Video

DEMOCRATS READY TO PASS CRYPTO LEGISLATION! MICHAEL BURRY SHORTING BITCOIN & CME COIN!

Crypto News: Democrats meet to discuss passing Clarity Act. Wall Street giant CME Group is eyeing its own ‘CME Coin,’ CEO says. Michael Burry shares bearish post on Bitcoin.

Brought to you by ✅ VeChain is a versatile enterprise-grade L1 smart contract platform https://www.vechain.org/

💡Get the (Re)Thinking Crypto Book on Amazon – https://www.amazon.com/dp/B0D2525DYX

🖥️ Learn Crypto with Expert Commentary – http://MyCryptoCourse.com

Sponsors:

🔐 Safely Store your Crypto with Trezor Hardware Wallets – https://affil.trezor.io/SHlz

🏠 Propy (PRO) is a blockchain-based real estate marketplace and decentralized title registry that leverages smart contracts to facilitate property transactions globally https://propy.com/home/ & https://propy.com/home/ownyourtomorrow/

🏦 Learn about iTrustCapital’s powerful Premium Custody Account (PCA) and tax-advantaged Crypto IRA platforms https://www.itrustcapital.com/go/thinkingcrypto

🖥️ Sign up with Santiment to get quality crypto metrics – https://app.santiment.net/pricing?fpr=thinkingcrypto Get 25% discount with code THINKINGCRYPTO

🌟Uphold – Signup with Uphold. https://uphold.sjv.io/gbED4X

Terms Apply. Cryptoassets are highly volatile. Your capital is at risk.

📰 Sign up for the Free Thinking Crypto Weekly Newsletter https://thinkingcrypto.substack.com/

✅ Become a Channel Member – https://www.youtube.com/channel/UCjpkwsuHgYx9fBE0ojsJ_-w/join

🔥 Buy Merch & support the Podcast https://my-store-574b5b.creator-spring.com/

🧙♂️Merlin – http://tinyurl.com/MerlinTCYouTube

“I am a Merlin partner and get compensated for purchases made through links in this content”this content”

Follow on social media:

➡️ X(Twitter) – https://x.com/thinkingcrypto

➡️ Facebook – https://www.facebook.com/thinkingcrypto/

➡️ LinkedIn – http://linkedin.com/company/thinking-crypto

➡️ Instagram – https://www.instagram.com/thinkingcrypto/

➡️ TikTok – https://www.tiktok.com/@thinkingcrypto5

➡️ Threads – https://www.threads.net/@thinkingcrypto

➡️ Website – https://www.ThinkingCrypto.com/

🔊 Listen to content on Apple Podcasts – https://podcasts.apple.com/us/podcast/thinking-crypto-news-interviews/id1458945676

🔊 Listen to content on Spotify – https://open.spotify.com/show/221AV5A65v7uYEsuMviVKl

💼Business Inquiries💼

hellothinkingcrypto@gmail.com

⏰ Time Stamps ⏰

00:00 Intro

00:38 Bitcoin analysis Michael Burry

05:02 Democrats Clarity Act

09:10 CME Group Coin

11:20 Scott Bessent Bitcoin Reserve

13:18 SBI Group Strium Tokenization

15:00 Ripple Prime Hyperliquid

15:53 Bitnomial Tezos XTZ futures

16:39 Blockchain Intelligence TRM Labs $70M

18:09 Canada Crypto Custody rules

19:24 Bitwise Chorus One Crypto Staking

=================================================

📺 Interviews Playlists 📺

– All Interviews – https://youtube.com/playlist?list=PL5rDfH3ofGEe8rCbwJojpipmwwkvWhbQD

– Must Watch Interviews – https://youtube.com/playlist?list=PL5rDfH3ofGEdqEaSrjC3UHOQdw1eyeYRU

– Bitcoin Interviews – https://youtube.com/playlist?list=PL5rDfH3ofGEcjtw8URfr7-DfBi_J_O0ip

– Altcoin Interviews – https://youtube.com/playlist?list=PL5rDfH3ofGEeZ3QES9lD1f59YTWuQv-uv

– Crypto Regulators & Politicians Interviews – https://youtube.com/playlist?list=PL5rDfH3ofGEdsqA213osf2u-PbT1b7uM4

– Investment Firms & Hedge Funds – https://youtube.com/playlist?list=PL5rDfH3ofGEfa-HsusfQBB6blH3KR09mj

– Internet Pioneers & Entrepreneurs – https://youtube.com/playlist?list=PL5rDfH3ofGEdqCYps3eexnovm2WNWeP3o

=================================================

#Crypto #Bitcoin #MichaelBurry #CryptoNews #Cryptocurrency #BTC #BitcoinNews #ETF #News #Ripple #XRP #XRPNews #RippleXRP #Ethereum #EthereumNews #ETH #Solana #money #investing #trading #Altcoin #Altcoins #NFTs #Metaverse #Podcast #ThinkingCrypto

=================================================

– The Thinking Crypto Podcast is your home for the best Crypto News and Interviews – crypto, cryptocurrency, crypto news, bitcoin, bitcoin news, xrp, xrp news, ripple, ripple news, ripple xrp, ethereum, ethereum news, cardano, ada, solana, altcoins, defi, news, interviews, podcast, metaverse, nft, altcoin daily, cryptosrus, coin bureau, altcoin news, bitcoin today, markets, investing

=================================================

Disclaimer – The Thinking Crypto podcast and Tony Edward are not financial or investment experts. You should do your own research on each cryptocurrency and make your own conclusions and decisions for investment. Invest at your own risk, only invest what you are willing to lose. This channel and its videos are just for educational purposes and NOT investment or financial advice.

Note that links included in this description might be affiliate links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel so I can continue to provide you with free content each week!

source

Video

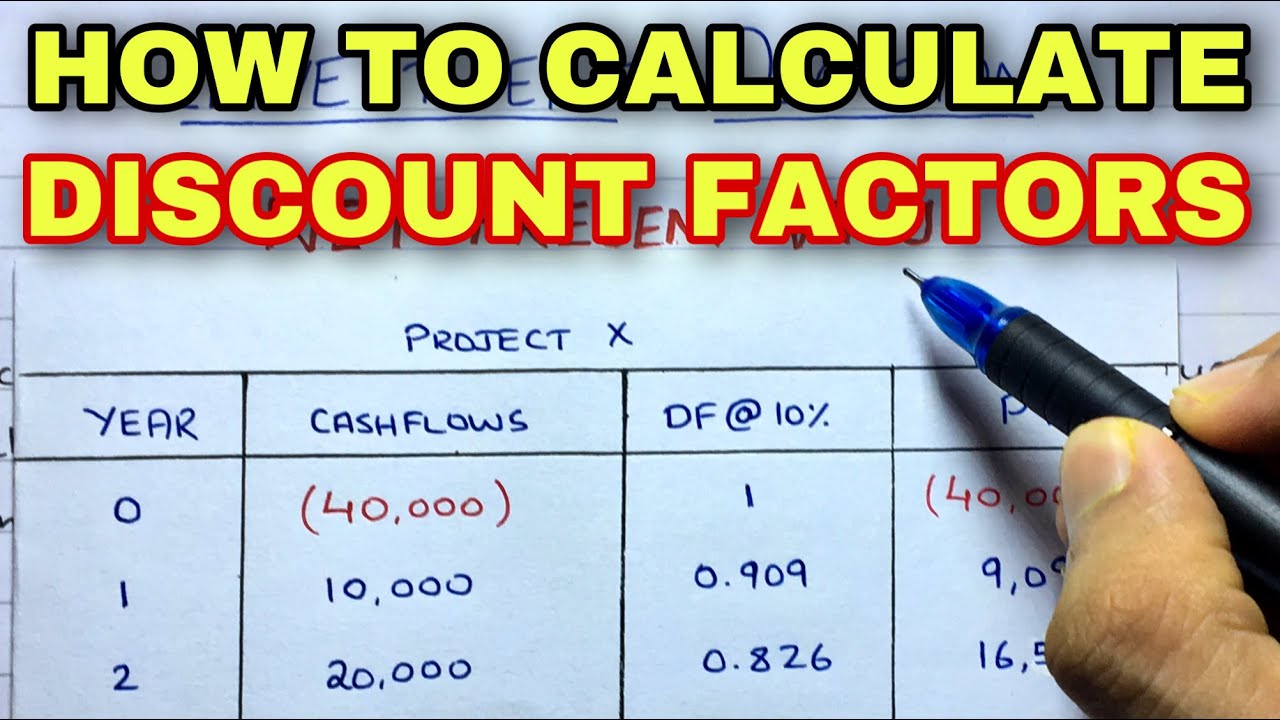

How to Calculate Discounting Factors? – Financial Management

Video

I Ranked the Best AI Tools to Make Money in 2026

✅ Get Your FREE AI Company Operating System here: https://go.danmartell.com/44Z7YRm

👥 Are you building an AI software company? Partner with me: https://go.danmartell.com/4qhrXmW

Not all AI tools are worth your time, or your money.

