Entertainment

Rep. Sara Jacobs Says Congress Is Basically Like High School

Rep. Sara Jacobs

High School Drama Never Ends … In Congress!!!

Published

TMZ.com

“You can’t sit with us” isn’t just a “Mean Girls” quote … it’s apparently a very real rule in Congress … and Rep. Sara Jacobs says she’s had to use it IRL!

TMZ caught up with the Democratic California congresswoman in Washington, D.C. on Thursday, and she spilled the tea on Capitol Hill being basically one giant high school … with cliques and cool kids and unofficial rules.

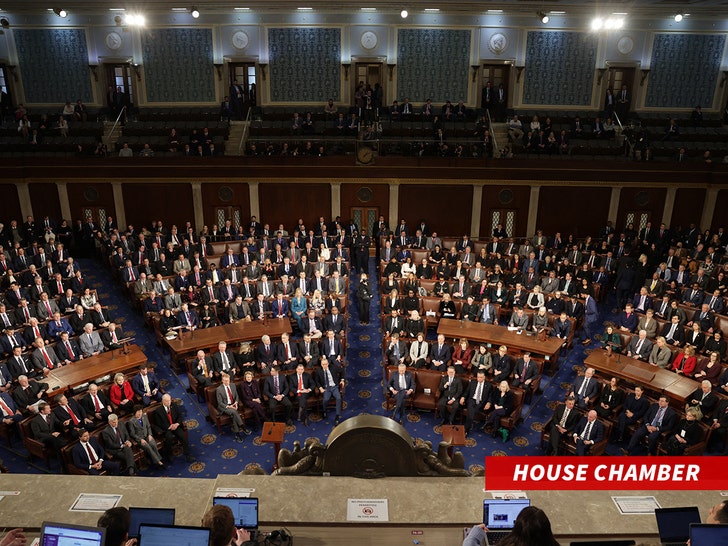

Watch the video … she takes us on the underground Congressional subway train and breaks down how the House floor’s lack of assigned seating doesn’t mean you can just plop down anywhere you like … because groups like “Penn Corner” and “California Row” already have their unofficial spots locked down like a school cafeteria.

Yeah, the rules are so strict she says she literally had to tell a newbie that very day to get up and move.

Sara goes full yearbook mode too, breaking down how Congress mirrors high school in every way — orientation for new members, lottery-style office assignments like dorm rooms, clubs to join, the whole deal. So if high school was your peak? Congrats … there’s a sequel on Capitol Hill!

Entertainment

“Survivor 50”'s Chrissy Hofbeck opens up about controversial season 35 finish and being bashed by previous cast

:max_bytes(150000):strip_icc():format(jpeg)/Survivor-50-Cover-Shoot-122225-10-7d586dfa86a04927a6495221500f499b.jpg)

“What I hate is that people say season 35 was a really good season until the finale, and then it sucked.”

Entertainment

President Trump Shares Racist Video of Michelle, Barack Obama as Apes

President Trump

Goes Apesh*t on the Obamas!!!

Published

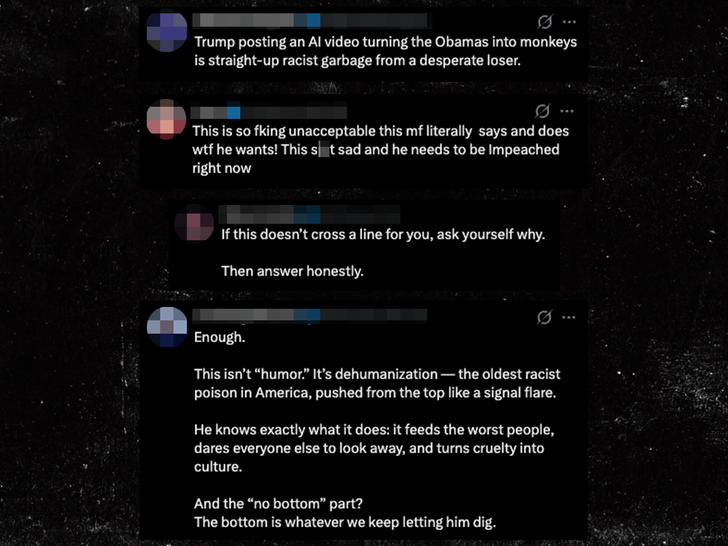

It’s no secret President Donald Trump and the Obamas don’t get along … but DT has now taken their bad vibes to a whole new level, posting a short video of Barack and Michelle depicted as apes.

