Crypto World

ETHZilla to Tokenize $4.7 Million in Manufactured Home Loans on Ethereum Layer 2

ETHZilla plans to tokenize the loan portfolio into a cash-flow-generating manufactured home loan token.

ETHZilla has announced its acquisition of a portfolio comprising 95 manufactured and modular home loans valued at approximately $4.7 million, with plans to tokenize these assets on Ethereum Layer 2. This strategic move is aimed at enhancing transparency and accessibility in real estate finance.

The tokenization initiative will be executed through the Liquidity.io ecosystem, with the launch expected in late February or early March.

“Manufactured housing loans offer predictable cash flows and strong underlying collateral, which we believe makes them well suited for tokenization within a regulated, transparent structure,” said McAndrew Rudisill, CEO of ETHZilla.

ETHZilla’s strategy is designed to meet institutional compliance and reporting standards, crucial for the integration of real-world assets into blockchain systems.

The manufactured housing market is projected to grow significantly, from $45.82 billion in 2024 to $75.1 billion by 2035, driven by affordability and sustainability.

This article was generated with the assistance of AI workflows.

Crypto World

EU Tokenization Companies Urge Fixes to DLT Pilot Rules

A group of European tokenization operators has urged EU policymakers to swiftly amend the bloc’s DLT Pilot Regime, warning that current asset limits, volume caps and time-limited licenses are preventing regulated onchain markets from scaling as the United States advances toward industrial-scale tokenization and near-instant settlement.

In a joint letter coordinated ahead of an upcoming parliamentary debate, tokenization and market infrastructure companies Securitize, 21X, Boerse Stuttgart Group, Lise, OpenBrick, STX and Axiology called for targeted changes to the DLT Pilot Regime, the EU’s regulatory sandbox for tokenized securities markets.

The companies said the EU’s broader Market Integration and Supervision Package sets the right long-term direction, but warned that existing constraints are already limiting the growth of regulated tokenized products in Europe. Pointing to the United States as a key contrast, they wrote:

Without timely action on the DLT Pilot Regime, the EU risks losing market relevance. The structural inertia of this package delays effective application until at least 2030 — creating not a temporary setback, but a critical strategic vulnerability.

They added that “global liquidity will not wait” if Europe remains constrained, warning it could migrate permanently to US markets as onchain settlement infrastructure matures.

Rather than calling for deregulation, the companies proposed a narrow technical “quick fix” that would keep existing investor protections intact. The changes would expand the scope of eligible assets, raise current issuance caps and remove the six-year limit on pilot licenses to allow regulated operators to scale products already live in other jurisdictions.

The group said the adjustments could be adopted quickly through a standalone technical update without reopening the EU’s broader market-structure reforms.

It warned that prolonged delays risk weakening the euro’s competitiveness in global capital markets as settlement and issuance activity shifts toward faster, fully digital market infrastructure.

Related: Gemini announces exit from UK, EU, Australia, slashes workforce

US regulators and exchanges advance tokenization framework

The US has taken regulatory steps toward tokenization by clarifying how tokenized securities can be issued, custodied and settled within existing market infrastructure.

On Dec. 11, 2025, the Securities and Exchange Commission (SEC) Trading and Markets Division outlined how broker-dealers can custody tokenized stocks and bonds under existing customer protection rules, signaling that blockchain-based securities will be governed within the traditional regulatory framework rather than treated as a new asset class.

The SEC issued a no-action letter on the same day to a subsidiary of Depository Trust & Clearing Corporation, clearing the way for a new securities market tokenization service. DTCC said its Depository Trust Company unit has been authorized to launch a service that tokenizes real-world assets already held in DTC custody.

On Jan. 28, the SEC issued guidance clarifying how it views tokenized securities, splitting them into two categories: those tokenized by issuers and those tokenized by unaffiliated third parties, a move aimed at giving companies a clearer regulatory footing as tokenization activity expands.

Alongside clearer US regulatory guidance, Nasdaq and the New York Stock Exchange have begun exploring tokenization within traditional market infrastructure.

In November 2025, Nasdaq said securing SEC approval for its September proposal to list tokenized stocks was a top priority, noting that the exchange was responding to public comments and regulator questions as the review process continued.

On Jan. 17, the NYSE said it is developing a platform to trade tokenized stocks and exchange-traded funds, pending regulatory approval, that would support 24/7 trading and near-instant settlement using blockchain-based post-trade systems.

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

Crypto World

Is Binance sending cease-and-desist letters?

Crypto investors are looking for someone to blame for a crashing market that has already shed one-fifth of its total market capitalization since the start of the year — and they have Binance squarely in their social media crosshairs.

However, the world’s largest crypto exchange is firing back, denying rumors that it’s sending legal letters to silence critics.

“Winning is the best response to FUD,” founder Changpeng Zhao (CZ) wrote today. “Binance saw net inflow for ALL 1 day, 7 day and 1 month periods, to the tune of $ billions. Some possible FUD sponsors saw the opposite,” he laughed.

Amid the bearish knock-on effects from Binance’s role in a massive liquidation event on October 10, sentiment against the company has continued to deteriorate.

Goodwill gestures by the exchange have failed to calm complaints, and some traders with losses even threatened Binance with legal action.

Recently, critics have been broadcasting ragebait and screenshots of alleged cease-and-desist letters about October 10–11, from Binance, or even an alleged direct message threat from CZ.

Schrödinger’s letters from Binance lawyers

Whether Binance’s law firms have sent cease-and-desist letters this week is a classic case of he said, she said. Thousands of people seem either entirely convinced or entirely unpersuaded.

Today, for example, CZ denied sending not only that direct message but also any legal letters over insolvency allegations.

In contrast, a trader with massive losses from October 10-11 insists that Binance group attorneys “are leveraging UAE law to warn me to delete my posts” and have threatened him with a lawsuit.

Elsewhere, a social post with over a million impressions claimed that Binance was suffering insolvency. Later, that same person claimed Binance mailed him a cease-and-desist letter about that insolvency claim — which again earned almost a million impressions.

However, Binance’s help desk called that letter a forgery, and Binance co-founder Yi He reiterated that correction.

Examples of allegations that Binance actually sent a cease and desist letter are replete on social media, but whether or not the company actually sent them is dubious.

Read more: Lawsuits are piling up against Binance over Oct. 10

Binance has sued writers in the past

Complicating this matter, Binance has a true history of suing reporters, which makes CZ’s statement today that he has “no need to issue any letters” difficult to believe.

Indeed, Binance sued Forbes and two of its writers after their negative publicity, and CZ also sued Bloomberg’s Hong Kong publisher.

Moreover, CZ has extensive experience in the legal system and often crafts precisely worded answers to difficult questions.

Within the last week, for example, CZ claimed, “I don’t have personal investments in Aster, and Binance as a company is not involved.” Although that statement was technically true, CZ nonetheless had money invested in Aster via his family office, YZi Labs.

In other words, his statement was only true because of a technicality of the word “personal.”

So whether and to what extent the crypto industry can trust CZ’s claim today that he has “no need to issue any letters” is a matter of public debate.

Despite Binance’s denials of cease-and-desist letters this week, moreover, some critics remain convinced that real letters might still be out there.

Protos has reached out to Binance for comment but didn’t receive an immediate response. We will update this story if we receive a reply.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Gate January Report Shows TradFi Volume Above $20B

In January 2026, digital asset trading platform Gate released its latest Transparency Report. The report shows that Gate continues to advance across key areas, including multi-asset trading, on-chain derivatives, and asset management, with its trading structure and user use cases steadily expanding.

While maintaining the stable operation of its core crypto asset business, Gate is accelerating its evolution toward a comprehensive digital asset platform that integrates traditional financial assets, on-chain trading, and yield management.

On the trading front, Gate’s derivatives market share has risen to 11%, marking it as one of the centralized exchanges with the largest period-on-period increase.

CryptoRank noted in its annual report that Gate’s perpetual futures trading volume grew from $911.2 billion in Q1 2025 to $2.42 trillion in Q3, remaining at a high level of $1.93 trillion in Q4. Additionally, Gate was recognized as the exchange with some of the fastest contract trading volume growth in 2025.

In the traditional financial assets segment, Gate TradFi now covers asset classes including metals, foreign exchange, indices, commodities, and selected popular equities. Since the launch, cumulative trading volume has exceeded $20 billion.

These features have been fully integrated into the Gate App and Web platform, allowing users to trade across multiple markets within a unified account system using USDT as margin. As demand for precious metals and macro-related assets increases, multi-asset price trading and cross-market hedging are emerging as new growth drivers.

Beyond trading and asset allocation, Gate is actively introducing AI capabilities into high-frequency user decision-making scenarios. Launched in January 2026, GateAI focuses on asset analysis and market interpretation, supporting market browsing and candlestick analysis through a global floating interface and contextual prompts.

In its first month, GateAI achieved a user satisfaction rate of approximately 88% and began to integrate into users’ daily trading decision workflows.

At the same time, Gate continues to strengthen its decentralized derivatives trading capabilities. In January, Gate DEX completed a brand and experience upgrade, with Gate Web3 officially rebranded as Gate DEX. The platform now supports one-click login via account or wallet, significantly lowering the barrier to on-chain trading.

Perp DEX recorded nearly 440,000 cumulative transactions monthly, reflecting a notable increase in on-chain perpetual trading activity. In addition, activity on the Gate Layer network continued to rise, with on-chain addresses surpassing 100 million and monthly transaction volume increasing by more than 22% month-on-month. User interaction and on-chain activity frequency continued to strengthen, providing foundational support for multi-chain asset circulation and ecosystem application deployment.

In asset management and structured products, multiple Gate product lines advanced in parallel. By the end of January, Staking recorded a total value locked (TVL) of $1.301 billion, having peaked at $1.512 billion during the month. ETH staking volume reached nearly 170,000 ETH, setting a new historical high.

Leveraged ETF tokens recorded trading volume of over 6.7 billion USDT in January, representing a month-on-month increase of 32.6%. Simple Earn saw cumulative subscriptions exceeding 2.5 billion USDT, with an average of more than 350,000 participating users per day. Holdings of BTC and GT continued to grow, indicating sustained user demand for core assets and more stable allocation strategies amid market volatility.

In terms of security and transparency, Gate continued to strengthen its reserve and verification mechanisms. In January, the overall reserve ratio increased to 125%, with total reserves valued at approximately $9.478 billion. BTC reserves reached a ratio of 140.69%, while reserves for major assets, including ETH, USDT, and GT all remained above 100%, keeping Gate’s asset backing and risk buffer capacity at an industry-leading level.

On the branding and community side, Gate continued to reinforce long-term connections with creators, users, and institutions through content system upgrades and high-quality event operations. Centered around Gate Square and Gate Live, the platform further refined content incentives and conversion pathways, promoting deeper integration between high-quality content, trading activity, and ecosystem collaboration.

Meanwhile, through closed-door institutional exchanges, annual community summits, and other multi-layered initiatives, Gate expanded professional dialogue and brand influence, further consolidating its position as a leading comprehensive crypto platform in terms of user ecosystem engagement and industry participation.

Overall, Gate is advancing across multiple business lines simultaneously. By continuously expanding asset coverage, product formats, and technological capabilities, the platform is progressively building a more structured and synergistic trading and asset management ecosystem.

As market conditions and user needs continue to evolve, Gate’s long-term development path as a comprehensive digital asset platform is becoming increasingly solid, with further potential to expand application scenarios and ecosystem boundaries.

Details can be found here.

About Gate

Gate, founded in 2013 by Dr. Han, is one of the world’s earliest cryptocurrency exchanges. The platform serves over 49 million users with 4,400+ digital assets and pioneered the industry’s first 100% proof-of-reserves. Beyond core trading services, Gate’s ecosystem includes Gate Wallet, Gate Ventures, and other innovative solutions.

For more information, please visit: Website | X | Telegram | LinkedIn| Instagram | YouTube

Disclaimer: This content does not constitute an offer, solicitation, or recommendation. You should always seek independent professional advice before making investment decisions. Note that Gate may restrict or prohibit certain services in specific jurisdictions. For more information, please read the User Agreement via https://www.gate.com/user-agreement.

Crypto World

BitMine’s Ethereum Treasury Drops $8B as Ether Falls Below $2,000

TLDR:

- BitMine’s ETH holdings drop to $8.4B, down $8B from the initial $16.4B investment.

- BMNR stock plunges 88% since its July peak amid Ether price declines.

- Over 2.9M ETH staked, generating 2.81% annual yield in staking rewards.

- BitMine holds $538M cash with no debt, allowing it to maintain ETH positions.

BitMine ETH losses have reached $8 billion following Ether’s decline below $2,000. Despite sharp declines, the company reports no debt obligations and continues earning staking income from its Ethereum holdings.

BitMine’s Ethereum Holdings and Stock Performance

BitMine Immersion Technologies (BMNR) currently holds 4.29 million ETH, purchased at an estimated total cost of $16.4 billion. At current prices below $2,000 per Ether, the portfolio’s market value has fallen to approximately $8.4 billion.

This represents nearly $8 billion in paper losses. BMNR shares have reacted sharply to Ether’s decline.

Since July, the stock has fallen 88% and hit a new low on Thursday, declining 7% on the day alone. This movement reflects investor concern over BitMine’s heavy exposure to Ethereum, especially amid declining prices.

The firm’s funding strategy differs from many other crypto treasuries. Rather than borrowing, BitMine relied on equity issuance to acquire its Ethereum and other digital assets.

According to Thomas Lee, Executive Chairman, the company faces no debt covenants or restrictions. This approach allows BitMine to hold its ETH through periods of market volatility without immediate pressure to sell.

In recent weeks, BitMine has continued Ethereum accumulation. The company added 41,788 ETH in the past week, following steady weekly purchases since December 2025.

This demonstrates a consistent commitment to maintaining and growing its Ethereum portfolio.

Financial Position, Staking, and Market Activity

BitMine maintains a strong cash position of $538 million while staking over 2.9 million ETH. Staked Ethereum generates an annual yield of approximately 2.81%, providing a steady income stream despite the market drawdown.

In addition to Ethereum, BitMine holds 193 Bitcoin and strategic investments in other companies. This includes a $200 million stake in Beast Industries and $19 million in Eightco Holdings.

These assets contribute to liquidity and diversify the company’s portfolio. Ethereum network activity has shown strong fundamentals, with daily transactions reaching an all-time high of 2.5 million and active addresses surpassing one million.

These metrics suggest robust usage and engagement, even as prices remain under pressure. BitMine also ranks among the most actively traded U.S.-listed stocks, averaging $1.1 billion in daily volume.

The firm’s large-scale Ethereum holdings, diversified portfolio, and staking income support its ability to ride out short-term market volatility.

Crypto World

These Three Altcoins Defy Crypto Winter With Technical Strength

Altcoin sentiment remains sour, but Midnight (NIGHT), Hyperliquid (HYPE), and Monero (XMR) are flashing accumulation signals and catalyst-driven strength. This offers a rare ‘risk-on’ pocket inside a weak market heading into early February 2026.

Our analysis flagged three tokens as candidates for fresh highs, with roadmap progress and improving money flow signals as key drivers. While the broader market shows extreme fear, capital is rotating toward projects with clear development milestones or durable narratives like privacy and decentralized trading.

Technical Breakouts for NIGHT, HYPE, and XMR

Midnight ($0.047, -4.3%) is advancing its Q1 2026 roadmap, centered on the ‘Kūkolu’ phase. This stage delivers a stable mainnet with trusted validators and privacy-first applications, according to a January update.

Technical indicators like the Chaikin Money Flow (CMF) are rising, indicating that outflows are shrinking. A key level to rebound from is $0.053, with a potential move back toward its prior all-time high near $0.120.

For its part, Hyperliquid’s CMF has moved above zero, suggesting inflows are now dominating. HYPE’s price at $33.74 also shows a reported -0.22 correlation with Bitcoin, implying more independent price action. Open interest on the decentralized perpetuals exchange surged to $793M around Jan. 26–27, up from $260M a month earlier. This reflects growing demand for its derivatives market structure.

Monero is trading near $305 after a sharp 30% correction over 11 days. Its Money Flow Index (MFI) suggests selling pressure is nearing exhaustion. Monero, a privacy coin launched in 2014, maintains a durable narrative focused on fungibility and censorship resistance.

A Flight to Quality Amidst Market Dispersion

While broad altcoin indexes are weak, dispersion is the key theme. The outperformance of these three tokens is not random. It is a flight to quality within specific narratives. Midnight represents progress in privacy-enhancing L1s. Hyperliquid reflects the growing market share of high-performance decentralized derivatives platforms.

Monero’s resilience indicates a persistent, non-speculative demand for private transactions. For a desk trader, these are not degenerate altcoin plays. They are targeted bets on maturing crypto sub-sectors that are showing independent strength against a risk-off macro backdrop.

The post These Three Altcoins Defy Crypto Winter With Technical Strength appeared first on Cryptonews.

Crypto World

Is a 37% Drop Next?

Bitcoin has entered a critical phase after its recent correction dragged the price toward the $70,000 level. Viewed through a macro lens, this move has exposed BTC to elevated downside risk.

Several on-chain and technical indicators now align with a bearish outlook. However, large holders are actively accumulating, attempting to slow or reverse the developing trend.

Sponsored

Bitcoin Loses A Major On-Chain Support

Bitcoin has dropped below the True Market Mean for the first time since September 2023. This metric reflects the aggregate cost basis of actively circulating supply. Trading below it signals weakening conviction among participants and marks a structural shift in market behavior.

The loss of this anchor confirms deterioration that has been forming since late November. From a mid-term perspective, Bitcoin is now confined within a broader valuation corridor. Upside momentum has weakened, while downside pressure continues to build across multiple timeframes.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On the downside, the Realized Price near $55,800 represents the historical level where long-term capital re-enters. On the upside, the True Market Mean of around $80,200 has flipped into resistance. This configuration limits recovery potential and increases the probability of further downside exploration.

Sponsored

Bitcoin’s Macro Outlook Suggests 37% Crash

This structural weakness aligns with a macro bearish setup visible on the charts. Bitcoin is breaking down from a Head and Shoulders pattern that has been developing for months. This formation carries a projected downside of roughly 37%, targeting $51,511 if fully realized.

The sharp 20% decline over the past week accelerated this breakdown. Rapid selling pressure confirmed the pattern’s neckline breach, intensifying bearish momentum. Such moves often lead to follow-through declines as trapped long positions unwind.

The next critical support below $70,000 sits at $68,072. Losing this level would validate the bearish projection. A decisive break would likely trigger additional liquidations, increasing volatility, and accelerating price movement toward lower structural levels.

Sponsored

BTC Whales Jump In As Rescue

Despite mounting bearish signals, Bitcoin whales are actively attempting to prevent further downside. Addresses holding between 10,000 and 100,000 BTC have accumulated more than 50,000 BTC in just four days. At current prices, this accumulation exceeds $3.58 billion.

This behavior reflects strategic positioning rather than speculative trading. Large holders often accumulate during periods of fear, especially after sharp corrections. Bitcoin slipping below $75,000 appears to have created an attractive entry zone for long-term capital.

If whale accumulation continues, it could absorb sell-side pressure and stabilize the price. Historically, such activity has preceded short-term rebounds. However, sustained impact depends on broader market sentiment and whether retail selling pressure subsides.

Sponsored

BTC Price Is Close To Falling Below $70,000

Bitcoin price is trading near $69,500 at the time of writing after a 20% weekly decline. For now, BTC is yet to close a daily candle below $70,000 psychological support. This level has acted as a demand zone in previous corrections, making it critical for near-term stability.

From a short-term perspective, downside risks remain elevated. A breakdown below $68,442 would likely trigger accelerated selling. Under that scenario, Bitcoin could fall toward $65,360. Losing that support may expose BTC to a deeper slide toward $62,893.

Alternatively, whale accumulation could influence price direction. A successful defense of $70,000 may allow Bitcoin to rebound toward $75,000. Reclaiming that level as support would invalidate the immediate bearish thesis and reopen the path toward $80,000 if momentum improves.

Crypto World

Strategy Reports $12.4B Fourth Quarter Loss As Bitcoin Falls

The Bitcoin buying company Strategy reported a net loss of $12.4 billion in the fourth quarter of 2025, driven down by Bitcoin’s 22% fall over the quarter.

Bitcoin (BTC) reached a peak high of $126,000 in early October, but tumbled over the quarter ending Dec. 31 to under $88,500. Bitcoin is down 30% so far this year to $64,500, below Strategy’s average cost per BTC of $76,052.

Strategy (MSTR) said on Thursday that despite the loss, its Q4 revenues rose 1.9% year-on-year to $123 million, driven in part by its business intelligence arm, but the recent Bitcoin sell-off saw its shares close 17% down on Thursday to $107.

Bitcoin’s latest tumble pushed it to a low of $62,500 on Thursday, leaving Strategy down 17.5% on its 713,502 Bitcoin holdings.

Strategy on strong financial footing, says finance boss

Despite the massive quarterly loss, Strategy chief financial officer Andrew Kang said in a statement that the company’s capital structure remains “stronger and more resilient today than ever before.”

“Strategy has built a digital fortress anchored by 713,502 Bitcoins and our shift to Digital Credit, which aligns with our indefinite Bitcoin horizon.”

Related: US won’t ‘bail out’ Bitcoin, says Treasury Secretary Bessent

The company boosted its cash holdings to $2.25 billion in Q4 to allow for 30 months of dividend payouts, signaling financial strength despite the market downturn.

Strategy also has no major debt maturing until 2027, meaning it isn’t under immediate pressure to repay borrowings and may not be forced to liquidate Bitcoin to meet obligations in the near term.

Strategy CEO Phong Le told investors on an earnings call that there’s no reason to panic about the company’s financial position and its Bitcoin strategy.

“I’m not worried, we’re not worried, and no, we’re not having issues.”

He noted that Strategy’s enterprise value is still above its $45 billion Bitcoin reserve and that its $8.2 billion of convertible debt only represents about 13% net leverage, below most Standard & Poor’s 500 companies.

Magazine: South Korea gets rich from crypto… North Korea gets weapons

Crypto World

Tether Invests $100 Million in US ‘Crypto Bank’ Anchorage Digital

Tether’s $100 million investment in Anchorage Digital underscores a commitment to secure, regulated financial systems, reinforcing Anchorage’s status as the first federally chartered crypto bank in the U.S.

Tether announced a $100 million strategic equity investment in Anchorage Digital today, Feb. 5. The move is aimed at bolstering secure and regulated financial infrastructure within the cryptocurrency industry, according to a press release from Tether today, Feb. 5.

Anchorage Digital, recognized as the first federally chartered crypto-focused bank in the United States, both fiat banking services as well as crypto custody, staking, and stablecoin issuance, primarily for institutional clients. The bank obtained its charter from the Office of the Comptroller of the Currency (OCC) in 2021, marking a pivotal moment in the regulation of digital assets in the U.S.

Paolo Ardoino, CEO of Tether, emphasized the strategic alignment between Tether and Anchorage. “Our investment in Anchorage Digital reflects a shared belief in the importance of secure, transparent, and resilient financial systems,” Ardoino said in a statement.

Nathan McCauley, co-founder and CEO of Anchorage Digital, echoed the sentiment, noting that “Tether’s investment is a strong validation of the infrastructure we’ve spent years building the hard way.”

Anchorage is the issuer of Tether’s recently launched dollar-backed stablecoin for U.S. markets, USAT, designed to comply with the GENIUS Act. Tether is the issuer of the largest stablecoin by market capitalization, USDT, which represents just over 60% of the sector.

This article was generated with the assistance of AI workflows.

Crypto World

BNB Chain Announces Support for ERC-8004 to Enable Verifiable Identity for Autonomous AI Agents

[PRESS RELEASE – Dubai, UAE, February 4th, 2026]

BNB Chain today announced its support for ERC-8004, a new on-chain identity standard designed to give autonomous AI agents verifiable, portable identity across platforms. The development represents an important step toward an open and scalable agent economy, where software can operate independently with persistent reputation, accountability, and user control.

Autonomous agents are software programs capable of making decisions, coordinating with other services, and carrying out actions on behalf of users. As these agents become more capable, they will need to operate beyond single apps or centralized platforms. For that to be possible, agents require a reliable way to prove who they are.

Under ERC-8004, an agent is no longer confined to one application or forced to restart its reputation every time it enters a new environment. Instead, it can maintain persistent identity as it moves across platforms, enabling other agents, services, and users to verify its legitimacy and track its history over time.

To complement ERC-8004, the BNB Chain community introduces BAPs (BNB Application Proposals), a new standard for the application layer. Unlike BEPs, which govern core protocol changes, BAPs define how apps work and communicate – covering interfaces, wallet and identity conventions, token and NFT standards, and app-to-app interoperability.

The first BAP, BAP-578, launches the Non-Fungible Agent (NFA) standard, enabling AI agents to exist as onchain assets that can hold assets, execute logic, interact with protocols, and be bought, sold, or hired. This marks the first step toward an open, predictable, and interoperable Agent Economy on BNB Chain.

Users can explore how to start building with ERC-8004 and BAP-578 on BNB Chain in the developer documentation HERE.

About BNB Chain

BNB Chain is a community-driven blockchain ecosystem that is removing barriers to Web3 adoption. It is composed of:

- BNB Smart Chain (BSC): A secure DeFi hub with the lowest gas fees of any EVM-compatible L1; serves as the ecosystem’s governance chain.

- opBNB: A scalability L2 that delivers some of the lowest gas fees of any L2 and rapid processing speeds.

- BNB Greenfield: Meets decentralized storage needs for the ecosystem and lets users establish their own data marketplaces.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

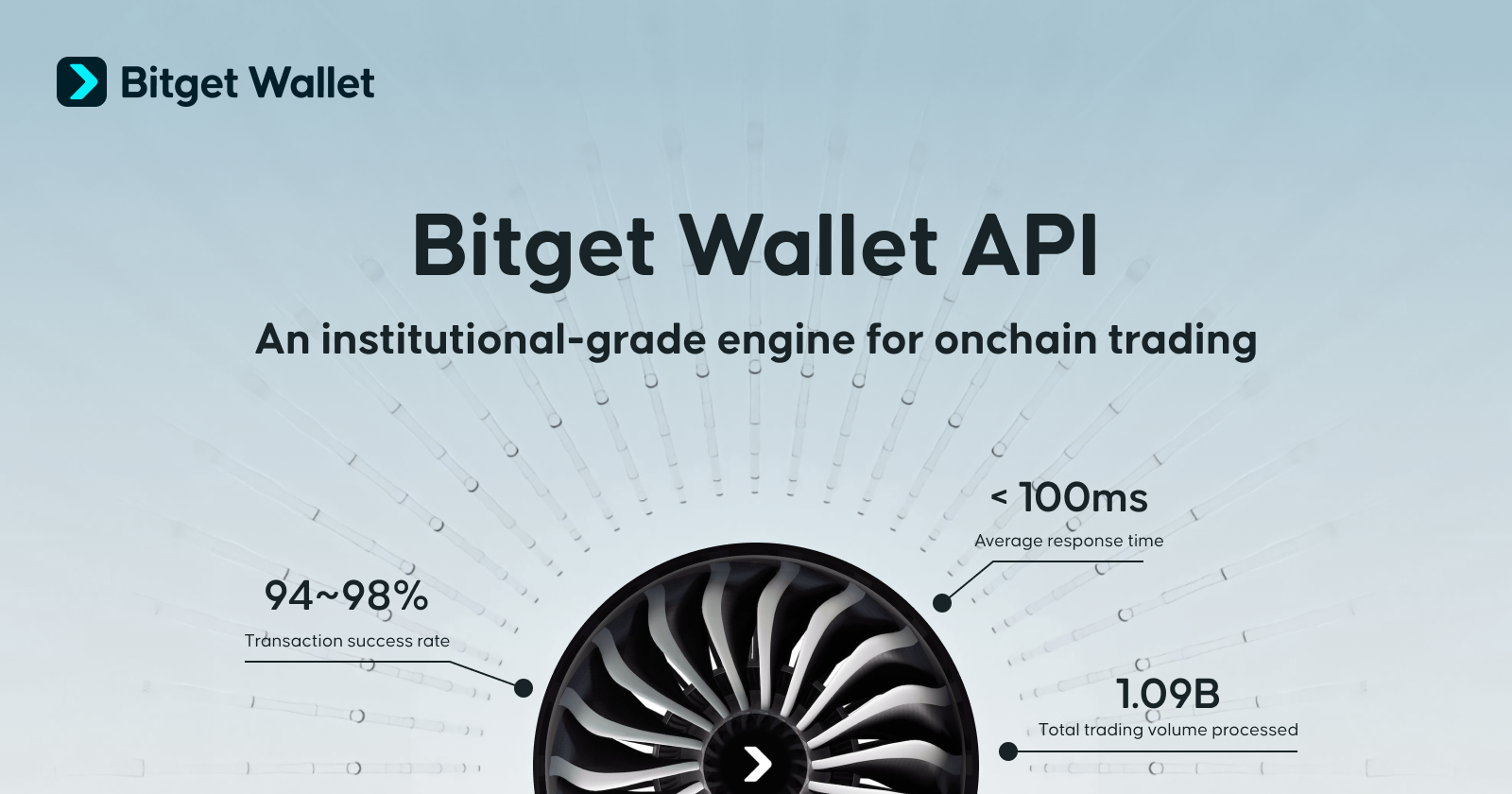

Bitget Wallet Expands Into B2B With Trading Infrastructure API

Launch signals strategic move to provide trading execution and market data services to fintech platforms.

San Salvador, El Salvador, February 5, 2026 – Bitget Wallet, the everyday finance app, has launched Bitget Wallet API, marking a strategic expansion into business-to-business infrastructure as more fintech firms and digital asset platforms look to offer onchain trading services at scale. The API allows partners to access trading execution, market data, and cross-chain asset transfers through a single integration, reducing the need for companies to build and maintain complex backend systems internally.

The move reflects a broader shift toward fintech platforms relying on specialized infrastructure rather than building full technology stacks in-house. BCG estimates B2B fintech services will grow at a 32% annual rate to reach $285 billion in revenues by 2026, alongside rapid growth in Wallet-as-a-Service and embedded finance. At the same time, decentralized exchange trading hit a five-year high in January 2026, with more than $400 billion traded, highlighting DEXs’ growing role as a core source of market liquidity.

“Onchain trading is reaching a wider audience, but the underlying infrastructure is still fragmented and difficult to operate at scale,” said Alvin Kan, COO of Bitget Wallet. “By making the same systems that run our consumer wallet available to partners, we’re supporting companies that want to build professional trading products without taking on unnecessary operational complexity. This makes a step beyond being solely a user-facing wallet toward supporting the broader financial ecosystem.”

At the core of the API is Bitget Wallet’s proprietary DEX-based trade execution engine, which currently handles about 80% of all trades executed within Bitget Wallet. The Trading API aggregates liquidity from 80 decentralized trading protocols and supports trading across Ethereum, Solana, Base, Polygon, Arbitrum, Morph and BNB Chain. By using intelligent routing to compare quotes across venues and select execution paths, the system is designed to improve pricing consistency and reduce failed trades. Bitget Wallet said recent transaction success rates across major networks have remained in the mid-to-high 90% range, with the service operating under a 99.9% availability target.

To support reliable execution, the API includes Sentinel, an automated monitoring system that continuously reviews liquidity sources and removes unstable or abnormal pools before trades are placed. Transactions are also routed through MEV-protected nodes, which are designed to limit interference such as front-running during periods of market volatility. These measures are intended to address common operational challenges faced by trading platforms as transaction volumes increase.

In addition to execution, the Market API provides real-time pricing and activity data across 33 blockchains, covering millions of cryptocurrencies as well as more than 200 widely traded stocks through tokenized market data. The service includes address-level insights, such as activity linked to experienced market participants, alongside automated risk indicators that help flag unusual assets or trading patterns. The API suite also includes a Cross-chain API, which allows assets to be converted and transferred between blockchains in a single process, with built-in tracking that gives users and platforms visibility into transaction progress from start to finish.

Users can visit the Bitget Wallet website for more information.

About Bitget Wallet

Bitget Wallet is an everyday finance app designed to make crypto simple, secure, and usable in daily life. Serving more than 90 million users worldwide, it offers an all-in-one platform to send, spend, earn, and trade crypto and stablecoins through blockchain-based infrastructure. With global on- and off-ramps, the app enables faster and borderless onchain finance, supported by advanced security and a $700 million user protection fund. Bitget Wallet operates as a fully self-custodial wallet and does not hold or control user funds, private keys, or user data. Transactions are signed by users and executed on public blockchains.

For more information, visit: X | LinkedIn | Telegram | YouTube | TikTok | Discord | Facebook

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World7 days ago

Crypto World7 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat7 days ago

NewsBeat7 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business7 hours ago

Business7 hours agoQuiz enters administration for third time

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat13 hours ago

NewsBeat13 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report