In this video, I rank the best and worst AI tools to help you actually get rich in 2026.

After testing 500+ tools across my companies, I’ll show you exactly which ones will 10x your income… and which ones aren’t worth the hype.

Tools mentioned:

Midjourney: https://www.midjourney.com/

Runway ML: https://runwayml.com/

ElevenLabs: https://elevenlabs.io/

HeyGen: https://www.heygen.com/

Gamma: https://gamma.app/

Leonardo AI: https://leonardo.ai/

Zapier: https://zapier.com/

Gumloop: https://www.gumloop.com/

n8n: https://n8n.io/

YourAtlas: https://youratlas.com/getstarted

Fyxer AI: https://www.fyxer.ai/

Notion AI: https://www.notion.so/product/ai

Buddy Pro AI: https://buddypro.ai/getstarted

Granola AI: https://www.granola.so/

ChatGPT: https://chat.openai.com/

Claude (Anthropic): https://www.anthropic.com/claude

Perplexity AI: https://www.perplexity.ai/

Gemini (Google): https://gemini.google.com/

NotebookLM: https://notebooklm.google/

Grok (xAI): https://x.ai/

Revio: https://www.getrevio.com/get-started

Lovable: https://lovable.dev/

Cursor AI: https://www.cursor.sh/

Apple Intelligence: https://www.apple.com/apple-intelligence/

▸▸ Subscribe to The Martell Method Newsletter: https://bit.ly/3XEBXez

▸▸ Get My New Book (Buy Back Your Time): https://bit.ly/3pCTG78

IG: @danmartell

source

Video

The First LGBT Divorce On Financial Audit

▶ *FREE TRIAL* To make our classes and budgeting app *more affordable*, we bundled them together for an *80% DISCOUNT* and for this month only, you can try DollarWise Central for *free* – check it out here and change your life: https://dollarwise.com/dollarwise-central/

▶▶ THEY ARE BEHIND ON THEIR TAXES— BOTH OF THEMMMMM WHAT THE F*CK THIS IS INSNAE. Become a Member to watch the post show: https://www.youtube.com/channel/UCLe_q9axMaeTbjN0hy1Z9xA/join And Watch Todays Post Show: https://youtu.be/dGcsIVsC2NM

▶▶▶Download the *DollarWise Budgeting App* today: *Apple:* https://apple.co/4iChGhr *Google Play:* https://bit.ly/sb-googleplay Don’t overcomplicate this crap! All you need is an automated / SIMPLE budget.

▶▶▶▶ *AND REMEMBER* those who sign up for DollarWise Premium *annual* get a signed version of the Cook Book, just submit proof of purchase here: https://tally.so/r/3xzPq5

Use Yrefy to refinance your private student loans today at: https://yrefy.com/hammer or call (888) Yrefy-78

Try ZipRecruiter FOR FREE at this exclusive web address: http://ZipRecruiter.com/CALEB

___________________________________________

▶EDUCATION:

1. Get your own free Hammer Financial Score: https://www.calebhammer.com

2. Get all of my educational programs for a much lower cost here, including the premium version of my budgeting app: https://dollarwise.com/dollarwise-central/

___________________________________________

▶RESOURCES

1. *I’VE MOVED MY INVESTMENTS TO WEBULL* do the same and transfer to my investing app of choice here: https://www.webull.com/k/Caleb and you get: *Cash bonus of $200 – $30,000* depending on initial funding amount, up to 8.1% APY, and up to 3.5% IRA Match.

2. Checking & Savings: Get up to $500^ before payday when you sign up and set up direct deposit. No credit check. No interest*. No mandatory fees: https://clickurl.ca/caleb-mypay

3. CourseCareers: Land a high-paying job with no experience or degree by going through an affordable online course https://coursecareers.com/CalebHammer

4. Get $20 from Acorns for free: sign up to get your bonus https://acorns.com/caleb

5. The credit building debit card: First 100,000 people to sign up for Fizz with code: HAMMER10 get $10: https://www.joinfizz.com/caleb (paid ad)

6. Helium Mobile: save a ton on your phone bill, sign up and get a FREE plan when using promo code CALEB https://hellohelium.com/

7. Online security: Protect your online privacy and security NOW and for free by following my link Aura: https://aura.com/hammer

8. Get an exclusive HighLevel 30-day trial: https://gohighlevel.com/calebhammer

___________________________________________

Chapters:

00:00 Intro

09:01 stop the CAP

19:29 girl is flabbergasted

34:00 oh the parents are D1 haters

46:44 OOF

01:01:18 what a joke

01:18:30 yiiiikes

01:30:29 Budget!!

___________________________________________

▶More Content

1. Financial Audit Follow-Ups here: https://www.youtube.com/@calebhammerclips

2. Caleb Hammer Livestreams: https://linktr.ee/calebhammerlive

3. Livestream Cutdown VODs: https://www.youtube.com/@livecalebhammer

___________________________________________

▶EXTRA

1. My socials: https://stan.store/calebhammer

2. Want to be a guest on Financial Audit? We film weekdays in our studio in Austin, Texas (in person only)! To apply, visit: http://calebhammer.com/apply

___________________________________________

▶*Some of the links and other products that appear in this video are from companies for which Caleb Hammer will earn an affiliate commission or referral bonus. This is not investment advice.

▶Sponsorship and business inquiries: business@calebhammer.com

source

Video

He’s so f*cked (I secretly brought in his wife) | Financial Audit

Go to my sponsor https://aura.com/hammer to try 14 days and let Aura go to work protecting your private information online! #sponsored

▶ *GET YOUR OWN HAMMER FINANCIAL SCORE* – Want to see where you stack against our guest? Get your free Hammer Financial Score: https://www.calebhammer.com

▶ *FREE TRIAL* To make our classes and budgeting app *more affordable*, we bundled them together for an *80% DISCOUNT* and for this month only, you can try DollarWise Central for *free* – check it out here and change your life: https://dollarwise.com/dollarwise-central/

▶▶ This post show is wild- I give her his phone to fully go through, and it gets juicy… watch here: https://www.youtube.com/channel/UCLe_q9axMaeTbjN0hy1Z9xA/join

▶▶▶Download the *DollarWise Budgeting App* today: *Apple:* https://apple.co/4iChGhr *Google Play:* https://bit.ly/sb-googleplay Don’t overcomplicate this crap! All you need is an automated / SIMPLE budget.

▶▶▶▶ *AND REMEMBER* those who sign up for DollarWise Premium *annual* get a signed version of the Cook Book, just submit proof of purchase here: https://tally.so/r/3xzPq5

Download the CFO’s guide to AI and Machine Learning for FREE at https://netsuite.com/HAMMER

Try it FOR FREE at this exclusive web address: https://ZipRecruiter.com/CALEB

▶▶▶▶▶Download the *DollarWise Budgeting App* today: *Apple:* https://apple.co/4iChGhr *Google Play:* https://bit.ly/sb-googleplay

▶▶▶▶▶▶ Watch this episode’s *POST* *SHOW* + get *MORE* Financial Audit here: https://www.youtube.com/channel/UCLe_q9axMaeTbjN0hy1Z9xA/join

___________________________________________

▶EDUCATION:

1. Get your own free Hammer Financial Score: https://www.calebhammer.com

2. Get all of my educational programs for a much lower cost here, including the premium version of my budgeting app: https://dollarwise.com/dollarwise-central/

___________________________________________

▶RESOURCES

1. *I’VE MOVED MY INVESTMENTS TO WEBULL* do the same and transfer to my investing app of choice here: https://www.webull.com/k/Caleb and you get: *Cash bonus of $200 – $30,000* depending on initial funding amount, up to 8.1% APY, and up to 3.5% IRA Match.

2. Checking & Savings: Get up to $500^ before payday when you sign up and set up direct deposit. No credit check. No interest*. No mandatory fees: https://clickurl.ca/caleb-mypay

3. CourseCareers: Land a high-paying job with no experience or degree by going through an affordable online course https://coursecareers.com/CalebHammer

4. Get $20 from Acorns for free: sign up to get your bonus https://acorns.com/caleb

5. The credit building debit card: First 100,000 people to sign up for Fizz with code: HAMMER10 get $10: https://www.joinfizz.com/caleb (paid ad)

6. Helium Mobile: save a ton on your phone bill, sign up and get a FREE plan when using promo code CALEB https://hellohelium.com/

7. Online security: Protect your online privacy and security NOW and for free by following my link Aura: https://aura.com/hammer

8. Get an exclusive HighLevel 30-day trial: https://gohighlevel.com/calebhammer

___________________________________________

Chapters:

00:00 Intro

08:04 oooo hes gonna be in trouuuuble

21:11 lol

33:41 the words and actions are not lining up..

45:12 but wait, theres more!!

01:00:22 this dude bruh

01:15:54 i didnt even know car washes had memberships lol

___________________________________________

▶More Content

1. Financial Audit Follow-Ups here: https://www.youtube.com/@calebhammerclips

2. Caleb Hammer Livestreams: https://linktr.ee/calebhammerlive

3. Livestream Cutdown VODs: https://www.youtube.com/@livecalebhammer

___________________________________________

▶EXTRA

1. My socials: https://stan.store/calebhammer

2. Want to be a guest on Financial Audit? We film weekdays in our studio in Austin, Texas (in person only)! To apply, visit: http://calebhammer.com/apply

___________________________________________

▶*Some of the links and other products that appear in this video are from companies for which Caleb Hammer will earn an affiliate commission or referral bonus. This is not investment advice.

▶Sponsorship and business inquiries: business@calebhammer.com

source

Video

Buy Feastables, Win Unlimited Money

Video

THE LARGEST XRP ACTIVATION JUST HAPPENED – MASSIVE GAME CHANGER

THE LARGEST XRP ACTIVATION JUST HAPPENED – MASSIVE GAME CHANGER

XRP News Today, Crypto News, Bitcoin News, Altcoin News, Ripple XRP Price, Ripple XRP Chart, Ripple SEC News

👉 Join FREE Discord (12,000+ members)

https://whop.com/cryptocrusaders/?pass=prod_kMpHoF9HbzFfO

💰 ITrustCapital ($100 Bonus)

https://www.itrustcapital.com/go/ncash

👉 Crypto Apparel

https://www.tokenizedthreads.com

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

NordVPN: https://go.nordvpn.net/aff_c?offer_id=15&aff_id=98794&url_id=902

DCENT Wallets:

Single Package: https://tinyurl.com/3nkyr8y9

2X Package: https://tinyurl.com/yk9kb5jx

Exchanges:

ByBit: https://partner.bybit.com/b/ncash

MEXC: https://bit.ly/3I4NsSG

Coinbase: https://bit.ly/3QXgU11

Uphold: https://bit.ly/3ONsmdu

MY SOCIALS:

Instagram: https://www.instagram.com/ncashofficial/

Twitter (X): https://x.com/NCashOfficial

TikTok: https://www.tiktok.com/@ncashofficial

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

Keywords: crypto, cryptocurrency, bitcoin, ethereum, blockchain, crypto trading, altcoins, btc, eth, cryptocurrency news, cryptocurrency trading, crypto news, bitcoin news, ethereum news, blockchain technology, crypto investing, bitcoin price, ethereum price, crypto analysis, crypto market, bitcoin trading, crypto tips, bitcoin investing, ethereum investing, crypto wallet, decentralized finance, defi, nft, non-fungible tokens, crypto mining, blockchain explained, crypto tutorial, bitcoin explained, ethereum explained, how to buy crypto, crypto exchange, coinbase, binance, crypto for beginners, crypto 2024, bitcoin prediction, crypto future, digital currency, crypto trends, blockchain future, smart contracts, crypto regulation, crypto updates, hodl, bitcoin halving, crypto bull run, crypto bear market, ico, initial coin offering, blockchain startups, crypto security, crypto scams, crypto hacks, crypto taxes, bitcoin wallet, ethereum wallet, crypto portfolio, crypto trading strategies, crypto market analysis, crypto investment strategy, blockchain applications, crypto finance, web3, metaverse, decentralized apps, dapps

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

LEGAL & REGULATORY DISCLAIMER

1. Channel Ownership & Purpose

This channel is operated by a legally registered business. All content shared is for informational and entertainment purposes only and reflects the views of the channel as an organization.

2. No Financial, Legal, or Tax Advice Provided

I am not a licensed financial advisor, attorney, or tax professional. Nothing presented here should be interpreted as financial, investment, legal, or tax advice. Always seek advice from qualified professionals before making any financial decisions.