Trump uploaded the shocking clip on his Truth Social platform Thursday night — and it begins with a voice speaking about alleged fraud in the 2020 presidential election. As you know, Trump lost to Joe Biden in the 2020 race, but Trump has always maintained the election was stolen from him.

Then the video cuts a brief scene showing Barack and Michelle’s heads superimposed on apes dancing in a jungle as The Tokens 1961 classic, “The Lion Sleeps Tonight,” plays in the background.

Karoline Leavitt addressed the clip in a statement to TMZ … “This is from an internet meme video depicting President Trump as the King of the Jungle and Democrats as characters from the Lion King. Please stop the fake outrage and report on something today that actually matters to the American public.”

Still, DT is getting ripped apart on social media for being racist, and California Governor Gavin Newsom is also getting in a few licks, calling the video “disgusting” and urging all Republicans to condemn it.

TMZ has reached out to the Obamas for comment … so far, no word back.

Entertainment

International Runway Model Cristina Pérez Galcenco Dead at 21

Cristina Pérez Galcenco

Global Runway Model Dead At 21

Published

Cristina Pérez Galcenco — a global runway model — has died at 21, according to media reports.

Galcenco’s body was discovered at her house in Malaga — a city in Spain — on February 3 … and her cause of death appeared to be natural, several outlets reported.

ABC — a Spanish newspaper — said Galcenco had moved to Malaga to enroll in a class at a school.

In the past few years, Galcenco had been strutting down catwalks from Madrid to Milan to Paris to London — as well as China.

She began her modeling career at just 14, hitting the runway at the Campoamor Fashion Show in the Spanish city of Oviedo.

Following her death, Campoamor’s organizers took to Instagram to post a photo and video celebrating her life.

As we said, Galcenco was only 21.

RIP

Entertainment

Milo Ventimiglia Speaks About Being a New Dad and Expecting Baby No 2

Milo Ventimiglia is getting candid about a massive year, which included losing his home in the L.A. fires, welcoming his first child with wife Jarah Mariano just two weeks later and now, expecting their second baby together.

Appearing on the Thursday, February 5 episode of Jimmy Kimmel Live!, Ventimiglia, 48, joked that he’d lost track of what day it was amid the chaos and that they “must be crazy” to go back to back with a second pregnancy.

“Got a beautiful daughter, she’s wonderful. What day is it?” Ventimiglia joked to host Kimmel, 58, as he shared details of how he was adjusting to fatherhood after welcoming daughter Ke’ala in January 2025. “Thursday, wonderful. It’s the same as Wednesday or Tuesday, yeah. They’re all the same. Monday, Tuesday, Thursday…”

After Kimmel asked whether Ke’ala was keeping the This is Us alum awake at night, Ventimiglia shared that while their daughter slept through until early hours of the morning, he and Mariano still fretted over her.

“She’s actually doing great, she’s sleeping through the night. She loves to wake up at 5.40 in the morning and talk to herself. Kinda jabber on and whatnot. My wife and I are laying in bed, like ‘Does she have her [pacifer]?’ ‘I don’t know, I can’t tell from the monitor.’ ‘Did she poop herself?’ ‘I don’t know, I can’t tell from the monitor,’” he recalled. “And then you’re kind of like, after a certain period of time, you know this. You walk in there, you’re like, well, she didn’t poop herself, and she’s got her [pacifier], so the world’s good.”

Ventimiglia also admitted that while he initially had grand plans to be a “wonderparent,” he was forced to take a step back and acknowledge the pair had faced a “hard and wonderful” year after losing their Malibu home and becoming first-time parents in a short period of time.

Jarah Mariano. Courtesy of Jarah Mariano/ Instagram

“Listen, my wife is the most unbelievable — Jarah, if you’re watching, you are the most unbelievable human being, creature, species of everything. She handles everything great. But you know, I mean, when you’re a first parent too, you kind of think you’re going to be this wonderparent,” he explained.

He continued, “I was striving to. I’m like, ‘Cool man, I’m going to be the healthiest, we’re going to feed this baby organic, we’re going to buy blenders, do all this stuff, we’re going to go argue with some dude named Kale about blueberries at the farmers’ market.’ Then after a while you’re like, ‘Oh, man, we had quite a year.’”

Ventimiglia was one of many celebrities and Californian residents who suffered the loss of their homes when fires wreaked havoc on the region last year. Mariano was heavily pregnant at the time and during his Kimmel appearance, Ventimiglia touched on the experience.

“If anybody doesn’t know, we lost our home in the fires in Malibu top of the year. It’s okay, it happened, thank you. Two weeks later, got the best blessing and our daughter was born. Six weeks later, on the road to do this movie that is coming out this month, I Can Only Imagine 2. Literally on the road,’” he said.

Joking that reality thwarted his super parent ambitions, Ventimiglia continued, “While you’re on the road you’re like, ‘Where’s my blender?’ It’s dawn. You’re not making organic foods anymore.”

After Kimmel trolled the Gilmore Girls alum about how much harder it will be to be a dad to two children, Ventimiglia also joked about being apprehensive about what’s on its way.

“You saw me hard swallow, right? I hard swallowed,” he remarked. “Now I know it’s coming. But at a certain point, don’t they start to entertain each other?”

Entertainment

Cruz Beckham Teams Up With Spice Girls For Sing-Along

Cruz Beckham is showing his support for mom Victoria Beckham courtesy of an impromptu sing-along of the 1998 hit song “Viva Forever,” with the Spice Girls themselves.

This is the latest in the three youngest Beckham siblings’ continued support for their parents, David and Victoria, amid the ongoing feud between the family and Brooklyn Beckham.

Article continues below advertisement

Cruz Beckham Teams Up With His Mom And The Spice Girls For A Sing-Along

In a video posted on Instagram, Cruz shared a look at himself playing the guitar, as Victoria and the Spice Girls (minus Mel B) sat around the table and sang a stripped-down version of the fan-favorite song, “Viva Forever.”

“I think I found my openers… you think they have potential? Something exciting coming later today 😉 keep an eye out and get involved,” Cruz captioned the video.

Cruz has always been a fan of his mother’s legendary pop star status, as evidenced back in 2023 when he got a “Posh” tattoo on his arm in honor of her Spice Girl moniker.

Article continues below advertisement

Victoria Beckham Has Been Spending Quality Time With The Spice Girls Recently

This is the second time in the last few weeks that Victoria has spent time with her Spice Girls group members, except for Mel B, who lives in Los Angeles.

In honor of Emma Bunton’s (Baby Spice) milestone 50th birthday, Victoria joined group members Geri Halliwell-Horner (Ginger Spice), and Melanie Chisholm (Mel C) on Saturday, January 24, for Bunton’s birthday bash

Victoria followed up the celebration on Sunday, January 25, by posting a photo on Instagram of the pop icons all together.

“Happy birthday to the most beautiful soul @emmaleebunton I love you girls so much @gerihalliwellhorner @melaniecmusic xxxxxxx,” she captioned the post.

David Beckham also couldn’t resist joining in on the special moment and left a sweet comment underneath the photo.

Article continues below advertisement

“This made me happy. I can only imagine how the Spice Girls fans feel @spicegirls @victoriabeckham special night celebrating Emma @emmaleebunton x,” he wrote.

Article continues below advertisement

The Beckham Family Presents Unity Amid Ongoing Tension With Brooklyn

Victoria was in the city to accept being appointed a Chevalier de l’Ordre des Arts et des Lettres (Knight of the Order of Arts and Letters) by the French Ministry of Culture. She was presented with the award for her significant contributions to fashion and culture.

During her acceptance speech, she thanked her family, who were in attendance to support her.

Article continues below advertisement

Brooklyn Beckham Has No Current Interest In Reconciliation With His Family

In addition to the shocking claims that Victoria “hijacked” the first dance at his wedding by dancing “inappropriately” and making him feel “uncomfortable” and “humiliated,” Brooklyn also alleged behind-the-scenes sabotage of his marriage and media manipulation.

“I have been silent for years and have made every attempt to keep these matters private,” Brooklyn wrote last month in a series of fiery posts.

“Unfortunately, my parents and their team have continued to go to the press, leaving me with no choice but to speak for myself and tell the truth about only some of the lies that have been printed,” he continued.

Brooklyn also made it very clear that he is not interested in mending fences with his family. “I do not want to reconcile with my family. I’m not being controlled, I’m standing up for myself for the first time in my life.”

Article continues below advertisement

Brooklyn’s Father-In-Law Recently Addressed The Family Feud

On February 3, during an appearance at the “WSJ Live Event,” Nelson Peltz, father of Brooklyn’s wife Nicola Peltz, addressed the drama between Brooklyn and his parents.

When asked about his daughter’s marriage, Peltz jokingly responded, “Has my family been in the press lately? I haven’t noticed that at all,” he said, according to PEOPLE.

“My advice is to stay the hell out of the press. How much good did that do?” he said when asked what advice he had given his family recently.

Peltz then addressed the Beckham family:

“My daughter and the Beckhams are a whole other story. That’s not for coverage here today, but I’ll tell you my daughter’s great, my son-law Brooklyn, is great, and I look forward to them having a long, happy marriage together.”

Entertainment

10 “Bridgerton” main cast members who left the series — and where they are now

:max_bytes(150000):strip_icc():format(jpeg)/Bridgerton-Rege-Jean-Page-Phoebe-Dynevor-Shelley-Conn-020426-b882562511e548cfb73f1bde9057d5fe.jpg)

“Bridgerton” has persevered as a Netflix favorite despite the departure of OG stars Regé-Jean Page and Phoebe Dynevor.

Entertainment

Kaley Cuoco Weighs in on Ashley Tisdale’s Toxic Mom Group Drama

Kaley Cuoco is sharing her two cents on Ashley Tisdale French’s “toxic mom group” drama.

Appearing on the Thursday, February 5 episode of Watch What Happens Live With Andy Cohen, the Big Bang Theory alum was asked via a fan question whether she had any thoughts on the viral parenting saga.

“I mean, if you don’t like being part of a group, just leave, baby,” Cuoco, 40, replied. “Do we have to talk about it?”

When host Cohen, 57, referenced Tisdale French’s The Cut essay and Substack post, both of which slammed her mom group, Cuoco doubled down on her belief that the public discourse surrounding the whole situation was unnecessary.

“You don’t have to do that. Just leave,” the actress, who shares daughter Matilda, 2, with Tom Pelphrey, said. Cuoco added, “Find a new group.”

In January, Tisdale French, 40, caused a stir when she exposed the dynamics of her mom group in a personal essay written for The Cut. In the piece, she called out the group as “toxic” and revealed she had ultimately quit it after feeling ostracized.

She did not mention any of the other moms involved by name, but Tisdale French frequently documented playdates with celebrities such as Meghan Trainor, Mandy Moore and Hilary Duff, each of whom have young children.

Kaley Cuoco and Ashley Tisdale in 2005. (Photo by Michael Bezjian/WireImage)

“I remember being left out of a couple of group hangs, and I knew about them because Instagram made sure it fed me every single photo and Instagram Story,” Tisdale French wrote. “I was starting to feel frozen out of the group, noticing every way that they seemed to exclude me. … I told myself it was all in my head, and it wasn’t a big deal. And yet, I could sense a growing distance between me and the other members of the group, who seemed to not even care that I wasn’t around much.”

Tisdale French described parting ways with the other mom by texting the group that it felt “too high school for me, and I don’t want to take part in it anymore.”

After fans pointed the finger at the famous mom group as being the one Tisdale French was referencing in the essay, her representative denied the speculation.

However, when Duff’s husband Matthew Coma, 38, uploaded a post mocking Tisdale French’s essay, it further fueled the fire and indicated that it was the celebrity group that included the Lizze Maguire star that Tisdale French had been talking about.

In his Instagram post, Coma took a swipe at the High School Musical star by sharing a fictional version of the article in The Cut.

“A mom group tell-all through a father’s eyes,” Koma’s article read. “When you’re the most self obsessed tone deaf person on earth, other moms tend to shift focus to their actual toddlers.”

Meanwhile, Cuoco is part of her own mom group. Following the headline-making drama surrounding Tisdale French’s mom group, Cuoco’s mom friends celebrated their own close connection.

“Mom groups are having a real moment on the interweb this week. Shoutout to my village, without whom I could be very lost and lonely,” Cuoco’s friend Ashley Jones wrote via Instagram on January 7, alongside several photos of their mom squad. “Tag your supportive ride or die mom group!”

Entertainment

$50,000 Offered For Return Of Nancy Guthrie

The Pima County Sheriff’s Department is now offering a $50,000 reward for the return of the 84-year-old, who disappeared from her home on January 31.

Article continues below advertisement

Police Offer Financial Reward For Nancy Guthrie’s Safe Return

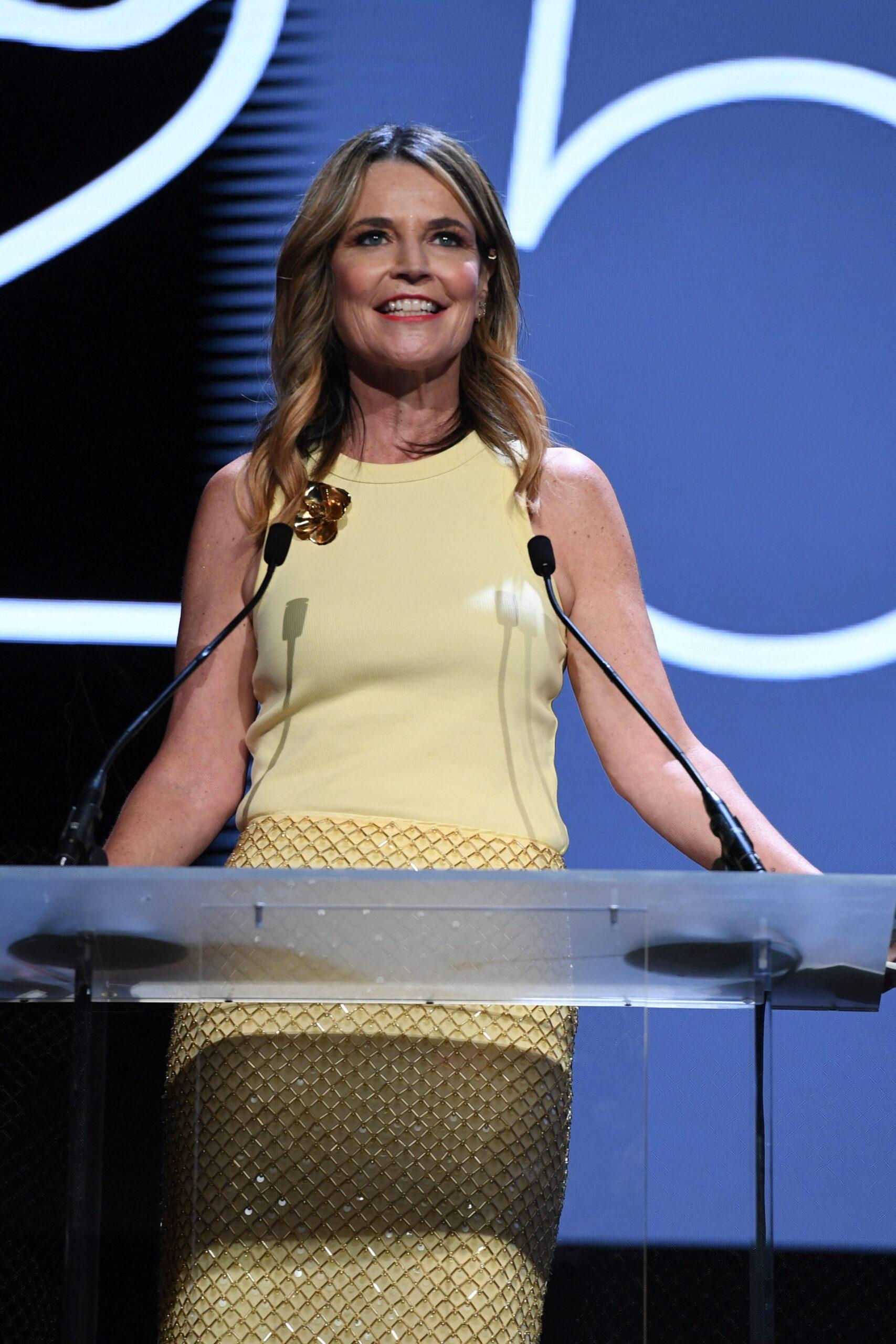

The Pima County Sheriff’s Department, in conjunction with the FBI, announced on Thursday, February 5, a $50,000 reward for the return of Nancy Guthrie, the mother of “Today” show co-host Savannah Guthrie, according to Variety.

Per the outlet, the reward is for any information leading to Nancy’s whereabouts and/or “the arrest and conviction of anyone involved in her disappearance,” according to FBI Special Agent in Charge Heith Janke.

“The FBI has agents, analysts and professional staff employees working day and night with our partners at the sheriff’s department,” Agent Janke said during a press briefing. “We have deployed additional intelligence and agents from our Phoenix office.”

Article continues below advertisement

Pima County Sheriff’s Department Recently Provided An Unfortunate Update In The Case

Chris Nanos, of the Pima County Sheriff’s Department, shared on Thursday that five days into the investigation into Nancy Guthrie’s disappearance there are still “no suspects.”

“At this time, we have not identified a suspect or a person of interest in this case,” Nanos said at the briefing, per Variety. “We are working our best to do that. To be clear: we have nobody of interest or any suspects that you would consider a prime suspect.”

“I have no clue where that comes from,” he clarified. “We have been very consistent — we are not discussing that at all, whether it’s forced entry or not forced entry.”

Article continues below advertisement

Savannah Guthrie Posted An Emotional Video Begging For Her Mother’s Return

In a video posted to Instagram, alongside her siblings Annie and Cameron, a visibly emotional Savannah pleaded for Nancy’s return.

“We too have heard the reports about a ransom letter in the media,” Savannah said in the video. “As a family, we are doing everything that we can. We are ready to talk. However, we live in a world where voices and images are easily manipulated. We need to know without a doubt that she is alive and that you have her. We want to hear from you and we are ready to listen. Please, reach out to us.”

“Mommy, if you are hearing this, you are a strong woman,” Savannah continued. “You are God’s precious daughter, Nancy. We believe and know that even in this valley He is with you.”

Article continues below advertisement

The “Today” show co-anchor also stressed that she and her family will not give up searching for her.

“Everyone is looking for you mommy, everywhere. We will not rest. Your children will not rest until we are together again. We speak to you every moment and we pray without ceasing and we rejoice in advance for the day that we hold you in our arms again. We love you,” she said.

Article continues below advertisement

NBC Announced Replacements For Savannah At The Winter Olympics Amid The Search

NBC confirmed on February 4, that Mary Carillo and Terry Gannon will host the 2026 Winter Olympics Opening Ceremony, while Ahmed Fahreed will host “Olympic Late Night,” as all three will take over duties from Guthrie, according to Entertainment Weekly.

“Our hearts go out to Savannah and the entire Guthrie family. They continue to have our full support,” Molly Solomon, executive producer/President of NBC Olympics Production, said in a statement announcing Guthrie’s replacements for the international sporting event.

Guthrie has been absent from the “Today” show since February 2, as she traveled to Arizona to join the search for her mother, who went missing on January 31.

A Ransom Note Surfaced Demanding Millions In Bitcoin For Nancy’s Return

On February 3, TMZ shared that a ransom note was sent to the outlet demanding millions in Bitcoin for Nancy’s safe return to her family.

TMZ sent the ransom note to the Pima County Sheriff’s Department after determining its authenticity.

Upon receipt, the sheriff’s department said they are “aware of reports circulating about possible ransom note(s) regarding the investigation into Nancy Guthrie” and “are taking all tips and leads very seriously.”

Entertainment

FBI Arrests ‘Imposter’ In Nancy Guthrie Case

Savannah Guthrie continues to search for her missing 84-year-old mother Nancy Guthrie, and as authorities call on the public for help, they have been confronted with an imposter.

The FBI recently revealed that an arrest has been made regarding an imposter, and the ransom note that was sent demanding millions in Bitcoin funds.

Article continues below advertisement

FBI Confirms Arrest Of Ransom Demand Imposter In Search For Nancy Guthrie

During a press briefing on Thursday, February 5, FBI Phoenix Special Agent in Charge Heith Janke confirmed the arrest of someone claiming to be involved in the disappearance of Nancy Guthrie, according to Us Weekly.

“We have made one arrest related to an imposter ransom demand, and a complaint will be presented to a magistrate judge later today,” Janke said at the briefing. “You will get more on that from the FBI and our U.S. Attorney’s office here in Arizona when it becomes available.”

“There’s no evidence to connect this to Nancy’s case. It was someone that was trying to profit off it,” Agent Janke added.

He then gave warning to those who may be inclined to present false information regarding the case in an attempt to collect reward money.

Article continues below advertisement

“My next message is to those imposters who are trying to take advantage and profit from this situation,” Janke said. “We will investigate and ensure you are held accountable for your actions. This is an 84-year-old grandma that needs vital medication for her wellbeing. You still have the time to do the right thing before this becomes a worse, much worse scenario for you.”

Article continues below advertisement

Authorities Offer Reward For The Safe Return Of Nancy Guthrie

Also during Thursday’s briefing, the Pima County Sheriff’s Department, in conjunction with the FBI, announced a $50,000 reward for the return of Nancy Guthrie, according to Variety.

The reward is for any information leading to Nancy’s whereabouts and/or “the arrest and conviction of anyone involved in her disappearance,” per Agent Janke.

“The FBI has agents, analysts and professional staff employees working day and night with our partners at the sheriff’s department,” Janke confirmed. “We have deployed additional intelligence and agents from our Phoenix office.”

Article continues below advertisement

Despite Ongoing Investigation Police Have ‘No Suspects’

Almost a full week since her disappearance on January 31, Chris Nanos of the Pima County Sheriff’s Department, provided the update that there are still “no suspects” in Nancy Guthrie’s disappearance.

“At this time, we have not identified a suspect or a person of interest in this case,” Nanos, per Variety. “We are working our best to do that. To be clear: we have nobody of interest or any suspects that you would consider a prime suspect.”

“I have no clue where that comes from,” he clarified. “We have been very consistent — we are not discussing that at all, whether it’s forced entry or not forced entry.”

Article continues below advertisement

Authorities Confirm Positive Match Of The Blood Found At The Crime Scene

According to PEOPLE, the FBI and the Pima County Sheriff’s Department have confirmed that the blood found on the exterior porch of Nancy’s Arizona home positively matches her DNA.

Earlier this week, authorities in the case previously labeled Nancy’s home as a crime scene after discovering what they described as “very concerning” conditions. They also said there has been “no proof of life” as of now.

Savannah Guthrie Posted A Video Plea For Her Mother’s Return

In an Instagram video, with her siblings Annie and Cameron, Savannah pleaded for her mother’s return.

“We too have heard the reports about a ransom letter in the media,” Savannah said in the video.

“As a family, we are doing everything that we can,” the “Today” show co-host said. “We are ready to talk. However, we live in a world where voices and images are easily manipulated. We need to know without a doubt that she is alive and that you have her. We want to hear from you and we are ready to listen. Please, reach out to us.”

“Mommy, if you are hearing this, you are a strong woman,” Savannah continued. “You are God’s precious daughter, Nancy. We believe and know that even in this valley He is with you.”

Entertainment

Guess Who These Brothers Turned Into!

Before these two cool bros turned into a pop rock duo, they were just runnin’ the concrete jungle, writing music at just 5 years old … and surrounded by acting and writing!

They were on Nickelodeon — both part of “The Naked Brothers Band.” One bro was the lead singer and guitarist, while the other played the drums …

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports4 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business20 hours ago

Business20 hours agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World20 hours ago

Crypto World20 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World19 hours ago

Crypto World19 hours agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation