Entertainment

Guess Who These Brothers Turned Into!

Before these two cool bros turned into a pop rock duo, they were just runnin’ the concrete jungle, writing music at just 5 years old … and surrounded by acting and writing!

They were on Nickelodeon — both part of “The Naked Brothers Band.” One bro was the lead singer and guitarist, while the other played the drums …

Entertainment

Taylor Sheridan’s Most Expensive Show Is at Risk of Being Forgotten

Taylor Sheridan is responsible for some of the greatest neo-Westerns and traditional Westerns to have been released. He began his career over 10 years ago with his work on Sicario, and after releasing several other critically acclaimed Western thrillers, he kicked off a television empire with the release of Kevin Costner’s Yellowstone. Not only did Yellowstone spawn several spin-offs that have already been released and countless more on the way, but it also established Sheridan as the most sought-after scribe in television. At this point, he’s earned a blank check from Paramount or any other studio to work on any movie or TV series.

The first Yellowstone spinoff, 1883, arrived several years ago. It’s over 100 years before the events of the flagship series, and it stars Tim McGraw and Faith Hill. It ran for only one season on Paramount+. The second Yellowstone spinoff came in the form of 1923, which stars Harrison Ford and Helen Mirren. Brandon Sklenar also made his breakout debut in 1923, and now he can be seen starring opposite Amanda Seyfried and Sydney Sweeney in The Housemaid. Sklenar has also been tapped to star in Taylor Sheridan’s next action movie, F.A.S.T., which will be released in theaters on April 23, 2027.

Between Yellowstone, Tulsa King, Landman, and more, Taylor Sheridan has more than his fair share of shows dominating the streaming charts. 1923 was also a major streaming contender, at least until the last week or so, when it now looks poised to fall out of the Paramount top 10 entirely. The second season of 1923 is one of the few TV shows Sheridan has written to earn a perfect 100% score from critics on the aggregate site Rotten Tomatoes. It’s also reportedly Sheridan’s most expensive show, clocking in with a price tag of around $22 million per episode.

What Is Taylor Sheridan Working on Next?

Taylor Sheridan has so many projects in the works that it’s almost impossible to predict exactly what he’s working on at the moment. His next two shows to hit the air, Marshals (March 1) and The Madison (March 14), are both spin-offs of the original Yellowstone, but the former is much more of a direct offshoot than the latter. In addition to the aforementioned action thriller, F.A.S.T., Sheridan is also writing new seasons of Landman, Tulsa King, and Mayor of Kingstown. He also recently wrapped production on Lioness Season 3, which is confirmed to be the final season of the show.

Be sure to watch both seasons of 1923 on Paramount+ and stay tuned to Collider for more streaming updates.

- Release Date

-

2022 – 2025-00-00

- Network

-

Paramount+

- Directors

-

Guy Ferland

- Franchise(s)

-

Yellowstone

Entertainment

Fans Split Over Potential All-Star Season Of ‘The Traitors’

Since a story surfaced that producers are reportedly working on an all-star cast for “The Traitors,” fans of the Peacock series appear sharply divided on the idea.

The report first appeared in The Sun on February 5 and has since sparked intense debate among viewers over the merits of a potential all-star season.

While some argue it’s too early in the show’s run to execute the concept, others have already begun drawing up their fantasy lineups of who they’d like to see return.

