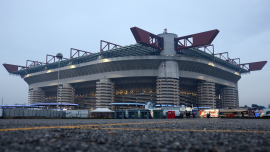

The 2026 Winter Olympics are upon us, as the best athletes in the world of winter sports meet in Milan Cortina, and for Team USA, the quest to rack up medals is set to begin.

Unlike in the Summer Olympics where Americans often dominate the podium, Team USA has lagged behind a bit in recent Winter Games. In 2022, Team USA finished fifth in the medal count with 25 total medals — although their nine gold medals was good for third.

This year, there are a number of American medal hopefuls looking to top that performance from four years ago, and become household names over the course of the next two weeks. (And here’s the 2026 Winter Games medal tracker.) There is nothing quite like the Olympics, where the entire nation can become infatuated with a breakout star in a sporting event rarely thought of on the national stage in non-Olympic years.

Winter Olympics 2026: Where to watch the Milan Cortina Games Opening Ceremony, time, date, tv channel

Shanna McCarriston

In 2026, Team USA is headlined by some longtime stars, first-time medal hopefuls and some youngsters that have been dominating their sport but haven’t yet gotten to do so on the Olympic stage. Below you can find some of the biggest American names to watch in various events throughout the next two weeks of competition.

Alpine Skiing

- Lindsey Vonn

- Mikaela Shiffrin

- Ryan Cochran-Siegle

Vonn’s comeback at 41 years old was already one of the headlines of the 2026 Games, but she’s become an even bigger story as she plans on competing on a torn ACL suffered a week ago. Vonn was viewed as a serious medal threat in the downhill, and it remains to be seen how effective she can be on her injured knee. But if video of her post-crash workout is any indication, she’s going to give it everything she’s got.

Shiffrin is a two-time gold medalist and one of the most decorated skiiers in history, and will be looking to add to her trophy case in the Giant Slalom and Slalom events this year. Her presence has been a bit overshadowed by her legendary teammate’s return, but she is one of the stars of Team USA and will look to remind the world of that over the next two weeks.

Cochran-Siegle was the only American to medal in alpine skiing at the 2022 Olympics, picking up a silver in the Super-G, and he’s a threat in multiple events on the men’s side.

Figure Skating

- Ilia Malinin

- Amber Glenn

- Alysa Liu

- Madison Chock and Evan Bates

The American figure skating team is expected to rack up the medals in Milan Cortina, with Malinin leading the way as the favorite in the men’s event. The “Quad God,” known for his routine filled with quadruple jumps, is entering his first Olympics but carries lofty expectations to take home gold.

Glenn and Liu are among the favorites in the women’s competition and will push each other for a podium spot. Glenn edged out Liu at the U.S. Figure Skating Championships for her third consecutive U.S. title. Liu is returning to the Olympics after retiring at 16 years old following the 2022 Olympics, and won gold at the 2025 World Championships.

Chock and Bates have won three consecutive world titles and five consecutive U.S. titles, and will be the favorites for gold in the pairs competition.

Hockey

- Laila Edwards

- Aerin Frankel

- Hilary Knight

- Connor Hellebuyck

- Auston Matthews

The U.S. women’s hockey team is the favorite to win gold and feature a mixture of veterans — like Knight, competing in her fifth Olympics — and young stars like Edwards and Frankel. It is a team loaded with talent that could produce a number of stars at this year’s Games.

On the men’s side, it’s the first time since 2014 that NHL stars are allowed to compete, and the result is a star-studded roster that will have eyes on gold as well. Two of the standouts are Hellebuyck, a goalie, and Matthews, a center, but there are big names up and down the roster for Team USA — and Canada and others — in the most anticipated Olympic men’s hockey tournament in some time.

Speedskating

- Jordan Stolz

- Erin Jackson

- Brittany Bowe

- Corinne Stoddard

On the men’s side, Stolz is the best speedskater in the world and is the favorite for gold in the 500m, 1000m and 1500m after winning season-long World Cup titles in all three events in 2024 and 2025.

On the women’s side, Jackson is the defending gold medalist in the 500m competition, but will face stiff competition from Stoddard, who is a threat to medal in the 500m, 1000m and 1500m distances. Bowe is a four-time Olympian and a former bronze medalist in the 1000m.

Freestyle Skiing

- Alex Hall

- Alex Ferreira

- Jaelin Kauf

- Nick Goepper

- Mac Forehand

- Tess Johnson

The Americans boast a deep roster in freestyle skiing, where they have medal contenders and past medal winners in multiple competitions.

Hall is the defending gold medalist in slopestyle, with Goepper a two-time silver medalist, but they’ll be challenged by a rising star in Forehand. Ferreira has two medals in halfpipe, but is still seeking his first gold. Kauf and Johnson are both threats for medals in the women’s moguls competition, with Kauf winning silver in 2022.

Snowboarding

- Chloe Kim

- Red Gerard

- Ollie Martin

Kim will have her sights set on a three-peat in the women’s halfpipe, but will come in without the practice time she hoped for as her training was interrupted by a crash that dislocated her shoulder last month. Gerard looks to get back on the podium after winning slopestyle gold in 2018, but will face stiff competition from Martin, a youngster who took home bronze in slopestyle and big air at the 2025 World Championships.

Curling

- Corey Thiesse and Korey Dropkin

- Danny Casper

Thiesse and Dropkin won the 2023 world title in mixed doubles and are the best bet to medal for Team USA in curling, which becomes everyone’s favorite sport for two weeks every four years. On the men’s side, Casper is the fresh face skipper for the American side, as he took down longtime stalwart and former gold medalist John Shuster at the trials, and he’ll be looking to shock the world and lead his team to a deep run in Milan Cortina.

Bobsled

- Kaillie Humphries

- Elana Meyers Taylor

- Kaysha Love

Humphries is a three-time gold medalist — winning two with Canada and one for Team USA after becoming a U.S. citizen in 2021 — and even at 40 years old remains a medal contender. Meyers Taylor is also a legend, with the most bobsled medals of any American in history with five, going for more at 41 years old. Love is the up-and-comer on the team, and after winning gold in the monobob at the 2025 World Championships is a clear threat to take the throne as the top American bobsledder.

Luge

- Summer Britcher

- Chevonne Chelsea Forgan and Sophia Kirkby

Britcher won twice during the World Cup circuit this year and is a threat to medal in Milan Cortina. In the doubles competition, Chelsea Forgan and Kirkby have twice won bronze at the World Championships and will aim for a podium finish in their first Olympic Games.

Skeleton

Ro is a former Summer Olympian in track and field, but made the move to the ice and has found tremendous success in skeleton. She won silver at the 2025 World Championships and will be a medal contender for Team USA.

Cross-Country Skiing

Diggins is the most accomplished American cross-country skiier in history and will retire after this year. The 2026 Olympics will be her fourth and she’s chasing after her first individual gold, and will be a podium threat in most every cross-country event.

Biathlon

- Campbell Wright

- Deedra Irwin

Irwin’s seventh place finish in 2022 was the best by an American woman in history, and she hopes to improve upon that with a podium finish in 2026. Wright, who gained U.S. citizenship from New Zealand in 2023, is a podium threat on the men’s side and, alongside Irwin, figures to make Team USA a threat to medal in the mixed relay.