Entertainment

The 16 best Korean movies on Netflix

:max_bytes(150000):strip_icc():format(jpeg)/netflix-best-korean-movies-020526-1-bd4b92f8b3184e2b893ebf893d94c83f.jpg)

The streamer carries K-dramas and tense thrillers in equal measure.

Entertainment

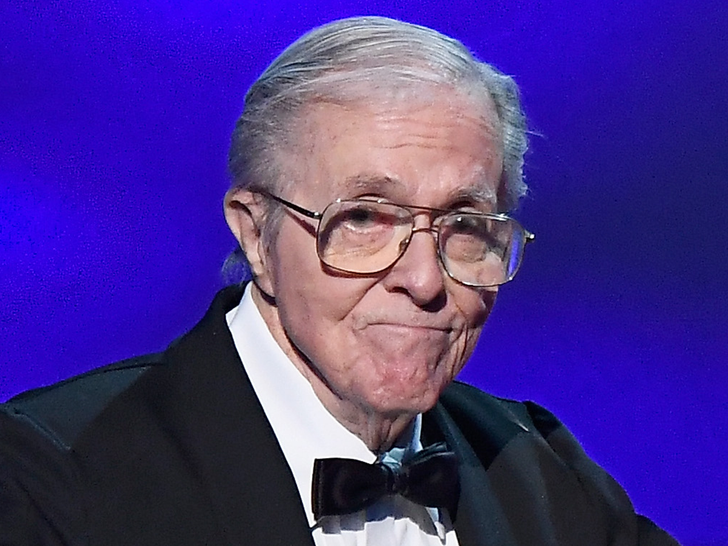

‘Will & Grace’ Bartender Charles C. Stevenson Jr. Dead at 95

Charles C. Stevenson Jr.

‘Will & Grace’ Bartender Dead at 95

Published

Charles C. Stevenson Jr. — the actor most famous for playing Smitty the bartender on “Will & Grace” — has died.

He died of natural causes on Jan. 19 in Camarillo, California, his son Scott confirmed to TMZ. Variety was first to report the news.

Aside from playing the beloved barman, Stevenson was known for portraying preachers, priests, and pastors in supporting roles throughout his decades-long career.

He is also recognized for his role as Sheriff Ryan in the 2008 Disney movie “Snow Buddies.” Other notable projects include “Murder, She Wrote,” “The Middle,” “My Name is Earl,” “Men in Black,” “Glee,” “Ghost World,” and “Pleasantville.”

Scott tells TMZ his father “had a blast every minute” of his career and said he was “proud to have been part of such a landmark show [‘Will & Grace’] and very happy to have made a lot of people laugh.”

He added … “I’m sure that if time hadn’t caught up with him he’d still be out there heading to casting calls, ready for another role to play and for a few more punch lines to deliver.”

Interestingly, Stevenson didn’t start acting until the 1980s, after he graduated from UC Berkeley with a degree in English and served in the Navy during the Korean War. He lived in Los Angeles for about 20 years, working on public service announcements and event coordination for Hollywood bigwigs such as Henry Winkler before jumping in front of the camera himself.

He is survived by 2 children — Charles III and Valerie — from his first marriage to Barbara Keller, and 3 kids — Catherine, Scott and William — from his marriage to Joy Stevenson. He is also survived by 8 grandchildren and 6 great-grandchildren.

He was 95.

RIP

Entertainment

10 Hilarious Sitcoms That Ended Before They Got Bad

For as long as television has been part of our lives, situation comedy, or what we call sitcoms, has been a staple of programming that has long made light of our normal, banal lives. Unlike stretch comedy, the sitcom allows us to watch as our protagonists engage in humorous situations week-to-week, often with a message that follows behind it.

Over the years, we have been treated to some of the best that the sitcom genre has to offer, but oftentimes, these types of shows have been notorious for overstaying their welcome. True, shows in other genres have a tendency to do this as well, going stale when it should have ended on a fresh note, but none have had as many examples of this as sitcoms have. So, we want to turn this somber premise on its head and give you the most hilarious sitcoms that, thankfully, ended right before they started to go past their sell-by date. So, without further ado, let’s dive in.

10

‘Arrested Development’ (2003–2006, 2013–2019)

We look back fondly on Fox’s Arrested Development because it’s a show that ended at exactly the right time. Created by Mitchell Hurwitz, Arrested Development was a masterclass in how to do absurdist humor in a primetime format. The sitcom follows the Bluth family, an extremely wealthy bunch who live very extravagant lifestyles. But when the patriarch of the family, George Bluth St. (Jeffrey Tambor), is arrested, the family loses their wealth, but they still try to live the lives they’ve always known, much to the chagrin of Michael Bluth (Jason Bateman), who desperately tries to keep his family together.

There is little question that Arrested Development was ahead of its time, being the pioneers of the “mockumentary” style that would become more prevalent in the 2010s. Not only that, but the writing and comedic performances were simply top-notch. But absurdist humor does have a shelf life, and thankfully, Arrested Development ended before things went off the rails.

This is such an underrated sitcom, a show that should be more beloved than it actually is. Community brought together a wide range of great comedic actors and made sitcom gold that didn’t feel like it was overstaying its welcome. Created by Dan Harmon, the show follows Jeff Winger (Joel McHale), who winds up being disbarred and suspended from his law firm after it turned out he was lying about getting his degree from Columbia University. To get that degree, he enrolls in a community college in Colorado and meets a class full of eccentric classmates.

Community is so beloved because it uses the “high-concept” model to absolute perfection. While episodes themed around such absurd plotlines, such as a paintball war, could have easily been seen as shameless slapstick, Community elevated these storylines to an art form, making them hilarious, and also quite crucial to the overall vibe of the sitcom. Community ended in a satisfying way, and it didn’t need to go beyond six seasons. Instead of remembering its downfall, we remember Community for the high-concept comedy it brought us week-after-week.

8

‘My Name is Earl’ (2005–2009)

There are plenty of people who believe in good karma, but Earl Hickey (Jason Lee) took this belief to another level entirely. The central premise of the underrated sitcom My Name Is Earl follows Earl, a small-time thief who, after losing a winning lottery ticket, becomes convinced that he has to turn his life around in order to be the best version of himself. How does he do it? By believing in the power of karma.

Much like Community, if My Name Is Earl was spearheaded by a showrunner who never got the overall premise, this sitcom would have gone bad in a hurry. But series creator Greg Garcia knew what this show could be, and, thankfully, NBC knew how long they could keep a show like this going. There are only so many bad deeds that Earl could fix, and stretching this series beyond its four-season run would have been overkill, with the series turning into slapstick comedy and situations to make things work.

7

‘A Different World’ (1987–1993)

With Black sitcoms focusing more on the success of African Americans, the late 1980s was the right time to look at the rising popularity of Historical Black Colleges and Universities (HBCUs). In 1987, NBC greenlighted a spin-off of The Cosby Show titled A Different World, which initially follows Denise Huxtable (Lisa Bonet) as she goes to her father’s alma mater, Hillman College.

A Different World would later go on to showcase the different personalities that made up Hillman after Debbie Allen took over as Executive Producer, allowing the show to thrive as a socially responsible sitcom. The issues drove the storylines of each episode of the sitcom, and the show had a deeper impact on higher education, with HBCUs gaining the respect that these institutions long deserved. A Different World was the right sitcom at the time, with the right timeframe, as you can only focus on a college for so long without going to great lengths to tell its story, which would have meant degrading the vibe that it worked so hard to build.

6

‘One Day at a Time’ (2017–2020)

In 1975, the late Norman Lear developed the sitcom One Day at a Time, which told the story of a divorced mother looking to rebuild her life in the big city of Indianapolis. 33 years after the initial series ended, developers Gloria Calderón Kellett and Mike Royce had the idea of rebooting that underrated classic for the modern era, and they hit it out of the park.

The re-tooled One Day at a Time follows Penelope Alverez (Justina Machado), an Army Nurse Corps veteran who struggles to return to civilian life. Not only does she have to deal with PTSD, but she has to do this while taking care of her kids. This could have been a flop, but the premise was very interesting, and the show had emotional heart to go along with the comedy. The show ended after four seasons, but that isn’t a bad thing, as it fell into the rut of running out of ideas, which would have strangled the overall message the series wanted to give to its viewers.

5

‘New Girl’ (2011–2018)

The 2010s were a particularly rough time for millennials. The economy was in bad shape, which meant the job prospects for those entering the workforce were bleak. So, we turned to our friends to get us through those dark times. That’s what makes Fox’s New Girl one of the 2010s’ best sitcoms.

Created by Elizabeth Meriweather, New Girl stars Zooey Deschanel as Jessica “Jess” Day, a school teacher who moves into a huge loft with three guys. With the show centered around Jess’ quirky personality, New Girl was a very enduring show that was comfortable to watch in the dark, cold economic climate that hung over the decade. This was a group of people who refused to grow up, and until they had to, and the series ended on the note that it was finally time to move on from their perpetual adolescence. Had the series gone on any longer, New Girl would certainly have run out of ideas, and we would be speaking of the show as a good one that went on longer than it should. Thankfully, we don’t have to think about it in that light.

4

‘Atlanta’ (2016–2022)

Some may question what Atlanta is here, but at its heart, the FX series is a sitcom, just not in the traditional sense. Created by Donald Glover, who rose in star power with NBC’s Community, the series follows Earn (Glover) in his daily life in a surreal version of Atlanta, Georgia. And by surreal, we do mean every letter of the word.

Atlanta was delightfully weird, but this surreal nature had a message to it, which allowed the show to talk about strong topics such as race, poverty, and celebrity culture without having to keep things PG-13. Atlanta was groundbreaking in its comedy and commentary, but after the underwhelming Season 3, it was evident that this show had a shelf life. Thankfully, the showrunners saw this too, and the series ended on a satisfying note in Season 4. Sure, the ending had more questions than answers, but that was the entire point.

3

‘Cheers’ (1982–1993)

Sometimes, you want to go where everybody knows your name, and for 11 seasons, that’s exactly where viewers went in the iconic NBC sitcom Cheers. The premise of Cheers was simple. It followed a former baseball pitcher, Sam Malone (Ted Danson), who owns and runs Cheers, a bar in Boston, and the patrons who frequented the bar.

While romance was a big part of the overall storyline, the main focus was on the bar itself and how it acts as a social institution within the neighborhood. With a premise as straightforward as Cheers, this show could easily have run for 15-plus seasons, but after Diane Chambers (Shelly Long) left after Season 5, the signs were there that this premise could not last for very long without its central couple. Sure, Cheers should have ended after Season 7, but there were still some great moments up until its finale in Season 11. Anything longer, and this beloved groundbreaking sitcom would have definitely overstayed its welcome, without a doubt.

2

’30 Rock’ (2006–2013)

There is no question about it, Tina Fey is a comedic genius. This was showcased during her time on Saturday Night Live, and looking to tell the story of her experience as a head writer on the iconic NBC sketch comedy series, she created 30 Rock, which looks at a fictional sketch comedy show that was airing on NBC.

The title 30 Rock refers to the address of NBC’s headquarters in New York, and Fey’s comedic writing was sharp as a tack. Fey is an expert when it comes to writing satirical, self-referential scripts, and nowhere was this stance put to good use than on 30 Rock. But even a show like this has its limits, and the cracks began to show late in Season 6, displaying that it was time for 30 Rock to come to an end, which it did after Season 7.

1

‘The Fresh Prince of Bel-Air’ (1990–1996)

Let’s be honest for a second, Will Smith didn’t have to go into acting. By the end of the 1980s, he had firmly made a name for himself as a hip-hop artist, winning Grammy Awards and pumping out hit albums. But Quincy Jones and Benny Medina had an idea, one that would change Smith’s life forever.

In 1990, NBC premiered The Fresh Prince of Bel-Air, which followed a fictionalized version of himself after he moved from West Philadelphia to the wealthy Los Angeles enclave of Bel-Air to live with his uncle (James Avery) and his family. While The Fresh Prince of Bel-Air hit all the sitcom tropes, it also dealt remarkably well with serious topics, especially child abandonment, which was the focus of one of the most emotionally powerful moments in television history. Acting as a fictional re-telling of Smith’s life, there were only so many seasons that this show could run without it becoming stale, and once the story was told, the show wrapped instead of extending it even further.

Entertainment

Jessie Buckley shares her personal “The Bride! ”playlist of songs that inspired her performance (exclusive)

:max_bytes(150000):strip_icc():format(jpeg)/The-Bride-Cover-Stills-020226-06-bea29dc53683481e82c592d718f6f29b.jpg)

Listen to her curated “Bridezilla” Spotify playlist shared exclusively with EW.

Entertainment

“Survivor 50”'s Chrissy Hofbeck opens up about controversial season 35 finish and being bashed by previous cast

:max_bytes(150000):strip_icc():format(jpeg)/Survivor-50-Cover-Shoot-122225-10-7d586dfa86a04927a6495221500f499b.jpg)

“What I hate is that people say season 35 was a really good season until the finale, and then it sucked.”

Entertainment

President Trump Shares Racist Video of Michelle, Barack Obama as Apes

President Trump

Goes Apesh*t on the Obamas!!!

Published

It’s no secret President Donald Trump and the Obamas don’t get along … but DT has now taken their bad vibes to a whole new level, posting a short video of Barack and Michelle depicted as apes.

Trump uploaded the shocking clip on his Truth Social platform Thursday night — and it begins with a voice speaking about alleged fraud in the 2020 presidential election. As you know, Trump lost to Joe Biden in the 2020 race, but Trump has always maintained the election was stolen from him.

Then the video cuts a brief scene showing Barack and Michelle’s heads superimposed on apes dancing in a jungle as The Tokens 1961 classic, “The Lion Sleeps Tonight,” plays in the background.

Karoline Leavitt addressed the clip in a statement to TMZ … “This is from an internet meme video depicting President Trump as the King of the Jungle and Democrats as characters from the Lion King. Please stop the fake outrage and report on something today that actually matters to the American public.”

Still, DT is getting ripped apart on social media for being racist, and California Governor Gavin Newsom is also getting in a few licks, calling the video “disgusting” and urging all Republicans to condemn it.

TMZ has reached out to the Obamas for comment … so far, no word back.

Entertainment

International Runway Model Cristina Pérez Galcenco Dead at 21

Cristina Pérez Galcenco

Global Runway Model Dead At 21

Published

Cristina Pérez Galcenco — a global runway model — has died at 21, according to media reports.

Galcenco’s body was discovered at her house in Malaga — a city in Spain — on February 3 … and her cause of death appeared to be natural, several outlets reported.

ABC — a Spanish newspaper — said Galcenco had moved to Malaga to enroll in a class at a school.

In the past few years, Galcenco had been strutting down catwalks from Madrid to Milan to Paris to London — as well as China.

She began her modeling career at just 14, hitting the runway at the Campoamor Fashion Show in the Spanish city of Oviedo.

Following her death, Campoamor’s organizers took to Instagram to post a photo and video celebrating her life.

As we said, Galcenco was only 21.

RIP

Entertainment

Milo Ventimiglia Speaks About Being a New Dad and Expecting Baby No 2

Milo Ventimiglia is getting candid about a massive year, which included losing his home in the L.A. fires, welcoming his first child with wife Jarah Mariano just two weeks later and now, expecting their second baby together.

Appearing on the Thursday, February 5 episode of Jimmy Kimmel Live!, Ventimiglia, 48, joked that he’d lost track of what day it was amid the chaos and that they “must be crazy” to go back to back with a second pregnancy.

“Got a beautiful daughter, she’s wonderful. What day is it?” Ventimiglia joked to host Kimmel, 58, as he shared details of how he was adjusting to fatherhood after welcoming daughter Ke’ala in January 2025. “Thursday, wonderful. It’s the same as Wednesday or Tuesday, yeah. They’re all the same. Monday, Tuesday, Thursday…”

After Kimmel asked whether Ke’ala was keeping the This is Us alum awake at night, Ventimiglia shared that while their daughter slept through until early hours of the morning, he and Mariano still fretted over her.

“She’s actually doing great, she’s sleeping through the night. She loves to wake up at 5.40 in the morning and talk to herself. Kinda jabber on and whatnot. My wife and I are laying in bed, like ‘Does she have her [pacifer]?’ ‘I don’t know, I can’t tell from the monitor.’ ‘Did she poop herself?’ ‘I don’t know, I can’t tell from the monitor,’” he recalled. “And then you’re kind of like, after a certain period of time, you know this. You walk in there, you’re like, well, she didn’t poop herself, and she’s got her [pacifier], so the world’s good.”

Ventimiglia also admitted that while he initially had grand plans to be a “wonderparent,” he was forced to take a step back and acknowledge the pair had faced a “hard and wonderful” year after losing their Malibu home and becoming first-time parents in a short period of time.

Jarah Mariano. Courtesy of Jarah Mariano/ Instagram

“Listen, my wife is the most unbelievable — Jarah, if you’re watching, you are the most unbelievable human being, creature, species of everything. She handles everything great. But you know, I mean, when you’re a first parent too, you kind of think you’re going to be this wonderparent,” he explained.

He continued, “I was striving to. I’m like, ‘Cool man, I’m going to be the healthiest, we’re going to feed this baby organic, we’re going to buy blenders, do all this stuff, we’re going to go argue with some dude named Kale about blueberries at the farmers’ market.’ Then after a while you’re like, ‘Oh, man, we had quite a year.’”

Ventimiglia was one of many celebrities and Californian residents who suffered the loss of their homes when fires wreaked havoc on the region last year. Mariano was heavily pregnant at the time and during his Kimmel appearance, Ventimiglia touched on the experience.

“If anybody doesn’t know, we lost our home in the fires in Malibu top of the year. It’s okay, it happened, thank you. Two weeks later, got the best blessing and our daughter was born. Six weeks later, on the road to do this movie that is coming out this month, I Can Only Imagine 2. Literally on the road,’” he said.

Joking that reality thwarted his super parent ambitions, Ventimiglia continued, “While you’re on the road you’re like, ‘Where’s my blender?’ It’s dawn. You’re not making organic foods anymore.”

After Kimmel trolled the Gilmore Girls alum about how much harder it will be to be a dad to two children, Ventimiglia also joked about being apprehensive about what’s on its way.

“You saw me hard swallow, right? I hard swallowed,” he remarked. “Now I know it’s coming. But at a certain point, don’t they start to entertain each other?”

Entertainment

Cruz Beckham Teams Up With Spice Girls For Sing-Along

Cruz Beckham is showing his support for mom Victoria Beckham courtesy of an impromptu sing-along of the 1998 hit song “Viva Forever,” with the Spice Girls themselves.

This is the latest in the three youngest Beckham siblings’ continued support for their parents, David and Victoria, amid the ongoing feud between the family and Brooklyn Beckham.

Article continues below advertisement

Cruz Beckham Teams Up With His Mom And The Spice Girls For A Sing-Along

In a video posted on Instagram, Cruz shared a look at himself playing the guitar, as Victoria and the Spice Girls (minus Mel B) sat around the table and sang a stripped-down version of the fan-favorite song, “Viva Forever.”

“I think I found my openers… you think they have potential? Something exciting coming later today 😉 keep an eye out and get involved,” Cruz captioned the video.

Cruz has always been a fan of his mother’s legendary pop star status, as evidenced back in 2023 when he got a “Posh” tattoo on his arm in honor of her Spice Girl moniker.

Article continues below advertisement

Victoria Beckham Has Been Spending Quality Time With The Spice Girls Recently

This is the second time in the last few weeks that Victoria has spent time with her Spice Girls group members, except for Mel B, who lives in Los Angeles.

In honor of Emma Bunton’s (Baby Spice) milestone 50th birthday, Victoria joined group members Geri Halliwell-Horner (Ginger Spice), and Melanie Chisholm (Mel C) on Saturday, January 24, for Bunton’s birthday bash

Victoria followed up the celebration on Sunday, January 25, by posting a photo on Instagram of the pop icons all together.

“Happy birthday to the most beautiful soul @emmaleebunton I love you girls so much @gerihalliwellhorner @melaniecmusic xxxxxxx,” she captioned the post.

David Beckham also couldn’t resist joining in on the special moment and left a sweet comment underneath the photo.

Article continues below advertisement

“This made me happy. I can only imagine how the Spice Girls fans feel @spicegirls @victoriabeckham special night celebrating Emma @emmaleebunton x,” he wrote.

Article continues below advertisement

The Beckham Family Presents Unity Amid Ongoing Tension With Brooklyn

Victoria was in the city to accept being appointed a Chevalier de l’Ordre des Arts et des Lettres (Knight of the Order of Arts and Letters) by the French Ministry of Culture. She was presented with the award for her significant contributions to fashion and culture.

During her acceptance speech, she thanked her family, who were in attendance to support her.

Article continues below advertisement

Brooklyn Beckham Has No Current Interest In Reconciliation With His Family

In addition to the shocking claims that Victoria “hijacked” the first dance at his wedding by dancing “inappropriately” and making him feel “uncomfortable” and “humiliated,” Brooklyn also alleged behind-the-scenes sabotage of his marriage and media manipulation.

“I have been silent for years and have made every attempt to keep these matters private,” Brooklyn wrote last month in a series of fiery posts.

“Unfortunately, my parents and their team have continued to go to the press, leaving me with no choice but to speak for myself and tell the truth about only some of the lies that have been printed,” he continued.

Brooklyn also made it very clear that he is not interested in mending fences with his family. “I do not want to reconcile with my family. I’m not being controlled, I’m standing up for myself for the first time in my life.”

Article continues below advertisement

Brooklyn’s Father-In-Law Recently Addressed The Family Feud

On February 3, during an appearance at the “WSJ Live Event,” Nelson Peltz, father of Brooklyn’s wife Nicola Peltz, addressed the drama between Brooklyn and his parents.

When asked about his daughter’s marriage, Peltz jokingly responded, “Has my family been in the press lately? I haven’t noticed that at all,” he said, according to PEOPLE.

“My advice is to stay the hell out of the press. How much good did that do?” he said when asked what advice he had given his family recently.

Peltz then addressed the Beckham family:

“My daughter and the Beckhams are a whole other story. That’s not for coverage here today, but I’ll tell you my daughter’s great, my son-law Brooklyn, is great, and I look forward to them having a long, happy marriage together.”

Entertainment

10 “Bridgerton” main cast members who left the series — and where they are now

:max_bytes(150000):strip_icc():format(jpeg)/Bridgerton-Rege-Jean-Page-Phoebe-Dynevor-Shelley-Conn-020426-b882562511e548cfb73f1bde9057d5fe.jpg)

“Bridgerton” has persevered as a Netflix favorite despite the departure of OG stars Regé-Jean Page and Phoebe Dynevor.

Entertainment

Kaley Cuoco Weighs in on Ashley Tisdale’s Toxic Mom Group Drama

Kaley Cuoco is sharing her two cents on Ashley Tisdale French’s “toxic mom group” drama.

Appearing on the Thursday, February 5 episode of Watch What Happens Live With Andy Cohen, the Big Bang Theory alum was asked via a fan question whether she had any thoughts on the viral parenting saga.

“I mean, if you don’t like being part of a group, just leave, baby,” Cuoco, 40, replied. “Do we have to talk about it?”

When host Cohen, 57, referenced Tisdale French’s The Cut essay and Substack post, both of which slammed her mom group, Cuoco doubled down on her belief that the public discourse surrounding the whole situation was unnecessary.

“You don’t have to do that. Just leave,” the actress, who shares daughter Matilda, 2, with Tom Pelphrey, said. Cuoco added, “Find a new group.”

In January, Tisdale French, 40, caused a stir when she exposed the dynamics of her mom group in a personal essay written for The Cut. In the piece, she called out the group as “toxic” and revealed she had ultimately quit it after feeling ostracized.

She did not mention any of the other moms involved by name, but Tisdale French frequently documented playdates with celebrities such as Meghan Trainor, Mandy Moore and Hilary Duff, each of whom have young children.

Kaley Cuoco and Ashley Tisdale in 2005. (Photo by Michael Bezjian/WireImage)

“I remember being left out of a couple of group hangs, and I knew about them because Instagram made sure it fed me every single photo and Instagram Story,” Tisdale French wrote. “I was starting to feel frozen out of the group, noticing every way that they seemed to exclude me. … I told myself it was all in my head, and it wasn’t a big deal. And yet, I could sense a growing distance between me and the other members of the group, who seemed to not even care that I wasn’t around much.”

Tisdale French described parting ways with the other mom by texting the group that it felt “too high school for me, and I don’t want to take part in it anymore.”

After fans pointed the finger at the famous mom group as being the one Tisdale French was referencing in the essay, her representative denied the speculation.

However, when Duff’s husband Matthew Coma, 38, uploaded a post mocking Tisdale French’s essay, it further fueled the fire and indicated that it was the celebrity group that included the Lizze Maguire star that Tisdale French had been talking about.

In his Instagram post, Coma took a swipe at the High School Musical star by sharing a fictional version of the article in The Cut.

“A mom group tell-all through a father’s eyes,” Koma’s article read. “When you’re the most self obsessed tone deaf person on earth, other moms tend to shift focus to their actual toddlers.”

Meanwhile, Cuoco is part of her own mom group. Following the headline-making drama surrounding Tisdale French’s mom group, Cuoco’s mom friends celebrated their own close connection.

“Mom groups are having a real moment on the interweb this week. Shoutout to my village, without whom I could be very lost and lonely,” Cuoco’s friend Ashley Jones wrote via Instagram on January 7, alongside several photos of their mom squad. “Tag your supportive ride or die mom group!”

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports5 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business21 hours ago

Business21 hours agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World21 hours ago

Crypto World21 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World20 hours ago

Crypto World20 hours agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know