Video

Banani – MONEY (Offizielles Musikvideo)

STREAME JETZT DEN NEUEN SONG “MONEY”

https://sptfy.com/BANANIMONEY

⭐ STARCODE: LAMI

👕 LAMI MERCH SHOP ► https://lami-shop.de

📸 Instagram ► https://www.instagram.com/sussy_lami/

📱 TikTok ► https://www.tiktok.com/@sussy_lami

🌐 Roblox Gruppe ► https://www.roblox.com/groups/9105377/LAMI-GRUPPE#!/

🌌 Discord ► https://discord.gg/Ctsqa7zapz

🎮 Roblox Profil ► https://www.roblox.com/users/1492820190/profile

#brookhaven #robloxbrookhaven #roblox

source

Video

Cryptocurrencies II: Last Week Tonight with John Oliver (HBO)

John Oliver discusses cryptocurrency, three of the biggest crypto companies to collapse over the past year, and what to do when your office is giving off “crime vibes”.

Connect with Last Week Tonight online…

Subscribe to the Last Week Tonight YouTube channel for more almost news as it almost happens: www.youtube.com/lastweektonight

Find Last Week Tonight on Facebook like your mom would: www.facebook.com/lastweektonight

Follow us on Twitter for news about jokes and jokes about news: www.twitter.com/lastweektonight

Visit our official site for all that other stuff at once: www.hbo.com/lastweektonight

source

Video

Crypto is Absolutely Done (MAJOR Legislation FAIL in Congress)

LIMITED TIME:

🟣 CoinW ($150 Bonus):

http://www.coinw.com/module/altcoin-daily?r=26418586

🟣 Join CoinW KOL community link:

https://t.me/CoinWKVMbot?start=ALTCOINDAILY

🎁 Altcoin Daily Merch:

https://m046hz-bk.myshopify.com

✅ Bitunix (no kyc, $100,000 bonus): https://www.bitunix.com/register?vipCode=AltcoinDaily

🟡 50% deposit bonus on first $100 (sign up on WEEX): https://www.weex.com/events/welcome-event?vipCode=oz5p&qrType=activity

🔵 Buy, Sell, & Trade Crypto on Coinbase:

https://advanced.coinbase.com/join/U5FN8P5

👉🔒 Get Ledger Wallet: Best Way to Keep your Crypto Safe!

https://www.ledger.com/?r=29fd4d75e9bc

🔴 Altcoin Daily in Spanish: https://www.youtube.com/@AltcoinDailyenEspanol

Follow Altcoin Daily on X: https://x.com/AltcoinDaily

Follow Altcoin Daily on Instagram: https://www.instagram.com/thealtcoindaily/

Video by Austin:

Follow Austin on Instagram: https://www.instagram.com/theaustinarnold/

Follow Austin on X: https://twitter.com/AustinArnol

TimeStamps:

00:00 Clarity Act Update

02:14 Banks Are Trying To Kill Crypto

05:32 Tom Lee’s BitMine Invests $200M into MrBeast

09:22 Raoul Pal “TAO is Going To Go Up”

***********************************************************************

#Bitcoin #Cryptocurrency #News #Ethereum #Invest #Metaverse #Crypto #Cardano #Binance #Chainlink #Polygon #Altcoin #Altcoins #DeFi #CNBC #Solana

***NOT FINANCIAL, LEGAL, OR TAX ADVICE! JUST OPINION! I AM NOT AN EXPERT! I DO NOT GUARANTEE A PARTICULAR OUTCOME I HAVE NO INSIDE KNOWLEDGE! YOU NEED TO DO YOUR OWN RESEARCH AND MAKE YOUR OWN DECISIONS! THIS IS JUST ENTERTAINMENT! USE ALTCOIN DAILY AS A STARTING OFF POINT!

Bitunix, WEEX, CoinW, Binance are exchange partners for the channel.

Polymarket is a channel partner.

*The channel is not responsible for the performance of sponsors and affiliates.

Disclosures of Material holdings:

Most of my crypto portfolio is Bitcoin, then Ethereum, but I hold many cryptocurrencies, possibly ones discussed in this video.

Material holdings over $5000 (in no particular order): BTC, ETH, SOL, MINA, DOT, SUPER, XCAD, LINK, INJ, BICO, METIS, SIS, BNB, PMX, LMWR, WMTx, HEART, TET, PAID, BORG, COTI, ADA, ONDO, ESE, ZKL, SUPRA, CELL, CTA, COOKIE, RSC, ATH, TAO.

Altcoin Daily is an ambassador for XBorg, Supra, WMTx.

This information is what was found publicly on the internet. This information could’ve been doctored or misrepresented by the internet. All information is meant for public awareness and is public domain. This information is not intended to slander harm or defame any of the actors involved but to show what was said through their social media accounts. Please take this information and do your own research.

bitcoin, cryptocurrency, crypto, altcoins, altcoin daily, blockchain, best investment, top altcoins, altcoin, ethereum, best altcoin buys, bitcoin crash, xrp, cardano, 2026, ripple, buy bitcoin, buy ethereum, bitcoin prediction, cnbc crypto, bitcoin crash, cnbc, crypto news, crypto crash, crypto expert, best crypto, crypto today, bitcoin price, bitcoin crash, bitcoin ta, crypto buy now, crypto expert, bloomberg crypto, ethereum news, trading crypto, brian armstrong, clarity act, fail, bitmine, tom lee, mrbeast,

source

Video

Dave Ramsey Was Wrong, Now She’s F*cked | Financial Audit

▶SHE HASN’T EVEN PAID OFF HER LAST COUCH- now she is looking to buy an even more expensive one… WHATTTT watch the post show here: https://www.youtube.com/channel/UCLe_q9axMaeTbjN0hy1Z9xA/join

▶▶Download my *budgeting app* today: *Apple:* https://apple.co/4iChGhr *Google Play:* https://bit.ly/sb-googleplay Don’t overcomplicate this crap! All you need is an automated / SIMPLE budget. This comes with automatic account connections, my budget-friendly cookbook, an online community, and exclusive discounts on my products- change your financial future *NOW*

▶▶▶ *AND REMEMBER* those who sign up for Simpler Budget Premium *annual* get a signed versions of the Cook Book and Simpler Budget Founders Edition Journal, just send proof of annual here: https://tally.so/r/3xzPq5

Use Yrefy to refinance your private student loans today at: https://yrefy.com/hammer or call (888) Yrefy-78

Get an exclusive HighLevel 30-day trial: https://gohighlevel.com/calebhammer

Try InVideo AI for free – https://invideo.io/i/CalebHammer. You can use my code ‘CALEBHAMMER50’ to get twice the number of video generation credits in your first month.

▶▶▶Download my *budgeting app* today: *Apple:* https://apple.co/4iChGhr *Google Play:* https://bit.ly/sb-googleplay

▶ Watch this episode’s *POST* *SHOW* + get *MORE* Financial Audit here: https://www.youtube.com/channel/UCLe_q9axMaeTbjN0hy1Z9xA/join

___________________________________________

▶EDUCATION:

1. Bundle my budgeting, debt, investing and real estate program for *15% off* https://calebhammer.com/classpack/

2. *The best budgeting program online: https://calebhammer.com/budget

3. Get my investing class and I’ll give you a $100 towards investing: https://calebhammer.com/investing

4. Win with GOOD debt and get out of BAD debt correctly, learn in my debt program: https://calebhammer.com/formula

5. Everything you need for buying your first home to buy your first investment property:

https://calebhammer.com/realestate/

6. Get your own free Hammer Financial Score: https://www.calebhammer.com

___________________________________________

▶RESOURCES

1. Checking & Savings: Get up to $500^ before payday when you sign up and set up direct deposit. No credit check. No interest*. No mandatory fees: https://clickurl.ca/caleb-mypay

2. CourseCareers: Land a high-paying job with no experience or degree by going through an affordable online course https://coursecareers.com/CalebHammer

3. Get $20 from Acorns for free: sign up to get your bonus https://acorns.com/caleb

4. Get an exclusive HighLevel 30-day trial: https://gohighlevel.com/calebhammer

5. The credit building debit card: First 100,000 people to sign up for Fizz with code: HAMMER10 get $10: https://www.joinfizz.com/caleb (paid ad)

6. Helium Mobile: save a ton on your phone bill, sign up and get a FREE plan when using promo code CALEB https://hellohelium.com/

7. Online security: Protect your online privacy and security NOW and for free by following my link Aura: https://aura.com/hammer

8. Therapy: Make SonderMind your mental health home in 2025. Sign up at: https://pages.sondermind.com/caleb/

9. Stock Investing: Earn up to $5,000 in Cash Back every year on your Stocks & ETFs. Terms apply: https://silomarkets.com/caleb

All investing involves risk. Silo Financial LLC (“Silo”) is registered with the SEC. The creator receives cash compensation and is not affiliated with Silo.

___________________________________________

▶OTHER CHANNELS:

1. Financial Audit Follow-Ups: https://www.youtube.com/@calebhammerclips

___________________________________________

Chapters:

00:00 Intro

00:41 Job & Income

10:16 Americans and their cars…

20:31 new reaction meme dropped

32:12 excuse after excuse after excuse

45:53 “does she love you?”

57:34 bro thinks hes deadpool

01:10:26 what does that even mean

01:27:05 Budget Time!!

01:32:50 Hammer Financial Score

___________________________________________

▶EXTRA

1. My website: https://calebhammer.com/

2. My socials: https://stan.store/calebhammer

3. Want to be a guest on Financial Audit? We film weekdays in our studio in Austin, Texas (in person only)! To apply, visit: http://calebhammer.com/apply

Any questions? Email:

casting@calebhammer.com

___________________________________________

▶*Some of the links and other products that appear in this video are from companies for which Caleb Hammer will earn an affiliate commission or referral bonus. Some of the offers mentioned may no longer be available. This is not investment advice.

▶Sponsorship and business inquiries: business@calebhammer.com

source

Video

XRP ANON LIED TO US !!!!! DAVID SCHWARTZ DELETED TWEET !!!! MR POOL XRP CRASH THEN PARABOLIC !!!!

Cardano, Ethereum, Solana, Dogecoin, Ukraine & Russia Crypto News!

Hit Like, Share, and Subscribe for more daily cryptocurrency news

———————————————————————————————————–

TRADE XRP & CRYPTOS WITH BITUNIX !!!!

► https://www.bitunix.com/act/partner?landingCode=zsubyblg

DISCORD LINK !!!!

►https://discord.gg/8JtWJcBmXH

X.COM LINK !!!!

►https://x.com/TheJWKShow

———————————————————————————————————–

Tags

►cryptocurrency,coinbase,altcoin,dogecoin

Tags

►,cryptocurrency,coinbase,altcoin,dogecoin

#binance #coinbase #xrp #newaltcoins #finance #ripple #stocks #binary #hodl #bitcoinexchange #altcoin #success #blockchaintechnology #mining #usa #cryptoworld #wealth #motivation #financialfreedom #cryptomining #bitcoinbillionaire #trade #altcoins #ico #gold #stockmarket #wallstreet #cryptoinvestor #cryptotrader #newaltcoin #alts #cryptoalts #cryptooasis #cryptopromodio #advertisingincrypto

► Rumble TheJWKShow ~ https://rumble.com/user/TheJWKShow

source

Video

how solve financial problems

Video

CZ CALLS BITCOIN SUPERCYCLE (UBS $7T SIGNAL)

In this video, we dive into the explosive statements from Binance founder CZ (Changpeng Zhao) at Davos 2026, where he declared that Bitcoin is entering a “Supercycle” that could defy every historical model we know.

💥 Join Our Trading Group

Discord – https://discord.gg/pJYe4Z9FWa

Toobit – https://www.toobit.com/en-US/affiliates/exclusive-activities?invite_code=DiscoverCrypto&activityId=1474

Blofin – https://partner.blofin.com/d/DiscoverCrypto

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

➡️ Protect your BTC From Taxes – https://bitcoinira.com/

➡️ Crypto Tax Services – https://www.decrypted.tax/

➡️ Use ‘DC20’ for 20% off Arculus – https://www.getarculus.com/products/arculus-cold-storage-wallet

Bitcoin Ticker Box – https://tickerbox.eu?sca_ref=8841235.jarE9W1myNW

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

➡️ Follow on X – https://x.com/DiscoverCrypto_

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

All of our videos are strictly personal opinions. Please make sure to do your own research. Never take one person’s opinion for financial guidance. There are multiple strategies and not all strategies fit all people. Our videos ARE NOT financial advice. Our videos are sponsored & include affiliate content. Digital Assets are highly volatile and carry a considerable amount of risk. Only use exchanges for trading digital assets. We never keep our entire portfolio on an exchange.

#bitcoin #crypto

source

Video

C.R.O – MONEY (Shot by BALLVE)

MONEY primer adelanto de ‘Cuervos’.

⚡️Seguí a C.R.O en su canal OFICIAL 🦇

https://www.youtube.com/channel/UC20cm05g3-UFwiPDc1QaClQ

Esto no es música….

C.R.O

https://instagram.com/crocraxker

Tweets by crocraxker33

Producción músical:

https://www.instagram.com/orodembow/

Anestesia Audiovisual

https://www.instagram.com/anestesia.av/

Booking C.R.O:

nocitacontrataciones@gmail.com –

Nocita Music – @nocitamusic

nocitacontrataciones@gmail.com

source

Video

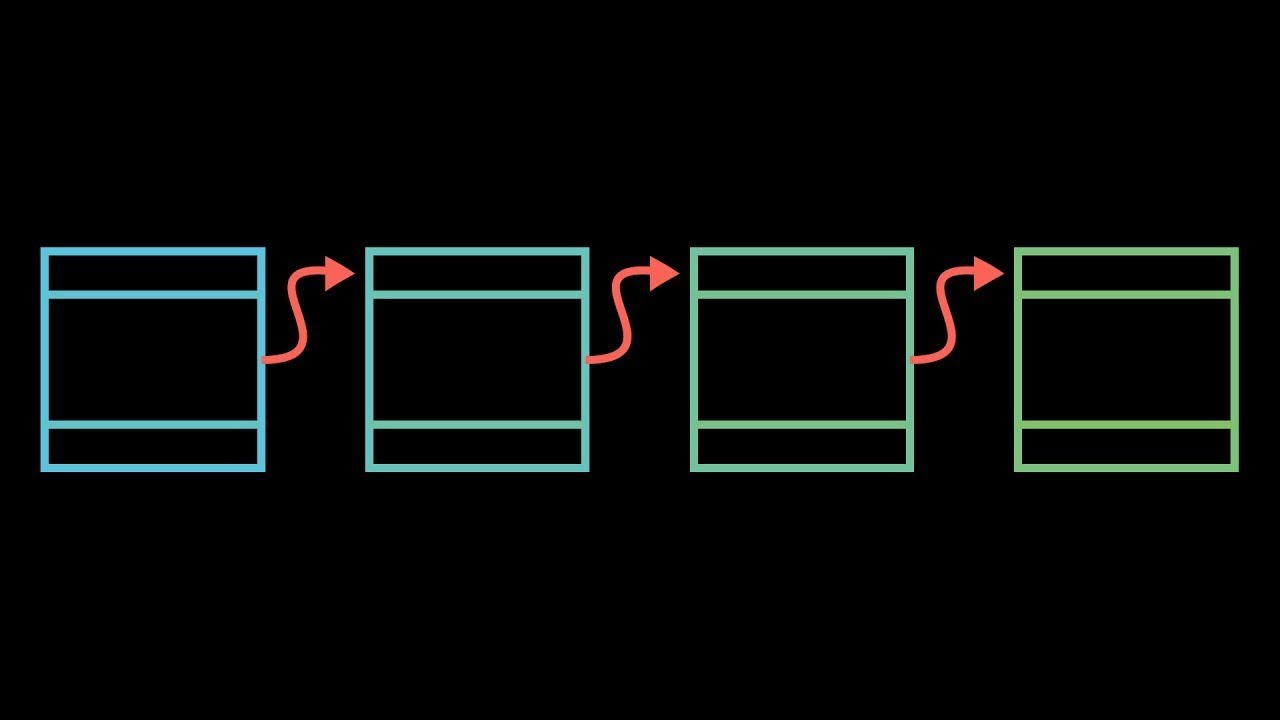

But how does bitcoin actually work?

The math behind cryptocurrencies.

Help fund future projects: https://www.patreon.com/3blue1brown

An equally valuable form of support is to simply share some of the videos.

Special thanks to these supporters: http://3b1b.co/btc-thanks

This video was also funded with help from Protocol Labs: https://protocol.ai/join/

Some people have asked if this channel accepts contributions in cryptocurrency form. As a matter of fact, it does:

http://3b1b.co/crypto

ENS: 3b1b.eth

2^256 video: https://youtu.be/S9JGmA5_unY

Music by Vincent Rubinetti: https://soundcloud.com/vincerubinetti/heartbeat

Here are a few other resources I’d recommend:

Original Bitcoin paper: https://bitcoin.org/bitcoin.pdf

Block explorer: https://blockexplorer.com/

Blog post by Michael Nielsen: https://goo.gl/BW1RV3

(This is particularly good for understanding the details of what transactions look like, which is something this video did not cover)

Video by CuriousInventor: https://youtu.be/Lx9zgZCMqXE

Video by Anders Brownworth: https://youtu.be/_160oMzblY8

Ethereum white paper: https://goo.gl/XXZddT

Timestamps:

0:00 – Introduction

2:25 – Ledgers and digital signatures

7:21 – The ledger is the currency

10:06 – Decentralization

12:26 – Cryptographic hash functions

14:38 – Proof of work and blockchains

19:42 – Double spending

21:41 – Block times, halvenings, and transaction fees

24:40 – Thanks

Thanks to these viewers for their contributions to translations

Italian: @lcl45

——————

Animations are largely made using manim, a scrappy open-source python library. https://github.com/3b1b/manim

If you want to check it out, I feel compelled to warn you that it’s not the most well-documented tool, and has many other quirks you might expect in a library someone wrote with only their own use in mind.

Music by Vincent Rubinetti.

Download the music on Bandcamp:

https://vincerubinetti.bandcamp.com/album/the-music-of-3blue1brown

Stream the music on Spotify:

If you want to contribute translated subtitles or to help review those that have already been made by others and need approval, you can click the gear icon in the video and go to subtitles/cc, then “add subtitles/cc”. I really appreciate those who do this, as it helps make the lessons accessible to more people.

——————

3blue1brown is a channel about animating math, in all senses of the word animate. And you know the drill with YouTube, if you want to stay posted on new videos, subscribe, and click the bell to receive notifications (if you’re into that).

If you are new to this channel and want to see more, a good place to start is this playlist: http://3b1b.co/recommended

Various social media stuffs:

Website: https://www.3blue1brown.com

Twitter: https://twitter.com/3Blue1Brown

Patreon: https://patreon.com/3blue1brown

Facebook: https://www.facebook.com/3blue1brown

Reddit: https://www.reddit.com/r/3Blue1Brown

source

Video

I Built an 11-Tab Financial Model in 10 Minutes. The $20/Month Tool That’s About Change How We Work.

My site: https://natebjones.com

Full Story w/ Excel Examples + Guide: https://natesnewsletter.substack.com/p/anthropic-just-put-claude-insider?r=1z4sm5&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true

________________________

What’s really happening with AI and spreadsheets? The common story is that foundation models competing on benchmarks is the main event—but the reality is more complicated.

In this video, I share the inside scoop on how Claude in Excel changes what knowledge work actually means:

• Why Anthropic embedded Opus 4.5 directly inside Microsoft’s 40-year-old software

• How data partnerships with Moody’s, S&P, and FactSet create moats benchmarks can’t match

• What Norway’s sovereign wealth fund learned from 213,000 hours saved

• Where the model race ends and workflow integration begins

For operators and builders, the strategic question has shifted—it’s no longer who trains the best model, but who controls the workflows where real decisions happen.

Subscribe for daily AI strategy and news.

For deeper playbooks and analysis: https://natesnewsletter.substack.com/

source

Video

Papo Man – No Hay Money

Papo Man – No Hay Money

#PapoMan #NoHayMoney

Suscríbete a mi canal: http://bit.ly/2nsSCCE

Escucha mi playlist aquí:

Videos Oficiales: http://bit.ly/2mQYi9j

Escucha mi música en tu plataforma favorita:

https://ONErpm.lnk.to/PapoMan

¡Sígueme en mis redes sociales!

Facebook: facebook.com/papomanlaleyenda/

Instagram: instagram.com/papomanlaleyenda/

Twitter: twitter.com/papomanleyenda?s=17

source

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World7 days ago

Crypto World7 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat7 days ago

NewsBeat7 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business8 hours ago

Business8 hours agoQuiz enters administration for third time

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat14 hours ago

NewsBeat14 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report