Business

Bank of Mexico Pauses in Rate-Cutting Cycle

MEXICO CITY—The Bank of Mexico left its benchmark interest rate unchanged Thursday, pausing after 12 consecutive cuts to assess the inflationary impact of recent tax and tariff increases.

The five-member board of governors voted unanimously to leave the overnight interest-rate target at 7.0% in their first monetary policy meeting of the year. The pause was widely expected.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

Markets eye brighter side: Sensex, Nifty recover from early losses amid IT rout

The Nifty IT index declined 1.5% on Friday, posting 5% losses for the week, as the slide in the US technology and AI stocks on concerns around rising AI-related spending at Alphabet and intensifying competitive pressures spilt over to the software services stocks in the rest of the world. Elsewhere in Asia, South Korea dropped 1.4% and Hong Kong slipped 1.2%. China was down 0.3%, Taiwan was flat, while Japan bucked the trend with an 0.8% rise. “IT stocks are having a rough time given the slump in tech stocks globally due to increasing focus on AI, and investors should stay cautious on the sector,” said UR Bhat, co-founder and director, Alphaniti. Bhat added that Friday’s pullback was likely supported by foreign buying.

Foreign portfolio investors were net buyers on Friday at ₹1,951 crore, while domestic institutions sold ₹1,265 crore. In February so far, global investors have purchased equities worth ₹9,716 crore after selling to the tune of over ₹34,000 crore in January.

Investors had to navigate sharp swings in the market through the week, starting with the Union budget in the special trading session on Sunday, the Indo-US trade deal finalisation on Monday, the risk-off sentiment in the technology sector and the RBI’s Monetary Policy on Friday when the central bank held the repo rate steady at 5.25%on expected lines. Analysts said investor mood now hinges on the fine print of the bilateral trade pact.

“The market is waiting for the fine print of the US-India trade deal as currently it seems like there is a possible risk of a large influx of American imports,” said Bhat. “If the deal favours Indian exports on balance, then there is scope for meaningful gains.”

Derivatives indicators pointed to growing uncertainty. A widening trading range suggested a lack of conviction among traders.

“The headline indices opened on a strong note after the US-India trade deal and rallied close to the lifetime high levels however, since then, it has been drifting lower, indicating caution,” said Ajit Mishra, SVP Research, Religare Broking. He added that “the levels around 25,400 are make or break for the market as any move lower could lead to a slide and result in gap closure around 25100.”

In commodities, gold rose 2.3% and silver jumped 4.7% to $74 on Friday morning, recovering from the early day losses. Mishra noted that while gold remained relatively stable, silver could face further pressure. Geopolitics could also play a role in the market direction.

Business

(VIDEO) Shaedon Sharpe Exits Trail Blazers-Grizzlies Game Early with Left Calf Injury

Portland Trail Blazers guard Shaedon Sharpe was forced to exit Friday night’s game against the Memphis Grizzlies early due to a left calf injury, leaving the team shorthanded in a crucial Western Conference matchup and raising immediate questions about his availability for the rematch on Saturday.

Sharpe, who has emerged as one of Portland’s most consistent scorers this season, played just 14 minutes before departing. He finished with two points on 0-for-2 shooting, including 0-for-1 from three-point range, along with two rebounds, two assists and two free throws made. The injury was announced during the game, with Sidy Cissoko checking in to start the third quarter in his place. The Trail Blazers later confirmed Sharpe would not return.

The exact moment of the injury was not immediately clear, as no specific play was highlighted in initial reports. Sharpe appeared to be moving normally early in the contest but was ruled out after evaluation by the medical staff. The severity remains undetermined, though the quick turnaround for Saturday’s second game against Memphis — the first of a back-to-back set — adds urgency to his recovery timeline.

Portland entered the night at 23-28, sitting 10th in the Western Conference standings amid a push to climb into play-in contention. Sharpe has been a key piece of that effort, averaging around 21.7 points, 4.6 rebounds and 3.0 assists per game this season. His scoring outburst has been particularly notable in recent weeks, including a stretch where he scored at least 19 points in six consecutive games while shooting nearly 50% from the field.

The 22-year-old, selected seventh overall in the 2022 NBA Draft, has developed into a dynamic wing for the rebuilding Trail Blazers. His athleticism, scoring ability off the dribble and improved playmaking have made him a cornerstone alongside veterans like Jerami Grant and newcomers such as Jrue Holiday. Friday’s limited output marked a departure from his recent form, where he had been a reliable source of offense.

The Grizzlies, at 20-29 and dealing with their own injury woes, presented a challenging but winnable opponent for Portland at Moda Center. Memphis was without several key contributors, including Ja Morant (elbow), Zach Edey (ankle), Brandon Clarke (calf) and others on the injury report. Ty Jerome, recently returned from his own calf issue, was sidelined for load management on the first night of the back-to-back.

Portland’s injury report heading into the game already featured absences and questionables. Damian Lillard remains out for the season with an Achilles injury, while others like Deni Avdija (back), Scoot Henderson (hamstring) and Matisse Thybulle (knee) have been in and out of the lineup. Sharpe’s early exit compounded the challenges, forcing coach Chauncey Billups to adjust rotations with increased minutes for reserves like Cissoko and Vit Krejčí.

Calf injuries can range from mild strains to more serious tears, often requiring days to weeks of rest depending on severity. In the NBA, such issues frequently lead to missed time, especially with the physical demands of the schedule. The Trail Blazers will likely monitor Sharpe closely overnight, with imaging or further evaluation possible before determining his status for Saturday.

The game itself unfolded as a competitive Western Conference battle between two teams hovering around .500 or below, both looking to string together wins in the second half of the season. Portland has shown flashes of potential with its young core, but consistency has been elusive. Sharpe’s absence could impact offensive spacing and transition scoring, areas where his explosiveness shines.

Fans and analysts expressed concern on social media and in post-game discussions. Sharpe’s recent hot streak had boosted optimism around the Blazers’ direction, and an injury now threatens to disrupt that momentum. Fantasy basketball managers, who have rostered Sharpe at high rates this season, also face decisions on whether to hold or seek replacements given the back-to-back uncertainty.

The Trail Blazers have emphasized player health in their rebuild, prioritizing long-term development over short-term risks. Head coach Billups has spoken frequently about managing minutes and avoiding overexertion for young talents like Sharpe and Donovan Clingan. This latest setback will test that approach once more.

Memphis, meanwhile, continues navigating a roster in flux following the trade deadline. New additions and returns from injury have yet to fully gel, but the team remains competitive despite missing star power. Their defense and rebounding have kept games close, even against healthier opponents.

As the night progressed without Sharpe, Portland leaned on Grant’s scoring and interior presence from Clingan. The outcome of the game was still in flux late, but the injury overshadowed much of the on-court action for Blazers supporters.

The team issued no immediate update beyond the ruling out, but a Saturday morning report is expected. If Sharpe is sidelined, it could open opportunities for others in the rotation while highlighting the depth challenges Portland faces.

Calf strains have plagued several players league-wide this season, including Memphis’ own Jerome earlier in the campaign. Recovery protocols typically involve rest, ice, compression and gradual return-to-play progression under medical supervision.

For Sharpe, who turned heads as a high-flying prospect out of Kentucky, staying healthy has been key to realizing his potential. This incident serves as a reminder of the physical toll of the NBA schedule, particularly for athletic wings who rely on burst and explosiveness.

Portland’s upcoming schedule includes the immediate rematch with Memphis before further tests against playoff contenders. Maintaining health will be critical as the team eyes a late-season surge.

The Trail Blazers and Grizzlies tip off again Saturday night in what could be a pivotal game for both squads’ positioning in the crowded Western Conference play-in race.

Business

Business News Live, Share Market News – Read Latest Finance News, IPO, Mutual Funds News

Air India opens first flagship Maharaja Lounge at Delhi airport’s Terminal 3

Air India has unveiled its inaugural flagship lounge, The Maharaja Lounge, at Delhi’s Terminal 3, marking a significant enhancement to its premium travel offerings. This new space, designed with Indian heritage and modern aesthetics, will cater to Business and First Class passengers, elite club members, and eligible Star Alliance travelers.

Business

Bitcoin bounces from lows to $70,000, signals stabilisation after macro-driven crash

In the past 24 hours, Bitcoin jumped 9.31% whereas Ethereum went up by 9.23% to trade at $2,083. Among the major altcoins, BNB, XRP, Solana, Tron, Dogecoin, Cardano rose 14% whereas Hyperliquid slid 6.77%.

Also Read | Thinking of pausing your mutual fund SIPs? A 6 month gap may cost you Rs 2 lakh additional lossRiya Sehgal, Research Analyst, Delta Exchange, said Bitcoin’s rebound from the $60,000 lows to above $70,000 and Ethereum’s recovery beyond $2,000 mark a potential turning point following the steepest two-week decline since mid-2022.Sehgal further added that this correction was largely macro-driven, triggered by risk-off sentiment, and leverage washouts, rather than any structural weakness within crypto. “Overall, the market appears to be shifting from panic to cautious optimism, signaling that the worst of the drawdown may be behind us, though volatility will likely remain elevated in the near term.”

The global crypto market capitalisation jumped 8.6% to $2.42 trillion, according to CoinMarketCap.

In the past week, Ethereum and Bitcoin were down by 22.62% and 15.68% respectively. Among the major altcoins, BNB, XRP, Solana, Tron, Dogecoin, Cardano were down over 26% whereas Hyperliquid was up by 3.11%.Nischal Shetty, Founder, WazirX said over the last 24 hours, crypto markets have seen short-term volatility, driven largely by technical factors and cautious sentiment rather than any fundamental shift in the ecosystem.

Also Read | Radhika Gupta urges investors to ignore ‘cats’ and think like a goldfish amid market chaos

“Importantly, continued investments by financial institutions into crypto infrastructure reinforce the long-term conviction that this space is becoming an integral part of the global financial system, beyond short-term price movements,” Shetty said.

Business

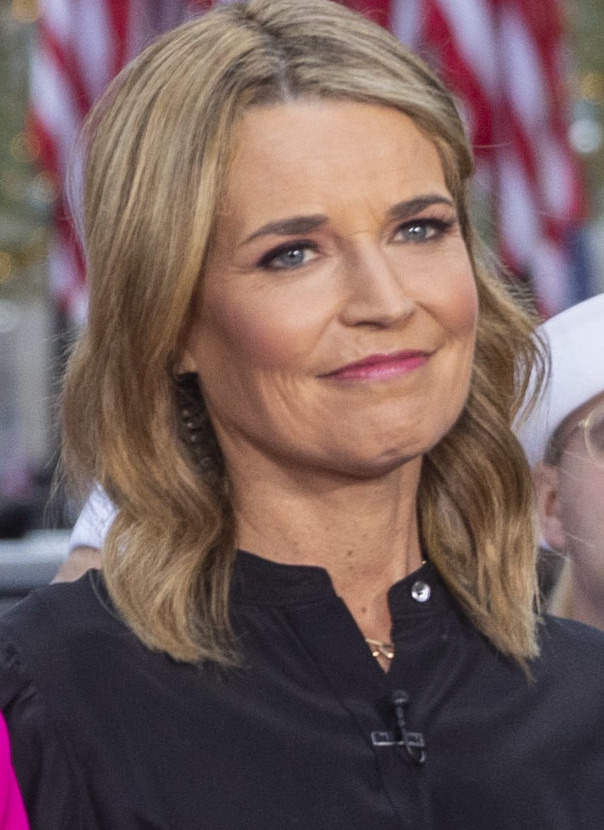

Chilling Bitcoin Ransom Demand Emerges in Search for Savannah Guthrie’s Mother

The investigation into the suspected abduction of Nancy Guthrie, the 84-year-old mother of Today show co-anchor Savannah Guthrie, has taken a high-tech and harrowing turn. Federal and local authorities confirmed Friday that multiple ransom notes, including a demand for millions of dollars in Bitcoin, are being treated as credible leads in the search for the missing octogenarian.

Nancy Guthrie was reported missing from her home in the Catalina Foothills, north of Tucson, on Feb. 1 after failing to appear for a Sunday church service. Five days into the search, the Pima County Sheriff’s Department and the FBI are racing against a ticking clock, complicated by the victim’s fragile health and the digital wall of a cryptocurrency ransom.

A ‘Credible’ Digital Ransom

The FBI’s Phoenix field office revealed that several media organizations, including TMZ and local station KOLD-TV, received messages purportedly from the kidnappers. According to FBI Special Agent in Charge Heith Janke, these notes contained “specific details” about the Guthrie residence that had not been released to the public, including references to a floodlight and an Apple Watch.

The primary demand is for a “substantial amount” of Bitcoin, reportedly totaling millions of dollars. The kidnappers established a hierarchy of deadlines: an initial cutoff of 5 p.m. on Thursday, followed by a secondary deadline this coming Tuesday.

“Every transaction in Bitcoin is logged on an open public ledger,” noted Ari Redbord, a former Department of Justice official now with TRM Labs. While the semi-anonymous nature of cryptocurrency often appeals to criminals, experts say law enforcement’s ability to “follow the money” on the blockchain provides a digital trail that cash or gold cannot match.

Evidence of a Struggle

The case was upgraded from a missing person report to a criminal investigation early in the week. Pima County Sheriff Chris Nanos confirmed that DNA testing of blood found on the porch of Nancy Guthrie’s home matched the 84-year-old.

Additional forensic evidence paints a chilling timeline of the abduction:

- Saturday, 9:30 p.m.: Family members drop Nancy off at her home after dinner.

- Sunday, 1:45 a.m.: The home’s doorbell camera is physically disconnected.

- Sunday, 2:28 a.m.: Software monitors indicate that Nancy’s pacemaker disconnected from her personal device, suggesting she was moved out of range of her home network.

“We believe Nancy is still out there,” Sheriff Nanos said during a press conference. “Our protocol is to assume she is alive until we are told otherwise, and we’re going to continue thinking that way until we find her.”

The Family’s Heartfelt Plea

Savannah Guthrie, who has taken an indefinite leave of absence from NBC, released a poignant video alongside her siblings, Annie and Camron. In the footage, Savannah’s voice breaks as she addresses the captors directly.

“We are ready to talk. However, we live in a world where voices and images are easily manipulated. We need to know without a doubt that she is alive.”

The plea for “proof of life” highlights the modern challenges of kidnapping in the age of AI. The family expressed fears that deepfake technology could be used to simulate Nancy’s voice or likeness to extract a ransom without her actually being safe.

The family also emphasized Nancy’s medical needs. The 84-year-old requires daily medication for heart issues and high blood pressure. “Her heart is fragile. She lives in constant pain,” Savannah said. “She needs her medicine to survive.”

Hoaxes and Red Herrings

The high-profile nature of the case has already attracted opportunists. On Thursday, authorities arrested Derrick Callella in Los Angeles. Callella is accused of sending “imposter” ransom notes to the Guthrie family demanding Bitcoin. Investigators clarified that Callella is a “scammer” attempting to profit from the tragedy and is not believed to be involved in the actual disappearance.

Ongoing Investigation

The FBI is currently offering a $50,000 reward for information leading to Nancy Guthrie’s return. President Donald Trump has also reportedly directed federal resources to assist in the search, calling the circumstances “very unusual.”

As the Tuesday deadline approaches, the Catalina Foothills community remains on edge. Neighbors have turned the local Saint Philip’s in the Hills Episcopal Church into a site for continuous prayer vigils, with a large photo of Nancy Guthrie illuminated by hundreds of candles.

Authorities are asking anyone with information, or anyone who may have seen a white van reported in the neighborhood prior to the disappearance, to contact the Pima County Sheriff’s Department immediately.

Business

Strategy Slides Even Further on Earnings Miss After Dismal Day

Strategy Slides Even Further on Earnings Miss After Dismal Day

Business

Health Care Roundup: Market Talk

The latest Market Talks covering the Health Care sector. Published exclusively on Dow Jones Newswires at 4:20 ET, 12:20 ET and 16:50 ET.

1610 ET – Jefferies pushes back the timing of first revenues from Neuren Pharmaceuticals’s trofinetide treatment for Rett Syndrome in the European Union following a setback in getting approval. Neuren says its partner, Acadia Pharmaceuticals, was recently informed by a key committee of the European Medicines Agency of a negative trend vote on its Marketing Authorization Application for trofinetide. Analyst David Stanton says this was likely due to concerns about the effect size of the confirmatory trial. “As a result of this news, and to be conservative, we now assume royalties from EU sales of trofinetide at start 4Q FY26,” Jefferies says. That’s six months later than its prior forecast. Jefferies cuts its FY 2026 net profit forecast for Neuren by 17% to A$48.1 million, from A$58.2 million. It retains a buy call on the stock. (david.winning@wsj.com; @dwinningWSJ)

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

Gold bounces back on softer dollar, US-Iran concerns; silver rebounds

Spot gold rose 3.9% to $4,954.92 per ounce by 2:18 p.m. ET (1918 GMT), recouping losses during a volatile Asia session following Thursday’s 3.9% decline. The yellow metal was headed for a weekly gain of about 2%.

U.S. gold futures for April delivery settled 1.8% higher at $4,979.80 per ounce.

CME Group had flagged a delay in publishing metals settlement, earlier in the day.

The U.S. dollar index fell 0.2%, making greenback-priced bullion cheaper for overseas buyers.

“The gold market is seeing perceived bargain hunting from bullish traders,” said Jim Wyckoff, senior analyst at Kitco Metals.

Iran’s top diplomat on Friday said that nuclear talks with the U.S. mediated by Oman were off to a “good start” and set to continue. The remarks could help allay concerns that failure to reach a deal might nudge the Middle East closer to war. Wyckoff said gold’s rebound lacks momentum and the metal is unlikely to break records without a major geopolitical trigger.

Gold, a traditional safe haven, does well in times of geopolitical and economic uncertainty.

Meanwhile, spot silver rose 8.6% to $77.33 an ounce after dipping below $65 earlier in the session, but was still headed for a weekly drop, down over 8.7%, following steep losses last week as well.

“What we’re seeing in silver is huge speculation on the long side,” said Wyckoff, adding that after years in a boom cycle, gold and silver now appear to be entering a typical commodity bust phase.

CME Group raised margin requirements for gold and silver futures for a third time in two weeks on Thursday to curb risks from heightened market volatility.

Spot platinum added 5.4% to $2,093.50 per ounce, while palladium rose 6.2% to $1,717.05.

Business

Regal Rexnord director Stoelting sells $1.71 million in stock

Regal Rexnord director Stoelting sells $1.71 million in stock

Business

’West Wing’ actor Timothy Busfield indicted on child sex offense charges

’West Wing’ actor Timothy Busfield indicted on child sex offense charges

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech9 hours ago

Tech9 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports1 hour ago

Sports1 hour agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports19 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat15 hours ago

NewsBeat15 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 hours ago

NewsBeat2 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”