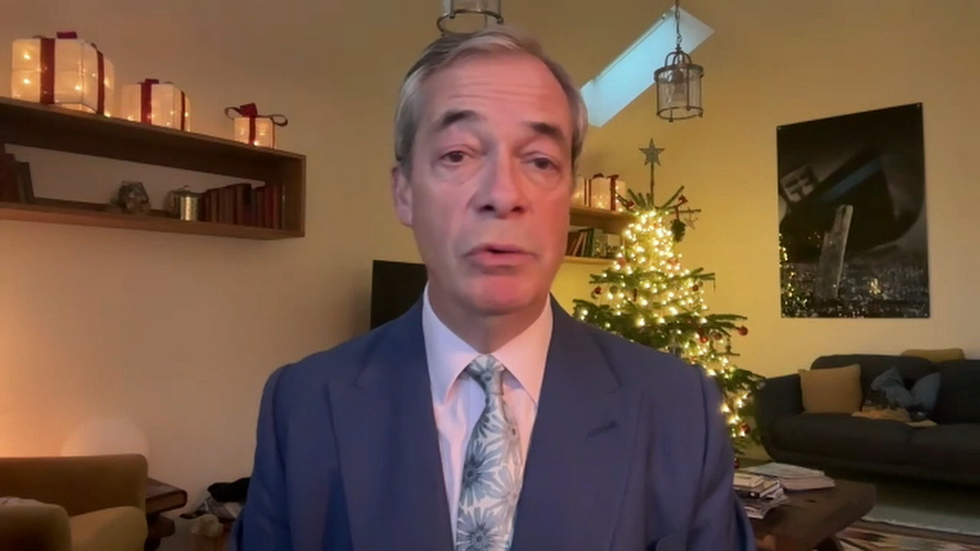

Nigel Farage has vowed to prove Reform UK’s membership numbers are genuine after Conservative Party leader Kemi Badenoch accused the party of “fraud”.

Speaking to GB News, Farage said: “I don’t mind all sorts of comments being made about me, but to be accused by her of being a fraudster, I’m sorry. I am not going to let this rest.”

The clash erupted after Reform UK claimed it had surpassed Conservative Party membership numbers, leading to a heated exchange between the two party leaders.

Badenoch accused Reform UK of “manipulating” supporters and running a fake membership counter on their website.

Nigel Farage launched a blistering attack on the Conservative party leader

GB News

Speaking to GB News Farage fumed: “We have had our work confirmed by several independent sources overnight.

“If the Conservative Party want us to call in one of the big four auditors to check the validity of our numbers against the ballot papers that were sent out at the leadership contest, thousands of which went to lapsed Conservative members and those that had resigned earlier this year, we can. I think if the truth came out, she’d be very, very embarrassed indeed.

LATEST DEVELOPMENTS:

Asked what he is going to do about the comments he said: “I will let you know in the next couple of days, but I will not let this rest. It’s absolutely disgusting that she should accuse us of defrauding the British public. It is quite wrong in every way.”

Dawn Neesom asked: “Are you implying that some sort of legal action may be coming?”

He responded: “I haven’t implied anything I’ve just said. I will let you know my course of action in the next couple of days, and I will prove that these members are not fake intrigue.”

Dawn asked: “Have you heard anything back from Kemi or the Tory party about your invitation to get the figures audited?”

Kemi Badenoch fumed at Reform UK

PA

Farage fumed back: “Not a thing. And I don’t suppose I will for a moment.

“They know as well as I do that many of those ballot papers they sent out last year were to lapsed members or those that had even sent in letters of resignation. Their membership figure, I would guess, is substantially lower than 131,000.”

Reform UK made its dramatic membership announcement on Boxing Day, claiming to have exceeded the Conservatives’ 131,680 members. In a provocative display, the party projected their membership tally onto the facade of Conservative Party headquarters in London.

The projection declared Reform UK as “the formal opposition” and included a pointed message: “Merry Christmas Kemi!”

Reform made its dramatic membership announcement on Boxing Day

GB News

Farage celebrated the moment on social media, declaring: “This is a big, historic moment. The youngest political party in British politics has just overtaken the oldest political party in the world.”

The party posted what it claimed was a “screenshot of our internal membership numbers” on social media platform X, showing 134,832 members.

Badenoch strongly rejected Reform UK’s membership claims, taking to social media platform X to accuse the party of digital manipulation.

“It’s not real. It’s a fake… coded to tick up automatically,” the Business Secretary wrote.

She claimed Conservative officials had been “watching the back end for days” and noticed Reform UK had “changed the code to link to a different site as people point this out”.

+ There are no comments

Add yours