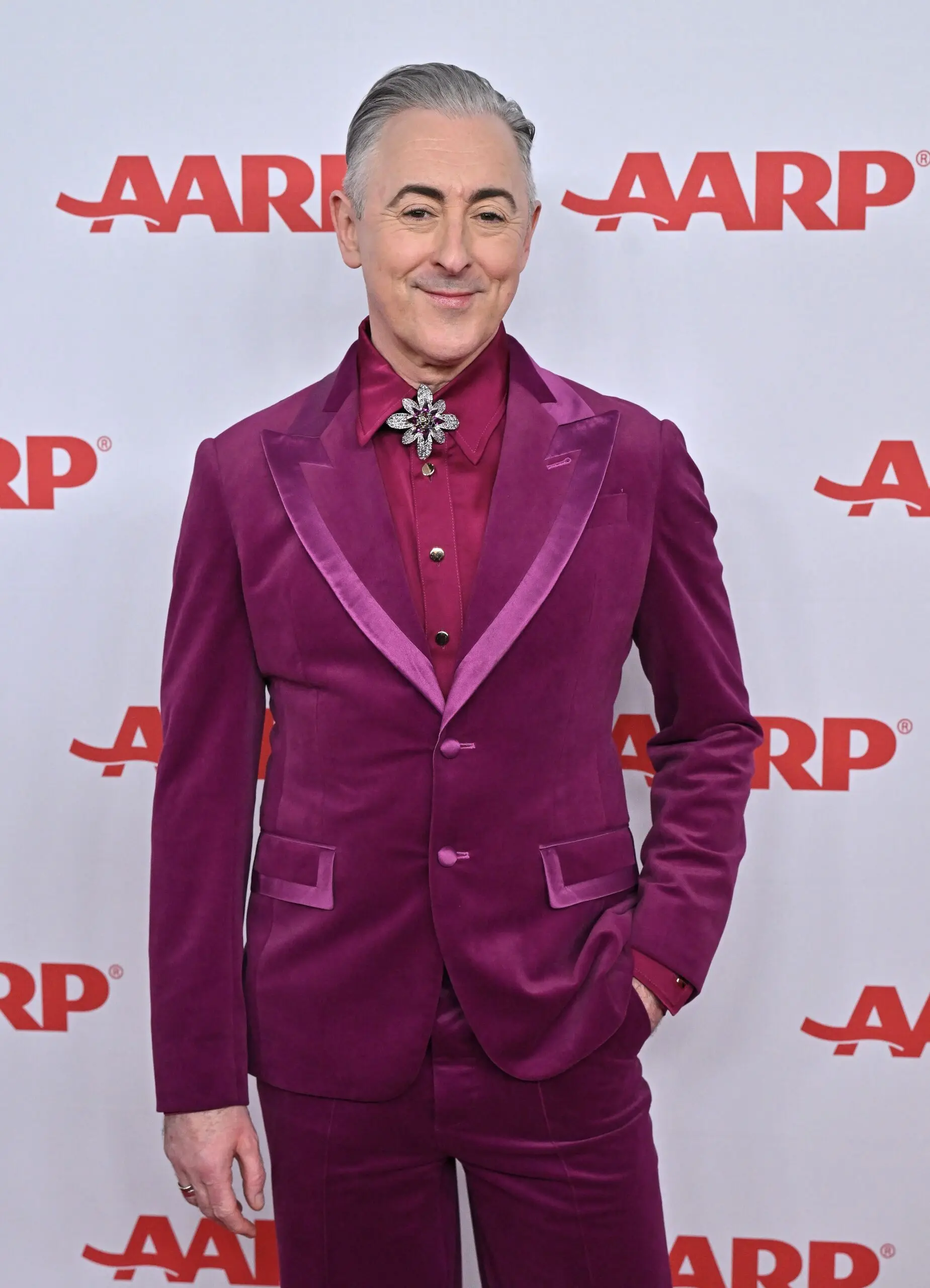

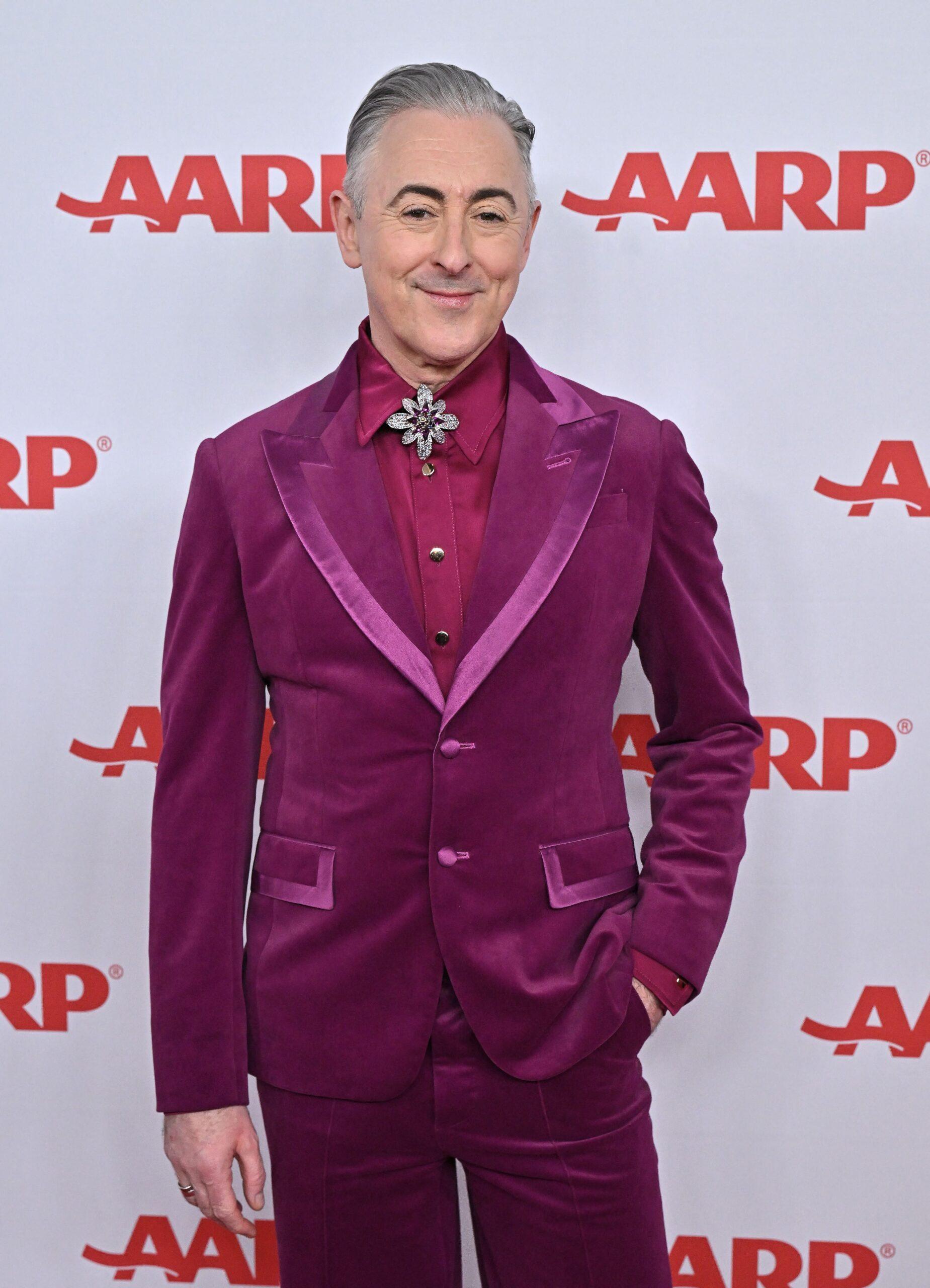

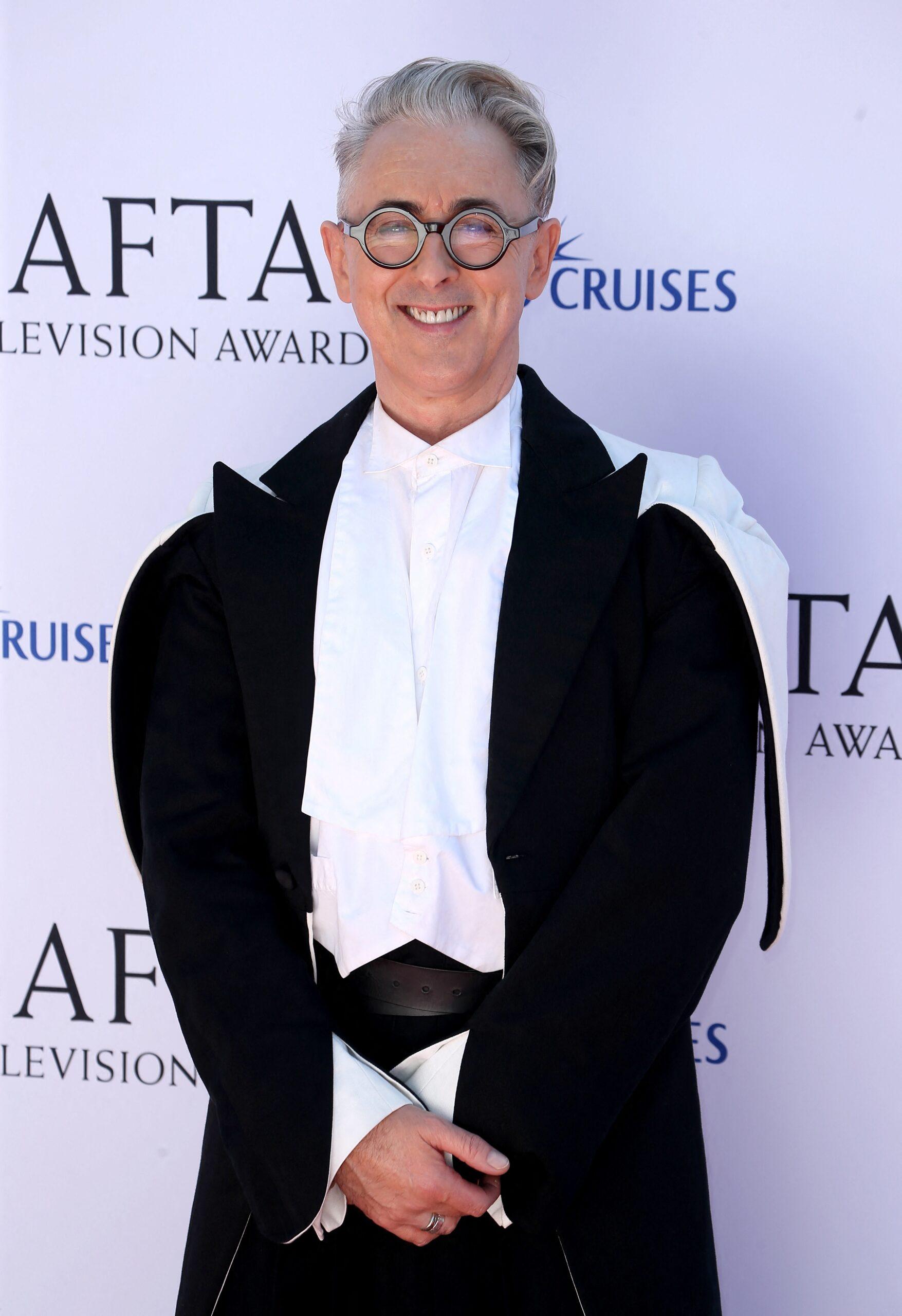

The discussion comes against the backdrop of the still-unfolding fourth season, which was previously described by host Alan Cumming as “absolute carnage.”

Article continues below advertisement

Reports Suggest Season 6 Of ‘The Traitors’ Could Be All-Stars

According to The Sun, Season 6 has been earmarked as the installment to introduce an all-star cast.

The report cited an alleged insider who claimed that while much of the current focus remains on finalizing the cast for the upcoming fifth season, work has already begun behind the scenes on Season 6.

“Traitors’ production are actively casting for Season 5 and putting the finishing touches on that cast,” the source reportedly said. “But they’re also already assembling an All-Star cast for the following year, Season 6, which will be the first time the show’s ever done that.”

Article continues below advertisement

Some Fans Argue ‘It’s Too Soon’ For An All-Star Season Of ‘The Traitors’

There is a clear divide among fans over the idea of an all-star season of “The Traitors.”

Yet even among viewers who oppose the concept, many say their hesitation comes down to timing rather than the idea itself.

In one thread discussing the report on X, a fan suggested that production should wait until Season 7 before attempting an all-star edition.

“We need at least one more season before they consider an all stars,” the user wrote.

That sentiment was echoed by another viewer, who compared the reported plans to “Big Brother’s” approach to all-star casting.

“[It’s] too early,” they said. “Season 7 should be all stars just like ‘Big Brother.’”

Article continues below advertisement

Speculation Grows Over Which Former Players Could Return

The same source quoted by The Sun in the report about a rumored all-star season also provided the names of players they claimed that production is already considering.

Lisa Rinna and Rob Rausch have been two of the main standouts from Season 4 and are listed among the said early favorites to return.

Other contestants who are namechecked include “Survivor” alumni Cirie Fields, Boston Rob Mariano, and Parvati Shallow.

Previous winners Dylan Efron and Gabby Windey are also said to be in the mix, along with “Real Housewives” star Phaedra Parks, who left a strong impression during Season 2.

Article continues below advertisement

Viewers Wonder Whether An All-Star Concept Works On A Celebrity-Centered Show

Beyond the fans concerned by the timing of a likely all-star Season 6 of “The Traitors,” an even more radical view has been emerging around the conversation on social media.

Since its first season, the popular series has been casting celebrities only, with reality TV stars from other shows often dominating the cast.

This fact has made some viewers question whether selecting from among those celebrities for a returnee-only season is not pushing the boat a little too far.

One particular fan warned that having too many massive egos in one season would negatively impact the storytelling.

“It would exacerbate the existing problems of the edit focusing on [a] few big personalities and fan favorites being targeted early or just under-edited overall,” the comment reads.

Article continues below advertisement

Season 5 Of ‘The Traitors’ Will Feature A Civilian Cast For The First Time

Before fans get a chance to see a potential all-star Season 6, they will first watch “everyday” people battle it out in the Scottish castle for the first time since the show premiered in 2023.

A promotional poster on the official casting website describes some of the characteristics production is seeking in potential Season 5 contestants.

“In this brand new version for NBC, you do not have to be a celebrity to play!” the advert reads. “We are looking for smart, strategic everyday people to compete in the ultimate game of trust and treachery.”

It remains to be seen whether Season 6 will indeed be an all-star edition, and whether any standout players from the Season 5 cast will factor into those plans.

Entertainment

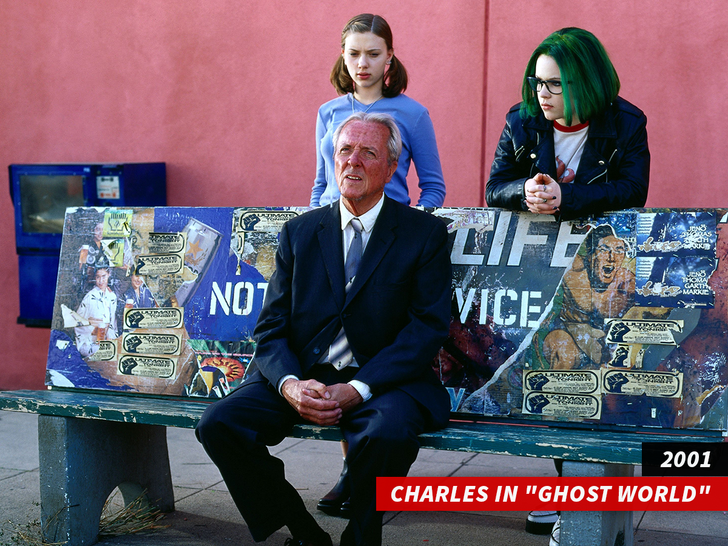

‘Will & Grace’ Bartender Charles C. Stevenson Jr. Dead at 95

Charles C. Stevenson Jr.

‘Will & Grace’ Bartender Dead at 95

Published

Charles C. Stevenson Jr. — the actor most famous for playing Smitty the bartender on “Will & Grace” — has died.

He died of natural causes on Jan. 19 in Camarillo, California, his son Scott confirmed to TMZ. Variety was first to report the news.

Aside from playing the beloved barman, Stevenson was known for portraying preachers, priests, and pastors in supporting roles throughout his decades-long career.

He is also recognized for his role as Sheriff Ryan in the 2008 Disney movie “Snow Buddies.” Other notable projects include “Murder, She Wrote,” “The Middle,” “My Name is Earl,” “Men in Black,” “Glee,” “Ghost World,” and “Pleasantville.”

Scott tells TMZ his father “had a blast every minute” of his career and said he was “proud to have been part of such a landmark show [‘Will & Grace’] and very happy to have made a lot of people laugh.”

He added … “I’m sure that if time hadn’t caught up with him he’d still be out there heading to casting calls, ready for another role to play and for a few more punch lines to deliver.”

Interestingly, Stevenson didn’t start acting until the 1980s, after he graduated from UC Berkeley with a degree in English and served in the Navy during the Korean War. He lived in Los Angeles for about 20 years, working on public service announcements and event coordination for Hollywood bigwigs such as Henry Winkler before jumping in front of the camera himself.

He is survived by 2 children — Charles III and Valerie — from his first marriage to Barbara Keller, and 3 kids — Catherine, Scott and William — from his marriage to Joy Stevenson. He is also survived by 8 grandchildren and 6 great-grandchildren.

He was 95.

RIP

Entertainment

10 Hilarious Sitcoms That Ended Before They Got Bad

For as long as television has been part of our lives, situation comedy, or what we call sitcoms, has been a staple of programming that has long made light of our normal, banal lives. Unlike stretch comedy, the sitcom allows us to watch as our protagonists engage in humorous situations week-to-week, often with a message that follows behind it.

Over the years, we have been treated to some of the best that the sitcom genre has to offer, but oftentimes, these types of shows have been notorious for overstaying their welcome. True, shows in other genres have a tendency to do this as well, going stale when it should have ended on a fresh note, but none have had as many examples of this as sitcoms have. So, we want to turn this somber premise on its head and give you the most hilarious sitcoms that, thankfully, ended right before they started to go past their sell-by date. So, without further ado, let’s dive in.

10

‘Arrested Development’ (2003–2006, 2013–2019)

We look back fondly on Fox’s Arrested Development because it’s a show that ended at exactly the right time. Created by Mitchell Hurwitz, Arrested Development was a masterclass in how to do absurdist humor in a primetime format. The sitcom follows the Bluth family, an extremely wealthy bunch who live very extravagant lifestyles. But when the patriarch of the family, George Bluth St. (Jeffrey Tambor), is arrested, the family loses their wealth, but they still try to live the lives they’ve always known, much to the chagrin of Michael Bluth (Jason Bateman), who desperately tries to keep his family together.

There is little question that Arrested Development was ahead of its time, being the pioneers of the “mockumentary” style that would become more prevalent in the 2010s. Not only that, but the writing and comedic performances were simply top-notch. But absurdist humor does have a shelf life, and thankfully, Arrested Development ended before things went off the rails.

This is such an underrated sitcom, a show that should be more beloved than it actually is. Community brought together a wide range of great comedic actors and made sitcom gold that didn’t feel like it was overstaying its welcome. Created by Dan Harmon, the show follows Jeff Winger (Joel McHale), who winds up being disbarred and suspended from his law firm after it turned out he was lying about getting his degree from Columbia University. To get that degree, he enrolls in a community college in Colorado and meets a class full of eccentric classmates.

Community is so beloved because it uses the “high-concept” model to absolute perfection. While episodes themed around such absurd plotlines, such as a paintball war, could have easily been seen as shameless slapstick, Community elevated these storylines to an art form, making them hilarious, and also quite crucial to the overall vibe of the sitcom. Community ended in a satisfying way, and it didn’t need to go beyond six seasons. Instead of remembering its downfall, we remember Community for the high-concept comedy it brought us week-after-week.

8

‘My Name is Earl’ (2005–2009)

There are plenty of people who believe in good karma, but Earl Hickey (Jason Lee) took this belief to another level entirely. The central premise of the underrated sitcom My Name Is Earl follows Earl, a small-time thief who, after losing a winning lottery ticket, becomes convinced that he has to turn his life around in order to be the best version of himself. How does he do it? By believing in the power of karma.

Much like Community, if My Name Is Earl was spearheaded by a showrunner who never got the overall premise, this sitcom would have gone bad in a hurry. But series creator Greg Garcia knew what this show could be, and, thankfully, NBC knew how long they could keep a show like this going. There are only so many bad deeds that Earl could fix, and stretching this series beyond its four-season run would have been overkill, with the series turning into slapstick comedy and situations to make things work.

7

‘A Different World’ (1987–1993)

With Black sitcoms focusing more on the success of African Americans, the late 1980s was the right time to look at the rising popularity of Historical Black Colleges and Universities (HBCUs). In 1987, NBC greenlighted a spin-off of The Cosby Show titled A Different World, which initially follows Denise Huxtable (Lisa Bonet) as she goes to her father’s alma mater, Hillman College.

A Different World would later go on to showcase the different personalities that made up Hillman after Debbie Allen took over as Executive Producer, allowing the show to thrive as a socially responsible sitcom. The issues drove the storylines of each episode of the sitcom, and the show had a deeper impact on higher education, with HBCUs gaining the respect that these institutions long deserved. A Different World was the right sitcom at the time, with the right timeframe, as you can only focus on a college for so long without going to great lengths to tell its story, which would have meant degrading the vibe that it worked so hard to build.

6

‘One Day at a Time’ (2017–2020)

In 1975, the late Norman Lear developed the sitcom One Day at a Time, which told the story of a divorced mother looking to rebuild her life in the big city of Indianapolis. 33 years after the initial series ended, developers Gloria Calderón Kellett and Mike Royce had the idea of rebooting that underrated classic for the modern era, and they hit it out of the park.

The re-tooled One Day at a Time follows Penelope Alverez (Justina Machado), an Army Nurse Corps veteran who struggles to return to civilian life. Not only does she have to deal with PTSD, but she has to do this while taking care of her kids. This could have been a flop, but the premise was very interesting, and the show had emotional heart to go along with the comedy. The show ended after four seasons, but that isn’t a bad thing, as it fell into the rut of running out of ideas, which would have strangled the overall message the series wanted to give to its viewers.

