Entertainment

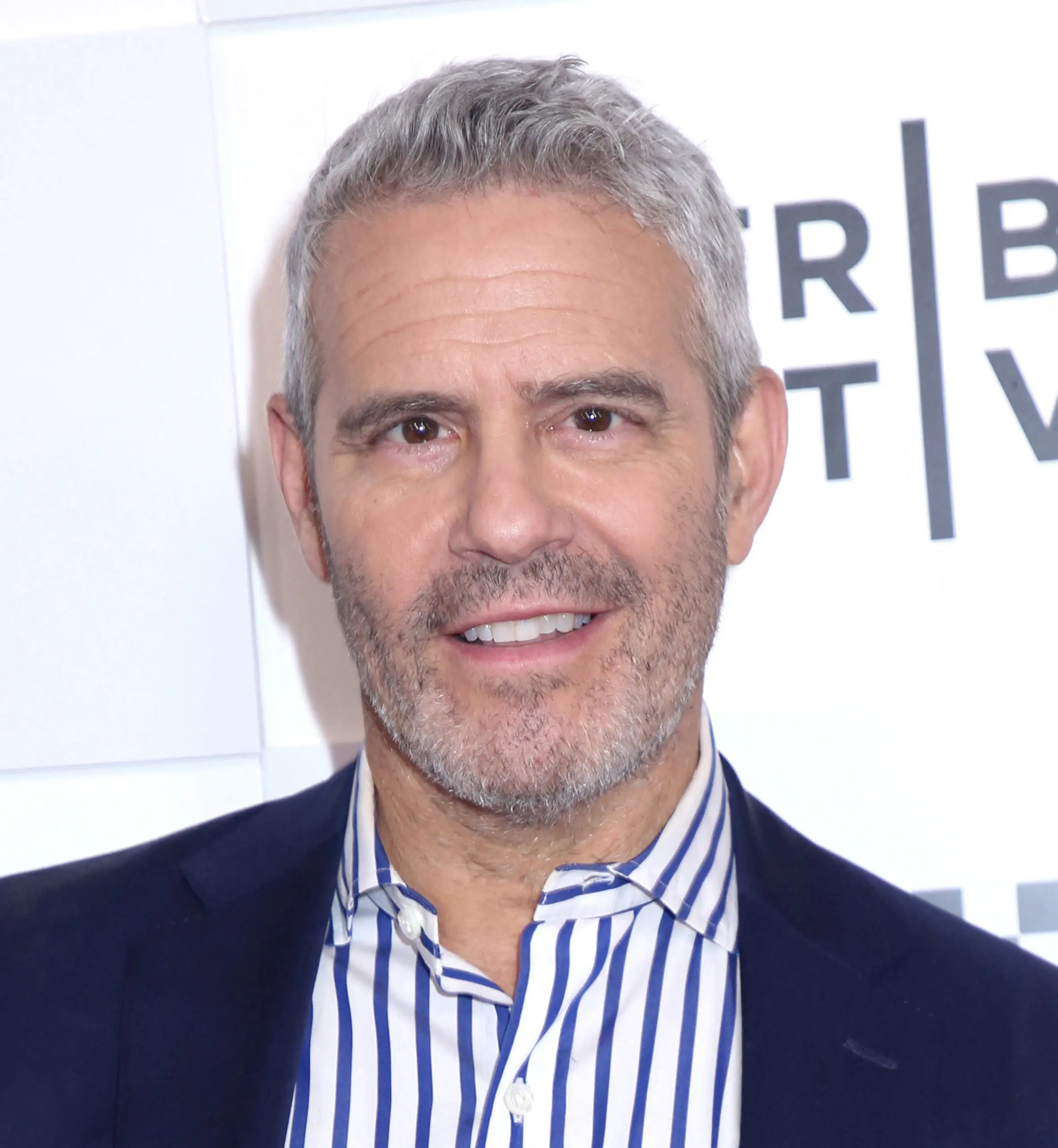

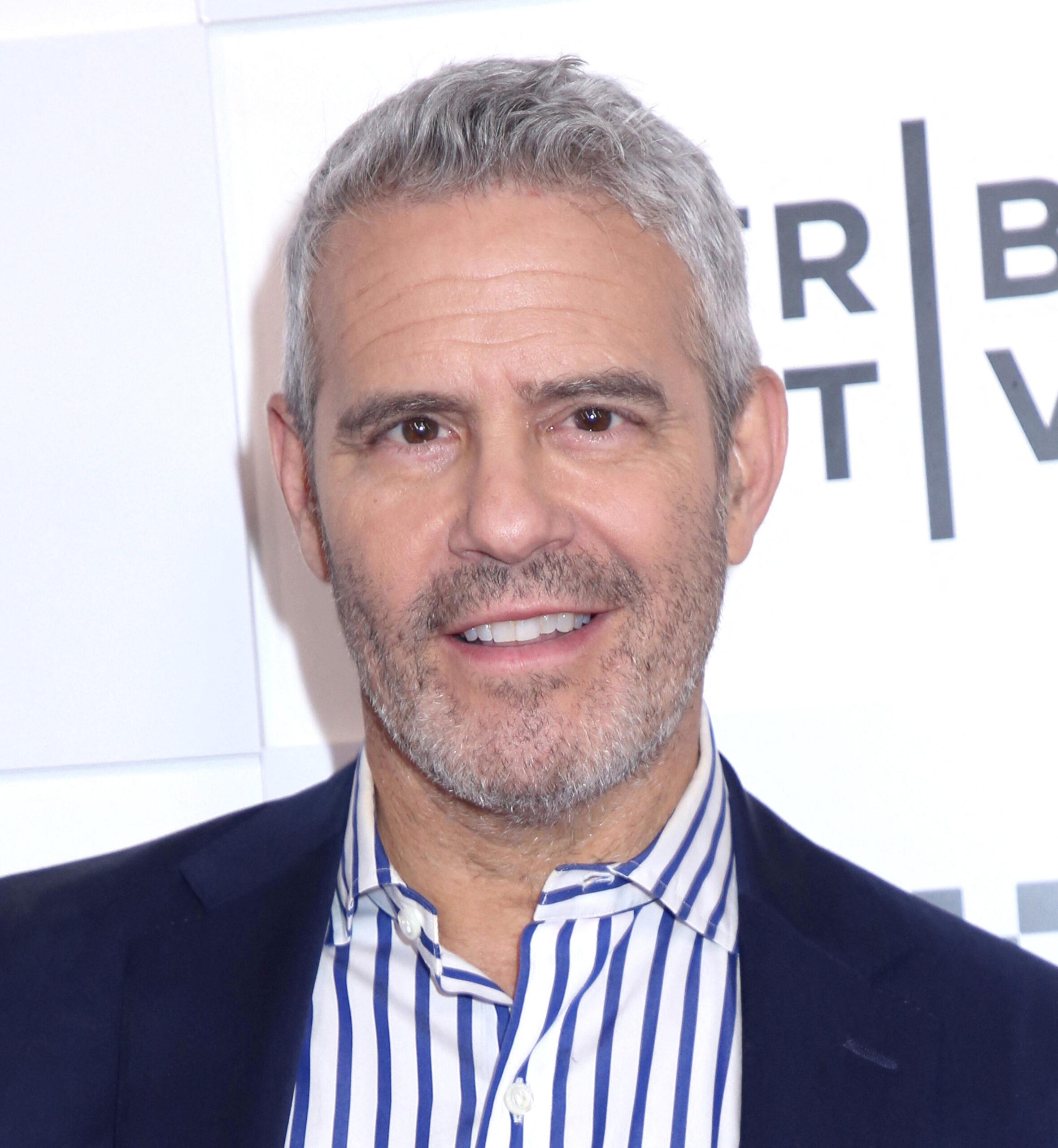

Andy Cohen Reacts To ‘Real Housewives Of New York’ Spin-Off

During a recent episode of his radio show, “Radio Andy,” the executive producer commented on the news that some of the franchise’s heavy hitters—including Ramona Singer and Sonja Morgan—are jumping to the E! Network for a new series centered on their lives.

The news that some of Bravo’s marquee players are starring in a new production on a different network comes years after Andy Cohen revealed that Bravo was relaunching “Real Housewives of New York” with an all-new cast after 13 years.

Article continues below advertisement

Andy Cohen Breaks His Silence On ‘Real Housewives Of New York’ Spin-Off Happening On E!

According to a press release from E!, Singer, Morgan, Jill Zarin, Kelly Bensimon, and Luann de Lesseps are reuniting for a new series tentatively titled “The Golden Life.”

“Bound by decades of shared history, fallouts and friendship, this fan-favorite group of New Yorkers are starting fresh together in the Sunshine State,” the show’s synopsis teased. “In this new ‘golden’ era of life, the longtime friends are thriving in and around Palm Beach with fabulous second homes and a bustling social scene. With their signature humor and non-stop hijinks, the series will follow the group as they navigate dating, family, and career milestones.”

However, the journey won’t be entirely seamless, as the synopsis also teased “unresolved drama” may reemerge after years away from the spotlight.

Article continues below advertisement

So, what did Cohen have to say about the news? “You know what? I’m so excited for them,” he declared.

Article continues below advertisement

Andy Cohen Shares More About The New York-Inspired Series ‘Golden Life’

Cohen revealed that he reached out to the ladies after learning of the move, adding that he believes it will be “a great show” and that he could “never root against” them because he loves seeing them together.

Cohen also explained how the show came to be, stating that many of the women “all live in Florida,” except de Lesseps and Bensimon. He then reminded his listeners that they could watch the ladies get together on a recent season of “Real Housewives: Ultimate Girls Trip” on Peacock.