3. Sponsorships & Affiliate Links

Some content may include sponsored material or affiliate links. I may receive a commission if you make a purchase or sign up through these links, at no extra cost to you. I only feature products or services I personally use or believe in. However, you are solely responsible for conducting your own research before engaging with any promoted product or service.

4. Geographic Limitations

This content is not directed at, nor intended for use by, individuals located in the United Arab Emirates, United Kingdom, United States, Canada, or any other jurisdiction where the marketing, promotion, or discussion of virtual assets is restricted or prohibited.

If you reside in such areas, please refrain from acting on or engaging with this content.

5. Cryptocurrency Risk Disclosure

Investing in cryptocurrencies involves significant risk, including but not limited to:

Complete loss of invested funds

High market volatility

Low liquidity

Irreversible transactions

Exposure to fraud, scams, or market manipulation

There is no guarantee of investor protection or legal recourse. Participation is entirely at your own risk.

6. No Guarantees or Assurances

I do not guarantee the accuracy, completeness, timeliness, or effectiveness of any strategies, opinions, or information shared. No profits, outcomes, or results are assured. All decisions and actions you take are your sole responsibility.

7. Content Subject to Change

The information provided may become outdated over time. I reserve the right to modify, update, or remove any content without prior notice.

8. EU MiCA & Canada Compliance Notice

In compliance with the EU Markets in Crypto-Assets Regulation (MiCA) and applicable Canadian regulations:

This content is not intended as financial promotion or investment advice under MiCA or Canadian law.

Crypto-assets discussed may not be appropriate for all investors and are not covered by deposit protection or investor compensation schemes in the EU or Canada.

Efforts are made to ensure that all statements are fair, balanced, and not misleading.

If you are located in the EU or Canada, please ensure your interaction with this content aligns with local legal and regulatory requirements.

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

Description Tags (Ignore)

#ripple #xrp #bitcoin

source

Video

Financial Advisors React to WILD Money Clips

Jump start your journey with our FREE financial resources: https://moneyguy.com/resources/

Reach your goals faster with our products: https://moneyguy.com/products/

Subscribe on YouTube for early access and go beyond the podcast: https://www.youtube.com/c/MoneyGuyShow?sub_confirmation=1

Connect with us on social media for more content: https://moneyguy.com/link-in-bio/

Take the relationship to the next level and become a client: https://moneyguy.com/become-a-client/

Bring confidence to your wealth building with simplified strategies from The Money Guy. Learn how to apply financial tactics that go beyond common sense and help you reach your money goals faster. Make your assets do the heavy lifting so you can quit worrying and start living a more fulfilled life.

source

Video

How To Create Your Financial Plan Easily ?

In this video, we’re going back to the basics.

It’s a practical walkthrough of how to manage your money from the ground up. From creating your emergency budget to understanding insurance, and starting your investment journey, this personal finance masterclass covers it all.

If you’re looking for clarity, structure, and real-world advice, this is where you start.

__________________________________________________________________________________

Get in Touch:

⏩ Email Us – support@finology.in

🌐 Website – https://www.finology.in/

📞 For queries, contact – 022-489-66660

_________________________________________________________________________________________

➡️ Finology’s Goal Planner: https://recipe.finology.in/

➡️ Join my WhatsApp channel: https://whatsapp.com/channel/0029Va8OXlYBVJl0V9G87p1O

➡️ Get Finology 30: https://tinyurl.com/finology-30-stocks

➡️Open your demat account on Zerodha: https://zerodha.com/open-account?c=ZMPXIG

➡️Buy Investonomy: https://amzn.to/4jkeM09

_________________________________________________________________________________________

Disclaimer: Mutual fund investments are subject to market risks. Read all scheme-related documents carefully before investing. This content is not investment advice or a recommendation. Past performance does not guarantee future results. Data, expense ratios, portfolio holdings, and riskometer classification can change. Viewers should do their own research and consult a registered investment adviser before investing.

Disclosure: Mr. Pranjal Kamra, the Director of Finology Ventures Private Limited, is a SEBI-registered investment Adviser with registration No: INA000012218. He further confirms that he does not hold any beneficial ownership, or interest in the securities discussed, nor has he received any compensation related to the views expressed.

source

Video

Middle class vs Rich people, mindset motivation #rich #money #loan

Business Loan rich people, middle class people, poor versus rich people, rich people mindset, money motivation, money business loan, Kesh Ambani, GAUTAM, Adani billionaires, millionaires, crorepati, Of India, rich people, Of India, rich kids, Of India, iPhone, new phones, new mobile phones, new iPhones, take loans to grow their business business loan, Home loan car loan, phone loan, phone EMI loan EMI

source

Video

Crypto Just Flipped – Trump Captures Venezuela’s Maduro

Buy, Sell, Trade Crypto (limited time):

✅ Bitunix (no kyc, $100,000 bonus): https://www.bitunix.com/register?vipCode=AltcoinDaily

🟡 50% deposit bonus on first $100 (sign up on WEEX): https://www.weex.com/events/welcome-event?vipCode=oz5p&qrType=activity

🎁 Altcoin Daily Merch:

https://m046hz-bk.myshopify.com

🟦 Start Trading on Polymarket (#1 Prediction Market): https://polymarket.com?via=altcoin-daily

🔵 Buy, Sell, & Trade Crypto on Coinbase:

https://advanced.coinbase.com/join/U5FN8P5

👉🔒 Get Ledger Wallet: Best Way to Keep your Crypto Safe!

https://www.ledger.com/?r=29fd4d75e9bc

🔴 Altcoin Daily in Spanish: https://www.youtube.com/@AltcoinDailyenEspanol

Follow Altcoin Daily on X: https://x.com/AltcoinDaily

Follow Altcoin Daily on Instagram: https://www.instagram.com/thealtcoindaily/

Video by Austin:

Follow Austin on Instagram: https://www.instagram.com/theaustinarnold/

Follow Austin on X: https://twitter.com/AustinArnol

TimeStamps:

00:00 Trump Captures Venezuela’s Maduro

02:12 Venezuela Explained

03:26 Bitcoin Just Flipped – What Comes Next?

***********************************************************************

#Bitcoin #Cryptocurrency #News #Ethereum #Invest #Metaverse #Crypto #Cardano #Binance #Chainlink #Polygon #Altcoin #Altcoins #DeFi #CNBC #Solana

***NOT FINANCIAL, LEGAL, OR TAX ADVICE! JUST OPINION! I AM NOT AN EXPERT! I DO NOT GUARANTEE A PARTICULAR OUTCOME I HAVE NO INSIDE KNOWLEDGE! YOU NEED TO DO YOUR OWN RESEARCH AND MAKE YOUR OWN DECISIONS! THIS IS JUST ENTERTAINMENT! USE ALTCOIN DAILY AS A STARTING OFF POINT!

Bitunix, WEEX, Binance are exchange partners for the channel.

Polymarket is a channel partner.

*The channel is not responsible for the performance of sponsors and affiliates.

Disclosures of Material holdings:

Most of my crypto portfolio is Bitcoin, then Ethereum, but I hold many cryptocurrencies, possibly ones discussed in this video.

Material holdings over $5000 (in no particular order): BTC, ETH, SOL, MINA, DOT, SUPER, XCAD, LINK, INJ, BICO, METIS, SIS, BNB, PMX, LMWR, WMTx, HEART, TET, PAID, BORG, COTI, ADA, ONDO, ESE, ZKL, SUPRA, CELL, CTA, COOKIE, RSC, ATH, TAO.

Altcoin Daily is an ambassador for XBorg, Supra, WMTx.

This information is what was found publicly on the internet. This information could’ve been doctored or misrepresented by the internet. All information is meant for public awareness and is public domain. This information is not intended to slander harm or defame any of the actors involved but to show what was said through their social media accounts. Please take this information and do your own research.

bitcoin, cryptocurrency, crypto, altcoins, altcoin daily, blockchain, best investment, top altcoins, altcoin, ethereum, best altcoin buys, bitcoin crash, xrp, cardano, 2026, ripple, buy bitcoin, buy ethereum, bitcoin prediction, cnbc crypto, bitcoin crash, cnbc, crypto news, crypto crash, crypto expert, best crypto, crypto today, bitcoin price, bitcoin crash, bitcoin ta, crypto buy now, crypto expert, bloomberg crypto, ethereum news, trading crypto, Trump, Captures, Venezuela, Maduro, oil, fox business crypto, Venezuela latest,

source

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports3 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business19 hours ago

Business19 hours agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World20 hours ago

Crypto World20 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”