5

‘New Girl’ (2011–2018)

The 2010s were a particularly rough time for millennials. The economy was in bad shape, which meant the job prospects for those entering the workforce were bleak. So, we turned to our friends to get us through those dark times. That’s what makes Fox’s New Girl one of the 2010s’ best sitcoms.

Created by Elizabeth Meriweather, New Girl stars Zooey Deschanel as Jessica “Jess” Day, a school teacher who moves into a huge loft with three guys. With the show centered around Jess’ quirky personality, New Girl was a very enduring show that was comfortable to watch in the dark, cold economic climate that hung over the decade. This was a group of people who refused to grow up, and until they had to, and the series ended on the note that it was finally time to move on from their perpetual adolescence. Had the series gone on any longer, New Girl would certainly have run out of ideas, and we would be speaking of the show as a good one that went on longer than it should. Thankfully, we don’t have to think about it in that light.

4

‘Atlanta’ (2016–2022)

Some may question what Atlanta is here, but at its heart, the FX series is a sitcom, just not in the traditional sense. Created by Donald Glover, who rose in star power with NBC’s Community, the series follows Earn (Glover) in his daily life in a surreal version of Atlanta, Georgia. And by surreal, we do mean every letter of the word.

Atlanta was delightfully weird, but this surreal nature had a message to it, which allowed the show to talk about strong topics such as race, poverty, and celebrity culture without having to keep things PG-13. Atlanta was groundbreaking in its comedy and commentary, but after the underwhelming Season 3, it was evident that this show had a shelf life. Thankfully, the showrunners saw this too, and the series ended on a satisfying note in Season 4. Sure, the ending had more questions than answers, but that was the entire point.

3

‘Cheers’ (1982–1993)

Sometimes, you want to go where everybody knows your name, and for 11 seasons, that’s exactly where viewers went in the iconic NBC sitcom Cheers. The premise of Cheers was simple. It followed a former baseball pitcher, Sam Malone (Ted Danson), who owns and runs Cheers, a bar in Boston, and the patrons who frequented the bar.

While romance was a big part of the overall storyline, the main focus was on the bar itself and how it acts as a social institution within the neighborhood. With a premise as straightforward as Cheers, this show could easily have run for 15-plus seasons, but after Diane Chambers (Shelly Long) left after Season 5, the signs were there that this premise could not last for very long without its central couple. Sure, Cheers should have ended after Season 7, but there were still some great moments up until its finale in Season 11. Anything longer, and this beloved groundbreaking sitcom would have definitely overstayed its welcome, without a doubt.

2

’30 Rock’ (2006–2013)

There is no question about it, Tina Fey is a comedic genius. This was showcased during her time on Saturday Night Live, and looking to tell the story of her experience as a head writer on the iconic NBC sketch comedy series, she created 30 Rock, which looks at a fictional sketch comedy show that was airing on NBC.

The title 30 Rock refers to the address of NBC’s headquarters in New York, and Fey’s comedic writing was sharp as a tack. Fey is an expert when it comes to writing satirical, self-referential scripts, and nowhere was this stance put to good use than on 30 Rock. But even a show like this has its limits, and the cracks began to show late in Season 6, displaying that it was time for 30 Rock to come to an end, which it did after Season 7.

1

‘The Fresh Prince of Bel-Air’ (1990–1996)

Let’s be honest for a second, Will Smith didn’t have to go into acting. By the end of the 1980s, he had firmly made a name for himself as a hip-hop artist, winning Grammy Awards and pumping out hit albums. But Quincy Jones and Benny Medina had an idea, one that would change Smith’s life forever.

In 1990, NBC premiered The Fresh Prince of Bel-Air, which followed a fictionalized version of himself after he moved from West Philadelphia to the wealthy Los Angeles enclave of Bel-Air to live with his uncle (James Avery) and his family. While The Fresh Prince of Bel-Air hit all the sitcom tropes, it also dealt remarkably well with serious topics, especially child abandonment, which was the focus of one of the most emotionally powerful moments in television history. Acting as a fictional re-telling of Smith’s life, there were only so many seasons that this show could run without it becoming stale, and once the story was told, the show wrapped instead of extending it even further.

Entertainment

Jessie Buckley shares her personal “The Bride! ”playlist of songs that inspired her performance (exclusive)

:max_bytes(150000):strip_icc():format(jpeg)/The-Bride-Cover-Stills-020226-06-bea29dc53683481e82c592d718f6f29b.jpg)

Listen to her curated “Bridezilla” Spotify playlist shared exclusively with EW.

Entertainment

“Survivor 50”'s Chrissy Hofbeck opens up about controversial season 35 finish and being bashed by previous cast

:max_bytes(150000):strip_icc():format(jpeg)/Survivor-50-Cover-Shoot-122225-10-7d586dfa86a04927a6495221500f499b.jpg)

“What I hate is that people say season 35 was a really good season until the finale, and then it sucked.”

Entertainment

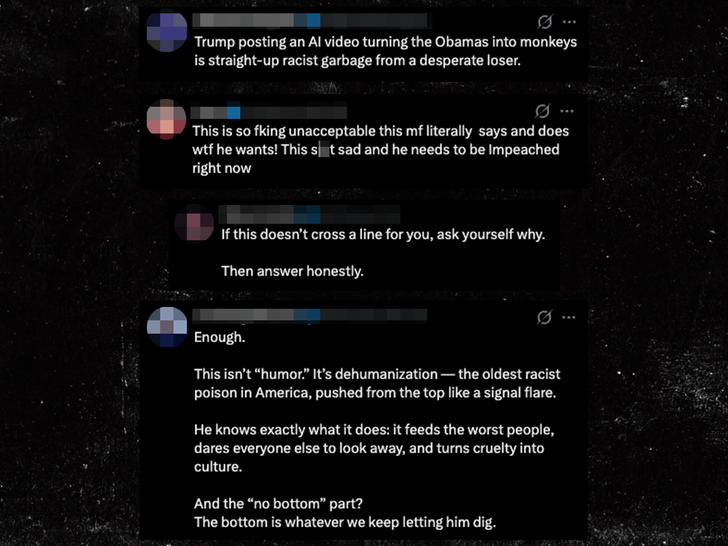

President Trump Shares Racist Video of Michelle, Barack Obama as Apes

President Trump

Goes Apesh*t on the Obamas!!!

Published

It’s no secret President Donald Trump and the Obamas don’t get along … but DT has now taken their bad vibes to a whole new level, posting a short video of Barack and Michelle depicted as apes.

Trump uploaded the shocking clip on his Truth Social platform Thursday night — and it begins with a voice speaking about alleged fraud in the 2020 presidential election. As you know, Trump lost to Joe Biden in the 2020 race, but Trump has always maintained the election was stolen from him.

Then the video cuts a brief scene showing Barack and Michelle’s heads superimposed on apes dancing in a jungle as The Tokens 1961 classic, “The Lion Sleeps Tonight,” plays in the background.

Karoline Leavitt addressed the clip in a statement to TMZ … “This is from an internet meme video depicting President Trump as the King of the Jungle and Democrats as characters from the Lion King. Please stop the fake outrage and report on something today that actually matters to the American public.”

Still, DT is getting ripped apart on social media for being racist, and California Governor Gavin Newsom is also getting in a few licks, calling the video “disgusting” and urging all Republicans to condemn it.

TMZ has reached out to the Obamas for comment … so far, no word back.

Entertainment

International Runway Model Cristina Pérez Galcenco Dead at 21

Cristina Pérez Galcenco

Global Runway Model Dead At 21

Published

Cristina Pérez Galcenco — a global runway model — has died at 21, according to media reports.

Galcenco’s body was discovered at her house in Malaga — a city in Spain — on February 3 … and her cause of death appeared to be natural, several outlets reported.

ABC — a Spanish newspaper — said Galcenco had moved to Malaga to enroll in a class at a school.

In the past few years, Galcenco had been strutting down catwalks from Madrid to Milan to Paris to London — as well as China.

She began her modeling career at just 14, hitting the runway at the Campoamor Fashion Show in the Spanish city of Oviedo.

Following her death, Campoamor’s organizers took to Instagram to post a photo and video celebrating her life.

As we said, Galcenco was only 21.

RIP

Entertainment

Milo Ventimiglia Speaks About Being a New Dad and Expecting Baby No 2

Milo Ventimiglia is getting candid about a massive year, which included losing his home in the L.A. fires, welcoming his first child with wife Jarah Mariano just two weeks later and now, expecting their second baby together.

Appearing on the Thursday, February 5 episode of Jimmy Kimmel Live!, Ventimiglia, 48, joked that he’d lost track of what day it was amid the chaos and that they “must be crazy” to go back to back with a second pregnancy.

“Got a beautiful daughter, she’s wonderful. What day is it?” Ventimiglia joked to host Kimmel, 58, as he shared details of how he was adjusting to fatherhood after welcoming daughter Ke’ala in January 2025. “Thursday, wonderful. It’s the same as Wednesday or Tuesday, yeah. They’re all the same. Monday, Tuesday, Thursday…”

After Kimmel asked whether Ke’ala was keeping the This is Us alum awake at night, Ventimiglia shared that while their daughter slept through until early hours of the morning, he and Mariano still fretted over her.

“She’s actually doing great, she’s sleeping through the night. She loves to wake up at 5.40 in the morning and talk to herself. Kinda jabber on and whatnot. My wife and I are laying in bed, like ‘Does she have her [pacifer]?’ ‘I don’t know, I can’t tell from the monitor.’ ‘Did she poop herself?’ ‘I don’t know, I can’t tell from the monitor,’” he recalled. “And then you’re kind of like, after a certain period of time, you know this. You walk in there, you’re like, well, she didn’t poop herself, and she’s got her [pacifier], so the world’s good.”

Ventimiglia also admitted that while he initially had grand plans to be a “wonderparent,” he was forced to take a step back and acknowledge the pair had faced a “hard and wonderful” year after losing their Malibu home and becoming first-time parents in a short period of time.

Jarah Mariano. Courtesy of Jarah Mariano/ Instagram

“Listen, my wife is the most unbelievable — Jarah, if you’re watching, you are the most unbelievable human being, creature, species of everything. She handles everything great. But you know, I mean, when you’re a first parent too, you kind of think you’re going to be this wonderparent,” he explained.

He continued, “I was striving to. I’m like, ‘Cool man, I’m going to be the healthiest, we’re going to feed this baby organic, we’re going to buy blenders, do all this stuff, we’re going to go argue with some dude named Kale about blueberries at the farmers’ market.’ Then after a while you’re like, ‘Oh, man, we had quite a year.’”

Ventimiglia was one of many celebrities and Californian residents who suffered the loss of their homes when fires wreaked havoc on the region last year. Mariano was heavily pregnant at the time and during his Kimmel appearance, Ventimiglia touched on the experience.

“If anybody doesn’t know, we lost our home in the fires in Malibu top of the year. It’s okay, it happened, thank you. Two weeks later, got the best blessing and our daughter was born. Six weeks later, on the road to do this movie that is coming out this month, I Can Only Imagine 2. Literally on the road,’” he said.

Joking that reality thwarted his super parent ambitions, Ventimiglia continued, “While you’re on the road you’re like, ‘Where’s my blender?’ It’s dawn. You’re not making organic foods anymore.”

After Kimmel trolled the Gilmore Girls alum about how much harder it will be to be a dad to two children, Ventimiglia also joked about being apprehensive about what’s on its way.

“You saw me hard swallow, right? I hard swallowed,” he remarked. “Now I know it’s coming. But at a certain point, don’t they start to entertain each other?”

Entertainment

Cruz Beckham Teams Up With Spice Girls For Sing-Along

Cruz Beckham is showing his support for mom Victoria Beckham courtesy of an impromptu sing-along of the 1998 hit song “Viva Forever,” with the Spice Girls themselves.

This is the latest in the three youngest Beckham siblings’ continued support for their parents, David and Victoria, amid the ongoing feud between the family and Brooklyn Beckham.

Article continues below advertisement

Cruz Beckham Teams Up With His Mom And The Spice Girls For A Sing-Along

In a video posted on Instagram, Cruz shared a look at himself playing the guitar, as Victoria and the Spice Girls (minus Mel B) sat around the table and sang a stripped-down version of the fan-favorite song, “Viva Forever.”

“I think I found my openers… you think they have potential? Something exciting coming later today 😉 keep an eye out and get involved,” Cruz captioned the video.

Cruz has always been a fan of his mother’s legendary pop star status, as evidenced back in 2023 when he got a “Posh” tattoo on his arm in honor of her Spice Girl moniker.

Article continues below advertisement

Victoria Beckham Has Been Spending Quality Time With The Spice Girls Recently

This is the second time in the last few weeks that Victoria has spent time with her Spice Girls group members, except for Mel B, who lives in Los Angeles.

In honor of Emma Bunton’s (Baby Spice) milestone 50th birthday, Victoria joined group members Geri Halliwell-Horner (Ginger Spice), and Melanie Chisholm (Mel C) on Saturday, January 24, for Bunton’s birthday bash

Victoria followed up the celebration on Sunday, January 25, by posting a photo on Instagram of the pop icons all together.

“Happy birthday to the most beautiful soul @emmaleebunton I love you girls so much @gerihalliwellhorner @melaniecmusic xxxxxxx,” she captioned the post.

David Beckham also couldn’t resist joining in on the special moment and left a sweet comment underneath the photo.

Article continues below advertisement

“This made me happy. I can only imagine how the Spice Girls fans feel @spicegirls @victoriabeckham special night celebrating Emma @emmaleebunton x,” he wrote.

Article continues below advertisement

The Beckham Family Presents Unity Amid Ongoing Tension With Brooklyn

Victoria was in the city to accept being appointed a Chevalier de l’Ordre des Arts et des Lettres (Knight of the Order of Arts and Letters) by the French Ministry of Culture. She was presented with the award for her significant contributions to fashion and culture.

During her acceptance speech, she thanked her family, who were in attendance to support her.

Article continues below advertisement

Brooklyn Beckham Has No Current Interest In Reconciliation With His Family

In addition to the shocking claims that Victoria “hijacked” the first dance at his wedding by dancing “inappropriately” and making him feel “uncomfortable” and “humiliated,” Brooklyn also alleged behind-the-scenes sabotage of his marriage and media manipulation.

“I have been silent for years and have made every attempt to keep these matters private,” Brooklyn wrote last month in a series of fiery posts.

“Unfortunately, my parents and their team have continued to go to the press, leaving me with no choice but to speak for myself and tell the truth about only some of the lies that have been printed,” he continued.

Brooklyn also made it very clear that he is not interested in mending fences with his family. “I do not want to reconcile with my family. I’m not being controlled, I’m standing up for myself for the first time in my life.”

Article continues below advertisement

Brooklyn’s Father-In-Law Recently Addressed The Family Feud

On February 3, during an appearance at the “WSJ Live Event,” Nelson Peltz, father of Brooklyn’s wife Nicola Peltz, addressed the drama between Brooklyn and his parents.

When asked about his daughter’s marriage, Peltz jokingly responded, “Has my family been in the press lately? I haven’t noticed that at all,” he said, according to PEOPLE.

“My advice is to stay the hell out of the press. How much good did that do?” he said when asked what advice he had given his family recently.

Peltz then addressed the Beckham family:

“My daughter and the Beckhams are a whole other story. That’s not for coverage here today, but I’ll tell you my daughter’s great, my son-law Brooklyn, is great, and I look forward to them having a long, happy marriage together.”

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports5 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business21 hours ago

Business21 hours agoQuiz enters administration for third time

-

NewsBeat51 minutes ago

NewsBeat51 minutes agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World22 hours ago

Crypto World22 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World21 hours ago

Crypto World21 hours agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation