Video

Dustin on Conor Downfall After Money

#ufc #mma #shorts #short #conormcgregor #dustinpoirier

source

Video

Singapore prime minister warns of turbulence ahead in ‘post-American’ order | FT Interview

Lawrence Wong tells FT editor Roula Khalaf ‘we are in the midst of a great transition to a multi-polar world’.

#singapore #lawrencewong #asia #geopolitics #roulakhalaf #trump #us #postamerican #trade #tariffs #china #uschina #asean #investment #investing

00:00 – Introduction

00:23 – The ‘post-American’ transition

01:43 – A world without the US?

02:56 – Is Trump right?

04:40 – Spheres of influence

05:29 – ASEAN

06:50 – Tariffs

08:59 – Supply chains

12:14 – Navigating US-China tensions

18:33 – Multilateral approach

20:51 – Investing in the US

22:05 – Europe

23:32 – Domestic changes

25:12 – Biggest challenge as PM

► Enjoying FT content? Get a daily slice of the very best FT journalism with FT Edit. Free for 30 days then just £4.99 a month

See if you get the FT for free as a student (http://ft.com/schoolsarefree) or start a £1 trial: https://subs.ft.com/spa3_trial?segmentId=3d4ba81b-96bb-cef0-9ece-29efd6ef2132.

► Check out our Community tab for more stories: https://www.youtube.com/@FinancialTimes/community

► Listen to our podcasts: https://www.ft.com/podcasts

► Follow us on Instagram: https://www.instagram.com/financialtimes

► Follow us on Instagram: https://www.tiktok.com/@financialtimes

source

Video

Where My Money (I Need That)

Provided to YouTube by Universal Music Group

Where My Money (I Need That) · Rick Ross

Port Of Miami

℗ 2006 The Island Def Jam Music Group

Released on: 2006-01-01

Producer: The Runners

Recording Engineer: Elvin “Big Chuck” Prince

Mixing Engineer: Ray Seay

Composer Lyricist: William Roberts

Composer Lyricist: Andrew Harr

Composer Lyricist: Jermaine Jackson

Auto-generated by YouTube.

source

Video

DEMOCRATS READY TO PASS CRYPTO LEGISLATION! MICHAEL BURRY SHORTING BITCOIN & CME COIN!

Crypto News: Democrats meet to discuss passing Clarity Act. Wall Street giant CME Group is eyeing its own ‘CME Coin,’ CEO says. Michael Burry shares bearish post on Bitcoin.

Brought to you by ✅ VeChain is a versatile enterprise-grade L1 smart contract platform https://www.vechain.org/

💡Get the (Re)Thinking Crypto Book on Amazon – https://www.amazon.com/dp/B0D2525DYX

🖥️ Learn Crypto with Expert Commentary – http://MyCryptoCourse.com

Sponsors:

🔐 Safely Store your Crypto with Trezor Hardware Wallets – https://affil.trezor.io/SHlz

🏠 Propy (PRO) is a blockchain-based real estate marketplace and decentralized title registry that leverages smart contracts to facilitate property transactions globally https://propy.com/home/ & https://propy.com/home/ownyourtomorrow/

🏦 Learn about iTrustCapital’s powerful Premium Custody Account (PCA) and tax-advantaged Crypto IRA platforms https://www.itrustcapital.com/go/thinkingcrypto

🖥️ Sign up with Santiment to get quality crypto metrics – https://app.santiment.net/pricing?fpr=thinkingcrypto Get 25% discount with code THINKINGCRYPTO

🌟Uphold – Signup with Uphold. https://uphold.sjv.io/gbED4X

Terms Apply. Cryptoassets are highly volatile. Your capital is at risk.

📰 Sign up for the Free Thinking Crypto Weekly Newsletter https://thinkingcrypto.substack.com/

✅ Become a Channel Member – https://www.youtube.com/channel/UCjpkwsuHgYx9fBE0ojsJ_-w/join

🔥 Buy Merch & support the Podcast https://my-store-574b5b.creator-spring.com/

🧙♂️Merlin – http://tinyurl.com/MerlinTCYouTube

“I am a Merlin partner and get compensated for purchases made through links in this content”this content”

Follow on social media:

➡️ X(Twitter) – https://x.com/thinkingcrypto

➡️ Facebook – https://www.facebook.com/thinkingcrypto/

➡️ LinkedIn – http://linkedin.com/company/thinking-crypto

➡️ Instagram – https://www.instagram.com/thinkingcrypto/

➡️ TikTok – https://www.tiktok.com/@thinkingcrypto5

➡️ Threads – https://www.threads.net/@thinkingcrypto

➡️ Website – https://www.ThinkingCrypto.com/

🔊 Listen to content on Apple Podcasts – https://podcasts.apple.com/us/podcast/thinking-crypto-news-interviews/id1458945676

🔊 Listen to content on Spotify – https://open.spotify.com/show/221AV5A65v7uYEsuMviVKl

💼Business Inquiries💼

hellothinkingcrypto@gmail.com

⏰ Time Stamps ⏰

00:00 Intro

00:38 Bitcoin analysis Michael Burry

05:02 Democrats Clarity Act

09:10 CME Group Coin

11:20 Scott Bessent Bitcoin Reserve

13:18 SBI Group Strium Tokenization

15:00 Ripple Prime Hyperliquid

15:53 Bitnomial Tezos XTZ futures

16:39 Blockchain Intelligence TRM Labs $70M

18:09 Canada Crypto Custody rules

19:24 Bitwise Chorus One Crypto Staking

=================================================

📺 Interviews Playlists 📺

– All Interviews – https://youtube.com/playlist?list=PL5rDfH3ofGEe8rCbwJojpipmwwkvWhbQD

– Must Watch Interviews – https://youtube.com/playlist?list=PL5rDfH3ofGEdqEaSrjC3UHOQdw1eyeYRU

– Bitcoin Interviews – https://youtube.com/playlist?list=PL5rDfH3ofGEcjtw8URfr7-DfBi_J_O0ip

– Altcoin Interviews – https://youtube.com/playlist?list=PL5rDfH3ofGEeZ3QES9lD1f59YTWuQv-uv

– Crypto Regulators & Politicians Interviews – https://youtube.com/playlist?list=PL5rDfH3ofGEdsqA213osf2u-PbT1b7uM4

– Investment Firms & Hedge Funds – https://youtube.com/playlist?list=PL5rDfH3ofGEfa-HsusfQBB6blH3KR09mj

– Internet Pioneers & Entrepreneurs – https://youtube.com/playlist?list=PL5rDfH3ofGEdqCYps3eexnovm2WNWeP3o

=================================================

#Crypto #Bitcoin #MichaelBurry #CryptoNews #Cryptocurrency #BTC #BitcoinNews #ETF #News #Ripple #XRP #XRPNews #RippleXRP #Ethereum #EthereumNews #ETH #Solana #money #investing #trading #Altcoin #Altcoins #NFTs #Metaverse #Podcast #ThinkingCrypto

=================================================

– The Thinking Crypto Podcast is your home for the best Crypto News and Interviews – crypto, cryptocurrency, crypto news, bitcoin, bitcoin news, xrp, xrp news, ripple, ripple news, ripple xrp, ethereum, ethereum news, cardano, ada, solana, altcoins, defi, news, interviews, podcast, metaverse, nft, altcoin daily, cryptosrus, coin bureau, altcoin news, bitcoin today, markets, investing

=================================================

Disclaimer – The Thinking Crypto podcast and Tony Edward are not financial or investment experts. You should do your own research on each cryptocurrency and make your own conclusions and decisions for investment. Invest at your own risk, only invest what you are willing to lose. This channel and its videos are just for educational purposes and NOT investment or financial advice.

Note that links included in this description might be affiliate links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel so I can continue to provide you with free content each week!

source

Video

Financial Freedom is Easy, After You Learn This

Start your business through Stan. Unlock your 14-day free trial at: https://join.stan.store/aliabdaal

Join the Lifestyle Business Academy waitlist: https://aliabdaal.com/lifestyle-business-academy/

——–

MY PRODUCTIVITY APPS

👻 Voicepal: AI Writing App (iOS/Android) – Download for Free → https://go.aliabdaal.com/voicepal/ytd

MY BOOK

📕 My New York Times bestselling book Feel-Good Productivity (2,000+ 5-star reviews) → https://go.feelgoodproductivity.com/amazon/yt

MY COURSES

🚀 Build a $100k/year lifestyle business without quitting your day job → https://go.aliabdaal.com/lifestylebusinessytd

🧠 My Productivity System: LifeOS → https://go.aliabdaal.com/lifeos/ytd

🤑 Grow / Monetise your YouTube Channel → https://go.aliabdaal.com/PTYA/yt

CONNECT WITH ME

💌 Join LifeNotes, my weekly email where I share what I’m reading & learning: https://go.aliabdaal.com/lifenotes/yt

📸 Instagram: https://instagram.com/aliabdaal

📱 TikTok: https://www.tiktok.com/@aliabdaal

👨💻 Linkedin: https://www.linkedin.com/in/ali-abdaal/

🌍 My website / blog: https://www.aliabdaal.com/

——–

Hey friends, does financial freedom feel like it’s always just out of reach, no matter how many budgeting tips you follow? In this video, I’m revealing the three paths to financial freedom, why conventional advice often falls short, and how to choose a wealth-building strategy that actually aligns with your lifestyle. This week’s episode is special: filmed live with real audience Q&A, where I tackle the questions that come up most when it comes to building lasting wealth. Hope you enjoy xx

🔗 LINKS MENTIONED IN THIS VIDEO

📗 The 4-Hour Work Week by Tim Ferris: https://geni.us/U0mzePk

📕 The Algebra of Wealth by Scott Galloway: https://geni.us/algebrawealth

📙 The Master: The Long Run and Beautiful Game of Roger Federer by Christopher Clarey: https://geni.us/masterfederer

📘 The Sweaty Startup by Nick Huber: https://geni.us/sweatystartup

⌚️ TIMESTAMPS

00:00 – Introduction

00:49 – Financial Freedom vs Time Freedom

02:36 – The 3 Paths to Financial Freedom

06:08 – How To Earn More Money

11:27 – Lifestyle Businesses

15:41 – How To Create Value

19:59 – Hard Work ≠ Financial Freedom

22:47 – Boring Wins Over Sexy

28:23 – Finding Your Target Audience

30:48 – Staying Consistent

35:46 – Idea Validation

38:50 – Balancing Time and Financial Freedom

42:34 – Time Management

46:34 – Setting The Right Goals

52:02 – How To Stay Motivated

PS: I donate 10% of my income to charity every year. Would you like to join me? Learn more about the 10% Pledge: https://aliabdaal.com/giving-what-we-can/

source

Video

THIS IS UNBELIEVABLE!! MASSIVE XRP BOMBSHELL BY SECRET RIPPLE INSIDER

🔥Thanks for supporting the channel. Like, share, and comment if this helped clarify what’s really happening.

💳 Uphold – Trade, Spend & Earn XRP Rewards

➖ U.S. Debit Card: https://uphold.sjv.io/559kj9

➖ Uphold Website: https://uphold.sjv.io/dOmGMq

🔸4% on elite card / 2% on virtual card🔸

🛡️Hardware Wallets I Use for XRP

D’CENT Biometric Wallets

– Single Device – 18% Discount ($159 → $129)

Biometric Wallet – Affiliates

– Two-Pack – 31% Discount ($318 → $219)

Biometric Wallet 2X Package – Affiliates

Ledger – Official Store

https://www.ledger.com/crypto-sensei

🔗Contact & Collaborations

– Business: cryptosensei@cryptonairz.com

– Collabs: BD Manager – @Jaalyn_T (Telegram)

– Collab Form: https://forms.gle/E6fskio5BBvd4zVn9

– Social Links: https://linktr.ee/Crypt0Sensei

(YouTube partnerships & brand deals only – no agencies)

📰FREE XRP Newsletter: https://joincryptonairz.com/Newsletter

❗Full Legal & Regulatory Disclaimer

https://docs.google.com/document/d/1T_wTsSkXDZqdgKDUOKfIEKF-a7ur2kX8gw-e3aAq_Q4/edit?usp=sharing

source

Video

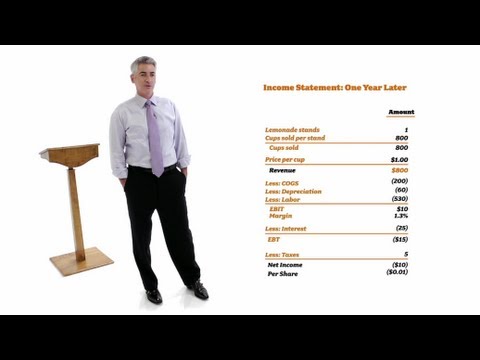

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour | Big Think

Become a Big Think member to unlock expert classes, premium print issues, exclusive events and more: https://bigthink.com/membership/?utm_source=youtube&utm_medium=social&utm_campaign=yt_desc

Everything You Need to Know About Finance and Investing in Under an Hour

Watch the newest video from Big Think: https://bigth.ink/NewVideo

Join Big Think Edge for exclusive videos: https://bigth.ink/Edge

———————————————————————————-

WILLIAM ACKMAN:

William Ackman is founder and CEO of Pershing Square Capital Management. Formed in 2003, the hedge-fund has acquired significant shares in companies such as JC Penney, General Growth Properties, Fortune Bands and Kraft Foods. Ackman advocates strategies of “activist investing,” the practice of using stock shares in publicly-traded companies to influence management practices in a way that benefits shareholder interests.

———————————————————————————-

TRANSCRIPT:

Hi, I’m Bill Ackman. I’m the CEO of Pershing Square Capital Management and I’m here today to talk to you about everything you need to know about finance and investing and I’m going to get it done in an hour and you’ll be ready to go.

How to Start and Grow a Business

So let’s begin. We’re going to go into business together. We’re going to start a company and we’re going to start a lemonade stand and now I don’t have any money today, so I’m going to have to raise money from investors to launch the business. So how am I going to do that? Well I’m going to form a corporation. That is a little filing that you make with the State and you come up with a name for a business. We’ll call it Bill’s Lemonade Stand and we’re going to raise money from outside investors. We need a little money to get started, so we’re going to start our business with 1,000 shares of stock. We just made up that number and we’re going to sell 500 shares more for a $1 each to an investor. The investor is going to put up $500. We’re going to put up the name and the idea. We’re going to have 1,000 shares. He is going to have 500 shares. He is going to own a third of the business for his $500.

So what is our business worth at the start? Well it’s worth $1,500. We have $500 in the bank plus $1,000 because I came up with the idea for the company. Now I’m going to need a little more than $500, so what am I going to do? I’m going to borrow some money. I’m going to borrow from a friend and he’s going to lend me $250 and we’re going to pay him 10% interest a year for that loan.

Now why do we borrow money instead of just selling more stock? Well by borrowing money we keep more of the stock for ourselves, so if the business is successful we’re going to end up with a bigger percentage of the profits.

So now we’re going to take a look at what the business looks like on a piece of paper. We’re going to look at something called a balance sheet and a balance sheet tells you where the company stands, what your assets are, what your liabilities are and what your net worth or shareholder equity is. If you take your assets, in this case we’ve raised $500. We also have what is called goodwill because we’ve said the business—in exchange for the $500 the person who put up the money only got a third of the business. The other two-thirds is owned by us for starting the company. That is $1,000 of goodwill for the business. We borrowed $250. We’re going to owe $250. That is a liability. So we have $500 in cash from selling stock, $250 from raising debt and we owe a $250 loan and we have a corporation that has, and you’ll see on the chart, shareholders’ equity of $1,500, so that’s our starting point.

Now let’s keep moving. What do we need to do to start our company? We need a lemonade stand. That’s going to cost us about $300. That is called a fixed asset. Unlike lemon or sugar or water this is something like a building that you buy and you build it. It wears out over time, but it’s a fixed asset. And then you need some inventory. What do you need to make lemonade? You need sugar. You need water. You need lemons…

Read the full transcript at https://bigthink.com/videos/learn-to-invest-and-start-a-business-in-under-an-hour

source

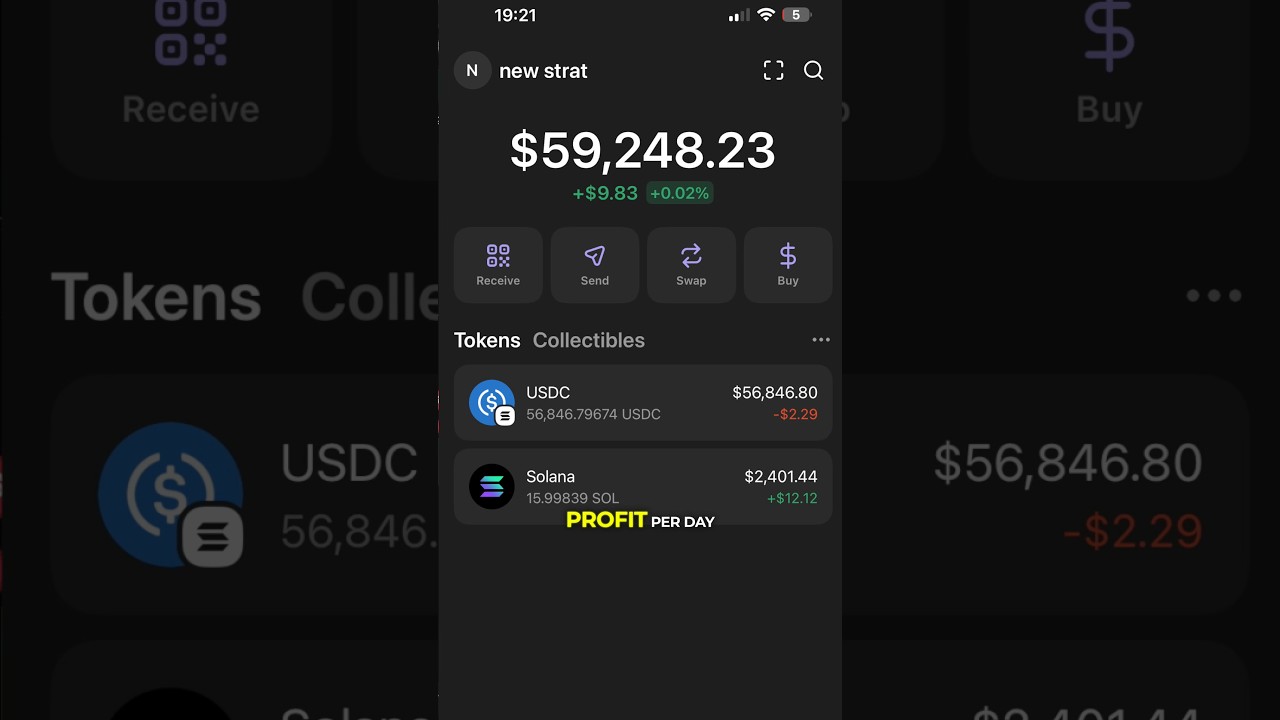

Video

This genius memecoin trading strategy makes me $1000 per day #memecoin #crypto

For entertainment only — not financial advice. Not for viewers in restricted regions. Crypto is high-risk.

*DISCLAIMER*

This content is for entertainment and educational purposes only. It does not constitute financial advice, investment recommendation, or an offer to buy or sell any cryptoassets.

Cryptoassets are high-risk and unregulated in many jurisdictions. You could lose all of your money.

Always do your own research (DYOR) and seek independent financial advice before making investment decisions.

The information presented is not intended for viewers in jurisdictions where cryptoasset promotions are restricted or prohibited.

You may be subject to tax obligations on any cryptoasset gains. Ensure compliance with the laws in your jurisdiction.

Contains referral links, where i may receive commissions.

source

Video

Most Batsh*t Insane Woman I’ve Ever Met | Financial Audit

You can go to my link https://aura.com/hammer to try 14 days for free. That’s enough time for Aura to start scrubbing your personal info off these data broker sites, automatically #sponsored

▶ *GET YOUR OWN HAMMER FINANCIAL SCORE* – Want to see where you stack against our guest? Get your free Hammer Financial Score: https://www.calebhammer.com

▶ *FREE TRIAL* To make our classes and budgeting app *more affordable*, we bundled them together for an *80% DISCOUNT* and for this month only, you can try DollarWise Central for *free* – check it out here and change your life: https://dollarwise.com/dollarwise-central/

▶▶ We learned more about his and her criminal record, and honestly- she should go to jail. We went through his whole wrap sheet too and it’s INSANE. Join Hammer Elite and watch todays post show: https://www.youtube.com/channel/UCLe_q9axMaeTbjN0hy1Z9xA/join And Watch Todays Post Show: https://youtu.be/a9X1va89WCA

▶▶▶Download the *DollarWise Budgeting App* today: *Apple:* https://apple.co/4iChGhr *Google Play:* https://bit.ly/sb-googleplay Don’t overcomplicate this crap! All you need is an automated / SIMPLE budget.

▶▶▶▶ *AND REMEMBER* those who sign up for DollarWise Premium *annual* get a signed version of the Cook Book, just submit proof of purchase here: https://tally.so/r/3xzPq5

Use code 50HAMMER to get 50% OFF plus free shipping on your first Factor box at https://bit.ly/3U6sqKD!

Go to https://ro.co/caleb to see if your insurance covers GLP-1s—for free.

Try InVideo AI for free – https://invideo.io/i/CalebHammer. You can use my code ‘CALEBHAMMER50’ to get twice the number of video generation credits in your first month.

___________________________________________

▶EDUCATION:

1. Get your own free Hammer Financial Score: https://www.calebhammer.com

2. Get all of my educational programs for a much lower cost here, including the premium version of my budgeting app: https://dollarwise.com/dollarwise-central/

___________________________________________

▶RESOURCES

1. *I’VE MOVED MY INVESTMENTS TO WEBULL* do the same and transfer to my investing app of choice here: https://www.webull.com/k/Caleb and you get: *Cash bonus of $200 – $30,000* depending on initial funding amount, up to 8.1% APY, and up to 3.5% IRA Match.

2. Checking & Savings: Get up to $500^ before payday when you sign up and set up direct deposit. No credit check. No interest*. No mandatory fees: https://clickurl.ca/caleb-mypay

3. CourseCareers: Land a high-paying job with no experience or degree by going through an affordable online course https://coursecareers.com/CalebHammer

4. Get $20 from Acorns for free: sign up to get your bonus https://acorns.com/caleb

5. The credit building debit card: First 100,000 people to sign up for Fizz with code: HAMMER10 get $10: https://www.joinfizz.com/caleb (paid ad)

6. Helium Mobile: save a ton on your phone bill, sign up and get a FREE plan when using promo code CALEB https://hellohelium.com/

7. Online security: Protect your online privacy and security NOW and for free by following my link Aura: https://aura.com/hammer

8. Get an exclusive HighLevel 30-day trial: https://gohighlevel.com/calebhammer

___________________________________________

Chapters:

00:00 Intro

12:32 what is she on about

18:23 OOP

31:23 she thinks caleb is a miracle worker

51:36 too late buddy

01:09:18 hold on, he might be onto something

01:23:29 why she playing dumb

___________________________________________

▶More Content

1. Financial Audit Follow-Ups here: https://www.youtube.com/@calebhammerclips

2. Caleb Hammer Livestreams: https://linktr.ee/calebhammerlive

3. Livestream Cutdown VODs: https://www.youtube.com/@livecalebhammer

___________________________________________

▶EXTRA

1. My socials: https://stan.store/calebhammer

2. Want to be a guest on Financial Audit? We film weekdays in our studio in Austin, Texas (in person only)! To apply, visit: http://calebhammer.com/apply

___________________________________________

▶*Some of the links and other products that appear in this video are from companies for which Caleb Hammer will earn an affiliate commission or referral bonus. This is not investment advice.

▶Sponsorship and business inquiries: business@calebhammer.com

source

Video

CORONA – MAS MONEY MAS CASH

La boliganga ahora pesa un MONTON , SALUDOS PA TODOS LOS QUE ESTAN HACIENDO MAS MONEY MAS CASH, bendiciones familia

source

Video

This indicator is flashing for the first time in crypto history.

Welcome Back To The Channel!

Join The Trading Giveaways On BTCC: https://tylerhill.pro/BTCC12726

Save Up To 37% On Crypto Taxes & Get A Free $100 With ITrust: https://tylerhill.pro/iTrustCapital12726

–

–

Join The Crypto School Today: https://tylerhill.pro/TheCSS12726

My Socials

X: https://tylerhill.pro/Twitter12726

Instagram: https://tylerhill.pro/Instagram12726

Personal YouTube https://www.youtube.com/channel/UCv1qDnOv077keVtw4w4HAug

Business Inquiries: : TylerHillHGA@gmail.com

————————————————————————————————————————————————————————————————————————————————————————————————————————————

Legal Disclaimer

This content is for educational and informational purposes only and does not constitute financial, legal, or tax advice. I am not a licensed financial advisor. Always do your own

research and consult a qualified professional before making any financial decisions.

#crypto #cryptotrading #cryptocurrency

source

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business16 hours ago

Business16 hours agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat23 hours ago

NewsBeat23 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World17 hours ago

Crypto World17 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World16 hours ago

Crypto World16 hours agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation