Crypto World

Tether Bets $150M on Gold.com to Scale Gold Tokenization

The investment arm of stablecoin issuer Tether revealed on Thursday a $150 million stake in Gold.com, the online marketplace for gold and other precious metals. The move equates to roughly 12% of Gold.com and lays the groundwork for embedding a tokenized gold layer into the platform’s offerings. In practice, the plan includes integrating Tether Gold into Gold.com’s ecosystem, enabling users to access tokenized gold through a familiar, regulated marketplace. This marks another step in Tether’s broader strategy to blend digital assets with traditional stores of value, while preserving the asset’s backing and recognized value.

Gold.com is a publicly listed online marketplace that sells gold and other precious metals, including silver and platinum, to markets including the United States and beyond. The collaboration will align Gold.com’s catalog with a tokenized gold framework, as developers explore ways for customers to interact with digital gold alongside physical holdings within a familiar shopping experience.

“Gold has played a central role in preserving value for centuries, particularly during periods of monetary stress and geopolitical uncertainty,” said Paolo Ardoino, Tether’s chief executive. “Gold exposure is not a trade for Tether; it is a hedge and a long-term allocation to protect our user base and ourselves in a world that is becoming increasingly unstable.” He added that the investment reflects a long-term belief that gold should be as accessible, transferable, and usable as modern digital money, without compromising on physical backing or ownership.

Key takeaways

- Tether’s investment arm is purchasing roughly a 12% stake in Gold.com for about $150 million, with plans to integrate Tether’s gold-backed token into the platform.

- The tie-up signals a deeper push to bring tokenized precious metals to mainstream crypto users and traditional gold buyers on a regulated marketplace.

- Beyond tokenized gold, the partners are exploring ways for customers to buy physical gold using Tether’s USD-backed stablecoins and related US-market tokens.

- The development comes as gold prices surged over the prior year, briefly peaking around $5,600 per ounce before easing to the mid-$4,800s in recent days.

- Separately, Tether disclosed a separate $100 million equity investment in Anchorage Digital to support wider USAt adoption, with Anchorage aiming to advance toward a public listing next year.

- Tether reported a $10 billion profit in 2025, driven mainly by interest income on its large USDT reserves backing USDt obligations.

Tickers mentioned: $XAUt, $USDT, $USAT

Sentiment: Neutral

Market context: The deal aligns with a broader shift toward tokenized assets and on-chain settlement in the precious metals space, while stability and regulatory considerations continue to influence stablecoin use and cross-asset integrations.

Why it matters

For investors and users, the partnership could lower barriers to accessing gold through a digital wrapper that preserves physical backing while improving liquidity and settlement speed. By embedding a gold-backed token into a widely used marketplace, Gold.com could broaden the audience for tokenized precious metals beyond niche crypto circles into mainstream retail investors and institutions alike. The move also highlights Tether’s strategic emphasis on expanding utility for its suite of stablecoins and tokenized assets, creating a potential blueprint for other traditional commodities to leverage blockchain rails without sacrificing physical custody or auditability.

The collaboration also reflects a growing appetite among crypto-native firms and regulated platforms to bridge the gap between digital currencies and real-world assets. The emphasis on a regulated marketplace aims to address concerns about transparency, custody, and transparency—issues that have historically vexed both crypto enthusiasts and traditional precious metals buyers. If the integration proceeds as planned, it could pave the way for more cross-asset products that blend the reliability of physical gold with the efficiency of on-chain transfers and programmable payments.

Beyond Gold.com, the broader strategy includes expanding the use of stablecoins in tangible assets, such as physical metals, and leveraging Tether’s footprint in regulated financial ecosystems. The separate investment in Anchorage Digital underscores another pillar of this strategy: enabling USAt adoption within a compliant, bank-partnered framework as the new US-regulated stablecoin aims to gain traction in the American market while the parent company contemplates a future public listing. Collectively, these moves illustrate a deliberate attempt to normalize and scale tokenized gold as a legitimate instrument for hedging, allocation, and everyday commerce within a regulated environment.

From a financial perspective, the developments come amid positive momentum for gold in macro contexts marked by uncertainty and shifting risk appetite. Gold’s performance over the past year showed a notable run-up before some retracement, a pattern that can benefit tokenized representations by offering a familiar, tradable exposure that blends physical value with blockchain-enabled features like fractional ownership, faster settlement, and cross-border accessibility.

In tandem, Tether’s financial disclosures signal the broader health of the stablecoin ecosystem. The company reported a substantial profit in 2025, largely supported by interest earnings tied to its USDt reserves, which back USDt liabilities across the ecosystem. While this profitability does not guarantee future performance, it reinforces the scale at which stablecoin markets operate and the potential financial bedrock for continued investment in on-chain asset classes.

The evolving narrative around tokenized gold and stablecoin-enabled purchases could transform how ordinary investors interact with precious metals. If successful, Gold.com’s platform could become a practical gateway for users to convert digital liquidity into tangible metal holdings, while enabling new on-ramps and off-ramps that tie digital wallets to regulated, physical markets. This convergence of digitized assets and real-world goods represents a continuation of a broader fintech trend: the digitization of traditional assets with the added benefits of programmability, auditability, and cross-border efficiency.

What to watch next

- Timeline for integrating the tokenized gold layer (XAUt) into Gold.com’s user experience and any custody or compliance milestones.

- Regulatory updates affecting tokenized precious metals and stablecoins in major markets, including disclosures around reserves and audit practices.

- Adoption metrics for USDT and USAt within Gold.com and related platforms, including any pilot programs for gold purchases with stablecoins.

- Progress of Anchorage Digital’s USAt initiative and any forthcoming regulatory or market-facing milestones, including the planned public listing.

Sources & verification

- Tether’s official press release announcing the $150 million strategic investment in Gold.com and its plans to expand access to tokenized and physical gold. See: Tether makes a $150 million strategic investment in Gold.com.

- Gold.com platform overview and listing details (public marketplace for precious metals).

- Tether’s separate $100 million equity investment in Anchorage Digital aimed at accelerating USAt adoption and the bank’s impending public listing.

- Gold price context referenced: approximately 80% rally over the prior 12 months, peaking near $5,600 per ounce and retreating to around $4,800 at the time of reporting.

- Tether’s 2025 profitability mentioned in relation to USDT reserve-backed income and overall reserve profile.

Tether expands tokenized-gold access with Gold.com stake

The disclosure of a $150 million investment for a roughly 12% stake signals a deliberate, strategic step for Tether into the intersection of tokenized commodities and regulated retail platforms. The proposed path—embedding Tether Gold into Gold.com’s existing ecosystem—suggests a roadmap where physical gold and digital representations can be bought, held, and exchanged with comparable ease to other digital assets. By tying a publicly accessible marketplace to a token representing real-world gold, the arrangement is designed to deliver on the promise of on-chain liquidity without sacrificing the security and custody that come with physical metal ownership.

