Video

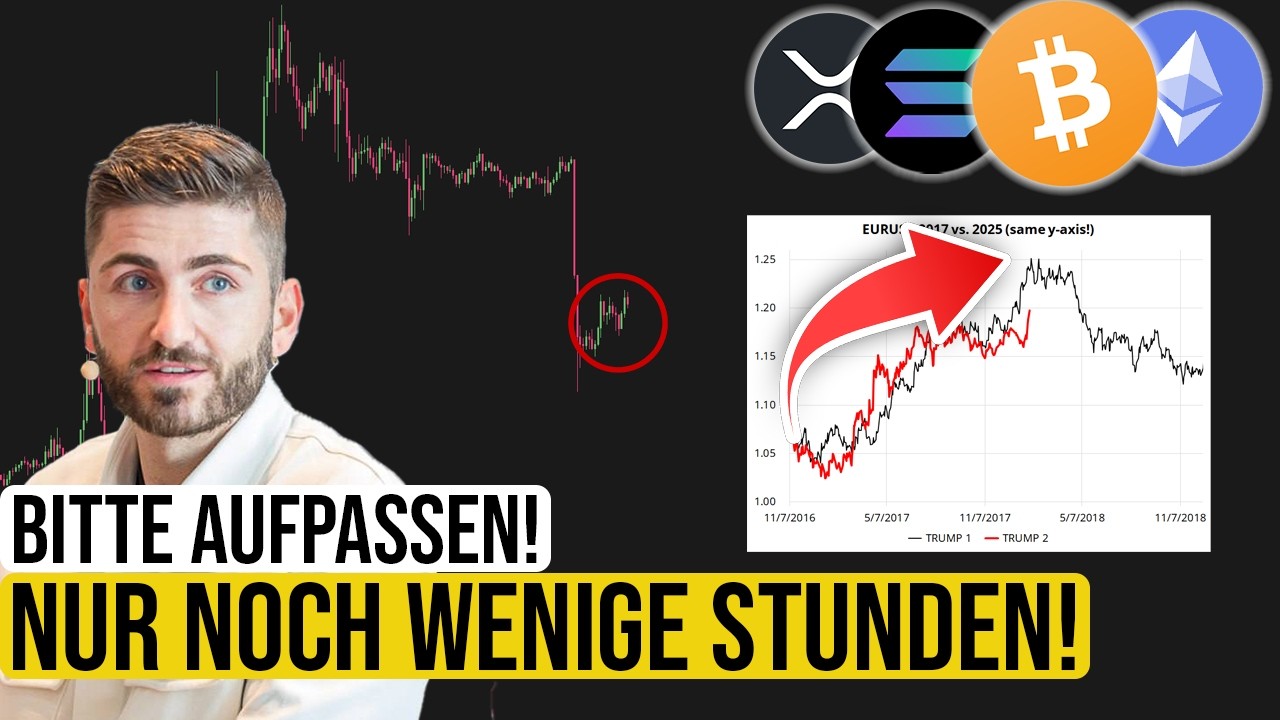

Achtung: Wiederholt sich die Geschichte? Das passiert bei Bitcoin & Makro! Krypto News

Aktuellste Bitcoin Prognosen, Marktanalysen & Insights zu Altcoins, Makroökonomie und Trading-Strategien.

Hier findest du alle Tools, Tutorials und Ressourcen, die ich selbst nutze 👇

💰 BESTE BÖRSEN & TOOLS:

✅ NEU: BYBIT EU

https://partner.bybit.eu/b/FURKANCCTV

➝ (Exklusiv $5.100 Bonus für neue Nutzer)

✅ Beste Trading-Börse (Testsieger): BINGX https://bingx.com/de-de/act/chanelActivityStyle3/F5Z6RX6Z

➝ (Exklusiv $11.500 Bonus + 10% Fee Rabatt)*

✅Bester Grid Trading Bot: PIONEX https://www.pionex.com/de/activities/common/1121741232/Furkan?referral=FurkanCCTV

➝ (1.150 USDT Bonus geschenkt)*

➝ Kopiere meine persönlichen Trades: https://www.pionex.com/en/activities/kol-follow-order?share_code=coinchecktv

➝ Grid Trading Tutorial (BEGINNER): https://youtu.be/7a2DvHwYhZY

➝ Grid Trading Tutorial (ADVANCED): https://youtu.be/bRqCc68I7Cc

✅ Beste Spot-Börse (Testsieger): BITVAVO https://bitvavo.com/de/affiliate/coinchecktv

➝ (10€ Neukundenbonus + günstigste Spot Fees)*

📊 ANALYSEN & INSIGHTS:

⚡️ Unsere Kursanalysen & Insights: MAKROVISIONPRO https://terminal.makro-vision.com/

➝ (14 Tage kostenlos testen)*

⚡️ Meine Hardware-Wallet: https://shop.ledger.com/de/r/furkan-yildirim?r=b22e ➝ (10€ in BTC geschenkt)

⚡️ Bestes Steuertool: COINTRACKING https://cointracking.info/?ref=C257471

➝ (10% Rabatt auf alle Steuerpakete)*

🎓 TRADING TUTORIALS

⭐️ Trading Strategie der Wale: https://youtu.be/S8qLKZ9vDAw?si=IOfkCHRncaBb-1H9

⭐️ Bitcoin Scalping Strategie: https://youtu.be/iQKHr6eCb7A

⭐️ Kostenlose 8h Videoreihe: https://youtube.com/playlist?list=PLXxmjiPcqnmgN3jngzAAsJ0tde0ALi-sV

🌍 COMMUNITY & KANÄLE

✨ Folge mir für mehr Insights: https://twitter.com/FurkanCCTV

✨ Community Chat-Gruppe: https://t.me/CoinCheckTelegram

✨ News & Alerts: https://t.me/CoinCheckNews

🧠 ÜBER MICH:

Ich bin Furkan, Bitcoin- und Krypto-Analyst seit 2017.

Auf CoinCheck TV teile ich tägliche Marktanalysen, Strategien und Einschätzungen zur globalen Wirtschaft.

Nach meinem Studium des Wirtschaftsingenieurwesens habe ich in der Blockchain-Forschung an der TU Dortmund gearbeitet.

Mein Ziel: Krypto & Makro-Themen verständlich, datenbasiert und wissenschaftlich fundiert erklären.

👉 Wenn dir fundierte Bitcoin- und Krypto-Analysen gefallen, abonniere den Kanal und aktiviere die Glocke, um kein Update zu verpassen.

———————————————————————————————-

Timestamps:

00:00 Krypto: Aktuelle Lage & News

04:17 Makro: Wichtige Entwicklungen & Muster

17:00 Bitcoin Analyse, Daten & meine Strategie

► Kontakt:

✉️ E-Mail: info@coinchecktv.de (nur geschäftliche Anfragen)

✉️ Telegram: @coinchecktv

Ich nehme keine Spenden mit Kryptowährungen an. Falls du mich unterstützen möchtest, kannst du das mit den oben gelisteten Affiliate-Links tun. Die genannten Konditionen für Bonuszahlungen sind ohne Gewähr. Die Verantwortung für die Auszahlung, Voraussetzungen und Fristen obliegt der betreibenden Plattformen.

Ich bin kein Anlage- und/oder Steuerberater und für die Richtigkeit der Infos in diesem Video übernehme ich keine Gewähr. In diesem Video werden keine Garantien oder Versprechungen zu Gewinnen gemacht. Alle Aussagen in diesem und anderen Videos auf meinem Kanal entsprechen meiner subjektiven Meinung.

*

Einige der Links sind sogenannte Affiliate-Links. Mit der Nutzung dieser Links unterstützt du mich durch Provisionen, die andernfalls an die Plattformen gehen würden. Es entstehen dabei nie Mehrkosten für dich. Vielen Dank für die Unterstützung. Die Angebote richten sich ausschließlich an Nutzer, die ihren ständigen Wohnsitz an einem Ort haben, wo die jeweilige Plattform eine Lizenz besitzt.

Wichtiger Hinweis: Keine Plattform bietet eine vollständige Sicherheit. Jede Börse kann gehackt werden oder pleite gehen. Aus diesem Grund rate ich jedem keine Gelder auf den Börsen langfristig zu lassen. Es droht ein Totalverlust bei einer Insolvenz.

#Bitcoin #krypto #btc

source

Video

How to get financial freedom at an early age?

In this episode, we sit down with Mr Biren Parekh to discuss money, investing, real estate, and the practical decisions that shape long-term financial freedom.

From his early life and first salary to investing frameworks, asset allocation, exits, passive income, and early retirement, this conversation covers real, actionable insights that everyday investors can relate to. We also discuss buying vs renting a home in Mumbai, how much money is “enough,” and how young earners can plan for financial independence.

This episode focuses on practical financial thinking, not hype, making it especially useful for salaried professionals, young investors, and anyone planning long-term wealth.

About The Guest

Biren Parekh is a seasoned BFSI professional and investor with nearly three decades of experience across banking, financial services, and technology. He is currently associated with CRISIL Limited and is based in Mumbai. Alongside his corporate leadership roles, he is an active investor with a strong interest in long-term wealth creation, asset allocation, and practical financial decision-making. His investing approach is shaped by real-world experience, disciplined thinking, and a focus on risk management rather than short-term speculation.

💡 What we spoke about

• Biren Parekh’s early life and money lessons

• His first salary and first investment

• Stocks that delivered outsized long-term returns

• Renting vs buying a home in Mumbai

• When it actually makes sense to buy a house

• What passive income really means and what it includes

• Ideal asset allocation at different income levels

• When investors should exit a stock

• How a 25-year-old earning ₹1 lakh a month can plan to retire by 40

• How much money is needed to be financially free

• Silver prices and their relevance in asset allocation

⏰ Timestamps

0:21 – How was it growing up? Where did you grow up?

0:52 – What was your first salary?

1:31 – When was your first investment?

3:08 – Have any of your shares grown significantly over time?

5:47 – If I am a 25-year-old earning ₹1,00,000 a month, where should I invest to retire by 40?

8:38 – What is passive income and what does it include?

13:24 – How much money does one need to be financially free?

15:36 – At what salary package can one decide to buy a house?

18:16 – Ideal asset allocation on a ₹50,000 monthly salary

19:55 – When should investors ideally exit a stock?

23:00 – Is your home rented or owned? When did you buy your first home?

23:33 – Is it better to rent or buy a home in Mumbai?

#BirenParekh,#InvestorTalk,#PersonalFinanceIndia,#InvestingInIndia,#WealthCreation,#FinancialFreedom,#AssetAllocation,#StockMarketIndia,#MoneyMindset,#PassiveIncome,#EarlyRetirement

source

Video

Money Vs Power by Right To Shiksha

Video

DUMP CRYPTO FOR GOLD & SILVER? BITCOIN, XRP, ETHEREUM, & SOLANA ANALYSIS!

Brian from Santiment joined me to review the crypto market metrics for Bitcoin, Ethereum, Ripple XRP, Solana, and Avax. We also look at the surging price and sentiment for gold and silver.

🖥️ Sign up with Santiment to get quality crypto metrics – https://app.santiment.net/pricing?fpr=thinkingcrypto Get 25% discount with code THINKINGCRYPTO

💡Get the (Re)Thinking Crypto Book on Amazon – https://www.amazon.com/dp/B0D2525DYX

🖥️ Learn Crypto with Expert Commentary – http://MyCryptoCourse.com

Sponsors:

🔐 Safely Store your Crypto with Trezor Hardware Wallets – https://affil.trezor.io/SHlz

🏠 Propy (PRO) is a blockchain-based real estate marketplace and decentralized title registry that leverages smart contracts to facilitate property transactions globally https://propy.com/home/ & https://propy.com/home/ownyourtomorrow/

✅ VeChain is a versatile enterprise-grade L1 smart contract platform https://www.vechain.org/

🏦 Learn about iTrustCapital’s powerful Premium Custody Account (PCA) and tax-advantaged Crypto IRA platforms https://www.itrustcapital.com/go/thinkingcrypto

🌟Uphold – Signup with Uphold. https://uphold.sjv.io/gbED4X

Terms Apply. Cryptoassets are highly volatile. Your capital is at risk.

📰 Sign up for the Free Thinking Crypto Weekly Newsletter https://thinkingcrypto.substack.com/

✅ Become a Channel Member – https://www.youtube.com/channel/UCjpkwsuHgYx9fBE0ojsJ_-w/join

🔥 Buy Merch & support the Podcast https://my-store-574b5b.creator-spring.com/

🧙♂️Merlin – http://tinyurl.com/MerlinTCYouTube

“I am a Merlin partner and get compensated for purchases made through links in this content”this content”

Follow on social media:

➡️ X(Twitter) – https://x.com/thinkingcrypto

➡️ Facebook – https://www.facebook.com/thinkingcrypto/

➡️ LinkedIn – http://linkedin.com/company/thinking-crypto

➡️ Instagram – https://www.instagram.com/thinkingcrypto/

➡️ TikTok – https://www.tiktok.com/@thinkingcrypto5

➡️ Threads – https://www.threads.net/@thinkingcrypto

➡️ Website – https://www.ThinkingCrypto.com/

🔊 Listen to content on Apple Podcasts – https://podcasts.apple.com/us/podcast/thinking-crypto-news-interviews/id1458945676

🔊 Listen to content on Spotify – https://open.spotify.com/show/221AV5A65v7uYEsuMviVKl

💼Business Inquiries💼

hellothinkingcrypto@gmail.com

⏰ Time Stamps ⏰

00:00 Intro

03:34 Bitcoin analysis

10:31 Bitcoin whale activity

14:31 Bitcoin MVRV

18:00 Ethereum Analysis

19:27 XRP Analysis

25:02 Solana Analysis

26:34 Avax Analysis

=================================================

📺 Interviews Playlists 📺

– All Interviews – https://youtube.com/playlist?list=PL5rDfH3ofGEe8rCbwJojpipmwwkvWhbQD

– Must Watch Interviews – https://youtube.com/playlist?list=PL5rDfH3ofGEdqEaSrjC3UHOQdw1eyeYRU

– Bitcoin Interviews – https://youtube.com/playlist?list=PL5rDfH3ofGEcjtw8URfr7-DfBi_J_O0ip

– Altcoin Interviews – https://youtube.com/playlist?list=PL5rDfH3ofGEeZ3QES9lD1f59YTWuQv-uv

– Crypto Regulators & Politicians Interviews – https://youtube.com/playlist?list=PL5rDfH3ofGEdsqA213osf2u-PbT1b7uM4

– Investment Firms & Hedge Funds – https://youtube.com/playlist?list=PL5rDfH3ofGEfa-HsusfQBB6blH3KR09mj

– Internet Pioneers & Entrepreneurs – https://youtube.com/playlist?list=PL5rDfH3ofGEdqCYps3eexnovm2WNWeP3o

=================================================

#Crypto #Bitcoin #Gold #Silver #CryptoNews #Cryptocurrency #BTC #BitcoinNews #ETF #News #Ripple #XRP #XRPNews #RippleXRP #Ethereum #EthereumNews #ETH #Solana #money #investing #trading #Altcoin #Altcoins #NFTs #Metaverse #Podcast #ThinkingCrypto

=================================================

– The Thinking Crypto Podcast is your home for the best Crypto News and Interviews – crypto, cryptocurrency, crypto news, bitcoin, bitcoin news, xrp, xrp news, ripple, ripple news, ripple xrp, ethereum, ethereum news, cardano, ada, solana, altcoins, defi, news, interviews, podcast, metaverse, nft, altcoin daily, cryptosrus, coin bureau, altcoin news, bitcoin today, markets, investing

=================================================

Disclaimer – The Thinking Crypto podcast and Tony Edward are not financial or investment experts. You should do your own research on each cryptocurrency and make your own conclusions and decisions for investment. Invest at your own risk, only invest what you are willing to lose. This channel and its videos are just for educational purposes and NOT investment or financial advice.

Note that links included in this description might be affiliate links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel so I can continue to provide you with free content each week!

source

Video

The Banking Collapse is STARTING | Financial Crisis 2.0.

🚨 Sign up for the Gemini Credit Card: https://Gemini.com/kevin 🚨 ⚠️✅💎 Meet Kevin Membership: https://MeetKevin.com 💎 ✅ ⚠️

⚠️🔥 HouseHack Startup: https://househack.com 🔥⚠️ (Read any solicitation paperwork before investing; investing involves risk – this video is not a solicitation).

🤯💥 Life Insurance Sponsor: https://metkevin.com/life💥🤯

#GeminiCreditCard #CryptoRewards This video is sponsored by Gemini. All opinions expressed by the content creator are their own and not influenced or endorsed by Gemini.

The Bitcoin Credit Card™ is a trademark of Gemini used in connection with the Gemini Credit Card®, which is issued by WebBank. For more information regarding fees, interest, and other cost information, see Rates & Fees: gemini.com/legal/cardholder-agreement

Some exclusions apply to instant rewards; these are deposited when the transaction posts. 4% back is available on up to $300 in spend per month for a year (then 1% on all other Gas, EV charging, and transit purchases that month). Spend cycle will refresh on the 1st of each calendar month. See Rewards Program Terms for details: gemini.com/legal/credit-card-rewards-agreement

Checking if you’re eligible will not impact your credit score. If you’re eligible and choose to proceed, a hard credit inquiry will be conducted that can impact your credit score. Eligibility does not guarantee approval.

The appreciation of cardholder rewards reflects a subset of Gemini Cardholders from 10/08/2021 to 04/06/2025 who held Bitcoin rewards for at least one year. Individual results will vary based on spending, selected crypto, and market performance. Cryptocurrency is highly volatile and may result in gains or losses. This information is for general informational purposes only and does not constitute investment advice. Past performance is not indicative of future results.

😇 Affiliates and Paid Promotions 😇

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

➡️ Life Insurance Sponsor: My favorite life insurance you can get in as litle as 5 minutes! https://metkevin.com/life

➡️ Webull Sponsor: My favorite stock-app for charting and trades! https://metkevin.com/webull

➡️ HSA Sponsor: Tax Deductions via a Health-Savings Account: https://metkevin.com/hsa

➡️ My 360-Camera Sponsor: https://metkevin.com/360x

*See terms and conditions at affiliated webpages. Offers are subject to change. These are affiliated/paid promotions.

🥰 SOCIAL MEDIA & DISCUSSIONS 🥰

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

Twitter / X: https://twitter.com/realMeetKevin

Tik Tok: https://www.tiktok.com/@realmeetkevin

Instagram: https://www.instagram.com/meetkevin

🚀 COURSE INQUIRIES 🚀

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

Email staff@meetkevin.com for course requests or support.

➡️ SPONSORSHIP INQUIRIES ➡️

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

Email meetkevin@creatorsagency.co for sponsorships.

📝 LEGAL DISCLAIMER 📝

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

This video or description does not constitute personalized financial, legal, real estate, investment, or other advice (we don’t know your situation; so it’s impossible to provide you personalized advice.). Therefore, evaluate your own suitability. Assume any referenced product or service is a paid promotion, though Kevin does his best to let ya know if a mention is paid or unpaid. While Kevin’s experience with a product or service may be good, your experience may suck – Kevin can’t be response for that; so be warned and conduct your own diligence. Any mention of stocks or analysis may be reliable today, but not tomorrow or even hours later. Recognize businesses and people change rapidly and the accuracy of information cannot be guaranteed. Additionally, any mention of being a pilot, flying a jet, or showing or commenting on aviation is solely incidental to part-91 flight operations Kevin Paffrath is taking for his own purposes. Any videos of FAA-related or aviation-related content are solely incidental to flights that would have occurred regardless of video content, though some may see the aircraft Kevin flies as an advertisement for the products and services, investment strategies, or wealth strategies Kevin promotes. Kevin Paffrath is licensed with the California Department of Real Estate under 01893132. His broker is HouseHack, license 02236137.

source

Video

I Tested Fake Money from the Dark Web..

Video

Bitcoin vs Ethereum: Which is the Better Investment?

Compare Bitcoin and Ethereum investments with ₹2 lakh at 15% CAGR. Ethereum shows higher growth (₹6L in 10 years, ₹30L+ in 20 years), while Bitcoin offers stability. Understand which cryptocurrency aligns with your risk tolerance and long-term financial goals.

#XRPPricePrediction

#EthereumNews

#BlockchainBattle

#BTC

#AltcoinAnalysis

#BitcoinPricePrediction

#BlockchainInsights

#CryptoShowdown

#EthereumUpdate

#AltcoinInsights

#BTCTrends

#BitcoinAnalysis

#EthereumPricePrediction

#BitcoinNewsToday

#EthereumAnalysis

#PersonalFinance

#EthereumInvesting

#DigitalAssets

#BitcoinElliottWaveAnalysis

#BTCPrice

#ETHNews

#BTCAnalysis

#CryptoMarket

#CryptoNewsToday

#ETHPrice

#Ethereum

#CryptoTradingStrategies

source

Video

Harusnya Mindset KEUANGAN Para Sandwich Generation Tuh Gini! | SUARA BERKELAS #14

Belajar lebih banyak lagi bareng Melvin Mumpuni di: https://lynk.id/finansialku

Solusi mencapai tujuan finansialmu 👉 https://lynk.id/se.uang

Lacak pengeluaranmu dengan Expense tracker 👉 https://lynk.id/se.kelas/qZA9oGd

Hasilin ratusan juta dari industri kreatif 👉 https://lynk.id/edutify/on2D3XA

Baca Buku Generasi Ekspektasi 👉 https://s.shopee.co.id/7fHec5zQqL

Spotify: https://open.spotify.com/show/0u1uZUrZ69mhEhx5N7LcnQ?si=e2961c188ca64fe3

Follow IG dan Submit Pertanyaan: https://www.instagram.com/se.kelas/

Bikin Podcast: https://www.instagram.com/heystudio_id/

#growth #selfdevelopment #uang #kaya

Apa aja yang dibahas Bilal & Melvin?

00:00 Intro

01:50 Fenomena hidup serba konsumtif anak 20an.

07:29 Solusi untuk mencegah pengeluaran yang konsumtif?

09:41 MINDSET menghasilkan duit jadi lebih mudah.

14:11 3 sumber penghasilan.

17:36 Cara mengembangkan sumber penghasilan.

20:15 Definisi aset secara sederhana.

source

Video

Parmish Verma : Time Is Money (Official Video)

Parmish Verma’s “Time Is Money” is the ultimate flex anthem of the year — a hard-hitting banger where he shows off everything he’s earned through hustle and grind. From struggles to success, it’s all about living proof that time really is money.

Streaming Links :

Insta

https://tinyurl.com/3vmbvee5

Spotify

https://tinyurl.com/fjzer3yz

Amazon Music

https://tinyurl.com/y9ff68ps

Apple Music

https://tinyurl.com/vj9dbp4m

Gaana

https://tinyurl.com/4jk4xfje

JioSaavn

https://tinyurl.com/yxfhzx5n

YouTube Music

https://tinyurl.com/3ejnkcwc

Speed Records Presents

🎵- Credits

Song – Time Is Money

Singer – Parmish Verma

Lyrics – Laddi Chahal

Music Composer – Black Virus

Producer – Zorawar

Composer – Laddi Chahal

Mix Master – Dense

🎥 – Credits

Director – Agam Mann & Aseem Mann

Styled by – Medha Bahuguna

Photography – Beej Lakhani

Line Production – Akshay Kapoor

DOP – Shinda Singh

Editor – Mr LUV

Color – Grade Onkar Singh

AD – Rajat Yadav

👨💻 – Credits

Digitally Powered By – Scope Digital

Lyrics :

Birkin moddeyan ch, gutt van cleef ni

Ho hermes pairan ch main karaan ki tareef teri

Sohniye drip di tu layi phiren agg

Teri saheli sadi fan te yaaran da sara jagg

Chori chori takkdi ae mittran di whip nu ni

Kade iced out kade glock de clip nu ni

Navi navi uttari lage jo teri sangh jehi ni

Time is money tu yaaran toh jehda mangdi

Nazaraan milauni ae te naale escape karen

Mittran di ghadi dekh ghadi mudi vape karen

Masti ch lagdi ae phirdi ae jhoomdi ni

Gallan toh ta lagge mainu fan mashroom di

Mainu lagge billo bali ni tu fan-cy

Assi old school kudiye tu gen-z

Akhaan vich nasha thalle personal benz ni

Lean di shukeen kude bali ae trendy ni

Lambo dekh kudi kehndi f*** wow

What when how chalo chhado mitti pao

Ho aari aari aari, ho enni chheti na,

Ho enni chheti nhi khulni sadi whip di tere layi baari

Ho sanu puggdiyan yaariyan

Ho gedi baith ke jihna na jaavan maari

Ho chandigarhon sadhe teen ghante ch dubai

Naal yaar veli kai munde patte fun de

Ghadiyan te gaddiyan da shonk munde nu

Whip tiffany blue wait kre runway

Ho menu puchhan shareek tankhaha meriyan

Ho deni cullinan baapu nu salaha meriyan

Kamm kaar set main le ke jaavan jet

Mainu jithe jithe le ke jaan raahan meriyan

Ho pump rakhde sharir phansi doleyan ch sando

Kari lift g-class te grounded lembo

Har din har waar, shaniwar aitwar

We don’t pray for, we just pray for cars

Ho gardana ghumdiyan jadon shehron langhdi

Ho time is money tu yaaran toh jehda mangdi

Ho time is money tu yaaran toh jehda mangdi

I’m sorry girl

My time is my money

Let’s go boys

Slab

I’m handling some motherf*cking business homie

I hope you talk, you call about money!

