received.

“As a family, we are doing everything that we can. We are ready to talk,” she said. “However, we live in a world where voices and images are easily manipulated. We need to know without a doubt that she is alive and that you have her. We want to hear from you and we are ready to listen. Please, reach out to us.”

The Today show star added that her family “will not rest” until Nancy is found. “We speak to you every moment. And we pray without ceasing and we rejoice in advance that the day that we hold you in our arms again. We love you, mom,” she said.

Nancy, 84, was last seen on Saturday, January 31, before she was reported missing in Arizona. Authorities confirmed Nancy’s home is being treated as a crime scene but have insisted there are no potential suspects at this time.

“Detectives are working closely with the Guthrie family,” the Pima County Sheriff’s Department noted in a statement on Wednesday. “While we appreciate the public’s concern, the sharing of unverified accusations or false information is irresponsible and does not assist the investigation.”

Scroll down to see how some of Hollywood’s biggest stars are rallying around Savannah and her family amid Nancy’s disappearance:

“May God hold Nancy and her family in the palm of His hands,” Jennifer Garner wrote.

“Please bring her home🙏🏻❤️,” Valerie Bertinelli added

Julie Chen Moonves wrote that she hoped Nancy is “safe and unharmed,” adding, “Please Lord God, reveal what You know and deliver Nancy back home to her family and safety without harm or incident. Please guide investigators with Your wisdom and knowledge to find Nancy. Please use them as Your tools to bring her home safely. Until You bring Nancy back to her children and those who love her and will protect and care for her, please Lord Jesus place a hedge of protection around Nancy and allow her and her children to feel Your Light, Your presence and Your peace. I pray this all in the healing mighty name of Jesus. Amen and amen 🙏 ❤️🙏.”

“Oh sweet Savannah. We are all praying for her and you and your family. Sending love to Nancy. and hoping whoever has her has a rise of consciousness and brings her home to you. 🙏❤️,” Monica Lewinsky wrote.

Maria Shriver reposted Savannah’s video via her own Instagram account, writing, “This story continues to be without any answers, but what is without a doubt is this family’s love for their mama. @savannahguthrie and her siblings describe her so beautifully, as being their center, their heart, their home. They desperately want her home. They need their mama.”

Shriver added, “Regardless of their age, their mama is their guiding light. So I’m praying for my friend, her family, and their mama, as I know so many others are. I believe in the power of prayer, the power of love, the power of friends. Sending love. ♥️.”

Teresa Giudice‘s daughter Gia wrote, “My prayers are with you and your family🙏 bring her home❤️.”

“Oh Savannah, our hearts and prayers are with you and your family, and especially your beautiful mom. ❤️🙏,” Ree Drummond commented.

Olympian Lindsey Vonn said she’s “praying for her and all of you 🙏🏻🙏🏻🙏🏻🙏🏻.”

“Praying for you and your family daily ❤️🙏🏻❤️🥺,” Jenna Dewan added.

“We love you, Savannah, we are all praying for you and your dear mom ❤️❤️,” Ellie Kemper wrote.

Saturday Night Live‘s Chloe Fineman wrote, “Sending you so much love ❤️❤️❤️❤️❤️💔💔💔💔💔💔.”

“I can’t fathom what you’re all going through,” wrote Sophia Bush. “Sending love to you and your family and prayers for her safe return 🙏.”

Allison Janney told Savannah she’s “praying for your Mom to come home safely.”

“Praying for your precious family and for Nancy 🙏❤️,” Elizabeth Chambers wrote.

Smart energy pays enters the US market, targeting scalable financial infrastructure

Why is the NHS registering babies as ‘theybies’?

Adam Back says Liquid BTC is collateralized after dashboard problem

When Money Enters #motivation #mindset #selfimprovement

Weekend Open Thread – Corporette.com

Wikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

Donald Trump Criticises Keir Starmer Over China Discussions

Sky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

U.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

Sinner battles Australian Open heat to enter last 16, injured Osaka pulls out

Bitcoin Drops Below $80K, But New Buyers are Entering the Market

Market Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

Quiz enters administration for third time

KuCoin CEO on MiCA, Europe entering new era of compliance

Entergy declares quarterly dividend of $0.64 per share

Shannon Birchard enters Canadian curling history with sixth Scotties title

Still time to enter Bolton News’ Best Hairdresser 2026 competition

US-brokered Russia-Ukraine talks are resuming this week

GAME to close all standalone stores in the UK after it enters administration

Russia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report