From a narrative standpoint, the deal sits at the crossroads of longstanding financial prudence and modern digital finance. Gold has historically served as a hedge during periods of monetary stress, and proponents argue that tokenized gold can offer similar hedging benefits with the added advantages of transparency, faster settlement, and global reach. The collaboration aligns with an ongoing effort to make gold more usable in everyday commerce, rather than a passive, siloed store of value. As the two entities work toward practical implementations, observers will be watching for regulatory clarity on tokenized precious metals, reserve disclosures to ensure physical backing, and user-friendly features that safeguard ownership while enabling efficient cross-border transfers.

At the heart of the project is a careful balance between accessibility and custodial responsibility. The tokenized representation of gold—whether through a token like XAUt or other digital wrappers—needs to be backed by verifiable physical gold holdings and auditable reserves. Tether’s emphasis on maintaining robust backing and a clear, auditable linkage between the digital token and the underlying metal is essential to sustaining trust in both the token and the broader platform. The integration into Gold.com—an established, publicly listed marketplace—could help normalize tokenized gold as a legitimate instrument for both retail and professional investors, especially if the process remains seamlessly integrated with conventional payment rails and secure custody solutions.

Another dimension of the story concerns the broader ecosystem around stablecoins and their role in real-world asset markets. The push to enable USDT and USAt payments for physical gold hints at a potential tipping point in how on-chain liquidity is channeled into tangible assets. The USAt initiative, described in tandem with Anchorage Digital, underscores a broader ambition to advance regulated, US-facing stablecoins within a framework that aligns with formal banking and custody standards. As markets become more comfortable with stablecoins as a medium of exchange for real assets, the prospects for a more interconnected financial system—where tokenized commodities and traditional assets coexist on integrated platforms—could improve both efficiency and investor confidence.

In this broader context, Gold.com’s positioning as a gateway to tokenized and physical gold could reshape how ordinary investors approach precious metals. If the partnership proves durable, it could encourage other marketplaces to explore tokenized representations of widely traded commodities, expanding the menu of digital-physical hybrids available to users. Yet the path is not without risk: the success of such a venture depends on continued regulatory clarity, rigorous reserve management, and the ability to deliver a user experience that minimizes complexity while maximizing transparency. As with any cross-asset initiative, the outcome will hinge on execution, governance, and the ability to demonstrate tangible value for both token holders and traditional gold buyers alike.

Crypto World

$6 Million HBAR Liquidations Ahead If Price Breaks This Pattern

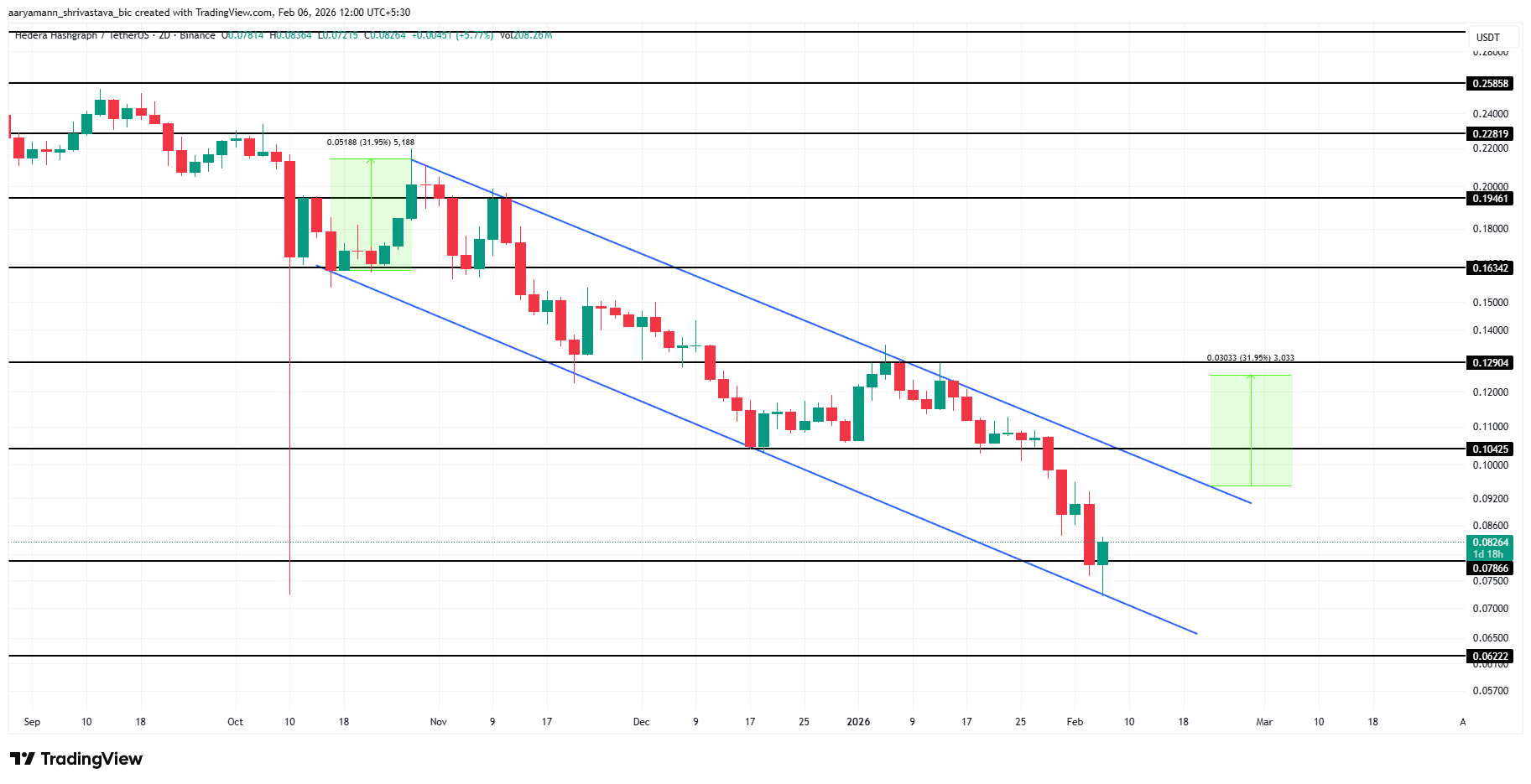

Hedera has remained under selling pressure after a steady decline brought HBAR back to retest a long-standing technical pattern. The token has been trading within this structure for several months, limiting upside attempts.

While multiple indicators now point toward a bullish setup, price action has yet to confirm the shift, keeping sentiment cautious.

HBAR Has An Underlying Bullish Trigger

HBAR’s Money Flow Index is showing early signs of strength despite continued price weakness. On the two-day chart, the indicator is forming a bullish divergence with the price. While HBAR has printed a lower low, the MFI has held higher lows, indicating rising buying pressure beneath the surface.

Sponsored

Sponsored

This divergence suggests that selling momentum is gradually fading. As sellers lose control, buyers begin to step in without immediately pushing prices higher. Such conditions often precede trend reversals, especially when supported by compression patterns and improving momentum indicators across higher timeframes.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

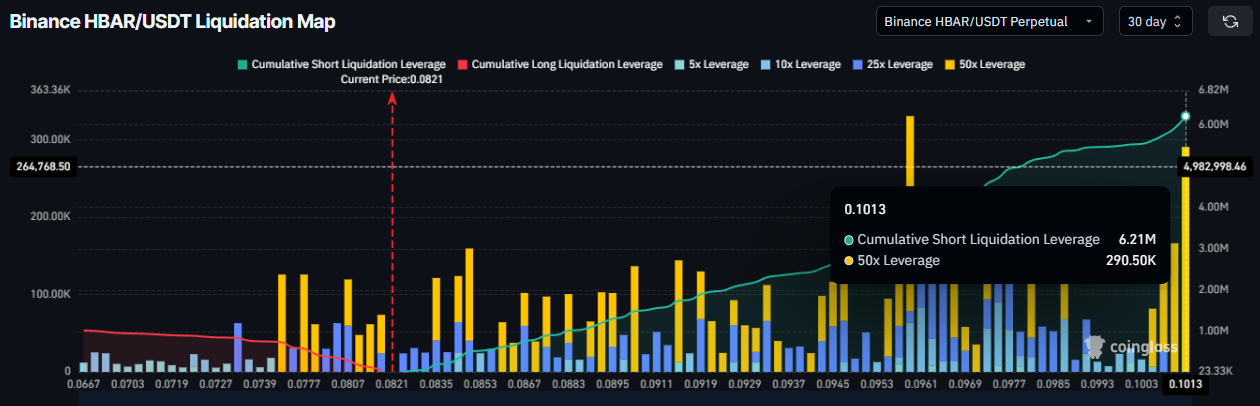

Derivatives data highlights growing risk for bearish traders. The liquidation map shows that a breakout in HBAR price would place significant pressure on short positions. If the price reaches $0.1013, approximately $6.2 million in short liquidations could be triggered, forcing rapid position closures.

Given the pattern HBAR is currently trading within, a breakout could occur quickly once resistance is breached. Forced liquidations typically accelerate price movement, amplifying upside momentum. As a result, short traders face heightened exposure if HBAR breaks above its current range.

HBAR Price Breakout Is Possible

HBAR price is trading near $0.0826 at the time of writing, holding above the $0.0786 support level. The altcoin has been moving within a descending channel for nearly four months. This structure reflects prolonged consolidation while volatility continues to compress.

A breakout from this pattern appears increasingly likely as selling pressure dissipates on a macro scale. Confirmation would require HBAR to breach the channel’s upper trendline and flip $0.1042 into support. Such a move would trigger short liquidations and push the price toward $0.129, the pattern’s projected 32% upside target.

However, downside risk remains if broader market conditions fail to improve. A loss of the $0.0786 support would weaken the structure. Under that scenario, HBAR could slide toward $0.0622. A move to that level would invalidate the bullish thesis entirely.

Crypto World

Bitcoin Slides Below $70,000 After Breaking Key Support

Editor’s note: eToro crypto analyst Simon Peters outlines the forces behind bitcoin’s sharp pullback from its October 2025 highs, pointing to a broader risk-off environment, leverage unwinds, and fragile investor sentiment across global markets. The commentary focuses on key technical and on-chain indicators now in focus, including long-term support levels and valuation metrics that have historically marked major market bottoms. As bitcoin trades under renewed selling pressure, the analysis frames the current correction within past cycles, while highlighting the conditions that could help stabilize prices if macro and market dynamics begin to shift.

Key points

- Bitcoin has fallen sharply from its October 2025 peak amid global risk-off sentiment.

- Liquidation of leveraged positions has intensified downside pressure.

- The 200-week moving average is being watched as a potential long-term support level.

- Historical cycles show similar corrections in 2015, 2018, 2020, and 2022.

- On-chain MVRV Z-score signals bitcoin may be nearing long-term fair value.

Why this matters

The analysis offers a timely snapshot of market psychology as bitcoin navigates one of its deepest post-ETF drawdowns. For investors and builders, long-term indicators like the 200-week moving average and MVRV Z-score provide context beyond short-term volatility. In a market increasingly influenced by macro conditions and institutional flows, understanding where leverage resets and valuation metrics converge is key to assessing whether the current correction is a pause or a potential inflection point.

What to watch next

- Bitcoin’s behavior around the 200-week moving average.

- Evidence of reduced leverage and easing forced liquidations.

- Changes in ETF inflows as broader risk sentiment evolves.

- Shifts in macro and geopolitical conditions impacting risk assets.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Abu Dhabi, United Arab Emirates – February 05, 2026: “After reaching an all-time high of $126,500 in October 2025, bitcoin has continued to slide as broader risk-off sentiment spills into the crypto market,” said Simon Peters, Crypto Analyst at eToro.

“Heightened geopolitical tensions, macroeconomic uncertainty and disappointing earnings forecasts have led investors to reassess risk assets, including technology stocks and crypto, while the liquidation of leveraged long positions has further accelerated the downturn.

“After breaking multiple support levels, bitcoin is now trading just below $70,000 and remains under significant selling pressure.

“From a technical perspective, analysts are closely watching bitcoin’s 200-week moving average as a potential area where the price could find a bottom. Historically, this level has acted as strong support following major corrections and bear markets in 2015, 2018, 2020 during the Covid pandemic, and most recently in 2022.

“Could history repeat itself in 2026? It remains to be seen. Once leverage is flushed out of the system, selling pressure eases and ETF inflows resume, this could help stabilise prices and signal the end of the current correction.

“From an on-chain perspective, the widely used MVRV Z-score — which assesses whether bitcoin is trading above or below its fair value — is also pointing towards a potential long-term buying opportunity.”

Media Contact:

PR@etoro.com

About eToro

eToro is the trading and investing platform that empowers you to invest, share and learn. We were founded in 2007 with the vision of a world where everyone can trade and invest in a simple and transparent way. Today we have 40 million registered users from 75 countries. We believe there is power in shared knowledge and that we can become more successful by investing together. So we’ve created a collaborative investment community designed to provide you with the tools you need to grow your knowledge and wealth. On eToro, you can hold a range of traditional and innovative assets and choose how you invest: trade directly, invest in a portfolio, or copy other investors. You can visit our media centre here for our latest news.

Crypto World

DeFi Development Guide to Vault Infrastructure (2026)

In 2026, the biggest challenge for Web3 founders is no longer launching a protocol. It is building a business that lasts. While thousands of platforms compete for attention, only a few manage to convert liquidity into predictable revenue, retain users beyond incentive cycles, and operate with financial discipline. The difference is not marketing, but infrastructure supported by enterprise-grade DeFi development.

Today’s most resilient crypto platforms are built on systems that quietly compound capital, stabilize cash flow, and strengthen user loyalty in the background. Through advanced DeFi development practices, leading teams are moving beyond short-term yield tactics and embracing structured vault architectures as a core business layer. This shift is redefining how modern Web3 companies think about growth, monetization, and valuation. In this guide, we break down why DeFi vault infrastructure is becoming the foundation of sustainable Web3 business models, how top platforms are leveraging it to outperform competitors, and what founders must do now to stay ahead in an increasingly capital-efficient market.

The Changing Economics of Web3 Platforms

In early DeFi (2020–2022), growth was driven by hype, aggressive incentives, and short-lived liquidity mining, which boosted TVL but created unstable business models. Today’s on-chain data shows a far more nuanced reality. As of early 2026, TVL in DeFi is around $129 billion, with Ethereum accounting for roughly 55% of that share (~$71 billion), underscoring continued core liquidity concentration in blue-chip ecosystems. This sustained TVL also reflects stronger demand for protocols that offer real utility, like lending, stablecoin liquidity, and yield mechanisms, rather than simple token-incentive farming.

As capital becomes more selective, founders and product leaders are shifting focus toward sustainable infrastructure rather than one-off token rewards. Platforms with structured vault systems benefit from higher capital efficiency, treasury utilization, and user retention compared to those relying solely on manual yield farming or emission-driven inflows. Against this backdrop, serious teams now treat yield infrastructure as a core business function rather than an add-on. Partnering with an experienced DeFi development company enables protocols to embed automated yield generation directly into their platforms, boosting long-term TVL resilience, reducing dependence on external aggregators, and creating sustainable revenue streams that align with evolving market expectations.

What Is DeFi Vault Infrastructure?

DeFi vault infrastructure refers to a system of smart contracts, automation tools, and risk controls that manage user funds and deploy them into optimized yield strategies. In simple terms, vaults:

- Collect user or treasury assets.

- Execute predefined strategies

- Harvest and reinvest rewards.

- Optimize gas and liquidity.

- Protect capital with built-in safeguards.

When users search for DeFi vaults crypto solutions, they are usually looking for this complete infrastructure layer, not just a basic staking contract or manual farming setup. Professional vault systems are not “set and forget” products. They are continuously optimized, monitored, and upgraded frameworks built through advanced DeFi development processes to ensure long-term performance, security, and scalability.

Explore how enterprise-grade vault architecture can power your next growth phase.

Why DeFi Yield Vaults Are Becoming Business-Critical

For Web3 companies, vaults now serve three strategic purposes.

- Revenue Generation

Vaults create recurring income through:

- Performance fees

- Management fees

- Strategy incentives

- Protocol-owned liquidity

- Yield-sharing mechanisms

These revenue streams help platforms move beyond short-term token speculation and build sustainable monetization models. This transforms volatile token economies into predictable, long-term revenue engines powered by DeFi yield vaults.

- User Retention

Platforms that offer built-in yield products retain users longer and reduce capital outflows. Instead of moving funds to external protocols in search of better returns, users can access optimized strategies directly within your ecosystem.

This leads to:

- Higher platform stickiness

- Improved lifetime user value

- Stronger community loyalty

- Reduced dependency on third-party aggregators

Integrated vault systems turn yield generation into a core user experience rather than a separate activity, driven by professional DeFi development practices that ensure scalability, security, and long-term performance.

- Capital Efficiency

Treasuries and idle balances can be deployed into structured, risk-managed strategies instead of remaining dormant. This allows protocols to generate returns on unused capital while maintaining liquidity and operational flexibility.

Improved capital efficiency:

- Strengthens financial resilience

- Enhances treasury sustainability

- Improves investor confidence

- Supports long-term governance stability

Well-designed vaults ensure that capital continuously works for the platform.

Leading platforms such as Yearn Finance and Beefy Finance demonstrated early how vault-based models outperform manual yield farming at scale through automation, diversification, and continuous optimization. Today, many new protocols are adopting similar approaches through custom DeFi development company partnerships to accelerate deployment, strengthen security, and build revenue-focused infrastructure from day one.

Inside a Professional DeFi Vault Strategy

A sustainable DeFi Vault Strategy is not about chasing the highest advertised APY. Instead, it focuses on creating a balanced system that optimizes yield while maintaining liquidity, security, and long-term scalability. High-performing DeFi vaults are built on carefully engineered frameworks developed through advanced DeFi development, rather than short-term incentive exploitation.

A mature vault strategy typically includes three core layers.

- Yield Source Selection

The first step is identifying reliable and diversified yield sources. Professional teams evaluate multiple income streams to reduce dependency on a single protocol.

Common sources include:

- Lending protocols that generate stable interest

- Stablecoin liquidity pools with low volatility

- LP incentive programs on major DEXs

- Staking mechanisms for network rewards

This diversified approach helps DeFi vaults maintain consistent returns across market cycles.

- Risk Modeling and Capital Protection

Every yield opportunity carries risk. Without proper modeling, high returns can quickly turn into major losses.

Enterprise-grade DeFi vault protocol systems apply strict risk frameworks, including:

- Comprehensive smart contract audits

- Slippage and liquidity impact controls

- Volatility exposure analysis

- Exit liquidity and stress testing

- Counterparty and protocol risk assessments

A professional DeFi development company integrates these safeguards into the strategy layer to protect both user funds and platform reputation.

- Automation and Optimization Logic

Automation transforms strategy design into a scalable financial engine. Without efficient execution, even strong strategies lose profitability.

Well-designed DeFi yield vaults rely on automation features such as:

- Dynamic harvest thresholds to balance rewards and gas costs

- Gas fee optimization mechanisms

- Rebalancing triggers based on market conditions

- Emergency withdrawal and fallback systems

- Strategy pause and redeployment tools

Through structured DeFi development, these systems operate continuously without manual intervention.

Get a customized vault strategy designed for performance and risk control.

Why Strategy Engineering Determines Long-Term Success

Together, yield selection, risk modeling, and automation form the operational backbone of every reliable DeFi vault system. When these components are poorly designed, platforms become vulnerable to volatility, liquidity disruptions, and long-term performance decline. Many teams underestimate these challenges and deploy fragile architectures that slowly lose TVL and user trust without experienced DeFi Development support. As a result, strategic planning, rigorous testing, and continuous optimization become essential for building resilient, scalable, and sustainable yield infrastructure.

Key Features Founders Should Demand in DeFi Vault Infrastructure

Before choosing any vault solution, founders and product leaders must assess whether the system is built for long-term growth or short-term experimentation. Not all DeFi yield vaults are designed for enterprise use, and weak infrastructure can expose platforms to financial and reputational risk. A reliable solution, built through professional DeFi development, should deliver the following core capabilities.

- Security Architecture

Since DeFi Vaults crypto platforms manage high-value assets, security must be the top priority. Founders should look for:

- Multi-layer smart contract audits

- Emergency pause and recovery systems

- Multisignature governance controls

An experienced DeFi development company ensures that these safeguards are embedded from day one.

- Strategy Flexibility

Markets change quickly, and vault systems must adapt. A scalable DeFi vault protocol should support:

- Modular and upgradeable strategies

- Custom risk parameters

- Automated rebalancing

This flexibility keeps DeFi yield vaults competitive in evolving market conditions.

- Transparency

Trust depends on visibility. Professional vault infrastructure must provide:

- On-chain fund tracking

- Performance dashboards

- Public reserve verification

These features strengthen user confidence and institutional credibility.