Har din har waar, shaniwar aitwar

We don’t pray for, we just pray for cars

Ho gardana ghumdiyan jadon shehron langhdi

Ho time is money tu yaaran toh jehda mangdi

Ho time is money tu yaaran toh jehda mangdi

Like || Share || Spread || Love

Enjoy & stay connected with us!

► Subscribe to Speed Records : http://bit.ly/SpeedRecords

► Like us on Facebook: https://www.facebook.com/SpeedRecords

► Follow us on Twitter: https://twitter.com/Speed_Records

► Follow us on Instagram: https://instagram.com/speedrecords

► Follow on Snapchat : https://www.snapchat.com/add/speedrecords

OldSchoolTieIndia –

https://www.youtube.com/channel/UCX6Xc3BjHWAWSTYkoPwxMx

Speed Records Haryanvi

Youtube: https://bit.ly/2kSrhZK

Instagram: https://www.instagram.com/speedharyanviofficial

punjabi, punjabi music, punjabi latest music, punjabi latest songs, punjabi romantic songs, punjabi sad songs, latest punjabi songs 2024, punjab, speed records, Punjabi Songs, All hit punjabi songs, New punjabi songs 2024, All new punjabi songs 2024, All new latest punjabi songs 2024, Hit punjabi song, Parmish Verma, Time Is Money, Parmish Verma new song, Parmish Verma 2025 song, Time Is Money Parmish Verma, Time Is Money song, Time Is Money Parmish, Parmish Verma flex song, Punjabi flex anthem, Parmish Verma Time Is Money official video, Punjabi rap 2025, Punjabi motivation song, Parmish Verma latest song, Time Is Money Parmish Verma lyrics, Speed Records Parmish Verma, Time Is Money Parmish Verma reaction, Parmish Verma music video, Time Is Money Parmish Verma status, Punjabi hip hop 2025, Time Is Money Parmish reel song, Parmish Verma hard song, Parmish Verma attitude song, Parmish Verma success song, Punjabi trending song, Parmish Verma new video, Parmish Verma lifestyle, Parmish Verma Rolex, Parmish Verma Range Rover, Parmish Verma motivational song

Speed Records Bhojpuri –

Youtube: https://bit.ly/2y8HSez

Instagram: https://bit.ly/2xM2WYL

Snapchat: https://www.snapchat.com/add/speedbhojpuri

Oops TV –

Oops TV Facebook Link – https://m.facebook.com/oopstvfun/

Poon Poon –

Snapchat – https://www.snapchat.com/add/poonpoon0001

Youtube – http://bitly.com/2hwYOnx

Facebook – https://www.facebook.com/officialpoonpoon

Instagram – https://instagram.com/poonpoonofficial

source

Video

Do You Need a Financial Advisor? Find Out Now!

Do You Need a Financial Advisor? Find Out Now!

Jump start your journey with our FREE financial resources: https://moneyguy.com/resources/

Reach your goals faster with our products: https://learn.moneyguy.com/

Subscribe on YouTube for early access and go beyond the podcast: https://www.youtube.com/c/MoneyGuyShow?sub_confirmation=1

Connect with us on social media for more content: https://moneyguy.com/link-in-bio/

Take the relationship to the next level and become a client: https://moneyguy.com/work-with-us/

Bring confidence to your wealth building with simplified strategies from The Money Guy. Learn how to apply financial tactics that go beyond common sense and help you reach your money goals faster. Make your assets do the heavy lifting so you can quit worrying and start living a more fulfilled life.

source

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World5 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video1 day ago

Video1 day agoWhen Money Enters #motivation #mindset #selfimprovement

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech1 hour ago

Tech1 hour agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World10 hours ago

Crypto World10 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards