Crypto World

Aster Testnet Launches; Mainnet Rollout and New Features Coming in Q1

TLDR

- Aster’s layer-1 blockchain testnet is now live for all users, marking a key milestone for the platform.

- The Aster team plans to launch the mainnet in the first quarter of 2026.

- New features, including fiat currency on-ramps, will be introduced in Q1 2026.

- Aster will release its code for developers, fostering ecosystem growth and innovation.

- The platform’s shift to a perpetual futures DEX positions it as a competitor to Hyperliquid.

Aster, a decentralized crypto exchange (DEX) and perpetual futures platform, has announced the launch of its layer-1 blockchain testnet. The testnet is now available to all users, with the mainnet rollout scheduled for the first quarter of 2026. This major milestone is part of the company’s ambitious plans to enhance its platform and expand its offerings.

Aster’s Upcoming Features and Q1 2026 Launch Plans

Aster’s roadmap for 2026 includes several key developments that will significantly enhance its services. The introduction of fiat currency on-ramps will allow users to seamlessly convert their traditional currency into digital assets. Along with this, Aster will release its code for developers, enabling third-party builders to contribute to the platform’s growth.

The upcoming Aster layer-1 mainnet is designed to improve the platform’s efficiency and scalability. It will also serve as the backbone for future features and expansions. These developments are expected to increase Aster’s appeal to both traders and developers, fostering a more vibrant ecosystem.

In March 2025, Aster rebranded as a perpetual futures DEX. This move positioned the platform as a competitor to Hyperliquid, another prominent perpetual futures DEX. Hyperliquid operates on its own application-specific blockchain network, highlighting the trend of Web3 projects developing custom layer-1 blockchains for high-throughput transactions.

Aster’s decision to launch its own layer-1 blockchain aligns with this growing trend. It reflects the increasing demand for specialized blockchains that can handle high transaction volumes. By moving away from general-purpose chains like Ethereum and Solana, Aster aims to provide a more tailored and efficient solution for its users.

Surge in Perpetual Futures Trading Volume and Market Growth

The perpetual futures market saw a sharp rise in trading volume during 2025. According to DefiLlama, the cumulative trading volume nearly tripled, growing from approximately $4 trillion to over $12 trillion by the year’s end. About $7.9 trillion of this volume was generated in 2025, signaling increasing interest in crypto derivatives.

Monthly trading volumes hit the $1 trillion mark in October, November, and December. This surge highlights the growing demand for perpetual futures contracts, which allow traders to keep positions open without expiration dates.

Crypto World

These Three Altcoins Defy Crypto Winter With Technical Strength

Altcoin sentiment remains sour, but Midnight (NIGHT), Hyperliquid (HYPE), and Monero (XMR) are flashing accumulation signals and catalyst-driven strength. This offers a rare ‘risk-on’ pocket inside a weak market heading into early February 2026.

Our analysis flagged three tokens as candidates for fresh highs, with roadmap progress and improving money flow signals as key drivers. While the broader market shows extreme fear, capital is rotating toward projects with clear development milestones or durable narratives like privacy and decentralized trading.

Technical Breakouts for NIGHT, HYPE, and XMR

Midnight ($0.047, -4.3%) is advancing its Q1 2026 roadmap, centered on the ‘Kūkolu’ phase. This stage delivers a stable mainnet with trusted validators and privacy-first applications, according to a January update.

Technical indicators like the Chaikin Money Flow (CMF) are rising, indicating that outflows are shrinking. A key level to rebound from is $0.053, with a potential move back toward its prior all-time high near $0.120.

For its part, Hyperliquid’s CMF has moved above zero, suggesting inflows are now dominating. HYPE’s price at $33.74 also shows a reported -0.22 correlation with Bitcoin, implying more independent price action. Open interest on the decentralized perpetuals exchange surged to $793M around Jan. 26–27, up from $260M a month earlier. This reflects growing demand for its derivatives market structure.

Monero is trading near $305 after a sharp 30% correction over 11 days. Its Money Flow Index (MFI) suggests selling pressure is nearing exhaustion. Monero, a privacy coin launched in 2014, maintains a durable narrative focused on fungibility and censorship resistance.

A Flight to Quality Amidst Market Dispersion

While broad altcoin indexes are weak, dispersion is the key theme. The outperformance of these three tokens is not random. It is a flight to quality within specific narratives. Midnight represents progress in privacy-enhancing L1s. Hyperliquid reflects the growing market share of high-performance decentralized derivatives platforms.

Monero’s resilience indicates a persistent, non-speculative demand for private transactions. For a desk trader, these are not degenerate altcoin plays. They are targeted bets on maturing crypto sub-sectors that are showing independent strength against a risk-off macro backdrop.

The post These Three Altcoins Defy Crypto Winter With Technical Strength appeared first on Cryptonews.

Crypto World

Is a 37% Drop Next?

Bitcoin has entered a critical phase after its recent correction dragged the price toward the $70,000 level. Viewed through a macro lens, this move has exposed BTC to elevated downside risk.

Several on-chain and technical indicators now align with a bearish outlook. However, large holders are actively accumulating, attempting to slow or reverse the developing trend.

Sponsored

Bitcoin Loses A Major On-Chain Support

Bitcoin has dropped below the True Market Mean for the first time since September 2023. This metric reflects the aggregate cost basis of actively circulating supply. Trading below it signals weakening conviction among participants and marks a structural shift in market behavior.

The loss of this anchor confirms deterioration that has been forming since late November. From a mid-term perspective, Bitcoin is now confined within a broader valuation corridor. Upside momentum has weakened, while downside pressure continues to build across multiple timeframes.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On the downside, the Realized Price near $55,800 represents the historical level where long-term capital re-enters. On the upside, the True Market Mean of around $80,200 has flipped into resistance. This configuration limits recovery potential and increases the probability of further downside exploration.

Sponsored

Bitcoin’s Macro Outlook Suggests 37% Crash

This structural weakness aligns with a macro bearish setup visible on the charts. Bitcoin is breaking down from a Head and Shoulders pattern that has been developing for months. This formation carries a projected downside of roughly 37%, targeting $51,511 if fully realized.

The sharp 20% decline over the past week accelerated this breakdown. Rapid selling pressure confirmed the pattern’s neckline breach, intensifying bearish momentum. Such moves often lead to follow-through declines as trapped long positions unwind.

The next critical support below $70,000 sits at $68,072. Losing this level would validate the bearish projection. A decisive break would likely trigger additional liquidations, increasing volatility, and accelerating price movement toward lower structural levels.

Sponsored

BTC Whales Jump In As Rescue

Despite mounting bearish signals, Bitcoin whales are actively attempting to prevent further downside. Addresses holding between 10,000 and 100,000 BTC have accumulated more than 50,000 BTC in just four days. At current prices, this accumulation exceeds $3.58 billion.

This behavior reflects strategic positioning rather than speculative trading. Large holders often accumulate during periods of fear, especially after sharp corrections. Bitcoin slipping below $75,000 appears to have created an attractive entry zone for long-term capital.

If whale accumulation continues, it could absorb sell-side pressure and stabilize the price. Historically, such activity has preceded short-term rebounds. However, sustained impact depends on broader market sentiment and whether retail selling pressure subsides.

Sponsored

BTC Price Is Close To Falling Below $70,000

Bitcoin price is trading near $69,500 at the time of writing after a 20% weekly decline. For now, BTC is yet to close a daily candle below $70,000 psychological support. This level has acted as a demand zone in previous corrections, making it critical for near-term stability.

From a short-term perspective, downside risks remain elevated. A breakdown below $68,442 would likely trigger accelerated selling. Under that scenario, Bitcoin could fall toward $65,360. Losing that support may expose BTC to a deeper slide toward $62,893.

Alternatively, whale accumulation could influence price direction. A successful defense of $70,000 may allow Bitcoin to rebound toward $75,000. Reclaiming that level as support would invalidate the immediate bearish thesis and reopen the path toward $80,000 if momentum improves.

Crypto World

Strategy Reports $12.4B Fourth Quarter Loss As Bitcoin Falls

The Bitcoin buying company Strategy reported a net loss of $12.4 billion in the fourth quarter of 2025, driven down by Bitcoin’s 22% fall over the quarter.

Bitcoin (BTC) reached a peak high of $126,000 in early October, but tumbled over the quarter ending Dec. 31 to under $88,500. Bitcoin is down 30% so far this year to $64,500, below Strategy’s average cost per BTC of $76,052.

Strategy (MSTR) said on Thursday that despite the loss, its Q4 revenues rose 1.9% year-on-year to $123 million, driven in part by its business intelligence arm, but the recent Bitcoin sell-off saw its shares close 17% down on Thursday to $107.

Bitcoin’s latest tumble pushed it to a low of $62,500 on Thursday, leaving Strategy down 17.5% on its 713,502 Bitcoin holdings.

Strategy on strong financial footing, says finance boss

Despite the massive quarterly loss, Strategy chief financial officer Andrew Kang said in a statement that the company’s capital structure remains “stronger and more resilient today than ever before.”

“Strategy has built a digital fortress anchored by 713,502 Bitcoins and our shift to Digital Credit, which aligns with our indefinite Bitcoin horizon.”

Related: US won’t ‘bail out’ Bitcoin, says Treasury Secretary Bessent

The company boosted its cash holdings to $2.25 billion in Q4 to allow for 30 months of dividend payouts, signaling financial strength despite the market downturn.

Strategy also has no major debt maturing until 2027, meaning it isn’t under immediate pressure to repay borrowings and may not be forced to liquidate Bitcoin to meet obligations in the near term.

Strategy CEO Phong Le told investors on an earnings call that there’s no reason to panic about the company’s financial position and its Bitcoin strategy.

“I’m not worried, we’re not worried, and no, we’re not having issues.”

He noted that Strategy’s enterprise value is still above its $45 billion Bitcoin reserve and that its $8.2 billion of convertible debt only represents about 13% net leverage, below most Standard & Poor’s 500 companies.

Magazine: South Korea gets rich from crypto… North Korea gets weapons

Crypto World

Tether Invests $100 Million in US ‘Crypto Bank’ Anchorage Digital

Tether’s $100 million investment in Anchorage Digital underscores a commitment to secure, regulated financial systems, reinforcing Anchorage’s status as the first federally chartered crypto bank in the U.S.

Tether announced a $100 million strategic equity investment in Anchorage Digital today, Feb. 5. The move is aimed at bolstering secure and regulated financial infrastructure within the cryptocurrency industry, according to a press release from Tether today, Feb. 5.

Anchorage Digital, recognized as the first federally chartered crypto-focused bank in the United States, both fiat banking services as well as crypto custody, staking, and stablecoin issuance, primarily for institutional clients. The bank obtained its charter from the Office of the Comptroller of the Currency (OCC) in 2021, marking a pivotal moment in the regulation of digital assets in the U.S.

Paolo Ardoino, CEO of Tether, emphasized the strategic alignment between Tether and Anchorage. “Our investment in Anchorage Digital reflects a shared belief in the importance of secure, transparent, and resilient financial systems,” Ardoino said in a statement.

Nathan McCauley, co-founder and CEO of Anchorage Digital, echoed the sentiment, noting that “Tether’s investment is a strong validation of the infrastructure we’ve spent years building the hard way.”

Anchorage is the issuer of Tether’s recently launched dollar-backed stablecoin for U.S. markets, USAT, designed to comply with the GENIUS Act. Tether is the issuer of the largest stablecoin by market capitalization, USDT, which represents just over 60% of the sector.

This article was generated with the assistance of AI workflows.

Crypto World

BNB Chain Announces Support for ERC-8004 to Enable Verifiable Identity for Autonomous AI Agents

[PRESS RELEASE – Dubai, UAE, February 4th, 2026]

BNB Chain today announced its support for ERC-8004, a new on-chain identity standard designed to give autonomous AI agents verifiable, portable identity across platforms. The development represents an important step toward an open and scalable agent economy, where software can operate independently with persistent reputation, accountability, and user control.

Autonomous agents are software programs capable of making decisions, coordinating with other services, and carrying out actions on behalf of users. As these agents become more capable, they will need to operate beyond single apps or centralized platforms. For that to be possible, agents require a reliable way to prove who they are.

Under ERC-8004, an agent is no longer confined to one application or forced to restart its reputation every time it enters a new environment. Instead, it can maintain persistent identity as it moves across platforms, enabling other agents, services, and users to verify its legitimacy and track its history over time.

To complement ERC-8004, the BNB Chain community introduces BAPs (BNB Application Proposals), a new standard for the application layer. Unlike BEPs, which govern core protocol changes, BAPs define how apps work and communicate – covering interfaces, wallet and identity conventions, token and NFT standards, and app-to-app interoperability.

The first BAP, BAP-578, launches the Non-Fungible Agent (NFA) standard, enabling AI agents to exist as onchain assets that can hold assets, execute logic, interact with protocols, and be bought, sold, or hired. This marks the first step toward an open, predictable, and interoperable Agent Economy on BNB Chain.

Users can explore how to start building with ERC-8004 and BAP-578 on BNB Chain in the developer documentation HERE.

About BNB Chain

BNB Chain is a community-driven blockchain ecosystem that is removing barriers to Web3 adoption. It is composed of:

- BNB Smart Chain (BSC): A secure DeFi hub with the lowest gas fees of any EVM-compatible L1; serves as the ecosystem’s governance chain.

- opBNB: A scalability L2 that delivers some of the lowest gas fees of any L2 and rapid processing speeds.

- BNB Greenfield: Meets decentralized storage needs for the ecosystem and lets users establish their own data marketplaces.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

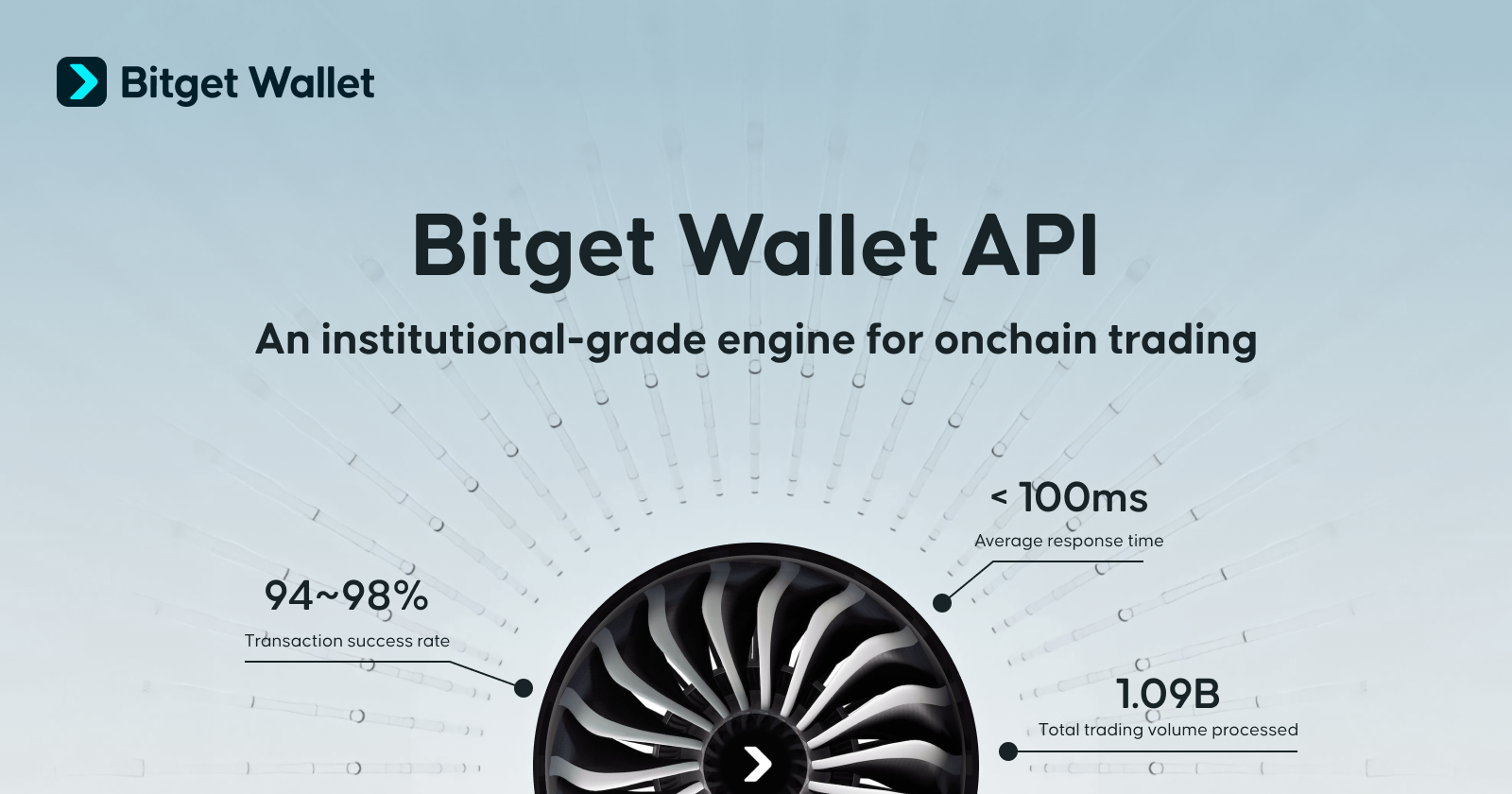

Bitget Wallet Expands Into B2B With Trading Infrastructure API

Launch signals strategic move to provide trading execution and market data services to fintech platforms.

San Salvador, El Salvador, February 5, 2026 – Bitget Wallet, the everyday finance app, has launched Bitget Wallet API, marking a strategic expansion into business-to-business infrastructure as more fintech firms and digital asset platforms look to offer onchain trading services at scale. The API allows partners to access trading execution, market data, and cross-chain asset transfers through a single integration, reducing the need for companies to build and maintain complex backend systems internally.

The move reflects a broader shift toward fintech platforms relying on specialized infrastructure rather than building full technology stacks in-house. BCG estimates B2B fintech services will grow at a 32% annual rate to reach $285 billion in revenues by 2026, alongside rapid growth in Wallet-as-a-Service and embedded finance. At the same time, decentralized exchange trading hit a five-year high in January 2026, with more than $400 billion traded, highlighting DEXs’ growing role as a core source of market liquidity.

“Onchain trading is reaching a wider audience, but the underlying infrastructure is still fragmented and difficult to operate at scale,” said Alvin Kan, COO of Bitget Wallet. “By making the same systems that run our consumer wallet available to partners, we’re supporting companies that want to build professional trading products without taking on unnecessary operational complexity. This makes a step beyond being solely a user-facing wallet toward supporting the broader financial ecosystem.”

At the core of the API is Bitget Wallet’s proprietary DEX-based trade execution engine, which currently handles about 80% of all trades executed within Bitget Wallet. The Trading API aggregates liquidity from 80 decentralized trading protocols and supports trading across Ethereum, Solana, Base, Polygon, Arbitrum, Morph and BNB Chain. By using intelligent routing to compare quotes across venues and select execution paths, the system is designed to improve pricing consistency and reduce failed trades. Bitget Wallet said recent transaction success rates across major networks have remained in the mid-to-high 90% range, with the service operating under a 99.9% availability target.

To support reliable execution, the API includes Sentinel, an automated monitoring system that continuously reviews liquidity sources and removes unstable or abnormal pools before trades are placed. Transactions are also routed through MEV-protected nodes, which are designed to limit interference such as front-running during periods of market volatility. These measures are intended to address common operational challenges faced by trading platforms as transaction volumes increase.

In addition to execution, the Market API provides real-time pricing and activity data across 33 blockchains, covering millions of cryptocurrencies as well as more than 200 widely traded stocks through tokenized market data. The service includes address-level insights, such as activity linked to experienced market participants, alongside automated risk indicators that help flag unusual assets or trading patterns. The API suite also includes a Cross-chain API, which allows assets to be converted and transferred between blockchains in a single process, with built-in tracking that gives users and platforms visibility into transaction progress from start to finish.

Users can visit the Bitget Wallet website for more information.

About Bitget Wallet

Bitget Wallet is an everyday finance app designed to make crypto simple, secure, and usable in daily life. Serving more than 90 million users worldwide, it offers an all-in-one platform to send, spend, earn, and trade crypto and stablecoins through blockchain-based infrastructure. With global on- and off-ramps, the app enables faster and borderless onchain finance, supported by advanced security and a $700 million user protection fund. Bitget Wallet operates as a fully self-custodial wallet and does not hold or control user funds, private keys, or user data. Transactions are signed by users and executed on public blockchains.

For more information, visit: X | LinkedIn | Telegram | YouTube | TikTok | Discord | Facebook

Crypto World

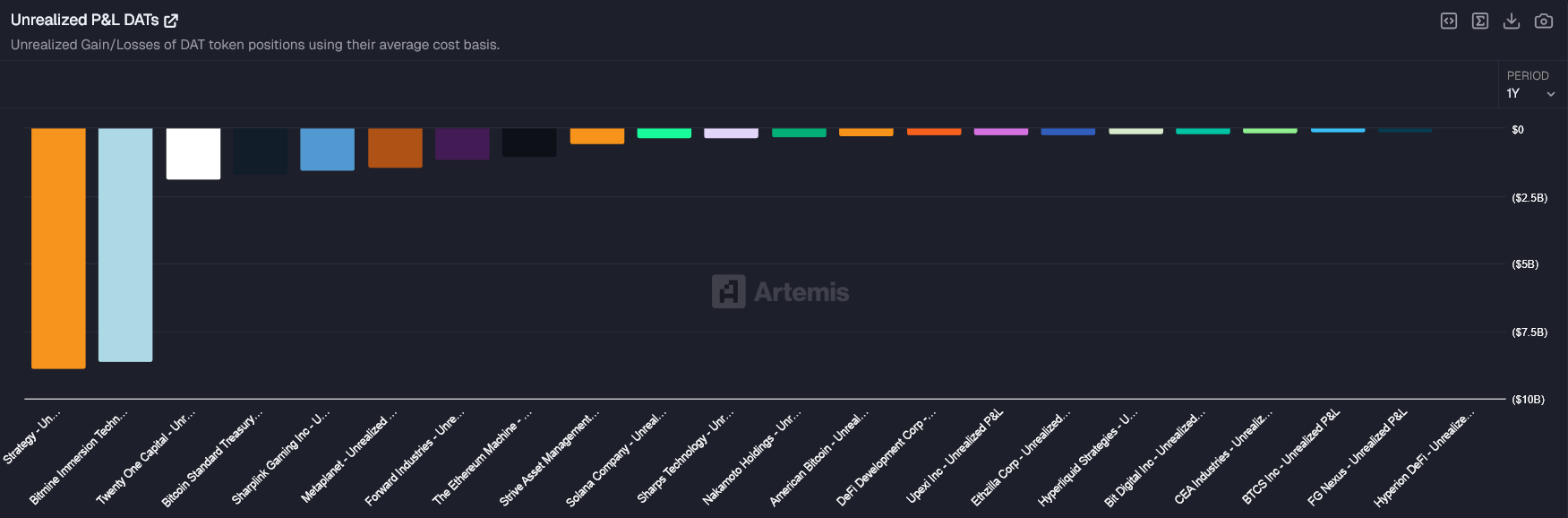

Bitcoin Crash Destroys Every Crypto Treasury: Is Bankruptcy Next?

Crypto treasury companies are under growing financial stress after Bitcoin and Ethereum fell nearly 30% in a week, wiping out an estimated $25 billion in unrealized value across digital asset balance sheets.

Data tracking public crypto treasury firms shows that none currently hold assets above their average cost basis. The sharp drawdown has pushed most treasury strategies into loss territory at the same time, raising concerns about liquidity, financing, and long-term viability.

Sponsored

Losses Spread Across the Entire Digital Asset Treasury Sector

The sell-off hit treasury-heavy firms simultaneously.

Large holders recorded the deepest paper losses, dragging cumulative unrealized P&L sharply negative. The losses are unrealized, but the scale matters because it weakens balance sheets and equity valuations.

As a result, the market has shifted from rewarding crypto accumulation to pricing survival risk.

Sponsored

Market Premiums Have Collapsed

A key stress signal is the collapse in market net asset value (mNAV), which compares a company’s equity valuation to the value of its crypto holdings.

Several major treasury firms now trade below an mNAV of 1, meaning the market values their equity at a discount to the assets they hold. This eliminates the ability to raise capital efficiently through equity issuance without dilution.

MicroStrategy, one of the largest corporate Bitcoin holders, trades below its asset value despite holding tens of billions of dollars in crypto.

That discount limits its flexibility to fund further purchases or refinance cheaply.

Sponsored

Liquidity Drives Bankruptcy Risk

Unrealized losses alone do not cause bankruptcy. The risk rises when falling asset prices collide with leverage, debt maturities, or ongoing cash burn.

Mining firms and treasury vehicles that rely on external financing face the highest exposure. If crypto prices remain depressed, lenders may tighten terms, equity markets may stay closed, and refinancing options could narrow.

Sponsored

This creates a feedback loop. Lower prices reduce equity value, which limits capital access and increases pressure on balance sheets.

A Stress Phase, Not a Collapse

The current drawdown reflects forced deleveraging and tighter financial conditions rather than a failure of crypto assets themselves.

However, if prices fail to recover and capital markets remain restrictive, stress could intensify.

For now, crypto treasury firms remain solvent. But the margin for error has narrowed sharply.

Crypto World

Bitcoin’s Chance Of Returning To $90K By March Is Slim

Key takeawys:

-

Bitcoin fell below $63,000 as weak US job data and concerns over AI industry investments fueled investor risk aversion.

-

Options markets show a 6% chance of Bitcoin returning to $90,000 by March.

Bitcoin (BTC) slid below $63,000 on Thursday, hitting its lowest level since November 2024. The 30% drop since the failed attempt to break $90,500 on Jan. 28 has left traders skeptical of any immediate bullish momentum. The current bearish sentiment is fueled by weak US job market data and rising concerns over massive capital expenditure within the artificial intelligence sector.

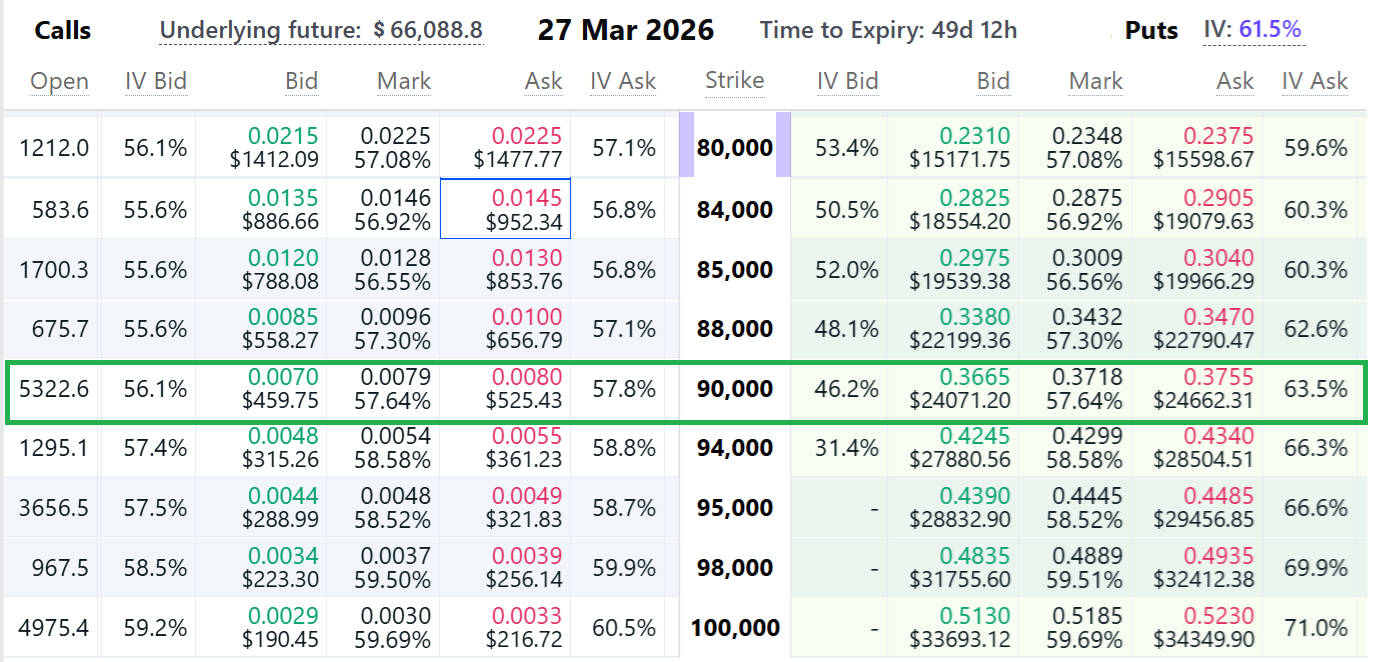

Regardless of whether Bitcoin’s slump was triggered by macroeconomic shifts, options traders are now pricing in just 6% odds of BTC reclaiming $90,000 by March.

On Deribit exchange, the right to buy Bitcoin at $90,000 on March 27 (a call option) traded at $522 on Thursday. This pricing suggests investors see little chance of a massive rally. According to the Black-Scholes model, these options reflect less than 6% odds of Bitcoin reaching $90,000 by late March. For context, the right to sell Bitcoin at $50,000 (a put option) for the same date traded at $1,380, implying a 20% probability of a deeper crash.

Quantum computing risks and forced liquidation fears drive Bitcoin selling

Market participants have reduced crypto exposure due to emerging quantum computing risks and fears of forced liquidations by companies that built Bitcoin reserves through debt and equity. In mid-January, Christopher Wood, global head of equity strategy at Jefferies, removed a 10% Bitcoin allocation from his model portfolio, citing the risk of quantum computers reverse-engineering private keys.

Strategy (MSTR US), the largest publicly listed company with onchain BTC reserves, recently saw its enterprise value dip to $53.3 billion, while its cost basis sat at $54.2 billion. Japan’s Metaplanet (MPJPY US) faced a similar gap, valued at $2.95 billion against a $3.78 billion acquisition cost. Investors are worried that a prolonged bear market might force these companies to sell their positions to cover debt obligations.

External factors likely contributed to the rise in risk aversion, and even silver, the second-largest tradable asset by market capitalization, suffered a 36% weekly price drop after reaching a $121.70 all-time high on Jan. 29.

Bitcoin’s 27% weekly decline closely mirrors losses seen in several billion-dollar listed companies, including Thomson Reuters (TRI), PayPal (PYPL), Robinhood (HOOD) and Applovin (APP).

US employers announced 108,435 layoffs in January, up 118% from the same period in 2025, according to outplacement firm Challenger, Gray & Christmas. The surge marked the highest number of January layoffs since 2009, when the economy was nearing the end of its deepest downturn in 80 years.

Related: Next Bitcoin accumulation phase may hinge on credit stress timing–Data

Market sentiment had already weakened after Google (GOOG US) reported on Wednesday that capital expenditure in 2026 is expected to reach $180 billion, up from $91.5 billion in 2025. Shares of tech giant Qualcomm (QCOM US) fell 8% after the company issued weaker growth guidance, citing that supplier capacity has been redirected toward high-bandwidth memory for data centers.

Traders expect investments in artificial intelligence to take longer to pay off due to rising competition and production bottlenecks, including energy constraints and shortages of memory chips.

Bitcoin’s slide to $62,300 on Thursday reflects uncertainty around economic growth and US employment, making a rebound toward $90,000 in the near term increasingly unlikely.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

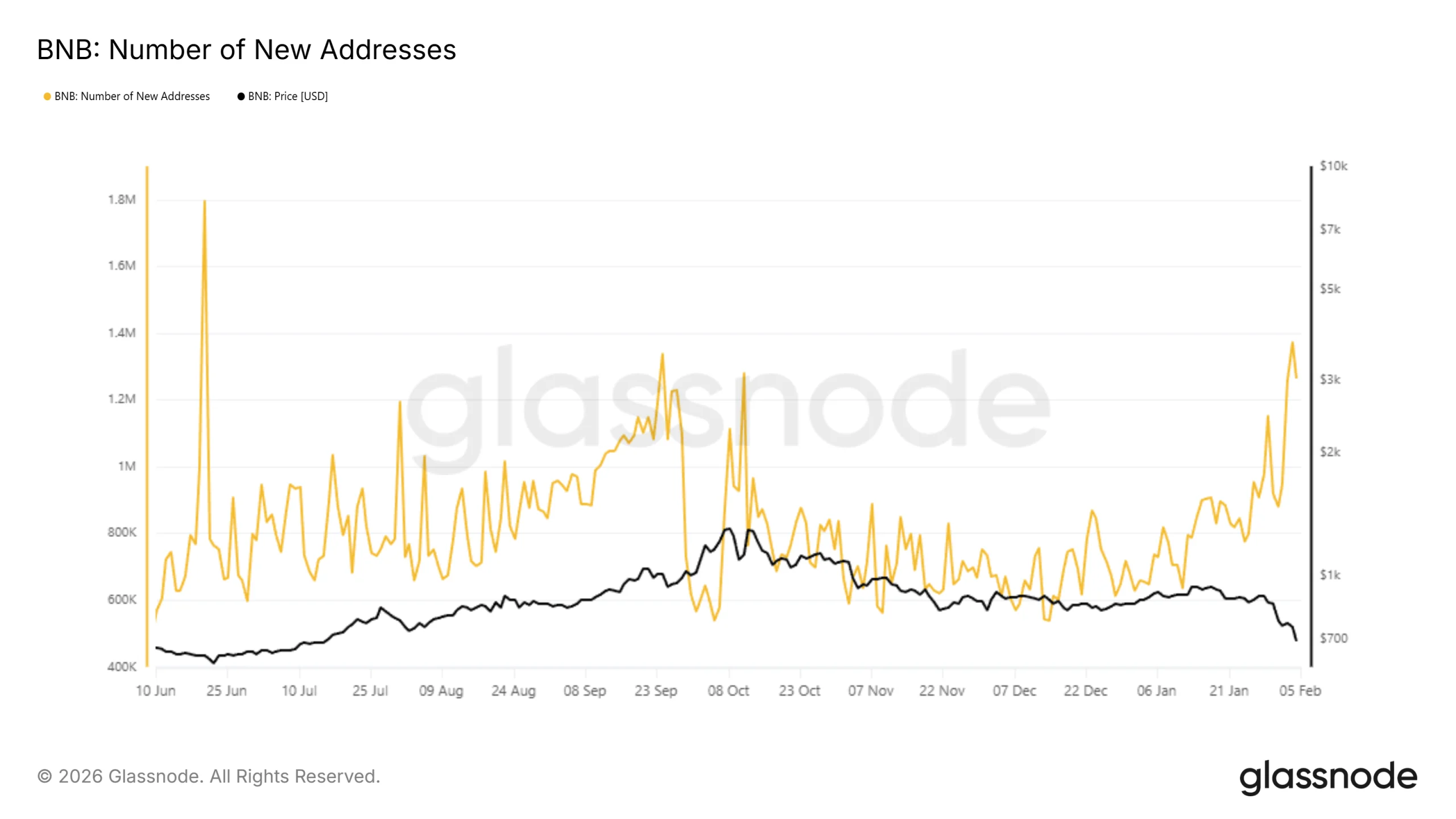

Can 1 Million New BNB Holders Undo Price Crash to 7-Month Low?

BNB has experienced a sharp correction, with the price falling from $900 to near $700 in recent sessions. The decline erased months of gains and pushed the asset to a seven-month low.

While selling pressure has dominated, the downturn may not be finished unless holder behavior shifts. Emerging on-chain trends suggest conditions could still change.

BNB Is Observing A Flood Of New Holders

BNB’s network activity has shown notable strength despite the price crash. New address creation has risen consistently over recent days, peaking near 1.3 million additions. Even now, the network continues to add more than 1 million new addresses daily. This growth signals sustained interest during a volatile period.

Sponsored

Sponsored

New addresses are significant because they often represent fresh capital entering the ecosystem. While existing holders are facing selling pressure, new participants can help absorb supply. Historically, strong network growth during corrections has supported stabilization. For BNB, this influx may counterbalance distribution if buying interest persists.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Despite improving on-chain participation, derivatives data remains bearish. Futures market positioning shows a clear skew toward downside risk. Liquidation maps highlight approximately $43 million in short liquidation leverage compared with just $6 million on the long side. This imbalance reflects strong bearish conviction among leveraged traders.

Such positioning often amplifies volatility. If price continues to decline, long liquidations could accelerate losses. The map shows the largest cluster of long contracts sitting at $682, BNB’s next support. Losing this support would also trigger $3.07 million in long liquidations. For now, the dominance of bearish exposure suggests caution.

BNB Price Correction Could Continue

BNB price has declined 22.5% over the past seven days and is trading near $698 at the time of writing. Technical indicators point to continued weakness. The Fibonacci Extension tool identifies $682 as the next major support level, making it a critical zone for near-term price stability.

If broader market conditions remain bearish, downside risks increase. Continued liquidations or heightened volatility could push BNB below $682. A breakdown there would likely send the price toward $650 or lower. Such a move would deepen losses and reinforce bearish sentiment among short-term investors.

A recovery scenario depends on capital inflows offsetting bearish pressure. If demand strengthens, BNB could reclaim $735 and advance toward $768. Flipping the latter into support would invalidate the bearish thesis. Under that outcome, BNB price may recover toward $821, signaling renewed confidence.

Crypto World

Bitcoin’s Shot at $90K by March Is Slim

The flagship cryptocurrency has come under renewed selling pressure, extending a slide that has left market participants cautious about any near-term rebound. The latest move comes as a combination of softer U.S. job data and renewed concerns about AI-sector capital expenditure weigh on risk appetite. The price retreat follows a roughly 30% decline from a late-January high after a failed attempt to push above the $90,500 level on Jan. 28. As macro cues accumulate, derivatives markets hint at a cautious stance, suggesting that a rapid snapback may be unlikely in the near term as investors digest the evolving risk backdrop.

Key takeaways

- Bitcoin slipped below $63,000, entering a seasonally volatile zone as macro data challenges persist and AI-sector investment concerns mount.

- Options markets imply a relatively low probability of a swift rally back to $90,000 by March, with pricing signaling a muted upside scenario.

- Concerns over quantum computing risks and the prospect of forced liquidations by debt-funded Bitcoin holders have amplified risk-off sentiment.

- Public-company Bitcoin holdings and equity-structure dynamics show growing strain, as some firms face large unrealized gaps between market value and cost bases.

- Broader tech and AI narratives—capped by elevated capital expenditure plans and supply-chain bottlenecks—contribute to a cautious market tone across traditional equities as well as crypto.

- Risk-off conditions intensified after a run of negative headlines across large-cap names and an uptick in January layoffs across the U.S. economy.

Tickers mentioned: $BTC, TRI, PYPL, HOOD, APP, QCOM, MSTR, MPJPY

Sentiment: Bearish

Price impact: Negative. The ongoing price drift below key support levels reflects a softer near-term outlook and heightened risk-off sentiment.

Trading idea (Not Financial Advice): Hold. Caution remains warranted as macro headlines and AI investment cycles influence liquidity and risk appetite.

Market context: The current environment blends macro fragility with sector-specific dynamics in AI and tech, creating a cautious tone for risk assets. Liquidity conditions and derivative positioning continue to shape price action as investors weigh near-term catalysts against longer-term macro trends.

Why it matters

The forces weighing on Bitcoin are not isolated to crypto alone. A broader risk-off mood is filtering through global markets, with technology and AI-driven narratives playing a central role. The debilitation of a near-term revival above important thresholds underscores a structural challenge for the asset class: while institutional interest remains, upside momentum has been tempered by macro headwinds and the fear of swift retracements triggered by external shocks.

On the derivative side, traders are pricing in relatively modest odds of a dramatic rally, with call options at elevated strike levels pricing in limited upside potential. For context, on the Deribit exchange, a March 27 call option with a strike of $90,000 traded at around $522, suggesting that market participants assign a low probability to a rapid surge in price in the weeks ahead. The corresponding put options reveal a sense of potential downside risk priced into the market as well, underscoring a balanced but cautious risk-reward calculus in the near term. These dynamics echo the broader tension between bull-case scenarios and risk-off realities facing cryptos amid evolving macro data and capital allocation concerns.

Beyond price dynamics, a suite of fundamental developments has intensified risk aversion. Quantum computing fears—specifically worries that advanced quantum systems could threaten private keys—have led some investors to rethink crypto exposure. In mid-January, Christopher Wood, global head of equity strategy at Jefferies, removed a 10% Bitcoin allocation from his model portfolio, arguing that quantum threats introduce a material tail risk to hodling strategies and that the market could respond abruptly to new information. While such positioning shifts reflect sentiment rather than immediate price catalysts, they contribute to a cautious macro backdrop for crypto markets.

On the corporate front, the landscape of on-chain exposure among publicly traded firms remains a focal point. MicroStrategy (MSTR) remains the largest holder with on-chain BTC reserves, but the company’s enterprise value has fallen to around $53.3 billion while its cost basis sits near $54.2 billion. Similar gaps exist for Metaplanet (MPJPY US), where the market cap stood at roughly $2.95 billion against an acquisition cost of about $3.78 billion. The potential for a prolonged bear phase to force such entities to sell reserve holdings to service debt has investors watching balance sheets closely, even as executives underscore long-term conviction in the technology and underlying use cases.

Additional macro factors are weighing on risk assets as well. The week’s early data showed broad risk-off momentum, with silver, often viewed as a risk-off asset, retreating sharply after reaching an all-time high in late January. While crypto markets are distinct from traditional commodities, the cross-asset pull—driven by higher risk sentiment and macro uncertainties—helps explain the correlation in recent weeks between the performance of large-cap equities and crypto assets.

In the broader tech arena, larger dynamics around AI investment cadence are shaping the indirect risk profile for crypto markets. Google’s parent company signaled that capital expenditure in 2026 will be materially higher than in 2025, highlighting a continued push into data-center infrastructure. At the same time, Qualcomm reported softer guidance as supplier capacity shifts toward high-bandwidth memory for data centers, underscoring a delicate balance between innovation cycles and near-term profitability. Analysts anticipate that AI spending could deliver longer payoff horizons than many investors currently expect, a factor that compounds uncertainty for risk-sensitive assets, including crypto.

Against this backdrop, Bitcoin appears unlikely to stage a rapid rebound toward the $90,000 region in the near term. The price action around $62,000–$63,000 has become a focal point for traders watching for a sustainable bottom or a capitulatory event that could usher in a new phase for accumulation. The path forward for the asset will likely depend on a combination of macro resilience, continued liquidity, and the pace at which AI-capital expenditure and its supply-chain constraints unwind.

What to watch next

- Upcoming U.S. payrolls data and macro indicators, which could shape risk sentiment and liquidity conditions.

- Derivative flows and March expiry activity (including BTC options around key strike levels like $90,000).

- Updates on AI-capex realization and supply-chain bottlenecks affecting tech stocks and related risk assets.

- Monitor developments around large on-chain BTC holdings and any potential forced-liquidation events tied to debt covenants.

- Central bank signals and policy expectations that could influence risk appetite across crypto and traditional markets.

Sources & verification

- Deribit options data for March 27 BTC calls and puts, including the $90,000 strike call and $50,000 strike put pricing.

- Public-company BTC holdings and balance-sheet implications (on-chain context and company-level risk exposure).

- Jefferies note referencing a reduced Bitcoin allocation due to perceived quantum-computing risks.

- January layoff data from Challenger, Gray & Christmas (108,435 layoffs) and related macro commentary.

- Alphabet (EXCHANGE: GOOG) capex trajectory for 2026 and Qualcomm (EXCHANGE: QCOM) guidance signals; broader AI-funding implications.

Bitcoin under pressure in a cautious macro environment

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World7 days ago

Crypto World7 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat7 days ago

NewsBeat7 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business6 hours ago

Business6 hours agoQuiz enters administration for third time

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat13 hours ago

NewsBeat13 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report