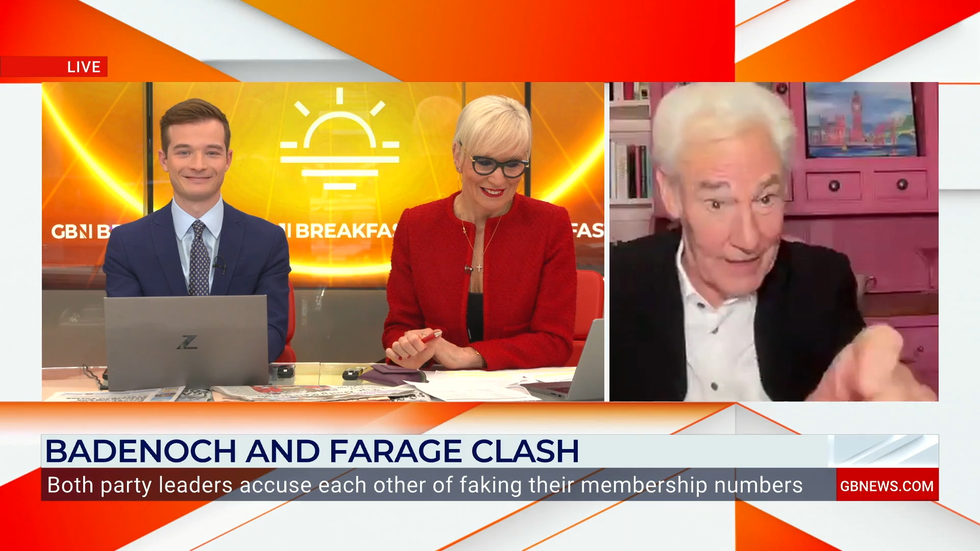

Political commentator Peter Spencer has warned that Business Secretary Kemi Badenoch is “very frightened” of Nigel Farage and his growing Reform UK party.

Speaking to GB News, Spencer emphasised that Farage “is not to be underestimated,” pointing to his historical influence in British politics.

The comments come amid an escalating public row between Badenoch and Farage over Reform UK’s membership numbers, which erupted on Boxing Day when the party claimed to have overtaken Conservative Party membership figures.

Speaking to GB News, political commentator Peter Spencer said: “Kemi Badenoch is going to hit back and hit back as hard as she can because she is very frightened of Nigel Farage.

“It is worth remembering that Farage pretty much single-handedly spooked David Cameron into holding the referendum on Brexit, and to David Cameron’s enormous cost.

“As for the nation, it’s another matter. But, so you know, he’s not to be underestimated.

LATEST DEVELOPMENTS:

‘FRAUD!’ Nigel Farage unleashes furious rant at Kemi Badenoch: ‘This won’t rest’- Starmer slammed for smothering UK in red tape as new quango created every week since election win

- Starmer faces fresh calls to abandon Chagos deal after Mauritius rejects deal

“Of course, the other point to remember is that although the Reform Party only ended up with a handful of votes at the last election largely thanks to a rather clunky voting system, the fact is that they did get some four million votes.

“This means that both the Labour Party and the Tory Party have every good reason to be extremely frightened of them.

“In fact, I would argue particularly the Labour Party, because of the fact that Reform UK came second in getting over 100 seats and most of which were held by the Labour Party.”

In a provocative move, Reform UK projected its membership tally onto Conservative Party headquarters in London, claiming to have surpassed the Tories’ 131,680 members.

The display included a message reading “Merry Christmas Kemi!” alongside Reform’s declaration of being “the formal opposition”.

Badenoch swiftly accused Farage of “manipulating” his supporters with fake membership figures.

“It’s a fake clock coded to tick up automatically,” Badenoch wrote on social media platform X. “We’ve been watching the back end for days and can also see they’ve just changed the code to link to a different site as people point this out.”

Farage responded furiously to Badenoch’s accusations, vowing on GB News to pursue the matter further.

“I don’t mind all sorts of comments being made about me, but to be accused by her of being a fraudster, I’m sorry. I am not going to let this rest,” Farage told presenters Dawn Neesom and Cameron Walker.

He called Badenoch’s allegations “absolutely disgusting” but declined to specify what action he would take, saying only that he would reveal his plans “in the next couple of days”.

Farage challenged Badenoch to allow one of the “Big Four” accountancy firms to audit both parties’ memberships.

+ There are no comments

Add yours