Crypto World

Bitcoin Slips Below $70K as Extreme Fear Grips Crypto Markets

TLDR:

- Bitcoin slipping below $70K triggers renewed selling pressure as sentiment moves into extreme fear.

- Crypto Fear & Greed Index drops near its lowest levels this year, reflecting intense market anxiety.

- BTC hits a low near $67,000, the weakest level since late 2024, deepening the downtrend.

- Broader risk asset sell‑offs contribute to crypto market losses and heightened caution.

Bitcoin slipping below $70K deepened the market’s downturn. The asset price has dropped to $67,000, a 15‑month low and about 46% below its all‑time high.

Volatility surge has intensified selling pressure across crypto markets, pushing sentiment into Extreme Fear. The market reacted with broader risk asset sell‑offs, even as some long‑term models suggest potential recovery paths.

Market Reaction and Oversold Conditions

Bitcoin slipping below $70K dropped nearly 8% on the day, positioning the cryptocurrency approximately 46% below its all-time high. The Fear & Greed Index currently reads Extreme Fear, reflecting widespread caution among traders.

Headlines have emphasized the bearish sentiment, but statistical models present a different narrative. Breaking below a round number like $70K often triggers emotional reactions.

Psychological floors make declines feel more dramatic, creating heightened fear. Historically, similar breaches represent temporary overshoots rather than structural breakdowns.

Volatility is a normal feature of Bitcoin’s late-cycle patterns, which test market conviction and penalize impatience.

Using a 15+ year Bitcoin power-law model with R² = 0.961, the current spot price of $67.7K is roughly 45% below the modeled fair value of ~$123K. This deviation indicates a historically large gap between price and trend.

At 22 months post-halving, typical cycles show overbought conditions, yet Bitcoin is registering a Z-score of -0.85—the lowest recorded at this stage. Such readings signal statistical undervaluation rather than structural weakness.

Historically, oversold regimes have produced consistent forward returns. One-year forward performance was 100% positive, with average gains exceeding 100%.

The correlation between 18-month Z-scores and future returns stands at -0.745, meaning the depth of undervaluation explains over half of forward return variance.

Patience and Recovery Potential

Mean reversion plays a key role in Bitcoin’s response to oversold conditions. The estimated half-life of deviation is approximately 133 days, suggesting that time could help align price with trend levels.

Based on historical patterns, this positions Bitcoin for a gradual path toward ~$111K by mid-2026. Market sentiment is heavily influenced by short-term fear.

Social media and headlines have amplified declines, but statistical evidence provides a clearer perspective. Past cycles demonstrate that patient positioning in oversold phases is historically rewarded.

Temporary volatility and drawdowns are part of the market’s mechanism, allowing long-term value to compound quietly. Even with the current discomfort, these conditions represent an opportunity.

Price reacts to leverage, flows, and sentiment, while value accumulates in the background. Historical data confirms that statistically cheap levels rarely remain undervalued for long, offering a disciplined path for market participants to navigate short-term fear.

Crypto World

Pi Network’s PI Crashed to New ATL, But This Metric Signals More Downside Ahead

Millions and millions of PI tokens will be released in the following weeks, which could bring even more pain for the bulls.

The past several weeks have not been kind to the cryptocurrency markets. This trend only intensified on Thursday when the entire market bled out, with multiple double-digit price crashers.

Naturally, Pi Network’s PI token was not spared, and it dumped to fresh all-time lows of under $0.135 (on CoinGecko). This meant that the asset has plunged by over 30% in the last month alone. On a broader scale, PI is down by more than 95% since its all-time high marked on February 26, 2025.

Despite this massive correction, some members of the ever-vocal and optimistic Pi Network community tried to find the silver linings. This one, for example, outlined the skyrocketing PI transaction volume, which, he believes, shows “increased interest in PI despite the manipulation games done by whales.”

This one was even more bullish, predicting a mind-blowing surge to $4 from the current dip in the first six months after the second Mainnet migration and once old Pioneers (Pi Network users and investors) are done selling off.

More Pain to Come?

If we are being realistic, it’s hard to even imagine such a rally happening soon. Not only because the overall crypto market seems to be dominated by the bears, but also due to PI’s recent price performance and the unlocking schedule for new tokens.

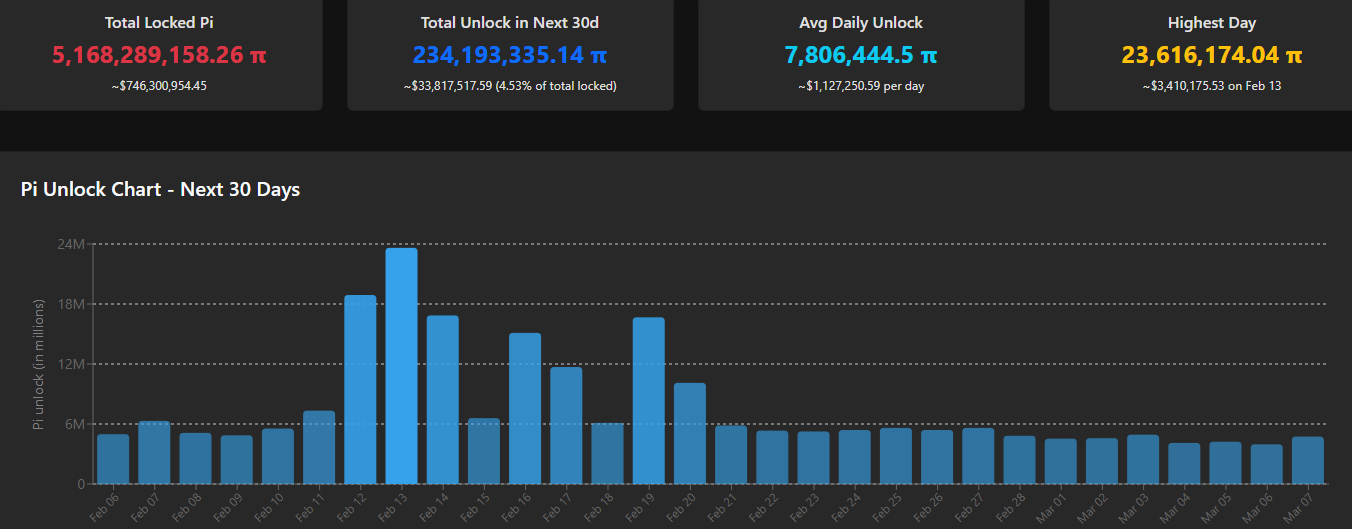

Data from PiScan shows that almost 8 million coins will be freed in the next month on average. What’s even more worrying is the fact that this number will skyrocket to over 18 million on February 12 and to 23.6 million on February 13.

Such a massive number of tokens to be unlocked might result in more immediate selling pressure from investors who have been waiting a long time for their holdings to become available for trading. This is particularly true in such a time of panic.

You may also like:

The Good News

On the positive side, the chart above demonstrates that the number of unlocked tokens will decline after February 20 and will normalize, which could ease the selling pressure. Additionally, there are rumors circulating online that one of the largest and oldest exchanges, Kraken, might be planning to list Pi Network’s native token, which could boost its liquidity and legitimacy among investors.

🚨 BREAKING: Kraken Exchange is

preparing to integrate the Pi blockchain and list $PI for trading 👀

If confirmed, this could be a major step for Pi ecosystem adoption.

⁰Eyes on what comes next.#PiNetwork #PI #Kraken #CryptoNews #Altcoins pic.twitter.com/BAWZLcGQnH— SMC KAPIL DEV (@smckapildev) February 6, 2026

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

RWA Perps heat up as gold, silver whipsaw; ONDO, PAXG, MKR, LINK lead RWA trade

RWA perps volume explodes above $15B as gold and silver crash, Binance cements dominance, and ONDO, PAXG, MKR, LINK front-run the real‑world assets trade.

Summary

- CoinMarketCap says RWA perps are “carving out an interesting niche” by letting traders speculate on gold and silver via crypto derivatives, with “genuine momentum” in early 2026.

- Binance controls 68.37% of YTD RWA perps volume, with OKX at 14.63% and MEXC at 9.25%, concentrating liquidity and potential liquidation cascades on a handful of venues.

- On Jan. 30, RWA perps volume hit $15.57B as gold futures plunged 11% and silver crashed 28%, while spot RWA tokens ONDO, PAXG, MKR, and LINK anchor the tokenization narrative.

The RWA perpetuals market is suddenly where the adrenaline is. As CoinMarketCap put it, “the RWA Perpetuals market is carving out an interesting niche… by letting traders speculate on real-world commodities like gold and silver using crypto derivatives,” with early 2026 showing “genuine momentum” on the back of extreme precious‑metal volatility.

Leading the way are ONDO (ONDO), PAXG (PAXG), MKR (MKR), LINK (LINK), which analysts say may be bucking the broader crypto bear trend.

Volatility, flows, and exchanges

CoinMarketCap’s data show clear venue concentration: “Binance dominates with 68.37% market share in YTD Volume, followed by OKX (14.63%) and MEXC (9.25%). Bitget (4.77%) and Gate (4.52%) combine for under 10%.” That kind of skew tells you where liquidity — and liquidation cascades — are most likely to cluster.

The flow has been violent. On January 30, RWA perps volume hit $15.57 billion as “gold futures plunged around 11% (closing near $4,745/oz), while silver had its worst single day since 1980, crashing about 28% from nearly $115/oz down to $78/oz.” February 2 still pushed $10.96 billion, with gold down another 2% to roughly $4,652/oz and silver slipping to $77.

By February 5, volume rebounded to $12.06 billion as silver “dropped another 9% to $76 per ounce, while gold slipped about 1.24%,” a sequence CoinMarketCap summarized as “explosive moves fueled by speculation running hot, margin calls forcing positions closed, and macro news sending shockwaves through the markets.”

Crypto bleed and RWA bid

Context matters: “crypto itself has been bleeding badly in early 2026. Bitcoin’s down ~49% from its late 2025 peak, and the overall market has shed trillions in what feels like full capitulation mode.” That backdrop is exactly why RWA perps “are emerging as something genuinely different… a way for crypto traders to get exposure to TradFi assets and speculate without leaving their native ecosystem,” offering diversification and hedging that “pure crypto can’t provide right now.”

Among spot RWA‑themed tokens, names like Ondo (ONDO), Maker (MKR), PAX Gold (PAXG), and Chainlink (LINK) sit at the core of the narrative, spanning tokenized Treasuries, on‑chain collateralized credit, gold‑backed exposure, and oracle infrastructure for tokenized assets.

Major coin prices and 24h moves

As of the latest session, Bitcoin (BTC) trades around $73,420, down roughly 3.9% over 24 hours. Ether (ETH) changes hands near $2,165, off about 5.7% in the same period, while Solana (SOL) sits around $93, down approximately 7.7%. The broader market has seen similar pressure, with total crypto capitalization sliding sharply in early February.

(For full live pricing and deeper breakdowns, see the crypto.news price pages for BTC, ETH, SOL, ONDO, MKR, PAXG, and LINK.)

Crypto World

Pump.fun Expands Trading Infrastructure by Acquiring Vyper

Pump.fun has expanded its footprint in on-chain trading by acquiring Vyper, the Solana-based trading terminal, and winding down Vyper’s standalone product to merge its infrastructure into Pump.fun’s Terminal ecosystem. The transition is set to begin with the shutdown of core Vyper features on Feb. 10, while limited functionality remains accessible as users are directed to Pump.fun’s Terminal (the former Padre) for continued access to trading tools. The deal’s financial terms were not disclosed, and Pump.fun did not comment for this article. The move underscores a broader consolidation strategy as Pump.fun seeks to unify token launches, execution, and analytics under a single platform, even as Solana-based memecoin activity cools from the speculative peak of late 2024 and early 2025. The acquisition follows Pump.fun’s earlier push into trading infrastructure, positioning the company to streamline workflow across the memecoin ecosystem.

Key takeaways

- Pump.fun is consolidating its trading workflow by absorbing Vyper, integrating the terminal into its broader ecosystem rather than maintaining standalone tooling.

- Vyper will begin winding down its core product on Feb. 10, with limited functions remaining as users migrate to Pump.fun’s Terminal (formerly Padre).

- The deal’s terms were not disclosed, and Pump.fun did not provide comment prior to publication.

- The move follows Pump.fun’s October acquisition of Padre, which was rebranded to Terminal, and signals a broader pivot toward end-to-end trading infrastructure.

- DefiLlama data show Pump.fun’s monthly revenue peaked at over $137 million in January 2025, but fell to about $31 million in January 2026, illustrating a cooling memecoin market.

Sentiment: Neutral

Market context: The consolidation comes as the memecoin sector, which once heated Solana-based launch activity, has cooled amid slower momentum and tightened liquidity. The industry is calibrating trading workflows, liquidity provisioning, and analytics to weather shifting risk appetite and evolving regulatory scrutiny.

Why it matters

The acquisition of Vyper marks a notable shift in how meme-centric platforms orchestrate their trading infrastructure. By folding a standalone terminal into a broader platform, Pump.fun aims to deliver a unified experience that spans token launches, liquidity management, and execution analytics. For users, this could mean simplified onboarding and a more cohesive set of tools, reducing the need to juggle multiple interfaces across separate services. For the broader market, the move signals ongoing consolidation among infrastructure players as platforms seek to lock in users during periods of normalization after the frenetic memecoin era.

Central to the narrative is the Solana (CRYPTO: SOL) blockchain’s role in memecoin activity. Pump.fun’s strategy has long leaned on Solana-based launches, where liquidity and speculative demand previously surged, driving short-term revenue growth. The latest integration suggests that Pump.fun intends to offer a more durable, end-to-end workflow—combining launch capabilities with execution and analytics—potentially stabilizing revenue streams even as speculative dynamics recede. Investors will be watching how the Terminal ingestion affects execution quality, slippage, and the reliability of data streams as the platform absorbs Vyper’s user base and tooling.

From a governance and product perspective, the move foreshadows further shifts as platforms recalibrate their product mix away from standalone memecoin gimmicks toward sustainable infrastructure. Pump.fun’s earlier steps—acquiring Padre and launching an investment arm, Pump Fund, in January—signal a pivot beyond pure memecoin speculation toward more diversified funding and support for early-stage projects. The company’s stated intent to back non-crypto ventures through the hackathon underscores a broader strategic realignment toward building an ecosystem with longer-term value capture, beyond the transient popularity of individual memecoins.

What to watch next

- Feb. 10: Operational shutoff of Vyper’s core features and the continued migration of users to Terminal. Monitor any service interruptions or migration pain points.

- Progress of Terminal integration: Assess how quickly users adapt to the combined workflow for launches, execution, and analytics and whether feature parity with Vyper is maintained.

- Subsequent expansion: Look for additional upgrades or partnerships that broaden Terminal’s capabilities beyond memecoin launches, including non-crypto or cross-chain integrations.

- Regulatory and market context: Stay aware of changing regulatory signals and macro conditions that influence liquidity and risk sentiment in on-chain trading.

Sources & verification

- Vyper announced the wind-down and migration plan with Feb. 10 as a milestone (X post by TradeonVyper).

- DefiLlama revenue data for Pump.fun showing a peak of over $137 million in January 2025 and ~ $31 million in January 2026.

- Cointelegraph reporting on Pump.fun’s acquisition of Padre (trading terminal) in October, which was later rebranded as Terminal.

- Pump.fun’s launch of Pump Fund and the January 20 hackathon aimed at supporting early-stage projects beyond crypto.

- Contextual background on the broader memecoin market’s expansion and subsequent cooling, including market-cap discussions tracked by CoinMarketCap.

Expansion and consolidation: Pump.fun absorbs Vyper into its Terminal ecosystem

Pump.fun’s latest move extends a pattern of vertical integration designed to streamline how users interact with memecoin launches, liquidity provisioning, and on-chain analytics. By absorbing Vyper, a trading terminal with a dedicated user base, into Terminal, the company is effectively folding a specialized toolset into a broader platform that aspires to cover more of the user journey—from initial token ideas to live trading and data-driven decision making. The timeline is explicit: on Feb. 10, core parts of Vyper will cease operating as a standalone product, while limited functionalities will remain accessible to bridge the transition. Users are being redirected to Pump.fun’s Terminal, which had previously been known as Padre, signaling a seamless migration path for existing customers.

The strategic logic behind the acquisition aligns with a broader industry trend: platforms seeking to lock in users by offering a one-stop shop for token launches, liquidity management, and analytics. As memecoin momentum cooled—from the heady days when celebrity-led token drops and government officials’ involvement helped spur a parabolic interest to a more measured pace—providers have sought to preserve revenue by bundling services. DefiLlama’s data capture demonstrates how Pump.fun’s revenue trajectory paralleled this cycle: a record of $137 million in January 2025, followed by a steep 77% decline in the year that followed, landing around $31 million in January 2026. The consolidation may be a pragmatic response to such revenue pressure, creating a more sustainable platform that can weather fluctuating demand while still serving a highly specialized user base.

Industry observers note that the Solana-based ecosystem has been a focal point for memecoin activity, with a number of tokens and launchpads anchored to that network. The rebranding and consolidation around Terminal indicates a shift from a project-centric model to an infrastructure-centric approach—one that prioritizes execution quality, reliability, and analytics accuracy for traders and project teams launching new tokens. The absence of disclosed financial terms in the deal leaves questions about the valuation and future revenue sharing, but the strategic intent is clear: unify tools under a single umbrella to improve user experience and potentially stabilize monetization channels beyond speculative token launches.

In tandem with the acquisition, Pump.fun has already pursued related strategic moves. The October acquisition of Padre, which was subsequently renamed Terminal, extended the company’s reach into the trading floor’s core capabilities. Earlier in January, Pump.fun broadened its footprint by launching Pump Fund, an investment arm intended to diversify beyond memecoins, and kicked off a $3 million hackathon to back early-stage projects, including ventures not directly tied to crypto. Together, these steps signal an evolution from a meme-driven growth model toward a more diversified ecosystem play that emphasizes sustainable infrastructure, broader funding initiatives, and broader use cases for its technology stack. The market will likely scrutinize how this transition affects liquidity, execution quality, and the platform’s ability to attract high-quality launches in a shifting macro environment.

https://platform.twitter.com/widgets.js

Crypto World

Bitcoin May Need Two Years to Flip $93,500 Back to Support

Bitcoin (BTC) liquidated billions of dollars going into Friday as BTC price action set bearish records.

Key points:

-

Bitcoin liquidates $2.6 billion as it sees its first red $10,000 daily candle ever.

-

BTC price action dives further in percentage terms than on any day since the 2022 bear market.

-

It may take until 2028 for Bitcoin to return above $93,500 again.

Bitcoin seals biggest daily dollar rout in history

Data from TradingView showed BTC/USD consolidating after bouncing from $59,930 — its first trip below the $60,000 mark since October 2024.

Sustained selling pressure during Thursday’s US trading session eventually sparked a liquidation cascade, with $2.6 billion in crypto positions wiped out over 24 hours, per data from CoinGlass.

Commenting, crypto market participants noted that the liquidation tally had surpassed both the COVID-19 crash from March 2020 and the reaction to the implosion of exchange FTX in late 2022.

COVID crash: $1.2B in liquidations.

FTX crash: $1.5B in liquidations.

Random Thursday (today): $1.7B in liquidations. pic.twitter.com/iY1vaYCjnd

— Alex Mason 👁△ (@AlexMasonCrypto) February 5, 2026

Bitcoin price action also brought back historical bear-market records elsewhere.

In percentage terms, Thursday’s daily candle was the largest daily decline since the FTX debacle — an event that sparked the bear-market low of $15,600.

“The ETF holders have never experienced this kind of sell-off,” Joe Consorti, head of growth at Bitcoin equity company Horizon, responded on X, referring to institutional investors with exposure to the US spot Bitcoin exchange-traded funds (ETFs).

They saw net outflows of $434 million on Thursday, per data from UK-based investment firm Farside Investors.

BTC/USD, meanwhile, achieved an unenviable new feat, falling by more than $10,000 in a day for the first time.

“Yesterday was the highest volume day on $BTC since August 2024,” trader Jelle added.

“One for the history books.”

BTC price “trend reversal,” only in 2028?

In a grim outlook for Bitcoin bulls, crypto trader and analyst Rekt Capital said that it could be 2028 before a true rebound occurs.

Related: Will Bitcoin rebound to $90K by March? Here’s what BTC options say

Using the BTC price cycle model as a guide, including a key moving average crossover at the end of January, Rekt Capital foresees a classic bear market year for 2026.

“Looks like it indeed is the year of the Bitcoin Bear Market,” he wrote in an X post.

“2027 will be the Bottoming Out year for BTC. And 2028 will be the Trend Reversal year where $93500 would be finally broken.”

A separate post warned of “bearish acceleration” on BTC/USD, again mimicking the 2022 bear market.

The Bearish Acceleration phase of the Bitcoin cycle is in progress$BTC #Crypto #Bitcoin https://t.co/5H7VPvksnH pic.twitter.com/XnPU3FeNhO

— Rekt Capital (@rektcapital) February 5, 2026

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Goldman Sachs to tap Anthropic AI model to automate accounting, compliance

Goldman Sachs has been working with the artificial intelligence startup Anthropic to create AI agents to automate a growing number of roles within the bank, the firm’s tech chief told CNBC exclusively.

The bank has, for the past six months, been working with embedded Anthropic engineers to co-develop autonomous agents in at least two specific areas: accounting for trades and transactions, and client vetting and onboarding, according to Marco Argenti, Goldman’s chief information officer.

The firm is “in the early stages” of developing agents based on Anthropic’s Claude model that will collapse the amount of time these essential functions take, Argenti said. He expects to launch the agents “soon,” though he declined to provide a specific date.

“Think of it as a digital co-worker for many of the professions within the firm that are scaled, are complex and very process intensive,” he said.

Goldman Sachs CEO David Solomon said in October that his bank was embarking on a multi-year plan to reorganize itself around generative AI, the technology that has made waves since the arrival of OpenAI’s ChatGPT in late 2022. Even as investment banks like Goldman are experiencing surging revenue from trading and advisory activities, the bank will seek to “constrain headcount growth” amid the overhaul, Solomon said.

The news from Goldman, a leading global investment bank, comes as model updates from Anthropic, co-founded by a former OpenAI executive, have sparked a sharp selloff among software firms and their credit providers as investors wager on who the winners and losers from the AI trade will be.

Goldman began last year by testing an autonomous AI coder called Devin, which is now broadly available to the bank’s engineers. But it quickly found that Anthropic’s AI model could work in other parts of the bank, said Argenti.

“Claude is really good at coding,” Argenti said. “Is that because coding is kind of special, or is it about the model’s ability to reason through complex problems, step by step, applying logic?”

Argenti said the firm was “surprised” at how capable Claude was at tasks besides coding, especially in areas like accounting and compliance that combine the need to parse large amounts of data and documents while applying rules and judgment, he said.

Now, the view within Goldman is that “there are these other areas of the firm where we could expect the same level of automation and the same level of results that we’re seeing on the coding side,” he said.

The upshot is that, with the help of the agents in development, clients will be onboarded faster and issues with trade reconciliation or other accounting matters will be solved faster, Argenti said.

Goldman could next develop agents for tasks like employee surveillance or making investment banking pitchbooks, he said.

While the bank employs thousands of people in the compliance and accounting functions where AI agents will soon operate, Argenti said that it was “premature” to expect that the technology will lead to job losses for those workers.

Still, Goldman could cut out third-party providers it uses today as AI technology matures, he said.

“It’s always a tradeoff,” Argenti said. “Our philosophy right now is that we’re injecting capacity, which in most cases will allow us to do things faster, which translates to a better client experience and more business.”

Crypto World

Coinbase UK CEO Says Tokenised Collateral Is Moving Into Market Mainstream

Tokenised collateral is shifting from experimental pilots into core financial market infrastructure, according to comments from Keith Grose, UK CEO of Coinbase, as central banks and institutions accelerate real-world deployment.

Grose explains growing engagement from central banks signals that tokenisation has moved beyond the crypto-native ecosystem and into mainstream financial plumbing, particularly around liquidity and collateral management.

From Pilots to Production

“When central banks start talking about tokenised collateral, it’s a sign this technology has moved beyond crypto and into core market infrastructure,” Grose said.

He pointed to new data from Coinbase, showing that 62% of institutions have either held or increased their crypto exposure since October, despite periods of market volatility.

According to Grose, this sustained institutional presence reflects a shift in priorities. Rather than speculative exposure, firms are increasingly focused on operational tools that allow them to deploy digital assets at scale within existing risk frameworks.

Demand for Institutional-Grade Infrastructure

Coinbase said it is seeing growing institutional demand for services such as custody, derivatives and stablecoins, which Grose said are essential for managing risk and supporting day-to-day financial activity. “That tells us the market is building for real-world use,” he said.

He added that tokenised assets and stablecoins are expected to move from being conceptual possibilities to becoming everyday instruments for liquidity and collateral management. This transition, Grose said, will define the next phase of market development through 2026 as infrastructure matures and regulatory clarity improves.

The Role of UK Regulation

Grose highlighted the importance of the UK regulatory environment in unlocking further capital allocation into tokenised markets. While the UK has made progress in developing a framework for digital assets, he said policy choices around stablecoins will be critical to sustaining momentum.

“In the UK, to grow tokenisation we need no limits or blocking of stablecoin rewards,” Grose said. He argued that allowing investors to keep funds circulating within the digital economy would help unlock a genuinely liquid, 24/7 tokenised marketplace.

As institutions move from testing to deploying tokenised collateral in live market environments, Grose expects adoption to accelerate across custody, derivatives and stablecoin-based settlement.

With central banks increasingly engaged and institutional exposure holding firm, tokenisation is positioning itself as a foundational layer of modern financial infrastructure rather than a niche crypto application.

What Is Tokenisation and Why It Matters

Tokenisation is the process of representing a real-world asset on a blockchain. Tokens can stand for a wide range of assets both financial and non-financial, including cash, gold, stocks and bonds, royalties, art, real estate and other forms of value.

In practice, anything that can be reliably tracked and recorded can be tokenised, with the blockchain acting as a shared ledger that records ownership and transfers in a transparent and verifiable way.

As tokenisation continues to develop, its implications for markets, infrastructure and risk management are becoming clearer, prompting further research and analysis into how on-chain assets can reshape financial systems.

The post Coinbase UK CEO Says Tokenised Collateral Is Moving Into Market Mainstream appeared first on Cryptonews.

Crypto World

Pump.fun Expands Trading Infrastructure With Vyper Acquisition

Pump.fun has acquired crypto trading terminal Vyper, which will wind down its standalone product and migrate its infrastructure into the Solana memecoin launchpad’s ecosystem.

On Friday, Vyper said core parts of its product will begin shutting down on Tuesday, while limited functions will remain accessible. Users were directed to Pump.fun’s Terminal (formerly Padre) to continue using the tools.

The move reflects a broader strategy by Pump.fun to consolidate more of the trading workflow, from token launches to execution and analytics, as memecoin activity cools from the speculative frenzy of late 2024 and early 2025.

The companies did not disclose the financial terms of the deal. Pump.fun did not respond to a query from Cointelegraph before publication.

Expansion beyond token launches

Pump.fun’s acquisition of Vyper follows earlier moves into trading infrastructure. On Oct. 24, Pump.fun acquired trading terminal Padre to strengthen liquidity and improve execution for tokens launched on its platform. Padre was later rebranded and now operates as Terminal.

In January, Pump.fun also launched an investment arm called Pump Fund, marking what the company described as a pivot away from a pure memecoin focus.

On Jan. 20, Pump Fund debuted alongside a $3 million hackathon aimed at backing early-stage projects, including those not directly related to crypto.

Related: MEV trading returns to court in Pump.fun class-action lawsuit

Consolidation amid a cooling memecoin market

The expansion comes as memecoin activity has fallen from peaks when celebrities and several government leaders launched their own tokens. Pump.fun’s growth was driven by intense speculative activity on Solana, but revenue has since fallen as the popularity of memecoins weakened.

Data from DefiLlama shows that Pump.fun’s monthly revenue peaked at more than $137 million in January 2025. That figure fell 77% over the following year, with the platform generating about $31 million in January 2026.

In December 2024, the estimated market capitalization of memecoins tracked by CoinMarketCap surpassed $100 billion. At the time of writing, the sector was valued at about $28 billion, a decline of about 72%.

Magazine: Hong Kong stablecoins in Q1, BitConnect kidnapping arrests: Asia Express

Crypto World

GBP/USD Declines After Bank of England Decision

Yesterday’s decision by the Bank of England came as a surprise to forex traders. While the Official Bank Rate was left unchanged at 3.75%, markets were caught off guard by the notably dovish signals regarding future policy.

According to media reports, four out of nine Monetary Policy Committee members voted for an immediate rate cut. This has brought forward expectations of easing by the Bank of England, making the pound less attractive to hold and triggering its weakness yesterday.

Technical Analysis of GBP/USD

Price action in GBP/USD has been forming an upward trend (outlined by a channel) since November last year. However, yesterday’s move has put this channel at risk of a downside break.

It is worth noting that the market had only recently been in a very strong bullish phase. GBP/USD was advancing along the blue support line and even pushed above the upper boundary of the ascending channel.

Sentiment then shifted abruptly. Bears stepped in aggressively, driving the pair lower and breaking through several technical levels in sequence:

→ the blue trendline;

→ the upper boundary of the channel;

→ the channel median, reinforced by the 1.3640 level.

As a result, the price fell towards the lower boundary of the channel, strengthened by the 1.3530 level, which had acted as resistance in late December and early January.

Almost all of the bullish gains made in late January have now been erased. It cannot be ruled out that today’s rebound in GBP/USD is merely a technical recovery — a pause that allows bears to regroup before attempting a break below the lower boundary of the ascending channel, potentially steering the market into a downward trajectory (shown in red).

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

U.S. layoffs spike to 17-year high on UPS, Amazon cuts

The U.S. jobs market is cooling fast, a timely blow that could force the Federal Reserve to loosen its purse strings and potentially put a floor under the price of bitcoin .

Planned layoffs, the job cuts that companies have announced but not yet executed, surged by 205% to 108,435 in January, according to data tracked by global outplacement firm Challenger, Gray & Christmas. That’s the highest reading since January 2009, months after Lehman Brothers collapsed and pushed the global economy into recession.

Year-on-year, the announced cuts rose 118%, indicating a sharp weakening in the labor market in the first year of Donald Trump’s second stint as president. The technology industry announced 22,291 reductions, with Amazon (AMZN) accounting for most, while United Parcel Service (UPS) announced 31,243 planned cuts.

Andy Challenger, workplace expert at Challenger, Grey & Christmas, called it a high figure for January, in any case a seasonally weak month for hiring.

“It means most of these plans were set at the end of 2025, signaling employers are less-than-optimistic about the outlook for 2026,” Challenger said.

This data clashes with the Bureau of Labor Statistics’ monthly payrolls report, which still paints a resilient labor market picture.

Private reports are increasingly becoming early warning flags, signaling cracks forming before the official figures. Earlier this month, the blockchain-based Truflation showed a precipitous drop in real-time inflation, to under 1%, even as the official CPI lingers well above the Fed’s 2% target.

Together, these unofficial indicators suggest the Fed may soon need to relax policy by lowering borrowing costs to support the economy. The potential easing could bode well for assets like bitcoin, which is now down nearly 50% from its record high of over $126,000.

The Fed this month left the benchmark borrowing rate unchanged in the 3.5%-3.75% range, while flagging concerns about inflation. Analysts’ projections on what it will do next are all over the place.

JPMorgan expects the Fed to keep rates unchanged throughout this year and then increase sometime in 2027, while other banks expect at least two 25-basis-point rate cuts this year.

An economist who correctly predicted Japan’s fiscal issues expects Trump’s nominee for Fed chairman, Kevin Warsh, to cut rates by 100 basis points before the mid-term elections in November.

Crypto World

Strategy to initiate a BTC security program addressing quantum uncertainty

Quantum computing is moving from theory to long term strategic consideration, and Strategy (MSTR) has made it clear it intends to be proactive rather than reactive during the company’s Q4 earnings call on Thursday.

Strategy, the largest corporate holder of bitcoin, plans to initiate a bitcoin security program to coordinate with the global cyber, crypto, and bitcoin security community.

The company addressed growing discussion around quantum risk and reaffirmed its commitment to bitcoin security, framing quantum not as an immediate threat but as a future engineering challenge the network can prepare for.

Strategy reported a net loss of $12.4 billion for the quarter. Shares fell 17% on the day, trading as low as $104, but market focus quickly shifted to executive chairman Michael Saylor’s commentary.

Saylor revisited a long list of historical Bitcoin FUD (fear, uncertainty and doubt) that the network has already overcome quantum concerns, while acknowledging that quantum deserves serious long term planning.

The company outlined a range of key points on quantum computing, predicting that quantum technology is likely more than a decade away and pointing out that the Bitcoin community is already researching quantum-resistant cryptography.

Shares are up 6% in pre-market trading as bitcoin has rebounded to $65,000.

Read More: Galaxy CEO Mike Novogratz doesn’t see quantum as big threat for bitcoin

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports1 hour ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business17 hours ago

Business17 hours agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat24 hours ago

NewsBeat24 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World18 hours ago

Crypto World18 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”