- Compliance Readiness

As regulations tighten globally, compliance has become essential. Mature vault systems should include:

- KYC-friendly integrations

- Geo-restriction controls

- Regulatory reporting tools

Through advanced DeFi development, platforms can balance decentralization with legal readiness. Together, these features separate enterprise-grade DeFi yield vaults from experimental deployments and enable sustainable, scalable Web3 business models.

Future Outlook: Vaults as Financial Operating Systems

Over the next three years, vaults will evolve beyond yield tools.

They will become:

- Treasury management systems

- Liquidity orchestration layers

- Cross-chain revenue engines

- Institutional onboarding gateways

Protocols that invest early in advanced DeFi yield vaults will control the financial infrastructure of their ecosystems. Those who delay will become dependent on external aggregators and lose margin.

Conclusion

In 2026, the difference between market leaders and market followers is no longer technology. It is infrastructure. Platforms that invest early in scalable DeFi yield vaults and professional DeFi development services are building predictable revenue systems, stronger user retention, and long-term capital resilience. Those who delay remain dependent on external aggregators and shrinking margins.

This is why forward-thinking founders choose Antier as their strategic DeFi development partner. With enterprise-grade security, customized strategies, and battle-tested architecture, we help Web3 businesses turn vault systems into growth engines.

If you want to lead your market instead of reacting to it, start building today. Book your vault strategy session now

Frequently Asked Questions

01. What is the biggest challenge for Web3 founders in 2026?

The biggest challenge is building a sustainable business that lasts, rather than just launching a protocol.

02. How are today’s resilient crypto platforms different from those in early DeFi?

Today’s platforms focus on stable cash flow and user loyalty through advanced DeFi development, moving away from short-term yield tactics.

03. Why is DeFi vault infrastructure important for Web3 business models?

DeFi vault infrastructure enhances capital efficiency, treasury utilization, and user retention, making it a core business function for sustainable growth.

Crypto World

Pi Network’s PI Crashed to New ATL, But This Metric Signals More Downside Ahead

Millions and millions of PI tokens will be released in the following weeks, which could bring even more pain for the bulls.

The past several weeks have not been kind to the cryptocurrency markets. This trend only intensified on Thursday when the entire market bled out, with multiple double-digit price crashers.

Naturally, Pi Network’s PI token was not spared, and it dumped to fresh all-time lows of under $0.135 (on CoinGecko). This meant that the asset has plunged by over 30% in the last month alone. On a broader scale, PI is down by more than 95% since its all-time high marked on February 26, 2025.

Despite this massive correction, some members of the ever-vocal and optimistic Pi Network community tried to find the silver linings. This one, for example, outlined the skyrocketing PI transaction volume, which, he believes, shows “increased interest in PI despite the manipulation games done by whales.”

This one was even more bullish, predicting a mind-blowing surge to $4 from the current dip in the first six months after the second Mainnet migration and once old Pioneers (Pi Network users and investors) are done selling off.

More Pain to Come?

If we are being realistic, it’s hard to even imagine such a rally happening soon. Not only because the overall crypto market seems to be dominated by the bears, but also due to PI’s recent price performance and the unlocking schedule for new tokens.

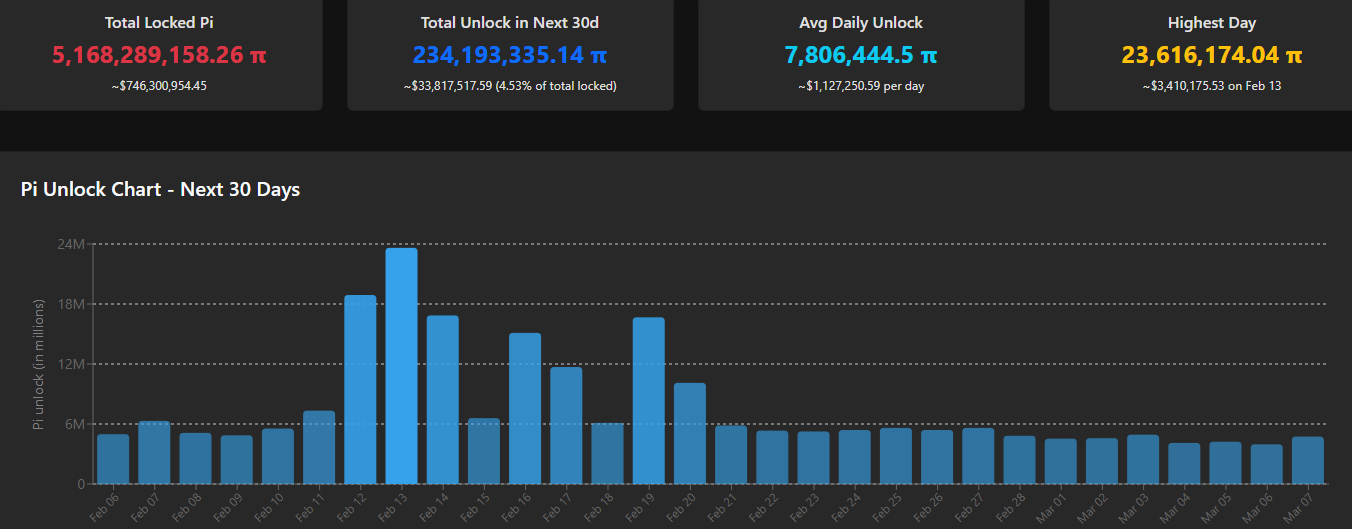

Data from PiScan shows that almost 8 million coins will be freed in the next month on average. What’s even more worrying is the fact that this number will skyrocket to over 18 million on February 12 and to 23.6 million on February 13.

Such a massive number of tokens to be unlocked might result in more immediate selling pressure from investors who have been waiting a long time for their holdings to become available for trading. This is particularly true in such a time of panic.

You may also like:

The Good News

On the positive side, the chart above demonstrates that the number of unlocked tokens will decline after February 20 and will normalize, which could ease the selling pressure. Additionally, there are rumors circulating online that one of the largest and oldest exchanges, Kraken, might be planning to list Pi Network’s native token, which could boost its liquidity and legitimacy among investors.

🚨 BREAKING: Kraken Exchange is

preparing to integrate the Pi blockchain and list $PI for trading 👀

If confirmed, this could be a major step for Pi ecosystem adoption.

⁰Eyes on what comes next.#PiNetwork #PI #Kraken #CryptoNews #Altcoins pic.twitter.com/BAWZLcGQnH— SMC KAPIL DEV (@smckapildev) February 6, 2026

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

RWA Perps heat up as gold, silver whipsaw; ONDO, PAXG, MKR, LINK lead RWA trade

RWA perps volume explodes above $15B as gold and silver crash, Binance cements dominance, and ONDO, PAXG, MKR, LINK front-run the real‑world assets trade.

Summary

- CoinMarketCap says RWA perps are “carving out an interesting niche” by letting traders speculate on gold and silver via crypto derivatives, with “genuine momentum” in early 2026.

- Binance controls 68.37% of YTD RWA perps volume, with OKX at 14.63% and MEXC at 9.25%, concentrating liquidity and potential liquidation cascades on a handful of venues.

- On Jan. 30, RWA perps volume hit $15.57B as gold futures plunged 11% and silver crashed 28%, while spot RWA tokens ONDO, PAXG, MKR, and LINK anchor the tokenization narrative.

The RWA perpetuals market is suddenly where the adrenaline is. As CoinMarketCap put it, “the RWA Perpetuals market is carving out an interesting niche… by letting traders speculate on real-world commodities like gold and silver using crypto derivatives,” with early 2026 showing “genuine momentum” on the back of extreme precious‑metal volatility.

Leading the way are ONDO (ONDO), PAXG (PAXG), MKR (MKR), LINK (LINK), which analysts say may be bucking the broader crypto bear trend.

Volatility, flows, and exchanges

CoinMarketCap’s data show clear venue concentration: “Binance dominates with 68.37% market share in YTD Volume, followed by OKX (14.63%) and MEXC (9.25%). Bitget (4.77%) and Gate (4.52%) combine for under 10%.” That kind of skew tells you where liquidity — and liquidation cascades — are most likely to cluster.

The flow has been violent. On January 30, RWA perps volume hit $15.57 billion as “gold futures plunged around 11% (closing near $4,745/oz), while silver had its worst single day since 1980, crashing about 28% from nearly $115/oz down to $78/oz.” February 2 still pushed $10.96 billion, with gold down another 2% to roughly $4,652/oz and silver slipping to $77.

By February 5, volume rebounded to $12.06 billion as silver “dropped another 9% to $76 per ounce, while gold slipped about 1.24%,” a sequence CoinMarketCap summarized as “explosive moves fueled by speculation running hot, margin calls forcing positions closed, and macro news sending shockwaves through the markets.”

Crypto bleed and RWA bid

Context matters: “crypto itself has been bleeding badly in early 2026. Bitcoin’s down ~49% from its late 2025 peak, and the overall market has shed trillions in what feels like full capitulation mode.” That backdrop is exactly why RWA perps “are emerging as something genuinely different… a way for crypto traders to get exposure to TradFi assets and speculate without leaving their native ecosystem,” offering diversification and hedging that “pure crypto can’t provide right now.”

Among spot RWA‑themed tokens, names like Ondo (ONDO), Maker (MKR), PAX Gold (PAXG), and Chainlink (LINK) sit at the core of the narrative, spanning tokenized Treasuries, on‑chain collateralized credit, gold‑backed exposure, and oracle infrastructure for tokenized assets.

Major coin prices and 24h moves

As of the latest session, Bitcoin (BTC) trades around $73,420, down roughly 3.9% over 24 hours. Ether (ETH) changes hands near $2,165, off about 5.7% in the same period, while Solana (SOL) sits around $93, down approximately 7.7%. The broader market has seen similar pressure, with total crypto capitalization sliding sharply in early February.

(For full live pricing and deeper breakdowns, see the crypto.news price pages for BTC, ETH, SOL, ONDO, MKR, PAXG, and LINK.)

Crypto World

Pump.fun Expands Trading Infrastructure by Acquiring Vyper

Pump.fun has expanded its footprint in on-chain trading by acquiring Vyper, the Solana-based trading terminal, and winding down Vyper’s standalone product to merge its infrastructure into Pump.fun’s Terminal ecosystem. The transition is set to begin with the shutdown of core Vyper features on Feb. 10, while limited functionality remains accessible as users are directed to Pump.fun’s Terminal (the former Padre) for continued access to trading tools. The deal’s financial terms were not disclosed, and Pump.fun did not comment for this article. The move underscores a broader consolidation strategy as Pump.fun seeks to unify token launches, execution, and analytics under a single platform, even as Solana-based memecoin activity cools from the speculative peak of late 2024 and early 2025. The acquisition follows Pump.fun’s earlier push into trading infrastructure, positioning the company to streamline workflow across the memecoin ecosystem.

Key takeaways

- Pump.fun is consolidating its trading workflow by absorbing Vyper, integrating the terminal into its broader ecosystem rather than maintaining standalone tooling.

- Vyper will begin winding down its core product on Feb. 10, with limited functions remaining as users migrate to Pump.fun’s Terminal (formerly Padre).

- The deal’s terms were not disclosed, and Pump.fun did not provide comment prior to publication.

- The move follows Pump.fun’s October acquisition of Padre, which was rebranded to Terminal, and signals a broader pivot toward end-to-end trading infrastructure.

- DefiLlama data show Pump.fun’s monthly revenue peaked at over $137 million in January 2025, but fell to about $31 million in January 2026, illustrating a cooling memecoin market.

Sentiment: Neutral

Market context: The consolidation comes as the memecoin sector, which once heated Solana-based launch activity, has cooled amid slower momentum and tightened liquidity. The industry is calibrating trading workflows, liquidity provisioning, and analytics to weather shifting risk appetite and evolving regulatory scrutiny.

Why it matters

The acquisition of Vyper marks a notable shift in how meme-centric platforms orchestrate their trading infrastructure. By folding a standalone terminal into a broader platform, Pump.fun aims to deliver a unified experience that spans token launches, liquidity management, and execution analytics. For users, this could mean simplified onboarding and a more cohesive set of tools, reducing the need to juggle multiple interfaces across separate services. For the broader market, the move signals ongoing consolidation among infrastructure players as platforms seek to lock in users during periods of normalization after the frenetic memecoin era.

Central to the narrative is the Solana (CRYPTO: SOL) blockchain’s role in memecoin activity. Pump.fun’s strategy has long leaned on Solana-based launches, where liquidity and speculative demand previously surged, driving short-term revenue growth. The latest integration suggests that Pump.fun intends to offer a more durable, end-to-end workflow—combining launch capabilities with execution and analytics—potentially stabilizing revenue streams even as speculative dynamics recede. Investors will be watching how the Terminal ingestion affects execution quality, slippage, and the reliability of data streams as the platform absorbs Vyper’s user base and tooling.

From a governance and product perspective, the move foreshadows further shifts as platforms recalibrate their product mix away from standalone memecoin gimmicks toward sustainable infrastructure. Pump.fun’s earlier steps—acquiring Padre and launching an investment arm, Pump Fund, in January—signal a pivot beyond pure memecoin speculation toward more diversified funding and support for early-stage projects. The company’s stated intent to back non-crypto ventures through the hackathon underscores a broader strategic realignment toward building an ecosystem with longer-term value capture, beyond the transient popularity of individual memecoins.

What to watch next

- Feb. 10: Operational shutoff of Vyper’s core features and the continued migration of users to Terminal. Monitor any service interruptions or migration pain points.

- Progress of Terminal integration: Assess how quickly users adapt to the combined workflow for launches, execution, and analytics and whether feature parity with Vyper is maintained.

- Subsequent expansion: Look for additional upgrades or partnerships that broaden Terminal’s capabilities beyond memecoin launches, including non-crypto or cross-chain integrations.

- Regulatory and market context: Stay aware of changing regulatory signals and macro conditions that influence liquidity and risk sentiment in on-chain trading.

Sources & verification

- Vyper announced the wind-down and migration plan with Feb. 10 as a milestone (X post by TradeonVyper).

- DefiLlama revenue data for Pump.fun showing a peak of over $137 million in January 2025 and ~ $31 million in January 2026.

- Cointelegraph reporting on Pump.fun’s acquisition of Padre (trading terminal) in October, which was later rebranded as Terminal.

- Pump.fun’s launch of Pump Fund and the January 20 hackathon aimed at supporting early-stage projects beyond crypto.

- Contextual background on the broader memecoin market’s expansion and subsequent cooling, including market-cap discussions tracked by CoinMarketCap.

Expansion and consolidation: Pump.fun absorbs Vyper into its Terminal ecosystem

Pump.fun’s latest move extends a pattern of vertical integration designed to streamline how users interact with memecoin launches, liquidity provisioning, and on-chain analytics. By absorbing Vyper, a trading terminal with a dedicated user base, into Terminal, the company is effectively folding a specialized toolset into a broader platform that aspires to cover more of the user journey—from initial token ideas to live trading and data-driven decision making. The timeline is explicit: on Feb. 10, core parts of Vyper will cease operating as a standalone product, while limited functionalities will remain accessible to bridge the transition. Users are being redirected to Pump.fun’s Terminal, which had previously been known as Padre, signaling a seamless migration path for existing customers.

The strategic logic behind the acquisition aligns with a broader industry trend: platforms seeking to lock in users by offering a one-stop shop for token launches, liquidity management, and analytics. As memecoin momentum cooled—from the heady days when celebrity-led token drops and government officials’ involvement helped spur a parabolic interest to a more measured pace—providers have sought to preserve revenue by bundling services. DefiLlama’s data capture demonstrates how Pump.fun’s revenue trajectory paralleled this cycle: a record of $137 million in January 2025, followed by a steep 77% decline in the year that followed, landing around $31 million in January 2026. The consolidation may be a pragmatic response to such revenue pressure, creating a more sustainable platform that can weather fluctuating demand while still serving a highly specialized user base.

Industry observers note that the Solana-based ecosystem has been a focal point for memecoin activity, with a number of tokens and launchpads anchored to that network. The rebranding and consolidation around Terminal indicates a shift from a project-centric model to an infrastructure-centric approach—one that prioritizes execution quality, reliability, and analytics accuracy for traders and project teams launching new tokens. The absence of disclosed financial terms in the deal leaves questions about the valuation and future revenue sharing, but the strategic intent is clear: unify tools under a single umbrella to improve user experience and potentially stabilize monetization channels beyond speculative token launches.

In tandem with the acquisition, Pump.fun has already pursued related strategic moves. The October acquisition of Padre, which was subsequently renamed Terminal, extended the company’s reach into the trading floor’s core capabilities. Earlier in January, Pump.fun broadened its footprint by launching Pump Fund, an investment arm intended to diversify beyond memecoins, and kicked off a $3 million hackathon to back early-stage projects, including ventures not directly tied to crypto. Together, these steps signal an evolution from a meme-driven growth model toward a more diversified ecosystem play that emphasizes sustainable infrastructure, broader funding initiatives, and broader use cases for its technology stack. The market will likely scrutinize how this transition affects liquidity, execution quality, and the platform’s ability to attract high-quality launches in a shifting macro environment.

https://platform.twitter.com/widgets.js

Crypto World

Bitcoin May Need Two Years to Flip $93,500 Back to Support

Bitcoin (BTC) liquidated billions of dollars going into Friday as BTC price action set bearish records.

Key points:

-

Bitcoin liquidates $2.6 billion as it sees its first red $10,000 daily candle ever.

-

BTC price action dives further in percentage terms than on any day since the 2022 bear market.

-

It may take until 2028 for Bitcoin to return above $93,500 again.

Bitcoin seals biggest daily dollar rout in history

Data from TradingView showed BTC/USD consolidating after bouncing from $59,930 — its first trip below the $60,000 mark since October 2024.

Sustained selling pressure during Thursday’s US trading session eventually sparked a liquidation cascade, with $2.6 billion in crypto positions wiped out over 24 hours, per data from CoinGlass.

Commenting, crypto market participants noted that the liquidation tally had surpassed both the COVID-19 crash from March 2020 and the reaction to the implosion of exchange FTX in late 2022.

COVID crash: $1.2B in liquidations.

FTX crash: $1.5B in liquidations.

Random Thursday (today): $1.7B in liquidations. pic.twitter.com/iY1vaYCjnd

— Alex Mason 👁△ (@AlexMasonCrypto) February 5, 2026

Bitcoin price action also brought back historical bear-market records elsewhere.

In percentage terms, Thursday’s daily candle was the largest daily decline since the FTX debacle — an event that sparked the bear-market low of $15,600.

“The ETF holders have never experienced this kind of sell-off,” Joe Consorti, head of growth at Bitcoin equity company Horizon, responded on X, referring to institutional investors with exposure to the US spot Bitcoin exchange-traded funds (ETFs).

They saw net outflows of $434 million on Thursday, per data from UK-based investment firm Farside Investors.

BTC/USD, meanwhile, achieved an unenviable new feat, falling by more than $10,000 in a day for the first time.

“Yesterday was the highest volume day on $BTC since August 2024,” trader Jelle added.

“One for the history books.”

BTC price “trend reversal,” only in 2028?

In a grim outlook for Bitcoin bulls, crypto trader and analyst Rekt Capital said that it could be 2028 before a true rebound occurs.

Related: Will Bitcoin rebound to $90K by March? Here’s what BTC options say

Using the BTC price cycle model as a guide, including a key moving average crossover at the end of January, Rekt Capital foresees a classic bear market year for 2026.

“Looks like it indeed is the year of the Bitcoin Bear Market,” he wrote in an X post.

“2027 will be the Bottoming Out year for BTC. And 2028 will be the Trend Reversal year where $93500 would be finally broken.”

A separate post warned of “bearish acceleration” on BTC/USD, again mimicking the 2022 bear market.

The Bearish Acceleration phase of the Bitcoin cycle is in progress$BTC #Crypto #Bitcoin https://t.co/5H7VPvksnH pic.twitter.com/XnPU3FeNhO

— Rekt Capital (@rektcapital) February 5, 2026

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Goldman Sachs to tap Anthropic AI model to automate accounting, compliance

Goldman Sachs has been working with the artificial intelligence startup Anthropic to create AI agents to automate a growing number of roles within the bank, the firm’s tech chief told CNBC exclusively.

The bank has, for the past six months, been working with embedded Anthropic engineers to co-develop autonomous agents in at least two specific areas: accounting for trades and transactions, and client vetting and onboarding, according to Marco Argenti, Goldman’s chief information officer.

The firm is “in the early stages” of developing agents based on Anthropic’s Claude model that will collapse the amount of time these essential functions take, Argenti said. He expects to launch the agents “soon,” though he declined to provide a specific date.

“Think of it as a digital co-worker for many of the professions within the firm that are scaled, are complex and very process intensive,” he said.

Goldman Sachs CEO David Solomon said in October that his bank was embarking on a multi-year plan to reorganize itself around generative AI, the technology that has made waves since the arrival of OpenAI’s ChatGPT in late 2022. Even as investment banks like Goldman are experiencing surging revenue from trading and advisory activities, the bank will seek to “constrain headcount growth” amid the overhaul, Solomon said.

The news from Goldman, a leading global investment bank, comes as model updates from Anthropic, co-founded by a former OpenAI executive, have sparked a sharp selloff among software firms and their credit providers as investors wager on who the winners and losers from the AI trade will be.

Goldman began last year by testing an autonomous AI coder called Devin, which is now broadly available to the bank’s engineers. But it quickly found that Anthropic’s AI model could work in other parts of the bank, said Argenti.

“Claude is really good at coding,” Argenti said. “Is that because coding is kind of special, or is it about the model’s ability to reason through complex problems, step by step, applying logic?”

Argenti said the firm was “surprised” at how capable Claude was at tasks besides coding, especially in areas like accounting and compliance that combine the need to parse large amounts of data and documents while applying rules and judgment, he said.

Now, the view within Goldman is that “there are these other areas of the firm where we could expect the same level of automation and the same level of results that we’re seeing on the coding side,” he said.

The upshot is that, with the help of the agents in development, clients will be onboarded faster and issues with trade reconciliation or other accounting matters will be solved faster, Argenti said.

Goldman could next develop agents for tasks like employee surveillance or making investment banking pitchbooks, he said.

While the bank employs thousands of people in the compliance and accounting functions where AI agents will soon operate, Argenti said that it was “premature” to expect that the technology will lead to job losses for those workers.

Still, Goldman could cut out third-party providers it uses today as AI technology matures, he said.

“It’s always a tradeoff,” Argenti said. “Our philosophy right now is that we’re injecting capacity, which in most cases will allow us to do things faster, which translates to a better client experience and more business.”

Crypto World

Coinbase UK CEO Says Tokenised Collateral Is Moving Into Market Mainstream

Tokenised collateral is shifting from experimental pilots into core financial market infrastructure, according to comments from Keith Grose, UK CEO of Coinbase, as central banks and institutions accelerate real-world deployment.

Grose explains growing engagement from central banks signals that tokenisation has moved beyond the crypto-native ecosystem and into mainstream financial plumbing, particularly around liquidity and collateral management.

From Pilots to Production

“When central banks start talking about tokenised collateral, it’s a sign this technology has moved beyond crypto and into core market infrastructure,” Grose said.

He pointed to new data from Coinbase, showing that 62% of institutions have either held or increased their crypto exposure since October, despite periods of market volatility.

According to Grose, this sustained institutional presence reflects a shift in priorities. Rather than speculative exposure, firms are increasingly focused on operational tools that allow them to deploy digital assets at scale within existing risk frameworks.

Demand for Institutional-Grade Infrastructure

Coinbase said it is seeing growing institutional demand for services such as custody, derivatives and stablecoins, which Grose said are essential for managing risk and supporting day-to-day financial activity. “That tells us the market is building for real-world use,” he said.

He added that tokenised assets and stablecoins are expected to move from being conceptual possibilities to becoming everyday instruments for liquidity and collateral management. This transition, Grose said, will define the next phase of market development through 2026 as infrastructure matures and regulatory clarity improves.

The Role of UK Regulation

Grose highlighted the importance of the UK regulatory environment in unlocking further capital allocation into tokenised markets. While the UK has made progress in developing a framework for digital assets, he said policy choices around stablecoins will be critical to sustaining momentum.

“In the UK, to grow tokenisation we need no limits or blocking of stablecoin rewards,” Grose said. He argued that allowing investors to keep funds circulating within the digital economy would help unlock a genuinely liquid, 24/7 tokenised marketplace.

As institutions move from testing to deploying tokenised collateral in live market environments, Grose expects adoption to accelerate across custody, derivatives and stablecoin-based settlement.

With central banks increasingly engaged and institutional exposure holding firm, tokenisation is positioning itself as a foundational layer of modern financial infrastructure rather than a niche crypto application.

What Is Tokenisation and Why It Matters

Tokenisation is the process of representing a real-world asset on a blockchain. Tokens can stand for a wide range of assets both financial and non-financial, including cash, gold, stocks and bonds, royalties, art, real estate and other forms of value.

In practice, anything that can be reliably tracked and recorded can be tokenised, with the blockchain acting as a shared ledger that records ownership and transfers in a transparent and verifiable way.

As tokenisation continues to develop, its implications for markets, infrastructure and risk management are becoming clearer, prompting further research and analysis into how on-chain assets can reshape financial systems.

The post Coinbase UK CEO Says Tokenised Collateral Is Moving Into Market Mainstream appeared first on Cryptonews.

Crypto World

Pump.fun Expands Trading Infrastructure With Vyper Acquisition

Pump.fun has acquired crypto trading terminal Vyper, which will wind down its standalone product and migrate its infrastructure into the Solana memecoin launchpad’s ecosystem.

On Friday, Vyper said core parts of its product will begin shutting down on Tuesday, while limited functions will remain accessible. Users were directed to Pump.fun’s Terminal (formerly Padre) to continue using the tools.

The move reflects a broader strategy by Pump.fun to consolidate more of the trading workflow, from token launches to execution and analytics, as memecoin activity cools from the speculative frenzy of late 2024 and early 2025.

The companies did not disclose the financial terms of the deal. Pump.fun did not respond to a query from Cointelegraph before publication.

Expansion beyond token launches

Pump.fun’s acquisition of Vyper follows earlier moves into trading infrastructure. On Oct. 24, Pump.fun acquired trading terminal Padre to strengthen liquidity and improve execution for tokens launched on its platform. Padre was later rebranded and now operates as Terminal.

In January, Pump.fun also launched an investment arm called Pump Fund, marking what the company described as a pivot away from a pure memecoin focus.

On Jan. 20, Pump Fund debuted alongside a $3 million hackathon aimed at backing early-stage projects, including those not directly related to crypto.

Related: MEV trading returns to court in Pump.fun class-action lawsuit

Consolidation amid a cooling memecoin market

The expansion comes as memecoin activity has fallen from peaks when celebrities and several government leaders launched their own tokens. Pump.fun’s growth was driven by intense speculative activity on Solana, but revenue has since fallen as the popularity of memecoins weakened.

Data from DefiLlama shows that Pump.fun’s monthly revenue peaked at more than $137 million in January 2025. That figure fell 77% over the following year, with the platform generating about $31 million in January 2026.

In December 2024, the estimated market capitalization of memecoins tracked by CoinMarketCap surpassed $100 billion. At the time of writing, the sector was valued at about $28 billion, a decline of about 72%.

Magazine: Hong Kong stablecoins in Q1, BitConnect kidnapping arrests: Asia Express

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports2 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business18 hours ago

Business18 hours agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World18 hours ago

Crypto World18 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”