Article continues below advertisement

Andy Cohen Says The New York ‘Ultimate Girls Trip’ Felt Like The Series Finale

The “RHONY” legacy version of “Ultimate Girls Trip” originally aired on Bravo in 2023 and featured the aforementioned cast members, along with Dorinda Medley and Kristen Taekman. It premiered two years after season 13 (the last time the ladies were part of the network’s flagship show).

Speaking of the legacy trip to Saint Barthélemy, Cohen described it as “a series finale in a weird way.”

“They kind of wrapped it all up, but now they’re embarking on — their new lives, and yeah. So, I wish them well, and I’m happy for the fans who wanted to see this,” Cohen said.

Article continues below advertisement

“We’re thrilled to welcome reality TV royalty to E! for a reunion fans have been waiting for,” Val Boreland, President of Entertainment, VERSANT, said in a statement. “The energy within this group has always been electric and we’re excited to watch it unfold in a new chapter of life by the beach.”

Cohen Announces Rebooted ‘RHONY’ After 13 Years

The OG women of “RHONY” are reuniting after the series was rebooted and completely recast by Bravo in 2022. Cohen announced the bold decision to rebuild in a previous interview, according to the Daily Dish, explaining that producers felt they were “at a crossroads for [the show].”

Cohen also revealed that recasting the series would allow the network to tell different stories from a more diverse group of women.

“There are thousands of stories to tell here. This is the most multicultural, diverse, and energetic and exciting city in America: We are searching for a multicultural group of friends who really best reflect the most exciting city in the country. We’re looking for a group of women who are real friends, and who are of diverse backgrounds, races and religions,” he said.

Article continues below advertisement

Season 14 of the series aired in July 2023 and consisted of Sai De Silva, Ubah Hassan, Erin Lichy, Jenna Lyons, Jessel Taank, and Brynn Whitfield.

‘Real Housewives’ Is Turning 20!

Beyond the antics of the Big Apple alumni, fans will see several iconic faces later in 2026 when Bravo airs “Roaring 20th,” a special celebrating the franchise’s 20th anniversary.

According to The Blast, the limited series will feature many big names, including Porsha Williams, Kyle Richards, Vicki Gunvalson, Lisa Barlow, Teresa Giudice, and NeNe Leakes.

Entertainment

Quinton Aaron ‘Excited’ For Super Bowl in Positive Health Update

Quinton Aaron

I’m Feeling Good Enough to Watch the Super Bowl!!!

Published

Quinton Aaron is still in the hospital … but it sure sounds like things are looking up, as TMZ just got a great update from his family.

As you know … “The Blind Side” star is recovering in the hospital from a spinal stroke … and for a while there, it was sounding not so good. But, it seems he is on the mend.

The Aaron family tells TMZ … “Quinton is in a jovial mood, now laughing and smiling and is communicating to the best of his ability while he continues to recover. He’s watching tv and is excited to watch the Super Bowl from his hospital bed this weekend.”

There is also an update on the woman by his side, previously making medical decisions for him, who claimed to be his wife — but his family has called BS on all that.

His “wife” Margarita tells TMZ … she received a call a couple of days ago from a hospital official telling her she is no longer allowed at the hospital. She’s concerned Quinton is going to believe she abandoned him, and she does not have any way of reaching him since she has his cell phone. She tells us she still loves Quinton, and it’s killing her she can’t be by his side.

Margarita previously told us … she and Aaron “got spiritually married.” She added … she does NOT have power of attorney, and has never made medical decisions on Quinton’s behalf.

Get well soon, Quinton, and enjoy the big game!

Entertainment

Stefon Diggs Sued Days Before Super Bowl Appearance

Stefon Diggs Sued

Your Goons Beat Me Up After You Lied About Me Stealing Your Ferrari

Published

More legal trouble for Stefon Diggs … he’s getting slapped with a lawsuit a couple days before his New England Patriots play in Super Bowl LX.

The Patriots star wide receiver is being sued for defamation and more … according to a new lawsuit obtained by TMZ.

In the docs, a man who claims he used to work for Stefon says in July 2024, Stefon requested he arrange for Stefon’s Ferrari to be transported from Miami to New York and then to Houston … but he says the Ferrari was stolen in Houston.

The guy claims law enforcement concluded the Ferrari was stolen by third parties in a sophisticated theft … but he says Stefon started telling people in their circles that the guy stole the car.

He vehemently denies stealing the Ferrari, and says he was never arrested or charged in the case … and he claims Stefon’s false allegations caused his concierge and consulting business to suffer.

What’s more, the man claims members of Stefon’s circle started confronting him after Stefon allegedly started spreading the false theft narrative.

He says people close to Stefon approached him at restaurants in Houston and Miami and even came to his home demanding he return gifts given to him by Stefon.

In the docs, the man claims in January 2025, Stefon texted him that he was “responsible and accountable for all actions of those around me.”

The man claims in December 2025, he was assaulted at Tootsie’s Cabaret in Miami by two men in Stefon’s circle … and he says Stefon’s brother, NFL player Trevon Diggs, saw it all go down and did nothing to stop the alleged beatdown.

In his suit, he says he suffered a laundry list of injuries in the alleged attack … including a torn ACL.

The guy claims Stefon defamed him, engaged in a civil conspiracy, and is vicariously liable for the actions of the guys who allegedly beat him up.

He’s going after Stefon and others for damages. Trevon is also named as a defendant.

We reached out to Stefon … so far, no word back.

Entertainment

Shein Faces Backlash Over AI Designer Theft

Shein has come under fire for allegations from Black designers who believe the company used AI to copy their designs, images, and likenesses without their consent. Some believe the company has even taken their designs and altered them for their own profit.

What’s really going on, and how has the company been able to allegedly do so?

Now, The Shade Room’s Justin Carter is looking into the claims and sharing information every designer should know on ‘TSR Investigates.’

More On Shein’s Alleged AI Designer Theft

According to Carter, when fashion content creator Sabra Johnson saw a colorful puffer coat vest in a runway video, she wanted to have it immediately. Its designers, Bruce and Glen Proctor, ultimately sent Johnson the coat, and she took pictures dressed in it, showing it off.

Johnson went viral with the photos. Then, she soon noticed that her pictures were posted in Shein marketing campaigns — without her consent. Bruce and Glen then took their frustrations to the ‘net, airing Shein out for apparently stealing their design.

“They are stealing from small designers — usually Black and minority designers,” Johnson warned her followers online.

Here’s What Designers Should Know

Per Carter, Johnson’s assertion appears to be true. Online, designers have apparently been calling out Shein for years, accusing the company of copying their work. But that’s not all. Jade Da Gem, creator of Dulse Clothing, says she believes Shein scraped her promotional photos and altered the skin tone of her models. Furthermore, Johnson believes that Shein used AI to edit her photos into a marketing video.

Scroll above to watch as Carter shares the believed-to-have-been-altered content. Additionally, Carter breaks down previous legal action against the company for alleged infringement while also speaking to Jonathan D’Silva, an intellectual property attorney, about important information for designers to know.

RELATED: Arizona Black Ski Weekend Chaos Goes Viral | TSR Investigates

What Do You Think Roomies?

Entertainment

OnlyFans Star Says Patriots QB Drake Maye Doesn’t ‘Look Happy’ With Wife

A popular OnlyFans content creator made the bold choice to shoot her shot with married New England Patriots quarterback Drake Maye ahead of Super Bowl LX.

“OK, this might get me canceled, but I don’t care,” Forrest Smith said in a video captured by TMZ Sports and published on Friday, February 6. “Did you guys see Drake Maye at the end of that AFC Championship [game]? He did not look happy.”

Smith then turned her attention to Drake’s wife, Ann Michael Maye, who the NFL star married in June 2025.

“I don’t know what’s up with his wife,” Smith said. “She kinda reminds me of a tradwife. She’s, like, 23. He can do so much better than that.”

The OnlyFans star added, “I know. I shouldn’t say that.”

Ann has gained notoriety in recent months for her viral TikTok account, where she routinely shares baking videos with her more than 500k followers.

“I’m not doing anything after the Super Bowl, and if you win I think you could have a better time than going to Disney with your wife. Yeah, I’ll be around,” Smith said.

Smith even sent a DM to the Patriots quarterback, 23, via Instagram that started, “Drake 👀.”

“You didn’t look too happy after that AFC win,” she wrote. “You deserve to be celebrated! I’m excited to watch you crush it at the Super Bowl. Instead of Disney, why don’t you come to Miami and hang with me? I have a fun party we can go to. Lmk what you think xo.”

Drake Maye and his wife Ann Michael Maye. Maddie Meyer/Getty Images

Drake has not responded to Smith’s DM at the time of publication.

The Patriots star currently has plenty on his plate, with Super Bowl 60 against the Seattle Seahawks on the horizon.

After Drake and New England booked their ticket to Santa Clara, California for the big game with a win over the Denver Broncos on Sunday, January 25, some suggested that Drake and Ann’s interaction on the field afterwards was a bit awkward.

“His body language is throwing me off,” one person commented on a video posted by the NFL via Instagram. “This was hard to watch. She was so excited for him.”

Another wrote, “He looks like he couldn’t care less that she’s there – and this is coming from a die hard Patriots fan. It hardly looks like a couple celebrating going to the Super Bowl. Awkward.”

In the time since, however, Drake has done nothing but gush about his relationship with Ann.

“My teammates have the right to whatever they choose but I would definitely advise them to eventually get married,” Drake told reporters on Monday, February 2. “It’s one of the best things I’ve experienced in my life. There’s no better feeling than coming home to a wife that loves you and cares for you.”

He continued, “I know my teammates, some of them are experiencing different parts of their life. I chose to get married young, and I don’t regret it one bit.”

Super Bowl 60 between the Patriots and Seahawks kicks off on NBC and Peacock Sunday, February 8, at 6:30 ET.

Entertainment

Anna Kepner’s Stepbrother Arrested Following Her Death on Cruise Ship

Anna Kepner

Stepbrother Arrested After Asphyxiation Death On Cruise

Published

|

Updated

The stepbrother of Anna Kepner — who was found asphyxiated during a family cruise vacation — was arrested this week and appeared in a Florida courthouse Friday to face a judge, TMZ has confirmed.

According to a law enforcement source … the 16-year-old stepbrother was led by U.S. Marshals into a Miami federal courtroom for an appearance … but since he’s a juvenile, the case was sealed. It’s unclear if he has been charged in a federal complaint or indictment.

After his court appearance, the stepbrother was released to the custody of a guardian, according to ABC News.

On November 7, Kepner’s body was reportedly discovered inside the cabin she shared with her stepbrother on the Carnival Horizon. She was allegedly asphyxiated after someone put her in a chokehold.

Just after her death, media reports surfaced claiming Anna’s stepbrother had a strange infatuation with her. Steven Westin, the father of Anna’s ex-boyfriend, told one outlet the stepbrother climbed on top of Anna’s bed on a single occasion.

We’ve reached out to the feds for more information … so far no word back.

Entertainment

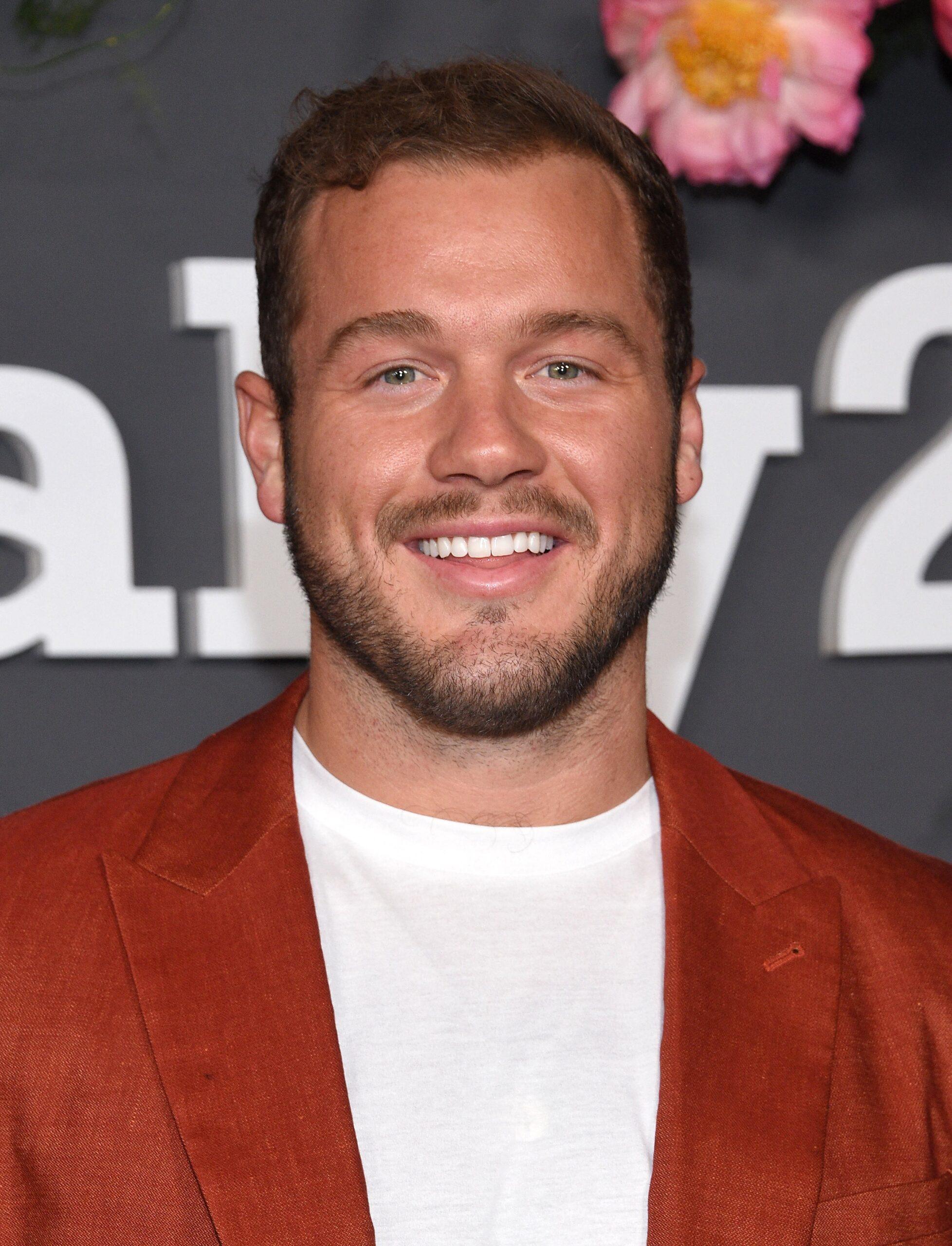

Colton Underwood Received Horrifying Death Threat Over ‘The Traitors’

Colton Underwood has faced intense backlash from viewers of “The Traitors” since season 4 began airing in January 2026. Today, the “Bachelor” alum is opening up about his experience inside the Scottish castle, revealing that he has received terrifying messages from viewers regarding his role in the series.

Warning: this article contains spoilers for “The Traitors,” season 4, episode 8.

Article continues below advertisement

Colton Underwood Says He Received A Death Threat From A Viewer That Had Him Shaken

Speaking with Variety, Underwood immediately addressed toxicity from this season’s viewers, thanking Peacock for issuing a statement and reminding the audience to be kind to the show’s players. “I totally understand the intensity of rooting and being upset when your player goes home,” Underwood said. However, he said there were a “few lines” that were crossed as the season progressed.

Underwood became a focal point of the show earlier in the season after co-star Michael Rapaport made a comment that many viewers interpreted as a slight against Underwood’s sexuality. Underwood said that after Rapaport’s comments aired, he received terrifying death threats—one so shocking he sent it to the show’s producers.

Article continues below advertisement

“… somebody told me to stick a gun up my a** and pull the trigger and called me the F word in it,” he said. “That’s crossing the line.”

Article continues below advertisement

Colton Underwood Seems OK With How He Went Home In Episode 8 Of ‘The Traitors’

Underwood was murdered by Traitors Candiace Dillard Bassett and Rob Rausch at the start of episode 8. While disappointing, Underwood seemed OK going out the way he did.

“I think at that point of the game, I knew the only way that I was going to make it to the end was to get recruited,” he said. “So either I was getting recruited or getting murdered. If I was going to go out, I would rather have gone out murdered than banished, because I think part of the game and the fun of it is defending yourself at the roundtable and holding your own.”

Underwood added that being banished at the roundtable means a person didn’t do a good enough job defending themselves against the accusations. “So if I went out, I always wanted to go out getting murdered,” he stated.

Article continues below advertisement

How Does Colton Underwood Feel About How He Played The Game?

Throughout the season, Underwood clashed with several players, including “Big Brother” legend Tiffany Mitchell and “Real Housewives of Beverly Hills” alum Lisa Rinna. Although he didn’t win the series, the father of one said he’s “proud” of how he played.

Underwood described his gameplay as “intense,” calling himself the “ultimate competitor.” He also shared that being a fan of the show has added an extra element for him.

“So there’s weirdly a part of me now that’s very excited to watch the rest of the season as a fan again, instead of the intensity in which I had to watch myself on that show,” he added.

Article continues below advertisement

Lisa Rinna Details Needing To Heal After Leaving The ‘Traitors’ Castle

According to The Blast, Rinna recently opened up about her experience filming the intense reality series, which concluded in episode 7 when a majority of the remaining cast voted to eliminate her.

“I wanted to go home,” Rinna said. “I could care less at that point.”

Rinna’s daughter, Amelia Gray, reportedly said that being in a situation where one has to lie and deceive for an extended period can alter one’s state of mind. “That does something to your brain,” she said.

Rinna agreed, explaining that it took her “a minute to kind of recalibrate.”

Fans React To Underwood’s Murder

Social media users appeared ecstatic following Underwood’s murder on the most recent episode of “The Traitors.”

“COLTON HAS BEEN MURDERED,” one user wrote alongside a GIF of Jane Lynch cheering during an episode of “Glee.”

“ROB ACTUALLY LET CANDIACE MURDER COLTON????? WE ARE SOO UPPP!” another user wrote.

“THEY MURDERED COLTON NO WAAAAAAAAAAAAAY THANK YOU CANDIACE DILLARD BASSETT,” a third shared.

“THANK YOU CANDIACE I couldn’t stand one more second of Colton screen time,” another posted.

“And let’s clap it up for my girl Candiace doing her biggest of ones getting that … Colton out of her castle. She did what those losers in the castle were scared to do,” a fifth wrote.

Entertainment

Victoria Woods Responds To Finesse2Tymes (Videos)

Roomies, the drama is far from over. Victoria Woods has responded after Finesse2Tymes said she was “dead wrong” and not entitled to her sister GloRilla’s money.

RELATED: Here’s What GloRilla Has Previously Shared About Her Parents, Siblings & Upbringing In Memphis (VIDEOS)

Finesse2Tymes Says Victoria Woods Is “Dead Wrong” & Not Entitled To GloRilla’s Money

On Friday, February 6, Instagram user @livebitez posted footage from an apparent recent livestream of Finesse’s. Furthermore, in one clip, Finesse is seen seemingly addressing Woods, saying, “You ain’t did what you was supposed to did to be somebody. B***h. You ain’t no singing b***h… ain’t no rapping b***h. You ain’t not motherf*****g dancing b****h…”

In a second clip, Finesse is seen telling viewers that Woods is “dead wrong.”

“It’s just that simple, man. You don’t go to the internet and talk about your folk like that ’cause you ain’t got no motherf*****g hustle,” he said. “Get up off your ass! Go sell some ass…”

Ultimately, Finesse explained the energy behind his words by noting that Woods reminds him of his family.

Click here to watch the NSFW video of what he said.

Victoria Woods Responds To Finesse2Tymes

Victoria Woods didn’t miss Finesse2Tymes’ message and took to her Facebook Story on Friday to respond.

“Now, Finesse, you want to sit here and talk about me selling a** but you the one that got the biggest booty. And you the one that got the tummy tuck. H*e, you the one over there looking like a Coke bottle, b***h. You need to go sell some ass and get Shugg out of jail, h*e,” she said.

Additionally, from there, Woods urged the rapper to keep her name out of his mentions. Furthermore, she went on to mention that he’s upset about “every label” dropping him.

“But if you want to go there, we can go there,” she added. “‘Cause you ain’t hitting on s**t, bro. You only spread about 5 or 6 thousand, h*e. We in the same boat — to be really honest.”

Furthermore, on Facebook, Woods shared an NSFW post about Finesse. See it here.

More On The Back & Forth Between GloRilla & Her Sister

As The Shade Room previously reported, earlier this week, Victoria Woods turned heads when she accused GloRilla of not liking her family and their parents not being “straight.” Specifically, Woods alleged she had to give their mom $1,800 to help cover her $2,400 rent.

“…ion gaf about how yall put it she ain’t gave none of the ones she struggled with SH*T! !Same house with [rats] and [roaches] sleeping on busted air mattresses taking baths outta water bottles when our parents couldn’t make ends meet she’s Wrong no matter how yall put it,” Woods alleged.

Woods didn’t directly respond to her sister. But she shared apparent text messages from their mom, seemingly showing her financial support, per The Shade Room.

But Woods didn’t let up on her claims.

Then, Glo dropped a few spicy reposts about her sister.

Ultimately, Woods went on to sit down with TMZ, airing her sister out.

All of this, apparently, led Tory Lanez to reach out to Woods, sending her $2,500 for financial help.

RELATED: Victoria Woods Alleges Tory Lanez Sent Her $2,500 As Claressa Shields Seemingly Weighs In On Her Back-And-Forth With GloRilla (PHOTOS)

What Do You Think Roomies?

Entertainment

Max Viewers Just Made This 133-Minute Superhero Franchise-Starter Their #1 Movie

Nearly five years after his last big-screen appearance, Tom Holland‘s web-slinger is finally swinging back into action this year with Spider-Man: Brand New Day. Releasing on July 31, the film has been mostly shrouded in mystery for now, though it’ll see Peter Parker reintroduce himself to the world after having Doctor Strange erase everyone’s memories of him in Spider-Man: No Way Home. Most of the excitement thus far has instead come from the casting. Both Zendaya and Jacob Batalon will be back as Peter’s girlfriend MJ and best friend Ned Leeds, but it also features the big-screen debut of Jon Bernthal as The Punisher and the live-action debut of Marvin Jones III as Tombstone, alongside the return of Mark Ruffalo as The Hulk and three high-profile new additions in Stranger Things star Sadie Sink, The Bear‘s Liza Colón-Zayas, and Severance standout Tramell Tillman.

One other inclusion will also harken back to the beginning of Spidey’s MCU journey — Michael Mando as Mac Gargan, aka Scorpion. He first appeared as an associate of Adrian Toomes/The Vulture (Michael Keaton) in Spider-Man: Homecoming back in 2017, though he may have an even bigger role to play this time around. Fittingly, that first solo film for Holland, which kicked off a pivotal reboot of the character for the cinematic universe after his appearance in Captain America: Civil War, is now getting a lot of attention ahead of Brand New Day‘s arrival. Viewers are revisiting Peter Parker’s origins en masse, though not on the platform you’d expect.

On HBO Max, Spider-Man: Homecoming is currently at the top of the platform’s worldwide film charts, beating out more recent titles like the I Know What You Did Last Summer reboot and Death of a Unicorn, as well as older hits like Michael Mann‘s Blackhat. Most impressive, however, is the fact that it’s doing so without being available for U.S. subscribers. The Jon Watts-directed feature instead accomplished the feat by simply hitting #1 in 20 different countries. It’s a testament to the enduring popularity of Spidey and Homecoming in particular, which is still considered among the MCU’s best efforts from the Infinity Saga and a standout superhero coming-of-age story.

What Happened in ‘Spider-Man: Homecoming’?

For a refresher, Homecoming saw Peter returning to New York with a newfound spring in his step after getting to fight with the Avengers in Civil War. Living with his Aunt May (Marisa Tomei), he starts coming into his own as Spider-Man under the guidance of genius tech billionaire Tony Stark/Iron Man (Robert Downey Jr.), all while trying to go about his normal daily routine as a teenager. When the Vulture emerges having profited immensely on the creation and sale of weaponry made with salvaged Chitauri technology, Parker wants to use the opportunity to prove himself as a hero. Toomes proves to be a dangerous foe for the young wallcrawler, though, putting Peter’s powers to the test in an effort to save everything he holds dear. Fleshing out the feature was a stacked supporting cast, including Jon Favreau, Gwyneth Paltrow, Donald Glover, Laura Harrier, Tony Revolori, Bokeem Woodbine, and more. At the time, it was among the top-five highest-grossing films in the MCU ever, earning $880.9 million at the box office.

Spider-Man: Homecoming is now streaming on HBO Max. Stay tuned here at Collider for more on the biggest streaming success stories throughout the year.

- Release Date

-

July 7, 2017

- Runtime

-

133 minutes

- Producers

-

Avi Arad, Kevin Feige, Louis D’Esposito, Matt Tolmach, Patricia Whitcher, Stan Lee, Victoria Alonso, Amy Pascal

Entertainment

“Home Alone” star Daniel Stern's prostitution case gets final ruling

:max_bytes(150000):strip_icc():format(jpeg)/Daniel-Stern-Home-Alone-011226-4df2f676475643d0b9cae082b632cef7.jpg)

The actor was charged in January for an alleged incident that occurred in December.

Entertainment

Hogwarts Is Being Reimagined for HBO Max’s ‘Harry Potter’

The wizarding world isn’t just coming back — it’s being rebuilt from the ground up. New set images from HBO Max’s upcoming Harry Potter series reveal that Hogwarts is getting a full-scale reimagining, and fans are already dissecting every brick, branch, and greenhouse in sight.

Filming is currently underway in the UK for the long-gestating TV adaptation, which is slated to debut in 2027, and the latest photos give us our clearest look yet at how expansive this version of Hogwarts is shaping up to be. Visible constructions include the Hogwarts courtyard, what appears to be Professor Sprout’s greenhouse, and the unmistakable outline of the Whomping Willow — a deep-cut tease that’s already sending Chamber of Secrets and Prisoner of Azkaban fans spiraling.

The greenhouse is a particularly intriguing reveal. As book readers will remember, it’s where Professor Sprout — head of Hufflepuff House — teaches Herbology, and it plays a pivotal role in Harry Potter and the Chamber of Secrets with the introduction of Mandrakes. Seeing that set go up this early suggests HBO Max is thinking long-term, planting seeds (literally) for future seasons well before the first one even airs.

Who Stars in ‘Harry Potter’?

The new Harry Potter series stars Dominic McLaughlin as Harry Potter, Arabella Stanton as Hermione Granger, and Alastair Stout as Ron Weasley, alongside John Lithgow as Albus Dumbledore, Paapa Essiedu as Severus Snape, Janet McTeer as Minerva McGonagall, and Nick Frost as Rubeus Hagrid. The Weasley family includes Katherine Parkinson as Molly Weasley, with Tristan Harland, Gabriel Harland, Ruari Spooner, and Gracie Cochrane appearing as Fred, George, Percy, and Ginny Weasley, while Lox Pratt plays Draco Malfoy.

Other Hogwarts students include Rory Wilmot as Neville Longbottom, Leo Earley as Seamus Finnigan, Alessia Leoni as Parvati Patil, Sienna Moosah as Lavender Brown, and Amos Kitson as Dudley Dursley. Additional cast members include Bel Powley as Petunia Dursley, Daniel Rigby as Vernon Dursley, Bertie Carvel as Cornelius Fudge, Paul Whitehouse as Argus Filch, Luke Thallon as Quirinus Quirrell, Louise Brealey as Madam Hooch, and Leigh Gill as Griphook.

The series has been filming since the early summer of 2025, and is set to continue all the way through until later this year, at which point a short break will be undertaken ahead of Season 2‘s adaptation of Harry Potter and the Chamber of Secrets.

- Showrunner

-

Francisca Gardiner

- Directors

-

Mark Mylod

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech9 hours ago

Tech9 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports19 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat14 hours ago

NewsBeat14 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 hours ago

NewsBeat2 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World1 day ago

Crypto World1 day agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation